Spur Therapeutics Announces Oral Presentation Highlighting New Clinical Data for FLT201 in Gaucher Disease at Upcoming European Society of Gene & Cell Therapy (ESGCT) 31st Annual Congress

LONDON, Oct. 03, 2024 (GLOBE NEWSWIRE) — Spur Therapeutics, formerly Freeline Therapeutics, today announced that it will present updated clinical data from its GALILEO-1 first-in-human clinical trial of FLT201, its adeno-associated virus (AAV) gene therapy candidate for Gaucher disease Type 1, at the European Society of Gene & Cell Therapy (ESGCT) 31st Annual Congress being held October 22-25, 2024, in Rome, Italy.

Details of the oral presentation are below:

| Abstract Title: | Results from GALILEO-1, a First-In-Human Clinical Trial of FLT201 Gene Therapy in Patients with Gaucher Disease Type 1 |

| Session: | 3A – AAV Vectors as Tools in Gene Therapy of Rare Diseases – Recent Development to Improve Efficacy and Safety |

| Date & Time: | Wednesday, October 23 from 08:30-10:30 a.m. CEST (02:30-04:30 a.m. ET) |

| Presenter: | Francesca Ferrante, MD, Spur Therapeutics |

Additional details on the meeting can be found at the ESGCT 31st Annual Congress website.

About Spur Therapeutics

Spur Therapeutics is a clinical-stage biotechnology company focused on developing life-changing gene therapies for debilitating chronic conditions. By optimizing every component of its product candidates, Spur aims to unlock the true potential of gene therapy to realize outsized clinical results.

Spur is advancing a breakthrough gene therapy candidate for Gaucher disease and a potential first-in-class gene therapy candidate for adrenomyeloneuropathy, as well as a research strategy to move gene therapy into more prevalent diseases, including forms of Parkinson’s, dementia, and cardiovascular disease. Expanding our impact, and advancing the practice of genetic medicine.

Toward life-changing therapies, and brighter futures. Toward More™

For more information, visit www.spurtherapeutics.com or connect with Spur on LinkedIn and X.

Contact

Naomi Aoki

naomi.aoki@spurtherapeutics.com

+ 1 617 283 4298

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Skanska converts retail space into healthcare facility in New York, USA, for USD 84M, about SEK 880M

STOCKHOLM, Oct. 3, 2024 /PRNewswire/ — Skanska has signed two supplemental contracts with a healthcare client to renovate an existing retail building into a healthcare facility in New York, USA. These contracts total USD 84M to date, about SEK 880M, which will be included in the US order bookings for the third quarter 2024.

The project includes the renovation of an approximately 15,000 square meter, existing three-story building. The scope of work entails new exam rooms, consultation and staff offices for physician practices including gastroenterology, orthopaedics, cardiology/nuclear medicine and pulmonology.

A radiology department will include equipment such as MRIs and CTs, and the ambulatory surgery center will include spaces such as operating rooms, procedure rooms, as well as prep and recovery rooms. The building’s entire mechanical, electrical and plumbing systems and infrastructure will be replaced.

Construction is underway and is scheduled for completion in the fourth quarter of 2026.

For further information please contact:

Chris Mckniff, Communications Director, Skanska USA, tel +1 (347) 409 2719

Andreas Joons, Press Officer, Skanska Group, tel +46 76 870 75 51

Direct line for media, tel +46 (0)10 448 88 99

This and previous releases can also be found at www.skanska.com.

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/skanska-converts-retail-space-into-healthcare-facility-in-new-york-usa-for-usd-84m-about-sek-880m-302266408.html

View original content:https://www.prnewswire.com/news-releases/skanska-converts-retail-space-into-healthcare-facility-in-new-york-usa-for-usd-84m-about-sek-880m-302266408.html

SOURCE Skanska

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are You Richer Than Your Friends? Here's How To Tell Without Asking

Ever wonder if you’re doing better financially than your friends? It’s a common thought, but you can’t ask them for their bank balance.

So, how do you figure it out without making things awkward? Here’s a simple, no-guesswork method using statistics and data.

Don’t Miss:

The Age Factor: Where Do You Stand?

Your age plays a big part in how much wealth you’ve had time to build. Check out these median and mean net worth numbers for different age groups:

-

Under 35: Median: $39,040 | Mean: $183,380

-

35-44: Median: $135,530 | Mean: $548,070

-

45-54: Median: $246,700 | Mean: $971,270

-

55-64: Median: $364,270 | Mean: $1,564,070

-

65-74: Median: $410,000 | Mean: $1,780,720

-

75 and over: Median: $334,700 | Mean: $1,620,100

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

Your friends might be different ages or in different financial situations, but if you’re above the median for your group, you might be doing better than you think!

Homeownership: The Big Wealth Booster

Owning a home tends to put you ahead in the wealth game. Here’s how homeownership stacks up:

Homeowners: About $396,200 in net worth

Renters: Around $10,400

If you’ve bought a house and most of your friends are still renting, you’re likely in a stronger financial position.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

Does Education Pay Off?

When you meet up with your old classmates, you might notice that education can affect net worth. Based on Federal Reserve data:

No high school diploma:

Median net worth: $20,780

Average net worth: $137,580

High school diploma:

Median net worth: $73,890

Average net worth: $304,590

Some college:

Median net worth: $89,280

Average net worth: $374,010

College degree:

Median net worth: $308,800

Average net worth: $1,516,910

The average net worth for college graduates is over $1.5 million, more than four times the average for those with some college education.

Trending: General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50/share with a $1,000 minimum.

Where You Live Matters

Location is key. If you’re in a high-cost area like California or New York, you’re likely doing better than someone in a lower-cost state. But remember, a big salary in Los Angeles might not stretch as far as a modest one in a more affordable place like Texas.

Career Paths: Who’s Earning What?

Of course, your career choice can significantly impact your net worth. Here are some average salaries for different professions:

-

Doctors: The average physician salary across all specialties is $363,000.

-

Lawyers: The average lawyer salary is $163,770 per year.

-

Software Engineers: The average salary for a Software Engineer in the U.S. is $136,053.

-

Teachers: The average salary for teachers is $69,544 per year.

See Also: Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million with just $500.

The Stuff You Can’t See

Here’s the tricky part – you can’t always tell who’s wealthier just by appearances. That friend with the flashy car might have a mountain of debt, while someone living more modestly could be sitting on a nice nest egg.

Does It Really Matter?

Your financial journey is unique. Instead of stressing over whether you’re richer than your friends, focus on your progress. What matters is whether you’re building toward the life you want, not where you rank compared to everyone else.

True wealth isn’t just about money. It’s about having enough to live comfortably, enjoy life, and keep the stress over bills to a minimum. If you’re doing that, you’re already winning – no matter what anyone else’s bank account says.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Are You Richer Than Your Friends? Here’s How To Tell Without Asking originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Daniel Spence Executes Sell Order: Offloads $360K In PaySign Stock

Revealing a significant insider sell on October 3, Daniel Spence, 10% Owner at PaySign PAYS, as per the latest SEC filing.

What Happened: Spence’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 100,000 shares of PaySign. The total transaction value is $360,500.

As of Thursday morning, PaySign shares are down by 0.0%, currently priced at $3.67.

Delving into PaySign’s Background

PaySign Inc is a provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing designed for businesses, consumers, and government institutions. The Company creates customized, payment solutions for clients across industries, including pharmaceutical, healthcare, hospitality, and retail. The company’s revenues include fees generated from cardholder fees, interchange, card program management fees, transaction claims processing fees, and settlement income.

Understanding the Numbers: PaySign’s Finances

Revenue Growth: PaySign’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 29.8%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company maintains a high gross margin of 52.93%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): PaySign’s EPS is below the industry average. The company faced challenges with a current EPS of 0.01. This suggests a potential decline in earnings.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.12.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 24.43 is lower than the industry average, implying a discounted valuation for PaySign’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 3.81, PaySign’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 27.58, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Understanding Crucial Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of PaySign’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ViaDerma, Inc. Reports Strong Financial Results for Q2 2024, Achieving Positive Net Income and Significant Cash Flow Growth

LOS ANGELES, Oct. 03, 2024 (GLOBE NEWSWIRE) — ViaDerma, Inc. VDRM, an innovator in transdermal drug delivery and topical antibiotic products, announced its financial results for the second quarter and six-month period ending June 30, 2024. The company delivered a strong financial performance with notable revenue consistency, positive net income, and a robust increase in cash reserves.

Financial Highlights for Q2 2024:

- Revenue: ViaDerma maintained steady revenues of $300,191 for the first half of 2024, compared to $300,230 for the same period in 2023, showing resilience in its sales despite challenging market conditions.

- Net Income: The company achieved a net income of $54,008 for the six-month period, a significant improvement from the net loss of $75,576 reported during the same period in 2023. This turnaround reflects a positive shift in profitability, representing a 171.5% increase in earnings.

- Cash Reserves: Cash and cash equivalents surged to $826,175 as of June 30, 2024, a remarkable 7,972% increase compared to $10,243 at the end of 2023. This growth is attributed to enhanced cash flow from operations and improved financial management.

- Liabilities: The company reduced its total liabilities to $1,096,509, compared to $1,157,684 at the end of 2023, reflecting a 5.3% decrease in its debt burden.

The recent sale of 1 million units of its tetracycline-based topical antibiotic to Nigeria is not reflected in the financial results for Q2 2024. The first 500,000 units were shipped from the manufacturer in August 2024, with another 500,000 units scheduled for October 2024. The revenues from the August shipment will appear in the next quarterly report.

The report also highlighted ViaDerma’s continued progress in its operations, particularly with its lead product, Vitastem, an FDA-registered topical antibiotic that has gained significant market traction. This product continues to be met with strong customer acceptance and positive clinical outcomes, contributing to the company’s steady revenue stream.

ViaDerma is advancing its product pipeline with innovations in anti-aging skincare, pain management, hair-loss treatments, sexual wellness products and a CBD-based product targeting inflammation and conditions like nicotine addiction, fibromyalgia, and multiple sclerosis. The company is also strengthening its market presence by adopting a wholesale distribution model to boost sales and expand product availability in new regions, and exploring joint ventures with established pharmaceutical companies.

“We’re pleased with our strong Q2 results, which we believe marks the beginning of what we expect will lead to significantly higher growth for our Company,” said Dr. Christopher Otiko, President and CEO of ViaDerma.

About ViaDerma, Inc.

ViaDerma, Inc. VDRM is a publicly traded specialty pharmaceutical company committed to bringing new products to market and licensing its innovative transdermal drug delivery technology solutions to current leaders in the pharmaceutical industry in a wide variety of therapeutic areas. For more information, please visit: https://viaderma.com

Any forecast of future performance is a “forward looking statement” under securities laws. Such statements are included to allow potential investors the opportunity to understand management’s beliefs and opinions with respect to the future so that they may use such beliefs and opinions as one factor among many in evaluating an investment.

Contact information:

Investor Relations

Email: ir@viaderma.com

Phone: 310-734-6111

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stryker Stock Gains 18.6% YTD: What's Driving its Share Price?

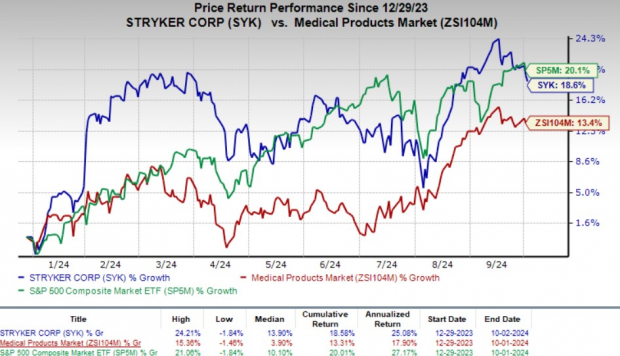

Stryker Corporation SYK has witnessed substantial gains in the year-to-date period. Shares of the company have rallied 18.6% compared with 13.4% growth of the industry. The S&P 500 Composite has risen 20.1% during the same time frame.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #3 (Hold) company appears to be a solid wealth creator for investors at the moment.

Headquartered in Kalamazoo, MI, Stryker is one of the world’s largest medical device companies operating in the global orthopedic market. The company has three business segments — Orthopaedics, MedSurg and Neurotechnology & Spine.

Strength in Stryker’s flagship Mako Total Knee Platform, which enables surgeons to do pre-operative planning and precise surgeries, looks promising. The company is also adopting several cost-cutting measures, including restructuring plans. Its prospects seem promising on the back of strong customer demand for its existing products as well as new launches. Stryker’s recent acquisitions also raise optimism about the stock.

Image Source: Zacks Investment Research

Catalysts for Stryker’s Growth

The surge in the company’s share price can be attributed to its advanced robotic arm-assisted surgery platform, Mako, a strong product lineup and strategic acquisitions. The positive sentiment, driven by a solid second-quarter fiscal 2024 performance and promising business potential, is expected to continue aiding it.

Stryker ended the second quarter on a high note, with both earnings and revenues showing year-over-year improvement. The company saw robust performance in the U.S. market, particularly in Instruments, Medical, Endoscopy, Trauma and Extremities, and Mako, which likely boosted the stock’s price.

SYK has increased its revenue and earnings forecasts for fiscal 2024, likely attracting investor interest. The company now anticipates organic revenue growth of 9-10% for fiscal 2024, up from the previous guidance of 8.5-9.5%. Adjusted earnings per share for 2024 are now expected to be between $11.90 and $12.10, indicating 12% growth at the midpoint compared with the earlier projection of $11.85-$12.05.

SYK’s extensive product range has also garnered investor optimism. Its broad product spectrum shields it from significant sales declines during economic downturns. The company’s vast experience in medical robotics, artificial intelligence and mechatronics has kept it at the forefront of the MedTech industry.

In August, SYK launched the Pangea Plating System, which received FDA clearance in late 2023. The Pangea System offers variable-angle plating for diverse patient demographics with a comprehensive and adaptable portfolio. With the Pangea System, Stryker has become a key partner for trauma-related products, including plates, nails and external fixation devices, supported by dedicated staff and excellent service.

In June, Stryker introduced the LIFEPAK 35 monitor/defibrillator, a device featuring advanced technology aimed at improving workflow efficiency and providing advanced clinical solutions for emergency responders and healthcare professionals. Additionally, the company launched the Gamma4 Hip Fracture Nailing System in Germany on June 4.

In addition to expanding organically, Stryker has bolstered its expansion by way of acquisitions. Last month, the company completed the buyout of Vertos Medical, a privately held company providing a minimally invasive solution for treating chronic lower back pain caused by lumbar spinal stenosis.As a result of the acquisition, Stryker is set to expand its minimally invasive pain management portfolio with differentiated treatments and expand its reach across ambulatory surgery centers.

In June, Stryker also acquired care.ai, a privately held company specializing in AI-assisted virtual care workflows, smart room technology and ambient intelligence solutions. The company closed the acquisition of NICO Corporation, a privately held company providing a systematic approach to minimally invasive surgery for tumor and intracerebral hemorrhage ICH procedures, in September.

SYK also announced the completion of the acquisition of MOLLI Surgical Inc., a privately held company specializing in the development of wire-free soft tissue localization technology for breast-conserving surgery, in August. In July, Stryker completed the previously announced acquisition of Artelon, a privately held company specializing in innovative soft tissue fixation products for foot and ankle and sports medicine procedures.

Risk Factors

As Stryker continues to acquire a large number of companies, which improves revenue opportunities, it is also likely to add to integration risks, putting gross and operating margins under pressure. Frequent acquisitions may affect the company’s balance sheet in the form of a high level of goodwill and intangible assets.

A negative change in exchange rates is also a threat to SYK’s core operations. The trend is likely to continue for the rest of 2024, though, at a slower pace. The company is also facing inflationary pressure, leading to lower margins.

A Look at Estimates

SYK’s EPS for fiscal 2024 and 2025 is projected to increase 13.2% and 12.1% to $12.00 and $13.45 on a year-over-year basis, respectively. The Zacks Consensus Estimate for EPS for fiscal 2024 and 2025 has remained stable over the past 30 days.

Revenues for fiscal 2024 and 2025 are anticipated to rise 9.2% and 7.8%, respectively, to $22.37 billion and $24.12 billion on a year-over-year basis.

Stocks to Consider

Some better-ranked stocks in the broader medical space are Universal Health Service UHS, Quest Diagnostics DGX and Baxter International BAX, each carrying a Zacks Rank #2 (Buy).

Universal Health Service has an estimated long-term growth rate of 19%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average being 14.58%.

Universal Health Service has gained 47% compared with the industry’s 47.7% rise so far this year.

Quest Diagnostics has an estimated long-term growth rate of 6.2%. DGX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 3.31%.

Quest Diagnostics shares have gained 12.3% so far this year compared with the industry’s 19% rise.

Baxter’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 3.74%.

BAX’s shares have declined 6.9% so far this year against the industry’s 13.3% growth.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

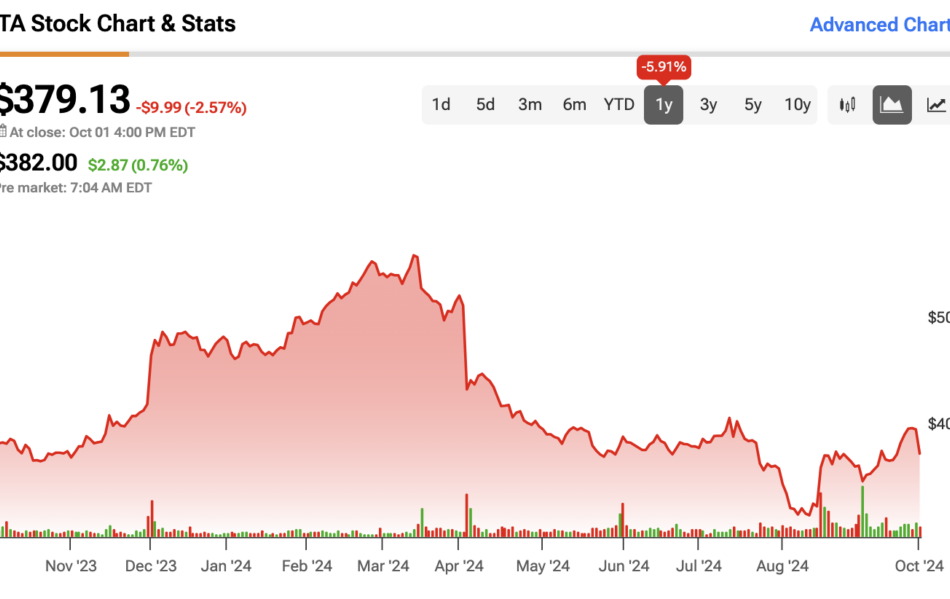

Ulta Plummets 32% From Highs, Presenting a Rare Investment Opportunity

Ulta Beauty (ULTA) has sustained a 32% drop from its 52-week highs, presenting a rare investment opportunity. As the leading specialty beauty retailer in the U.S., Ulta continues to post strong results despite a slowdown in sales growth, which has spooked some investors. In fact, the company remains highly profitable, keeps expanding its footprint, and returns tons of cash to shareholders. With shares now trading at compelling valuations and Warren Buffett recently taking a stake in the company, I believe Ulta offers a notable upside potential for long-term investors. Hence, I am bullish on the stock.

Investors Miss the Bigger Picture in Q2 Results

Ulta’s Q2 Fiscal 2024 results may have received a lukewarm response from the market, further fueling the cautious sentiment surrounding the stock. While net sales rose 0.9% year-over-year, reaching $2.55 billion, the market seems overly focused on the 1.2% dip in comparable sales, driven by a 1.8% decline in transactions. I understand why some might raise red flags over declining same-store sales, but I think this narrow focus misses the bigger picture. To me, the real story is Ulta’s ability to sustain its strength in a normalizing market, which only reinforces my bullish outlook on the stock.

In the Q2 earnings call, CEO Dave Kimbell emphasized that after experiencing an extended period of accelerated growth, the Beauty category is entering a normalization phase. Additionally, heightened competitive pressures in Prestige Beauty, particularly with the introduction of over 1,000 new distribution points by competitors in recent years, have challenged Ulta’s market share in key segments like Makeup and Hair Care. Despite these headwinds, the company’s overall positioning remains strong, especially as it expands its store count and digital capabilities.

Should Investors Be Worried About Revenue Deceleration?

Despite the 0.9% growth in Ulta’s net sales for Q2 marking a noticeable slowdown compared to previous quarters, I still remain bullish on the stock. In fact, Ulta’s top-line growth has recorded a sequential deceleration for 13 out of the last 14 quarters. However, I don’t find this deceleration overly concerning. According to Circana data, the beauty industry grew by just 3% in the first half of 2024, with mass beauty barely advancing. In this context, Ulta’s recent performance is relatively consistent with industry trends. It’s also critical to remember that the company is cycling against tough comps from 2022 and 2023, which saw quarterly growth rates from 20% to 65%.

In the meantime, Ulta has continued executing its expansion strategy, opening 17 new stores during the quarter (it also closed one, hence the 16 net) and ending the period with 1,411 stores. Along with strong digital sales and membership metrics, Ulta’s resilience as it traverses an evolving competitive landscape is quite evident. The company had 43.9 million active members at the end of the quarter, up 5% compared to last year, which should further support its top-line performance in the quarters ahead.

Profitability Remains Robust Despite Margin Pressures

Another important point to highlight, despite the current downturn in share prices, is that profitability remains a key factor for optimism. Although its gross margin fell to 38.3% from 39.3% a year earlier, the company remains highly profitable. The decrease was primarily driven by lower merchandise margins and higher store fixed costs, including payroll and benefits.

Yet, Ulta’s operating margin held a solid 12.9% despite these pressures. However, the company effectively demonstrated its ability to manage its cost structure, with its debt-free balance sheet providing additional support due to the absence of interest expenses and the contribution of interest income.

Valuation & Share Buybacks Signal a Buying Opportunity

Regarding its valuation, I view Ulta as one of the cheapest specialty retailers on the market. The company trades at a forward P/E of 17.4 times this year’s expected EPS, with earnings growth expected to rebound from next year. Given Ulta’s prolonged track record of revenue and earnings growth, as well as its clean balance sheet and aggressive capital return profile, I find today’s valuation multiple quite compelling.

Speaking of aggressive capital returns, Ulta repurchased $212.3 million worth of stock in Q2, pushing the total amount of repurchases over the past four quarters to $962.7 million. The company has now retired nearly 27% of its shares outstanding over the past decade, while $1.6 billion remains under its $2 billion repurchase authorization.

Warren Buffett Shows Confidence in Ulta

Warren Buffett’s Berkshire Hathaway ($BRK.A)($BRK.B) invested roughly $266 million in Ulta Beauty last month (now valued at around $269 million), which can naturally be seen as a strong endorsement of the company’s long-term potential. Known for identifying undervalued companies with solid fundamentals, I think Buffett’s investment shows trust in Ulta’s ability to endure near-term challenges while confirming the stock’s compelling valuation at today’s price levels.

Is ULTA Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Ulta Beauty maintains a Moderate Buy consensus rating based on 13 Buys, nine Holds, and two Sells assigned in the past three months. At $404.83, the average ULTA stock price target implies 4.22% upside potential.

If you’re unsure which analyst you can trust when you want to buy and sell ULTA stock, Christopher Horvers is the most accurate analyst covering the stock (on a one-year timeframe). He boasts an average return of 16.64% per rating and a 71% success rate. Click on the image below to learn more.

Key Takeaway

In conclusion, despite Ulta’s recent slowdown in sales growth and investor concerns over declining same-store sales, the company’s investment case remains compelling. Ulta keeps expanding its store footprint, maintaining solid profitability, and returning significant capital to shareholders through stock buybacks.

With Ulta’s valuations looking rather attractive at its current levels, a debt-free balance sheet, and Warren Buffett’s recent investment signaling confidence, I believe Ulta is well-positioned for noteworthy long-term returns.

Bullish Move: John Birchall Shows Confidence, Acquires $72K In Powell Industries Stock

John Birchall, Managing Director at Powell Industries POWL, disclosed an insider purchase on October 2, based on a new SEC filing.

What Happened: Birchall made a significant move by purchasing 400 shares of Powell Industries as reported in a Form 4 filing with the U.S. Securities and Exchange Commission. The transaction’s total worth stands at $72,856.

Powell Industries shares are trading up 2.69% at $237.84 at the time of this writing on Thursday morning.

Delving into Powell Industries’s Background

Powell Industries Inc is a United States-based company that develops, designs, manufactures, and services custom-engineered equipment and systems for electrical energy distribution, control, and monitoring. The company’s principal products comprise integrated power control room substations, custom-engineered modules, electrical houses, traditional and arc-resistant distribution switchgear and control gear, and so on. These products are applied in oil and gas refining, offshore oil and gas production, petrochemical, pipeline, terminal, mining and metals, light-rail traction power, electric utility, pulp and paper, and other heavy industrial markets. The company generates the majority of its sales from the United States.

Financial Insights: Powell Industries

Positive Revenue Trend: Examining Powell Industries’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 49.8% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: With a low gross margin of 28.37%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Powell Industries’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.85.

Debt Management: Powell Industries’s debt-to-equity ratio is below the industry average at 0.0, reflecting a lower dependency on debt financing and a more conservative financial approach.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 21.64 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.98 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 15.05 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Powell Industries’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is the Social Security Bridge Strategy Your Key to More Retirement Income?

When it comes to claiming Social Security, most retirees can’t wait to start collecting those checks. A 2020 report from the Bipartisan Policy Center found that more than 70% of Social Security beneficiaries currently claim their benefits before age 64. In fact, 29% of new retirees claimed their benefits before age 62 in 2022.

Delaying your benefits beyond full retirement age (FRA) will result in larger Social Security payments when the time comes to collect. A retirement strategy known as the Social Security bridge is one way to create an enlarged stream of guaranteed income without an annuity. Researchers at the Center for Retirement Research at Boston College recently examined this relatively unknown strategy and found that many workers would use it if given the opportunity.

A financial advisor can help you make a plan for creating stable and reliable income in retirement. Find a trusted advisor today.

The Social Security ‘Bridge’ Strategy Definition

The bridge strategy is a method for locking in higher lifetime Social Security benefits by using 401(k) assets as a stopgap. Instead of claiming Social Security immediately after leaving the workforce, a new retiree uses their 401(k) assets or other savings as a substitute for Social Security until age 70 when they can claim their largest possible benefit.

Delaying Social Security until the maximum claiming age (70) can increase a retiree’s benefits by 76% compared to claiming at age 62, according to Alica H. Munnell and Gal Wettstein of the Center for Retirement Research at Boston College. That’s because benefits increase by as much as 8% for every year they are delayed between FRA and age 70. On the flip side, claiming Social Security before reaching FRA diminishes a person’s benefit.

The bridge strategy capitalizes on this incentive and creates a larger stream of annuitized income.

“Using their 401(k) assets as a substitute for Social Security benefits when they retire – as a ‘bridge’ to delayed claiming – would allow participants, in essence, to buy a higher Social Security benefit,” Munnell and Wettstein wrote. “The potential for enhancing annuity income through Social Security is substantial, since the majority of retirees claim before their FRA and about 95 percent claim before age 70.”

And unlike a traditional annuity, Social Security benefits are adjusted annually for inflation to preserve a beneficiary’s purchasing power. Then again, a Social Security bridge may not be beneficial for people with shorter life expectancies. It will also reduce a person’s nest egg earlier in retirement and may diminish or completely deplete the inheritance they plan leave for loved ones.

Annuities vs. Social Security Bridge

An annuity is a contract you sign with an insurance company, whereby you pay a lump sum or make periodic payments in exchange for guaranteed payments at a later date. Although they are often considered expensive and complex, annuities can provide peace of mind to retirees who are worried they may outlive their savings.

“Although annuities would ensure higher levels of lifetime income, reduce the likelihood that people will outlive their resources, and alleviate some of the anxiety associated with most retirement investing, the market for annuity products is miniscule,” Munnell and Wettstein wrote, adding that academics have argued for decades that using retirement assets to purchase an annuity can mitigate longevity risk.

But the researchers noted that people are reluctant to exchange the 401(k) balances they’ve spent decades accumulating for a future income stream.

“Moreover, they often do not appreciate the insurance that annuities provide against running out of income, and tend to view the low expected returns associated with this service within an investment framework … The complexity of annuities and consumer distrust of insurance companies further reinforce biases against buying them as investments.”

Instead of using 401(k) assets to buy an annuity from an insurance company, the Social Security bridge strategy pays the retiree an amount equal to the Security benefits they would have claimed at retirement. By delaying Social Security until age 70, the retiree maximizes their eventual benefits and creates a larger stream of annuitized income.

Also, unlike payments from annuities, Social Security benefits are adjusted annually for inflation, which helps retirees protect their purchasing power.

“Purchasing additional Social Security income does not involve handing over accumulated assets to an insurance company, provides a familiar form of lifetime income that is adjusted for inflation, and does not expose the purchaser to higher costs from adverse selection,” Munnell and Wettstein wrote.

Consider using SmartAsset’s free tool to match with up to three fiduciary advisors if you’d like to discuss your Social Security strategy.

Should You Use the Bridge Strategy?

To gauge this strategy, the Center for Retirement Research conducted an online survey in early 2021 that asked participants whether they would use an employer “bridge” plan that would automatically pay them an amount equal to their Social Security benefits from their 401(k) balance when they retire.

The survey, which was administered by the Nonpartisan and Objective Research Organization at the University of Chicago, polled 1,349 workers between the ages of 50 and 65 with at least $25,000 in their 401(k) accounts.

Researchers learned that despite the novelty of the strategy, a “substantial minority” of respondents said they would use the bridge. In fact, nearly 27% of participants who were given only a limited description of the concept said they would use it if offered by their employer.

The more information respondents were given about the Social Security bridge strategy, the most interested they were. Almost 33% reported a similar interest when the bridge option was framed as insurance with both its pros and cons explicitly explained. Thirty-five percent of the respondents who were given a thorough explanation of the mechanics of the bridge option said they would use it if offered the chance.

Meanwhile, over 31% of respondents said they would not opt out of the bridge option if it was their employer’s default offering.

“The results show that a substantial minority would be interested in the bridge option,” Munnell and Wettstein wrote. “Furthermore, individuals presented with the pros and cons of annuitization versus investment chose to allocate a small but meaningfully larger share of their assets to the bridge strategy.”

“More strikingly, those defaulted into the bridge option ended up allocating much more of their assets to the bridge,” they added.

Consider speaking with a financial advisor if you have question about your own Social Security benefit options.

Bottom Line

The Social Security bridge is a method for delaying Social Security benefits until age 70, whereby a retiree temporarily supports themselves using 401(k) assets or other savings. As a result of delaying their benefits until age 70, a retiree enhances their future payments by approximately 76% compared to claiming Social Security at the earliest possible time (age 62). The Center for Retirement Research at Boston College found that approximately a third of workers between 50 and 65 years old would use this strategy if their employer offered it.

Retirement Planning Tips

-

The 4% Rule is perhaps the most well-known rule of thumb when it comes to retirement planning. The strategy dictates that a retiree can withdraw 4% of their savings in the first year of retirement (adjusting subsequent withdrawals for inflation) and have enough money to last 30 years. However, researchers recently found the 4% Rule may be outdated. New research suggests that retirees following a fixed withdrawal strategy should only take out 3.3% of their savings in the first year.

-

A financial advisor can help you plan for retirement and devise a withdrawal strategy that meets your needs. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/mphillips007, ©iStock.com/Zinkevych, ©iStock.com/FredFroese

The post Boost Your Social Security Benefits in Retirement With This ‘Bridge’ Strategy appeared first on SmartAsset Blog.

High-Grade Copper and Silver Found at Majuba Hill Deposit

Source: Streetwise Reports 10/01/2024

Giant Mining Corp. BFGFF has announced high-grade copper and silver mineralization from recent drilling at its Majuba Hill Copper-Silver Deposit in Pershing County, Nevada. The company intersected significant mineralization in drill hole MHB-30. It revealed 74.0 feet of 2.6% copper and 30.1 grams per tonne (g/t) silver within a broader intercept of 218.0 feet containing 1.35% copper and 73.4 g/t silver. Combining copper and silver values, the overall copper equivalent (CuEq) for the drill hole is calculated at 2.1% CuEq from surface to a depth of 218.0 feet, including a higher-grade zone from 140.0 to 214.0 feet at 2.9% CuEq.

Key Highlights:

- Drill Hole MHB-30 Results: 74.0 feet of 2.6% copper and 30.1 g/t silver within a broader intercept of 218.0 feet with 1.35% copper and 73.4 g/t silver.

- Copper Equivalent: 0 to 218.0 feet of 2.1% CuEq, with a higher-grade zone of 2.9% CuEq from 140.0 to 214.0 feet.

- Ongoing Drilling: MHB-31 drilled to a depth of 1,086 feet, with results pending.

- Historical Context: Majuba Hill has produced copper, silver, tin, gold, and zinc from historic underground workings.

- Exploration Progress: Over 83,925 feet of exploration and development drilling have been completed at the project.

- CEO Quote: David Greenway stated the results “significantly exceeded our expectations for high-grade copper-silver mineralization.”

- Future Development: The 2024 drilling program aims to expand the near-surface mineralization and support a maiden NI 43-101 mineral resource estimate.

Giant Mining’s CEO David Greenway expressed optimism regarding these results, stating in the news release, “We are excited by the results of hole MHB-30, which significantly exceeded our expectations for high-grade copper-silver mineralization.” The company expects continued progress as it awaits further drill results from hole MHB-31, which was drilled to a total depth of 1,086 feet.

The Majuba Hill project has a long history of producing high-grade copper, silver, tin, gold, and zinc, with more than 83,925 feet of exploration drilling completed. The company’s 2024 drilling campaign is focused on expanding the near-surface mineralization and targeting additional areas for future development.

Into The Metals Sector

The copper sector has shown growth in 2024, driven by rising demand across several industries, particularly in renewable energy and electric vehicles. According to Watcher.Guru on September 25, “Copper prices are skyrocketing in the charts after the Federal Reserve announced an interest rate cut of 50 bps last week.”

Prices increased from US$9,200 to US$9,600 over the week, with copper gaining considerable bullish momentum. This surge pushed copper to become one of the top gainers in the commodity markets, increasing by 13.3% year-to-date. Commodity Markets Analyst Tianyu anticipated continued positive performance into Q4 2024, predicting both demand and prices would rise by year-end.

According to The Economic Times, on September 30, central bank buying and geopolitical tensions also had a strong impact on silver, which has traditionally been tied to gold’s performance. In the article, XM Australia CEO Peter McGuire emphasized that silver has benefitted from the broader demand for precious metals as a store of value, particularly in regions like India and China, where it has been part of their culture for millennia. He added that the overwhelming buying by central banks, combined with retail interest, has continued to push silver prices upward, reflecting a similar trajectory to gold in the current global economic climate.

Some Giant Catalysts

Giant Mining’s ongoing exploration efforts at the Majuba Hill Copper-Silver Deposit align with the growing global demand for copper. According to the company’s September 2024 investor presentation, copper is a critical component in EV motors, batteries, and wiring systems. Each electric vehicle requires approximately 183 pounds of copper, significantly more than traditional internal combustion engine vehicles. As EV adoption rises, the demand for copper is expected to increase, positioning Majuba Hill as a key contributor to meeting future supply needs.

In addition to copper, the consistent presence of silver in the Majuba Hill deposit enhances the overall value of the project. As noted in the presentation by Buster Hunsaker, Consulting Geologist, the silver values, which are closely associated with copper mineralization, offer additional recovery potential using flotation techniques. These silver results further bolster the economic viability of the deposit, complementing the copper production targets.

The 2024 drill program at Majuba Hill, which includes both reverse circulation and core drilling, is designed to expand the near-surface resource and increase the confidence level for a maiden NI 43-101 mineral resource estimate (MRE). This estimate will provide a clearer picture of the project’s overall potential, with targeted grades ranging from 0.15% to 0.30% copper for an estimated 50 to 100 million tonnes of material.

Third-Party Expert Analysis

*In a September 9 article, John Newell of John Newell & Associates wrote highly of Giant mining, saying, “We believe the shares represent good value at the bottom of the share trading range, and therefore we have a Buy recommendation on the shares as a good contrarian value play.”

He continued, “With its prime location in Nevada, robust infrastructure, promising geology, and strong potential for large-scale copper production, Giant Mining Corp. stands out as an attractive speculative play in the junior mining space. The company’s systematic exploration of the Majuba Hill property could unlock a world-class copper resource, capitalizing on the growing demand for copper driven by the electrification of the global economy.”

For investors seeking exposure to copper in a stable and mining-friendly jurisdiction, Giant Mining Corp. offers a compelling investment opportunity with significant upside potential. Giant Mining represents an enticing opportunity in the copper exploration sector, given the share’s sharp decline.

*Ron Struthers of the Struthers Resource Stock Report on September 13 highlighted Giant Mining’s recent completion of core drilling and the preparation for a 16-hole reverse circulation (RC) drilling program.

Struthers stated, “Giant Mining Corp. has completed core drilling with two holes and is preparing for the planned 16-hole reverse circulation (RC) drilling program at the Majuba Hill porphyry copper deposit.”

This RC drilling campaign, designed to target up to 12,800 feet (3,901 meters) across strategic areas, is viewed as a critical step in advancing the Majuba Hill project.

Ownership and Share Structure

According to Giant Mining Corp., approximately 18.6% of its shares are held by insiders. The remaining shares are held by retail investors.

Giant Mining Corp. has a market capitalization of approximately CA$5.75 million.

The company’s shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGFF, with these listings active since December 2017.

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Giant Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- * Disclosure for the quote from the John Newell article published on September 9, 2024

- For the quoted article (published on September 9, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

* Disclosures for the quotes from the Ron Struthers newsletter published on September 16, 2024

- Giant Mining Corp. is a paid advertiser at Playstocks.net

- All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.