CATIC Is a 2024 Top Workplaces Award Winner in Connecticut

ROCKY HILL, Conn., Oct. 4, 2024 /PRNewswire/ — The Hartford Courant recently recognized CATIC as a Top Workplaces award winner for 2024 (150-499 employees category). This is CATIC’s seventh consecutive year being named to this list in this category (https://www.courant.com/2024/09/25/top-workplaces-2024-these-are-the-connecticut-winners/). Since 2018, CATIC has been the recipient of this regional Top Workplaces award and was ranked in the top 15 among other local Connecticut businesses this year. CATIC was also recognized as a Top Workplaces USA recipient earlier this year for the second consecutive year.

Additionally, Top Workplaces Culture Excellence awards recognize organizations that excel in specific areas related to cultivating a dynamic workplace culture. CATIC was most recently recognized for the following areas: (1) Innovation; (2) Employee Appreciation; (3) Work-Life Flexibility; (4) Employee Well-Being; (5) Professional Development; (6) Compensation & Benefits; (7) Leadership; and (8) Purpose & Values.

CATIC is proud to be recognized as a regional Top Workplace winner again this year. “We are grateful for our hardworking and dedicated employees who have made us a part of this prestigious list,” said James M. Czapiga, Esq., President and CEO of the CATIC Family of Companies. “Our people make working at CATIC a truly special experience every day. We have built a strong culture of collaboration, inclusiveness, and innovation. We celebrate and thank our employees for all they do to earn this incredible honor.”

ABOUT CATIC:

CATIC, along with its sister company, CATIC Title Insurance Company, is currently the ninth largest title insurance underwriter in the United States and is the premier underwriter exclusively for independent agents. CATIC offers standard ALTA policies and expanded protection policies for both residential and commercial properties. The company is licensed in 44 states and is currently doing business in 25 states. CATIC is currently partnered with over 2,400 independent agents nationwide and is committed to preserving the independent agent’s critical role in the real estate eco-system. The company has been in business for over 50 years and is an underwriting member of the American Land Title Association (ALTA) and numerous other local land title associations. For its stability and dependability in the market, CATIC has earned an A’ rating from Demotech and an A- rating from Kroll Bond Ratings. For more information about the company, or to become a CATIC agent, please visit us at www.CATIC.com, or follow us on LinkedIn, Facebook, and Instagram.

ABOUT ENERGAGE:

Making the world a better place to work together.™

Energage is a purpose-driven company that helps organizations turn employee feedback into useful business intelligence and credible employer recognition through Top Workplaces. Built on 18 years of culture research and the results from 27 million employees surveyed across more than 70,000 organizations, Energage delivers the most accurate competitive benchmark available. With access to a unique combination of patented analytic tools and expert guidance, Energage customers lead the competition with an engaged workforce and an opportunity to gain recognition for their people-first approach to culture.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/catic-is-a-2024-top-workplaces-award-winner-in-connecticut-302267744.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/catic-is-a-2024-top-workplaces-award-winner-in-connecticut-302267744.html

SOURCE CATIC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ed Yardeni Sees Fed Pausing Rate Cuts for 2024 After Jobs Report

(Bloomberg) — The Federal Reserve’s monetary-easing campaign for 2024 may already be over as the strong labor report Friday underscores the stubborn resilience of the world’s largest economy, according to Wall Street veteran Ed Yardeni.

Most Read from Bloomberg

Further policy easing would risk sparking inflation just as oil prices rebound and China seeks to jump start its economy, according to the founder of Yardeni Research Inc., who famously coined the “Fed Model” and the “bond vigilante.”

The market prognosticator says the central bank’s September decision to lower rates by half a percentage point — a move usually reserved to tackle a recession or market crash — was “not necessary” with the economy riding high and the S&P 500 hovering near records.

“They don’t need to do more,” Yardeni wrote in an e-mailed response to questions. “I assume several Fed officials regret doing so much.”

Stocks climbed Friday while Treasury yields and the dollar spiked after government data showing the biggest increase in nonfarm payrolls in six months. The report also revised up the hiring numbers for the prior two months and indicated a drop in the unemployment rate.

Yardeni is the latest to chime in on Fed policy after the data on job growth topped all estimates. Earlier Friday, former Treasury Secretary Larry Summers said the central bank’s decision to cut interest rates last month was “a mistake.”

The release also prompted economists at Bank of America Corp. and JPMorgan Chase & Co. to trim their forecast for the Fed’s November interest-rate cut to a quarter-point from a half-point, echoing moves in swap contracts tied to the outcome of future Fed meetings.

Still, calling the Fed to pause completely for the rest of 2024 is out of consensus, to say the least. Many investors consider the Fed’s latest rate cut as a step toward normalizing its policy amid easing inflation after a round of aggressive tightening took the benchmark borrowing cost to a two-decade high.

That said, it’s an idea Ian Lyngen is now mulling. While the head of US rates strategy at BMO Capital Markets is sticking to his forecast for a quarter-point reduction in November, he reckons a slew of data on employment and inflation will determine the Fed’s policy trajectory before its Nov. 7 meeting. Should October’s payrolls report come in comparably strong and inflation prove sticky, US central bankers will likely refrain from rate cuts for now, per Lyngen.

“If anything, the employment update suggests that the Fed might be revisiting the prudence of cutting in November at all – although a pause is not our base case,” he wrote in a note to clients. “In our endeavor to be intellectually honest, it is worth briefly pondering what it would take for the Fed to pause next month.”

For critics of the Fed’s policy shift, the market has arguably priced in too many rate reductions already. The risk, according to Yardeni, is that additional easing feeds into investor euphoria that will set stage for a painful market event.

“Any further rate cuts would increase the odds of our 1990s-style meltup scenario for the stock market,” he said. In that episode, the S&P 500 lost more than a third of its value from peak to trough.

–With assistance from Sid Verma.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Decoding Mobileye Global's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on Mobileye Global MBLY.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MBLY, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Mobileye Global.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 50%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $1,333,493, and 2 are calls, for a total amount of $136,473.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $3.0 and $20.0 for Mobileye Global, spanning the last three months.

Volume & Open Interest Trends

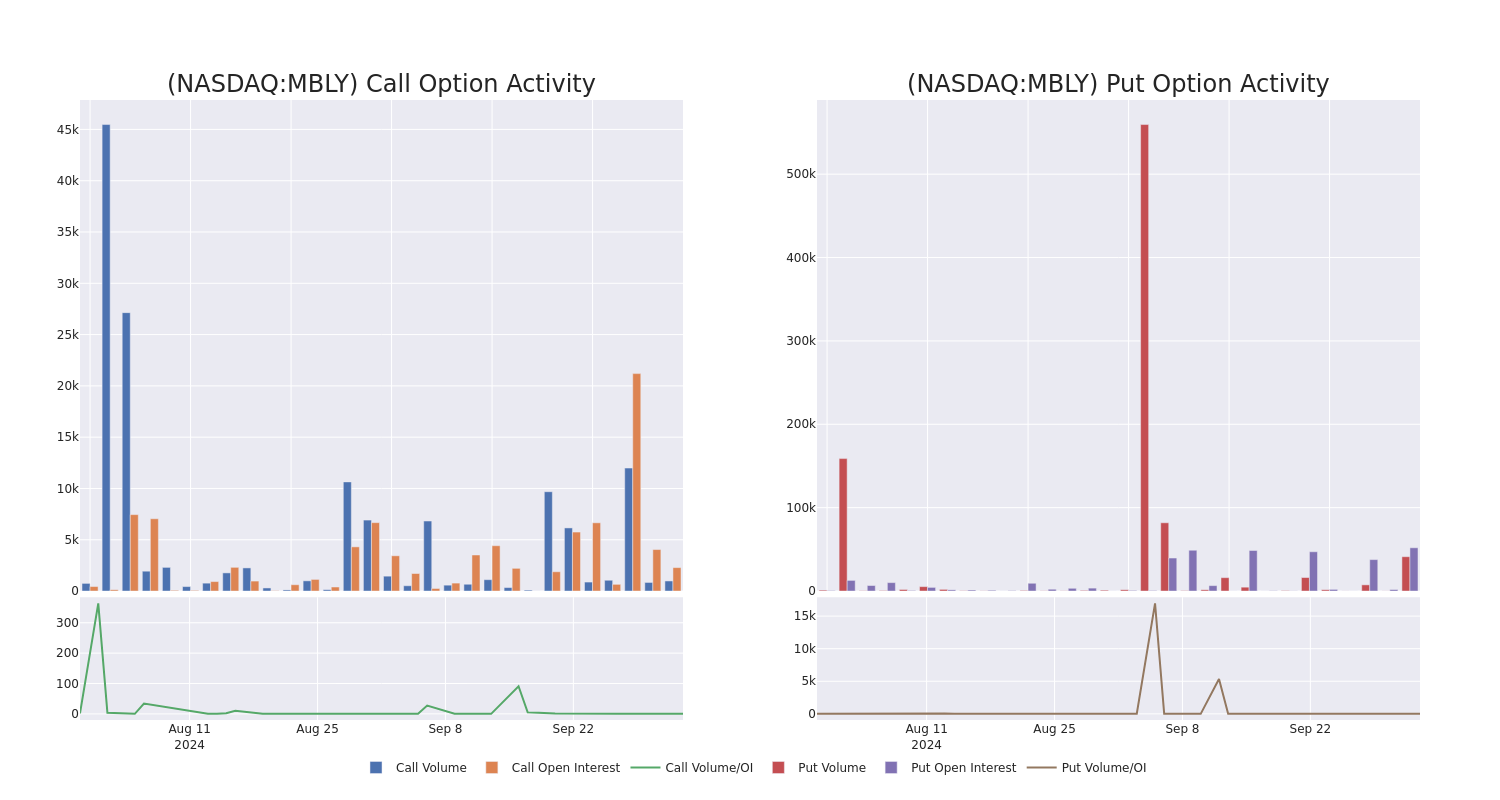

In today’s trading context, the average open interest for options of Mobileye Global stands at 6772.88, with a total volume reaching 42,170.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Mobileye Global, situated within the strike price corridor from $3.0 to $20.0, throughout the last 30 days.

Mobileye Global Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | PUT | SWEEP | BULLISH | 01/17/25 | $1.85 | $1.7 | $1.7 | $12.00 | $510.3K | 42.6K | 6.0K |

| MBLY | PUT | SWEEP | BULLISH | 01/17/25 | $1.7 | $1.65 | $1.7 | $12.00 | $270.7K | 42.6K | 10.5K |

| MBLY | PUT | TRADE | BEARISH | 01/17/25 | $1.7 | $1.65 | $1.7 | $12.00 | $137.3K | 42.6K | 12.0K |

| MBLY | PUT | SWEEP | BULLISH | 02/21/25 | $1.2 | $1.15 | $1.15 | $10.00 | $120.1K | 1.3K | 1.0K |

| MBLY | CALL | SWEEP | BEARISH | 01/17/25 | $0.75 | $0.7 | $0.7 | $20.00 | $96.8K | 2.2K | 943 |

About Mobileye Global

Mobileye Global Inc engages in the development and deployment of ADAS and autonomous driving technologies and solutions. It is building a portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. Mobileye is the Company’s only reportable operating segment. Its solutions comprise Driver Assist, Cloud-Enhanced Driver Assist, Mobileye SuperVision Lite, Mobileye SuperVision, Mobileye Chauffeur, Mobileye Drive, Self-Driving System & Vehicles. It also provides data services to Expedite Maintenance Operations with AI-Powered Road Survey Technology.

After a thorough review of the options trading surrounding Mobileye Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Mobileye Global Standing Right Now?

- Currently trading with a volume of 5,126,285, the MBLY’s price is up by 4.12%, now at $12.9.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 20 days.

Professional Analyst Ratings for Mobileye Global

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $16.333333333333332.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from UBS has revised its rating downward to Neutral, adjusting the price target to $14.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Mobileye Global, which currently sits at a price target of $20.

* Reflecting concerns, an analyst from Deutsche Bank lowers its rating to Hold with a new price target of $15.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Mobileye Global, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ZenaTech Strengthens Its Leadership With Management Team Appointments

TORONTO, Ontario, Oct. 04, 2024 (GLOBE NEWSWIRE) — ZenaTech, Inc. ZENA (“ZenaTech”), a technology company specializing in AI (Artificial Intelligence) drone solutions and enterprise SaaS (Software-as-a-Service) solutions, today announced new management team appointments. Craig Passley has been appointed Company Secretary, Sajjad Asif has been promoted to Chief Technology Officer (CTO), and Linda Montgomery has joined the company as Vice President of Corporate Development.

Craig Passley, Corporate Secretary, is a construction management executive at M/I Homes, a leading national homebuilder. Previously he served as Corporate Secretary for publicly traded company, Epazz, from 2005 and 2016, as well as for FlexFridge. Mr. Passley has a bachelor’s degree in engineering from Bradley University, a master’s degree in project management from the Keller Graduate School of Management, and an MBA from Lake Forest School of Management.

Sajjad Asif, Chief Technology Officer, was previously ZenaTech’s Vice President of Technology and has held various leadership roles with the ZenaTech group of companies. His background includes 18 years of professional experience specializing in software and drone technologies. He has served in leadership roles including CTO roles for various European technology companies. Mr. Asif holds a Master of Science in Software Engineering degree from Blekinge Tekniska Högskola (BTH) in Sweden, an MBA from AIOU in Pakistan, and a BS in Computer Science from PUCIT in Pakistan.

Linda Montgomery, Vice President of Corporate Development, has joined the company to lead corporate development. She has a professional career of over 20 years leading investor relations, business development and marketing for international technology companies, and has led investor relations for five IPOs. Ms. Montgomery has two degrees in business and marketing from the University of Manitoba and the University of Winnipeg, and an investor relations professional accreditation (CPIR) from the Ivey School of Business at Western University.

About ZenaTech

ZenaTech ZENA is a technology company specializing in AI drone solutions and enterprise SaaS solutions for mission-critical business applications. Since 2017, the company has leveraged its software development expertise and grown its drone design and manufacturing capabilities through ZenaDrone, to innovate and improve customer inspection, monitoring, safety, security, compliance, and field service processes. With over 100 enterprise software customers using our branded solutions in law enforcement, government, and industrial sectors, and drones being implemented in these plus agriculture, defense, and logistics sectors, ZenaTech helps drive exceptional operational efficiencies and cost savings. The company operates through six offices in North America, Europe, and UAE, and a growing global partner network.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Contacts for more information:

Company, Investors and Media:

Linda Montgomery

ZenaTech

312-241-1415

investors@zenatech.com

Investors:

Michael Mason

CORE IR

investors@zenatech.com

Safe Harbor

This press release and related comments by management of ZenaTech, Inc. include “forward-looking statements” within the meaning of U.S. federal securities laws and applicable Canadian securities laws. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. This forward-looking information relates to future events or future performance of ZenaTech and reflects management’s expectations and projections regarding ZenaTech’s growth, results of operations, performance, and business prospects and opportunities. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. In some cases, forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “aim”, “seek”, “is/are likely to”, “believe”, “estimate”, “predict”, “potential”, “continue” or the negative of these terms or other comparable terminology intended to identify forward-looking statements. Forward-looking information in this document includes, but is not limited to ZenaTech’s expectations regarding its revenue, expenses, production, operations, costs, cash flows, and future growth; expectations with respect to future production costs and capacity; the ability to deliver products to the market as currently contemplated; ZenaTech’s expectations regarding its revenue, expenses, and operations; ZenaTech’s anticipated cash needs and it’s needs for additional financing; ZenaTech’s intention to grow the business and its operations and execution risk; expectations with respect to future operations and costs; the volatility of stock prices and market conditions in the industries in which ZenaTech operates; political, economic, environmental, tax, security, and other risks associated with operating in emerging markets; regulatory risks; unfavorable publicity or consumer perception; difficulty in forecasting industry trends; the ability to hire key personnel; the competitive conditions of the industry and the competitive and business strategies of ZenaTech; ZenaTech’s expected business objectives for the next twelve months; ZenaTech’s ability to obtain additional funds through the sale of equity or debt commitments; investment capital and market share; changes in the target markets; market uncertainty; ability to access additional capital; management of growth (plans and timing for expansion); patent infringement; litigation; applicable laws, regulations, and any amendments affecting the business of ZenaTech.

Forward-looking statements are based on certain assumptions and analyses made by the management of ZenaTech in light of its experience and understanding of historical trends and current conditions and other factors management believes are appropriate to consider, which are subject to risks and uncertainties. Although ZenaTech’s management believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and actual results may vary materially from the forward-looking information presented. Given these risks and uncertainties underlying the assumptions made, prospective purchasers of ZenaTech’s securities should not place undue reliance on these forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, ZenaTech undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all such factors and to assess in advance the impact of each such factor on ZenaTech’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Potential investors should read this document with the understanding that ZenaTech’s actual future results may be materially different from what is currently anticipated.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024 RMD Rule Updates: How They Affect Your Retirement Income And Charitable Giving

As 2024 progresses, it’s important to be aware of several required minimum distribution (RMD) rule updates, particularly if you are nearing retirement. Whether navigating the new RMD age limit or looking at your charitable giving strategies, these changes can impact your retirement income, taxes and even Medicare costs.

Don’t Miss:

RMDs Now Begin at Age 73

One of the biggest changes from the SECURE 2.0 Act was raising the starting age for RMDs. Previously, retirees had to start taking distributions from their traditional IRAs and 401(k) accounts at age 72. Starting in 2024, the RMD age moved up to 73, giving account holders another year to keep their money growing tax-deferred.

If you were born between 1951 and 1959, you must begin your RMDs at 73. However, those born in 1960 or later can delay RMDs until 75, as the SECURE 2.0 Act pushed the RMD age to 75 in 2033.

Higher Medicare Premiums?

One hidden cost of RMDs is the potential increase in your Medicare premiums. When you start taking RMDs, your taxable income rises, which could push you into a higher income bracket. Your Medicare Part B and D premiums could increase if your income exceeds certain thresholds.

Watch Out for Penalties

Missing an RMD can result in significant penalties. Previously, the penalty for not taking your full RMD was 50% of the amount not withdrawn. However, thanks to the SECURE 2.0 Act, the penalty has been reduced to 25%. Correcting the mistake within two years will drop the penalty to 10%. Even that is a costly error, so it’s wise to stay on top of your RMD deadlines.

You can set up automatic withdrawals to avoid missing an RMD or mark your calendar ahead of time to ensure you don’t miss it.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Charitable Giving Opportunities

Charitable giving could be a smart option if you want to minimize taxes while fulfilling your RMD obligations. In 2024, you can make a Qualified Charitable Distribution (QCD) of up to $105,000 from your IRA if you’re over 70 ½. If donated to a qualified charity, this amount counts toward your RMD and is not taxed as income.

Additionally, retirees can donate up to $53,000 to eligible charities through charitable remainder trusts or gift annuities. This can be a great way to meet RMD requirements while supporting a cause you care about.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Roth 401(k) RMD Relief

Another notable change for 2024 is that Roth 401(k)s will no longer be subject to RMDs. Previously, account holders had to roll their Roth 401(k) into a Roth IRA to avoid taking distributions. Now, Roth 401(k) and Roth IRA holders can skip RMDs and allow their investments to grow tax-free throughout retirement.

The 2024 RMD rule changes offer new opportunities to manage retirement income, minimize taxes and plan for charitable giving. Consider talking with a trusted financial advisor to navigate these updates and maximize your retirement strategy.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article 2024 RMD Rule Updates: How They Affect Your Retirement Income And Charitable Giving originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Justice Department Defends Ban On Gun Ownership For Medical Cannabis Users

The U.S. Department of Justice (DOJ) is holding firm on its stance that medical marijuana users should not allowed to own a gun, citing safety risks.

In a recent filing, federal attorneys argued that the ban on gun ownership for cannabis users is constitutional and should remain in place.

This aligns with federal regulations barring gun access for individuals considered potentially dangerous, such as those who are mentally ill or under the influence, reported Marijuana Moment.

Pennsylvania Prosecutor Challenges Federal Gun Ban

This filing responds to a lawsuit by Robert Greene, the District Attorney of Warren County, Pennsylvania, who is a registered medical marijuana patient. Along with the Second Amendment Foundation, Greene filed suit against the DOJ, Attorney General Merrick Garland and other federal agencies, arguing that the ban infringes on his right to bear arms for self-defense.

The DOJ’s filing, submitted to the U.S. District Court for the Western District of Pennsylvania, seeks to dismiss Greene’s suit.

“Marijuana’s physical and mental effects impair a person’s judgment, including judgment about whether to use firearms,” it says.

The next step for Robert Greene’s case involves a federal court decision on his request for a preliminary injunction.

Read Also: Cannabis And Guns: Legal Battle Heats Up As Feds Block Weapons Sales Over Weed Smell, Lawsuits Ensue

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Contradictory Ruling In Texas Gun & Cannabis Rights Case

Greene’s case is not the only legal battle on this issue. In a separate case, the 5th U.S. Circuit Court of Appeals ruled that cannabis users cannot be barred from owning firearms.

The ruling arose from the case of Paola Connelly, a Texas resident whose right to bear arms was upheld despite her past marijuana use. “Marijuana user or not, Paola is a member of our political community and thus has a presumptive right to bear arms,” U.S. Circuit Judge Kurt Engelhardt ruled.

The decision is significant because it aligns with a 2022 Supreme Court decision stating that firearm laws should reflect historical gun ownership traditions.

While the DOJ has not commented on this ruling, it raises questions about how the federal government will address gun ownership rights among the millions of legal cannabis users nationwide.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are You Rich Enough To Be In The Top 1%? Here's Both The Income And Net Worth You Need to Rank Among The Wealthiest

The phrase “the one percent” gets tossed around a lot in conversations about wealth and inequality, whether in politics, protests, or everyday chats. But what does it mean to be in the top 1%? Let’s break it down by income and net worth to get a clearer picture of who’s part of this exclusive group.

Don’t Miss:

What Income Puts You in the Top 1%?

To be in the top 1% of earners in the U.S., a household must bring in at least $591,550 a year. For a single individual, the cutoff is $407,500. Remember, these numbers are averages and can vary depending on where you live. For example, earning that much in New York City might not stretch as far as it does in other parts of the country.

The Top 1% by Net Worth

When it comes to net worth, the threshold is even higher. To be part of the top 1% in the U.S., a household’s net worth needs to be at least $13.6 million. This measure includes everything you own – homes, investments, savings – minus debts.

Wealth tends to be a lot more unevenly distributed than income. Many households have little to no net worth, while the top tier sits on massive wealth. That’s why net worth often gives a clearer picture of someone’s financial status than income alone.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

Income vs. Net Worth: Which Tells the Real Story?

So, which is more important, income or net worth? It depends on what you’re trying to measure. Income is great for understanding how much someone earns in a year, but net worth is the better gauge for long-term financial stability and overall wealth. Someone with a high income might not have a high net worth if they spend a lot or have significant debt, while someone with a lower income but solid investments could be much wealthier.

How Many People Are in the 1%?

As of the latest numbers, there are around 1.3 million households and about 1.8 million individual workers who fall into the top 1% in the U.S. That’s a small slice of the population but represents a significant share of the country’s wealth and income.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

State-by-State Variations

The income required to be in the top 1% varies significantly across states. For example:

-

Connecticut has the highest threshold at $952,902

-

Massachusetts follows at $903,401

-

California comes in third at $844,266

-

On the lower end, Mississippi has a threshold of just $254,362

Understanding who makes up this elite group isn’t just about how much you earn right now but also what you’ve built over time.

Maybe you’re not in the top 1%, or maybe you are – everyone’s situation is different. Either way, talking with a financial advisor can be really helpful. They can guide you on where you stand and how to make the best decisions for your financial future, whether you’re growing your wealth or looking to manage what you’ve got.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Are You Rich Enough To Be In The Top 1%? Here’s Both The Income And Net Worth You Need to Rank Among The Wealthiest originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tradepulse Power Inflow Alert: Meta Platforms Inc. Receives Signal And Climbs Over 2.4% On The Day

STOCK RECEIVES 4TH SIGNAL IN LAST 5 TRADING SESSIONS FOR OVER 5% GAIN

Meta Platforms, Inc. META today experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

Today, at 10:37AM on October 4th, a significant trading signal occurred for Meta Platforms Inc. as it demonstrated a Power Inflow at a price of $582.40. This indicator is crucial for traders who want to know directionally where institutions and so-called “smart money” moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Meta’s stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Meta’s stock price, interpreting this event as a bullish sign.

Signal description

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted as a bullish signal by active traders.

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock’s overall direction, powered by institutional activity in the stock, for the remainder of the day.

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let’s not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

If you want to stay updated on the latest options trades for Meta, Benzinga Pro gives you real-time options trades alerts.

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The price at the time of the Power Inflow was $582.40. The returns on the High price ($596.52) and Close price ($595.94) after the Power Inflow were respectively 2.4% and 2.3%%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case the high of the day and close were very close but that is not always the case

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I Want to Roll Over $865k to a Roth IRA – Can I Do It Without Paying Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Converting a large sum like $865,000 to a Roth IRA is a strategic move for long-term tax benefits – including tax-free retirement income and eliminating required minimum distributions (RMDs) – but it often comes with a hefty upfront tax bill. The transition from a traditional IRA or 401(k) to a Roth IRA means paying taxes on the converted funds. But, with careful planning and strategic execution, it’s possible to minimize the tax impact. Here’s how you can do it.

Get matched with a financial advisor who can help you convert your retirement funds.

Understand the Basics of Roth IRA Conversions

When you convert funds from a traditional IRA or 401(k) to a Roth IRA, you’re essentially converting pre-tax dollars to after-tax dollars. This conversion triggers a taxable event, meaning you’ll owe income tax on the amount converted. The key to minimizing taxes lies in understanding the timing and amount.

Strategy 1: Partial Conversions Over Several Years

Instead of moving the entire $865,000 in one year, consider spreading it across multiple years. This strategy helps to avoid pushing yourself into a higher tax bracket. For example, if you’re currently in the 24% tax bracket, converting a large sum might push you into the 32% or 35% tax bracket, significantly increasing your tax liability.

Example Strategy:

-

Year 1: Convert $200,000

-

Year 2: Convert $200,000

-

Year 3: Convert $200,000

-

Year 4: Convert $200,000

-

Year 5: Convert $65,000

By spreading out the conversion, you keep your taxable income lower each year, potentially saving thousands in taxes.

Keep in mind, any amount you convert will typically be subject to the five-year rule, which means you can’t withdraw the converted amount without penalty for five years after you convert it.

A financial advisor can help you devise a personalized conversion strategy to minimize your conversion taxes. Talk to an advisor today.

Strategy 2: Leverage Lower Income Years

If you anticipate a year with lower income — such as retirement or a sabbatical — that might be the ideal time to execute a conversion (though you may have to wait five years to use that income). During a lower income year, your overall taxable income will be less, which means the rollover amount will be taxed at a lower rate.

Example Scenario: If you retire at 62 and plan to start taking Social Security at 67, the years between 62 and 67 might be prime for Roth conversions. With no employment income and delayed Social Security, your taxable income is lower, allowing for a more tax-efficient rollover.

Strategy 3: Utilize Tax Deductions and Credits

Take advantage of available tax deductions and credits to offset the tax liability of your rollover. Charitable contributions, medical expenses and business losses are examples of deductions that can lower your taxable income.

Example Tactics:

-

Charitable Contributions: If you itemize deductions, making large charitable contributions in the same year as your rollover can offset the increased taxable income.

-

Medical Expenses: If you have significant medical expenses that exceed 7.5% of your adjusted gross income, these can also be deducted, reducing your taxable income.

-

Business Losses: If you own a business, operational losses may be able to be used to offset your taxable income from the rollover.

Strategy 4: Contribute to a Health Savings Account (HSA)

Contributing to an HSA can lower your taxable income. HSAs offer triple tax benefits: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. Maximize your HSA contributions to reduce your overall taxable income.

Strategy 5: Convert During Market Downturns

When the market is down, the value of your traditional IRA or 401(k) investments may be lower. Converting during a downturn means you’re rolling over a smaller amount, thus incurring a lower tax bill. Additionally, any subsequent growth happens tax-free within the Roth IRA.

Consulting with a Financial Advisor

Given the complexity of tax laws and the significant amount involved, consulting with a financial advisor or tax professional is crucial. They can help tailor a strategy specific to your financial situation and goals, ensuring you maximize the benefits while minimizing the tax burden. If you are searching for a fiduciary financial advisor, this free tool can match you with up to three.

The Bottom Line

Rolling over $865,000 to a Roth IRA is a savvy financial move for long-term tax benefits, but it requires careful planning to avoid a large tax bill. By spreading the conversion over multiple years, leveraging lower income years, utilizing tax deductions and credits, contributing to an HSA and converting during market downturns, you can strategically minimize your tax liability. Consult with a financial advisor to develop a personalized plan that aligns with your financial goals.

Tools for Retirement Planning

-

How much money will you need to retire? Find out by using the SmartAsset retirement calculator.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Hammarby Studios

The post I Want to Convert $865k to a Roth IRA. How Do I Avoid Paying Taxes? appeared first on SmartReads by SmartAsset.

US dividend ETFs bask in investor attention after jumbo Fed rate cut

By Suzanne McGee

(Reuters) – U.S. exchange-traded funds (ETFs) that invest in dividend-paying stocks have enjoyed a rush of inflows since the Federal Reserve kicked off its rate cutting cycle last month, though a jump in U.S. Treasury yields could slow the deluge of investor funds.

The group of 135 U.S. dividend ETFs tracked by Morningstar pulled in $3.05 billion in September, the same month the Fed cut interest rates by 50 basis points, its first reduction since 2020. That compares to average monthly inflows of $424 million in the first eight months of 2024.

Their newfound popularity has been driven by investors seeking income-generating products ahead of declines in yields that are expected to occur as the Fed continues cutting interest rates.

“The pivot in monetary policy translates into cash looking for new homes, and dividend-yielding stocks will be one of the beneficiaries,” said Nick Kalivas, head of factor and equity ETF strategy at Invesco.

Whether the trend continues remains to be seen: benchmark 10-year Treasury yields have shifted higher in recent weeks and hit two-month highs on Friday, after a blowout U.S. employment number pointed to a resilient economy that likely does not need the Fed to deliver more large cuts this year.

Still, Josh Strange, founder and president of Good Life Financial Advisors of NOVA, said the revival of interest in dividend stocks is a reaction to rising valuations in sectors such as tech as well as in broader markets, in addition to shifts in monetary policy.

At 21.5 times future 12-month earnings estimates, the S&P 500’s valuation is near its highest level in three years and is well above its long-term average of 15.7, according to LSEG Datastream.

“The S&P 500 has become increasingly concentrated in just a few names, and the momentum has all concentrated around AI, making these stocks look frothy,” Strange said.

Yields offered by dividend ETFs vary by strategy, but can range from just under 2% to as much as 3.6%. By comparison, benchmark 10-year Treasuries yield fell to around 3.6% in September.

Energy and financial stocks often appear in dividend ETFs, including Chevron Corp., JP Morgan Chase and Exxon Mobil. But they also feature pharmaceutical companies like Proctor & Gamble, utilities such as Verizon (VZ.N> or Southern Co. and retailers like Home Depot.

“If you seek out high dividend payouts, you’re making a tradeoff: you also want to own companies that will grow and be capable of increasing those payouts,” said Sean O’Hara, president of Pacer ETFs, discussing the outlook for dividend ETFs and related products in the latest edition of Inside ETFs.

To lessen the risk of owning companies with deteriorating fundamentals, Pacer builds ETF portfolios based on companies’ free cash flows, such as the $24.8 billion Pacer US Cash Cows ETF, launched in 2016. It has attracted $7.1 billion in inflows in the last 12 months.

(Reporting by Suzanne McGee; Editing by Ira Iosebashvili and Deepa Babington)