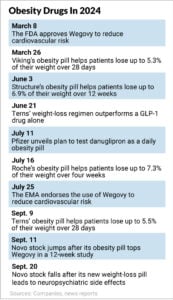

As Weight-Loss Drugs Battle, Upstart Viking Therapeutics Threatens Eli Lilly, Novo Nordisk, Pfizer

A new player in weight-loss drugs has captured Wall Street’s interest and could soon take on superstars Novo Nordisk (NVO) and Eli Lilly (LLY). The rise of Viking Therapeutics (VKTX) also spells trouble for Pfizer (PFE) stock as the pharma giant struggles to become relevant in the fast-growing drug market.

Viking, which launched in 2012, is a small biotech company with no sales yet. Viking Therapeutics stock has a market cap of roughly $7 billion. But its two-pronged approach to weight loss has taken Wall Street by storm.

Just three months ago, VKTX stock catapulted 28% in one day after Viking said it’s exploring a monthly dose of its weight-loss shot, which would be more convenient than the weekly shots currently on the market. The news hammered shares of biopharma’s old guard, including Pfizer stock as the 175-year-old drug giant plays catch-up in what’s projected to be a $105 billion market by 2030. However, IBD stock data shows that Viking has work to do as the company gears up for battle with weight-loss drug leaders Eli Lilly and Novo Nordisk.

↑

X

How Novo Nordisk, Wegovy And Ozempic Are Changing The Weight-Loss Game For Patients And Investors

Still, capturing even a small piece of this market could be huge, says Viking Therapeutics Chief Executive Brian Lian.

“If you assume the market size is $100 billion, it’s most likely larger,” he told Investor’s Business Daily. “Even 3% or 4% of that market — that’s a bigger revenue driver than many pharma companies have in their entire pipeline. You don’t need 40% market share. Viking wouldn’t need that to be successful.”

Pfizer Stock Slumps, Viking Therapeutic Stock Soars

The VKTX stock surge on news of Viking Therapeutics’ plan for a monthly dose weight-loss drug shot underscored how it could become a major player in a market now dominated by Eli Lilly and Novo Nordisk.

But weight-loss drugs are a dynamic market, closely watched by Wall Street.

Shares of Big Pharma stocks AstraZeneca (AZN) and Roche (RHHBY) have risen on news of their efforts in obesity treatment. Amgen (AMGN) stock has trended higher since May as Wall Street watches for more details from its monthly weight-loss shot, which is still in testing.

Pfizer has been a laggard for years, but Pfizer shares rallied in July after the company announced it was moving forward with its daily weight-loss pill.

Viking Therapeutics Eyes Massive Weight-Loss Drugs Market

The weight-loss drugs brawl now features injectable treatments from two of pharma’s biggest names, Novo Nordisk and Lilly. Their drugs, Wegovy and Zepbound, respectively, brought in a combined $4.74 billion in 2023 sales. This year, they’re expected to generate a combined $14.39 billion, according to FactSet.

By 2029, the latest year for which there are estimates, their sales could rocket to $40.6 billion.

So, it’s easy to see why investors are closely watching next-generation efforts — especially the pivot to pills.

Could Weight-Loss Pills Replace Shots?

Oral medications are easier to store, while injectable drugs must be refrigerated. Unlike shots, pills don’t require an autoinjector, syringe or pen. Further, Terns Pharmaceuticals (TERN) Chief Executive Amy Burroughs says it’s easier to titrate oral medications. This means slowly increasing the drug’s dosage to offset side effects.

Oral weight-loss drugs also are easier to combine with other treatments.

Roche and AstraZeneca are using the latter strategy.

AstraZeneca’s diabetes medicine Farxiga is well-known. The company also is working on a pill to lower LDL cholesterol. Ruud Dobber, executive vice president of biopharmaceuticals at AstraZeneca, imagines a world in which patients could take combination pills to simultaneously cut weight and treat diabetes, high cholesterol or other cardiovascular conditions. The approach features “very attractive combinations,” Dobber told IBD.

On an even simpler level — that’s also bullish for Pfizer stock and others — some people don’t want to jab themselves once a week, Structure Therapeutics (GPCR) Chief Executive Raymond Stevens said in an interview.

“They want to pop the pill with their coffee and drive to work,” he said. “They’re not wanting needles.”

Manufacturing Is Key For Weight-Loss Drugs

Manufacturing remains a concern, thanks to the drug/device combination required by injectable drugs. In fact, it has been a key sticking point for Wegovy and Zepbound. The Food and Drug Administration has, at times, listed semaglutide and tirzepatide injections — the chemical names of the two drugs — as being in shortage.

Eliminating the autoinjector, syringe or pen could remove a speed bump in the manufacturing process for weight-loss drugs, says Manu Chakravarthy, global head of cardiovascular, renal and metabolism product development for Roche’s Genentech subsidiary.

“Our obligation is to really bring forward transformative medicines to the masses,” he told IBD. “In our view, it cannot just be done with one or two agents — injectables or orals. We need a whole slew of them, especially when it comes to the type of scale we’re talking about.

But despite the manufacturing woes of Wegovy and Zepbound, Structure Therapeutics’ Stevens credits Novo’s and Lilly’s injectable drugs for opening up the market in weight-loss drugs. In 2023, the two companies “provided enough material for 5 million patients, combined,” he said.

“We know in the U.S. the need for these drugs is in excess of 100 million,” he said. That market is poised to grow dramatically, he added. “There will be 1.5 billion people by 2030 globally in need of metabolism medications.”

Viking Therapeutics Stock Surges This Year

That massive need is partly why VKTX stock has shined lately.

Viking is a development-stage biotech company, meaning it has yet to offer commercial products. The company’s lead drug is called VK2735. Like Eli Lilly’s Zepbound, VK2735 mimics both the GLP-1 and the GIP hormones to stoke, potentially, greater weight loss than drugs like Novo’s Wegovy. Wegovy targets only the GLP-1 hormone.

Viking has drawn attention for a unique, dual approach to obesity drugs. The company is testing oral and injectable forms of VK2735.

CEO Lian doesn’t expect oral drugs to be a “game-changer” in the weight-loss drugs race. Instead, he expects patients who’ve lost weight with injections to switch to pills as a means of maintaining that weight loss.

“Anybody you know who has tried an injection has said that it’s not a big deal,” he said. “Orals will be an option for new patient starts. But it will be a smaller population because of this rapid expansion of injectables. … It’s an expansion (with orals) but it’s incremental.”

Lian said having both oral and injectable weight-loss options puts Viking Therapeutics in a unique position. Patients won’t have to start on a Lilly or Novo shot and then switch to a pill from Pfizer, Roche or Structure. Instead, they can start on Viking’s shot and then switch to the oral form of the same drug.

Viking Therapeutics stock has been on a roller coaster this year. On Feb. 27, shares skyrocketed 121% after Viking said its weight-loss shot prompted patients to lose 13.1% more weight over 13 weeks than the placebo group. The oral formulation of the same Viking drug helped patients lose 5.3% of their weight over 28 days.

Can Pfizer Stock Turn Around?

Viking’s rise as a potential biotech powerhouse in the obesity drug race highlights a major industry narrative: the struggle of Pfizer.

The pharma giant founded in 1849 grabbed the global spotlight during the Covid crisis when, together with Moderna (MRNA), it helped blaze the trail for much-needed vaccines.

But in the battle for dominance in weight-loss drugs, Pfizer has fallen behind faster-moving rivals. The company’s weight-loss efforts have come in fits and starts, much to investors’ chagrin.

Pfizer stock has dropped off markedly after hitting a record high near 62 in late 2021. Shares are now below 30 and have a poor IBD Relative Strength Rating of 27. This puts Pfizer stock in the bottom third of all stocks when it comes to 12-month performance. In comparison, Viking Therapeutics shares have a perfect RS Rating of 99.

Pfizer’s Hefty Bet

Like other companies, Pfizer is making hefty bets on the oral weight-loss space. The company has scrapped two GLP-1-targeting drugs since mid-2023. That includes a twice-daily version of danuglipron after more than half the participants in a study dropped out due to side effects. Now, Pfizer believes its once-a-day version of danuglipron could hit the market second behind Lilly’s orforglipron. Orforglipron also targets the GLP-1 hormone.

“You can bet that like every Pfizer program, it will be very fast,” Pfizer Chief Scientific Officer Mikael Dolsten told analysts during the company’s June-quarter earnings conference call.

Not everyone agrees. Evercore ISI analyst Umer Raffat says Pfizer is likely buying time to see the data from another oral GLP-1 drug in earlier testing. Leerink Partners analyst David Risinger says Pfizer probably won’t have test results for danuglipron in patients with obesity until 2026.

Meanwhile, Pfizer has a third pill in testing with an undisclosed mechanism.

Viking Therapeutics Vs. Pharma’s Old Guard

The quest for the best weight-loss drugs will undoubtedly continue.

Pfizer and Roche are testing oral drugs that target GLP-1 alone. Roche rattled Novo and Lilly stocks on July 17 when the company said its weight-loss drug helped patients lose 6.1% more body weight over a month than the placebo group. Pfizer stock rose nearly 2% that day, while shares of Viking Therapeutics slumped almost 13%.

Lilly’s Zepbound and Viking’s VK2735 work on the GLP-1 and GIP hormones. They work together to slow how fast the stomach empties itself and improve blood sugar markers.

Novo and Structure are testing drugs that target amylin. Combining those with a GLP-1 drug could lead to even greater weight loss. Last month, Novo Nordisk said its amylin-targeting drug outperformed Wegovy in a 12-week study. Terns is testing a drug that targets THR beta in the hopes of improving fat loss vs. muscle loss. But it’s still early days for those efforts.

The myriad options could offer even more proof of the size of the space.

“I think you’re going to see a lot of these uses tailored to a specific patient’s profile,” Viking Therapeutics CEO Lian said. “The amylin plus GLP-1 might be a little better in a diabetic person who is overweight. Glucagon, GLP-1 and GIP might be better in the non-diabetic population. Each combination will find its niche in the market depending on the individual profile.”

Pfizer’s Dolsten acknowledged the power behind combination agents. Some patients might only need a GLP-1 drug to lose 10% body weight and improve their metabolic health.

“Other patients may want to have more body weight loss and may need combo agents,” he said. “And you really see that now from the peptide companies that they (have) single, double mechanism action.”

Being A ‘Me Too’ In Weight-Loss Treatments

Finding new approaches beyond GLP-1 has proved to be tricky for drugmakers.

In late September, Novo Nordisk stock tumbled after the company said a pill it acquired along with startup Inversago Pharmaceuticals caused patients to experience neuropsychiatric side effects. Novo’s pill blocks a cannabinoid receptor. This receptor helps regulate weight and energy balance.

Though patients lost roughly 16 pounds over 16 weeks at the lowest dose, they also reported mild to moderate anxiety, irritability and sleep disturbances. In addition, they faced the same gastrointestinal side effects that plague GLP-1 drugs. The results also hurt Corbus Pharmaceuticals (CRBP), which is testing a drug that uses the same mechanism to treat obesity. Corbus stock crashed more than 62% on Sept. 20.

Novo plans to run a second study in 2025 seeking a better balance between safety and effectiveness.

Still, there is merit to finding something beyond GLP-1 to stoke weight loss, says Third Bridge analyst Lee Brown. He says companies will need to figure out how to differentiate their weight-loss drugs. This could be partly why Pfizer stock remains under pressure.

“If you’re going to be a latecomer to the market, being a late me-too isn’t the best strategy,” he told IBD. “I do think the question is if you’re a dual or a triple (agonist), but you’re (a) weekly (shot), are you going to get pushed aside by an oral GLP that’s a me-too? I would hope not, but this gets back to how we think about needles and how that’s going to be impacted by supply and demand.”

Viking Therapeutics Outperforms Lilly, Novo Nordisk, Pfizer Stock

The obesity drugs battle paints a stunning picture on Wall Street. IBD stock ratings and research tools show Viking stock outperforming Big Pharma’s old guard. It’s not even close.

Viking Therapeutics has a perfect Relative Strength Rating, while Pfizer stock ranks in the bottom one-third of all stocks in terms of 12-month performance. Novo and Lilly stocks are performing better, but still lag Viking. Novo ranks with a 27, while Eli Lilly has an 86.

The picture changes somewhat when considering the companies’ IBD Composite Rating, which combines fundamental and technical performance factors. On a 1 to 99 scale, Eli Lilly tops the group with a 97 rating, followed by Novo Nordisk with 71, Viking with 55 and Pfizer stock with 41.

Viking Therapeutics: High Expectations

In other words, Viking stock’s performance on Wall Street has been impressive, based on high expectations of its obesity offerings. But it has yet to deliver on the fundamentals. While the 12-year-old company’s shares are crushing Pfizer stock, Viking isn’t expected to have any product sales until 2026 and analysts project adjusted losses until 2029.

On a technical basis, Viking Therapeutics stock is trading just above its 50-day and 200-day moving averages, though it remains below its record high at 99.41, achieved on Feb. 28, according to MarketSurge. Meanwhile, it faces two pharma powerhouses, Eli Lilly and Novo Nordisk, whose weight-loss treatments already dominate a rapidly growing market.

But Viking’s Lian is confident. No one has successfully launched an obesity-treating pill yet. And the company is working hard on an injectable that could also take on the biggest names in weight-loss drugs.

“It’s an exciting and dynamic space and we’re positioned well,” he said. “We’re going to move as aggressively as possible.”

Follow Allison Gatlin on X, the platform formerly known as Twitter, at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Novavax Stock Rocketed This Year, But Challenges Persist. Is It A Buy Or A Sell?

The Cream Of The Crop: 5 Biotechs That Outrank Most Stocks

How To Research Growth Stocks: Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

5 Super Semiconductor Stocks to Buy Hand Over Fist Heading Into 2025

The world’s biggest technology companies are spending an enormous amount of money building data centers, and they are filling them with graphics processing chips (GPUs) designed for artificial intelligence (AI) development.

GPUs are built for parallel processing, meaning they can handle large volumes of data and multiple workloads at once, which is key to training AI models and performing AI inference. Based on recent financial reports:

-

Microsoft spent $55.7 billion on capital expenditures (capex) during its fiscal 2024 year (ended June 30), most of which went toward AI data center infrastructure and chips.

-

Amazon spent $30.5 billion on capex during the first half of 2024, mostly related to AI.

-

Alphabet spent $25 billion on AI capex in the first half of 2024.

-

Meta Platforms plans to spend between $37 billion and $40 billion on AI capex for the whole of 2024.

-

Oracle spent $6.9 billion on AI capex in its fiscal 2024 year (ended May 31).

Microsoft, Amazon, Meta, and Oracle have explicitly said they plan to spend even more money in the coming year. That spells opportunity for the semiconductor industry, so here are five top chip stocks to buy heading into 2025.

1. Nvidia

When it comes to data center GPUs, Nvidia (NASDAQ: NVDA) is the undisputed leader. Its H100 GPU set the benchmark for the AI industry last year, and the company is now gearing up to ship an entirely new generation of chips based on its Blackwell architecture.

Blackwell-based systems like the GB200 NVL72 will perform AI inference at up to 30 times the speed of equivalent H100 systems. Plus, individual GB200 GPUs are expected to sell for between $30,000 and $40,000 each, which is in line with what data center operators originally paid for the H100. In other words, Blackwell paves the way for a substantial improvement in cost efficiency for developers, who normally pay for computing capacity by the minute.

Nvidia CEO Jensen Huang expects Blackwell GPUs to start contributing billions of dollars to the company’s revenue in the final quarter of fiscal 2025 (which runs from November to January), and shipments will scale up from there.

Nvidia is on track to generate an estimated $125.5 billion in total revenue in fiscal 2025, representing a 125% increase from the prior year. Its stock isn’t cheap, but it does trade at a reasonable forward price to earnings (P/E) ratio of 29.1 when measured against the company’s forecast fiscal 2026 earnings per share.

Simply put, investors who are willing to hold Nvidia stock for at least the next 18 months are likely paying a reasonable price today.

2. Micron Technology

Micron Technology (NASDAQ: MU) is a leading supplier of memory and storage chips for data centers, personal computers, and smartphones. In AI data center settings, memory chips complement GPUs by storing data in a ready state so it can be called upon instantly for training and inference. Since AI requires mountains of data to learn and improve, demand is soaring for more memory capacity.

Micron’s latest HBM3E (high-bandwidth memory) 36 gigabyte (GB) units for the data center deliver up to 50% more capacity than any competing product today while consuming 20% less energy. It was selected to power Nvidia’s H200 GPU, and potentially also its Blackwell GB200 GPUs. In fact, Micron is now completely sold out of HBM3E until 2026.

Beyond the data center, every tier-1 manufacturer of Android-based smartphones uses Micron’s LP5X DRAM memory. Many of them have launched AI-enabled devices this year with minimum memory capacity requirements doubling compared to their non-AI predecessors from last year. There is a similar trend in personal computing, with most AI-enabled PCs launching with a minimum DRAM capacity of 16GB compared to 12GB last year.

Higher memory requirements directly translate into more revenue for Micron. In its recent fiscal 2024 fourth quarter (ended Aug. 29), the company’s revenue surged 93% year over year to $7.7 billion, and it’s forecasting more strength to come.

3. Axcelis Technologies

Axcelis Technologies (NASDAQ: ACLS) isn’t a semiconductor producer. Instead, it makes ion implantation equipment which is critical to the fabrication process for central processing units (CPUs), memory chips, and power devices that regulate the flow of electric power in high-current applications.

AI data centers have become a new opportunity for power device makers (and Axcelis’ equipment) because they consume substantial amounts of energy. Some of Axcelis’ customers have started using trench MOFSET (metal oxide semiconductor field effect transistor) power devices with a silicon carbide chemistry, which is more robust and heat-efficient than traditional silicon chemistries. Silicon carbide power devices are more implant intensive, which is a direct tailwind for Axcelis’ business.

Additionally, Axcelis is benefiting from the growing demand for high-capacity memory chips in the data center, computers, and smartphones. As manufacturers of memory chips expand production to meet that demand, they will need more of Axcelis’ equipment, and the company has already started building inventory in anticipation for a strong 2025.

In fact, Axcelis’ guidance suggests 2025 could be the strongest year in the company’s history with a record $1.3 billion in revenue potentially in the cards.

4. Broadcom

Broadcom (NASDAQ: AVGO) is a multifaceted AI organization with a presence in semiconductors, equipment, cybersecurity, cloud software, and more. Its semiconductor business is the focus for investors right now because several of its products are experiencing significant demand from companies building AI infrastructure.

Broadcom makes AI accelerators (data center chips) for hyperscale customers (which typically include Microsoft, Amazon, and Alphabet). During its recent fiscal 2024 third quarter (ended Aug. 4), the company said that business grew by a whopping three-and-a-half times compared to the year-ago period. Similarly, it saw fourfold sales growth in its Tomahawk 5 and Jericho3-AI Ethernet switches for the data center. These regulate how quickly data flows from one point to another.

Coming into Q3, Broadcom is expected to deliver $51 billion in total revenue for fiscal 2024, with $11 billion attributable to AI. However, following the strong results I just highlighted, the company revised those numbers higher to $51.5 billion and $12 billion, respectively.

Broadcom is currently knocking on the door of the exclusive $1 trillion club, which is home to just six U.S. technology giants right now.

5. Advanced Micro Devices (AMD)

Advanced Micro Devices (NASDAQ: AMD) is one of the world’s top chip suppliers in the consumer electronics industry. Its hardware can be found in everything from Sony‘s PlayStation 5 to the infotainment systems in Tesla‘s electric vehicles. However, the company is now trying to compete with Nvidia in the data center segment with its new MI300 GPUs.

The MI300 was designed as an alternative to Nvidia’s H100, and it’s attracting top customers like Oracle, Microsoft, and Meta Platforms. However, with Nvidia set to launch its Blackwell lineup, AMD is already gearing up to release a faster GPU called the MI350 next year. It will be based on a new architecture called Compute DNA (CDNA) 4, which could deliver 35 times more performance than CDNA 3 chips like the MI300. AMD intends for this architecture to compete directly with Blackwell.

AMD is already a leader in AI chips for the personal computing segment, with an estimated market share of 90%. It recently launched the Ryzen AI 300 series for notebooks, which features the fastest neural processing unit (NPU) in the industry. The company says more than 100 platforms will launch with those chips from leading PC manufacturers like Asus, Acer, HP Inc., and more.

AMD is coming off a whopping 115% year-over-year growth in its data center revenue and 49% growth in its client segment revenue (which is home to Ryzen AI chips) in the second quarter of 2024. But the AI revolution is just getting warmed up, so the best might still be to come.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, HP, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

5 Super Semiconductor Stocks to Buy Hand Over Fist Heading Into 2025 was originally published by The Motley Fool

Massive Insider Trade At Extra Space Storage

Joseph Margolis, Chief Executive Officer at Extra Space Storage EXR, executed a substantial insider sell on October 3, according to an SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Margolis sold 7,500 shares of Extra Space Storage. The total transaction value is $1,338,900.

Extra Space Storage shares are trading down 3.13% at $170.79 at the time of this writing on Friday morning.

Delving into Extra Space Storage’s Background

Extra Space Storage is a fully integrated real estate investment trust that owns, operates, and manages almost 3,800 self-storage properties in 42 states, with over 285 million net rentable square feet of storage space. Of these properties, approximately one half is wholly owned, while some facilities are owned through joint ventures and others are owned by third parties and managed by Extra Space Storage in exchange for a management fee.

Extra Space Storage’s Economic Impact: An Analysis

Revenue Growth: Extra Space Storage’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 58.52%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Navigating Financial Profits:

-

Gross Margin: With a high gross margin of 73.29%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Extra Space Storage’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 0.88.

Debt Management: Extra Space Storage’s debt-to-equity ratio is below the industry average. With a ratio of 0.83, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 48.17 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 11.6, Extra Space Storage’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 22.52 reflects market recognition of Extra Space Storage’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Extra Space Storage’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Airlines Soar Or Stall? What Insider Trades Say About Industry's Future

Airline stocks have endured a year of turbulence, reflected by wild swings in share price, industry expectations and earnings. Recent insider trades of airline companies could indicate where the industry will head next.

The Trades: Benzinga Edge compiles information on insider trade filings.

Southwest Airlines Co LUV experienced a flurry of insider activity in recent days. Director Rakesh Gangwal invested over $100,000,000 in Southwest shares in late September and early October. Executive Chairman Gary C Kelly bought $1,000,000 of Southwest shares in late September.

Delta Air Lines, Inc. DAL is the largest American airline company. The Atlanta-based giant experienced several insider sales in early 2024. President Glen W Hauenstein sold $4,904,600 in Delta stock in April, over 30% of his total holding. Executive Vice President Peter W Carter sold $2,500,000 of Delta shares that month, over 25% of his position.

Delta has experienced a volatile year. Its share price rose over 30% from January to mid-May, but a subsequent drawdown erased much of its gains. A recovery followed from August to late September.

Several Allegiant Travel Company ALGT executives have sold shares in 2024. Chief Marketing Officer Scott DeAngelo sold over $1,000,000 in Allegiant stock in May. DeAngelo has since resigned from the company. Chief Operating Officer Frank Wilper and Director Gary Ellmer also made sales in the spring and summer.

Why it Matters: Insider trading activity is often viewed as a valuable indicator of a company’s future prospects. When top executives or board members buy or sell shares, it can signal their confidence—or lack thereof—in the company’s performance. In the case of airline stocks, this insider movement may be especially relevant as the industry navigates a turbulent environment marked by fluctuating demand, rising fuel costs, and post-pandemic recovery.

For investors, tracking these insider trades provides a critical lens into how industry leaders perceive future risks and opportunities, which can guide their own strategies in an increasingly volatile market.

Also Read:

Photo: Tupungato/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NuScale Power Soars 270% – Analysts Forecasts More Gains Ahead

NuScale Power SMR is an industrial company that is still early on but whose share price has skyrocketed in 2024. Shares are up nearly 270% this year, yet the company generated just $1 million in revenue last quarter. I’ll dive into what NuScale does and what I ultimately think about the stock.

NuScale: A First Mover in Small Modular Reactors

NuScale is a nuclear power company, but it approaches nuclear power in a nontraditional way. The company specializes in making Small Modular Reactors (SMRs), which are much smaller than traditional ones. They produce less energy but can theoretically be built faster.

So far, there are few SMRs operating worldwide. One in China took around nine years to finish construction. China expects to complete another project in 2026, with a construction time of around five years. The most recently built large nuclear reactors in the US, the VOGTLE 3 and 4, took just over 10 years to construct.

SMRs may have many significant advantages over large reactors. First, companies can construct them closer to where the energy is needed. This decreases the amount of energy lost in transfer because the electricity doesn’t have to travel as far from its generation point.

It also allows companies to expand the network of reactors over time. This can help meet the needs of certain regions more immediately. However, the construction time data we have so far cast doubt on exactly how much faster companies can build modular reactors.

NuScale is currently approved by the Nuclear Regulatory Commission (NRC) to build its VOYGR-12 power plants. These consist of up to 12 of the company’s NuScale Power Modules (NPMs), each of which can generate 50 megawatts of electricity (MWe). For context, the VOGTEL reactors can each generate around 1,215 MWe. So, an NPM generates around 4% of the power of new large reactors.

Opportunity Remains Despite a Massive Hiccup

In 2020, NuScale became the first company to achieve Standard Design Approval (SDA) from the NRC. This means that VOYGR-12 plants can begin construction without needing to be approved every time the company gets a deal, speeding up the company’s ability to scale its production.

However, NuScale has faced significant roadblocks in getting any plants operational. In late 2023, the company announced that the Utah Associated Municipal Power Systems (UAMPS) terminated its agreement with the firm to build a plant. It was supposed to be NuScale’s first operational plant.

According to M.V. Ramana at the University of British Columbia, Vancouver, the estimated cost of the plant went from $3 billion to $9.3 billion. This resulted in the UAMPS exercising its right to exit the project. On a per MWe basis, the new estimated cost of the project was 250% more than the initial cost of the VOGTLE project.

Many believe that nuclear energy must be part of the equation to meet the energy needs of the future and transition to a net-zero economy. This is especially true due to the rise of GenAI and the massive amount of electricity that data centers require to function.

Data center companies want to use renewable power, like nuclear, to run their facilities. It reduces emissions, and they prefer it over wind and solar, which are less reliable. This is great for companies like NuScale and is a big reason why its stock price has soared despite its low revenue.

Analyst Price Targets and NuScale’s Valuation

On average, Wall Street price targets signal that NuScale is currently somewhat overvalued. The average price target of $9.69 implies a 22% downside potential. However, the most recently updated price target from Craig-Hallum signals that shares could rise 31% from their current level.

Although the market opportunity for NuScale is massive, it’s hard not to be alarmed by the company’s valuation. The stock is valued at more than 43 times its projected sales over the next twelve months.

This measure is also known as the company’s forward price-to-sales (P/S) ratio. It’s used instead of the forward price to earnings (P/E) ratio because NuScale has negative earnings. The 43x forward P/S figure is higher than 98% of all publicly traded companies worldwide.

If NuScale succeeds, it will have a huge opportunity. However, its past implementation failures are concerning. The overall uncertainty around the economics of small nuclear reactors makes paying 43x an unsavory proposition for my taste.

The article “NuScale Power Soars 270% – Analysts Forecasts More Gains Ahead” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer Stock Tumbles on Recent News. Time to Buy or Stay Away?

It’s been a tough few months for Super Micro Computer (NASDAQ: SMCI), whose stock has come under pressure for a variety of reasons this year. The stock first dropped in April following a mixed reaction to its fiscal 2024 third-quarter results. That trend extended to its fourth-quarter earnings release in early August with declining margins worrying investors.

The company was then the subject of a short-selling report in late August from Hindenburg Research, which accused the company of accounting manipulation, evading sanctions, and related-party self-dealings by management. Not helping matters, the company delayed the filing of its 10-K shortly following the short report, though management has denied any wrongdoing.

On Sept. 26, the stock sank even further following a report from The Wall Street Journal alleging the Department of Justice (DOJ) is also investigating the company. Neither the DOJ nor the company have confirmed the investigation.

And most recently, Supermicro completed its 10-for-1 stock split on Oct. 1. These various developments have all made the stock very volatile with shares down 66% from their March peak. But Supermicro is still up over 45% year to date, and that raises the question: What should investors do with the stock now?

So what does Super Micro Computer do anyway?

Supermicro designs and manufactures servers and storage systems. It assembles what is commonly referred to as white box servers, which are basically the generic-brand versions of servers, using commercially available retail computer parts. It competes against other white box server providers as well as brand name offerings from Dell, Lenovo, and Hewlett Packard Enterprise.

The company has benefited from the massive data center buildouts as part of the artificial intelligence (AI) craze. The company’s revenue has been surging with 143% growth in its fiscal 2024 fourth quarter (ended June 30) to $5.31 billion. Supermicro has credited its next-generation air-cooled and DLC rack scale AI GPU platforms for its strong growth. These systems are used to stop servers from overheating and failing while also reducing energy costs.

While Supermicro has ridden strong AI tailwinds, it’s ultimately in a highly competitive, low-margin business without a lot of differentiation. Its revenue may have soared last quarter, but its gross margin sank to 11.2% from 17.0% a year ago and 15.5% the previous quarter. The company blamed its margin pressure on a combination of product mix, reduced prices to win new designs, and the costs of ramping up its direct liquid-cooled (DLC) rack scale AI GPU clusters. Management is projecting its gross margin will gradually improve throughout fiscal 2025 and return to a range of 14% to 17%.

An 11% gross margin is slim, and even 17% isn’t exactly robust. By comparison, the chip companies fueling the AI infrastructure buildout have much higher gross margins with both Nvidia and Broadcom boasting gross margins of at least 60% last quarter.

Should investors be worried by a possible DOJ probe?

At this point, the short report allegations against Supermicro are just that, allegations. And investors must be aware Hindenburg Research released the report in the hopes of driving the stock price down for the benefit of its short position. The firm succeeded in doing just that.

Meanwhile, the DOJ probe reported by The Wall Street Journal has remained unconfirmed by DOJ officials and company management.

That said, Supermicro has run afoul of U.S. regulatory agencies in the past. The SEC fined the company in 2020 over accounting issues after accusing the company of shipping products to warehouses at quarter-end and recognizing it as revenue before the products reached customers. The company ultimately agreed to pay a $17.5 million fine without admitting or denying the details of the SEC investigation.

Given this history, the Hindenburg report and DOJ news are a bit worrisome. However, Supermicro still sells real products, has real customers, and is benefiting from rapid AI development.

Time to buy the stock or stay away?

Even before the company’s latest headaches, I did not think Supermicro was a particularly good investment given its margin profile and pricey stock. Following these reports, the bull case becomes even harder to accept.

Regarding valuation, though, the recent sell-off has made the stock a lot more attractive with a forward price-to-earnings (P/E) ratio below 10 and a price/earnings-to-growth (PEG) ratio of just 0.2. A PEG ratio under 1.0 is generally considered undervalued. However, as the below chart shows, it has been pretty common for the stock to trade at even lower valuations in the past.

Given the uncertainty surrounding the stock, I’d stay on the sidelines. However, this is not a situation where investors should be rushing to sell out of their positions given Supermicro’s current valuation and the growth of AI-related spending.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Super Micro Computer Stock Tumbles on Recent News. Time to Buy or Stay Away? was originally published by The Motley Fool

NextCure to Give Two Presentations at Society for Immunotherapy of Cancer Annual Meeting

BELTSVILLE, Md., Oct. 04, 2024 (GLOBE NEWSWIRE) — NextCure, Inc. NXTC, a clinical-stage biopharmaceutical company committed to discovering and developing novel, first-in-class and best-in-class therapies to treat cancer, today announced two presentations at the Society for Immunotherapy of Cancer (SITC) annual meeting, to be held in Houston, TX from November 6-10, 2024. NextCure will share pre-clinical data from LNCB74 (B7-H4 ADC) and biomarker data from NC410 combination study with pembrolizumab in ICI-naïve MSS/MSI-L CRC during poster sessions.

Poster Presentation Details:

Title: LNCB74 is a B7-H4 antibody-drug conjugate with a β-glucuronide linker-MMAE payload system to enhance therapeutic index in B7-H4 expressing cancers

Lead Author: Shannon M. Kahan

Abstract Number: 1051

Session Date & Time: Friday, November 8, 2024, 5:30 – 7:00 PM

Title: NC410 in combination with pembrolizumab improves anti-tumor responses by promoting collagen remodeling and tumor immunity in advanced ICI naive MSS/MSI-L colorectal cancer (CRC)

Lead Author: Alina Barbu

Abstract Number: 632

Session Date & Time: Saturday, November 9, 2024, 7:10 – 8:30 PM

About NextCure, Inc.

NextCure is a clinical-stage biopharmaceutical company that is focused on advancing innovative medicines that treat cancer patients that do not respond to, or have disease progression on, current therapies, through the use of differentiated mechanisms of actions including antibody-drug conjugates, antibodies and proteins. We focus on advancing therapies that leverage our core strengths in understanding biological pathways and biomarkers, the interactions of cells, including in the tumor microenvironment, and the role each interaction plays in a biologic response. http://www.nextcure.com

Cautionary Statement Regarding Forward-Looking Statements

Statements made in this press release that are not historical facts are forward-looking statements. Words such as “expects,” “believes,” “intends,” “hope,” “forward” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve substantial risks and uncertainties that could cause actual results to differ materially from those projected in any forward-looking statement. Such risks and uncertainties include, among others: our limited operating history and no products approved for commercial sale; our history of significant losses; our need to obtain additional financing; risks related to clinical development, including that early clinical data may not be confirmed by later clinical results; risks that pre-clinical research may not be confirmed in clinical trials; risks related to marketing approval and commercialization; and NextCure’s dependence on key personnel. More detailed information on these and additional factors that could affect NextCure’s actual results are described in NextCure’s filings with the Securities and Exchange Commission (the “SEC”), including NextCure’s most recent Form 10-K and subsequent Form 10-Q. You should not place undue reliance on any forward-looking statements. NextCure assumes no obligation to update any forward-looking statements, even if expectations change.

Investor Inquiries

Timothy Mayer, Ph.D.

NextCure, Inc.

Chief Operating Officer

(240) 762-6486

IR@nextcure.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell To Bobby Welcomes George Campbell as Chief Strategist Officer

Miramar, FL October 03, 2024 –(PR.com)– SellToBobby.com, the homebuyer in Florida and a company experiencing rapid growth, is proud to announce the appointment of George Campbell as its new Chief Strategist Officer (CSO).

George Campbell brings with him a wealth of experience in the real estate industry, with a strong background in acquisitions, dispositions, and asset management. Over his accomplished career, Campbell has demonstrated exceptional leadership and strategic thinking, guiding teams and organizations to success in highly competitive markets.

“George’s extensive expertise and forward-thinking approach make him the ideal addition to our team,” said Bobby Suarez. “We are confident that under his leadership, Sell To Bobby will continue to grow and innovate, offering unparalleled services to homeowners looking to maximize the value of their properties.”

As Chief Strategist Officer, Campbell will oversee the development and execution of Sell To Bobby’s strategic initiatives, including expansion efforts and optimizing the company’s operations to better serve clients across Florida.

“I am thrilled to join Sell To Bobby and help drive the company’s vision forward,” said Campbell. “The real estate landscape is evolving, and Im excited to be part of a team that is dedicated to helping homeowners achieve their financial goals through innovative solutions.”

With Campbell’s leadership, Sell To Bobby is poised to enhance its service offerings, bringing even greater value to homeowners looking to sell their properties.

Contact Information:

Sell To Bobby LLC

Janina Scuderi

305-614-3115

Contact via Email

www.selltoBobby.com

Read the full story here: https://www.pr.com/press-release/922091

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Fortress Energy Chief Executive Officer Makes $50.00M Stock Purchase

On October 3, a substantial insider purchase was made by Wesley R Edens, Chief Executive Officer at New Fortress Energy NFE, as per the latest SEC filing.

What Happened: In a significant move reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Edens purchased 5,793,742 shares of New Fortress Energy, demonstrating confidence in the company’s growth potential. The total value of the transaction stands at $49,999,993.

New Fortress Energy‘s shares are actively trading at $9.38, experiencing a up of 3.93% during Friday’s morning session.

Get to Know New Fortress Energy Better

New Fortress Energy is an integrated gas-to-power company. Its business model spans the entire production and delivery chain from natural gas procurement and liquefaction to logistics, shipping, terminals, and conversion or development of a natural gas-fired generation. It has invested in floating, liquefied natural gas vessels to both lower the cost of acquiring gas while securing a long-term supply for its terminals. Its segments include terminals and infrastructure, or T&I, and ships.

A Deep Dive into New Fortress Energy’s Financials

Negative Revenue Trend: Examining New Fortress Energy’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -23.75% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Holistic Profitability Examination:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 37.0%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, New Fortress Energy exhibits below-average bottom-line performance with a current EPS of -0.44.

Debt Management: New Fortress Energy’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 5.3, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Market Valuation:

-

Price to Earnings (P/E) Ratio: New Fortress Energy’s P/E ratio of 7.63 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.77, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): New Fortress Energy’s EV/EBITDA ratio, surpassing industry averages at 12.86, positions it with an above-average valuation in the market.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Exploring Key Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of New Fortress Energy’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's Troubles Mount As DOJ, SEC Throw Their Weight Behind Class Action Lawsuit Alleging AI Chip Giant Misrepresented Crypto Revenue

The U.S. Justice Department and the SEC have backed the class action lawsuit against AI chip giant Nvidia Corp. NVDA in the Supreme Court, which accused Nvidia of hiding its cryptocurrency revenue.

What Happened: The DOJ and SEC are advocating for the continuation of the lawsuit, which was brought against the company in 2018, Cointelegraph reported Thursday.

In an amicus brief, U.S. Solicitor General Elizabeth Prelogar and SEC senior lawyer Theodore Weiman argued that the lawsuit had “sufficient details” to survive a district court dismissal, urging the apex court to greenlight its revival by an appeals court.

The DOJ and the SEC didn’t immediately respond to Benzinga’s request for comment.

Why It Matters: This lawsuit has been a significant point of contention since 2017, when Nvidia shareholders filed a lawsuit alleging the company misled investors by classifying revenues from the sale of cryptocurrency mining chips as gaming revenues.

The case was initially dismissed, but the investor group appealed the decision, leading to the Ninth Circuit appeals court reviving it in August last year. Nvidia then petitioned the Supreme Court to reverse it, and the top court agreed to listen to the company’s arguments in June earlier this year.

Price Action: Nvidia shares rose 3.4% on Thursday to close at $122.85, but declined marginally by 0.1% in after-hours trading, according to data from Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.