What the Options Market Tells Us About Li Auto

Whales with a lot of money to spend have taken a noticeably bearish stance on Li Auto.

Looking at options history for Li Auto LI we detected 28 trades.

If we consider the specifics of each trade, it is accurate to state that 32% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $860,030 and 21, calls, for a total amount of $1,880,832.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $55.0 for Li Auto over the last 3 months.

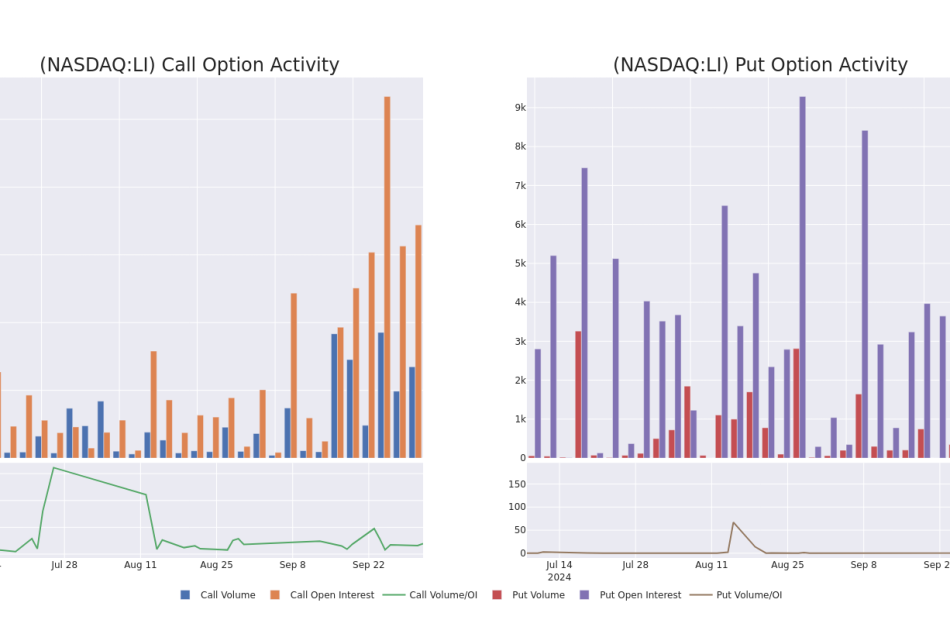

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Li Auto’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Li Auto’s whale trades within a strike price range from $20.0 to $55.0 in the last 30 days.

Li Auto Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LI | PUT | TRADE | BULLISH | 11/15/24 | $2.09 | $2.05 | $2.06 | $27.00 | $412.0K | 29 | 2.0K |

| LI | CALL | SWEEP | BEARISH | 11/15/24 | $4.35 | $4.2 | $4.2 | $27.00 | $310.8K | 2.9K | 2.3K |

| LI | CALL | SWEEP | BEARISH | 11/15/24 | $4.45 | $4.3 | $4.3 | $27.00 | $216.7K | 2.9K | 573 |

| LI | CALL | SWEEP | BEARISH | 11/15/24 | $3.6 | $3.45 | $3.6 | $28.00 | $216.0K | 742 | 624 |

| LI | CALL | SWEEP | BEARISH | 11/15/24 | $4.35 | $4.2 | $4.25 | $27.00 | $205.2K | 2.9K | 1.0K |

About Li Auto

Li Auto is a leading Chinese NEV manufacturer that designs, develops, manufactures, and sells premium smart NEVs. The company started volume production of its first model Li One in November 2019. The model is a six-seater, large, premium plug-in electric SUV equipped with a range extension system and advanced smart vehicle solutions. It sold over 376,000 NEVs in 2023, accounting for about 4% of China’s passenger new energy vehicle market. Beyond Li One, the company expands its product line, including both BEVs and PHEVs, to target a broader consumer base.

Having examined the options trading patterns of Li Auto, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Li Auto

- With a trading volume of 19,054,648, the price of LI is up by 4.79%, reaching $29.97.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 36 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Li Auto options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply