Prediction: These 2 Phenomenal Stocks Are Set to Soar

After a volatile few years in the stock market, it’s difficult to identify growth stocks with clear paths higher. Macroeconomic uncertainty threatens financial results and investor confidence, but long-term investors can always focus on companies with strong operational metrics, high-quality products, and reasonable valuations. These two stocks combine all those qualities, making them compelling breakout candidates for investors.

AppLovin

AppLovin (NASDAQ: APP) provides artificial intelligence (AI) software that allows advertisers to reach customers in targeted and efficient ways. The company aims to reduce the cost for businesses to acquire customers while also reaching more qualified prospects. Consumer marketing is an ever-changing landscape, but it’s undeniably valuable. Media ad spending is nearly $400 billion annually in the United States, with digital platforms taking 80% of total spending. These dollars supported major companies that connect businesses with consumers, such as Alphabet, Meta Platforms, Snap, and Microsoft. If AppLovin can deliver demonstrable returns on ad spending for its customers, its value proposition is strong and straightforward.

It’s hard to argue with the company’s results. AppLovin delivered consistently strong revenue growth, with a 44% expansion in its most recent quarter. After swinging into profitability recently, its bottom-line performance has been even more impressive. The company’s free cash flow is up more than 500% since 2021, capped off with 102% growth in its most recent quarter.

Investors and analysts have taken note of these impressive operating metrics. The stock is up 230% year to date, but it still has a reasonable valuation. Its price-to-sales (P/S) ratio is above 11, which is somewhat expensive. However, the company’s rapid growth rate and wide profit margin justify that valuation. Its forward price-to-earnings (P/E) ratio is 21, and its price-to-cash flow ratio is around 25. Those are both exceptionally affordable for a company with AppLovin’s growth rate.

The stock will likely experience volatility if difficult macroeconomic times lie ahead, and the company’s future performance will be challenged by stiff competition. Nonetheless, this stock is priced to deliver huge gains if the company maintains the level of operational excellence that it has managed in recent years.

Zscaler

Zscaler (NASDAQ: ZS) is one of the cybersecurity stocks that has fallen somewhat out of favor relative to its peers. Since the start of 2022, Zscaler stock has fallen 46%, while the First Trust NASDAQ Cybersecurity ETF is up 13%. CrowdStrike and Palo Alto Networks soared even higher over the period.

Zscaler’s lagging performance can be attributed to slowing growth combined with an unsustainably high valuation. The stock’s P/S ratio was around 60 three years ago, and its forward P/E ratio was above 80 earlier this year. Those levels were difficult to sustain as growth slowed, and the stock suffered.

Long-term investors can’t get too sidetracked by momentum. Zscaler couldn’t deliver the results necessary to justify those aggressive valuation ratios, but it’s still been impressive. The top line marches consistently higher. Even its “slow” growth rate is over 30%, which is higher than many high-profile companies’ aspirations.

Continued sales growth has led the company near profitability. The company is just short of break-even on a GAAP basis, and it’s notched impressive free cash flow expansion that is slightly outpacing sales growth.

Zscaler reported 115% net dollar retention in its most recent quarter. This is a clear indicator of customer satisfaction, product enhancements, and effective sales strategies. Gartner has rated Zscaler as a leader of the Secure Service Edge industry for three straight years, ranking it right alongside or ahead of its key competitors.

Growth investors may not be enamored with Zscaler’s past few years, but the stock is far less speculative now. It’s a reliable cash flow generator with a respected product portfolio and metrics to support that claim. Its forward P/E ratio is just under 60, which isn’t expensive compared to its high-profile cybersecurity peers. That’s especially true when you consider its forecast growth rate, which is one of the highest among established cybersecurity stocks. After a few difficult years, Zscaler’s valuation now offers real upside potential.

Should you invest $1,000 in AppLovin right now?

Before you buy stock in AppLovin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AppLovin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Downie has positions in Alphabet and Microsoft. The Motley Fool has positions in and recommends Alphabet, CrowdStrike, Meta Platforms, Microsoft, Palo Alto Networks, and Zscaler. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: These 2 Phenomenal Stocks Are Set to Soar was originally published by The Motley Fool

Elon Musk Says America 'Headed For Bankruptcy' As National Debt Skyrockets $204B In A Day

Elon Musk expressed concerns over the financial trajectory of the United States, suggesting the nation is on the brink of bankruptcy.

What Happened: As per economist E.J. Antoni on Thursday, Federal debt increased by $204 billion on the very first day of the new fiscal year, jumping to a new record of $35.669 trillion.

Additionally, the Treasury had to reduce its cash reserves by $72 billion, resulting in a deficit exceeding $275 billion in just one day.

Musk responded, “America is headed for bankruptcy.”

Why It Matters: The issue of national debt is not new but has gained increased attention. Former Coinbase Global Inc. CTO, Balaji Srinivasan, argues that the actual U.S. debt is much higher when considering entitlements like Social Security and Medicare. He estimates the real figure to be $175.3 trillion. This perspective suggests that the financial obligations of the U.S. are far greater than the reported $35 trillion, raising questions about fiscal sustainability.

Earlier, Robert Kiyosaki, the renowned financial educator and the author of the best-selling book Rich Dad, Poor Dad, also expressed his concerns over the escalating U.S. debt. In a series of posts on X, Kiyosaki warned about the growing $35 trillion U.S. debt, calling it “the real problem” that “neither [Donald] Trump nor Kamala [Harris] can solve.”

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

iCAD Highlights Global Availability of ProFound Cloud and International Expansion Milestones at JFR 2024

NASHUA, N.H. and PARIS, Oct. 03, 2024 (GLOBE NEWSWIRE) — iCAD, Inc. ICAD (“iCAD” or the “Company”) a global leader in clinically proven AI-powered cancer detection solutions, today announced its participation in the 72nd edition of the Journées Francophones de Radiologie (JFR) 2024 Meeting, taking place from October 4-7 in Paris, France. At JFR, iCAD will premier ProFound Cloud, a secure, scalable SaaS platform designed to deliver the company’s advanced AI solutions to healthcare providers worldwide.

Global Commercial Availability of ProFound Cloud

In its first two full quarters of U.S. availability, ProFound Cloud has processed nearly 100,000 cases, demonstrating rapid early adoption. Achieving processing speeds more than 50% faster than many traditional on-premises solutions, the ProFound Cloud is an efficient solution for deploying the ProFound AI Suite. With recent global distribution partnerships and regulatory clearances, the availability of Profound Cloud is expanding around the globe.

“We are thrilled to expand our global reach with ProFound Cloud, an innovative SaaS solution that provides radiologists worldwide with secure and cost-effective access to our cutting-edge AI tools,” said Dana Brown, President and CEO of iCAD. “As we continue to expand both in the U.S. and internationally, our focus remains on equipping healthcare providers with AI-driven technologies that enhance diagnostic accuracy and operational efficiency across breast health.”

The launch of its new Cloud platform represents a key milestone in iCAD’s global expansion.

Over the past quarter, iCAD has made significant progress across three key areas—strengthening partnerships, securing new regulatory clearances, and expanding its AI capabilities:

- Global Distribution Partnerships: iCAD has forged new commercial distribution alliances in countries such as Dominican Republic, France, Spain, Turkey, United Arab Emirates and with leading healthcare technology companies, including Tamer, Ozel and deepc, expanding the availability of its ProFound AI solutions globally.

- Regulatory Clearances in Key Markets: In line with its global growth strategy, iCAD has recently received regulatory clearances for its ProFound AI platform in South Africa and the United Arab Emirates.

- ProFound Cloud Expansion: Built on Google Cloud Platform (GCP), ProFound Cloud provides a scalable, secure, and affordable platform for healthcare providers to access iCAD’s AI-driven breast health technologies. The platform offers continuous updates and improved operational efficiency, making it a versatile solution for institutions of all sizes.

“As we continue to establish new partnerships and expand our AI solutions, our commitment to making world-class breast health technologies accessible to clinicians globally remains at the forefront,” said Brown. “The progress we’ve made this past quarter reflects our dedication to driving innovation in breast cancer detection.”

iCAD JFR24 Mini-Symposium Program

As part of the JFR 2024 program, iCAD will host an AI Symposium led by Prof. Bruno Boyer of the Centre for Medical Imaging Italy in Paris:

- Date and Time: Friday, October 4, 2024 | 09:45 – 10:10 AM

- Location: Room 251

- Speaker: Prof. Bruno Boyer, Centre for Medical Imaging, Italy, Paris

- Topic: Contribution of iCAD’s Artificial Intelligence Solutions for Better Breast Cancer Screening: Detection, Density, and Risk – A review of the latest clinical studies and case reviews.

Prof. Boyer will discuss how iCAD’s ProFound AI suite is advancing breast cancer screening, focusing on the role of AI in cancer detection, breast density evaluation, and risk assessment. He will also review recent clinical studies highlighting the efficacy of these technologies.

Visit iCAD at JFR 2024

Attendees are invited to visit the iCAD booth #226A for live demonstrations of the company’s AI-powered technologies and to learn more about its commitment to transforming breast health. To connect with the iCAD team at JFR or schedule a virtual demo, visit our event page: https://www.icadmed.com/about/news-events/upcoming-tradeshows-and-meetings/jfr-2024

About iCAD, Inc.

iCAD, Inc. ICAD is a global leader on a mission to create a world where cancer can’t hide by providing clinically proven AI-powered solutions that enable medical providers to accurately and reliably detect cancer earlier and improve patient outcomes. Headquartered in Nashua, N.H., USA, iCAD’s industry-leading ProFound Breast Health Suite provides AI-powered mammography analysis for breast cancer detection, density assessment and risk evaluation. Used by thousands of providers serving millions of patients, ProFound is available in over 50 countries. In the last five years alone, iCAD estimates reading more than 40 million mammograms worldwide, with nearly 30% being tomosynthesis. For more information, including the latest in regulatory clearances, please visit www.icadmed.com.

Forward-Looking Statements

Certain statements contained in this News Release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about the expansion of access to the Company’s products, improvement of performance, acceleration of adoption, expected benefits of ProFound AI®, the benefits of the Company’s products, and future prospects for the Company’s technology platforms and products. Such forward-looking statements involve a number of known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited, to the Company’s ability to achieve business and strategic objectives, the willingness of patients to undergo mammography screening, whether mammography screening will be treated as an essential procedure, whether ProFound AI will improve reading efficiency, improve specificity and sensitivity, reduce false positives and otherwise prove to be more beneficial for patients and clinicians, the impact of supply and manufacturing constraints or difficulties on our ability to fulfill our orders, uncertainty of future sales levels, to defend itself in litigation matters, protection of patents and other proprietary rights, product market acceptance, possible technological obsolescence of products, increased competition, government regulation, changes in Medicare or other reimbursement policies, risks relating to our existing and future debt obligations, competitive factors, the effects of a decline in the economy or markets served by the Company; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. The words “believe,” “demonstrate,” “intend,” “expect,” “estimate,” “will,” “continue,” “anticipate,” “likely,” “seek,” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. The Company is under no obligation to provide any updates to any information contained in this release. For additional disclosure regarding these and other risks faced by iCAD, please see the disclosure contained in our public filings with the Securities and Exchange Commission, available on the Investors section of our website at http://www.icadmed.com and on the SEC’s website at http://www.sec.gov.

CONTACTS

Media inquiries:

pr@icadmed.com

Investor Inquiries:

John Nesbett/Rosalyn Christian

IMS Investor Relations

icad@imsinvestorrelations.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BOARDWALK REIT PROVIDES OPERATIONAL UPDATE AND ANNOUNCES TIMING OF THIRD QUARTER RESULTS

CALGARY, AB, Oct. 3, 2024 /PRNewswire/ – Boardwalk Real Estate Investment Trust – BEI

Boardwalk REIT (“Boardwalk”, “the Trust”, “We”, “Our”) is providing an update highlighting the continued strong demand for affordable rental housing. The Trust’s average occupied rent continues to represent exceptional value at an average of $1,485 per month for August 2024, approximately 36% below the Canadian average listing rent of $2,310 for a two-bedroom apartment unit, as per the recent Rentals.ca September 2024 Rent Report. Edmonton, the Trust’s largest market, has an average listing rent for a two-bedroom apartment of $1,704, as per the same report.

Sam Kolias, Chairman and Chief Executive Officer commented:

“We commend our policymakers‘ focus on increasing housing supply to match the strong demand growth in Canada. This has resulted in increased supply and has begun to provide much needed balance in many Canadian markets with increased availability of higher priced newly-built supply as discussed in our previous conference calls.

Calgary is an example of a market where effective public policy encouraged supply growth to meet unprecedented demand growth through the reduction of red tape in development and by providing certainty on the negative impacts that price controls have for maintaining affordable housing. The recent increase in purpose-built rental supply in the downtown Calgary node provides increased balance and sustainability to the housing market while also preserving the high affordability and lifestyle advantage that Calgarians benefit from. The recent increase in supply helps provide affordable housing units to the market by freeing up additional units as some renters are able to move-up to newly delivered communities as they come online. Edmonton, the Trust’s largest market, remains amongst the most affordable in Canada, and a destination for housing affordability and lifestyle. We commend our policymakers in Alberta and Saskatchewan who continue to allow our open and competitive marketplace to deliver sustainable outcomes for all stakeholders.

Maintaining high occupancy remains a key priority for the Trust heading into the seasonally slower winter months. As a result, we have recently taken a more conservative approach on market rent adjustments to ensure strong occupancy, while our strategic self-moderation of rental adjustments over the last several years has positioned the Trust to continue to deliver strong revenue growth. The Trust continues to see renewal leasing spreads within its targeted 7-9% range on a year-over-year basis in Alberta heading into the latter part of 2024.

Our occupied rents of $1,485 are a reflection of the exceptional value and affordability our Boardwalk communities offer. There remains a significant mark-to-market opportunity across our portfolio and our Resident-first approach of being flexible with our Resident Members, and moderating adjustments continues to provide us with high occupancy of 98.1%, higher retention rates, strong NPS scores, lower turnover and higher margins. We continue to provide exceptional affordability and results, a win-win for all our stakeholders.”

Same Property Portfolio Occupancy

|

Oct-23 |

Nov-23 |

Dec-23 |

Jan-24 |

Feb-24 |

Mar-24 |

|

|

Same Property |

98.9 % |

98.9 % |

99.0 % |

99.0 % |

98.8 % |

98.8 % |

|

Apr-24 |

May-24 |

Jun-24 |

Jul-24 |

Aug-24 |

Sep-24 |

|

|

98.8 % |

98.6 % |

98.6 % |

98.6 % |

98.7 % |

98.4 % |

|

|

Oct-24 |

||||||

|

98.1 % |

1 Preliminary occupancy as of the first day of each month

Occupied Rent

|

Aug-23 |

Sep-23 |

Oct-23 |

Nov-23 |

Dec-23 |

Jan-24 |

|

|

Occupied Rent 2 |

$1,348 |

$1,357 |

$1,366 |

$1,375 |

$1,388 |

$1,398 |

|

Feb-24 |

Mar-24 |

Apr-24 |

May-24 |

Jun-24 |

Jul-24 |

|

|

$1,404 |

$1,418 |

$1,430 |

$1,444 |

$1,460 |

$1,477 |

|

|

Aug-24 |

||||||

|

$1,485 |

|

2 Occupied rent is a component of rental revenue and represents same properties only. It is calculated for occupied suites as of the first day of each month as the average rental revenue, adjusted for other rental revenue items such as fees, specific recoveries, and revenue from commercial tenants. September 2024 figure to be announced with Q3 Results. |

Timing of Boardwalk REIT’s Third Quarter Financial Results

Boardwalk REIT’s financial results for the three-month period ended September 30, 2024, will be released the evening of November 5, 2024.

We invite you to participate in the teleconference to be held to discuss these results the following day (Wednesday, November 6, 2024) at 11:00 am (Mountain),1:00 pm (Eastern). Senior management will speak to the results and provide a financial and operational update. The presentation will be made available on our website prior to the call (please visit: www.bwalk.com/investors).

Teleconference:

To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3XTW8Vw to receive an instant automated call back.

You can also dial direct to be entered to the call by an operator using the traditional conference call instructions below.

The telephone numbers for the conference are toll-free 1-888-510-2154 (within North America) and 437-900-0527 (International).

Note: Please provide the operator with the below Conference Call ID or Topic when dialing in to the call.

Conference ID: 84448

Topic: Boardwalk Real Estate Investment Trust, 2024 Third Quarter Results.

Webcast:

Investors will also be able to listen to the call and view the slide presentation by visiting www.bwalk.com/investors on the morning of the call. An information page will be provided for any software and system requirements. The live webcast will also be available by clicking below:

Boardwalk REIT Third Quarter Results Webcast Link

Boardwalk to Attend Nareit’s REITworld 2024 Annual Conference

Boardwalk is pleased to share that it will be attending Nareit’s REITworld 2024 Annual Conference on Monday, November 18 and Tuesday, November 19, 2024.

Corporate Profile:

Boardwalk REIT strives to be Canada’s friendliest community provider and is a leading owner/operator of multi-family rental communities. Providing homes in more than 200 communities, with over 34,000 residential suites totaling over 29 million net rentable square feet, Boardwalk has a proven long-term track record of building better communities, where love always livestm. Our three-tiered and distinct brands: Boardwalk Living, Boardwalk Communities, and Boardwalk Lifestyle, cater to a large diverse demographic and have evolved to capture the life cycle of all Resident Members. Boardwalk’s disciplined approach to capital allocation, acquisition, development, purposeful re-positioning, and management of apartment communities allows the Trust to provide its brand of community across Canada creating exceptional Resident Member experiences. Differentiated by its peak performance culture, Boardwalk is committed to delivering exceptional service, product quality and experience to our Resident Members who reward us with high retention and market leading operating results, which in turn, lead to higher free cash flow and investment returns, stable monthly distributions, and value creation for all our stakeholders.

Boardwalk REIT’s Trust Units are listed on the Toronto Stock Exchange, trading under the symbol BEI.UN. Additional information about Boardwalk REIT can be found on the Trust’s website at www.bwalk.com/investors.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Information in this news release that is not current or historical factual information may constitute forward-looking statements and information (collectively, “forward-looking statements”) within the meaning applicable of securities laws. The use of any of the words “expect”, “anticipate”, “may”, “will”, “should”, “believe”, “intend” and similar expressions are intended to identify forward-looking statements. Implicit in these forward-looking statements, particularly in respect of Boardwalk’s objectives for its current and future periods, Boardwalk’s strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates, assumptions, intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations are estimates and assumptions subject to risks and uncertainties which could cause Boardwalk’s actual results to differ materially from the forward-looking statements contained in this news release. Specifically, Boardwalk has made assumptions surrounding the impact of economic conditions in Canada and globally, Boardwalk’s future growth potential, prospects and opportunities, the rental environment compared to several years ago, relatively stable interest costs, access to equity and debt capital markets to fund (at acceptable costs) the future growth program to enable the Trust to refinance debts as they mature, the availability of purchase opportunities for growth in Canada, general industry conditions and trends, changes in laws and regulations including, without limitation, changes in tax laws, mortgage rules and other temporary legislative changes, increased competition, the availability of qualified personnel, fluctuations in foreign exchange or interest rates, and stock market volatility. These assumptions, although considered reasonable by the Trust at the time of preparation, may prove to be incorrect.

![]() View original content:https://www.prnewswire.com/news-releases/boardwalk-reit-provides-operational-update-and-announces-timing-of-third-quarter-results-302266308.html

View original content:https://www.prnewswire.com/news-releases/boardwalk-reit-provides-operational-update-and-announces-timing-of-third-quarter-results-302266308.html

SOURCE Boardwalk Real Estate Investment Trust

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: Will Reinvesting My RMD Trigger Double Taxation?

If I am not spending all my required minimum distribution (RMD) money each year, can I roll some of this back into my stocks? If so, will I be taxed on the amount rolled back in? Would this be considered double taxation? If I’m only taxed on the additional interest this money generates when I reinvest it, how would this interest be calculated & kept track of? Also, would this extra income be better spent on some other investment, like real estate, considering that you can write off expenses?

-Karen

You can use your RMD money in any way you like, including reinvesting it in stocks. It would then behave like any other non-retirement investments you have. The RMD itself would not get taxed again, so there would be no double taxation. But if the new investments generated any income, that would be taxed.

Each year, you receive 1099s for any interest or dividends earned on securities or information about any securities that were sold. If you chose to invest directly in rental real estate, you would be taxed on any rental income in excess of expenses. Other real estate investment options would be taxed more like regular securities than direct ownership of rental properties.

Consulting with a financial advisor may help determine which investments would work best along with your existing investments and retirement accounts. Connect with a fiduciary advisor.

When You Don’t Need Your RMD

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

RMDs must be withdrawn from pre-tax retirement accounts whether you need or want to take the money out. Since that money has not yet been taxed, the IRS wants to make sure the withdrawals are taken and the money is finally taxed.

But what you do with your RMD money is totally up to you. Among the many options for that money you could:

-

Use it to pay regular expenses

-

Invest it

-

Contribute to a Roth IRA (if you have enough earned income)

-

Donate it directly to a charity as a qualified charitable distribution (QCD) and avoid RMD taxes (assuming the RMD is from an IRA)

-

Gift it to someone you love

-

Save it for a rainy day

There are no restrictions on what you do with your RMD after you’ve taken it, as long as you do take the required amount. (But if you need help planning for and managing your RMDs, connect with a financial advisor and see how they can help.)

Many Investment Options

Investing your RMD can be a great way to keep your money working for you. Before you decide how to invest it, review your entire portfolio to determine the best way to add value to your current holdings. You’ll also want to consider how soon you might want to use that money – your time horizon – since that can affect your investment choices as well.

Stocks offer the opportunity for growth, especially over the long term. Many corporations regularly pay dividends to their shareholders, which would increase your current income streams or could be reinvested. You can invest in stocks directly or through mutual funds or exchange-traded funds (ETFs). (A financial advisor can help you evaluate different investments and choose the best fits for your situation.)

Real estate can also be a lucrative investment, and it can be done in several ways. Along with buying properties to either rent or flip, you can also invest in real estate investment trusts (REITS), real estate funds or crowdfunded real estate.

-

REITs are similar to mutual funds and ETFs but hold dozens or hundreds of rental properties or mortgages, offering a diverse real estate portfolio with every share.

-

Real estate mutual funds or ETFs hold a variety of REITs and possibly other real estate focused securities (like construction industry stocks, for example).

-

Crowdfunding pools money from many investors to fund real estate projects or purchase private real estate investments that would otherwise be inaccessible to most investors.

REITs, real estate funds and crowdfunding offer the opportunity to invest in real estate with minimal cash outlay, which can be a more flexible financial choice.

How Investments Are Taxed

Investments get taxed only when you earn money from them. The form those earnings take depends on the type of investment. For example, stocks may provide dividend income, bonds provide interest income and rental properties generate rental income. In addition to those ongoing earnings, investments will also be taxed when you sell them for a profit.

When you buy any investment, the total amount you pay for that investment counts as your basis. The basis is used to calculate any gains or losses when the investment is eventually sold. That means you won’t pay tax on the amount you invested, just the extra money you receive when you sell it.

For example, if you bought some stock for $10,000 and later sold it for $12,000, you would only pay tax on the $2,000 profit. (If you need help planning around the taxes that you’ll pay on investments, consider speaking with a financial advisor.)

Tax Benefits of Direct Real Estate Investments

Investing in rental properties offers a unique opportunity to generate positive cash flow and tax losses. That’s due to the wide variety of expense write-offs that rental properties offer. Landlords can deduct expenses directly linked to the property along with the costs of running this business.

Common real estate tax write-offs include:

-

Mortgage interest

-

Property insurance

-

Property taxes

-

Management fees

-

Repairs and maintenance

-

Advertising for tenants

-

Legal fees

-

Accounting fees

Along with these cash-intensive expenses, rental properties are also subject to depreciation. That allows you to deduct a portion of the cost of the property every year, increasing the write-offs. These expenses offset the rents that are collected and reduce the taxable income the investment generates. (If you’re looking to invest in rental properties, a financial advisor can help you plan for doing so.)

Bottom line: Reinvesting your RMD can provide the potential for additional growth and income in retirement. Evaluating your portfolio, especially with input from a trusted financial advisor, can help you figure out which types of investments will be most suitable for your situation.

Tips for Finding a Financial Advisor

-

If you need help finding and choosing a financial advisor, start by assessing your needs and goals. Perhaps you’re seeking help selecting investments or managing restricted stock units (RSUs) that your company has granted. Or maybe you’re looking for comprehensive financial planning services. Evaluating your needs and objectives can help you determine what services the advisor you hire will need to provide.

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Michele Cagan, CPA, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column. Questions may be edited for length and clarity.

Please note that Michele is not a participant in the SmartAsset AMP platform, nor is she an employee of SmartAsset. She was compensated for this article.

Photo credit: ©iStock.com/Andrii Dodonov, ©iStock.com/shapecharge

The post Ask An Advisor Can I Reinvest My RMD in Stocks or Real Estate? I Worry About Double Taxation appeared first on SmartReads by SmartAsset.

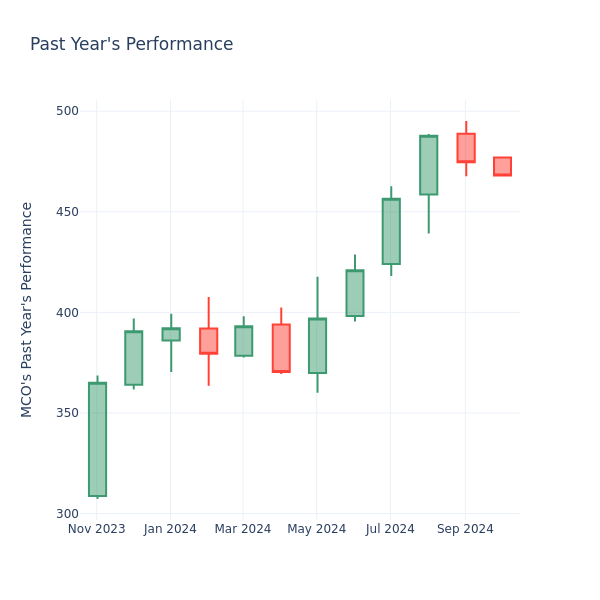

Price Over Earnings Overview: Moodys

Looking into the current session, Moodys Inc. MCO shares are trading at $467.97, after a 0.47% drop. Over the past month, the stock decreased by 3.28%, but over the past year, it actually increased by 47.57%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company’s price-to-earnings ratio.

How Does Moodys P/E Compare to Other Companies?

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of 42.89 in the Capital Markets industry, Moodys Inc. has a higher P/E ratio of 46.46. Shareholders might be inclined to think that Moodys Inc. might perform better than its industry group. It’s also possible that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

4 Top Dividend Stocks Yielding at Least 4% to Buy Without Hesitation This October

Dividend stocks can be powerful investments. They’ve historically outperformed the market with lower volatility. The biggest driver of that outperformance is dividend growth.

Brookfield Renewable (NYSE: BEP)(NYSE: BEPC), Oneok (NYSE: OKE), NNN REIT (NYSE: NNN), and Alexandria Real Estate Equities (NYSE: ARE) stand out for their ability to pay dividends. They offer higher payouts, all with more than a 4% yield, compared with the sub-1.5% average of the S&P 500, and they’ve steadily increased those payouts. With more dividend growth ahead, you shouldn’t hesitate to buy them this month.

Powerful growth ahead

Brookfield Infrastructure currently yields around 4.4%. The global renewable energy producer has grown its payout at a 6% compound annual rate over the last two decades. It expects that growth to continue. It’s targeting to deliver 5% to 9% annual dividend growth over the long term.

The company already has all of the power needed to support its dividend growth plan for the next several years. A combination of inflation-driven rate increases, margin enhancement activities, and development projects should fuel 8% to 13% annual funds from operations (FFO) per share growth through 2029. That growth is highly visible and largely secured. Meanwhile, accretive acquisitions will enhance its growth profile and ability to increase its payout.

Ample fuel to continue increasing the dividend

Oneok also offers a dividend yield of around 4.4%. The pipeline giant has delivered over a quarter century of dividend stability and growth. While it hasn’t increased its payment every year, it has grown its dividend at a peer-leading rate of more than 150% over the past decade.

The company currently plans to increase its dividend by 3% to 4% annually over the next several years. Acquisitions are the main factor fueling that outlook. The company closed its transformative transaction to acquire Magellan Midstream Partners last year. That deal will add an average of 20% to its free cash flow per share through 2027. Meanwhile, it recently agreed to buy Medallion Midstream and a large stake in EnLink Midstream for $5.9 billion. The deal will be immediately accretive to its free cash flow, further enhancing its ability to increase its dividend.

An elite REIT

NNN REIT currently yields around 4.8%. The real estate investment trust (REIT) recently achieved a key dividend milestone. It has increased its payment for 35 straight years. It’s one of only three REITs and less than 80 publicly traded companies that have reached this landmark.

The REIT completes a steady diet of accretive acquisitions each year to drive its rising dividend. It buys freestanding retail properties net leased to growing national and regional retailers across many categories, like automotive service locations, convenience stores, and restaurants. It builds relationships with its tenants, which provides it with new acquisition opportunities as they expand. Over 70% of its acquisition volume since 2007 has been from existing relationships. With a strong balance sheet and tenant base, the REIT should be able to continue growing its portfolio and shareholder payout in the future.

A very healthy dividend

Alexandria Real Estate Equities has a dividend yield of around 4.4%. The REIT has steadily grown its payout over the years, including by a 5.4% compound annual rate since 2020. It has a low dividend payout ratio of 55% of its FFO, allowing it to retain significant cash to reinvest in growing its portfolio.

The office REIT focuses on life science properties, which are in high demand. It has an extensive pipeline of development projects currently under construction, providing lots of visibility into its future earnings growth. Alexandria has a fortress-like balance sheet, evidenced by a credit rating that’s in the top 10% of all publicly traded REITs. That gives it ample financial capacity to continue expanding its portfolio and dividend.

Top-notch dividend growth stocks

Brookfield Renewable, Oneok, NNN REIT, and Alexandria Real Estate Equities all offer dividend yields above 4%. They also have excellent records of increasing their payouts, which seems likely to continue. You can confidently buy these dividend stocks this month.

Should you invest $1,000 in Brookfield Renewable Partners right now?

Before you buy stock in Brookfield Renewable Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Matt DiLallo has positions in Brookfield Renewable and Brookfield Renewable Partners. The Motley Fool has positions in and recommends Alexandria Real Estate Equities and Brookfield Renewable. The Motley Fool recommends Brookfield Renewable Partners and Oneok. The Motley Fool has a disclosure policy.

4 Top Dividend Stocks Yielding at Least 4% to Buy Without Hesitation This October was originally published by The Motley Fool

Costco fans already love their gold and silver bars. Now here comes another precious metal

Costco Wholesale (COST) is getting further into the precious metals business. While gold bars and silver coins have previously been top of mind for shoppers, the retailer is now adding a third precious metal: platinum.

Costco is selling the one-ounce platinum bars for $1,089.99 on its website, alongside its popular gold bars and silver coins. The platinum bars are available for purchase online only to loyalty members. They cannot be delivered to Louisiana, Nevada, or Puerto Rico.

In April, the company struck gold — almost literally. At the time, Costco was reportedly raking in $200 million each month by selling gold bars, according to a research note from Wells Fargo (WFC).

Costco started selling its gold bars last September for $2,000 a pop. By late January, it began to offer one-ounce silver coins in a package of 25 for $675.

The company recently reported strong quarterly earnings, which were fueled primarily by its e-commerce business, including categories such as: appliances, home furnishings, gift cards, and gold and silver.

Gary Millerchip, Costco’s chief financial officer, told investors during the company’s Sept. 26 earnings call that Costco has been helping customers by maintaining low prices on essential items such as chicken, macadamia nuts, Spanish olive oil, and two-pack baguettes.

“We want to be the first to lower prices and the last to raise prices,” Millerchip said.

The commitment to low prices comes, however, as Costco raises its membership fee for the first time in seven years. As of Sept. 1, individual memberships now cost $65, up from $60, while executive memberships increased to $130 from $120.

Millerchip said the timing of the membership hike was “very deliberate,” noting that the two-year delay was partly due to the impact of COVID-19 and rising inflation. Costco typically raises its membership fee every five years.

Warren Buffett Is Selling Apple Stock and Buying This Magnificent Oil Stock Instead

Warren Buffett finally did it. After making a monster investment in Apple (NASDAQ: AAPL) many years ago and watching it appreciate by multiples of his cost basis, the legendary investor is trimming Berkshire Hathaway‘s (NYSE: BRK.B) stake. According to filings with the SEC, Buffett has sold approximately half of Berkshire’s stake in Apple, raising around $80 billion in cash. Yes, that’s how big a winner Apple was for the company.

What is he doing with all this cash? The largest stock purchase for Berkshire Hathaway in the second quarter was Occidental Petroleum (NYSE: OXY). Here’s why he is selling Apple and buying this oil stock instead.

Expanding Apple valuation

Apple has made its investors a fortune over the last few decades. After releasing the revolutionary iPhone — perhaps the most successful single product in history — its stock has generated huge returns for shareholders. Total return in the last 10 years alone is close to 1,000%.

While that is all fine and dandy, today the company is seeing stagnating revenue growth amid market saturation for smartphones. Revenue has essentially been flat over the last few years as fewer people have upgraded to new iPhones, which is the only true needle mover for the company. It has struggled to innovate and convince people to buy new phones while battling a consumer recession in China. Recent products such as the Apple Vision Pro look like flops so far, and the company has fallen behind in artificial intelligence to competitor Alphabet.

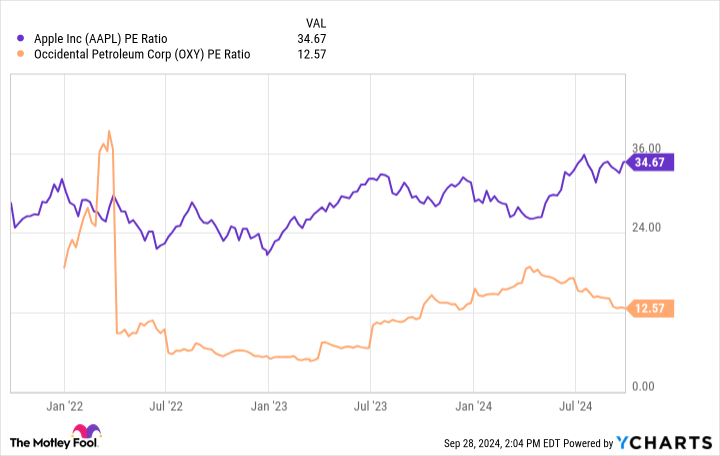

Stagnating sales are coupled with an expanded earnings multiple. Apple’s price-to-earnings ratio (P/E) is now closing in on 35, which is wildly expensive for a low-growth business. Given Buffett’s intense focus on valuation in his investment process, it is no surprise to see him unloading his shares in the iPhone maker. The upside doesn’t look too appetizing at these levels.

A cheap oil stock?

Buffett’s biggest purchase last quarter was in Occidental Petroleum. Berkshire Hathaway owns a whopping 27.25% of Occidental’s outstanding shares, making it the largest shareholder by far in the company.

Why is Buffett attracted to the stock? First and foremost is the valuation. Oil and gas companies have been neglected by investors for years as they focus on exciting technology companies. Occidental Petroleum trades at a P/E of 12.6, which is around one-third that of Apple. The company is one of the largest oil producers in the United States, with over 82% of its production coming from domestic sources. This makes it less risky than other oil companies that have to deal with adversarial foreign governments.

Occidental can also play as a hedge for oil prices. Rising oil prices can be inflationary and affect other parts of the economy and the Berkshire Hathaway portfolio. If oil prices rise, Occidental Petroleum will benefit, but likely hurt the earnings power of Berkshire’s railroad subsidiary by increasing input costs. This way, Berkshire Hathaway is playing both sides of the situation. No matter what happens, it comes out on top.

Even better for Buffett, Occidental trades at a cheap P/E when oil prices are falling. The current level for crude oil is $68 a barrel, which is well off the highs of around $100 a barrel or higher in 2022. If the price of oil starts to rise again, Occidental’s earnings power will rise too.

A lesson in the risk-free rate

With his selling of Apple and buying of Occidental Petroleum, Buffett is giving investors an important lesson in the risk-free rate and how it can affect your investing decisions.

Today, Berkshire Hathaway has a cash pile approaching $300 billion sitting in short-term U.S. Treasury bills. These bills earn around 5% in yield every year and can be considered the risk-free rate for investors. Why? Because you can compare them to the earnings yield of other stocks in your portfolio.

An earnings yield is the inverse of the P/E and tells you how much in earnings you are yielding each year from a company, based on the current stock price. Apple’s earnings are not growing, and it has a P/E of close to 35. Invert that P/E, and you have an earnings yield of 2.9%. Buffett is saying he would rather own Treasury bills than get a 2.9% yield owning Apple stock.

But what if we look at Occidental Petroleum’s earnings yield? Take one divided by 12.6, and its earnings yield is 7.9%. That is much higher than the current Treasury yield. While it’s not the entire story for any stock, comparing the earnings yield to the risk-free rate is a good way to gauge whether you should buy the stock. This likely came into consideration when Buffett was selling Apple and buying shares of Occidental Petroleum.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett Is Selling Apple Stock and Buying This Magnificent Oil Stock Instead was originally published by The Motley Fool

Market Digest: MCK

Summary

Big Finish to the Third Quarter as Election Looms: Our Monthly Survey of the Economy, Interest Rates, and Stocks The stock market wrapped a strong third quarter in which the S&P 500 rose 5.5%. But the focus now shifts. The 2024 presidential election, which is less than 40 days away, has been far from static. Both parties chose their nominees long ago and the battle between Joe Biden and Donald Trump appeared to be set. Yet the months leading up to the election have been full of twists and surprises. Former President Trump was grazed by a bullet in the first of two assassination attempts, and following a disastrous debate performance, President Biden ceded the nomination to Vice President Kamala Harris with the backing of most of the Democratic Party. Notably, neither the Trump-Biden debate nor the Harris-Trump debate had much of a lasting impact on the polls, most of which remain locked within a margin-of-error difference. The two candidates are behaving like, well, candidates, seeking to outdo each other with promised tax cuts and breaks without explaining how they plan to pay for such largesse. The race likely will come down to a handful of in-play states. Depending on down-ticket Senate and House races, the winner may or may not have a mandate to enact his or her party’s agenda. The Fed has started cutting interest rates and may cut again in November; there will be additional and important nonfarm payrolls data and inflation reports; and the third-quarter 2024 earnings season will get underway with perhaps the strongest annual EPS growth in 10 quarters. Yet all of that will take a back seat amid the intensifying atmosphere leading into Election Day. The Economy, Interest Rates, and Earnings The broadest measure of the U.S. economy, Gross Domestic Product (GDP), appeared to show a healthy and accelerating economy as of mid-year. The final (third of three) report of second-quarter GDP mirrored the preliminary report, and appears to indicate a normally growing economy. The highlight of the quarter was the recovery in consumer spending from depressed first-quarter levels. Note that historical GDP data were recently revised for all quarters and years from the first quarter of 2019 through the first quarter of 2024. The final report of second-quarter GDP showed growth of 3.0%, nearly double the 1.6% growth rate (revised higher from 1.4%) reported for 1Q24. The revision between preliminary 2Q GDP and final 2Q GDP growth reflected upward revisions in private inventory investment and federal government spending, offset by downward revisions to non-residential fixed investment and exports. The increase in second-quarter 2024 GDP primarily reflected increases in personal consumption expenditures, private inventory investment, non-residential fixed investment, and total government spending. These gains were partly offset by a decline in residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased and exceeded exports. Personal consumption expenditures for 2Q24 increased 3.0%, up from 1.9% for 1Q24 and 2.5% for all of 2023. Spending on goods increased 3.0% in 2Q24, after falling 1.2% in 1Q24. Durable goods spending rebounded by a sharp 5.5% in 2Q24, after declining 1.8% in the prior quarter. Durable goods spending was up 3.9 % for all of 2023. Non-durable goods spending also bounced back, rising 1.7% for 2Q24 after declining 0.8% for 1Q24. The decline in annual inflation growth has been concentrated mainly in goods, while services inflation remains somewhat elevated. Consumers now appear more willing to buy goods at stable, or in some cases lower, prices. Consumer spending on services grew 2.7% in 2Q24, and was the one component of PCE that declined from the first quarter. Consumer spending on services grew 3.4% in 1Q24. Some of the growth in consumer services spending has been driven by rent equivalent and insurance, two costs consumers cannot control and many cannot avoid. Assuming the weak trend in 1Q24 consumer spending showed the consumer under siege from inflation, the bounce-back in second-quarter consumer spending suggests that consumers are adapting to structurally higher prices. We expect PCE within the GDP accounts to continue to send conflicting signals, with goods spending more volatile than services. Non-residential fixed investment, the proxy for corporate capital spending, rose at a 3.9% annual rate in 2Q24, after rising at a 4.5% annual rate in 1Q24 and at a 6.0% rate in 2023. For 2Q24, spending on equipment increased in high-single-digit percentages, while intellectual property and structures spending was little changed. PCE and non-residential fixed investment represent about four-fifths of gross domestic product in any quarter. In 2Q24, consumer spending added 1.90 percentage points to GDP, while non-residential fixed investment added 0.53 percentage points. Residential fixed investment, which surprised with 13.7% growth in 1Q24, dropped back into negative territory, declining 2.4% in 2Q24. The export-import balance heavily favored imports in 2Q24, as it did in 1Q24. Exports grew 1.0% in 2Q24, while imports were up 7.6%. Given the higher dollar value of imports, the net exports-imports balance subtracted nearly a percentage point (90 basis points) from overall 2Q24 GDP growth. We expect this category to remain volatile quarter over quarter. Another volatile element in GDP has been the change in private inventories. This category added 105 basis points (bps) to GDP in 2Q24, after subtracting 49 bps from 1Q24 GDP growth and 42 bps from 2023 growth. Disruptions in the distribution channel began with the trade and tariff wars of 2017-2020 and worsened with the supply-chain crisis in 2021-2022 and the supply-chain glut in 2023. As these effects begin to fade, the change in private inventories may shed the excessive volatility in this series that has prevailed since the pandemic. Sharply higher tariffs under a new administration, however, could be another potentially disruptive factor. Overall government spending was up 3.1% and added just over one-half percentage point to GDP growth. Federal spending was revised up to 3.3% growth in 2Q24 after declining 0.4% in 1Q24. State and local government spending grew 2.3%. The price index for gross domestic purchases increased 2.5% in 2Q24, compared with a revised increase of 3.1% in 1Q24. And the PCE price index advanced 2.5%, down from 3.4% in 1Q24. The core PCE index of 2.8% also came down from 3.7% for 1Q24. Higher GDP with lower price increases in 2Q24 marked a real improvement from 1Q24. Outside the generally strong GDP accounts, the economic picture is mixed. U.S. economic indicators generally suggest deceleration, although growth continues at a subdued level. The consumer economy continues to send mixed signals, with jobs and wages still growing — but at a meaningfully slower pace. The U.S. economy generated 142,000 new jobs in August, below the consensus call of 160,000. Reflecting soft July and June data, the trailing three-month nonfarm payrolls average is down to 116,000 as of this writing, well below the 12-month average of 202,000. While growth in new jobs continues to slow, multiple indicators of the employment economy — including the unemployment rate, wage growth, and the average work week — improved in August from July levels. The unemployment rate ticked down to 4.2% in August 2024 from a multi-year high of 4.3% in July; unemployment was 3.8% a year earlier in August 2023. Average hourly earnings increased 14 cents month to month for August and were 3.8% higher year over year, versus 3.6% for July. Annual wage growth continues to run above inflation, but the premium has narrowed. In August, the Bureau of Labor Statistics within the Department of Labor reported revised data showing 818,000 fewer nonfarm payroll jobs than initially reported for the trailing one-year period. From April 2023 through March 2024, the economy added about 2.1 million new jobs — 30% fewer than the initially reported 2.9 million. Most industries reported downward revisions, with notably lower levels in information services, professional & business services, and mining & logging. Transportation & warehousing was the only category to be revised higher, indicative of our increasing reliance on e-commerce. The consumer seems slightly more optimistic, or perhaps reconciled to higher prices. Retail sales for August edged up 0.1% month over month, after a 1.1% surge in July. On a year-over-year basis, retail sales were up 2.1% in August, compared with 2.9% annual growth reported for July 2024. Annual growth as of August 2024 was particularly strong for health and personal care items, non-store (online) retail, and gasoline & vehicle parts. Purchasing managers across the industrial economy remain cautious. ISM’s manufacturing PMI came in at 47.2% for August 2024, up from 46.8% for July 2024 though still in contraction territory (below 50) for the twenty-first time in the past 22 months. ISM’s services PMI was at 51.5% in August, up slightly from 51.4% in July. Services PMI slipped into contraction territory in June, but has since rebounded; this series has been in positive territory in seven of the eight months reported in 2024. The services economy is significantly larger than the manufacturing economy, and continued strength in this category is vital to ongoing economic growth. Industrial production in August rose 0.8%, rebounding from a 0.9% decline in July. Capacity utilization in August grew to 78.0% from 77.4% for July, but remains two percentage points below the long-run average. Straddling the commercial and consumer economies is housing. Consistent with the negative residential fixed investment data from 2Q24 GDP, the housing economy continues to struggle. Based on SAAR (seasonally adjusted annual rate), both new and existing home sales are running at less than two-thirds of peak pandemic levels. The Fed’s first interest-rate cut in four years, however, has started a process that finally may reignite the housing sector. Pent-up Millennial cohort demand for housing has coincided with Baby Boomers locked into too-large homes by a low mortgage rate. Rates on a 30-year fixed mortgage as of late-September 2024 were down nearly a full point from the 2024 peak in the 7.25% range. Still, rates remain high by historical standards. Following second-quarter strength, Argus’ Director of Economic Research Chris Graja, CFA, raised the Argus forecast for 2024 GDP growth to 1.9% from a prior 1.7%. Following second-quarter strength, Chris expects quarterly GDP to grow in the sub-2% range in the third and fourth quarters. We expect GDP growth in the 2% range in 2025, with the economy strengthening into the second half as lower rates stimulate consumer and business activity. Given the overhang of high prices and interest rates, and with the consumer weary from years of inflation, our GDP growth forecasts for 2024 and 2025 are likely to remain volatile. We also continue to believe the U.S. economy can avoid recession in 2024 and 2025, as it did in 2023 and 2022. The central bank started its rate-hiking campaign in March 2022. Sixteen months and more than five percentage points later, the Fed halted in July 2023; and it held rates steady for eight consecutive meetings. Finally, at its mid-September 2024 FOMC meeting, the Fed cut interest rates. Weariness with inflation has given way to worries about recession. At the beginning of the central-banking rate-hiking campaign, investors feared that the fed was ‘behind the curve’ in its fight against inflation. With inflation down to within less than a point of the Fed’s 2% target, that now seems like the last war. Investors again fear that the Fed is ‘behind the curve,’ this time in its need to cut rates before the U.S. tips into recession. The Fed famously has a dual mandate that seeks to maintain pricing (inflation) at a reasonable growth rate of 2%, while simultaneously promoting maximum employment. The balance of risks, investors had come to believe, had shifted away from inflation and toward concerns about the jobs economy. On Wednesday 9/18/24, the U.S. Federal Reserve Bank cut the fed funds rate by 50 basis points. The last time the Fed cut rates was more than four years again in 2020, amid the turbulence and extraordinary circumstances of global COVID-19 pandemic. Normally, the Fed cuts rates when growth is slowing and the economy is at risk of slipping into recession. This time, the Fed has started its rate-cutting cycle at a time when GDP is growing, companies are reporting solid earnings growth, the workforce is close to full employment, and annual wage growth is higher than annual inflation growth. The 9/18/24 post-meeting comment from the Fed sought to provide reassurance on the health of the economy, noting that recent indicators suggest economic activity has ‘continued to expand at a solid pace.’ But Fed officials acknowledge that job gains have slowed, and the unemployment rate has moved higher. The FOMC believes that risks to achieving its employment and inflation objectives are ‘roughly in balance.’ Given these factors, the FOMC decided to lower the target range for the fed funds rate by half a percentage point, to 4.75%-5.0%. Heading into the meeting, the futures market appeared to be anticipating a 50-bps cut. The consensus of economists and market strategists, on the other hand, indicated expectations for a 25-bps cut. The thinking of many economists was that a 50-bps cut would send the message that the patient (the U.S. economy) needed some serious medicine; and serious medicine is only administered when the patient is really sick. Yet the FOMC under Chairman Powell has shown itself unafraid of aggressive action when such action appeared to be needed. The Powell-led Fed in summer through fall 2022 hiked interest rates in 75-basis-point increments four straight times. The FOMC was uniform in its belief that 50 bps was the appropriate cut with 11 of the 12 FOMC members voting for the 50-bps cut. Reversals in Fed policy, and particularly the move from raising rates to cutting rates, often come at a fraught time for the economy. In those periods, the economy is seen as vulnerable to too little stimulus, while inflation is at risk of returning from too much stimulus. In our view, Mr. Powell has maintained a calm manner in addressing the dual mandate, a necessary tone in the shift from restrictive to accommodative monetary policy. The Fed’s preferred inflation gauge, the core PCE price index, rose 0.1% in August and was up 2.7% year over year. The monthly increase was the lowest since early 2021. The annual change was up 0.1% from the July reading, which had been the lowest annual rate of change the core PCE price index since March 2021. The core PCE data confirmed inflation inputs from the August CPI report issued in mid-September. The all-items CPI rose 0.2% month over month in August, flat with July. On an annual basis, the August all-items CPI was up 2.5%, sharply down from 2.9% in July and 3.0% in June. Core CPI was up 0.3%, and the annual change in core CPI was 3.2%, level with July. Goods inflation has come off markedly, while inflation in services is still stubbornly high. The index for shelter rose 0.5% month over month in August and was the ‘main factor’ in the increase in all-items CPI, according to the Bureau of Labor Statistics. Late in March 2022, the two-year U.S. Treasury note yield first moved above the yield on the 10-year Treasury. The twos-10s spread remained inverted though July 2024. Now, the yield curve is normally sloped for the first time in two and a half years. The 10-year Treasury yield was 3.75% as of the end of September, compared with 3.91% as of the end of August; the cycle peak for the 10-year yield was at the 4.9% level in October 2023. The two-year Treasury yield was 3.55% as of the end of September, down from 3.91% as of the end of August and the peak level of 5.2% as of October 2023. Argus expects short-term yields to move lower from current levels; long yields may not move higher, but they are expected to widen their relative premium to short yields. While we have likely seen the end to twos-10s inversion in this cycle, two- and 10-year yields could remain in proximity in the near term. Argus Fixed Income Strategist Kevin Heal is modeling two additional quarter-point rate cuts in 2024, one at the November and one at the December FOMC meetings. Note that the November FOMC meeting occurs post-election. These cuts, if enacted, would bring the Fed’s central tendency to the 4.25%-4.50% level by year-end. On a preliminary basis, Argus’ fixed-income strategy anticipates three additional quarter-point cuts in 2025, bringing the central tendency to 3.50%-3.75% by December 2025. The Fed is expected shape its accommodative policy, according to Kevin, based on the state of the economy in 2025. First-quarter 2024 earnings outpaced expectations, but were below the double-digit growth that prevailed during the pandemic and immediate post-pandemic era. Second-quarter 2024 earnings from continuing operations are up by high-single-digit to low-double-digit percentages, according to our vendor survey. Along with GDP growth, second-quarter earnings represent a bulwark against growing recession concerns. After S&P 500 companies reported results, second-quarter 2024 earnings from continuing operations were up 11.5% compared with 2Q23 EPS, according to FactSet, and up 12.9% according to Refinitiv. According to Bloomberg, 2Q24 earnings are up 12.5% on a share-weighted basis and 16.5% on a market-cap-weighted basis. This premium of market-cap-weighted to share-weighted EPS growth is reflective of the earnings outperformance of large-capitalization companies compared with small- and mid-caps. An unusually high percentage of companies (more than 25%) reported negative earnings for 2Q24. The average EPS decline for the negative-earnings group, which is heavily weighted in Energy, Materials, and Real Estate, is 16%. For the 75% of companies reporting positive EPS, average earnings growth is a robust 22%. A key reason investors are optimistic about second-half 2024 earnings growth is that the negative drag from Energy, Materials, and Real Estate is expected to diminish in 3Q24 and potentially reverse in 4Q24. At the sector level, the strongest earnings growth came from Financial, Information Technology, and Utilities — all up in high-teen to low-twenties percentages year over year. Other sectors reporting positive EPS growth include Communication Services, Healthcare, Consumer Discretionary, Consumer Staples, and Industrial, in descending order. As noted, Energy, Materials, and Real Estate were all down; Materials was off in high single digits, while Energy and Real Estate earnings were down 20%-21% from a year earlier. According to Argus President John Eade, our stock-bond barometer is near equilibrium. A key risk to valuations would be earnings growth failing to meet the market’s targets and/or inflation or interest rates ticking higher. Either of those factors would result in elevated valuations, but represent modest risks. Domestic and Global Markets At times during the third quarter, the strong stock-market gains compiled in the first half of 2024 appeared at risk of dissipating. Both July and August had strong sell-offs but rallied to post wins. Since 1980, September has been the worst month for the S&P 500, with an average decline of over 1%; the number-two worst month, August, has averaged a fractional decline since 1980. September 2024 started with steep selloffs, yet ended with a 2.0% gain on the S&P 500 to cap a 5.5% gain for the full quarter. For the first quarter of 2024, the S&P 500 was led by the growth stocks. That changed in 2Q24 as sector rotation away from growth leadership got underway. The third quarter featured significant rotation away from growth sectors and toward areas with cyclical or defensive characteristics. These trends also are playing out at the individual index level. At the nine-month 2024 mark, the S&P 500 had delivered total return (with dividend) of 22.1%. The Nasdaq was close behind, up 21.8% on a total-return basis. In almost any year in which the overall stock market is up in solid double digits at the three-quarters mark, the Nasdaq typically has built a significant performance lead over the broad S&P 500. We believe the similarity in S&P 500 and Nasdaq performance in 2024 to date reflects heavy investor concentration in the so-called Magnificent 7 stocks, which lead both indices. Wilshire Large Cap Growth expanded its premium to Wilshire Large Cap Value to about 12 percentage points at quarter-end, from nine percentage points at the end of August. In the first half, this premium was in double-digit percentage points. With investors taking profits in t

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level