Smart Money Is Betting Big In VRT Options

Financial giants have made a conspicuous bearish move on Vertiv Hldgs. Our analysis of options history for Vertiv Hldgs VRT revealed 31 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $83,958, and 28 were calls, valued at $2,020,528.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $150.0 for Vertiv Hldgs over the recent three months.

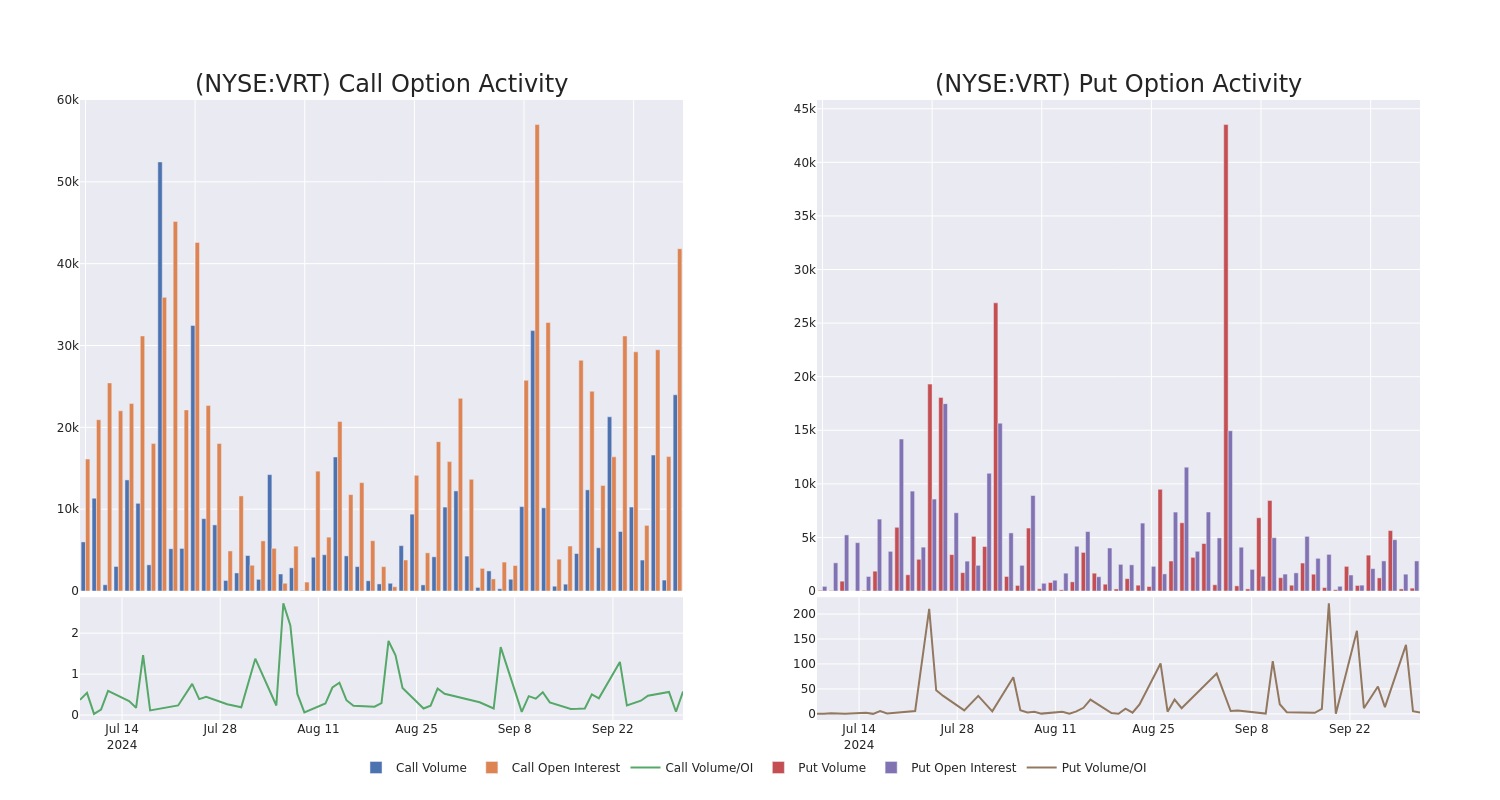

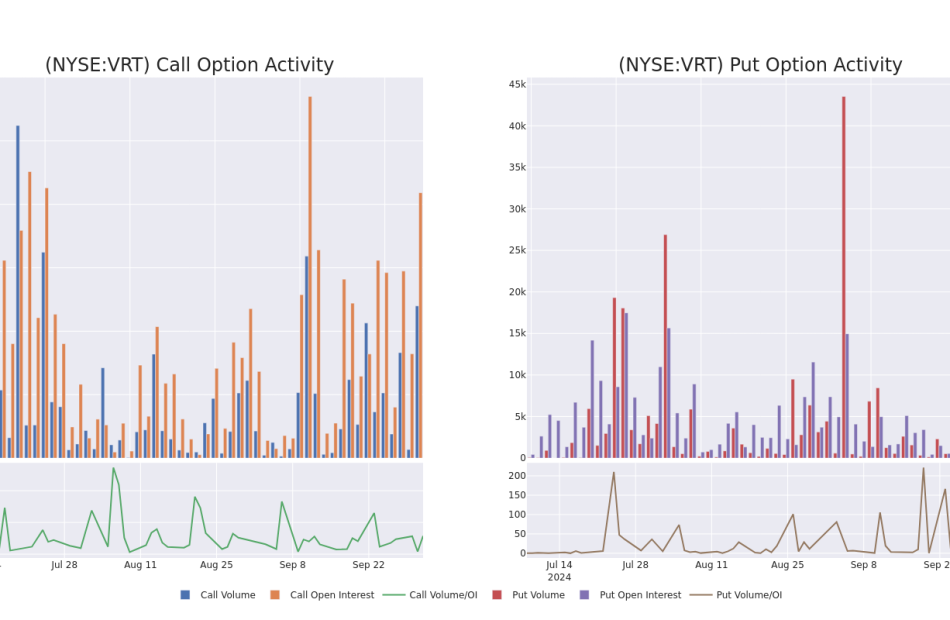

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vertiv Hldgs’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vertiv Hldgs’s substantial trades, within a strike price spectrum from $50.0 to $150.0 over the preceding 30 days.

Vertiv Hldgs Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $10.3 | $10.2 | $10.2 | $100.00 | $323.3K | 3.9K | 606 |

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $10.3 | $10.2 | $10.2 | $100.00 | $175.4K | 3.9K | 279 |

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $3.4 | $3.4 | $3.4 | $120.00 | $155.0K | 714 | 475 |

| VRT | CALL | SWEEP | BULLISH | 10/18/24 | $3.2 | $3.1 | $3.2 | $105.00 | $128.0K | 6.4K | 2.8K |

| VRT | CALL | SWEEP | BULLISH | 01/17/25 | $23.4 | $23.1 | $23.4 | $85.00 | $114.6K | 5.2K | 49 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

After a thorough review of the options trading surrounding Vertiv Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Vertiv Hldgs Standing Right Now?

- With a trading volume of 6,116,950, the price of VRT is up by 5.0%, reaching $102.5.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 21 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Vertiv Hldgs options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply