Joanne Smee Collins Of Brady Shows Optimism, Buys $135K In Stock

In a recent SEC filing, it was revealed that Joanne Smee Collins, Board Member at Brady BRC, made a noteworthy insider purchase on October 4,.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Friday unveiled that Collins made a notable purchase of 1,809 shares of Brady, valuing at $135,005.

Monitoring the market, Brady‘s shares down by 0.0% at $73.64 during Friday’s morning.

Delving into Brady’s Background

Brady Corp provides identification solutions and workplace safety products. The company offers identification and healthcare products that are sold under the Brady brand to maintenance, repair, and operations as well as original equipment manufacturing customers. Products include safety signs and labeling systems, material identification systems, wire identification, patient identification, and people identification. Brady also provides workplace safety and compliance products such as safety and compliance signs, asset tracking labels, and first-aid products. The company is organized and managed on a geographic basis with two reportable segments: Americas & Asia which derives maximum revenue, and Europe & Australia.

Breaking Down Brady’s Financial Performance

Revenue Challenges: Brady’s revenue growth over 3 months faced difficulties. As of 31 July, 2024, the company experienced a decline of approximately -0.73%. This indicates a decrease in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Navigating Financial Profits:

-

Gross Margin: Achieving a high gross margin of 51.56%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.16, Brady showcases strong earnings per share.

Debt Management: With a below-average debt-to-equity ratio of 0.12, Brady adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 18.09 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 2.66 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 12.05, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Deep Dive into Insider Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Brady’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Harris To Survey Helene Impact In North Carolina One Day After Trump Visit

Hurricane Helene has left a devastating mark on the Southeast, prompting urgent federal responses and highlighting stark political divides as communities struggle to recover.

Vice President Kamala Harris is visiting North Carolina to support the state’s recovery efforts following Hurricane Helene. Her trip comes just a day after Former President Donald Trump‘s visit, during which he reportedly made misleading claims about the federal response to the disaster, according to AP News.

On Friday, White House Senior Deputy Press Secretary Andrew Bates issued a memo calling these accusations “bald-faced lies.” This exchange highlights the contrasting narratives from both parties regarding the storm’s aftermath. President Joe Biden also toured the affected areas, spending two days in the Carolinas, Florida, and Georgia to assess the damage and meet with farmers whose crops were devastated by the hurricane.

Biden has mobilized 1,000 active-duty soldiers to support the 6,000 National Guard members and 4,800 federal aid workers who are currently working in six states impacted by the severe weather, BBC News reported.

Meanwhile, in a letter sent late Friday to congressional leaders, Biden urges Congress to provide immediate federal assistance to communities impacted by Hurricane Helene. He warns of an impending funding shortfall for the Small Business Administration’s disaster loan program. Biden also requests additional resources for FEMA’s Disaster Relief Fund to ensure continued recovery efforts. Furthermore, he underscores the importance of comprehensive disaster relief for other communities nationwide that are also in need.

Gov. Roy Cooper (D-N.C.) announced this week that over 50,000 individuals have registered for FEMA assistance, with approximately $6 million already disbursed, AP News added.

At least 223 individuals have lost their lives, and hundreds are still unaccounted for due to the devastation caused by Hurricane Helene, which made landfall in Florida on September 26, reported NBC News. Over a week later, many residents and communities continue to be cut off, hundreds of thousands are without electricity, and inconsistent service has complicated communication.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Michael Saylor Once Said 'Bitcoin's Days Are Numbered.' Now He Holds More Than A Billion Worth Of King Crypto: Here's What Changed For One Of Crypto's Biggest Advocates

Michael Saylor is regarded as one of the most influential advocates of Bitcoin BTC/USD, and MicroStrategy Inc. MSTR, a software firm established by him, functions more like a proxy of the leading cryptocurrency.

But not many know that the Bitcoin evangelist wasn’t bullish on the asset from the get-go. In fact, the man himself has expressed surprise at some of his old takes on the cryptocurrency.

What happened: On Dec. 19, 2013, Saylor tweeted something typical of any skeptic who may come to your mind while reading this article.

“Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling,” Saylor had remarked.

Saylor was asked about the tweet in a September 2020 podcast with Anthony Pompliano, founder and CEO of Professional Capital Management.

“I’m really ashamed to say — I didn’t know I tweeted it until the day that I tweeted that I bought $250 million worth of Bitcoin,” Saylor replied with a childlike glee.

“I literally forgot I ever said that,” he added, admitting “what an idiot” he was.

See Also: Bitcoin ‘Not A Safe Haven’ But Rising Trump Odds Could Fuel A Rally: Standard Chartered

Why It Matters: Less than seven years from the tweet he forgot, Saylor’s MicroStrategy adopted Bitcoin as its primary reserve asset, becoming the first publicly listed company to pursue this strategy.

The company hasn’t looked back since then, and as of this writing, MicroStrategy is the world’s largest corporate owner of Bitcoin, with a stash worth more than $15 billion, according to bitcointreasuries.net.

Moreover, since adopting Bitcoin, MicroStrategy’s stock has outperformed every company in the S&P 500, including AI powerhouse NVIDIA Corp. NVDA.

Meanwhile, Saylor’s journey has been exciting, from saying “Bitcoin’s days are numbered” to it being the “swarm of cyber hornets serving the goddess of wisdom.”

He recently disclosed that he owned nearly $1 billion in the leading cryptocurrency and made his intentions clear to acquire more in the future.

Price Action: At the time of writing, Bitcoin was exchanging hands at $61,022.74, down 0.65% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy closed down 0.75% to $163.41 during Thursday’s regular trading session.

What‘s Next: Anthony Pompliano will be a headline speaker at Benzinga’s Future of Digital Assets event on Nov. 19.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The 2025 Social Security COLA Will Be Announced This Month. Here's What That Means for Retirees.

Are you currently receiving Social Security retirement benefits? If so, you’ll want to mark Oct. 10 on your calendar. That’s when you’ll hear how much bigger 2025’s monthly payments will be. Hopefully it will be enough of an improvement to offset the rising prices of… well, pretty much everything so far this year.

But how much of an increase are we due, and for that matter, what does it mean — in practical terms — for the program’s current beneficiaries? Keep reading.

COLA coming up!

What the heck’s a COLA? It’s an acronym for “cost-of-living adjustment.” Recognizing that living costs rise over time, the Social Security Administration regularly raises the payments made to beneficiaries of all its programs. The most watched COLA update, of course, is the one that affects 67.7 million people, including roughly 53.2 million people age 65 and older.

The Social Security Administration doesn’t offer any official hints at what any particular year’s COLA will be. But we have a rough idea of what’s coming. Data from the Bureau of Labor Statistics indicates overall consumer costs are up 2.5% since the last time the entitlement program announced a COLA in October 2023. Removing ever-volatile prices of food and fuel from the calculation, consumer prices are higher by 3.2% for the same 12-month stretch. The Senior Citizens League’s most recent estimate is for a 2.5% increase.

In other words, it would be surprising if the increase wasn’t at least in that ballpark.

As for what this means in more relatable terms, in that this year’s average monthly Social Security payment stands at $1,907, a 2.63% increase would put 2025’s average monthly benefit somewhere around $1,957. That’s $50 more per month. Note, however, that people receiving larger payments will see bigger nominal increases, while retirees cashing smaller-than-average checks right now will see less net improvement. Everyone sees the same COLA, but it’s a percentage-based improvement relative to their current monthly benefit.

You can beat a lackluster cost-of-living adjustment

But that’s not going to be enough no matter how much more money you end up getting? If you feel that way, you’re not alone.

Although Social Security’s COLA is based on the U.S. Bureau of Labor Statistics’ official inflation data, it comes after underlying price increases are in place and have already taken their financial toll. You may be playing catch-up on your bills by the time you see any benefit from it.

It’s also arguable that the annual COLA doesn’t reflect reality — particularly for retirees, since they’re more likely to spend more on healthcare than the average worker does. That’s what number-crunching from The Senior Citizens League indicates, anyway. It suggests that over the course of the past 15 years, the average U.S. retiree collecting Social Security benefits has actually lost $370.23 worth of monthly buying power they theoretically weren’t supposed to lose.

While there’s not a lot you can do about Social Security’s upcoming cost-of-living adjustment, there are some things retirees can do to offset an inadequate COLA. Here are the three that could help the most.

1. Revisit your dividend stocks

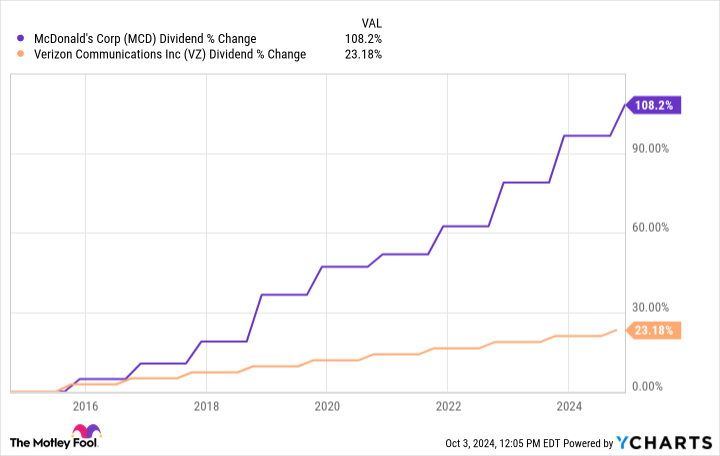

If you own any stocks at all, then you’re probably holding at least some dividend-paying names. But are your dividend stocks the best dividend stocks for your portfolio? They may not be, if your overall dividend growth isn’t firmly outpacing inflation. For example, while Verizon‘s forward-looking dividend yield of 6% is impressive, since 2014 the telecom giant’s payout has only grown at an average annual pace of about 2%. Conversely, McDonald’s current yield of 2.33% is just so-so, but its quarterly dividend has more than doubled over the past 10 years.

The point is, if you’re relying on dividend stocks to provide spendable income, you may actually be losing buying power over time without even realizing it.

2. Rethink your fixed income holdings

Since you’ll want to take a fresh look at your dividend stocks, it wouldn’t hurt to review bonds, CDs, and other fixed-income instruments either… especially now, with interest rates apt to continue sliding from their multi-year peak.

You’ll still always want to diversify your bond portfolio, just as you do with stocks. It just might not hurt to lock in a few more holdings at higher rates than you might normally choose to, before the Federal Reserve makes good on its plans to push rates lower over the course of the coming couple of years.

3. Not all “cash” is the same

Given the likelihood that you’ve got at least some of your savings currently held as cash, think about moving part of that money over to a higher-yielding money market fund. These funds are only paying a little less than 5% right now, and those yields are likely to sink in step with overall interest rates. Given that you’re earning practically nothing on the cash in your checking or savings account, though, that’s huge.

There’s a catch… sort of. Whereas the money in most checking accounts is always immediately available, and savings accounts can often be accessed next-day, cashing out most money market holdings shortly after buying them might incur a small early redemption fee. You’ll have to check with your bank or broker for the specifics on the money market you had in mind. Fortunately, the minimum expected holding period is usually only a few weeks, and if you really need this cash in the meantime, you can get to it.

There’s a fourth, less desirable option… although it may not be quite as miserable as you might fear. That is, go back to work.

Returning to the workplace probably wasn’t what you had in mind for this time of your life. Living with the stress of not having enough spendable income, however, likely wasn’t what you had planned either. There’s a balance to be found.

Don’t worry. Working once you’ve started collecting Social Security retirement benefits won’t affect your payments until and unless your earnings reach a certain threshold. For perspective, beneficiaries can earn as much as $22,320 this year before the Social Security Administration begins to reduce the size of your monthly checks. If your only aim is keeping up with the rising cost of living, you won’t even need to make that much.

Keep your eyes and ears open on the 10th. That’s when the big COLA question will be answered.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

The 2025 Social Security COLA Will Be Announced This Month. Here’s What That Means for Retirees. was originally published by The Motley Fool

Labor Market Surprises With Strength, Energy Stocks Rally On Israel-Iran Tensions, Chinese Tech Giants Rebound: This Week In The Markets

It was a relatively flat week for major stock indices as traders opted for caution following the rallies of recent weeks and amid intensifying conflict in the Middle East.

On Tuesday, Iran launched a barrage of missiles at Israel, retaliating after Israeli forces announced the killing of Hezbollah leader Hassan Nasrallah during airstrikes in Beirut.

Israel mulling a counterattack against Iran caused oil prices and energy stocks to surge, driven by concerns over supply disruptions in a critical oil-producing region. A basket of U.S. oil and gas stocks, the Energy Select Sector SPDR Fund XLE, recorded its strongest weekly performance in two years.

Major Chinese tech giants, as tracked by the iShares MSCI China ETF MCHI, saw another week of strong gains driven by heightened investor enthusiasm for domestic stimulus policies.

The U.S. labor market continues to defy gravity. In September, 254,000 new non-farm payroll jobs were added, significantly beating forecasts.

The unemployment rate dropped more than expected, and wages grew faster than anticipated. As a result, market participants and economists are rethinking the need for further aggressive interest rate cuts by the Federal Reserve.

US-Israel Talks Propel Oil Prices

Oil prices rallied when President Joe Biden said the U.S. is in discussions with Israel about potential strikes on Iranian oil facilities. The geopolitical tensions and potential military action have raised concerns about the stability of energy markets, contributing to the surge in oil prices.

Zuckerberg’s AR Vision

Mark Zuckerberg suggests Meta Platforms Inc.‘s META upcoming AR device, Orion, could become the next major tech shift after smartphones. He sees augmented reality as a transformative force, with Orion possibly leading the charge in a new era of immersive, wearable technology, revolutionizing how people interact with the digital world.

Cramer’s China focus

Jim Cramer highlights that investor “hot money” is shifting from Nvidia Corp. NVDA and Apple Inc. AAPL toward Chinese stocks. He advises those interested in the Chinese market to focus on Alibaba Group Holding Limited BABA, emphasizing it as a key player amid the growing investment interest in China’s tech sector.

Ford EV growth

Ford Motor Co.‘s F U.S. electric vehicle sales gained momentum in the third quarter despite a slowdown in its top-selling Mustang Mach-E SUV. The Michigan-based automaker experienced strong performance from its F-150 Lightning and E-Transit models, bolstering its efforts to expand its presence in the U.S. electric vehicle market.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Energy Stocks Notch Biggest Weekly Gains In 2 Years, Exxon Hits Record Highs As Crude Surges To $75 On Israel-Iran Jitters

Shares of U.S. energy giants surged this week, marking the strongest performance in two years, as fears of a wider conflict in the Middle East between Iran and Israel drove oil prices to $75 per barrel.

The Energy Select Sector SPDR Fund XLE, which tracks 31 major U.S. energy companies, including giants like Exxon Mobil Corp. XOM and Chevron Corp. CVX, recorded a remarkable 6.4% gain this week.

Investors poured nearly $300 million into the XLE ETF this week, the highest inflow since late July, according to Tradingview data.

Exxon Mobil, the largest U.S. oil company, reached a record high of $125 per share on Friday. The stock posted its sixth consecutive day of gains, ending the week up over 7%, marking its best performance since October 2022.

Oil prices continued their rally, with West Texas Intermediate (WTI) crude recording its fourth straight day of gains, hitting levels last seen in late August. The geopolitical tensions between Israel and Iran have sparked concerns over global oil supply disruptions.

Rising Middle East Tensions, Biden Calls For Measured Israeli Response

Israel promised a strong retaliation after Iran launched more than 180 ballistic missiles on Tuesday. While Israel’s air defense systems successfully intercepted most of the missiles, the attack further intensified the already heightened regional instability.

On Friday, President Joe Biden addressed the escalating crisis during a rare appearance at the White House daily press briefing. He mentioned Israel’s right to defend itself but said the country had not yet decided how it would respond to Iran’s ballistic missile strike.

Biden said he advised Israel against further escalating the conflict, suggesting that Israel might consider alternatives to targeting oil fields in its retaliation.

In his first public appearance since the attack, Iran’s Supreme Leader Ayatollah Ali Khamenei defended the strike as “legitimate punishment” for what he called Israeli crimes and urged greater resistance against Israel in the region, Reuters reported.

Iran’s deputy commander of the Islamic Revolutionary Guard Corps also issued a stark warning, stating that Iran could target Israeli oil refineries and gas fields if Israel chooses to strike Iranian territory.

This Week’s Top 10 Performing US Energy Stocks

U.S. energy stocks posted sharp gains, with the top performers this week including:

| Name | Price Chg. % (5D) | Market Cap |

| Diamondback Energy, Inc. FANG | 13.62% | $57.14B |

| APA Corporation APA | 9.36% | $9.92B |

| The Williams Companies, Inc. WMB | 9.04% | $60.02B |

| Marathon Oil Corporation MRO | 8.44% | $16.06B |

| Occidental Petroleum Corporation OXY | 8.35% | $51.71B |

| Halliburton Company HAL | 8.25% | $27.38B |

| ConocoPhillips COP | 8.19% | $131.57B |

| EOG Resources, Inc. EOG | 8.05% | $75.23B |

| Devon Energy Corporation DVN | 7.94% | $26.33B |

| Kinder Morgan, Inc. KMI | 7.82% | $52.15B |

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brady Director Trades $135K In Company Stock

On October 4, BRADLEY RICHARDSON, Director at Brady BRC executed a significant insider buy, as disclosed in the latest SEC filing.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Friday, RICHARDSON increased their investment in Brady by purchasing 1,809 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $135,005.

As of Friday morning, Brady shares are down by 0.0%, currently priced at $73.64.

Delving into Brady’s Background

Brady Corp provides identification solutions and workplace safety products. The company offers identification and healthcare products that are sold under the Brady brand to maintenance, repair, and operations as well as original equipment manufacturing customers. Products include safety signs and labeling systems, material identification systems, wire identification, patient identification, and people identification. Brady also provides workplace safety and compliance products such as safety and compliance signs, asset tracking labels, and first-aid products. The company is organized and managed on a geographic basis with two reportable segments: Americas & Asia which derives maximum revenue, and Europe & Australia.

Unraveling the Financial Story of Brady

Decline in Revenue: Over the 3 months period, Brady faced challenges, resulting in a decline of approximately -0.73% in revenue growth as of 31 July, 2024. This signifies a reduction in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: The company excels with a remarkable gross margin of 51.56%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Brady’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.16.

Debt Management: Brady’s debt-to-equity ratio is below the industry average at 0.12, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: Brady’s P/E ratio of 18.09 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 2.66 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 12.05, Brady demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Transaction Codes Worth Your Attention

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Brady’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spine Surgery Robots Market Size to Hit USD 525.3 million by 2031, at a CAGR of 14.0%, Boosting Precision in Spinal Procedures | Exclusive Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 04, 2024 (GLOBE NEWSWIRE) — According to a report published by Transparency Market Research, the global spine surgery robots market was worth US$ 158.4 Mn in 2022 and is expected to reach US$ 525.3 Mn by 2031, at a CAGR of 14.0 % between 2023 and 2031.

Spine surgery robots are advanced robotic systems designed to assist surgeons in performing complex spinal surgeries with greater precision, accuracy, and control. These systems are typically used in minimally invasive procedures, enhancing a surgeon’s ability to navigate intricate spinal anatomy while reducing the risk of human error.

Robotic platforms used in spine surgery often integrate imaging technologies such as CT scans or fluoroscopy, allowing real-time visualization during surgery. The robots assist in guiding surgical instruments and placing implants with high precision, minimizing trauma to surrounding tissues and reducing patient recovery times.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/spine-surgery-robots-market.html

Spine Surgery Robots Market Overview

Spine surgery robots have revolutionized the field of spinal surgery by providing enhanced precision, improved outcomes, and greater efficiency. These robotic systems assist surgeons in performing complex spinal procedures with greater accuracy than traditional methods. By offering real-time imaging and advanced navigation capabilities, spine surgery robots minimize the risk of human error, leading to better alignment and placement of implants. Additionally, the precision of robotic systems often results in reduced surgical trauma, shorter recovery times, and less postoperative pain for patients. The ability to perform minimally invasive procedures with robotic assistance also contributes to reduced hospital stays and faster overall rehabilitation.

The spine surgery robots market (척추 수술 로봇 시장) is experiencing robust growth due to several key factors. First, the increasing prevalence of spinal disorders and conditions, such as degenerative disc disease and scoliosis, is driving demand for advanced surgical solutions. As the aging population grows, the incidence of age-related spinal issues is rising, further fueling market expansion. Additionally, technological advancements in robotic systems are enhancing their capabilities and affordability. Innovations in imaging technology, software algorithms, and robotic hardware are making these systems more effective and accessible to a broader range of healthcare facilities.

Another significant driver is the growing focus on minimally invasive surgical techniques. Spine surgery robots facilitate minimally invasive procedures that offer substantial benefits over traditional open surgeries, including reduced blood loss, smaller incisions, and quicker recovery times. The increasing preference for such techniques among both surgeons and patients is contributing to the market’s growth.

Furthermore, increasing investments in healthcare infrastructure and rising awareness about the benefits of robotic-assisted surgeries are also boosting market expansion. As more hospitals and surgical centers adopt advanced technologies, the demand for spine surgery robots continues to rise. Government initiatives and funding for research and development in robotic surgery are also supporting market growth by encouraging innovation and improving the overall quality of care in spinal surgery.

In conclusion, the spine surgery robots market is expanding rapidly due to a combination of rising spinal disorder prevalence, technological advancements, the shift towards minimally invasive procedures, and increased healthcare investments. These factors collectively drive the adoption of robotic systems in spinal surgery, leading to improved patient outcomes and market growth.

Spine Surgery Robots Market Regional Insights

- North America generated the largest market value in 2023. The region is also expected to maintain its dominance during the forecast period.

According to the latest spine surgery robots market analysis, North America held the largest share in 2022. The rising prevalence of spinal disorders and the increasing demand for minimally invasive surgical procedures are driving the adoption of advanced robotic systems. These robots offer precision and improved outcomes, which both – surgeons and patients highly value.

Additionally, the rapid advancements in robotic technology, including enhanced imaging capabilities and software innovations, are further fueling market growth. North America benefits from a strong ecosystem of technological innovation, with leading companies continuously developing more sophisticated and efficient robotic solutions for spine surgery.

Furthermore, increased healthcare expenditure and investment in cutting-edge medical technologies by both – public and private sectors in North America contribute to the market expansion. The region’s well-established healthcare infrastructure and supportive regulatory environment also facilitate the integration and adoption of new robotic technologies in spine surgery.

Prominent Players Operating in the Spine Surgery Robots Industry

Medtronic plc, Zimmer Biomet, Globus Medical, Inc., TINAVI Medical Technologies Co., Ltd., Point Robotics MedTech, Inc., NuVasive, Inc., Brainlab AG, Curexo, Inc., Accelus, Inc., Synaptive Medical are some of the leading key players operating in the sector.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=55677<ype=S

Market Segmentation

Component

- Systems

- Instrument & Accessories

- Services & Others

Method

- Minimally Invasive

- Open Surgery

Application

- Spinal Fusion

- Vertebral Compression Fractures

More Trending Reports by Transparency Market Research –

- Infant Resuscitators Market – The global infant resuscitators market (유아 소생기 시장) was valued at US$ 253.1 million in 2022. It is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2031, reaching over US$ 401.4 million by the end of 2031.

- Mechanical Thrombectomy Devices Market – The mechanical thrombectomy devices market (기계적 혈전제거 장치 시장) was valued at US$ 1.1 billion in 2022. It is expected to grow at a CAGR of 6.4% from 2023 to 2031, reaching over US$ 1.8 billion by the end of 2031.

- Sanitization Robots Market – The sanitization robots market (위생 로봇 시장) was valued at US$ 927.3 million in 2022. It is projected to advance at an impressive CAGR of 19.2% from 2023 to 2031, reaching over US$ 4.8 billion by 2031.

- Microcatheter Market – The global microcatheter market (마이크로 카테터 시장) was valued at US$ 799.7 million in 2022. It is estimated to grow at a CAGR of 5.3% from 2023 to 2031, reaching approximately US$ 1.3 billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

U.S. Money Supply Recently Did Something for the First Time Since the Great Depression — and It May Signal a Massive Move to Come in Stocks

For the better part of two years, the bulls have been running wild on Wall Street. In 2024 alone, the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and innovation-driven Nasdaq Composite (NASDAQINDEX: ^IXIC) all soared to multiple record-closing highs.

But if history teaches investors anything, it’s that the stock market rarely moves up or down in a straight line. Though there’s no such thing as a forecasting tool that can, with 100% accuracy, concretely tell the future and accurately predict short-term directional moves in the Dow Jones, S&P 500, and Nasdaq Composite, it doesn’t stop investors from trying to gain an edge.

One such predictive tool, which thus far, has a perfect track record of correlating with sizable moves in the stock market spanning more than a century, is currently portending a massive move to come in equities.

U.S. M2 money supply did something no one has witnessed in 90 years

The forecasting tool in question that has a flawless track record when back-tested back to 1870 is U.S. money supply.

While there are five different measures of money supply, economists tend to focus on M1 and M2. The former comprises cash and coins in circulation, as well as demand deposits in a checking account. In short, it’s money you can immediately access and spend.

Meanwhile, M2 takes into account everything you’d find in M1 and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000. This is still money consumers can access and spend, but it requires a little more work to get to. It’s also the money supply measure that’s been blaring a warning for Wall Street.

With few exceptions, M2 money supply slopes up and to the right. This is a fancy way of saying that the amount of capital in circulation tends to increase over time, which is normal and expected, given that the U.S. economy is growing at a relatively steady pace over the long run.

But in those rare instances over the last 154 years when M2 money supply has notably declined, it’s been a look-out-below moment for the U.S. economy and stock market.

U.S. M2 money supply is reported monthly by the Board of Governors of the Federal Reserve and peaked at $21.722 trillion in April 2022. As of the latest report for August 2024, M2 stood at $21.175 trillion, which is down 2.52% from its all-time high. Last year marked the first year-over-year decline in M2 money supply of at least 2% since the Great Depression.

But as you’ll note from the chart, M2 money supply is once again rising on a year-over-year basis. Despite M2 declining by a peak of 4.74%, as of October 2023, this drop has been nearly halved in less than a year.

Furthermore, even the peak 4.74% drop in M2 from its all-time high pales in comparison to the historic year-over-year increase in M2 money supply of more than 26% registered during the COVID-19 pandemic. Multiple rounds of fiscal stimulus injected capital into the U.S. economy at an otherworldly pace. The decline we’ve witnessed over the last two-plus years may ultimately be a benign reversion to the mean following a historic expansion of U.S. money supply.

Then again, it might represent something more nefarious.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

Although the post above from Reventure Consulting CEO Nick Gerli is more than a year old, it highlights a key correlation between year-over-year changes in M2 money supply and the U.S. economy.

Since 1870, there have only been five instances where M2 money supply has declined by at least 2% on a year-over-year basis — 1878, 1893, 1921, 1931-1933, and 2023. The prior four occurrences all correlate with periods of depression for the U.S. economy, as well as a double-digit unemployment rate.

Understand that there’s a pretty big caveat to this historic correlation. Namely, the Federal Reserve didn’t exist in 1878 or 1893, and both the nation’s central bank and federal government had limited knowledge of how to counter steep economic contractions and high unemployment in 1921 and during the Great Depression, when compared to present day. With the knowledge and monetary/fiscal tools now available, a depression would be highly unlikely.

Nevertheless, M2 money supply is still 2.52% below its record high set 28 months prior. A notable decline in M2 suggests that consumers will have to forgo some of their discretionary purchases, which has historically been a recipe for economic weakness, if not a recession.

Based on a study from Bank of America Global Research, around two-thirds of the S&P 500’s peak-to-trough drawdowns occur during, not prior to, recessions being declared. Thus, the historic decline we’ve witnessed in M2 may be signaling a massive move lower to come in stocks.

History differs significantly based on your investment time frame

The prospect of a stock market correction or bear market probably isn’t something the investing community wants to hear about. However, history is a two-sided coin that, in many instances, strongly favors investors with a long-term mindset.

Despite all the well-wishing in the world, recessions are a perfectly normal and inevitable part of the economic cycle. Since the end of World War II, there have been a dozen recessions in the U.S., which works out to a downturn every roughly 6.6 years.

But what’s interesting about recessions is how quickly they resolve. Out of the 12 recessions over the last 79 years, just three surpassed the 12-month mark, and none endured longer than 18 months. Comparatively, most periods of growth have lasted multiple years, with two economic expansions reaching the 10-year mark.

Even though stocks and the U.S. economy aren’t tethered at the hip, a steadily growing economy would be expected to have a positive impact on corporate earnings over time. Earnings growth is a key ingredient to sending stock valuations higher.

This variance in perspective, based on your investment time frame, is also easily identified on Wall Street.

In June 2023, shortly after the S&P 500 was confirmed to be in a new bull market (i.e., had bounced more than 20% from its 2022 bear market low), the researchers at Bespoke Investment Group released the data set you see above on social media platform X. This data set measured the length of every bear and bull market in the S&P 500, dating back to the start of the Great Depression in September 1929.

Whereas the average S&P 500 bear market has endured for 286 calendar days, or roughly 9.5 months, over a 94-year period, the typical bull market has stuck around for 1,011 calendar days, or about two years and nine months.

To add, the longest S&P 500 bear market in history (630 calendar days), which occurred from Jan. 11, 1973 through Oct. 3, 1974, is shorter than 13 out of 27 S&P 500 bull markets. There have been nine bull markets that have ranged from 1,324 calendar days to 4,494 calendar days.

Even without being able to pinpoint ahead of time when stock market corrections will begin, how long they’ll last, or where the ultimate bottom will be, close to a century of history makes it crystal clear that maintaining perspective and being optimistic is a winning formula on Wall Street.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 768% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of September 30, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

U.S. Money Supply Recently Did Something for the First Time Since the Great Depression — and It May Signal a Massive Move to Come in Stocks was originally published by The Motley Fool

Aluminum Sulfate Market to Reach $1.5 Billion, Globally, by 2033 at 3.2% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 04, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Aluminum Sulfate Market by Grade (Standard Grade, Low Iron Grade and Iron Free Grade), Form (Solid and Liquid), and Application (Water Treatment, Paper Manufacturing, Dyeing, Pharmaceutical and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the aluminum sulfate market was valued at $1.1 billion in 2023, and is estimated to reach $1.5 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Prime determinants of growth

The global aluminum sulfate market is experiencing growth due to increase in demand for water treatment and growth in the paper and pulp industry. However, stringent environmental regulations and safety standards hinder the market growth to some extent. Moreover, utilization in chemical manufacturing processes presents additional opportunities for aluminum sulfate. Aluminum sulfate serves as a precursor in the production of several other chemicals such as aluminum hydroxide, alum, and sodium aluminate. Aluminum hydroxide, derived from aluminum sulfate, is extensively used in the manufacture of flame retardants, ceramics, and pharmaceuticals. Alum, formed by the reaction of aluminum sulfate with potassium sulfate or sodium sulfate has applications in water treatment, papermaking, and leather tanning industries.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A63376

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $1.1 billion |

| Market Size in 2033 | $1.5 billion |

| CAGR | 3.2% |

| No. of Pages in Report | 420 |

| Segments Covered | Grade, Form, Application, and Region |

| Regional Scope | North America, Europe, Asia-Pacific, LAMEA |

| Drivers | Increase in demand for water treatment Growth in the paper and pulp industry |

| Opportunity | Utilization in chemical manufacturing processes |

| Restraint | Stringent environmental regulations and safety standards |

Standard grade segment to maintain its dominance by 2033

By grade, the standard grade segment held the highest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. The increase in need for effective water treatment solutions is a primary driver for the standard grade of aluminum sulfate. The contamination of water resources becomes a critical issue as urbanization and industrial activities escalate. Municipalities and industries are increasingly investing in water treatment facilities to ensure the provision of clean and safe water. Standard grade aluminum sulfate is widely utilized in these processes due to its efficiency in coagulating and flocculating impurities, thereby enabling the removal of suspended solids, organic matter, and pathogens.

Liquid segment to maintain its dominance by 2033

By form, the liquid segment held the highest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. The expansion of industrial activities and wastewater treatment drive the demand for liquid aluminum sulfate in the treatment of industrial effluents. Industries such as pulp and paper, textiles, food and beverage, and mining generate wastewater that contains various contaminants and pollutants. Liquid aluminum sulfate is commonly used as a flocculant in wastewater treatment plants to facilitate the removal of suspended solids, heavy metals, and organic compounds from industrial effluents. The demand for effective wastewater treatment chemicals such as liquid aluminum sulfate is expected to grow during the forecast period as industries face increasing regulatory pressure to comply with environmental standards and discharge limits.

Procure Complete Report (420 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/aluminum-sulfate-market

Water treatment segment is expected to lead the trail by 2033

By application, the water treatment segment held the highest market share in 2023 and is estimated to dominate during the forecast period. The demand for potable water and efficient wastewater management systems escalates as cities expand and populations increase. Urban areas generate significant amounts of wastewater that must be treated to prevent environmental contamination and health risks. Aluminum sulfate is integral in these treatment processes, effectively removing impurities, suspended particles, and organic matter from water, thereby ensuring it meets safety and quality standards for consumption and environmental discharge. In addition, environmental regulations and water quality standards also drive the demand for aluminum sulfate in water treatment. Governments and environmental agencies are increasingly imposing stringent regulations to protect water resources from pollution and ensure safe drinking water for the public.

Asia-Pacific is expected to experience fastest growth throughout the forecast period

By region, Asia-Pacific was the fastest growing region in terms of revenue in 2023. The paper and pulp industry in the Asia-Pacific region is expanding rapidly, driven by surge in demand for paper products, packaging materials, and hygiene products. Aluminum sulfate is a key ingredient in the papermaking process, used for sizing and improving the paper’s resistance to water and ink absorption. The industry’s growth is fueled by rise in literacy rates, surge in e-commerce sector that require more packaging materials, and the overall economic development in the region.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/aluminum-sulfate-market/purchase-options

Leading Market Players:

- Kishida Chemical Co., Ltd.

- Henan Fengbai Industrial Co., Ltd.

The report provides a detailed analysis of these key players in the global aluminum sulfate market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.