DAVA REMINDER – Robbins LLP Reminds DAVA Stockholders to Seek Counsel in Light of the Pending Lead Plaintiff Deadline

SAN DIEGO, Oct. 04, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities that purchased or otherwise acquired Endava PLC DAVA securities between May 23, 2023 and February 28, 2024. Endava provides technology services for clients in consumer products, healthcare, mobility, and retail verticals in North America.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Endava PLC (DAVA) Misled Investors Regarding its Business Prospects

According to the complaint, during the class period, defendants failed to disclose to investors that: (1) demand for the Company’s services was declining; (2) the Company’s clients delayed or canceled projects; (3) as a result, the Company’s fiscal 2023 and 2024 revenue and earnings would be adversely affected; and (4), as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

On February 29, 2024, Endava issued a press release reporting disappointing financial results for second quarter 2024, announcing a disappointing outlook for third quarter and full fiscal year 2024, and noting that some of the Company’s clients had delayed their orders due to economic uncertainty. On this news, the price of Endava’s ADS plummeted $26.65, or nearly 42%, to close at $37.17.

What Now: You may be eligible to participate in the class action against Endava PLC. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by October 25, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Endava PLC settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/192943a4-e9d0-4ca8-af09-c2200329d816

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Reportedly Already Moved X Headquarters From San Francisco To This Little-Known Location

Elon Musk has officially moved the headquarters of X (formerly known as Twitter) from San Francisco to a lesser-known spot in Texas called Bastrop. This small town, located about 30 miles east of Austin, is now the social media platform’s new home base, surprising many who thought the move would be to the tech hub of Austin itself.

Don’t Miss:

Musk’s decision to relocate X to Bastrop has raised some eyebrows. After all, the town is more well-known for its serene atmosphere and beautiful scenery than for being home to tech behemoths. Nevertheless, it’s somewhat used to Musk’s endeavors by now as it’s already home to some of his other companies, like SpaceX and The Boring Company, which have been expanding rapidly in the area.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

The new headquarters is located in a shopping center called Hyperloop Plaza, which Musk owns and it features other Musk-related businesses, including a convenience store humorously named the Boring Bodega.

X’s real estate director, Nicole Hollander, stated that the company plans to move employees from their Austin office to the new Bastrop location, making it the primary office for Central Texas employees.

Alongside growing his businesses, Musk also focuses on local education by opening a new private school called Ad Astra this fall. The school aims to develop “curiosity, creativity, and critical thinking in the next generation of problem solvers” through hands-on STEM learning. The application process for kids aged three to nine is already closed for next year. The school has plans to grow to K-12 in the future.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

While some people are happy that Musk’s move creates local jobs, many residents are worried. His companies are expanding so quickly in Bastrop that it’s sparking debates about how this growth will affect the community. Plans for a company town and a 110-home subdivision for employees concern locals about possible environmental problems and how their town might change.

However, Musk’s move to Bastrop seems to be finalized, as the business has already updated its official records with the new address. The action is just one more sign of Musk’s growing influence in Texas, where several of his companies – including Tesla – are already well-established.

Elon Musk is dedicated to turning this sleepy Texas town into a major hub for his businesses as X settles into its new headquarters in Bastrop. Whether this will benefit the local community or cause more concern is still up in the air, but one thing is certain: Bastrop, Texas, is now on everyone’s radar.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dine Brands' Transformation Plan: A Recipe for Recovery?

Dine Brands Global, Inc. DIN is the driving force behind beloved restaurant sector brands like Applebee’s, IHOP, and Fuzzy’s Taco Shop. Through a strategic franchise model, Dine Brands has successfully established a widespread presence across the globe, capturing the hearts (and stomachs) of a large and diverse customer base.

The company’s franchise-heavy approach offers unique advantages for scaling operations and building brand recognition, but Dine Brands hasn’t been immune to industry challenges.

However, despite these challenges, Dine Brands remains a company with a diverse portfolio of established brands and an extensive global reach. To address its challenges and unlock growth potential, the company has been actively implementing a strategic transformation focused on enhancing the customer experience, menu innovation, and digital engagement, but will this revitalized approach be enough to unlock Dine Brands’ potential and propel the company towards a path of growth and profitability?

A Mixed Picture With Upside

Dine Brands’ financial reports reflect the broader challenges currently being faced by the restaurant industry. While the company has a strong portfolio of established brands like Applebee’s and IHOP and an extensive global reach, it has grappled with declining same-store sales and difficulties meeting its financial guidance.

Dine Brand’s earnings report for the second quarter of 2024 showed a 1% decline in revenue compared to the same quarter last year, with earnings per share (EPS) of $1.71 exceeding analyst expectations but falling short of the previous year’s $1.82.

However, several factors suggest the potential for a turnaround. Notably, Dine Brands’ analyst community upgraded the stock, raising the price target to $47 from $34. The bullish outlook hinges on several key catalysts, including a potential $100 million+ accelerated share repurchase plan, the company’s free cash flow generation (forecasted at $99.2 million in 2024 and $107.5 million in 2025), and ongoing efforts to optimize the value proposition of Applebee’s and IHOP.

Despite these positive signals, Dine Brands faces several challenges. The restaurant industry is currently contending with inflationary pressures, rising costs, and the potential for an economic downturn, which could further impact the company’s revenue and earnings growth. Dine Brand’s competition remains strong, with established players vying for market share alongside the rapidly expanding fast-casual segment.

Specifically, Dine Brands needs to address the declining appeal of casual dining among younger demographics and find innovative ways to enhance the customer experience and drive traffic to its restaurants. Furthermore, Dine Brands carries a significant debt load with a debt-to-equity ratio (D/E) of around five as of the latest quarter. The high debt levels could limit its financial flexibility and hinder its ability to invest in growth initiatives. The company’s negative return on equity of -35.88% in the latest quarter also raises concerns about its efficiency in generating profits from shareholder investments.

Dine Brands Eyes Turnaround with Debt Management and Stock Buyback

Dine Brands’ potential for a significant turnaround, fueled by analyst’s optimistic projections and the planned stock buyback, is undeniable. However, a cautious approach is warranted when considering an investment in this company. The current low stock valuation, with shares down 30% year-to-date, could reflect the market’s apprehension about Dine Brands’ ability to successfully execute its turnaround strategy in the face of current headwinds. The ongoing decline in same-store sales, a critical measure of a restaurant company’s health, remains a concern and could persist if macroeconomic conditions worsen.

Dine Brands has been proactive in managing its considerable debt load. The company recently refinanced its debt to lower interest expenses and gain greater financial flexibility. Additionally, a significant portion of the company’s strong free cash flow is earmarked for an accelerated share repurchase program in the second half of 2025. This initiative aims to reduce the number of outstanding shares, lowering the debt-to-equity ratio and potentially boosting earnings per share.

In addition to the debt reduction, Dine Brands is laser-focused on enhancing its core brands, Applebee’s and IHOP. This includes initiatives to elevate the customer experience, introduce menu innovations like all-day breakfast and gourmet burgers to cater to evolving consumer preferences, and bolster digital engagement through loyalty programs to attract a younger demographic. Dine Brands also recognizes the vital role of its franchisees and is committed to supporting them, including financial assistance, operational guidance, and marketing resources. While the primary focus is improving domestic performance, Dine Brands continues exploring international expansion opportunities for long-term revenue growth and diversification.

Navigating Challenges: Dine Brands’ Long-Term Growth Story

Several indicators suggest a positive outlook for Dine Brands’ future. The analyst upgrade and increased price target reflect optimism about the company’s ability to overcome challenges and deliver improved financial results in the coming years. While acknowledging the current difficulties, management remains confident in the company’s long-term potential and believes the strategic initiatives outlined above will position Dine Brands for sustained growth and profitability.

However, investors should not overlook the inherent risks associated with this investment. The restaurant industry is highly sensitive to economic fluctuations, and a potential downturn could significantly impact Dine Brands. Consumers may reduce spending on dining out, leading to lower restaurant traffic and impacting revenue and profitability. The competitive landscape also remains intense, requiring Dine Brands to execute its strategies flawlessly to gain market share and maintain brand relevance in a crowded field. Additionally, the success of the turnaround strategy hinges on the company’s ability to implement its initiatives effectively, and unforeseen challenges may arise during this transformation

Dine Brands offers a compelling investment opportunity with significant upside potential, particularly given the analyst upgrades and the potential for a stock buyback. However, it is not a risk-free investment. Investors with higher risk tolerance and a long-term investment horizon may consider adding Dine Brands to their portfolio. However, it is crucial to carefully weigh the company’s strategic initiatives, the competitive landscape, and potential economic risks before making investment decisions.

The article “Dine Brands’ Transformation Plan: A Recipe for Recovery?” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medicenna to Present Clinical and Preclinical Data at the 39th Annual Meeting of the Society for Immunotherapy of Cancer (SITC)

Updated clinical results to be presented from the ongoing Phase 1/2 ABILITY-1 study of MDNA11 in advanced or metastatic solid tumors

Preclinical data on MDNA113, Medicenna’s first-in-class, masked, tumor-targeted bifunctional anti-PD1-IL-2 Superkine, and on its IL-2 agonists in glioblastoma, will also be presented

TORONTO and HOUSTON, Oct. 04, 2024 (GLOBE NEWSWIRE) — Medicenna Therapeutics Corp. (“Medicenna” or the “Company”) MDNAMDNAF, a clinical-stage immunotherapy company focused on the development of Superkines, announced today that it will present three posters at the 39th Annual Meeting of the Society for Immunotherapy of Cancer (“SITC”), taking place from November 6 – 10, 2024 in Houston, Texas.

The Company will present updated clinical data from the ongoing Phase 1/2 ABILITY-1 Study evaluating MDNA11, a long-acting ‘beta-enhanced not-alpha’ interleukin-2 (“IL-2”) super-agonist, as both a monotherapy and in combination with pembrolizumab (KEYTRUDA®) in patients with advanced or metastatic solid tumors. In addition, new pre-clinical data on the Company’s MDNA113, a novel first-in-class, masked, tumor-targeted bifunctional anti-PD1-IL-2 Superkine, and on Medicenna’s IL-2 agonists in glioblastoma, will also be presented at the conference.

Details for the poster presentations are as follows:

Title: Results from ABILITY-1 monotherapy dose escalation and ongoing monotherapy

expansion with MDNA11, a long-acting ‘beta-enhanced not-alpha’ IL-2 Superkine, in patients

with advanced solid tumors

Abstract Number: 684

Presentation Date: Saturday, November 9, 2024

Title: MDNA113 is a conditionally activatable anti-PD1-IL-2SK with a removable IL-13 dual masking/tumor-targeting domain to limit systemic immune stimulation while maximizing anti-tumor response

Abstract Number: 961

Session Date: Friday, November 8, 2024

Title: Stimulation of IL-2 signaling with highly selective IL-2R agonists enhances immune

effector cell response in mouse and patient-derived glioblastomas

Abstract Number: 963

Session Date: Friday, November 8, 2024

The full text of the abstracts will be available on the SITC 2024 website. Following the conclusion of the SITC 2024 Meeting, a copy of the posters will be available on the “Scientific Presentations” page of Medicenna’s website.

About MDNA11

MDNA11 is an intravenously administered, long-acting ‘beta-enhanced not-alpha’ IL-2 Superkine specifically engineered to overcome the shortcomings of aldesleukin and other next generation IL-2 variants by preferentially activating immune effector cells (CD8+ T and NK cells) responsible for killing cancer cells, with minimal or no stimulation of immunosuppressive Tregs. These unique proprietary features of the IL-2 Superkine have been achieved by incorporating seven specific mutations and genetically fusing it to a recombinant human albumin scaffold to improve the pharmacokinetic (PK) profile and pharmacological activity of MDNA11 due to albumin’s natural propensity to accumulate in highly vascularized sites, in particular tumor and tumor draining lymph nodes. MDNA11 is currently being evaluated in the Phase 1/2 ABILITY-1 study as both a monotherapy and in combination with pembrolizumab (KEYTRUDA®).

About the ABILITY-1 Study

The ABILITY-1 study (NCT05086692) is a global, multi-center, open-label study that assesses the safety, tolerability, pharmacokinetics, pharmacodynamics and anti-tumor activity of MDNA11 as monotherapy or in combination with pembrolizumab (KEYTRUDA®). In the combination dose escalation of the Phase 2 study, approximately 6-12 patients are expected to be enrolled and administered ascending doses of MDNA11 intravenously once every two weeks in combination with pembrolizumab. This portion of the study includes patients with a wide range of solid tumors with the potential for susceptibility to immune modulating therapeutics. Upon identification of an appropriate dose regimen for combination, the study will proceed to a combination dose expansion cohort.

About MDNA113

MDNA113 is a novel, first-in-class tumor-targeted and tumor-activated bi-functional anti-PD1-IL2 Superkine with exceptionally high affinity for IL-13Rα2 without binding to the functional IL-13R⍺1. IL-13Rα2 is overexpressed in a wide range of solid tumors, including cold tumors with minimal to no expression in normal tissues. IL-13Rα2 expressing tumors also have abundant matrix metalloprotease in the tumor microenvironment that may efficiently activate MDNA113. IL-13Rα2 expression is associated with poor clinical outcome in multiple tumor types including prostate cancer, pancreatic cancer, ovarian cancer, liver cancer, breast cancer and brain cancer, with an annual world-wide incidence of over 2 million.

About Medicenna Therapeutics

Medicenna is a clinical-stage immunotherapy company focused on developing novel, highly selective versions of IL-2, IL-4 and IL-13 Superkines and first-in-class Empowered Superkines. Medicenna’s long-acting IL-2 Superkine, MDNA11, is a next-generation IL-2 with superior affinity toward CD122 (IL-2 receptor beta) and no CD25 (IL-2 receptor alpha) binding, thereby preferentially stimulating cancer-killing effector T cells and NK cells. Medicenna’s IL-4 Empowered Superkine, bizaxofusp (formerly MDNA55), has been studied in 5 clinical trials enrolling over 130 patients, including a Phase 2b trial for recurrent GBM, the most common and uniformly fatal form of brain cancer. Bizaxofusp has obtained FastTrack and Orphan Drug status from the FDA and FDA/EMA, respectively. Medicenna’s early-stage high-affinity IL-2β biased IL-2/IL-15 Super-antagonists, from its MDNA209 platform, are being evaluated as potential therapies for autoimmune and graft-versus host diseases. Medicenna’s early-stage BiSKITs™ (Bifunctional SuperKine ImmunoTherapies) and the T-MASK™ (Targeted Metalloprotease Activated SuperKine) programs are designed to enhance the ability of Superkines to treat immunologically “cold” tumors.

For more information, please visit www.medicenna.com, and follow us on Twitter and LinkedIn.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include, but are not limited to, express or implied statements regarding the future operations of the Company, estimates, plans, strategic ambitions, partnership activities and opportunities, objectives, expectations, opinions, forecasts, projections, guidance, outlook or other statements that are not historical facts, such as statements on the therapeutic potential and safety profile of MDNA11 and MDNA113. Drug development and commercialization involve a high degree of risk, and only a small number of research and development programs result in commercialization of a product. Results in early-stage pre-clinical or clinical studies may not be indicative of full results or results from later stage or larger scale clinical studies and do not ensure regulatory approval. You should not place undue reliance on these statements, or the scientific data presented.

Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expect”, “believe”, “seek”, “potentially” and similar expressions. and are subject to risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include the risks detailed in the latest annual information form of the Company and in other filings made by the Company with the applicable securities regulators from time to time in Canada.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date hereof and except as required by law, we do not intend and do not assume any obligation to update or revise publicly any of the included forward-looking statements.

This news release contains hyperlinks to information that is not deemed to be incorporated by reference in this new release.

Investor/Media Contact:

Christina Cameron

Investor Relations, Medicenna Therapeutics

(647) 953-0673

ir@medicenna.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

George Weston Limited Enters into Automatic Share Purchase Plan

TORONTO, Oct. 4, 2024 /CNW/ – WN – George Weston Limited (“Weston”) announced today that it has entered into an automatic share purchase plan (“ASPP”) with a broker in order to facilitate repurchases of Weston’s common shares (“Common Shares”) under its previously announced normal course issuer bid (“NCIB”).

Weston previously announced that it had received approval from the Toronto Stock Exchange (“TSX”) to, during the 12-month period commencing May 27, 2024 and terminating May 26, 2025 purchase up to 6,646,057 Common Shares, representing approximately 5% of the 132,921,158 Common Shares issued and outstanding as of May 13, 2024, by way of a NCIB on the TSX or through alternative trading systems or by such other means as may be permitted under applicable law.

During the effective period of Weston’s ASPP, Weston’s broker may purchase Common Shares at times when Weston would not be active in the market due to insider trading rules and its own internal trading blackout periods. Purchases will be made by Weston’s broker based upon parameters set by Weston when it is not in possession of any material non-public information about itself and its securities, and in accordance with the terms of the ASPP. Outside of the effective period of the ASPP, Common Shares may continue to be purchased in accordance with Weston’s discretion, subject to applicable law. The ASPP has been entered into in accordance with the requirements of applicable Canadian securities laws.

About George Weston Limited

George Weston Limited is a Canadian public company founded in 1882. The Company operates through its two reportable operating segments, Loblaw Companies Limited and Choice Properties Real Estate Investment Trust. Loblaw provides Canadians with grocery, pharmacy, health and beauty, apparel, general merchandise, financial services and wireless mobile products and services. Choice Properties owns, manages and develops a high-quality portfolio of commercial and residential properties across Canada.

SOURCE George Weston Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/04/c1518.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/04/c1518.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lockheed Shares More Profit, Raises Dividend & Buyback Authorization

Lockheed Martin Corp. LMT announced that its board of directors approved a 4.8% hike in its quarterly dividend to $3.30 per share, marking the 22nd consecutive annual dividend hike. The revised quarterly dividend is payable on Dec. 27, 2024, to shareholders of record at the close of the business on Dec. 2, 2024.

The company’s new annualized dividend rate is $13.20. The current dividend yield is 2.08%, better than the Zacks S&P 500 composite’s 1.24%.

Along with dividend payments, Lockheed’s management continues to increase shareholder value by repurchasing shares. The board authorized an additional $3 billion for share repurchases, which resulted in a total authorization under the repurchase program of nearly $10 billion.

Can Lockheed Sustain Dividend Hikes?

Lockheed has a platform-centric focus and leveraged presence in the Army, Air Force, Navy and IT programs of the U.S. Department of Defense that guarantee a steady inflow of follow-on orders. The company continues to clinch big defense deals from the U.S. government and allied countries. As a consequence, it exited the second quarter of 2024 with a record backlog of $158.3 billion, backed by increasing demand and a rising global defense budget. This shall boost LMT’s sales growth and cash flow in the coming quarters.

Apart from domestic orders, the company also enjoys the advantage of having a wide international customer base. In the second quarter of 2024, 25.8% of total net sales were from international customers. The company is focused on expanding its international footprint, which continues to support earnings.

Lockheed Martin is the largest U.S. defense contractor with a platform-centric focus that guarantees a steady inflow of follow-on orders from its leveraged presence in the Army, Air Force, Navy and IT programs. The F-35 program continues to be a key growth program for Lockheed. The production of F-35 jets is expected to continue for many years ahead, given the U.S. government’s current inventory target of 2,456 aircraft for the Air Force, Marine Corps and Navy. This will support its top line and boost its earnings.

Courtesy of Lockheed’s global presence, strong backlog, F-35 program and contract wins, the company continues to generate strong operating cash flow, which provides assurance that it will be able to sustain shareholder-friendly moves in the future as well.

Other Aerospace Companies’ Recent Dividend Hikes

Here are some defense companies that have been rewarding shareholders with impressive dividend payouts.

On May 14, 2024, Northrop Grumman Corp. NOC announced that its board of directors approved a 10% hike in its quarterly dividend to $2.06 per share, marking the 21st consecutive annual dividend hike.

Northrop boasts a long-term (three to five years) earnings growth rate of 8.7%. The Zacks Consensus Estimate for NOC’s 2024 sales implies an improvement of 5.4% from the previous year’s level.

On May 10, 2024, Curtiss-Wright CW announced that its board of directors declared a 5% increase in the quarterly dividend to 21 cents per share. The company authorized an additional $300 million for future share repurchases, increasing the total available authorization to $400 million.

Curtiss-Wright boasts a four-quarter earnings surprise of 11.52%, on average. The Zacks Consensus Estimate for CW’s 2024 sales implies an improvement of 7.1% from the prior-year figure.

On May 2, 2024, RTX Technologies RTX announced a dividend of 63 cents per, calling for an increase of 6.8% over the prior quarter’s dividend amount.

RTX Technologies has a long-term earnings growth rate of 10.4%. The Zacks Consensus Estimate for RTX’s 2024 sales calls for an improvement of 7% from the prior-year figure.

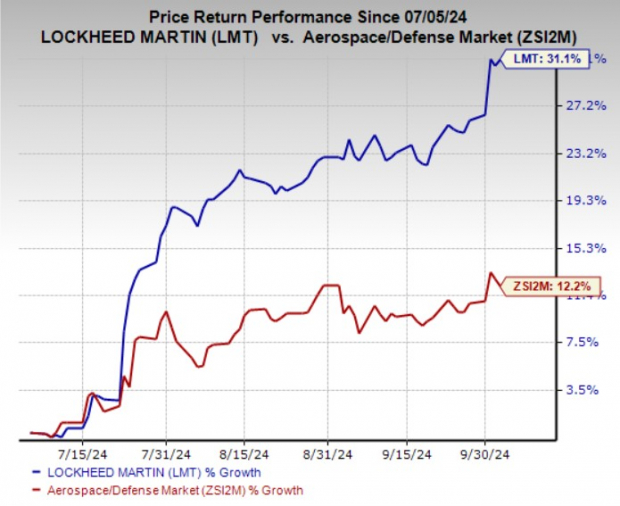

LMT Stock Price Movement

In the past three months, shares of LMT have rallied 31.1% compared with its industry’s rise of 12.2%.

Image Source: Zacks Investment Research

LMT’s Zacks Rank

Lockheed Martin currently carries a Zacks Rank #2 (Buy).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top Wall Street Forecasters Revamp Accolade Price Expectations Ahead Of Q2 Earnings

Accolade, Inc. ACCD will release earnings results for its second quarter, before the opening bell on Tuesday, Oct. 8.

Analysts expect the Seattle, Washington-based company to report a quarterly loss at 44 cents per share, versus a year-ago loss of 43 cents per share. Accolade is projected to post quarterly revenue of $105.01 million, according to data from Benzinga Pro.

On June 27, Accolade reported first-quarter financial results and issued worse-than-expected FY25 revenue guidance.

Accolade shares fell 2.4% to close at $3.68 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Guggenheim analyst Sandy Draper maintained a Buy rating and cut the price target from $13 to $6 on June 28. This analyst has an accuracy rate of 72%.

- Stifel analyst David Grossman maintained a Buy rating and cut the price target from $13 to $8 on June 28. This analyst has an accuracy rate of 61%.

- Morgan Stanley analyst Ricky Goldwasser maintained an Equal-Weight rating and cut the price target from $12 to $6 on June 28. This analyst has an accuracy rate of 74%.

- Needham analyst Ryan MacDonald maintained a Buy rating and slashed the price target from $13 to $8 on June 28. This analyst has an accuracy rate of 62%.

- Raymond James analyst maintained an Outperform rating and raised the price target from $12 to $16 on Jan. 9. This analyst has an accuracy rate of 78%.

Considering buying ACCD stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Gains 1%; Spirit Airlines Shares Plunge

U.S. stocks traded higher midway through trading, with the Nasdaq Composite gaining more than 100 points on Friday.

The Dow traded up 0.32% to 42,145.03 while the NASDAQ rose 0.76% to 18,053.79. The S&P 500 also rose, gaining, 0.45% to 5,725.76.

Check This Out: How To Earn $500 A Month From Phillips 66 Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Consumer discretionary shares jumped by 0.7% on Friday.

In trading on Friday, real estate shares dipped by 1.6%.

Top Headline

The U.S. economy added 254,000 jobs in September, compared to a revised 159,000 gain in August, and topping market estimates of 147,000. The unemployment rate declined to 4.1% in September from 4.2% in the previous month.

Equities Trading UP

- Phoenix Motor Inc. PEV shares shot up 127% to $0.79 after the company reported a substantial increase in the first-quarter results.

- Shares of Apogee Enterprises, Inc. APOG got a boost, surging 24% to $84.76 after the company reported better-than-expected second-quarter financial results and raised its FY25 adjusted EPS guidance above estimates.

- Beneficient BENF shares were also up, gaining 68% to $1.99 after the company announced its subsidiary, Beneficient Company Holdings, consummated a previously announced transaction pursuant to which approximately $126 million of its preferred equity was redesignated as non-redeemable.

Equities Trading DOWN

- AMTD Digital Inc. HKD shares dropped 17% to $4.3411.

- Shares of ZIM Integrated Shipping Services Ltd. ZIM were down 13% to $18.93.

- Spirit Airlines, Inc. SAVE was down, falling 27% to $1.63 following a report suggesting that the company is exploring the potential of filing for bankruptcy.

Commodities

In commodity news, oil traded up 1.2% to $74.62 while gold traded down 0.4% at $2,667.50.

Silver traded down 1.3% to $32.055 on Friday, while copper rose 0.4% to $4.5720.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 rose 0.48%, Germany’s DAX rose 0.64% and France’s CAC 40 climbed 1.15%. Spain’s IBEX 35 Index rose 0.24%, while London’s FTSE 100 rose 0.21%.

The S&P Global UK construction PMI jumped to 57.2 in September compared to 53.6 in the previous month, while France construction PMI declined to 37.9 in September from 40.1 in the earlier month. The HCOB Eurozone construction PMI climbed to 42.1 in September versus 41.4 in the prior two months.

Asia Pacific Markets

Asian markets closed mixed on Friday, with Japan’s Nikkei 225 gaining 0.22%, Hong Kong’s Hang Seng Index gaining 2.82% and India’s BSE Sensex dipping 0.98%.

The HSBC India services PMI was revised downward to 57.7 in September versus a preliminary reading of 58.9. The S&P Global Hong Kong SAR PMI surged to 50.0 in September compared to August’s reading of 49.4.

Economics

The U.S. economy added 254,000 jobs in September, compared to a revised 159,000 gain in August, and topping market estimates of 147,000. The unemployment rate declined to 4.1% in September from 4.2% in the previous month.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Supreme Court will weigh Mexico's $10 billion lawsuit against U.S. gun makers

WASHINGTON (AP) — The Supreme Court said Friday it will decide whether to block a $10 billion lawsuit Mexico filed against leading U.S. gun manufacturers over allegations their commercial practices have helped caused much bloodshed there.

The gun makers asked the justices to undo an appeals court ruling that allowed the lawsuit to go forward despite broad legal protections for the firearm industry.

A federal judge has since tossed out the bulk of the lawsuit on other legal grounds, but Mexico could appeal that dismissal. Mexico argues the companies knew weapons were being sold to traffickers who smuggled them into Mexico and decided to cash in on that market. The government estimates 70% of the weapons trafficked into Mexico come from the United States.

The defendants include big-name manufacturers such as Smith & Wesson, Beretta, Colt and Glock. They say Mexico has not shown the industry has purposely done anything to allow the weapons to be used by cartels and is trying to “bully” gunmakers into adopting gun-control measures.

Originally filed in 2021, the lawsuit was initially tossed out by a district court who cited legal protections for gun makers from damages resulting from criminal use of firearms.

But the 1st U.S. Circuit Court of Appeals revived the case under an exception to that law. The gunmakers appealed that ruling to the Supreme Court, arguing they have followed lawful practices and the case has no business in American courts.

U.S. District Judge F. Dennis Saylor in Boston again dismissed the case against six of the eight companies in August, ruling Mexico had not provided concrete evidence that any those companies’ activities in Massachusetts were connected to any suffering caused in Mexico by guns.

Still, with some claims remaining and an appeal possible, the gun makers argue the 1st Circuit ruling could hang over the industry for years if allowed to stand.

TScan Therapeutics Announces Upcoming Presentations at the Society for Immunotherapy of Cancer 39th Annual Meeting

WALTHAM, Mass., Oct. 04, 2024 (GLOBE NEWSWIRE) — TScan Therapeutics, Inc. TCRX, a clinical-stage biotechnology company focused on the development of T cell receptor (TCR)-engineered T cell (TCR-T) therapies for the treatment of patients with cancer, today announced the acceptance of three abstracts for poster presentation at the upcoming Society for Immunotherapy of Cancer (SITC) 39th Annual Meeting being held November 6 – 10 in Houston, TX and virtually.

Poster Presentation Details:

Title: Discovery of a MAGE-A4-specific TCR-T Therapy Candidate for Multiplex Treatment of Solid Tumors

Authors: Rutuja Kulkarni, Akshat Sharma, Vivin Karthik, Kenneth L Jahan, Rakshi Bala, Nicolas Gaspar, Amanda Kordosky, Daniel C Pollacksmith, Alok Das Mahopatra, Maytal Bowman, Drashti Shah, Victor Ospina, Sanket Shah, Skyler Martinez, Ryan E Kritzer, Jayanth Jawahar, Hana Husic, Shoshana Bloom, Emily Miga, Rachel Lent, Chandan K Pavuluri, Carolyn Hardy, Abigail Dooley, Alex Cristofaro, Zhonghua Zhu, Livio Dukaj, Antoine Boudot, Kimberly M Cirelli, Mollie M Jurewicz, Cagan Gurer

Abstract Number: 375

Session Date/Time: Friday, November 8; 9:00 a.m. – 7:00 p.m. Central Time

Location: Exhibit Halls AB – George R. Brown Convention Center

Title: Preclinical Models for T-Plex, a Customized Multiplexed TCR-T Cell Therapy Addressing Intra-Tumor Antigen and HLA Heterogeneity

Authors: Maytal Bowman, Amanda Kordosky, Daniel Pollacksmith, Alok Das Mohapatra, Debanjan Goswamy, Victor Ospina, Sanket Revadkar, Shubhangi Kamalia, Skyler Martinez, Gaenna Rogers, Teagan Parsons, Dalena Nguyen, Jenny Tadros, Ira Jain, Alexander Cristofaro, Jenna LaBelle, Ribhu Nayar, Nancy Nabilsi, Antoine Boudot

Abstract Number: 359

Session Date/Time: Friday, November 8; 9:00 a.m. – 7:00 p.m. Central Time

Location: Exhibit Halls AB – George R. Brown Convention Center

Title: Development of a Target Agnostic Platform to Assess the Reactivity of T Cell Receptor (TCR)-Engineered T Cell (TCR-T) Therapies to Primary Human Tissues

Authors: Sveta Padmanabhan, Shubhangi Kamalia, Drashti Shah, Shazad A Khokhar, Sadie Lee, Daniel C Pollacksmith, Kimberly M Cirelli, Vivin Karthik, Kenneth Jahan, Jenny Tadros, Teagan Parsons, Nancy Nabilsi, Andrew Ferretti, Dalena Nguyen, Livio Dukaj, Jin He, Ryan E Kritzer, Emily Miga, Alexander Cristofaro, Chandan K Pavuluri, Elisaveta Todorova, Tyler M Sinacola, Savannah G Szemethy, Kyra N Sur, Vandana Keskar, Carolyn Hardy, Hsin-Ho Huang, Zhonghua Zhu, Antoine J Boudot, Sonal Jangalwe, Ribhu Nayar, Gavin MacBeath

Abstract Number: 384

Session Date/Time: Saturday, November 9; 9:00 a.m. – 8:30 p.m. Central Time

Location: Exhibit Halls AB – George R. Brown Convention Center

A copy of the presentation materials will be added to the “Publications” section of the Company’s website at tscan.com once presentations have concluded.

About TScan Therapeutics, Inc.

TScan is a clinical-stage biotechnology company focused on the development of T cell receptor (TCR)-engineered T cell (TCR-T) therapies for the treatment of patients with cancer. The Company’s lead TCR-T therapy candidates, TSC-100 and TSC-101, are in development for the treatment of patients with hematologic malignancies to prevent relapse following allogeneic hematopoietic cell transplantation (the ALLOHATM Phase 1 heme trial). The Company is also developing TCR-T therapy candidates for the treatment of various solid tumors. The Company has developed and continues to expand its ImmunoBank, the Company’s repository of therapeutic TCRs that recognize diverse targets and are associated with multiple HLA types, to provide customized multiplex TCR-T therapies for patients with a variety of cancers.

Contacts

Heather Savelle

TScan Therapeutics, Inc.

VP, Investor Relations

857-399-9840

hsavelle@tscan.com

Maghan Meyers

Argot Partners

212-600-1902

TScan@argotpartners.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.