Here's 1 Incredibly Cheap Semiconductor Stock to Buy Following Micron Technology's Latest Results

Micron Technology (NASDAQ: MU) released its results for fiscal 2024 on Sept. 25. The data released offers a clear indication that the memory chip market is hot thanks to favorable supply/demand dynamics.

Micron reported $7.75 billion in fiscal Q4 revenue, a stunning increase of 93% year over year. Additionally, the company’s operating income margin swung to a positive 22.5% from a negative reading of 30.1% in the same quarter last year thanks to the recovery in memory prices. The improvements helped Micron report non-GAAP (generally accepted accounting principles) earnings of $1.18 per share for the quarter, as compared to a loss of $1.07 per share in the year-ago period.

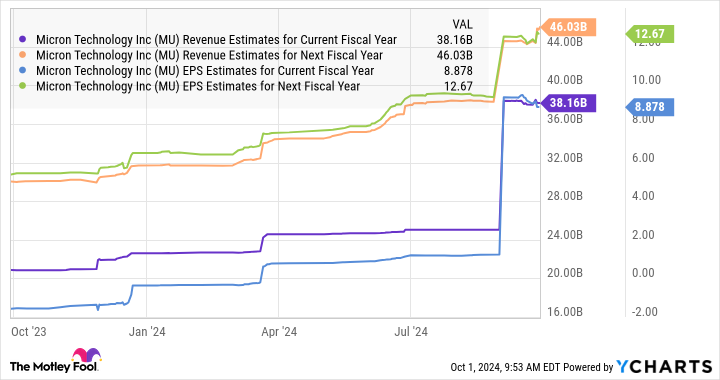

The company’s revenue for the entire fiscal year jumped 61% to $25 billion. Its adjusted earnings came in at $1.30 per share, as compared to a loss of $4.45 per share in the prior year period. Even better, analysts expect Micron to sustain this impressive level of growth over the next couple of fiscal years as well.

The growth forecast isn’t surprising as the memory market got a terrific boost thanks to the growing interest in all things artificial intelligence (AI). The rapid adoption of this technology created the need for more memory chips across different applications, ranging from data centers to smartphones to vehicles to personal computers (PCs).

Memory manufacturers such as Micron say they plan to spend more money to boost their production capacities. This is good news for Lam Research (NASDAQ: LRCX), a semiconductor equipment supplier that relies on the memory market for a significant chunk of its revenue.

Let’s look at the reasons why buying Lam Research stock could turn out to be a smart move following Micron’s impressive results.

Increasing memory capex will be a tailwind for Lam Research

Micron management pointed out on the company’s latest earnings conference call that its capital expenditures stood at $8.1 billion in fiscal 2024. That was an increase of 16% from the previous fiscal year. The company plans to spend $3.5 billion in capex in the first quarter of fiscal 2025, which points toward a much higher run rate than last year.

For the full year, Micron says that it expects “capex to be around the mid-30s percentage range of revenue.” Based on the $38 billion revenue estimate for the company, as seen in the chart earlier, its capex could jump to $13.3 billion in fiscal 2025 (at 35% of the top line). That would be a 64% increase from the preceding year.

Lam Research gets 36% of its revenue from selling memory manufacturing equipment. This explains why the company’s outlook for fiscal 2025 (which started in July this year) is much better than its performance last year. Lam Research’s fiscal 2024 revenue fell 14% from the previous year to $14.9 billion on account of a glut in the memory market due to weak demand from PCs and smartphones.

The company’s adjusted earnings also fell to $29 per share from $33.21 per share in fiscal 2023. However, the improved capital spending by memory specialists such as Micron is set to drive solid growth in Lam’s top line in the current fiscal year and beyond.

The improved top-line performance is set to filter down to the bottom line as well.

These improvements are not surprising, as Lam points out that memory demand is on track to improve on account of the growing need for high-bandwidth memory (HBM) chips used in data center graphics cards to train AI models. Additionally, Lam CEO Timothy Archer remarked on the company’s August earnings conference call that:

However, as AI use cases expand, we believe inferencing at the edge will spur content growth of low-power DRAM and NAND storage in enterprise PCs and smartphones. Investments for AI-enabled edge devices play particularly well to Lam’s strengths.

These AI-related catalysts are expected to send the memory chip market’s revenue to $260 billion in 2029 from just $89 billion last year. This explains why other memory manufacturers such as Samsung and SK Hynix also forecast huge increases in their capex. SK Hynix’s capex, for instance, is expected to jump a whopping 75% next year as the company ramps up HBM production capacity to meet the booming end-market demand.

Samsung’s dynamic random-access memory (DRAM) capex, on the other hand, is expected to increase 9% this year to $9.5 billion, followed by a stronger jump to $12 billion next year. Lam Research mentioned in its annual filing that Micron, Samsung, SK Hynix, and Taiwan Semiconductor Manufacturing are its “most significant customers.”

So, the increase in capital spending by these companies is going to be a robust growth driver for Lam Research, which explains why its revenue and earnings could increase nicely going forward.

The stock’s attractive valuation makes it worth buying

With a trailing price-to-earnings (P/E) ratio of 28 and forward earnings multiple of 22, investors are getting a good deal on Lam Research stock right now, considering the projected healthy increase in its top and bottom lines. These multiples represent a discount to the Nasdaq-100 index’s earnings multiple of 32 (using the index as a proxy for tech stocks).

At the same time, Lam’s price/earnings-to-growth ratio (PEG ratio), which is a forward-looking valuation measure that takes into account the company’s growth potential, makes buying this semiconductor stock a no-brainer.

A PEG ratio of less than 1 means that a stock is undervalued with respect to the earnings growth that it is set to deliver. And, as the chart tells us, Lam Research is indeed undervalued on this front. That’s why investors looking to add an AI stock to their portfolios would do well to buy Lam Research before it starts soaring.

Should you invest $1,000 in Lam Research right now?

Before you buy stock in Lam Research, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Here’s 1 Incredibly Cheap Semiconductor Stock to Buy Following Micron Technology’s Latest Results was originally published by The Motley Fool

Leave a Reply