Price Over Earnings Overview: Veralto

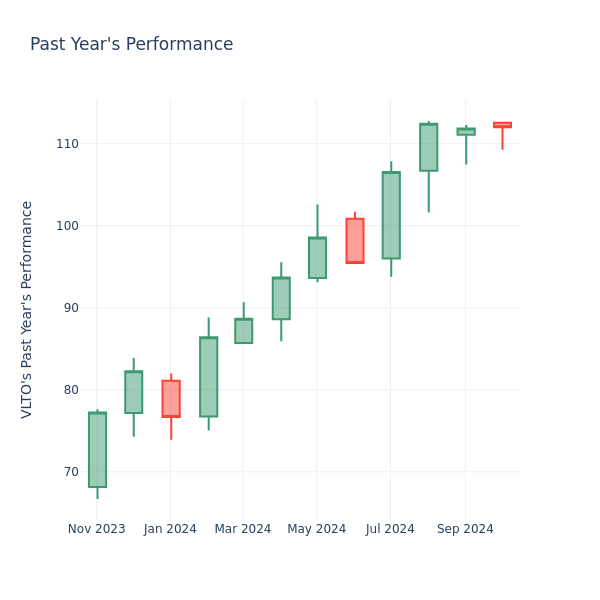

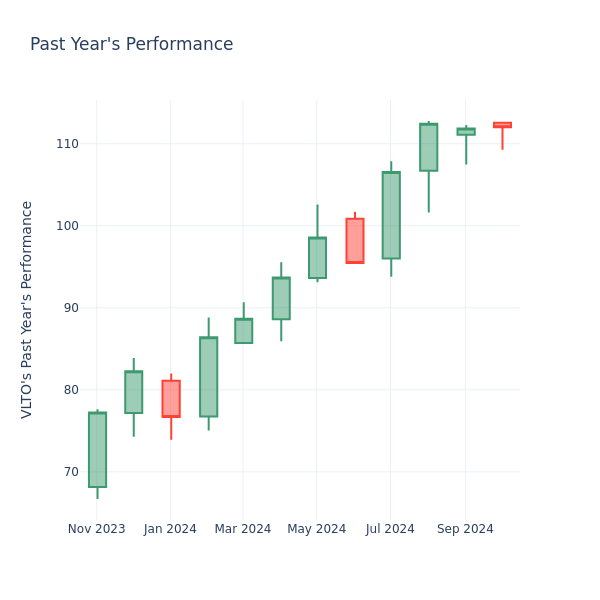

In the current session, the stock is trading at $112.02, after a 0.64% increase. Over the past month, Veralto Inc. VLTO stock increased by 3.04%, and in the past year, by 50.14%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Comparing Veralto P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 60.41 in the Commercial Services & Supplies industry, Veralto Inc. has a lower P/E ratio of 34.73. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Calcite Market to Reach $21.3 Billion, Globally, by 2033 at 5.4% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 04, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Calcite Market by Source (Natural Deposits and Artificially Produced), Form (Powder and Granule), and End-Use Industry (Construction, Cosmetic, Paints and Coatings, Pharmaceuticals, Plastics and Polymers, Paper and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the calcite market was valued at $12.7 billion in 2023, and is estimated to reach $21.3 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Prime determinants of growth

The global calcite market is experiencing growth due to expansion of the plastics and polymers industry and increase in use in paints and coatings. However, the environmental regulations on mining and extraction hinder the market growth to some extent. Moreover, development of high-performance coatings and paints opens avenues for the development of innovative, eco-friendly solutions present additional opportunities for the calcite market.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A12637

Report coverage and details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $12.7 billion |

| Market Size in 2033 | $21.3 billion |

| CAGR | 5.4% |

| No. of Pages in Report | 360 |

| Segments Covered | Source, Form, End-Use Industry, And Region. |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

Natural deposits segment is expected to lead the trail by 2033

Based on source, natural deposits segment held the highest market share in 2023 and is estimated to dominate during the forecast period. This dominance is primarily due to their widespread availability and historical use in various industries. Limestone and marble, primary sources of natural calcite, offer established supply chains and lower production costs compared to artificially produced calcites like precipitated calcium carbonate (PCC) . Moreover, natural deposits often provide calcite with desirable physical properties for applications in construction, agriculture, and chemicals. However, the artificially produced segment, particularly PCC, is gaining traction due to its superior purity, controlled particle size, and ability to meet stringent quality standards required in specialized applications such as pharmaceuticals and high-end coatings.

Powder segment is expected to lead the trail by 2033

Based on form, the powder segment held the highest market share in 2023 and is estimated to dominate during the forecast period. This is primarily due to its versatility and wide applicability across various industries. Calcite powder is favored for its fine particle size, which allows for easy incorporation into manufacturing processes such as plastics, paints, and coatings. It enhances properties like opacity, brightness, and mechanical strength effectively. Moreover, powder form calcite is preferred in applications where precise control over particle size and distribution is critical, ensuring consistent product quality and performance across different industrial sectors.

Procure Complete Report (232 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/calcite-market

Construction segment is expected to lead the trail by 2033

Based on end-use industry, the construction segment held the highest market share in 2023 and is estimated to dominate during the forecast period. This is primarily due to the extensive use of calcite in cement and concrete production, where it serves as a key ingredient to enhance strength and durability. As urbanization accelerates globally, especially in emerging economies like China and India, the demand for calcite in construction materials continues to rise. This sector’s dominance is further reinforced by ongoing infrastructure projects and building expansions, driving substantial growth and demand for calcite in the construction industry.

Asia-Pacific is expected to experience the fastest growth throughout the forecast period

Based on region, Asia-Pacific was the fastest-growing region in terms of revenue in 2023. Economic expansion, urbanization, and increasing infrastructure development in countries like China, India, and Southeast Asian nations boost demand for calcite in construction materials such as cement and concrete. Moreover, the region’s developing paper and packaging industries require calcite as a key pigment for improving printability and enhancing product quality. Additionally, growth in the plastics and polymers sector further fuels demand for calcite as a filler, driven by rising consumer goods manufacturing and packaging activities in the region.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/calcite-market/purchase-options

Leading Market Players: –

- J. M. Huber Corporation

- Minerals Technologies Inc.

- Columbia River Carbonates

- Mississippi Lime Company

The report provides a detailed analysis of these key players in the global calcite market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga Bulls And Bears: Nvidia, Apple, Amazon, Spirit Airlines — And Dogecoin Drops But Whale Activity Remains High

Benzinga examined the prospects for many investors’ favorite stocks over the last week — here’s a look at some of our top stories.

Stocks rocketed higher on Friday as fresh data revealed nonfarm payrolls surged by 254,000 in September. The unemployment rate slipped to 4.1%, defying projections that it would hold steady at 4.2%.

The S&P 500 climbed 0.22% for the week, while the Dow eked out a 0.09% gain. The Nasdaq, despite entering Friday with losses exceeding 1%, managed a 0.1% weekly rise, marking a notable turnaround.

Crude oil prices jumped again on Friday, capping off a nearly 9% weekly gain. The surge came amid heightened tensions in the Middle East, following Iran’s missile attack on Israel.

Chinese tech stocks, represented by the iShares MSCI China ETF MCHI, enjoyed another week of strong gains, driven by growing enthusiasm for domestic stimulus efforts.

Benzinga provides daily reports on the stocks most popular with investors. Here are a few of this past week’s most bullish and bearish posts that are worth another look.

The Bulls

“Nvidia CEO Jensen Huang Says Demand For Next-Gen Blackwell GPU Platform Insane: ‘Everyone Wants To Have The Most, And Everyone Wants To Be First,’” by Ananya Gairola, reports that Nvidia Corporation NVDA CEO Jensen Huang highlighted the overwhelming demand for the new Blackwell GPU platform, confirming it is in full production and expected to drive significant revenue growth despite investor concerns over delays.

“Is Dogecoin’s Bullish Momentum Over After 18% Retreat From Recent Highs? Not Yet, Say Analysts,” by Aniket Verma, highlights that despite Dogecoin DOGE/USD experiencing an 18% drop, analysts like Santiment and Ali Martinez believe its bullish potential remains strong, citing increased whale activity and technical signals of further upside.

“Apple’s iPhone 16 Pro Demand Correction In Sight: Analyst Highlights Delivery Trends Across Global Markets,” by Anusuya Lahiri, reports that a JPMorgan analyst sees stabilizing delivery times for Apple Inc. AAPL iPhone 16 Pro models, indicating a demand correction ahead, as lead times for base models moderate across key markets like the U.S., China, and Europe.

For additional bullish calls of the past week, check out the following:

The Bears

“Spirit Airlines Bankruptcy Chatter Has Critics Blaming Biden: Here’s What History Shows About Carrier Mergers,” by Anthony Noto, explores how Spirit Airlines, Inc. SAVE is in bankruptcy talks, with critics blaming the blocked JetBlue merger, while history shows that mergers in the airline industry often lead to job losses regardless of financial struggles.

“Humana Faces Sharp Decline In Medicare Star Ratings For 2025, Braces For 2026 Revenue Hit,” by Vandana Singh, reports that Humana Inc. HUM is anticipating a major drop in Medicare Advantage Star Ratings, with only 25% of members enrolled in plans rated four stars or above, which could lead to significant revenue losses in 2026.

“Amazon CEO Andy Jassy Faces Employee Revolt Over Full-Time Return To Office Mandate, 73% Consider Quitting: Survey,” by Kaustubh Bagalkot, reports that Amazon.com, Inc. AMZN CEO Andy Jassy is facing internal backlash as 73% of surveyed employees consider leaving due to a new full-time return-to-office policy starting in 2025, sparking concerns over morale and retention.

For more bearish takes, be sure to see these posts:

Cramer Says ‘Hot Money’ Flowing From Nvidia, Apple Into China, Focus On Alibaba ‘If You Must’

Keep up with all the latest breaking news and trading ideas by following Benzinga on Twitter.

Image created using artificial intelligence via Midjourney.

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WellQuest Living Appoints Connor MacLennan as Chief Investment Officer

Leading Senior Housing Company Welcomes Industry Veteran to Strengthen Investment Platform

SALT LAKE CITY, Oct. 4, 2024 /PRNewswire/ — WellQuest Living, a prominent senior housing owner, operator, and developer, is thrilled to announce the appointment of Connor MacLennan as its new Chief Investment Officer (CIO). MacLennan, who joins WellQuest Living from PGIM, brings a wealth of experience and a proven track record in investment management to the role. During his tenure at PGIM, MacLennan played an instrumental role in leading new senior housing investments and fostering key relationships that supported the company’s success.

As CIO, MacLennan will be responsible for overseeing and driving WellQuest’s growth strategy, building new debt and equity relationships, and elevating the company’s portfolio performance. His leadership will be vital in advancing WellQuest’s commitment to providing exceptional living environments for seniors across the country.

Steve Sandholtz, CEO of WellQuest Living, expressed his enthusiasm about the new appointment: “We are excited to welcome Connor to the WellQuest family. His extensive industry knowledge and relationships will be invaluable as we continue to expand our footprint and enhance our service offerings. His leadership and vision align perfectly with our strategic goals, and we look forward to the significant contributions he will make.”

MacLennan also shared his excitement about joining WellQuest Living: “I am honored to join WellQuest at such a pivotal time for the company. WellQuest has a remarkable reputation for excellence in senior housing, and I am eager to leverage my experience to help drive the company’s growth and achieve its long-term objectives. I look forward to collaborating with the talented team at WellQuest to deliver exceptional value for our stakeholders and enhance the quality of life for our residents.”

MacLennan’s appointment as CIO marks a significant step in WellQuest’s continued growth and success. His leadership will play a crucial role in shaping the future of the company and reinforcing its position as a leader in the senior housing industry.

About WellQuest Living:

WellQuest Living is a leading developer and operator of senior housing, committed to providing outstanding living environments for seniors. With a focus on innovation and excellence, WellQuest offers a range of services and amenities designed to enhance the quality of life for its residents. For more information, visit wqliving.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/wellquest-living-appoints-connor-maclennan-as-chief-investment-officer-302267892.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/wellquest-living-appoints-connor-maclennan-as-chief-investment-officer-302267892.html

SOURCE WellQuest

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Rallies, Small Caps Outperform On Strong Jobs Report, Chinese Stocks Soar To 32-Month Highs: What's Driving Markets Friday?

A stronger-than-expected September jobs report fueled gains on Wall Street, overshadowing investor concerns that had been driven by escalating geopolitical tensions in the Middle East earlier this week.

The U.S. economy added 254,000 nonfarm payroll jobs in September, a significant jump from August’s 159,000 and well above forecasts of 140,000. This marked the most robust employment growth since March 2024.

In addition, the unemployment rate dropped more than anticipated to 4.1%, while average hourly earnings also surpassed expectations, signaling a red-hot labor market.

Small-cap stocks outpaced their large-cap peers as worries about an economic slowdown subsided further. Meanwhile, traders adjusted their outlook for the Federal Reserve’s November meeting, reducing the probability of a 50-basis-point rate cut from 30% to just 10% as the stronger jobs data diminished the need for a more aggressive policy move.

U.S. Treasury yields rose sharply in response to the solid labor market data. The 2-year yield climbed by 20 basis points, while the 10-year yield increased by 12 basis points.

Chinese equities continued their upward trajectory, driven by ongoing domestic stimulus measures. The iShares China Large-Cap ETF FXI reached levels last seen in February 2022, just before Russia’s invasion of Ukraine.

Gold dipped 0.3% as the U.S. dollar strengthened and bond yields climbed. Oil prices extended their rally for the fourth consecutive session, with WTI crude hitting $75 per barrel during intraday trading.

Bitcoin BTC/USD surged 2.2%, climbing to $62,000.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Russell 2000 | 2,203.80 | 1.1 % |

| Nasdaq 100 | 19,932.47 | 0.7% |

| S&P 500 | 5,727.63 | 0.5% |

| Dow Jones | 42,146.54 | 0.3% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.5% to $570.47.

- The SPDR Dow Jones Industrial Average DIA inched 0.3% higher to $421.66.

- The tech-heavy Invesco QQQ Trust Series QQQ rose 0.7% to $484.95.

- The iShares Russell 2000 ETF IWM rallied 1.2% to $218.77.

- The Financial Select Sector SPDR Fund XLF outperformed, up 1.2%. The Real Estate Select Sector SPDR Fund XLRE lagged, down 0.8%.

Friday’s Stock Movers

- Semiconductor stocks rallied, with Advanced Micro Devices Inc. AMD leading gains, up over 4%.

- Rivian Automotive Inc. RIVN fell over 4% on a quarterly revenue miss.

- Spirit Airlines Inc. SAVE tumbled 26%, amid bankruptcy discussions with creditors following the failed merger with JetBlue Airways Corp. JBLU. Peers such as American Airlines Group Inc. AAL and United Airlines Holdings Inc. UAL rallied on the news, up by 5.4% and 3.6%, respectively.

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biobank Management Systems Market to Reach $4.6 Billion, Globally, by 2033 at 8.3% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 04, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Biobank Management Systems Market by Sample Type (Absorbable Human Tissue & Organ Samples, Plant & Animal Samples and Microbial Samples), and Application (Regenerative Medicine, Life Science Research, Clinical Research and Environmental Research): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the biobank management systems market was valued at $2.1 billion in 2023, and is estimated to reach $4.6 billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033.

Request Sample of the Report on Biobank Management Systems Market 2033 – https://www.alliedmarketresearch.com/request-sample/A323972

Prime Determinants of Growth

The biobank management systems market is primarily driven by a rise in demand for personalized medicine. Personalized medicine and genomic research require the efficient storage, management, and retrieval of biological samples and associated data. Biobanks play a crucial role in supporting research on diseases, drug discovery, and biomarker identification. Another significant driver is the rising prevalence of chronic diseases globally, prompting a heightened focus on large-scale epidemiological studies and population-based research. Biobanks provide valuable repositories of biological samples linked with clinical and demographic data, enabling researchers to conduct longitudinal studies and analyze genetic predispositions to diseases. Moreover, regulatory initiatives mandating stringent storage and data management standards for biological samples contribute to the adoption of sophisticated biobank management systems.

Report Coverage & Details

| Repot Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $2.1 billion |

| Market Size in 2033 | $4.6 billion |

| CAGR | 8.3% |

| No. of Pages in Report | 280 |

| Segments Covered | Sample Type, Application, and Region |

| Drivers |

|

| Opportunity |

|

| Restraint |

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A323972

Segment Highlights

The human tissue and organ samples segment dominated market share in 2023.

By sample type, human tissue and organ samples segment dominated the market share in 2023. This is attributed to a significant increase in medical research requiring access to high-quality human tissue and organ samples. These samples are crucial for studying diseases, developing new treatments, and understanding biological processes at a molecular level. Furthermore, the shift towards personalized or precision medicine relies heavily on the availability of diverse and well-characterized human tissue samples. Biobanks that manage these samples efficiently are thus in high demand to support research aimed at tailoring medical treatments to individual genetic profiles.

The clinical research segment dominated the market share in 2023.

By application, the clinical research segment dominated the market share in 2023. This is attributed to the growing emphasis on personalized and precision medicine, which relies heavily on the availability of high-quality biospecimens and associated clinical data. Biobanks that support clinical research provide essential resources for studying disease mechanisms, biomarkers, and drug responses tailored to individual patient profiles.

Regional Outlook

North America holds a dominant position in the market, attributed to high adoption of the biobank management systems during the surgeries, strong presence of major key players and well-established healthcare infrastructure and high investment in the research and development in biomedical field. However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period. This is attributed to expanding healthcare infrastructure, surge in prevalence of chronic diseases and emergence of Asia- Pacific region as major hub of biomedical and pharmaceutical research.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323972

Key Players

- Krishagni Solutions Pvt Ltd

- Information Management Services, Inc.

The report provides a detailed analysis of these key players in the global Biobank Management Systems market. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Healthcare Industry:

Nuclear Medicine Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Anesthesia Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Diabetic Retinopathy Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Ophthalmic Lasers Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Nears Record Highs On Hot Jobs Data: Dollar, Treasury Yields Surge As Aggressive Interest Rate Cut Hopes Fade

A hotter-than-expected jobs report spurred a premarket rally on Wall Street Friday, showcasing the U.S. economy’s resilience and easing concerns over an economic slowdown.

The strong labor data also led traders to rethink the Federal Reserve’s aggressive rate cuts, resulting in a jump in the dollar and Treasury yields.

What Happened: The U.S. economy added 254,000 jobs in September, far exceeding the expected 140,000. This marks an acceleration from August’s 159,000 figure and well above the 12-month average of 230,000. Payrolls for both July and August were upwardly revised by 55,000 and 17,000, respectively.

Private sector payrolls accounted for 223,000 jobs, while the government added 31,000. The unemployment rate fell unexpectedly by 0.1% to 4.1%, beating the forecasted 4.2%.

Wages grew by 0.4% in September, surpassing the expected 0.3%.

Why It Matters: The stronger-than-expected pace of job addition, coupled with a surprisingly lower unemployment rate and higher wage growth, signals a strong consumer spending outlook, which could lift corporate earnings, particularly as we head into the fourth quarter.

Yet the labor market’s strength also complicates the Federal Reserve’s efforts to curb inflation. Higher wages could stoke consumer demand, putting upward pressure on prices, potentially slowing disinflation efforts. This may lead the Fed to delay or scale back anticipated interest rate cuts.

Before the jobs report, the market had priced in a 30% chance of a 50-basis-point rate cut in November, according to the CME FedWatch Tool. Following the data release, those odds plummeted to 11%.

Market Reactions:

- The SPDR S&P 500 ETF Trust SPY jumped 0.9% in premarket trading, edging closer to its recent record highs.

- The Invesco QQQ Trust QQQ, which tracks major tech stocks, rallied 1.4%, driven by strong gains in the semiconductor sector. The iShares Semiconductor ETF SOXX surged 2.1%.

- Blue chips rose as well, with the SPDR Dow Jones Industrial Average ETF DIA up by 0.7%.

- Small caps outperformed large caps. The iShares Russell 2000 ETF IWM rallied 1.7%.

- Yields on the 10-year Treasury bond soared by 11 basis points to 3.96%. Yields on the policy-sensitive two-year note spiked by 15 basis points to 3.87%.

- The iShares 20+ Year Treasury Bond ETF TLT tumbled 1.2%.

- The U.S. Dollar Index, which is tracked by the Invesco DB USD Index Bullish Fund ETF UUP, rose 0.7%.

Top Gainers Post-Jobs Report:

Using the Movers function on Benzinga Pro, here are the top performers among U.S. mega-cap stocks in the 30 minutes following the release of the September jobs data.

| Company Name | Price | Change |

|---|---|---|

| KLA Corp. KLAC | $799.25 | +3.18% |

| Mitsubishi UFJ Financial Group MUFG | $10.18 | +3.18% |

| Applied Materials Inc. AMAT | $205.53 | +2.10% |

| Lam Research Corp. LRCX | $83.60 | +2.08% |

| Advanced Micro Devices Inc. AMD | $166.90 | +1.92% |

| ARM Holdings plc ARM | $142.44 | +1.91% |

| Shopify Inc. SHOP | $80.02 | +1.67% |

| Broadcom Inc. AVGO | $175.66 | +1.66% |

| Adobe Inc. ADBE | $510.58 | +1.59% |

| Bank of America Corp. BAC | $39.96 | +1.56% |

| Texas Instruments Inc. TXN | $204.82 | +1.56% |

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SMCI LITIGATION ALERT: Super Micro Computer Investors are Notified to Contact BFA Law before Imminent October 29 Deadline in Securities Fraud Class Action (Nasdaq:SMCI)

NEW YORK, Oct. 05, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Super Micro Computer, Inc. SMCI and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in Super Micro Computer, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/super-micro-computer-inc.

Investors have until October 29, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Super Micro Computer securities. The case is pending in the U.S. District Court for the Northern District of California and is captioned Averza v. Super Micro Computer, Inc., et al., No. 24-cv-06147.

What is the Lawsuit About?

The complaint alleges that Super Micro Computer is one of the largest providers of high-performance and high-efficiency servers. The complaint further alleges that during the Class Period, the Company misrepresented its financial growth, relationships with related parties, and its compliance with United States export restrictions.

On August 27, 2024, Hindenburg Research, a well-known short seller, published a report concerning Super Micro Computer that “found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

The next day, on August 28, 2024, Super Micro Computer announced that it needed to delay the filing of its Annual Report for the fiscal year ended June 30, 2024 to assess the effectiveness of its internal controls over financial reporting.

The news caused a significant 21% decline in the price of Super Micro Computer stock, from $562.51 per share on August 26, 2024 to $443.49 per share on August 28, 2024.

On September 26, 2024, the Wall Street Journal reported that the Justice Department was also investigating the Company.

Click here for more information: https://www.bfalaw.com/cases-investigations/super-micro-computer-inc.

What Can You Do?

If you invested in Super Micro Computer, Inc. you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/super-micro-computer-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/super-micro-computer-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Painting the Garden State: Davis Painting Expands Across All of New Jersey

JERSEY SHORE, N.J., Oct. 4, 2024 /PRNewswire/ — Davis Painting, a leader in residential and commercial painting services based in southeastern Pennsylvania, is proud to announce its expansion to the Jersey Shore through the acquisition of Craig Hamlin’s Colagio the Painter. With over 30 years of experience, Colagio the Painter has been a trusted name for high-quality painting services in the region, and this acquisition marks a significant milestone in Davis Painting’s growth strategy.

Craig Hamlin, the founder of Colagio the Painter, has built a solid reputation in the Jersey Shore community, providing exceptional craftsmanship and personalized customer service. With this acquisition, Davis Painting will continue the Colagio legacy while bringing innovations and expanded resources to the region. By combining Craig’s expertise and deep local knowledge with Davis Painting’s proven systems and customer-centric approach, homeowners and businesses along the Jersey Shore can expect a seamless transition and the same top-tier service they’ve come to know and trust.

“We’re incredibly excited to welcome Craig Hamlin and his team to the Davis Painting family,” said Colby Davis, CEO of Davis Painting. “The Jersey Shore is a vibrant, growing area, and this acquisition allows us to bring our superior painting services to a whole new clientele while preserving the excellence Craig and his team have delivered for decades.”

Building on the momentum of the Jersey Shore expansion, Davis Painting is also thrilled to announce another strategic acquisition to further its reach across the entire state of New Jersey. The company will be acquiring Tyler Hansen’s Painting by Tyler, a well-respected painting business known for its exceptional work across New Jersey. This acquisition will help Davis Painting broaden its footprint, allowing it to serve communities from North to South Jersey.

“With the acquisition of Painting by Tyler, we’re taking another big step toward our goal of becoming the go-to painting service provider for the northeast and eventually, the nation,” added Colby. “We are dedicated to maintaining the high standards that Tyler has established while leveraging our resources to offer even greater value and innovation to our customers.”

Davis Painting is committed to continuing its growth throughout the region while staying focused on its core values of quality, integrity, and customer satisfaction. With these new acquisitions, Davis Painting is well-positioned to deliver expert craftsmanship to more homes and businesses across New Jersey.

For more information about Davis Painting and its services, please visit www.davispainting.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/painting-the-garden-state-davis-painting-expands-across-all-of-new-jersey-302267802.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/painting-the-garden-state-davis-painting-expands-across-all-of-new-jersey-302267802.html

SOURCE Davis Painting

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Symbotic Inc Is Considered a Good Investment by Brokers: Is That True?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let’s see what these Wall Street heavyweights think about Symbotic Inc. SYM.

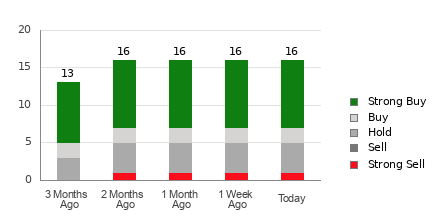

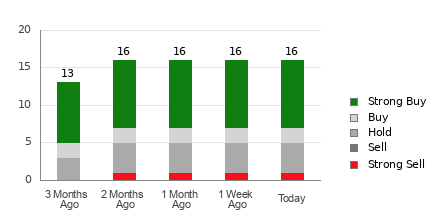

SYMBOTIC INC currently has an average brokerage recommendation of 1.88, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 16 brokerage firms. An ABR of 1.88 approximates between Strong Buy and Buy.

Of the 16 recommendations that derive the current ABR, nine are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 56.3% and 12.5% of all recommendations.

Brokerage Recommendation Trends for SYM

The ABR suggests buying SYMBOTIC INC, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock’s near -term price performance. So, validating the Zacks Rank with ABR could go a long way in making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations. Since the ratings issued by these analysts are more favorable than their research would support because of the vested interest of their employers, they mislead investors far more often than they guide.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company’s changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Should You Invest in SYM?

Looking at the earnings estimate revisions for SYMBOTIC INC, the Zacks Consensus Estimate for the current year has declined 40.9% over the past month to -$0.08.

Analysts’ growing pessimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates lower, could be a legitimate reason for the stock to plunge in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #4 (Sell) for SYMBOTIC INC.

Therefore, it could be wise to take the Buy-equivalent ABR for SYMBOTIC INC with a grain of salt.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.