Don't Be Fooled: Fed's Interest Rate Cut Has Almost Zero Effect on Your Credit Card Debt

STAFFORD, Texas, Oct. 04, 2024 (GLOBE NEWSWIRE) — Despite the recent interest rate cut by the Federal Reserve, consumers should not expect any significant impact on their credit card debt. While the Fed’s decision to lower interest rates may provide some relief for new loans or mortgages, the effect on credit card interest rates is minimal, according to experts at Money Management International (MMI).

“Typically, consumers feel the impact of Fed rate changes when they take out new debt,” said Kate Bulger, Vice President of Business Development at MMI. “For example, someone taking out a mortgage today may see a lower interest rate than a few months ago, saving them money over the life of the loan. However, the story is different for credit cards, where the interest rates often remain high despite Fed rate cuts.”

Why Credit Card Interest Rates Stay High

While the Federal Reserve sets the rate banks use when lending money to each other, this does not directly translate into lower credit card interest rates. Credit card issuers often add three percentage points to the Fed’s rate to determine the Prime Rate, which is the starting point for determining a consumer’s annual percentage rate (APR).

“Each lender sets their own rates based on factors like your credit score, payment history, and overall debt,” Bulger explained. “If you’re paying 22% APR today, the recent Fed rate cut may only drop it to 21.5%. Over-limit balances or missed payments, triggering what’s known as a ‘penalty rate’, may prevent any rate reduction at all.”

The Lag Between Fed Rate Cuts and Credit Card Rates

Many consumers are surprised that their credit card interest remains unchanged even after the Fed cuts rates. Bulger points out that there is often a lag between the Fed’s decision and any noticeable change in credit card interest rates.

“If you don’t see a change in about 45 days, it may be due to other factors, like your outstanding balance or credit history,” said Bulger. “While credit card interest rates rise along with interest rate increases from the Fed, they typically don’t follow the Fed downward as quickly.”

Credit Card Debt on the Rise

According to the MMI Consumer Distress Dashboard, the average credit card debt balance among new MMI clients has risen by 31% since 2022. At the same time, new clients are ending each month with a household budget deficit that has grown by 74% during the same period.

“We talk to consumers every day whose lives are held back by credit card debt,” said Bulger. “Their financial goals, from saving for a home to taking a family vacation, are put on hold because of their debt. It doesn’t have to be that way, and we’re here to help them find a path forward.”

About MMI

Money Management International (MMI) has been at the forefront of financial health solutions for over 65 years. As a leading nonprofit organization, MMI is dedicated to changing how America overcomes financial challenges by delivering timely and expert guidance. Recognized by major financial organizations and media outlets, MMI’s programs help individuals reach their financial goals and foster a life of financial wellness. Learn more at MoneyManagement.org.

For reporters looking to interview real people for stories, MMI has created a group of nearly 500 clients from across the country who are willing to share their experiences with the media in the hopes of helping others challenged with debt. Our peer advocates have paid off over $19 million of debt and now serve as MMI ambassadors. Hear from them on MMI’s podcast, Long Story $hort.

To schedule an interview with Kate Bulger or an MMI client, please contact:

Thomas Nitzsche, 404.490.2227, Thomas.Nitzsche@MoneyManagement.org

Lori Geary, 404.551.2151, lgeary@lexiconstrategies.com

Thomas Nitzsche Money Management International 404.490.2227 Thomas.Nitzsche@MoneyManagement.org Lori Geary Lexicon Strategies 404.551.2151 lgeary@lexiconstrategies.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Netflix stock is on a tear. But its big challenge is making sure people keep watching.

Netflix stock (NFLX) is up a resounding 50% since the start of the year, with its shares currently trading near the high end of their 52-week range.

But don’t break out the bubbly just yet: The company’s next big challenge is maintaining high — and consistent — viewership levels.

Netflix recently released the latest edition of its biannual viewership report, where the streaming giant revealed subscribers watched over 94 billion hours on the platform from January to June.

Perhaps even more notably, it was the first report that allowed investors to digest the year-over-year trends in Netflix’s global engagement. This comes after the streamer added more than 39 million subscribers over the 12-month period ending in June.

The majority of those subscriber gains stemmed from the continued rollout of Netflix’s password-sharing crackdown, along with the introduction of its cheaper ad-supported tier. But the company itself has said engagement, or the amount of viewing hours spent on the Netflix platform, is a more important metric than the actual number of subscribers, especially as more competitors enter the space.

The problem? When analyzing the aggregate reports, year-over-year engagement on the platform was pretty much flat. It’s unclear exactly why. But if this trend continues, it could have lasting consequences on the streamer’s future.

“This lack of growth may be worrying for Netflix for a number of reasons,” MoffettNathanson analyst Robert Fishman wrote in a look at the data last week. “For starters, if the lack of engagement growth is due to lack of real user growth, it implies that the subscriber growth we have seen has been simply improved monetization of an existing base — in other words, a de facto price increase.”

According to the numbers, total platform engagement inched up to 94 billion hours from January to June, representing a mere 1% increase from the 93.5 billion hours viewed during that same time period last year. This comes despite that 39 million-plus surge in subscribers over the past year.

Meanwhile, average daily hours viewed per subscriber decreased on the platform, falling 13% year over year to 1.9 hours so far in 2024, down from the prior 2.1 hours in the year-ago period.

For its part, Netflix isn’t so concerned. A company spokesperson told Yahoo Finance that engagement is healthy, even with recent headwinds from its crackdown on password sharers. The company also referenced its continued dominance in overall TV viewing, as shown by the Nielsen Gauge report.

Still, that lack of significant growth, according to Fishman, could imply insufficient pricing power, which is the company’s ability to raise streaming prices without reducing demand. Analysts have surmised Netflix may be preparing another round of price hikes later this year.

A pricing ceiling?

Pricing power has become especially important for streaming companies as consumers become more picky. On average, US consumers subscribe to four streaming services and spend about $61 per month, according to the latest Digital Media Trends report from Deloitte. That means fewer opportunities to retain loyal subscribers over time.

On top of that, subscriber churn — or the act of paying users canceling their streaming plans — was elevated in August compared to the year-ago period, according to the latest data from consumer measurement platform Antenna.

Across all streaming platforms, churn levels in August stood at 5.2%, higher than the 4.7% in the same month last year as more platforms implemented password-sharing crackdowns and upped their respective prices. Netflix saw churn rise to 2%, up from 1.8% in August 2023 but down from the 2.8% churn rate in July after the company phased out its basic tier.

The good news? Netflix still has the lowest churn rate across all of the major streaming players. But “there’s probably more of a pricing ceiling ahead than what we had 12 or 18 months ago,” CFRA analyst Ken Leon told Yahoo Finance.

Netflix’s “Basic” plan had been offered to US consumers for $11.99 a month. The removal of the plan comes as Netflix has touted the success of its less-than-two-years-old ad-supported offering, which comes at a cost of $6.99 per month. For ad-free experiences, Netflix offers plans that start at $15.49 per month.

But if engagement levels cannot be sustained, that lack of growth could spill over into its fledgling advertising business and crimp overall revenue.

“Engagement levels have a direct impact on revenues generated by Netflix’s growing ad tier,” Fishman said. “Stalled engagement growth now may mean stalled ad inventory growth (per subscriber) as well.”

Delivering strong top-line growth has become a priority for the company, especially as expectations remain elevated. Wall Street analysts expect Netflix to deliver nearly 15% revenue growth when it reports third quarter earnings on Oct. 17. Earnings are expected to surge by about 40% year over year, according to the latest estimates from Bloomberg.

For the full year, Netflix’s earnings are projected to rise about 60% year over year to $19.08 per share, while full-year revenue of $38.73 billion would mark an increase of about 15% on a yearly basis.

“The valuation of the stock speaks to a growth stock,” CFRA’s Leon told Yahoo Finance. “So if all of a sudden you’re delivering 8% to 10% growth and not 15%, that’s a problem and the stock will go down.”

“It’s the law of large numbers,” he added. “The ability for Netflix to just put up really strong revenue numbers really matters.”

Alexandra is a Senior Reporter at Yahoo Finance. Follow her on X @alliecanal8193 and email her at alexandra.canal@yahoofinance.com

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Bitcoin Could Hit New All-Time High If It Breaks Above This Resistance Level, Says Analyst

Bitcoin BTC/USD is on the verge of reaching a new all-time high, according to a prominent crypto analyst. The analyst suggests that Bitcoin must break through a significant resistance level to achieve this milestone.

What Happened: Bitcoin could reach a new peak if it surpasses the $64,000 resistance level.

Inmortal, a well-known trader, shared with his 216,300 followers on X that Bitcoin’s recent decline from around $66,000 to $60,000 might be forming a local bottom. He is considering going long on BTC if it demonstrates a swing failure pattern near $60,000 or gains acceptance above $63,000.

“Breakout above $64,000 = New ATH.”

Meanwhile, another analyst, Kaleo, predicts a short-term dip to approximately $57,000 or $58,000 before a rebound. He expects Bitcoin to rise gradually over the next month, especially after the presidential election, advising traders to accumulate during this period.

“Bitcoin. Still looking like a quick little chop to $57,000 or $58,000, followed by a grind higher the rest of the month into a full send post election.”

See Also: Remember SBF’s ‘I Didn’t Stash Billions Away’? The Latest FTX Repayment Update May Have Other Ideas

Why It Matters: The potential for Bitcoin to hit new highs comes amid a backdrop of strong market performance. Recently, cryptocurrency markets have been buoyed by positive labor market data, signaling the end of the summer lull and the start of a bullish fourth quarter.

Additionally, technical analysts have noted Bitcoin’s rebound above $61,500, suggesting that $80,000 is more likely than $40,000. This aligns with the current bullish sentiment, despite some bearish low-timeframe actions.

Furthermore, Standard Chartered has highlighted Bitcoin’s role as a hedge against traditional financial system issues, rather than geopolitical tensions. This perspective reinforces the notion that Bitcoin’s price movements are more influenced by financial market dynamics than geopolitical events.

Price Action: At the time of writing, Bitcoin is trading at $62,120, showing a 1.5% increase over the past 24 hours, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

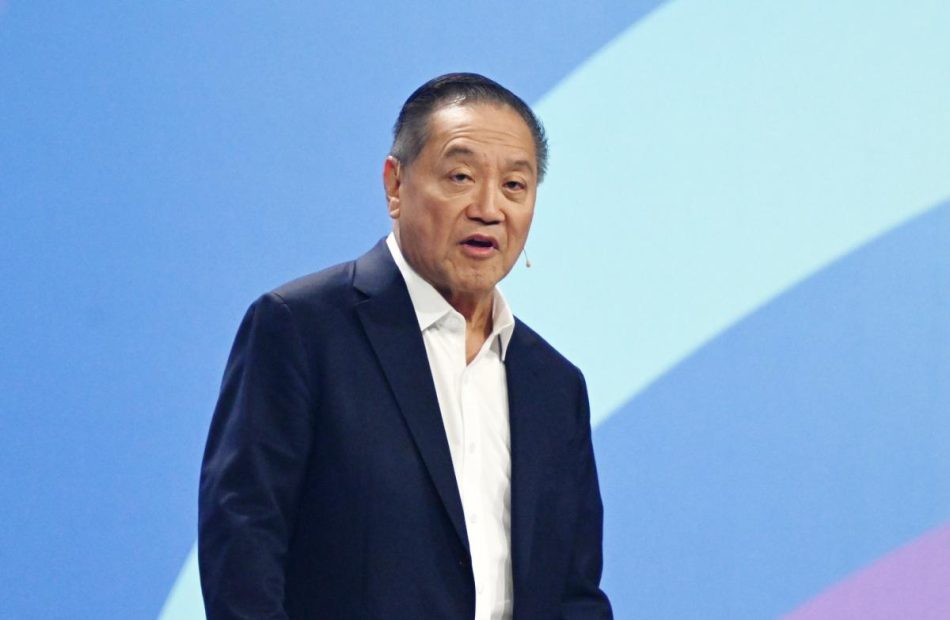

An $803-billion company most people have never heard of just knocked Tesla out of the Magnificent 7

With hardly anyone noticing, a tech titan you’ve probably never heard of has booted Tesla out of the heavily-hyped Magnificent Seven. Can it stay there?

The overlooked Magnificent Seventh is Broadcom, a tech company that produces both hardware and software. It’s well known in the infotech world but unfamiliar beyond it. The Magnificent Seven, conceived as a group of stocks in early 2023, are the most valuable U.S. tech companies by market capitalization. In descending order they include Apple (recent market cap: $3.4 trillion), Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla (recent market cap: $768 billion). Yet Broadcom’s market cap slipped past Tesla’s last spring and has stayed ahead of the EV-maker for most of the year. Its market cap is currently around $803 billion.

Broadcom is not guaranteed to stay ahead of Tesla, at least in the near term. Tesla’s stock is notoriously volatile, and its market cap could plausibly beat Broadcom’s for a time. But Broadcom’s long-term outlook is by far the sunnier of the two. Wall Street analysts on average expect its stock price to keep climbing, while they expect Tesla’s to continue to fall. Tesla’s stock has retreated to where it was almost four years ago, while Broadcom’s is up 290% since then.

So how did this quiet giant sneak into the highest reaches of tech royalty? Mostly by a combination of tech savvy and financial acumen. The company is a grandchild of Hewlett-Packard, which in 1999 spun off a company called Agilent Technologies, which in turn spun off a company called Avago to a pair of private equity firms in 2005. Avago began buying up semiconductor firms, in 2015 buying a big one called Broadcom and taking its name.

Broadcom’s PE ancestry has guided it ever since that spinoff. “Broadcom operates pretty much like a PE firm, where it invests in assets that can deliver quick returns,” says Naveen Chhabra, an analyst at the Forrester research and consulting firm. It’s “astute in terms of investing in firms where it can maintain or grow the revenue” and at the same time “can turn the company into a high margin business.”

View this interactive chart on Fortune.com

Exhibit A is Broadcom’s biggest acquisition, the cloud-computing firm VMware, which it bought last November. A Forrester report for VMware customers warns them, “Don’t let the price jumps shock you…. In most cases, customers will find the renewal quotes multiple times higher than what they paid in the past.”

Wall Street approves of Broadcom’s changes. “They appear to be killing it on VMware,” says Bernstein analyst Stacy Rasgon, “which markedly exceeded expectations in the quarter and which seems poised to continue growing.”

Shrewd acquisitions and management are central to Broadcom’s growth but don’t fully explain the company’s phenomenally swelling market cap. The other crucial factor is, not surprisingly, the AI frenzy. One of Broadcom’s most important businesses is designing semiconductors—computer chips—and in the past year, demand has been sky high. Broadcom’s sales of AI chips in fiscal 2023 were $4.2 billion, BofA Securities reports. The firm expects AI chip sales will rocket to $12.1 billion this year and $16.9 billion next year.

Broadcom’s chip expertise along with VMware’s success has propelled Broadcom’s market cap from just above that of McDonald’s when OpenAI released ChatGPT in November 2022, to Magnificent Seven levels today.

A critical element of Broadcom’s success and its future is CEO Hock Tan, who was recruited to run the company when Avago was spun off in 2005. Now age 72, he was born in Malaysia and earned engineering degrees from MIT plus an MBA from the Harvard Business School. He has spent most of his career in tech companies, though he also held finance jobs at PepsiCo and General Motors—thus the company’s joint expertise in technology and finance. In recent years, Tan has been among the most highly paid U.S. CEOs; he made $162 million last year. Succession is an obvious issue for the company, but no successor is apparent. Tan has said he’ll continue to run the company for at least four more years.

Wall Street analysts are mostly cheering for Broadcom. “Numbers look likely to keep going up,” says Bernstein’s Rasgon. “And valuation is looking increasingly attractive.” JP Morgan’s Harlan Sur says the stock “remains our top pick in semiconductors.”

No tree grows to the sky, but for now the sun is shining brightly on this company. Beyond that, the only certainty is that Broadcom can’t be anonymous anymore.

This story was originally featured on Fortune.com

ACHC INVESTIGATION ALERT: Acadia Healthcare Company Investors are Notified to Contact BFA Law about Securities Fraud Investigation (Nasdaq:ACHC)

NEW YORK, Oct. 05, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces an investigation into Acadia Healthcare Company, Inc. ACHC for potential violations of the federal securities laws.

If you invested in Acadia Healthcare, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc.

Why Did Acadia Healthcare’s Stock Drop?

Acadia is one of the largest for-profit chains of psychiatric hospitals in the United States.

On September 27, 2024, Acadia disclosed that it received a request for information from the U.S. Attorney’s Office for the Southern District of New York, a grand jury subpoena from the U.S. District Court for the Western District of Missouri, and that it expects similar requests from the U.S. Securities and Exchange Commission related to the company’s patient admissions, as well as its length of stay and billing practices. Acadia’s disclosure came one day after the U.S. Justice Department announced that Acadia had agreed to pay $19.85 million to settle allegations that between 2014 and 2017, the company knowingly submitted false claims for payment to Medicare and Medicaid for inpatient behavioral services that were not medically necessary, admitted patients ineligible for treatment, and failed to properly discharge patients when they no longer needed treatment. Additionally, on September 1, 2024, The New York Times published an investigative report which found that many of the illicit practices Acadia engaged in between 2014 and 2017 continue to this day.

The news has caused a precipitous decline in the price of Acadia stock. During morning trading on September 27, 2024, the price of Acadia stock declined more than 17%.

Click here for more information: https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc.

What Can You Do?

If you invested in Acadia Healthcare you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mexican Cartels Smuggling Drugs In Food Imports: Record-Breaking Meth Bust At US-Mexico Border Is Latest

Customs and Border Protection (CBP) seized over $17.4 million in methamphetamine from a tractor-trailer hauling a shipment of coconuts at the Mexico-Texas border.

The bust is one of many involving cartels slipping drugs across the border in fresh food shipments from Mexico, which is the largest supplier of vegetables to the U.S.

What Happened: While CBP officers conducted a secondary look at the tractor-trailer, their drug-detection doggies sniffed out 378 packages containing nearly 2,000 pounds of meth, which they seized then Homeland Security agents moved in to conduct a criminal investigation.

The bust, made at the Pharr International Bridge in Texas on Sept. 28, is the largest meth seizure in the history of the Hidalgo Port of Entry, the CBP reported.

“This seizure underscores the seriousness of the drug threat we face on a daily basis and the resolve of our officers to keep our communities safe,” said port director Carlos Rodriguez in a press release.

Fruits, Veggies, Illicit Drugs From Mexico To US Tables

It stands to reason that Mexican cartels and drug producers would choose to smuggle their products among the $19-billion in annual food imports that enter the U.S. across the southern border.

Also worth noting is that 98% of food products from Mexico enter the U.S. by way of land ports between Texas, New Mexico, Arizona and California.

In that nearly 90% of Mexico’s horticultural exports are destined for the U.S., drug smugglers have lots of fruit and veggie boxes to choose from.

Huge Salad Of Nasty Drugs

Although the Justice Dept. points out that the U.S. citizens produce most of their own methamphetamine, border agents report having confiscated enough meth at the southern border this summer to ruin anyone’s appetite.

- CBP officers confiscated $48 million worth of meth stashed within a lettuce shipment at the Hidalgo Port of Entry in August.

- The same month, officials found more than $5 million in meth that was dressed in bright green plastic packages with stripes, making them look like small watermelons.

- Another shipment of meth was found hidden in a shipment of cucumbers and bell peppers during a routine check at the same Pharr Port of Entry in July.

- In late May, nearly six tons of methamphetamine hidden in a shipment of green squash was confiscated.

CBP data shows that over 164,000 pounds of methamphetamine have been seized nationwide in 2024 alone.

Now Read:

Photo: Meth in melons, courtesy of Customs and Border Protection

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Selling A Business For $3.7 Billion Was A Mistake For 46-Year-Old–He Recounts It As His 'Saddest Day' Of Regret

Jyoti Bansal, the mastermind behind software company AppDynamics, lived out a fantasy many entrepreneurs can only dream about – launching a startup and selling it for a staggering $3.7 billion. However, what should have been a triumphant moment quickly turned into one of his biggest regrets.

Bansal, now 46, had spent years as a Silicon Valley software engineer before finally achieving his goal of becoming an entrepreneur. AppDynamics, the company he founded, solved a critical problem faced by large companies: fixing broken apps and preventing outages.

Don’t Miss:

But when Cisco swooped in with a last-minute acquisition offer in 2017, Bansal found himself at a crossroads. The deal would make him and hundreds of his employees immensely wealthy. Despite that, he says it became his “saddest day.”

Bansal had always dreamed of building a company for financial gain while solving a problem that plagued his industry. “When I started [AppDynamics], I didn’t think about a financial outcome,” he explains. “I just thought in terms of: This problem needs to be solved.” And solve it he did – AppDynamics became known for its ability to help companies troubleshoot and prevent software glitches.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

The sale of AppDynamics to Cisco came as a surprise. The company was on the verge of going public when Cisco made its offer. “We weren’t stopping our IPO,” Bansal recalls. “We had six days to figure out how to go about it.”

He describes sleepless nights agonizing over the decision, juggling conversations with the board, investors and other stakeholders. “People think it must’ve been an easy decision, but it was the hardest.”

The factors Bansal had to weigh were complex. There was the financial aspect – hundreds of employees stood to gain life-changing sums of money. “We had about 300 employees who made more than a million dollars,” he says.

See More: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

“Dozens walked away with $5 million or more.” Beyond the financials, Bansal was concerned with whether Cisco would allow AppDynamics to continue its mission and keep its company culture intact. To Cisco’s credit, they offered AppDynamics a high degree of independence, but something still didn’t sit right for Bansal.

After the sale, Bansal found himself grappling with feelings of loss. “I spent nine years of my life fully dedicated to what we were building,” he reflects. “Suddenly, it’s the end of a chapter.” Walking home from the celebration party, he realized he wasn’t ready to let go. “It was bittersweet – it felt like we were closer to the finish line, but not quite there.”

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

In the months that followed, Bansal tried to find solace in travel. He trekked the Himalayas, hiked Machu Picchu and went on safaris. But after six months, his bucket list was checked off and he was left feeling aimless. “Everyone told me, ‘You should retire. Go to the beach,'” he says. “But that’s not me.”

Determined to continue solving big problems, Bansal founded another company, Harness, which also creates software tools for developers. Ironically, it was valued at $3.7 billion in 2022 – the same price Cisco paid for AppDynamics. But this time, Bansal says the story is far from over.

When asked what he would do if he received a similar offer for Harness, Bansal didn’t hesitate. “We’d have to entertain it, but I know the answer is most likely no,” he says confidently. “At AppDynamics, it felt like we were closer to the finish line. At Harness, our journey is just starting.”

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Selling A Business For $3.7 Billion Was A Mistake For 46-Year-Old–He Recounts It As His ‘Saddest Day’ Of Regret originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aerospace Valves Market Size to Surpass USD 5.2 billion by 2031, Growing at a 4.9% CAGR Due to Expanding Aerospace Applications: Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 04, 2024 (GLOBE NEWSWIRE) — The global aerospace valves market is estimated to surge at a CAGR of 4.9% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for aerospace valves is estimated to reach US$ 5.2 billion by 2031.

Integration of digital technologies and sensors into aerospace valves enables real-time monitoring, predictive maintenance, and performance optimization. Smart valves enhance aircraft safety, efficiency, and maintenance practices, driving their adoption across commercial and military aircraft fleets.

The use of additive manufacturing, or 3D printing, for aerospace valve production offers advantages such as design flexibility, rapid prototyping, and lightweight components. This technology enables the manufacture of complex valve geometries and customized solutions, reducing lead times and production costs while enhancing performance.

Download Sample Copy of the Report:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=73009

Electro-hydraulic actuation systems for aerospace valves provide precise control, faster response times, and reduced energy consumption compared to traditional hydraulic systems. These systems improve aircraft maneuverability, reduce maintenance requirements, and enhance overall operational efficiency, particularly in fly-by-wire and autonomous aircraft applications.

With the growing connectivity of aircraft systems, cybersecurity becomes a critical concern for aerospace valves. Manufacturers are developing secure communication protocols, encryption methods, and intrusion detection systems to safeguard valve operations and prevent cyber threats, ensuring the integrity and reliability of onboard systems.

Aerospace Valves Market: Competitive Landscape

The aerospace valves market (سوق صمامات الفضاء الجوي) is characterized by intense competition driven by key players such as Honeywell International Inc., Parker Hannifin Corporation, and Eaton Corporation. These industry giants dominate with extensive product portfolios, technological expertise, and global reach.

Companies like Moog Inc. and Woodward Inc. specialize in advanced valve systems, enhancing aircraft performance and safety. Emerging players such as Triumph Group, Inc. and Crane Aerospace & Electronics focus on innovation and strategic partnerships to gain market share.

With increasing demand for fuel-efficient aircraft and stringent safety regulations, competition intensifies, driving continuous advancements in aerospace valve technologies. Some prominent players are as follows:

- CACPL Aerospace

- CIRCOR International Inc.

- Eaton

- Honeywell International Inc.

- Hy-Lok USA Inc.

- ITT Aerospace Controls

- JARECKI Valves

- Magnet-Schultz GmbH & Co. KG

- Nutek Aerospace

- PARKER HANNIFIN CORP

- Sitec Aerospace GmbH

- Spectrum Valves

- The Lee Company

- Valcor Engineering Corporation

Product Portfolio

- CACPL Aerospace delivers cutting-edge aerospace solutions, including precision components, systems integration, and engineering services. With a focus on innovation and reliability, CACPL Aerospace serves commercial and defense sectors worldwide, contributing to advancements in aviation technology and safety.

- CIRCOR International Inc. provides mission-critical flow control solutions for various industries, including aerospace, defense, and energy. From valves and pumps to instrumentation and control systems, CIRCOR’s products ensure efficiency, reliability, and safety in demanding environments, driving operational excellence for its customers.

Key Findings of the Market Report

- Check/non-return valves lead the aerospace valves market, ensuring fluid flow control and preventing backflow in critical aircraft systems.

- Titanium leads the aerospace valves market material segment due to its lightweight, corrosion resistance, and high strength-to-weight ratio properties.

- Fixed wing aircraft type segment leads the aerospace valves market, driven by the extensive use of valves in commercial and military fixed-wing aircraft.

To Get Sample PDF Brochure Here:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=73009

Aerospace Valves Market Growth Drivers & Trends

- Increasing demand for fuel-efficient aircraft drives the adoption of lightweight and high-performance aerospace valves.

- Technological advancements in valve materials and design enhance reliability and operational efficiency.

- Expansion of the commercial aviation sector, particularly in emerging economies, boosts market growth.

- Rising investments in defense aerospace programs fuel demand for advanced valve systems.

- Focus on sustainability and environmental regulations prompt innovation in eco-friendly valve solutions.

Global Aerospace Valves Market: Regional Profile

- North America leads the aerospace valves market, propelled by robust aerospace manufacturing capabilities, significant investments in research and development, and a strong presence of key industry players.

- The United States, in particular, boasts a thriving aerospace sector, with companies like Honeywell International Inc., Parker Hannifin Corporation, and Woodward, Inc. driving innovation and technological advancements in valve systems.

- Europe emerges as a prominent player in the aerospace valves market, supported by established aerospace industries in countries like the United Kingdom, France, and Germany.

- Companies such as Airbus and Safran contribute to the region’s market dominance with their expertise in aircraft manufacturing and propulsion systems, creating a high demand for advanced valve technologies.

- Asia Pacific showcases considerable potential for growth in the aerospace valves market, fueled by the region’s expanding aerospace sector and increasing investments in defense and civil aviation.

- Countries like China, India, and Japan are witnessing rapid growth in aircraft production, driving demand for high-performance valves. Initiatives to develop indigenous aerospace capabilities further stimulate market expansion in the region.

Aerospace Valves Market: Key Segments

By Type

- Ball Valves

- Butterfly Valves

- Emergency Inflation Valves

- Shut-off Valves

- Check / Non-return Valves

- Flow Control Valves

- Relief Valves

- Solenoid Valves

- Heater Valves

- Others (Isolation Valves, Drain Valves, etc.)

By Material

- Stainless Steel

- Aluminum

- Titanium

- Others (Carbon Steel, Brass, etc.)

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

By Application

- Fuel Systems

- Pneumatic Systems

- Hydraulic Systems

- Coolant Systems

- Water & Wastewater Systems

- Others (Inflation, Environmental Control System, etc.)

By End Use

- Civil Aviation

- OEM

- Aftermarket

- Military Aviation

- OEM

- Aftermarket

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=73009<ype=S

Explore More Trending Report by Transparency Market Research:

- Embedded System Market – The embedded system market (سوق النظام المدمج) Will Projected Surge to USD 159.12 billion by 2031, Growing at a 7.7% CAGR – TMR Report Analysis

- Semiconductor ICP-MS System Market – The global semiconductor icp-ms system market (نطاق سوق نظام أشباه الموصلات ICP-MS) to Grow at a CAGR of 4.7% During the 2023 to 2031 Forecast Period: TMR Study

- High-voltage Switchgear Market – The global high-voltage switchgear market (سوق المفاتيح الكهربائية ذات الجهد العالي) is estimated to grow at a CAGR of 5.3% from 2023 to 2031

- Data Center Accelerator Market– The global data center accelerator market (سوق مسرعات مركز البيانات) is estimated to advance at a CAGR of 22.5% from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Warren Buffett Stocks to Buy Hand Over Fist in October

Warren Buffett’s stock picks may be anything but flashy, but that’s kind of the point. Given enough time, value performs. And in the case of Buffett’s Berkshire Hathaway, it often outperforms. You’d be wise to borrow some of his ideas whenever possible.

To this end, here’s a closer look at three Berkshire holdings you may want to make a point of adding to your own portfolio this month as well.

1. Visa

Berkshire Hathaway doesn’t hold a massive stake in credit card company Visa (NYSE: V), for the record. Its 8.3 million-share position is only worth about $2.3 billion. That’s less than 1% of the total value of Berkshire’s stock holdings (and less than 1% of Visa itself).

Don’t mistake this relatively small position as a sign that this company’s potential is limited, though. The payments market isn’t just moving away from cash. It’s embracing digital ecosystems like the ones Visa can provide to merchants and institutional clients.

Case(s) in point: Earlier this year, this payment middlemen introduced platforms specifically built for Latin America’s governments. These tools include a means of collecting tax revenue, streamlining purchases of government property, and even making public disbursements like stimulus payments or social assistance.

Also earlier this year, Visa unveiled technology allowing merchants to not only accept card-based payments, but build their own customer-loyalty programs. Each such tool expands Visa’s breadth and depth, ultimately extending its reach and revenue.

And the numbers confirm as much. While the global economy’s been rather lethargic this year, Visa’s third-quarter revenue was up 10% year over year on a 7% increase in total payment volume, extending trends that have been underway for a year. That’s not huge, but it clearly outpaces worldwide economic growth.

Analysts expect this top-line growth pace to persist at least a couple more years, too, although given the scope of the opportunity to displace other forms of payments (in addition to introducing new profit centers that help merchants better connect with consumers), this growth could conceivably last for years.

That past and projected revenue growth, by the way, is driving even faster earnings growth. This is a high-margin business that scales up very cost effectively.

2. Occidental Petroleum

It would be easy to put oil and gas stocks like Occidental Petroleum (NYSE: OXY) on the shelf to be forever forgotten, particularly given this stock’s — along with crude oil’s — recent pullback. Not only are environmentally friendlier alternatives now available, but crude’s 20% tumble just since April is a reminder of how easily this business can be rattled and then unrattled by unpredictable geopolitical tensions. It’s just not worth it.

Except, maybe it is worth it — at least to Warren Buffett. There’s a reason Berkshire is not just sticking with it, but keeping Occidental as its sixth-biggest position, currently worth on the order of $13 billion. That reason is that oil (and gas) is hardly on its deathbed just yet.

Don’t misread the message. Alternatives like solar and nuclear power are here to stay. Even in the relatively advanced United States; however, fossil fuels still account for about 60% of our total utility power production, according to the U.S. Energy Information Administration, while renewables only generate roughly one-fifth of it. Factoring in automobiles, crude oil alone accounts for more than one-third of the country’s annual energy consumption, with natural gas making up more than another third.

Connecting the dots, it could take years for alternative energy sources to displace oil as the nation’s primary source of power, particularly given the ever-growing need for electricity. Assume the same applies in other parts of the world too.

To this end, the United States’ Energy Information Administration believes crude oil alone could still be the planet’s single-biggest source of power as far down the road as 2050. There’s a lot of money to be made by drilling, extracting, and refining oil in the meantime.

There are obviously several solid oil and gas stocks that would work just fine for your portfolio. Buffett’s partial to Occidental Petroleum and its management team, however. As he wrote in 2023’s annual letter to Berkshire Hathaway shareholders:

“Under Vicki Hollub’s leadership, Occidental is doing the right things for both its country and its owners. No one knows what oil prices will do over the next month, year, or decade. But Vicki does know how to separate oil from rock, and that’s an uncommon talent, valuable to her shareholders and to her country.”

It might be wise to just trust Warren Buffett’s personal judgment on this one.

3. Nu Holdings

Finally, add Nu Holdings (NYSE: NU) to your list of Warren Buffett stocks to buy hand over fist in October. It’s not a household name. In fact, there’s a good chance you’ve never even heard of it. Don’t let your lack of familiarity dissuade you, however.

There’s a reason you’ve never heard of it. It’s because Nu Holdings is an online bank built to serve the Latin American market. It already boasts over 100 million customers spread across Brazil, Mexico, and Colombia, although that still only scratches the surface of the ultimate opportunity. South and Latin America is home to over 600 million people, most of whom have only recently been given reason to explore such options.

And that’s key to understanding Buffett’s interest in this seemingly unlikely Berkshire Hathaway holding.

In short, Latin America is now in many ways where North America was 20 years ago. High-speed internet was still young then, and smartphones were relatively uncommon. We were on the verge of a game-changing intersection of both technologies though, which would put shopping, entertainment, banking, and information in everyone’s hands via a mobile device.

Perhaps the biggest difference between here and there is just that Latin America is evolving as a “mobile first” market, meaning most of its consumers use their smartphones as their primary web connection.

Whatever the case, it’s a market that’s primed for Nu Holdings’ offerings. Market research outfit Technavio suggests the region’s banking-as-a-service market is poised to grow at an annualized rate of more than 19% per year through 2028, jibing with other forecasts.

And Nu is clearly already capitalizing on this growth. Last quarter’s currency-adjusted revenue improved 65% year over year, more than doubling net income as a result.

It’s not a huge position for Berkshire Hathaway. As of the latest look, Berkshire’s only holding a little less than $1.5 billion worth of the overseas online bank. But the fact that Buffett and his lieutenants own any of this off-the-radar company at all, however, speaks volumes about its potential.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Visa. The Motley Fool recommends Nu Holdings and Occidental Petroleum. The Motley Fool has a disclosure policy.

3 Warren Buffett Stocks to Buy Hand Over Fist in October was originally published by The Motley Fool

'Blowout' September Jobs Report Spurs Reactions: 6 Economists Say Aggressive Fed Rate Cuts May Face Obstacles

The September jobs report came in hotter than predicted, with U.S. payrolls increasing by 254,000 and the unemployment rate surprisingly slipping to 4.1%. Wage growth exceeded expectations, rising 0.4% month-over-month and 4% year-over-year.

These robust numbers have sparked a fresh debate among economists about the Federal Reserve’s next move. The general consensus now seems to lean toward a more gradual approach to rate cuts, as the labor market’s resilience weakens the case for aggressive monetary easing.

Here’s how five experts are interpreting the latest jobs data.

“Blowout” Report Suggests Fed Should Stay Cautious

Economist Mohamed El-Erian describes the September jobs report as a “blowout,” highlighting the stronger-than-expected job creation and wage growth. He says that this data reinforces the strength of the labor market and “U.S. economic exceptionalism.”

El-Erian suggests the report offers a reason for the Fed to resist market pressure for significant rate cuts in 2024-25, favoring a more cautious approach to monetary easing.

According to Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, the September report suggests a turnaround following signs of labor market weakening earlier in the year.

He warns against overreacting to either overly optimistic or pessimistic reports, and sees this as further evidence of a growing economy with a solid labor market.

“This should put to rest – at least for the next month – the idea that the economy is about to fall off a cliff or that imminent doom is on the horizon,” he said.

He maintains a balanced outlook, suggesting that while one strong report doesn’t warrant excessive optimism, the data strengthens the case for investors to remain fully invested in equities as the economy continues to grow.

Joseph Brusuelas, principal and chief economist at RSM US LLP, highlights the strong wage growth in September, with a 0.4% monthly increase and 4% annualized growth, providing momentum as the U.S. heads into the crucial holiday season.

The economist underlines that “hiring remains rock solid,” even though some seasonal and technical factors may inflate the topline numbers. He sees the economy on track to grow at or above a 3% pace.

Brusuelas dismisses concerns of an imminent recession, instead signaling a “mid-cycle economic expansion” as hiring moderates from post-pandemic highs.

Looking ahead, he interprets the strong jobs data as support for the Federal Reserve to adopt a more gradual approach to rate cuts.

Broad Job Gains Point To Smaller Rate Cuts

The recent data flow raises questions about whether the Fed’s “super-sized cut was warranted,” says Aditya Bhave, U.S. economist at BofA Securities.

Bhave highlights the September jobs report, calling it “gangbusters,” as it reinforces his perspective with robust job growth, upward revisions to previous months, and a drop in the unemployment rate. Moreover, last week’s gross domestic product revisions also pointed to a healthier economy than previously thought.

Given the strength of recent economic reports, Bhave has revised his November forecast from a 50bp cut to 25bp, while maintaining the same path of rate cuts into 2025. He now projects a terminal rate between 3.0% and 3.25%, noting that the risks to this figure are skewed to the upside due to stronger-than-expected productivity growth.

Jeffrey Roach chief economist for LPL Financial emphasizes the broad-based payroll increase. He suggests that “this solid report increases the odds that the economy will continue to grow above trend in the next quarter” and that the Fed is likely to opt for a “quarter point” rate cut rather than a larger one.

However, he also highlights a slight drop in hours worked and a rise in the percentage of workers holding multiple jobs, suggesting some caution is warranted.

According to Nathaniel Casey, investment strategist at wealth management firm Evelyn Partners, the robust payroll data reassures markets of the U.S. economy’s strength.

He highlights that “the headline non-farm payroll figure saw its largest beat over consensus estimates since December 2023.”

While the unemployment rate’s drop to 4.1% is encouraging, he cautions that rising hourly earnings could trigger inflationary concerns.

The expert warns that with such strong labor market data, the likelihood of a 50-basis point rate cut has diminished, with markets now favoring a smaller 25-basis point cut in November.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.