Saxony-Anhalt Presents Current and Future Investment Opportunities at Expo Real

MAGDEBURG, Germany, Oct. 4, 2024 /PRNewswire/ — Innovative companies from high-tech industries looking to make history are warmly welcomed in Saxony-Anhalt. There is plenty of space for big plans here, as the Central German federal state offers Europe’s largest investment opportunity with 700 hectares of space at the High-Tech Park on the outskirts of its capital, Magdeburg. In addition, there are currently 19 more attractive commercial and industrial sites, each offering at least ten hectares of contiguous space, which will be showcased at the joint booth of the European Metropolitan Region of Central Germany at Europe’s largest B2B trade fair for real estate and investment, Expo Real in Munich.

“Saxony-Anhalt is currently experiencing remarkable investment momentum. Numerous innovative companies from various sectors have deliberately chosen our location – a testament to the attractiveness of our region. In addition to excellent location advantages, such as our central location and well-developed infrastructure, we offer attractive spaces for new projects. We will be highlighting these strengths at Expo Real to attract further investors to Saxony-Anhalt and fully leverage our region’s growth potential,” emphasized Dr. Robert Franke, Managing Director of IMG.

Sven Schulze, Minister for Economic Affairs, Tourism, Agriculture, and Forestry of Saxony-Anhalt is convinced: “The economy in the eastern German states has become a driving force for Germany. Saxony-Anhalt plays a special role in this, especially with recent settlements from Daimler Truck, Avnet, Wacker, and others. We want to continue this development and are working to attract more companies to the business location of Saxony-Anhalt.”

Saxony-Anhalt also offers strategic sites for near-term development in places such as Leuna, Köthen, Sangerhausen, Barleben, Stendal, Quedlinburg-Quarmbeck, and Sandersdorf-Brehna. Making its debut at Expo Real are also tourism-related investment opportunities in the emerging travel destination of Saxony-Anhalt, which impresses its visitors from home and abroad with spectacular attractions like UNESCO World Heritage sites, picturesque small towns, and unspoiled nature, resulting in continuously increasing numbers of guests and overnight stays.

For example, a hotel is planned across from the MEDIAN Clinic in the health resort of Flechtingen, and another is envisioned at Lake Geiseltal, which offers a unique view of the lake with a 190-meter-long pier. The marina is designed for approximately 165 boat berths. Along the new promenade, commercial spaces for maritime and dining establishments have been created, and vacation homes are planned on the slope behind the promenade.

On the southern shore of Lake Geiseltal, the city of Braunsbedra is offering two adjacent plots of land, one of 1.5 hectares for hotel construction and the other of 1.9 hectares for a holiday home settlement. At Bergwitzsee in the World Heritage region of Anhalt-Dessau-Wittenberg, an area of just over 4 hectares is to be developed for tourism and water sports. Additional potential lies in the historic Cultural Palace in Bitterfeld and the historic hotel and theater building “Reichskrone” in the cathedral city of Naumburg, for which investors are being sought.

You can find our latest press kit on investment opportunities in Saxony-Anhalt here.

We have also put together the corresponding pictures for you.

Contact: Sabine Kraus, +49 391/568 9920, sabine.kraus@img-sachsen-anhalt.de

Logo: https://new.stockburger.news/wp-content/uploads/2024/10/Sachsen_Anhalt_Logo.jpg

Photo: https://new.stockburger.news/wp-content/uploads/2024/10/Anhalt_Dessau_Heritage_Region.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/saxony-anhalt-presents-current-and-future-investment-opportunities-at-expo-real-302267655.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/saxony-anhalt-presents-current-and-future-investment-opportunities-at-expo-real-302267655.html

SOURCE Investment and Marketing Corporation Saxony Anhalt (IMG)

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vineet Nargolwala's Recent Buy: Acquires $135K In Brady Stock

In a recent SEC filing, it was revealed that Vineet Nargolwala, Board Member at Brady BRC, made a noteworthy insider purchase on October 4,.

What Happened: Nargolwala demonstrated confidence in Brady by purchasing 1,809 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Friday. The total value of the transaction is $135,005.

In the Friday’s morning session, Brady‘s shares are currently trading at $73.64, experiencing a down of 0.0%.

Get to Know Brady Better

Brady Corp provides identification solutions and workplace safety products. The company offers identification and healthcare products that are sold under the Brady brand to maintenance, repair, and operations as well as original equipment manufacturing customers. Products include safety signs and labeling systems, material identification systems, wire identification, patient identification, and people identification. Brady also provides workplace safety and compliance products such as safety and compliance signs, asset tracking labels, and first-aid products. The company is organized and managed on a geographic basis with two reportable segments: Americas & Asia which derives maximum revenue, and Europe & Australia.

Unraveling the Financial Story of Brady

Revenue Growth: Brady’s revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -0.73%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 51.56%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Brady’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 1.16.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.12.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 18.09, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 2.66 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 12.05 positions the company as being more valued compared to industry benchmarks.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Navigating the World of Insider Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Brady’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apogee Enterprises, Smart Sand And 3 Stocks To Watch Heading Into Friday

With U.S. stock futures trading mixed this morning on Friday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Apogee Enterprises Inc. APOG to report quarterly earnings at $1.23 per share on revenue of $335.29 million before the opening bell, according to data from Benzinga Pro. Apogee shares rose 0.1% to $68.50 in after-hours trading.

- Smart Sand, Inc. SND declared a special cash dividend of 10 cents per share and authorized a $10 million buyback. Smart Sand shares jumped 14% to $2.28 in the after-hours trading session.

- Analysts expect Lifecore Biomedical Inc. LFCR to post a quarterly loss at 47 cents per share on revenue of $23.18 million for the latest quarter. The company will release earnings after the markets close. Lifecore Biomedical shares fell 5.3% to close at $4.7050 on Thursday.

Check out our premarket coverage here

- Martin Midstream Partners L.P. MMLP agreed to be acquired by Martin Resource Management. Martin Midstream Partners shares jumped 9.7% to $3.95 in the after-hours trading session.

- AgEagle Aerial Systems, Inc. UAVS announced a reverse stock split of 1-for-50 shares of common stock. AgEagle Aerial Systems shares fell 5.4% to $0.1150 in the after-hours trading session.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

El-Erian Warns Fed After Jobs Data: ‘Inflation Is Not Dead’

(Bloomberg) — Mohamed El-Erian says the Federal Reserve needs to renew its focus on its fight against rising prices after September’s surprisingly hot jobs report served as a reminder that “inflation is not dead.”

Most Read from Bloomberg

His comments came after Friday’s numbers blew away estimates, triggering a jump in US stocks and bond yields. Nonfarm payrolls rose by 254,000 in September, the most in six months.

“This is not just a solid labor market, but if you take these numbers at face value, it’s a strong labor market late in the cycle,” El-Erian, the president of Queens’ College, Cambridge, told Bloomberg Television on Friday.

“For the Fed, it means push back much harder against pressure from the markets to put you in the single mandate box,” he added. “Enough talk about, ‘The Fed should only be concerned about maximum employment.’”

Investors rapidly slashed wagers on sharper Fed policy easing in November and December after the release. The data also showed the unemployment rate unexpectedly fell to 4.1%, while annual wage growth picked up to 4%.

Swaps traders are now factoring in a little over 50 basis points of interest-rate cuts from the US central bank before the end of the year, down from more than 60 on Thursday. They’ve become so skeptical of further easing that they are no longer fully pricing in a quarter-point move in November. Yields on the policy-sensitive two-year Treasury surged after the release, trading more than 18 basis points higher at 3.89%.

“For markets, this is pushing back on overly aggressive expectations of rate cuts by the Fed,” said El-Erian, who’s also a Bloomberg Opinion columnist. “This will get the market closer to what’s likely.”

Fed official Austan Goolsbee had a different take after the data. He said the jobs readout supported a case for lower rates in the months ahead while acknowledging that the central bank’s focus should remain on longer-term trends in inflation and the labor market.

“That we got a superb number, I’m extremely happy with, but let’s not lose sight of what’s the longer thread,” Goolsbee, president of the Federal Reserve Bank of Chicago, told Bloomberg Television.

“A large majority of the committee feels that conditions are going to improve on inflation, that we’re going to keep getting closer to the 2% target, that the unemployment rate is going to stabilize at full employment, and that rates are going to come down a lot over the next year, 12 to 18 months,” Goolsbee said.

–With assistance from Jonathan Ferro, Lisa Abramowicz, Annmarie Hordern and Michael McKee.

(Updates market pricing, adds comments from Goolsbee.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

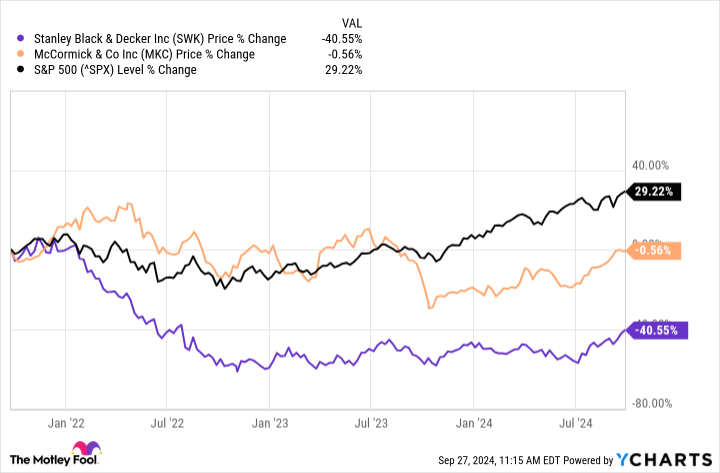

2 Overlooked and Unloved Dividend Stocks to Buy and Hold Forever

For income investors, sometimes the best combination is finding stocks that are oversold and that also offer dividends. Not only are dividends a fantastic way to grow wealth long-term, the reliable income can aid investors while they wait for the stock to rebound. Here are two stocks that have largely trailed the S&P 500 over the past three years, but that offer long-term stable businesses and respectable dividend yields.

Spice up your portfolio

McCormick (NYSE: MKC) is a global leader in flavor, spices, and seasoning, in two segments that generate over $6.5 billion in annual sales across 150 countries and territories. It has a long list of name brands that boast leading share positions in many markets.

Just this week, McCormick declared a quarterly dividend of $0.42 per share, marking the 100th year of consecutive dividend payments by the spice company. The dividend yield currently sits at a respectable 2%.

One of the growth drivers in the business comes from management’s Comprehensive Continuous Improvement (CCI) savings program, which helped drive a 60-basis-point improvement in gross margins during the second quarter, compared to the prior year. Management expects the trend to continue with higher gross margins during the second half of 2024, compared to the first half.

Management is also focusing innovation on specific higher-growth product opportunities, which should help reverse slowing sales volume overall. It’s also true that McCormick’s divestment of a small canning business is currently weighing on sales results.

As management focuses on higher growth opportunities while improving gross margins with its CCI program, the company has proven it will continue to return value to shareholders while they wait for the stock price to gain traction in the future.

Household name

While investors might not recognize or follow Stanley Black & Decker (NYSE: SWK) stock, chances are it’s still a household name for you. The company is a global leader in tools and outdoor products, and operates manufacturing facilities globally. Stanley Black & Decker owns an impressive list of other brands that include DeWalt and Craftsman, among others.

Stanley Black & Decker finds itself in a similar position to McCormick as it works diligently to reduce its cost structure and expand margins. The good news is that it’s seen significant progress, with Q2 gross margins jumping 28.4%, or up 600 basis points compared to the prior year.

As Stanley Black & Decker uses these cost-cutting savings to further growth in its powerful brands, it’s also reducing debt. The company’s cost cutting and strong cash generation during Q2 supported $1.2 billion in debt reduction. Investors shouldn’t forget its respectable dividend yield of 3%.

As the company continues to cut costs and reinvest in high-opportunity products and brands, it remains a solid long-term hold for income investors. Just look at how consistently Stanley Black & Decker has dished out dividends over time.

Buy now

Both of these companies have trailed the broader S&P 500 for the past three years, but they are working diligently to improve operating efficiencies and cut costs. Both companies own a list of stellar brands that can and will power growth again with innovation and reinvestment. It will take time for their stocks to regain traction in the market, but they’re positioned to rebound in the years ahead — and offer respectable dividend yields while investors wait.

Should you invest $1,000 in Stanley Black & Decker right now?

Before you buy stock in Stanley Black & Decker, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Stanley Black & Decker wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends McCormick. The Motley Fool has a disclosure policy.

2 Overlooked and Unloved Dividend Stocks to Buy and Hold Forever was originally published by The Motley Fool

Brady Recent Insider Activity

A new SEC filing reveals that Deidre Cusack, Board Member at Brady BRC, made a notable insider purchase on October 4,.

What Happened: Cusack’s recent purchase of 1,809 shares of Brady, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Friday, reflects confidence in the company’s potential. The total transaction value is $135,005.

Brady shares are trading down 0.0% at $73.64 at the time of this writing on Friday morning.

Delving into Brady’s Background

Brady Corp provides identification solutions and workplace safety products. The company offers identification and healthcare products that are sold under the Brady brand to maintenance, repair, and operations as well as original equipment manufacturing customers. Products include safety signs and labeling systems, material identification systems, wire identification, patient identification, and people identification. Brady also provides workplace safety and compliance products such as safety and compliance signs, asset tracking labels, and first-aid products. The company is organized and managed on a geographic basis with two reportable segments: Americas & Asia which derives maximum revenue, and Europe & Australia.

Brady’s Economic Impact: An Analysis

Negative Revenue Trend: Examining Brady’s financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -0.73% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 51.56%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Brady’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 1.16.

Debt Management: Brady’s debt-to-equity ratio is below the industry average. With a ratio of 0.12, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 18.09 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 2.66, Brady’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Brady’s EV/EBITDA ratio of 12.05 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Brady’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Restructuring Moves & AUM Aid Invesco, Muted Revenues a Concern

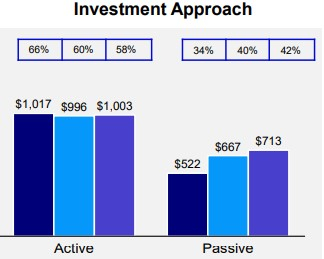

Invesco IVZ remains well-positioned for growth on the back of diversified offerings, efforts to enhance operating efficiency and solid assets under management balance. However, a high intangible assets composition on the balance sheet and subdued revenue performance are major headwinds.

Invesco’s Catalysts

Invesco has been recording steady improvement in the AUM balance. The metric witnessed a compound annual growth rate (CAGR) of 12.3% over the five years ended 2023. The OppenheimerFunds acquisition in 2019 led to a significant rise in the company’s AUM, turning it into one of the leading global asset managers. Invesco has been capitalizing on the rising demand for passive offerings, which constituted 42% of total AUM as of June 30, 2024, up from 34% in the corresponding period of 2023.

Image Source: Invesco Ltd.

IVZ has been executing initiatives to enhance operating efficiency. The company surpassed its goal for net cost synergies from the OppenheimerFunds acquisition and achieved $200 million in annualized net savings before the planned schedule. While adjusted operating expenses experienced a 2.2% rise in 2023, the trend reversed in the first six months of 2024. The company aims to generate $60 million in annual net savings this year as part of the organizational changes.

Further, Invesco holds a strong footprint in Europe, Canada and the Asia-Pacific, besides the United States. As of June 30, 2024, roughly 28% of the total AUM was from clients residing outside the United States. The acquisitions of Intelliflo, a leading U.K.-based advisor-focused digital solutions firm, and Europe-based Source, a leading independent specialist provider of ETFs, helped the company enhancing global market share and footprint. Such strategic pursuits, as well as diversified offerings, are likely to support the company in generating further momentum from business in such regions.

Factors That Weigh on Invesco

Invesco’s subdued top-line expansion is a major concern. Though total operating revenues grew in the first half of 2024, the metric has been experiencing a downtrend since the second half of 2020. Despite having a robust institutional pipeline, diversified product offerings, alternative investment strategies and strong retail channels, revenues are likely to remain subdued in the near term due to a challenging operating backdrop.

A substantial amount of intangible assets in the IVZ’s balance sheet is another major challenge, as these are subject to an annual review. As of June 30, 2024, goodwill and intangible assets amounted to $14.4 billion (53.1% of Invesco’s total assets). Several factors may trigger the initiation of impairment of the book value of such assets, due to which their values will be written down. This is expected to negatively impact the company’s financials. In 2023, amortization and impairment of intangible assets-related charges hampered the company’s profitability, resulting in a net loss.

Invesco currently carries a Zacks Rank #3 (Hold). Over the past three months, shares of the company have risen 17.1%, outperforming the industry’s growth of 15.8%.

Image Source: Zacks Investment Research

IVZ’s Peers Worth Considering

Some better-ranked asset managers worth a look are Ameriprise AMP and SEI Investments SEIC, carrying a Zacks Rank #2 (Buy).

Estimates for AMP’s current-year earnings have been revised marginally upward in the past week. Ameriprise’s shares have rallied 11% over the past three months.

Estimates for SEIC’s current-year earnings have been revised slightly north in the past seven days. Shares of SEI Investments have gained 6.7% over the past three months.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Satoshi Nakamoto About To Be Unveiled? Bitcoin Creator's Identity Focal Point Of Upcoming HBO Documentary

An upcoming documentary, revolving around the identity of Bitcoin’s BTC/USD mysterious creator, Satoshi Nakamoto, has piqued interest in the cryptocurrency world.

What Happened: A captivating trailer of the documentary titled ‘Money Electric: The Bitcoin Mystery” was dropped by HBO’s official social channels, claiming to “unravel” the “internet’s biggest mystery.”

The documentary included extracts from an interview with Blockstream CEO Adam Back, who claimed to have had email correspondence with the pseudonymous creator and was previously speculated to be Nakamoto himself.

Popular theories like collaboration with the government and Satoshi being not one but a group of people were also featured in the 2:30-minute trailer.

Why It Matters: The identity of Satoshi Nakamoto has been a subject of intense speculation and intrigue since the inception of Bitcoin.

Apart from Back, Australian computer scientist Craig Wright, late American software developer Hal Finney, and Litecoin LTC/USD creator Charlie Lee‘s names have been suspected of being Nakamoto.

That said, in July earlier this year, Wright, who had himself claimed to be Nakamoto, was ordered by a UK judge to publicly deny being the Bitcoin founder.

As reported in a Benzinga article from February 2024, Nakamoto’s true identity remains a closely guarded secret, with the pseudonymous creator currently ranked as the 26th richest person in the world.

Nakamoto is purported to have 1.1 million Bitcoin as of February 2024, according to on-chain analytics platform Arkham Intelligence, making him one of the richest people in the world.

Price Action: At the time of writing, Bitcoin was exchanging hands at $61,155.33, up 0.04% in the last 24 hours, according to data from Benzinga Pro.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

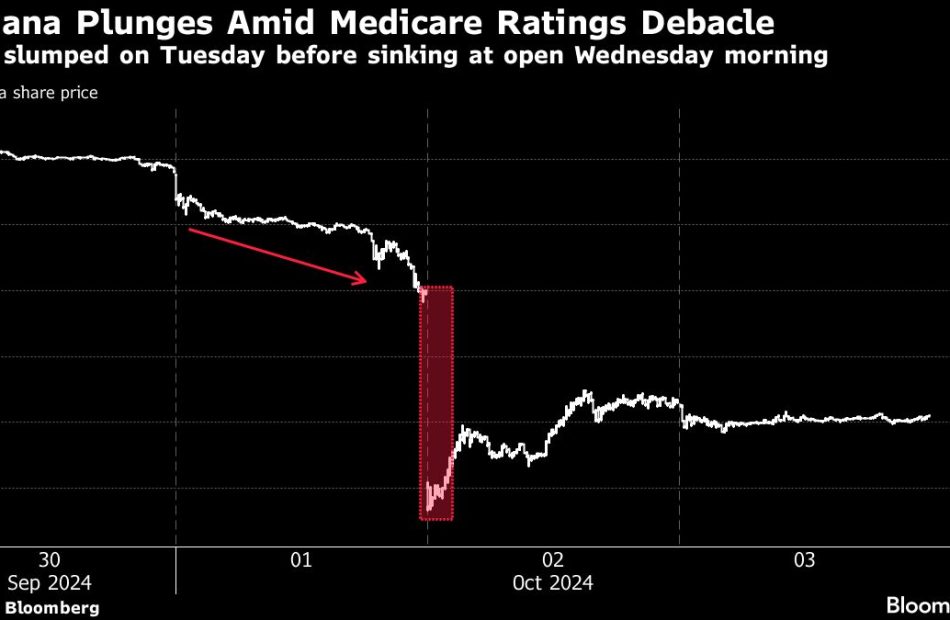

Medicare Mess Sends Humana Shares on Worst Fall Since Financial Crisis

(Bloomberg) — Humana Inc. investors haven’t struggled through anything this bad since the global financial crisis 15 years ago.

Most Read from Bloomberg

The health insurer’s stock price plunged 22% on Tuesday and Wednesday alone, something it last did in February 2009. And they kept falling, with shares suffering their worst week since 2020 and putting them at a level last seen in March of that year.

It all started on Tuesday, when speculation rippled through the stock market that Humana was going to lose high quality ratings on some of the major plans it manages for the US Medicare program. By early Wednesday morning, a week before the government is due to release its official Medicare ratings, the company confirmed the rumors were true. As a result, only about a quarter of its members will be in highly rated plans that generate extra revenue, down from 94% previously, Humana said.

The news sent its shares into a tailspin, falling as much as 24% within the first five minutes of Wednesday’s trading, its biggest intraday decline since Feb. 23, 2009. At the peak of the selloff on Wednesday morning, Humana had lost a third of its market value in just two sessions. It regained some of that decline by the end of the day.

All in all, it was a “worst case scenario” come to fruition, according to UBS analyst AJ Rice.

Quality ratings, also referred to as “star ratings,” range from one to five and help to drive billions of dollars in revenue for Medicare Advantage insurers. More stars allow plans to receive lucrative government bonus payments, while fewer stars can make it harder to attract new customers.

For Humana, a reduced rating would be catastrophic since its business is primarily focused on Medicare. The future hit to profits could reach as much as $23 per share in 2026, “which would almost eliminate 2026 earnings,” according to Bank of America analysts led by Joanna Gajuk. It also could push the firm’s margin recovery further out, according to Gajuk, who has a sell-equivalent rating on the stock.

Wall Street responded to Humana’s confirmation of Medicare’s decision by slashing price targets on the stock, and at least four analysts downgraded their ratings on the shares. Still, the Street consensus is for them to hit $342 in the next 12 months, a 42% jump from current levels. And of the 27 analysts covering Humana, 10 have buy ratings, 15 have holds and only two have sells.

The insurer has already seen surprise jumps in medical costs and tighter reimbursements from the government this year. Perhaps not surprisingly, investors are fleeing the troubled insurer, leading to a loss of nearly half of its market value, which has tumbled from around $56 billion at the start of 2024 to roughly $29 billion now.

Rippling Fear

Fears about falling star ratings, which are crucial for Medicare Advantage plans, are rippling across the health insurance industry. While the government hasn’t released its official star ratings, some are visible on Medicare’s plan finder tool that helps consumers shop for coverage.

That led to a jump in Clover Health Investments Corp. on Wednesday, as some of the health insurer’s Medicare Advantage plans for 2025 appear to have received higher quality ratings. And two large plans from CVS Health Corp. appeared to retain four-star ratings on the website, Evercore ISI analyst Elizabeth Anderson wrote in a note on Wednesday. Shares of the pharmacy chain gained afterward.

On the flip side, UnitedHealth Group Inc. sued the US government this week, claiming that its quality rating was unreasonably downgraded after one customer service phone call.

Regulators are expected to announce official results on or about Oct. 10.

Meanwhile, the cloud over Humana is spreading to other related companies. Shares of agilon health inc., which runs a platform for primary-care physicians treating Medicare patients, lost 20% on Tuesday, Wednesday and Thursday, its worst three-day streak in six months. The firm counts Humana among its key payer partners.

“We were surprised by the sharp decline in stars ratings,” BTIG analyst David Larsen, who holds a neutral rating on agilon, wrote in a research note Thursday. “We worry that if Humana saw such a large decline in ratings, and bonus payments, other payers may face even more pressure.”

–With assistance from John Tozzi and Brandon Harden.

(Updates details on stock and analyst data, and chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.