Spotlight on Roblox: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on Roblox RBLX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RBLX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 23 uncommon options trades for Roblox.

This isn’t normal.

The overall sentiment of these big-money traders is split between 34% bullish and 52%, bearish.

Out of all of the special options we uncovered, 19 are puts, for a total amount of $1,008,017, and 4 are calls, for a total amount of $169,189.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $47.5 for Roblox during the past quarter.

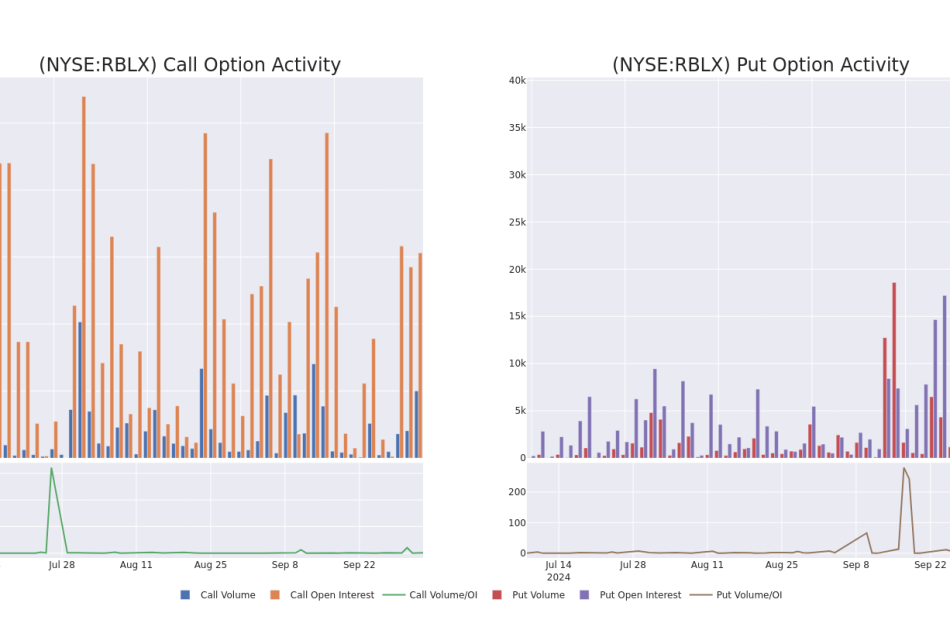

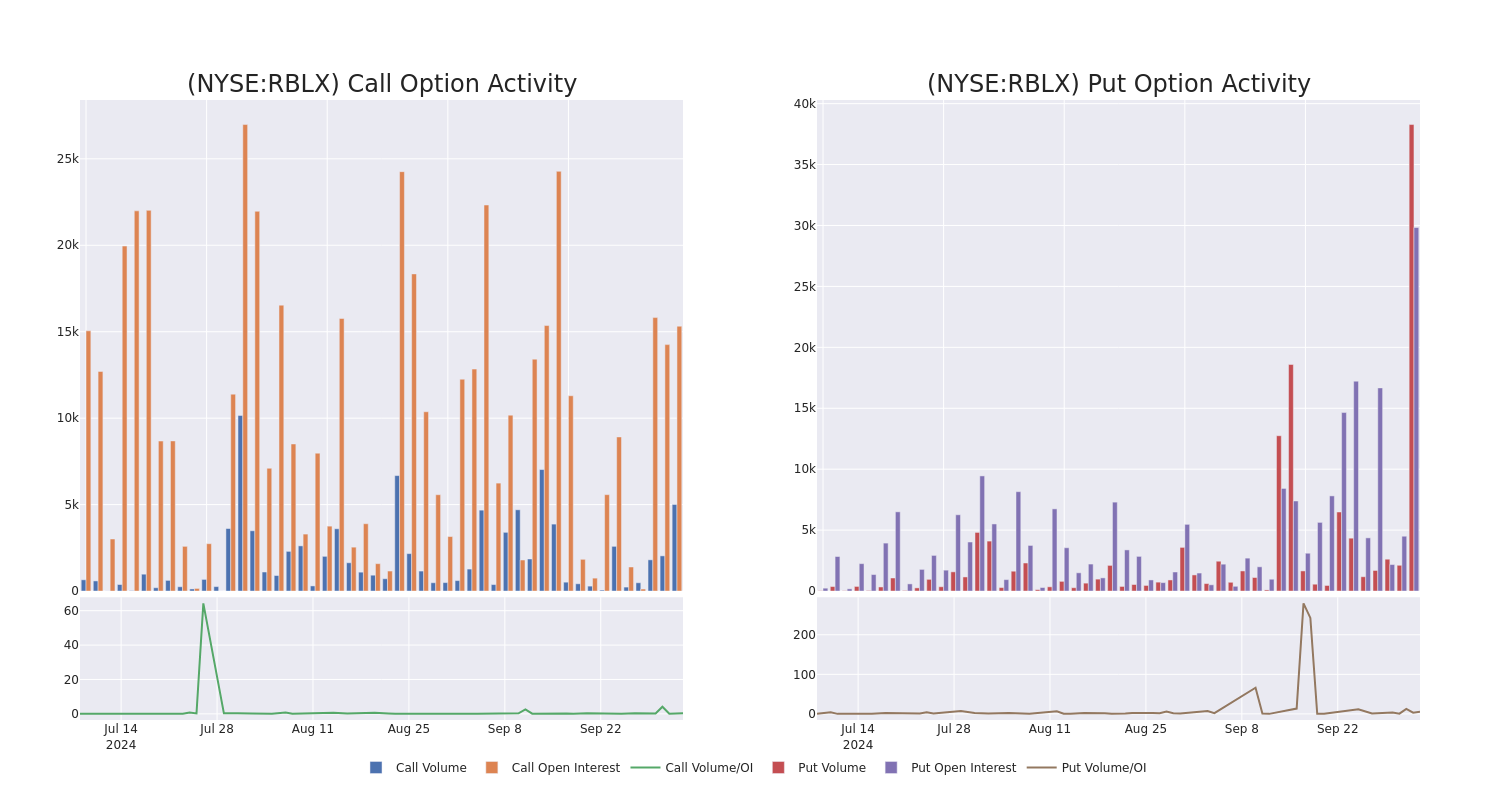

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Roblox’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Roblox’s whale activity within a strike price range from $35.0 to $47.5 in the last 30 days.

Roblox Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | SWEEP | BEARISH | 10/11/24 | $2.82 | $2.62 | $2.82 | $44.00 | $141.0K | 895 | 563 |

| RBLX | PUT | SWEEP | BULLISH | 10/11/24 | $2.35 | $2.15 | $2.15 | $43.00 | $106.2K | 238 | 681 |

| RBLX | PUT | SWEEP | BULLISH | 10/18/24 | $2.69 | $2.68 | $2.69 | $42.50 | $76.3K | 19.4K | 1.6K |

| RBLX | PUT | SWEEP | BEARISH | 10/18/24 | $2.89 | $2.68 | $2.69 | $42.50 | $74.5K | 19.4K | 2.5K |

| RBLX | PUT | SWEEP | BEARISH | 10/18/24 | $2.62 | $2.62 | $2.62 | $42.50 | $68.1K | 19.4K | 2.8K |

About Roblox

Roblox operates an online video game platform that lets young gamers create, develop, and monetize games (or “experiences”) for other players. The firm effectively offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning revenue in multiple places while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers then creating new games or franchises.

In light of the recent options history for Roblox, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Roblox

- With a volume of 8,184,512, the price of RBLX is down -1.14% at $41.7.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 27 days.

Professional Analyst Ratings for Roblox

2 market experts have recently issued ratings for this stock, with a consensus target price of $52.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Roblox with a target price of $51.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Roblox, targeting a price of $53.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roblox options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

There's a simple reason one of Wall Street's most bullish strategists expects a 40% rise in the S&P 500 by 2030

-

Ed Yardeni predicts the S&P 500 could reach 8,000 by 2030.

-

Yardeni’s prediction is based on a simple analysis of historical growth rates.

-

His bullish projection is supported by a “Roaring 2020s” scenario in which productivity grows.

There’s a simple reason one of the most bullish Wall Street strategists expects the stock market to continue rising in the years ahead: compound interest.

In a note on Thursday, Yardeni Research founder Ed Yardeni published a long-term chart of the S&P 500 that includes the potential future trajectory of the index based on compounded annual growth rates.

At a compounded annual growth rate of between 6% and 7%, the S&P 500 is on track to hit 8,000 by 2030, representing potential upside of about 40% from current levels.

Yardeni’s simple math-based projection isn’t outlandish when one considers that the long-term annualized growth rate of the S&P 500 is about 10% before inflation, and it’s been even higher at about 13% over the past decade.

Consistent earnings growth, favorable US demographics, and ongoing technological innovations have been driving the S&P 500 higher, and those factors should support a rising stock market in the years ahead.

“The S&P 500 stock price index is driven by its earnings per share (EPS), which has been growing mostly between 6% and 7% since the 1950s,” Yardeni said.

He added: “EPS could double to $400 by the end of the decade in our Roaring 2020s scenario,” Yardeni said.

Yardeni Research outlined its bullish “Roaring 2020s” scenario earlier this year. The forecast calls for increased productivity to fuel economic growth while inflation remains subdued.

If the S&P 500 does trade at the 8,000 level with EPS of $400, it would imply a price-to-earnings ratio of 20x, which is below current levels but slightly above the index’s long-term average.

Finally, interest rate cuts from the Federal Reserve should serve as another tailwind for stock prices in the years ahead, though Yardeni has cautioned that they could just add fuel to the fire, leading to a 1990’s style melt-up, which would be followed by a painful unwind.

“I raised the odds of an outright melt-up, like something we had in the 1990s,” Yardeni said last week. “I think that by cutting rates by 50 basis points and by indicating they want to do more, based on some of the recent comments, they risk overheating a warm economy. The economy’s doing quite well.”

Read the original article on Business Insider

5 Top Stocks to Buy in October

With the first three quarters of the calendar year in the books, investors are strolling into October with the major indexes at all-time highs and a more than 20% year-to-date gain in the S&P 500 and Nasdaq Composite. Go back even further, and the S&P 500 is up a staggering 50% since the start of 2023.

Efficiency improvements and artificial intelligence (AI)-powered innovations are sending ripple effects through the stock market — from changing how legacy companies do business to setting the stage for more demand for energy and electricity to power data centers.

The Federal Reserve just announced its first interest rate cut in four years, which was quickly followed by a Chinese stimulus package and rate cuts. With the cost of capital getting cheaper, there’s reason to believe consumer spending could get a much-needed uptick this fall.

Despite all the momentum heading into October, investors should still take a long-term approach. They should only invest in companies that they believe can deliver on promises and navigate the cycle, and that are worth holding for at least three to five years. Here’s why five Fool.com contributors picked Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), Shopify (NYSE: SHOP), Albemarle (NYSE: ALB), D.R. Horton (NYSE: DHI), and Chevron (NYSE: CVX) as top stocks to buy in October.

It’s time to pounce on affordable Berkshire shares

Anders Bylund (Berkshire Hathaway): It’s rarely a bad time to invest in Berkshire Hathaway. Warren Buffett’s insurance-based investing machine almost always looks ready to beat the stock market in the long run.

But you know what Buffett says about pricing. He prefers buying stock in amazing companies at a fair price. That’s his secret recipe for keeping business risks low and investor returns high. That wisdom-packed quote applies perfectly to Berkshire’s own stock right now.

The company is not putting much money in the market these days. Berkshire’s cash and short-term investment reserves have swelled to $277 billion, crushing the former record of $150 billion in the fall of 2021. More than 21% of Berkshire’s assets are held in the form of cash or liquid government bonds. That’s not exactly a record, but it’s the highest ratio seen since the aftermath of the dot-com bubble popping.

That’s exciting to me. I can’t wait to see what the investing legend will invest in when the time is right. But Berkshire’s market makers have a different view, driving the stock 3% lower in September. Whether you’re buying the high-priced Class A shares or the more affordable Class B stock, Berkshire trades at just 14.6 times trailing earnings today.

So Berkshire Hathaway is gearing up for a buying spree in the near to mid-future. Meanwhile, the stock is changing hands well below its 10-year average price-to-earnings (P/E) ratio of 21. It’s the best of both worlds — a wonderful company trading at a wonderful price. The time is unusually right to invest in Berkshire Hathaway.

Shopping for deals

Demitri Kalogeropoulos (Shopify): Investors should take a closer look at Shopify stock right now. The e-commerce platform’s shares have rallied since the company reported excellent operating results in August. It’s easy to see why Wall Street cheered that update. Sales volumes were up a healthy 22% in the period, and there’s room for that figure to expand for many more years as e-commerce rises from its current level of 16% of retail spending. But the stock is still far below its all-time high, and it has trailed the wider market in 2024.

That underperformance shouldn’t last long. Earnings are rising at a faster pace than sales as Shopify benefits from growth in its subscription services and payment processing. It isn’t done reaping the financial rewards from the spinoff of its logistics business, either. Gross profit margin improved to 51% of sales last quarter, from 49% of sales a year earlier.

Shopify executives are calling for another quarter of rising margins and ample cash flow for the selling period ending in late October. That positive momentum helps explain why Wall Street has placed such a premium on this stock, which is valued at over 13 times sales today. Yet for growth stock investors who don’t mind volatility, Shopify looks like a compelling long-term buy.

Buy this stock while there’s still time

Neha Chamaria (Albemarle): 2024 has been a rough year for Albemarle stock — it plunged 50% and hit its 52-week lows by mid-August. Although the lithium stock has rebounded since, it’s still down about 45% this year as of this writing. I still believe the sell-off is overdone, and it’s an opportunity to buy a magnificent value stock that could soar when its end markets recover.

The problem is not with Albemarle. It’s the weakness in lithium markets that sent the stock tumbling. Lithium prices peaked in 2022 and have plunged more than 90% since. The rally of 2022 driven by a supply deficit was unsustainable, as prices shot up too much and too fast. Soon enough, global lithium supply started to catch up with demand in anticipation of a boom in the electric vehicle (EV) market. Lithium prices cooled off, but before they could stabilize, the global EV market began slowing down in 2023. Albemarle’s top and bottom lines were bound to take a hit, as the company is one of the world’s largest producers of lithium for EV batteries.

However, lithium’s long-term growth potential remains intact, as it’s a critical element for the EV industry. Albemarle is taking necessary steps to preserve cash while it awaits a recovery. Albemarle’s financial flexibility has been its biggest strength over the decades, and it should be no different this time around.

When the business cycles turn, Albemarle could become one of the fastest-growing stocks in the industry, given its foothold and financial discipline. The company has also increased its dividend for 30 consecutive years. With recent industry developments renewing hopes of a recovery in lithium prices, now’s the time to load up on Albemarle stock.

A homebuilding homerun

Keith Speights (D.R. Horton): The Federal Reserve is lowering interest rates for the first time in four years. More rate cuts are likely on the way. Mortgage rates are also coming down as a result. If you think this news is great for homebuilders, you’re right. It’s especially great for the U.S.’s biggest homebuilder by volume — D.R. Horton.

Shares of D.R. Horton have soared 25% year to date. All this nice gain, though, has come since July, when anticipation of a forthcoming interest rate cut began to intensify. Investors knew that lower interest rates typically lead to lower mortgage rates, which make it more affordable for Americans to buy new homes.

D.R. Horton has been able to operate successfully, even in the high-rate environment of the last few years. However, the company has had to offer incentives such as mortgage rate buy-downs to help make the homes it built more affordable. Management expects that the Fed’s interest rate cuts could allow it to reduce the use of incentives to some extent, which would improve profitability.

While the rate cuts serve as a near-term catalyst for D.R. Horton, there’s an even more important long-term tailwind for the stock. The U.S. continues to face a major housing shortage. Zillow estimates that the country needs another 4.5 million homes.

Finally, the November U.S. elections could provide another spark for D.R. Horton. Vice President Kamala Harris has proposed tax incentives for homebuilders that sell homes to first-time homebuyers. Should she win the presidential election, D.R. Horton’s shares could soar even higher.

Chevron and its growing dividend are built to last

Daniel Foelber (Chevron): West Texas Intermediate crude oil prices — the U.S. benchmark — have fallen below $70 per barrel, the lowest level in 2024. The sell-off is dragging down the energy sector, including big names like Chevron, which is now less than 9% away from its 52-week low.

Chevron has performed significantly worse than its U.S. peer, ExxonMobil, in 2024, because of uncertainties regarding its acquisition of exploration and production company Hess. Chevron and ExxonMobil both announced blockbuster acquisitions in October 2023 to strengthen their cash flows and boost oil and gas production. ExxonMobil closed its deal in May, but Chevron was caught up in a series of challenges that have prevented the deal from going through.

On Sept. 30, Chevron got some good news: The Federal Trade Commission completed its antitrust review and concluded that the Hess deal could proceed, on the condition that Hess CEO John Hess not be appointed to Chevron’s board (but could serve as an advisor).

The market hates uncertainty, so the sooner Chevron can move forward with the deal, the better. While Hess would give Chevron better global diversification and access to low-cost reserves in offshore Guyana, it doesn’t really need the deal to go through. Chevron has a highly efficient portfolio and can generate plenty of cash flow to cover its dividend and capital expenditures, even at lower oil prices. It also has an excellent balance sheet with very little debt, given Chevron’s size.

Chevron has paid and raised its dividend for 37 consecutive years — meaning it has raised the dividend even during years when growth has slowed, or it reported a net loss. Chevron has accomplished this feat because it invests through the cycle and doesn’t structure its business to depend on high oil prices. When oil prices are high, Chevron tends to pay down debt and position itself so that it can be more flexible for the next downturn.

In the following chart, you can see that Chevron’s total net long-term debt declined during years of higher operating cash flow, but its debt-to-capital ratio was still at a healthy level even during industry downturns.

Chevron remains one of the well-rounded buys in the oil patch. With a 4.5% dividend yield, it stands out as a great buy for passive income investors in October.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Anders Bylund has no position in any of the stocks mentioned. Daniel Foelber has no position in any of the stocks mentioned. Demitri Kalogeropoulos has positions in Berkshire Hathaway, Shopify, and Zillow Group. Keith Speights has positions in Berkshire Hathaway, Chevron, and ExxonMobil. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Chevron, D.R. Horton, Shopify, and Zillow Group. The Motley Fool has a disclosure policy.

5 Top Stocks to Buy in October was originally published by The Motley Fool

Billionaire Hedge Fund Manager John Paulson Predicts a Market Crash If Harris Wins – Here's What He Said

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

John Paulson, the founder and President of the hedge fund turned family office Paulson & Co., has been one of the most vocal supporters of former President and Republican nominee Donald Trump. He was also reportedly under consideration as the Treasury Secretary provided Trump succeeds in the upcoming election.

The billionaire hedge fund manager first rose to prominence in 2008 after making nearly $15 billion by shorting the housing market, making him legendary on Wall Street.

Check It Out:

Paulson has long supported Trump and was one of the biggest donors to his 2016 and 2024 campaigns. The 68-year-old Harvard graduate is estimated to have raised $48 million for Trump’s current reelection campaign.

Paulson vs. Harris

Paulson distrusts Harris because of her plans to increase corporate and personal taxes. Furthermore, the current vice president and Democratic nominee’s plans to implement a “billionaire minimum tax” on unrealized capital gains have also been a source of contempt for the hedge fund manager.

“They want to raise the corporate tax rate from 21 to 28%, they want to raise the capital gains tax from 20% to 39% and then they want to add a tax on unrealized capital gains of 25%,” Paulson said. “I think if they implement those policies, we’ll see a crash in the markets, no question about it.”

Harris has also proposed implementing a 28% tax on long-term capital gains for households with a net annual income of over $1 million and a 25% tax on unrealized gains for households yielding over $100 million.

“If Harris is elected, I would pull money from the market,” Paulson said.

The billionaire investor also predicted an immediate recession if Harris wins this election season, similar to Trump’s claims of a 1929-like market crash.

“If the Biden-Harris team does come in and they were to implement what’s on their platform, which is a tax on unrealized gain, that’s going to cause massive selling of homes, of stocks, of companies, of art and that could … put us immediately into a recession, so hopefully that if they are elected, they won’t pursue that,” Paulson said.

Some Wall Street analysts agree that raising corporate taxes could weigh on publicly traded corporations, which have benefited from lower rates during the Trump administration. Yet, while a hit to company earnings could lower stock prices, none of the major S&P 500 companies have voiced similar concerns.

Trending: Commercial real estate has historically outperformed the stock market, but few investors have the capital or resources needed to invest in this asset class. Get started investing in commercial real estate today.

Paulson’s Support for Trump’s Tariffs

Trump has long advocated for tariffs, including plans to impose tariffs on Chinese imports as high as 60% to improve the domestic manufacturing sector.

“We’re going to be a tariff nation,” Trump said. “You will see a mass exodus of manufacturing from China to Pennsylvania, from Korea to North Carolina, from Germany to right here in Georgia.”

While Wall Street is concerned about the broader ramifications of Trump’s “America First strategy,” Paulson believes this to be a “need.”

“I think there’s a desire, a need to decouple from China,” Paulson said. “That’s why I respect Trump because he says these things. Maybe he doesn’t articulate them so well all the time, but when I listen and look into it, I find he’s correct,” he added.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Interest rates are falling but you can still make high yields in real estate. Find out how.

This article Billionaire Hedge Fund Manager John Paulson Predicts a Market Crash If Harris Wins – Here’s What He Said originally appeared on Benzinga.com

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against WEBTOON, Verve, Domino's, and Ardelyx and Encourages Investors to Contact the Firm

NEW YORK, Oct. 04, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of WEBTOON Entertainment, Inc. WBTN, Verve Therapeutics, Inc. VERV, Domino’s Pizza, Inc. DPZ, and Ardelyx, Inc. ARDX. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

WEBTOON Entertainment, Inc. WBTN

Class Period: Pursuant to the registration statement and prospectus issued in connection with the Company’s June 27, 2024 initial public offering

Lead Plaintiff Deadline: November 5, 2024

On August 8, 2024, after the market closed, Webtoon announced its financial results for second quarter 2024, which had ended just days after the IPO closed. The Company reported revenue of $321 million, which represented total revenue growth of only 0.1%. The Company further revealed advertising revenue declined 3.6% and IP Adaptations revenue declined 3.7%. The Company revealed its revenue and revenue growth had been “offset by the Company’s significant exposure to weaker foreign currencies.” Webtoon also reported a quarterly net loss of $76.6 million, or 70 cents.

On this news, Webtoon’s stock fell $7.88 or 38.2%, to close at $12.75 per share on August 9, 2024, on unusually heavy trading volume. By the commencement of this action, Webtoon stock has traded as low as $12.45 per share, a more than 40% decline from the $21.00 per share IPO price.

The complaint filed in this class action alleges that the Registration Statement made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that the Company experienced a deceleration in advertising revenue growth; (2) that the Company experienced a deceleration in IP adaptations revenue; (3) that the Company experienced exposure to weaker foreign currencies which offset revenue growth; (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

For more information on the Webtoon class action go to: https://bespc.com/cases/WBTN

Verve Therapeutics, Inc. VERV

Class Period: August 9, 2022 – April 1, 2024

Lead Plaintiff Deadline: October 28, 2024

The Complaint alleges that throughout the Class Period, Defendants made false and/or misleading statements and/or failed to disclose, among other things, that: (1) Defendants did not fully disclose the circumstances under which the Heart-1 Phase 1b clinical trial (the “Heart-1 Trial”) of VERVE-101 would be halted (VERVE-101 is an investigational gene editing medicine designed to be a single course treatment that permanently turns off the PCSK9 gene in the liver to reduce disease-driving low-density lipoprotein cholesterol (LDL-C)); (2) Defendants overstated the potential benefits of its proprietary lipid nanoparticle (LNP) delivery system; and (3) as a result, Defendants’ statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

For more information on the Verve class action go to: https://bespc.com/cases/VERV

Domino’s Pizza, Inc. DPZ

Class Period: December 7, 2023 – July 17, 2024

Lead Plaintiff Deadline: November 19, 2024

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (1) DPE, the Company’s largest master franchisee, was experiencing significant challenges with respect to both new store openings and closures of existing stores; (2) as a result, Domino’s was unlikely to meet its own previously issued long-term guidance for annual global net store growth; (3) accordingly, Domino’s business and/or financial prospects were overstated; and (4) as a result, the Company’s public statements were materially false and misleading at all relevant times.

For more information on the Domino’s class action go to: https://bespc.com/cases/DPZ

Ardelyx, Inc. ARDX

Class Period: October 31, 2023 – July 1, 2024

Lead Plaintiff Deadline: October 15, 2024

The Complaint alleges that, in its Forms 10-Q filed on October 31, 2023, and May 2, 2024, and in its Form 10-K filed on February 22, 2024, Ardelyx indicated that it would apply to include XPHOZAH in TDAPA. Further, on an earnings call on May 2, 2024, Defendant Michael Raab advised analysts that “our intent is to enter TDAPA.” But then on July 2, 2024, Ardelyx shocked investors by disclosing that it had decided not to apply to include XPHOZAH in TDAPA.

Upon the above news, Ardelyx’s stock price fell $2.29 per share, or 30.25%, to close at $5.28 per share on July 2, 2024.

For more information on the Ardelyx class action go to: https://bespc.com/cases/ARDX

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Six industry leaders elected to Midwest Real Estate Data Board of Managers

LISLE, Ill., Oct. 04, 2024 (GLOBE NEWSWIRE) — Midwest Real Estate Data (MRED) announces the election of six real estate professionals to the multiple listing service’s (MLS) Board of Managers. These industry leaders join 11 others on the Board to comprise the team that creates the strategy and policies that drive MRED forward.

Brokers elected are:

- Category 1: John Matthews of Baird & Warner, Category 2: Rose Schlickman of Key Realty, Luigui Corral of RE/MAX American Dream, and Category 3: Al Rossell of the Jack Carpenter Organization.

Association executives elected are:

- Tina Franklin of Kankakee-Iroquois-Ford Association of REALTORS® and Sharon Halperin of Oak Park Area Association of REALTORS® were elected to fill the association executive seats.

Others serving on the Board are: Fran Broude, Compass; Sue Miller, Dream Real Estate Inc.; Sue Wiskowski-Fair, Realty Executives Premiere; Lynn Madison, Lynn Madison REALTOR®; Jeff Gregory, Realty Executives Success; Aaron Starck, Berkshire Hathaway Starck Real Estate; Tommy Choi, Keller Williams ONEChicago; Pradeep Shukla, American Star Realty; Christopher De Santo, Realty Executives Legacy. Brad Baldwin of First Utah Bank and Tom Hurdelbrink (previously of Northwest Multiple Listing Service) will continue to serve as strategic managers.

“MRED is excited to welcome this outstanding group to our Board of Managers as they guide our strategic vision for the benefit of those we serve,” said MRED President and CEO Rebecca Jensen. “Our Board and its election process let us uniquely position ourselves to ensure our marketplace is well represented while we embrace any challenges our industry faces.”

Jeremy Sharp Midwest Real Estate Data LLC 630-799-1402 jeremy.sharp@mredllc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vera Therapeutics Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

BRISBANE, Calif., Oct. 04, 2024 (GLOBE NEWSWIRE) — Vera Therapeutics, Inc. VERA today announced that on October 2, 2024, the Compensation Committee granted inducement awards consisting of a non-qualified stock option to purchase 125,000 shares of Class A common stock and restricted stock units (RSUs) for 62,500 shares of Class A common stock to seven new employees under the Inducement Plan. The Compensation Committee approved the awards as an inducement material to the new employees’ employment in accordance with Nasdaq Listing Rule 5635(c)(4).

The stock option granted on October 2, 2024 has an exercise price per share equal to $41.75, Vera’s closing trading price on October 2, 2024. Each stock option will vest over four years, with 25% of the underlying shares vesting on the first anniversary of the applicable vesting commencement date and the balance of the underlying shares vesting monthly thereafter over 36 months, subject to the new employee’s continued service relationship with Vera through the applicable vesting dates. Each of the RSUs will vest over four years, with 25% of the underlying shares vesting on each anniversary of November 20, 2024, subject to the new employee’s continued service relationship with Vera through the applicable vesting dates. The awards are subject to the terms and conditions of the Inducement Plan and the terms and conditions of an applicable award agreement covering the grant.

About Vera

Vera Therapeutics is a late clinical-stage biotechnology company focused on developing treatments for serious immunological diseases. Vera’s mission is to advance treatments that target the source of immunological diseases in order to change the standard of care for patients. Vera’s lead product candidate is atacicept, a fusion protein self-administered as a subcutaneous injection once weekly that blocks both B-cell Activating Factor (BAFF) and A PRoliferation-Inducing Ligand (APRIL), which stimulate B cells and plasma cells to produce autoantibodies contributing to certain autoimmune diseases, including IgAN, also known as Berger’s disease, and lupus nephritis. In addition, Vera is evaluating additional diseases where the reduction of autoantibodies by atacicept may prove medically useful. Vera is also developing MAU868, a monoclonal antibody designed to neutralize infection with BK virus (BKV), a polyomavirus that can have devastating consequences in certain settings such as kidney transplant. Vera retains all global developmental and commercial rights to atacicept and MAU868. For more information, please visit www.veratx.com.

For more information, please contact:

Investor Contact:

Joyce Allaire

LifeSci Advisors

212-915-2569

jallaire@lifesciadvisors.com

Media Contact:

Madelin Hawtin

LifeSci Communications

MHawtin@lifescicomms.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq Gains Over 100 Points; Beneficient Shares Spike Higher

U.S. stocks traded higher toward the end of trading, with the Nasdaq Composite gaining more than 100 points on Friday.

The Dow traded up 0.37% to 42,165.39 while the NASDAQ rose 0.77% to 18,056.62. The S&P 500 also rose, gaining, 0.46% to 5,726.34.

Check This Out: How To Earn $500 A Month From Phillips 66 Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Financials shares jumped by 1.2% on Friday.

In trading on Friday, real estate shares dipped by 0.9%.

Top Headline

The total number of active U.S. oil rigs fell by five to 479 rigs this week, Baker Hughes Inc reported.

Equities Trading UP

- Phoenix Motor Inc. PEV shares shot up 188% to $1.0012 after the company reported a substantial increase in the first-quarter results.

- Shares of Apogee Enterprises, Inc. APOG got a boost, surging 24% to $85.08 after the company reported better-than-expected second-quarter financial results and raised its FY25 adjusted EPS guidance above estimates.

- Beneficient BENF shares were also up, gaining 53% to $1.82 after the company announced its subsidiary, Beneficient Company Holdings, consummated a previously announced transaction pursuant to which approximately $126 million of its preferred equity was redesignated as non-redeemable.

Equities Trading DOWN

- AMTD Digital Inc. HKD shares dropped 15% to $4.45.

- Shares of ZIM Integrated Shipping Services Ltd. ZIM were down 12% to $19.06.

- Spirit Airlines, Inc. SAVE was down, falling 27% to $1.6459 following a report suggesting that the company is exploring the potential of filing for bankruptcy.

Commodities

In commodity news, oil traded up 1.5% to $74.83 while gold traded down 0.5% at $2,665.30.

Silver traded down 0.3% to $32.375 on Friday, while copper rose 0.3% to $4.5670.

Euro zone

European shares closed mostly higher today. The eurozone’s STOXX 600 rose 0.44%, Germany’s DAX rose 0.55% and France’s CAC 40 climbed 0.85%. Spain’s IBEX 35 Index rose 0.35%, while London’s FTSE 100 fell 0.02%.

The S&P Global UK construction PMI jumped to 57.2 in September compared to 53.6 in the previous month, while France construction PMI declined to 37.9 in September from 40.1 in the earlier month. The HCOB Eurozone construction PMI climbed to 42.1 in September versus 41.4 in the prior two months.

Asia Pacific Markets

Asian markets closed mixed on Friday, with Japan’s Nikkei 225 gaining 0.22%, Hong Kong’s Hang Seng Index gaining 2.82% and India’s BSE Sensex dipping 0.98%.

The HSBC India services PMI was revised downward to 57.7 in September versus a preliminary reading of 58.9. The S&P Global Hong Kong SAR PMI surged to 50.0 in September compared to August’s reading of 49.4.

Economics

- The U.S. economy added 254,000 jobs in September, compared to a revised 159,000 gain in August, and topping market estimates of 147,000. The unemployment rate declined to 4.1% in September from 4.2% in the previous month.

- The total number of active U.S. oil rigs fell by five to 479 rigs this week, Baker Hughes Inc reported.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Gainers And Losers From October 4, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

This Telecom Giant Just Increased Its Dividend 35%, and It's Promising Many More Double-Digit Raises to Come

The telecom industry is full of great dividend payers that consistently raise their payouts year after year. But one of the newest dividend payers in the industry is making the case that it might be the best bet for long-term dividend investors.

T-Mobile (NASDAQ: TMUS) instituted a dividend last September. A year later, it announced its first-ever dividend increase — and it was a big one. Shareholders will receive $0.88 per share every quarter starting in December, a 35% bump from T-Mobile’s original dividend. What’s more, management is promising double-digit dividend growth for years to come.

Here’s why T-Mobile might be the best dividend stock of the bunch among the telecom giants.

All about cash flow

Since completing its merger with Sprint in 2020, T-Mobile has produced massive free cash flow growth for shareholders. Free cash flow grew from $3.2 billion that year to $13.6 billion last year. Over the next three years, management expects free cash flow to climb to between $18 billion and $19 billion.

For reference, T-Mobile’s biggest competitors, AT&T and Verizon, produced free cash flow of $16.8 billion and $18.7 billion, respectively, last year. The two expect to maintain similar levels of free cash flow this year.

T-Mobile has managed to grow its free cash flow to levels approaching its more established competitors’ with consistent execution exceeding its original guidance. For example, management delivered more than $8 billion in merger synergies since integrating Sprint, above its $7.5 billion target provided in 2021. It also completed the network integration a year earlier than planned.

T-Mobile’s spectrum portfolio ensured it could bid more strategically on FCC auctions for additional bands, which meant it didn’t have to pay exorbitant prices for new radio waves. As such, it could focus its capital investments on building out its 5G network, which remains well ahead of AT&T’s and Verizon’s in terms of coverage.

One area where T-Mobile hasn’t invested as much as AT&T and Verizon is fixed-line assets. It’s expressed interest in the area, and partnered with Metronet and Lumos to take advantage of their fiber assets. T-Mobile’s model of leasing most of its fixed-line assets keeps capital expenditures low, but comes with ongoing costs.

That said, T-Mobile has shown the strategy works well. Its wireless customer base has grown faster than the competition’s, and its home internet subscriber base is growing faster than that of its competitors combined. It’s now targeting 12 million home internet subscribers by 2027, primarily leveraging the added capacity of its 5G network. The result is strong conversion of service revenue to free cash flow.

T-Mobile plans to return most of that free cash flow to shareholders.

How much could the dividend keep growing?

At its investor day, management said it expects to generate $80 billion in “cumulative cash flexibility” between now and 2027. $50 billion of that is earmarked for T-Mobile’s capital return program, which consists primarily of share repurchases.

T-Mobile’s dividend remains a small part of its capital returns. Over the first year of its dividend, T-Mobile paid out about $3 billion total to shareholders in cash. Even with the big 35% raise, T-Mobile’s only going to pay out about $4 billion over the next year.

As T-Mobile uses much of its additional capacity to buy back shares, it increases its ability to raise its dividend in the future. With fewer shares to pay a dividend on, it has more cash per share to pay out.

Management said it’s targeting a mid-20% portion of free cash flow for its dividend. So, if free cash flow comes in around $18.5 billion in 2027, that’s a total dividend payment of about $4.6 billion. That would translate into about 10% dividend increases in each of the next two years as management aggressively reduces its share count.

Management also noted that there’s an additional $20 billion in the budget, which could be used for strategic investments or acquisitions. But if there’s any additional funds left, the shareholder return program is the likely beneficiary.

Importantly, there’s a lot of room for T-Mobile to increase the dividend as a percentage of free cash flow over time, since cash flow is very predictable in the industry. AT&T and Verizon paid out 48% and 59% of free cash flow in dividends last year, respectively.

T-Mobile’s stock is priced at a premium to AT&T and Verizon. Its enterprise value (EV)-to-EBITDA ratio of 12 is higher than both AT&T’s (6.8) and Verizon’s (8.8). But with strong EBITDA and free cash flow growth on the horizon, T-Mobile is worth the premium price. At the current share price, T-Mobile’s 1.7% yield might not look that appealing compared to the older telecom giants, but the potential for total returns from share repurchases and dividend growth over time is extremely attractive for patient investors.

Should you invest $1,000 in T-Mobile US right now?

Before you buy stock in T-Mobile US, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T-Mobile US wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

This Telecom Giant Just Increased Its Dividend 35%, and It’s Promising Many More Double-Digit Raises to Come was originally published by The Motley Fool