MEI Reminder – Robbins LLP Reminds MEI Stockholders to Seek Counsel in Light of the Pending Lead Plaintiff Deadline

SAN DIEGO, Oct. 04, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities that purchased or otherwise acquired Methode Electronics, Inc. MEI common stock between June 23, 2022 and March 6, 2024. Methode designs, engineers, and produces mechatronic products for Original Equipment Manufacturers (“OEMs”).

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Methode Electronics, Inc. (MEI) Misled Investors Regarding its Business Prospects

According to the complaint, defendants’ failure to disclose adverse facts regarding problems at the Company’s Monterrey facility and efforts to transition away from the GM center console program caused Methode stock to trade at artificially inflated prices during the class period.

Specifically, plaintiff alleges: (a) that the Company had lost highly skilled and experienced employees during the COVID-19 pandemic necessary to successfully complete the Company’s transition from its historic low mix, high volume production model to a high mix, low production model at its Monterrey facility; (b) that the Company’s attempts to replace its GM center console production with more diversified, specialized products for a wider array of vehicle manufacturers and OEMS, in particular in the EV space, had been plagued by production planning deficiencies, inventory shortages, vendor and supplier problems, and, ultimately, botched execution of the Company’s strategic plans; (c) that the Company’s manufacturing systems at its critical Monterrey facility suffered from a variety of logistical defects, such as improper system coding, shipping errors, erroneous delivery times, deficient quality control systems, and failures to timely and efficiently procure necessary raw materials; (d) that the Company had fallen substantially behind on the launch of new EV programs out of its Monterrey facility, preventing the Company from timely receiving revenue from new EV program awards; and (e) that, as a result of (a)-(d) above, the Company was not on track to achieve the 2023 diluted EPS guidance or the 3-year 6% organic sales CAGR represented to investors and such estimates lacked a reasonable factual basis.

Following a series of corrective disclosures, the price of Methode stock dropped precipitously from a class period high of over $50 per share to less than $10 per share by mid-June 2024 – a decline of more than 80%, causing investors to suffer hundreds of millions of dollars in financial losses.

What Now: You may be eligible to participate in the class action against Methode Electronics, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by October 25, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Methode Electronics, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/27b9596d-8964-43da-a117-6ba8daeddb75

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Universal Consulting Opportunities (UCO) Enters European Market as Exclusive Strategic Advisor to MLS Leader in Romania

UCO Leverages Its Expertise to Further MLS Leader’s Mission to Grow the MLS Concept and Enhance the Real Estate Industry for Professionals and Consumers

ALTAMONTE SPRINGS, Fla., Oct. 4, 2024 /PRNewswire/ — UCO, a subsidiary of Stellar MLS, a leading multiple listing service (MLS) in the U.S. and the fastest-growing in the world, has announced an agreement with MLS Leader to be its exclusive MLS strategic advisor in Romania. By sharing its expertise and experience, UCO will advance MLS Leader’s vision of being the leading MLS in the Romanian real estate marketplace.

MLS Leader has worked closely with the communities of real estate brokers and agents for more than a decade, continuously taking on the role of education and regulation, to build a transparent real estate market in the interest of real estate professionals, clients, and the general public. Being the source of information about properties and real estate transactions in Romania, MLS Leader’s mission is to provide real estate professionals a way to excel in their profession and offer valuable services at every step of their activities.

Through UCO, Stellar MLS brings its strategic experience in the MLS global realm to augment MLS Leader’s operational and technological expertise and will advise MLS Leader to enhance its innovative platform and services while building its membership of professionals within the real estate community of the European Union’s sixth most populous country.

“We’re proud to collaborate with MLS Leader on this important vision to promote a more transparent and efficient real estate market in Romania and beyond,” said Merri Jo Cowen, CEO of Stellar MLS and UCO. “Our team is focused on the MLS and supporting real estate professionals in Europe and across the globe.”

“As the pioneering MLS service in Europe, founded in 2007, MLS Leader (powered by Flexmls) has built a system that empowers real estate companies to successfully implement the MLS and exclusive representation model in a market beyond North America,” said Sorin Udrea, Founder and General Manager of MLS Leader.

“We are widely regarded as the most trusted source of market data in Romania, supporting agents with essential tools like CMA, market statistics, and client portals for buyer representation. With UCO as our strategic advisor, we are excited to accelerate our efforts toward establishing MLS Leader as the premier marketplace for real estate professionals specializing in exclusive representation in Romania.”

Cowen emphasized the expertise and dedication of UCO’s team of globally recognized business leaders, which includes Marion Weiler, UCO Vice President of Global Markets and Stellar MLS Vice President of Marketing and Communications, and Dr. Mathew Kallumadil, UCO Vice President of Global Markets and Stellar MLS Vice President of Technology and Innovation, in reaching this important milestone.

UCO has been actively engaged in global forums in France and Germany to support a forward-thinking approach to transforming the real estate industry. In October, UCO is a title partner of the International MLS Forum in Milan, where representatives of 45+ global markets will meet to understand and develop the MLS concept to bring about trust and transparency. UCO’s presence is supported through its partnerships with CEPI, the European Association of Real Estate Professions, and FIABCI, the International Real Estate Federation.

About UCO

With a mission to support real estate professionals across the globe, UCO offers expertise including but not limited to market entry, MLS development, and cross-border transactions. This expertise stems from a management team with over 100 years of combined experience in the real estate industry, including globally recognized business leaders who have worked with world-class organizations, and international professionals with 40 years of collective global experience, many of whom are fluent in multiple languages. By collaborating with global organizations like CEPI and FIABCI, UCO delivers tailored solutions to help real estate markets thrive globally, with an emphasis on trust, transparency, innovation, and sustainable growth. Whether you are enhancing existing operations or building new ones from the ground up, UCO is committed to helping real estate markets thrive – UCO specializes in meeting clients’ unique needs, wherever they may be in their MLS journey.

About MLS Leader (Powered by Flexmls)

Founded in 2007, MLS Leader is the first genuine multiple listing service in Europe, offering real estate professionals in Romania advanced tools to enhance market transparency and efficiency. MLS Leader’s mission is to empower real estate agents and appraisers with the resources to excel in their work and provide valuable services at every stage. By promoting the exclusive representation model, MLS Leader offers a robust platform that includes tools and information needed for successful real estate agency management, along with access to reliable market data, competitive analysis (CMA), and advanced client communication systems.

UCO Media Contact: Caryn McBride

Co-Communications

cmcbride@cocommunications.com

![]() View original content:https://www.prnewswire.com/news-releases/universal-consulting-opportunities-uco-enters-european-market-as-exclusive-strategic-advisor-to-mls-leader-in-romania-302267971.html

View original content:https://www.prnewswire.com/news-releases/universal-consulting-opportunities-uco-enters-european-market-as-exclusive-strategic-advisor-to-mls-leader-in-romania-302267971.html

SOURCE Stellar MLS

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Hock E Tan Sells $1.67M Worth Of Broadcom Shares

On October 3, a recent SEC filing unveiled that Hock E Tan, President and CEO at Broadcom AVGO made an insider sell.

What Happened: After conducting a thorough analysis, Tan sold 10,000 shares of Broadcom. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total transaction value is $1,671,410.

The latest market snapshot at Friday morning reveals Broadcom shares up by 1.65%, trading at $174.73.

About Broadcom

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

Financial Milestones: Broadcom’s Journey

Revenue Growth: Broadcom’s remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 47.27%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company excels with a remarkable gross margin of 63.92%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Broadcom’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of -0.4.

Debt Management: Broadcom’s debt-to-equity ratio surpasses industry norms, standing at 1.07. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 138.84, Broadcom’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 17.02, Broadcom’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 39.41, Broadcom demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Deciphering Transaction Codes in Insider Filings

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Broadcom’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A millennial with a Ph.D. and over $250k in student-loan debt says she's been looking for a job for 4 years. She wishes she prioritized work experience over education.

-

A millennial with a Ph.D. and more than $250,000 in student-loan debt says she can’t find a job.

-

She’s looking for business roles while working as a nurse to help pay the bills.

-

She says she wishes she prioritized work experience over her graduate degrees.

Over the past decade, A. Rasberry has placed a great deal of value on higher education. She’s now come to regret it.

Rasberry earned a bachelor’s, master’s, and doctorate degree in business management from Saint Leo University in Florida. However, she says she’s struggled to find a job in her field of study over the past four years. She also has more than $250,000 in student-loan debt, according to a document viewed by Business Insider.

“I graduated with my Ph.D. in 2020 and can’t find a job to save my life,” the 38-year-old, who lives in Virginia, told Business Insider via email. She asked for partial anonymity, using only the first initial of her first name and her last name, because of privacy concerns.

Since earning her Ph.D., Rasberry has applied for various business-management roles but had little success. She said she’d been forced to expand her job search and explore a new career in nursing to help her make ends meet.

“I thought education was the road to financial freedom,” she said. “But I was wrong.”

We want to hear from you. Are you struggling to find a job and comfortable sharing your story with a reporter? Please fill out this form.

Rasberry is among the Americans who are having a tough time finding work. In part, it’s because businesses across the US have significantly scaled back on hiring over the past two years. The ratio of job openings to unemployed people — an indicator of job availability — has declined considerably.

While the unemployment rate and layoff rate remain low compared with historical levels, the hiring slowdown means that many job seekers are having a considerably harder time than they were a few years ago.

Rasberry shared why she thinks her job search has been so challenging, how she made her career pivot, and her top piece of advice for people pursuing higher education.

‘Most organizations prefer experience over education’

After receiving her doctorate degree, Rasberry’s initial goal was to land an adjunct professor position. However, after speaking with people in the education field, she decided to change course.

“I’ve learned how difficult it is to get started in the field,” she said. “Essentially, after earning a Ph.D., I would have to go back to school to take more courses to support a teaching career.” She said she was told she’d specifically need more education-related credits.

As a result, Rasberry said, she decided to give up on teaching and focus on finding other roles in her area of study: business management.

But her job search has been challenging. Rasberry said she hasn’t landed many interviews, and when she has — and has been turned down — she’s had a hard time figuring out what went wrong. She said she’s expanded her job search to non-managerial bookkeeping, accounting, tutoring, and human-resources roles but that she hasn’t had much luck with these either.

Rasberry thinks the biggest obstacle in her job search is her lack of work experience.

While pursuing her degrees, she gained some entry-level work experience in banking, human resources, and bookkeeping roles. However, she said this experience might be insufficient in the eyes of employers.

“I am over qualified for most entry-level positions, but I am under qualified for management or leadership positions,” she said. “Ultimately, my degree has been both a blessing and a curse.”

Rasberry’s top piece of advice for people who pursue higher education is to do your homework. She said she wishes she’d spent more time evaluating her school’s job placement programs, internship partnerships, and the employment rates of recent graduates across different fields before she pursued her degrees.

She also recommended taking time to think about the value of a college degree and the best ways to use it to land a job.

“I learned most organizations prefer experience over education,” she said. “Had I known that I would not have spent so many years in college.”

Nursing is helping to pay the bills during her job search

Rasberry said that in recent years, she’d worked various part-time jobs to pay the bills.

“It feels next to impossible to work a single job and earn enough money to cover essentials like rent, fuel, electricity, etc. in the state of Virginia,” she said. One analysis found Virginia was the 13th-most expensive state when it comes to overall cost of living.

She said she’s completing a training program to work remotely for TurboTax as a tax expert. At the same time, she’s also exploring a new career: nursing. Rasberry said that for roughly the past year, she’d been working as much as 80 hours a week as a nurse.

“I am new to nursing, but I find it rewarding, and I like the shift flexibility,” she said.

Rasberry found a nursing role that provided free training and certification. But she said the downside was that this certification wouldn’t carry over to any other employers — limiting her opportunities in the industry. This is among the reasons she hasn’t stopped applying for business-related jobs.

Another reason is that she doesn’t think she’s paid particularly well — she said she was earning $21.50 an hour. In 2023, the median pay for a registered nurse in the US was about $41 an hour. Despite the long hours, she said the low pay is why she doesn’t view nursing as a full-time job.

“It doesn’t come with full time pay,” she said.

Rasberry said that in recent months, she’d begun focusing more on looking for remote roles such as the TurboTax opportunity. She said working remotely would make it easier to keep her nursing job, reduce her commuting costs, and care for her dog.

Over the past month, Rasberry finally had some luck in the job market. She said she landed a remote plan consultant position in the nursing field that pays about $70,000 a year — equivalent to an hourly rate of more than $30 an hour.

While she views this as a positive development, she said she’d “absolutely” continue searching for higher-paying roles in her field of study.

“When I’m not working, I’m online, putting in applications for employment,” she said.

Read the original article on Business Insider

Chinese EV Stocks Li Auto, BYD, Nio To Benefit From Rebound: Analyst

Macquarie Equity Research issued a positive outlook for the short-term Chinese EV market following a $142 billion (one trillion yuan) stimulus package. Analysts listed several positive catalysts, including new model launches, expanded margins due to operating leverage, the end of subsidies pulling demand forward, reduced discounting pressures and clarity on potential European Union (EU) tariffs, which had previously been uncertain for Chinese automakers.

The firm sees BYD BYDDF and NIO Inc – ADR NIO benefiting from the shift. BYD led the charge, selling 419,400 units in September, marking a 46% year-over-year increase. The company’s aggressive expansion overseas surprised the EV market.

Launching new models, particularly those based on its highly efficient DM-i hybrid technology, should help sustain its growth momentum in the coming months. Macquarie remains optimistic and has raised the price target for BYD shares to about $46.35 (HK$ 360), indicating a potential upside of over 20%.

Although on a much lower scale, Nio also had a successful September, selling 21,200 units, indicating a 35% year-over-year growth. The company successfully introduced a battery-as-a-service model, lowering consumers’ upfront costs.

Still, Macquarie sees the risks from domestic and foreign competition, believing that the battery-swapping technology is not widely adopted. It rates the stock as Neutral, with its U.S-listed share price target of $8.20, representing a modest upside of around 13.5%.

Li Auto Inc LI faces a more challenging outlook despite performing well in sales. The company sold 53,700 units in September, marking a 49% year-over-year increase. But, Macquarie believes there is a lack of a clear catalyst in the second half of the year, particularly as no new models are scheduled for release during this period.

Li Auto’s extended-range electric vehicles (EREVs) have been popular, but the market is notably shifting toward pure battery electric vehicles (BEVs). The company risks losing momentum without new BEV models or innovations in the near term.

Macquarie’s analysts point out that price competition pressuring the margins is one of the key risks, alongside a potential decline in demand for EREVs as consumers shift to fully electric vehicles.

Still, they acknowledge the possibility of Li Auto outperforming if its L series continues selling well and if it can successfully launch a BEV SUV in 2025. For now, Macquarie has set the price target at $33, giving it an upside of 10.4%. The firm also gave Li Auto stock a downgrade from Outperform to Neutral.

Read Next:

• China Was Tipping Into A Japan-Style ‘Lost Decade’ Of Deflation And Stagnation Before Late-September Stimulus Announcements, Says Legal Expert

Photos: Li Auto, BYD, Nio vehicles via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Newest Stock-Split Stock in the S&P 500. It Soared 12,870% Since Its IPO, and Wall Street Says It's Still a Buy Right Now.

The S&P 500 is the most widely followed stock market index in the U.S. and consists of the 500 largest publicly traded companies in the country. Given the scope of its membership, it is considered by many investors to be the most dependable gauge of overall stock market performance. To be included in the S&P 500, a company must meet the following criteria:

-

Be based in the U.S.

-

Have a market cap of at least $8.2 billion.

-

Have a minimum of 50% of its outstanding shares available for trading.

-

Be profitable on a GAAP basis in its most recent quarter.

-

Be profitable, in aggregate, over the preceding four quarters.

Deckers Outdoor (NYSE: DECK) is one of the most recent additions to the S&P 500, joining the fold on March 18, one of only 11 companies to be added to the index so far this year. Furthermore, the outdoor footwear and apparel specialist recently completed a 6-for-1 forward stock split, usually reserved for companies with years of strong business and financial results. Since it went public 21 years ago, Deckers shares have soared 12,870% (as of this writing), as the company has navigated the vagaries of the ever-changing outdoor apparel market. Those results aren’t relegated to some distant past either. Over the past five years, Deckers stock has surged 548%.

Despite its impressive rise, many on Wall Street believe there are additional gains to be had. Let’s look at why Deckers has been so successful and what the future holds.

From humble beginnings

Deckers got its start in the surf culture in the early 1970s, creating a comfortable yet stylish sandal that soon became a staple among California surfers. From those humble beginnings, Deckers has forged a multinational path by focusing on niche offerings with a wide appeal. Its iconic footwear brands include Hoka, Ugg, Teva, Ahnu, and Koolabura. The company’s expanding line of performance footwear, strong brands, and reputation for comfort have catapulted Deckers to international success.

These factors have helped the company generate impressive financial results, and the past year has pushed the stock to a new zenith. After delivering record sales and profitability during its fiscal 2024 (ended March 31), Deckers kicked off this year with a bang.

For its fiscal 2025 first quarter (ended June 30), the company generated revenue of $825 million, up 22% year over year, while its diluted earnings per share (EPS) of $4.52 soared 87%. If that wasn’t enough to grab shareholders’ attention, Deckers increased its full-year profit forecast to EPS of $30.20 at the midpoint of its guidance, which would mark a new high watermark for performance.

The enduring appeal of Deckers footwear has propelled the company to new heights, and that appears poised to continue. The company has been taking market share from its larger rivals. Furthermore, even as the competition is cutting prices and offering discounts to lure customers, Deckers is selling its most popular brands at full retail prices.

Last fiscal year, sales of the company’s luxury lifestyle brand Ugg climbed 16% to $2.2 billion, while its high-end Hoka running shoe brand surged 28% to $1.8 billion and they show no signs of slowing. Deckers is taking the lessons learned from its most popular makes to reignite sales of its other brands. The company is also working to expand its international and direct-to-consumer sales and those efforts could boost its results for the foreseeable future.

There’s another reason for investors to be excited. Since the company began buying back stock in 2012, Deckers has decreased its share count by nearly 34%, giving shareholders an even bigger piece of the earnings pie. The company bought back $152 million worth of stock in Q1 and has roughly $790 million remaining on its current repurchase authorization.

Analysts are still bullish on Deckers

Wall Street is famous for its diverse group of opinions, so it’s noteworthy that the majority of analysts that cover Deckers believe there’s still upside ahead. Of the 22 analysts that covered the stock in September, 16 rated it a buy or strong buy, and none recommend selling. Furthermore, an average price target of roughly $179 suggests that Deckers stock has 15% upside compared to Tuesday’s closing price.

However, UBS analyst Jay Sole is the biggest bull among his Wall Street colleagues, with a buy rating and a split-adjusted Street-high price target of $225. That suggests potential gains for investors of 45% compared to Tuesday’s closing price. The analyst cites Deckers’ robust quarterly results and the ongoing strong demand for its Hoka and Ugg brands.

Despite the stock’s relentless climb over the past few years, it’s still attractively priced, selling for roughly 30 times earnings, matching the current multiple of the S&P 500 — despite outpacing the index by a wide and growing margin in recent years. Perhaps more importantly, analysts’ consensus estimates are calling for EPS of $6.05 for Deckers next fiscal year, so the stock is selling for less than 26 times next year’s earnings — an even better bargain.

That’s why Deckers stock is a buy.

Should you invest $1,000 in Deckers Outdoor right now?

Before you buy stock in Deckers Outdoor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Deckers Outdoor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Danny Vena has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Meet the Newest Stock-Split Stock in the S&P 500. It Soared 12,870% Since Its IPO, and Wall Street Says It’s Still a Buy Right Now. was originally published by The Motley Fool

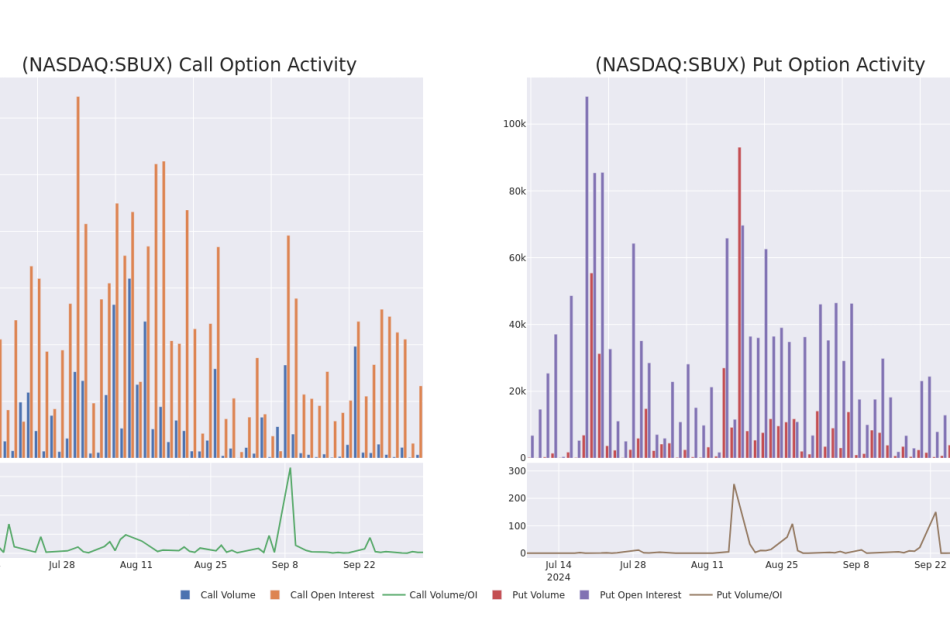

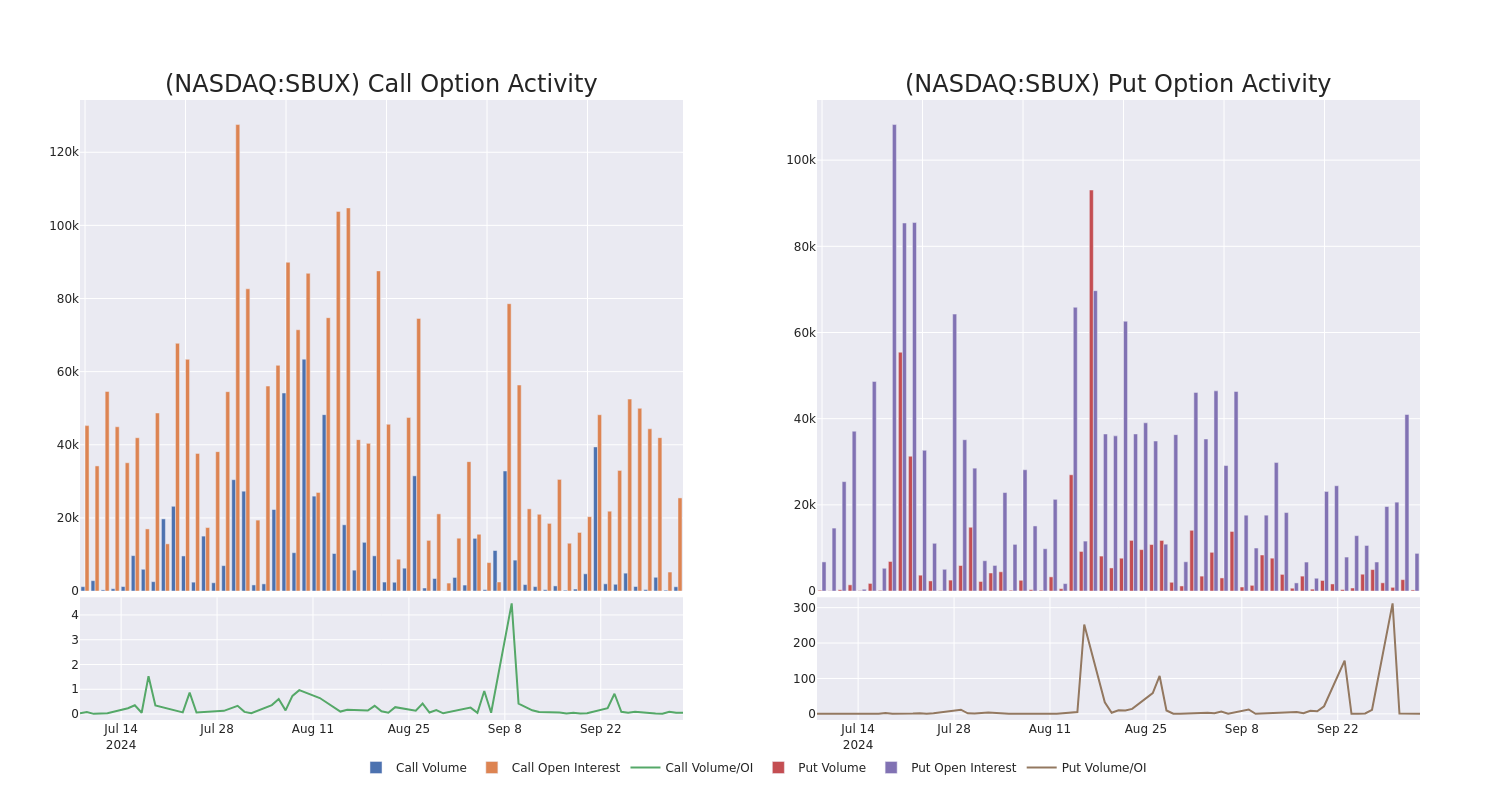

Check Out What Whales Are Doing With SBUX

Investors with a lot of money to spend have taken a bullish stance on Starbucks SBUX.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SBUX, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 8 options trades for Starbucks.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 12%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,650, and 7, calls, for a total amount of $435,875.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $100.0 for Starbucks during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Starbucks’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Starbucks’s whale activity within a strike price range from $75.0 to $100.0 in the last 30 days.

Starbucks Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SBUX | CALL | TRADE | NEUTRAL | 06/20/25 | $7.8 | $7.7 | $7.75 | $100.00 | $155.0K | 4.2K | 203 |

| SBUX | CALL | TRADE | BULLISH | 03/21/25 | $8.15 | $8.1 | $8.15 | $95.00 | $86.3K | 1.3K | 126 |

| SBUX | CALL | SWEEP | NEUTRAL | 11/15/24 | $2.83 | $2.75 | $2.75 | $100.00 | $50.6K | 10.5K | 213 |

| SBUX | CALL | SWEEP | NEUTRAL | 01/17/25 | $17.45 | $17.3 | $17.38 | $80.00 | $43.5K | 6.6K | 27 |

| SBUX | CALL | SWEEP | BULLISH | 11/15/24 | $21.1 | $20.45 | $21.04 | $75.00 | $42.0K | 174 | 12 |

About Starbucks

Starbucks is one of the most widely recognized restaurant brands in the world, operating more than 38,000 stores across more than 80 countries as of the end of fiscal 2023. The firm operates in three segments: North America, international markets, and channel development (grocery and ready-to-drink beverage). The coffee chain generates revenue from company-operated stores, royalties, sales of equipment and products to license partners, ready-to-drink beverages, packaged coffee sales, and single-serve products.

In light of the recent options history for Starbucks, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Starbucks Standing Right Now?

- Trading volume stands at 5,418,853, with SBUX’s price up by 1.13%, positioned at $96.64.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 27 days.

Expert Opinions on Starbucks

In the last month, 5 experts released ratings on this stock with an average target price of $104.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Bernstein has elevated its stance to Outperform, setting a new price target at $115.

* An analyst from JP Morgan persists with their Overweight rating on Starbucks, maintaining a target price of $105.

* An analyst from BMO Capital persists with their Outperform rating on Starbucks, maintaining a target price of $110.

* An analyst from Jefferies downgraded its action to Underperform with a price target of $76.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Starbucks with a target price of $118.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Starbucks, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

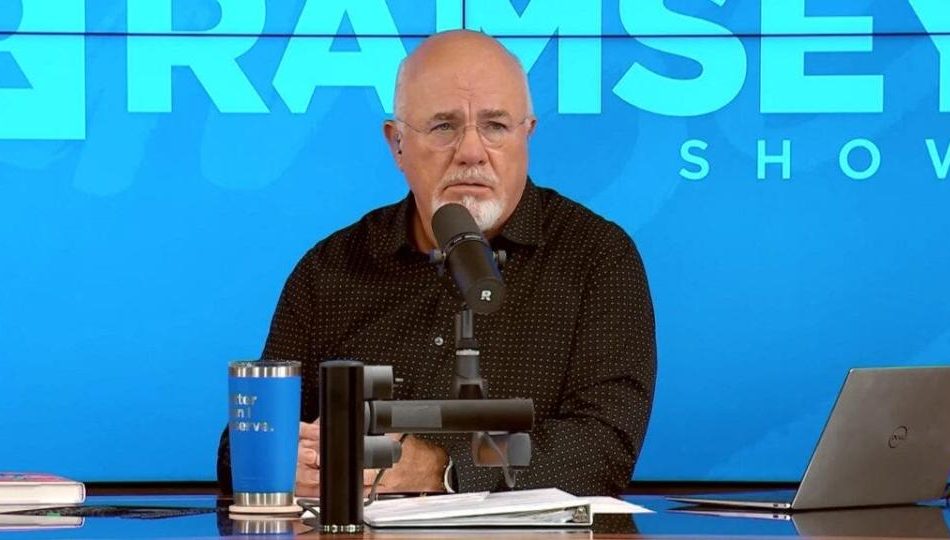

Are Folks In America That Stupid?' Dave Ramsey Says Americans Should Be More Suspicious Of The Fed Rate Cuts Timing

In a recent episode of The Ramsey Show, financial expert Dave Ramsey didn’t hold back when discussing the Federal Reserve’s latest rate cuts and timing – just weeks before a major election. Ramsey, known for his no-nonsense approach to personal finance, raised questions about the motives behind the Fed’s decision, saying it’s no coincidence that interest rates were lowered so close to Election Day.

Don’t Miss:

On Sept. 18, the Federal Reserve cut its interest rates by half a percentage point – the first cut since 2020. While some say this is a bold move to help a struggling national economy, Ramsey calls it bogus.

Ramsey opened his discussion with a bold statement: “We just got word a few moments ago – surprise, surprise, 45 days from the election, the Fed dropped the interest rate … That wasn’t possible four months ago or eight months ago, but right before the election, it’s possible. That’s just sus.”

Trending: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

He criticized what he sees as the politically motivated nature of the timing, asking listeners, “Are you folks in America that stupid? That you don’t look at this and go, well, that’s suspicious timing?”

The timing of the rate cut is significant because economic issues have been a focal point in the current administration’s challenges. Ramsey pointed out that it’s really hard to keep a party in office when the economy is struggling during an election year and emphasized that the Fed rate cuts are just a political move.

Ramsey believes the Fed’s decision to cut rates won’t immediately impact the housing market, despite mortgage rates being at their lowest levels since early 2023. He also mentioned that the real estate market hasn’t experienced a boom despite these lower rates. Homeowners are reluctant to sell homes with 2-3% mortgage rates and upgrade to homes with significantly higher rates.

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Ramsey proposed an additional theory: “Some people might be waiting on the Harris administration or the Trump administration to fix their life and they’re going to wait until after the election to decide whether they’re gonna buy a house or not.” Ramsey emphasized that waiting on political outcomes to change personal financial situations is misguided.

George Kamel agreed, noting that while supply and demand in the housing market remain issues, some potential buyers have been holding off, waiting for rate cuts to make homes more affordable.

Despite the hype, Ramsey warned that the Fed’s rate cut won’t immediately impact mortgage rates, as those are influenced more by the bond market. “It’ll be postelection before you see any benefit from that. But it’s all about perception … This is a PR move.”

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Ramsey and Kamel concluded the discussion by pointing out that these kinds of announcements, like the Fed rate cut or the promises of student loan forgiveness, are often politically motivated. As Kamel put it, “It’s amazing the timing of that,” and Ramsey agreed, saying, “Pretty much like during the congressional elections, midterm stuff, Biden came out and said he’s gonna forgive all student loans. And everybody knew he couldn’t do it.”

In the end, Ramsey’s message to his audience was clear: don’t let political timing cloud your judgment regarding personal finance.

If you are considering selling or purchasing a home, take the time to get informed about the economy and other factors that impact mortgage rates. Consider talking to a financial advisor to better understand your finances and how selling or purchasing a home at this time could impact your long-term goals.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Are Folks In America That Stupid?’ Dave Ramsey Says Americans Should Be More Suspicious Of The Fed Rate Cuts Timing originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

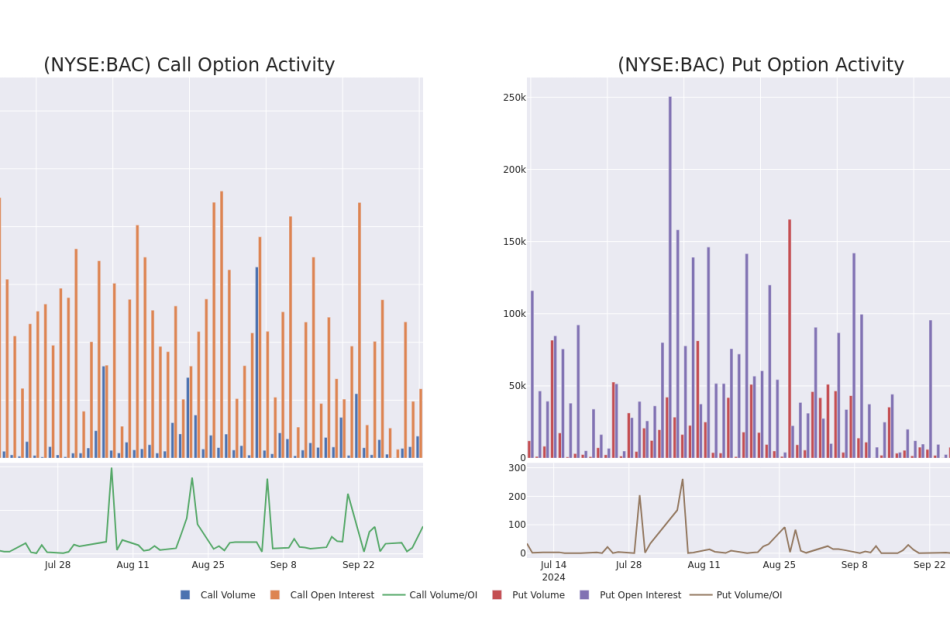

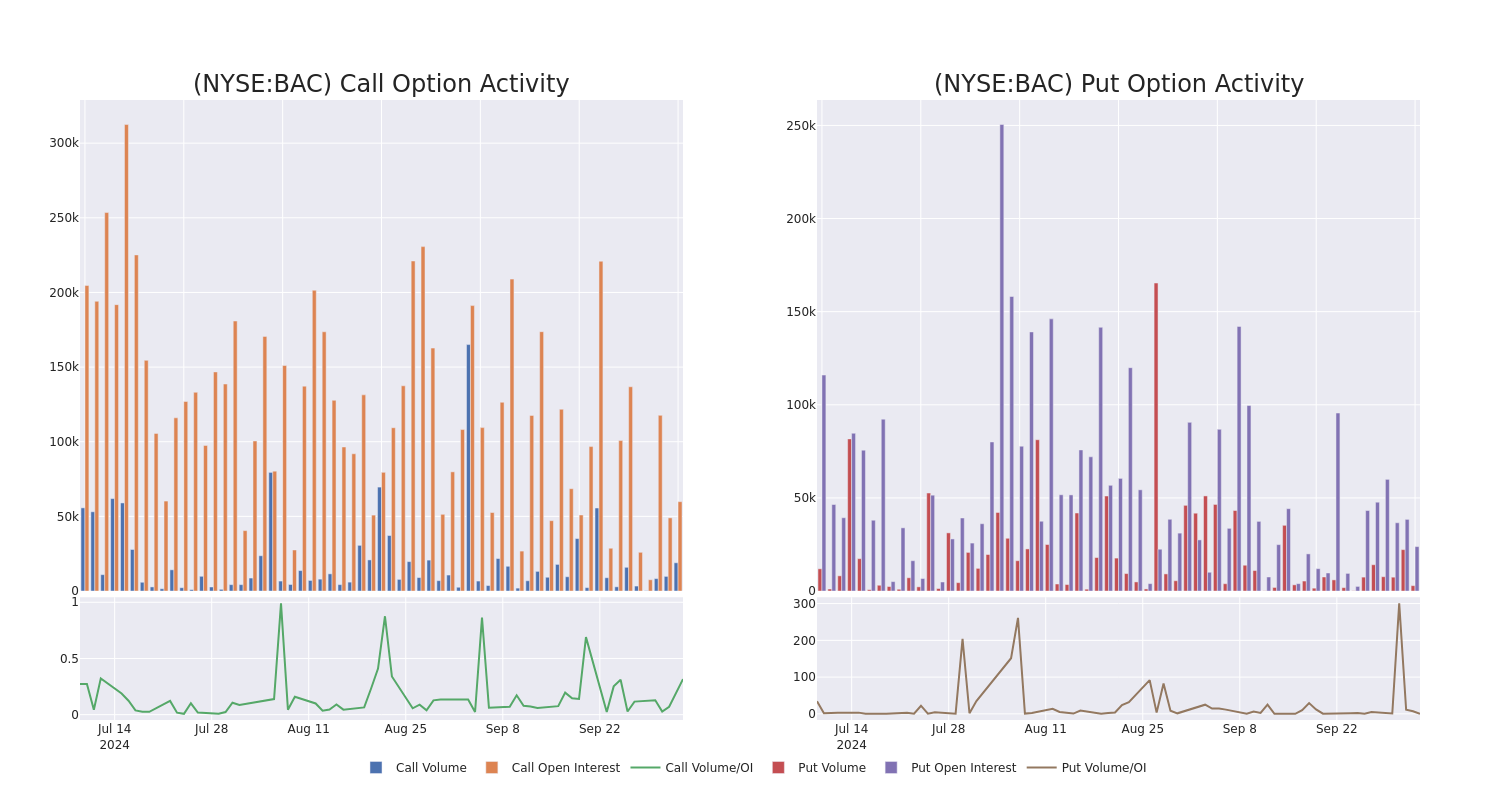

Unpacking the Latest Options Trading Trends in Bank of America

Deep-pocketed investors have adopted a bearish approach towards Bank of America BAC, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BAC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 11 extraordinary options activities for Bank of America. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 9% leaning bullish and 63% bearish. Among these notable options, 3 are puts, totaling $174,800, and 8 are calls, amounting to $420,064.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $28.0 to $42.0 for Bank of America during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Bank of America’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Bank of America’s whale activity within a strike price range from $28.0 to $42.0 in the last 30 days.

Bank of America 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | PUT | TRADE | BEARISH | 06/20/25 | $0.45 | $0.42 | $0.44 | $28.00 | $110.0K | 19.9K | 2.5K |

| BAC | CALL | TRADE | NEUTRAL | 06/20/25 | $9.45 | $9.35 | $9.4 | $32.00 | $94.0K | 15.0K | 200 |

| BAC | CALL | TRADE | BEARISH | 06/20/25 | $9.65 | $8.7 | $8.95 | $32.00 | $89.4K | 15.0K | 0 |

| BAC | CALL | SWEEP | BEARISH | 10/04/24 | $0.4 | $0.39 | $0.39 | $39.50 | $55.2K | 7.6K | 8.3K |

| BAC | CALL | TRADE | NEUTRAL | 06/20/25 | $2.78 | $2.63 | $2.7 | $42.00 | $54.0K | 17.8K | 0 |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

Having examined the options trading patterns of Bank of America, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Bank of America

- Trading volume stands at 33,691,554, with BAC’s price up by 2.01%, positioned at $40.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 11 days.

What The Experts Say On Bank of America

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $48.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Bank of America with a target price of $47.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Bank of America, targeting a price of $49.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Bank of America, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.