Here's Why Investors Should Retain TransUnion Stock for Now

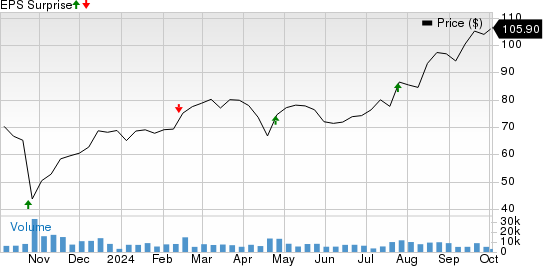

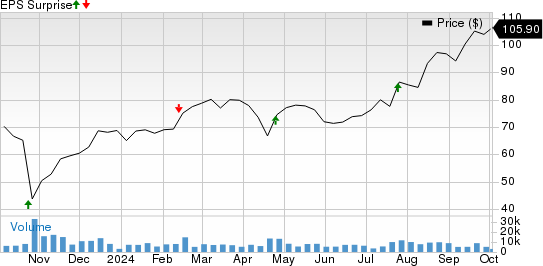

TransUnion TRU stock has rallied 51.3%, outperforming the 31% and 33.8% growth of the industry it belongs to and the Zacks S&P 500 composite in the past year, respectively.

TRU has an expected long-term (three to five years) EPS growth rate of 21.8%. The company’s earnings for 2024 and 2025 are anticipated to grow 15.1% and 18% year over year, respectively. Revenues are expected to increase 8% in 2024 and 7.5% in 2025.

Factors That Auger Well for TRU

TransUnion’s proactive efforts to render robust personalized financial products and services are commendable. The partnership with MoneyLion enhances consumer finance by integrating TransUnion’s extensive data with MoneyLion’s innovative platform. This collaboration will not only provide tailored financial offers to consumers but also empower financial institutions to make informed decisions and improve customer engagement. Such initiatives highlight TRU’s strategic alignment around a new global technology platform and solutions.

By consolidating independent products into integrated suites on a next-generation foundation, TransUnion is poised to accelerate innovation while reducing costs. This approach not only enhances operational efficiency but also allows for the leveraging of solutions across regions, driving revenue growth. It’s a smart move that positions the company well for future success in a competitive landscape.

TransUnion’s commitment to rewarding shareholders through dividends is commendable. The company has demonstrated a strong track record, paying $81.8 million in dividends in 2023, up from $77.8 million in 2022, and $61.8 million in 2021. In the second quarter of 2024, TransUnion declared a cash dividend of 10.5 cents per share. These consistent dividend initiatives significantly boost investor confidence and reflect the company’s dedication to returning value to its shareholders.

TransUnion’s current ratio (a measure of liquidity) at the end of the second quarter of 2024 was 1.66, higher than the preceding quarter’s 1.65 and the year-ago quarter’s 1.51. A current ratio of more than 1 often insinuates a company’s ability to pay off short-term debts with ease.

TRU: Key Risks to Watch

The increase in operating expenses poses a potential challenge for TransUnion’s bottom line. In the second quarter of 2024, total operating expenses rose by 6% year over year. This trend of rising costs has been consistent, with operating expenses increasing by 14% in 2021, 34% in 2022 and 20% in 2023. Such sustained increases in expenses could impact the company’s profitability moving forward.

Moreover, TRU faces intense competition in a diverse market, with rivals varying across different business segments, geographical areas and industry verticals. This high level of competition limits its pricing power and puts pressure on its earnings.

TRU’s Zacks Rank and Stocks to Consider

TRU currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are SPX Technologies, Inc. SPXC and Docusign DOCU.

SPX Technologies currently carries a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 18%.

SPXC delivered a trailing four-quarter earnings surprise of 10.6%, on average.

Docusign currently sports a Zacks Rank of 1. It has a long-term earnings growth expectation of 9.3%.

DOCU delivered a trailing four-quarter earnings surprise of 18.3%, on average.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply