Lender Expresses Concern Over Cannabist Company's 'Pray And Hope' Approach

FiSai US Management, a major creditor of The Cannabist Company CBSTF is growing increasingly concerned over the company’s management.

FiSai, which holds $50 million in secured notes due in 2026, has taken the unusual step of publicly airing its frustrations, reported Debra Borchardt of Green Market Report (GMR).

The lender sent a letter to New York-based The Cannabist on September 26, citing concerns about liquidity issues, underperformance, and a lack of strategic direction. FiSai accused CEO David Hart and chairman Michael Abbott of using a “pray and hope” approach, banking on favorable external factors, such as a positive presidential election outcome, to bail the company out.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Mounting Financial Pressure

The Cannabist’s debt burden is significant.

By 2025, the company faces $60 million in debt due, with an additional $185 million in senior secured debt maturing by February 2026. FiSai disclosed that it had offered refinancing options on September 3. However, the company has yet to respond, per GMR.

FiSai highlighted the competitive landscape, noting that other major cannabis companies face similar debt deadlines. The high demand for refinancing could make capital scarce and expensive.

Read Also: New Laws Could Unleash $1.7B Demand For Cannabis Loans, This Real Estate Stock Is Set To Capitalize

Series Of Missteps

FiSai’s complaints include what it calls a “just-in-time” financing strategy. The lender criticized the sale of key assets to Verano VRNOF, describing the move as a last-minute decision driven by poor cash management. FiSai also pointed to the failed Cresco CRLBF merger, claiming it exposed stakeholders to unnecessary risks and affected the company’s overall poor performance compared to other cannabis operators.

FiSai’s founders, Erich Griffin-Mauff and Jared Cohen, are experienced cannabis industry veterans. They expressed disappointment, particularly given their backgrounds in strategic development and corporate finance. With tensions between FiSai and The Cannabist now out in the open, the company’s financial future remains even more uncertain.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: 2 Stocks That'll Be Worth More Than Tesla 10 Years From Now

Tesla (NASDAQ: TSLA) gets a lot of media attention thanks to its high-profile founder and high-quality products. That’s translated to momentum in the stock market, but there are other great companies flying somewhat under the radar. Consider two other powerhouses with cheaper valuations and sustainable competitive advantages to unlock long-term growth.

Where will Tesla be in 10 years?

Tesla earned a place in the heralded “Magnificent Seven,” which are disruptive technology powerhouses that fueled market index performance throughout much of the past two years. Investors have been enamored with Tesla’s rapid ascent in the auto manufacturing industry and its dominant leadership of the emerging electric vehicle (EV) market.

Tesla stock was one of the market’s biggest success stories for years, but investors are questioning that narrative as they reconcile bullish expectations with the company’s financial results. Economic cycles and the business maturation process have interfered with Tesla’s growth and profitability, creating uncertainty around future cash flows.

Tesla’s total revenue grew 2% last quarter, while auto sales declined from the prior year. The shortfall was offset by growth in its energy storage segment. Its gross margin on auto sales fell from 17.5% to 13% over the past year. This is a worrying sign that suggests lost pricing power.

The drastic slash to margins could reflect the timing of certain model launches and aggressive pricing responses to macroeconomic conditions, but the rising threat of competition could play a pivotal role. Gross profit deterioration led Tesla to report lower operating profits. Capital expenditures continued to rise, squeezing free cash flow from both sides of the equation. Investors generally don’t look favorably upon narrow-margin businesses with volatile pricing and gross profits, so the recent trends are discouraging.

Tesla still dominates the global EV market, but that leadership is under attack. Its market share recently fell under 50%, with several major manufacturers catching up. It’s losing ground to the field, and the impact of its first-mover status appears to be dwindling. The prospect of price-competitive alternatives from China also casts an ominous shadow.

None of these factors are necessarily insurmountable issues. On the surface, Tesla makes a high-quality product, it’s growing and profitable, it’s effectively navigating a difficult selling environment, and it’s still at the top of a growth industry. Unfortunately for shareholders, all those favorable attributes are already assumed in the stock’s price.

Tesla’s market cap is $830 billion. Its forward P/E ratio is more than 70 and its price-to-sales ratio is 9.5. Those are both expensive, and they don’t fit with the company’s growth rate. The company’s financial returns would need to expand more than 30% to make its PEG ratio better aligned with the forward P/E. That might happen, but the threats to pricing and growth outlined above will be challenges. Investors might find high-quality stocks with more upside potential elsewhere in the market.

First stock to watch: Visa

Visa (NYSE: V) is one of the largest and most successful fintech companies. It tops a short list of peers as the global leader in card payment processing. Payment technology has been ripe for innovation in recent years, but Visa has managed to embrace emerging technologies to sustain its growth in the face of disruption.

Blockchain and PayPal would seem to be major threats, but Visa continues to expand along with global commerce. It’s managed to thrive as the fintech world changes around it.

Visa’s dominance is substantial enough that it recently came under scrutiny from regulators. The Department of Justice recently sued the payment processor, alleging a monopoly in the debit card market that increases prices for consumer goods across the board. Visa has dismissed the validity of the lawsuit, but it seems likely that there will be some compromise on fees charged to merchants for debit card transactions. That’s a challenge to growth from the current level, but the long-term catalysts are still in play.

Visa’s scale and technology base allows it to provide reliable, cheap, and efficient transaction services. This contributes to a strong brand and makes it exceptionally difficult for competitors to offer superior quality or more favorable pricing. That’s the basis of an economic moat that should protect the growth trajectory of Visa’s future cash flows.

The fintech leader’s $554 billion market cap would need to increase 65% to equal Tesla’s market cap. Visa’s forward P/E ratio is 24, which compares favorably to the 10% growth rate from its most recent quarter. Of course, capital market conditions ultimately dictate the performance of stocks in general, but Visa stock should continue climbing higher relative to the market as its cash flows expand.

Second stock to watch: Taiwan Semiconductor Manufacturing

Semiconductor stocks are notoriously cyclical, and industry leaders such as Nvidia and Broadcom have been caught up in the AI frenzy over the past two years. Those forces can promote volatility, making it difficult to forecast share prices.

Taiwan Semiconductor Manufacturing (NYSE: TSM), also known as TSMC, is a broader bet on the microchip industry as a whole. TSMC provides outsourced fabrication services for many of the largest chipmakers. Investors have seen various semiconductor powerhouses rise and fall with shifting trends in technology and computing. New generations of chips roll out every couple of years, which can rapidly shake up market share.

While its customers rise and fall, TSMC remains the go-to for production. It holds somewhere between 50% and 60% of the global chip foundry market. The company’s prospects are essentially tied to long-term demand for semiconductors and the avoidance of catastrophic geopolitical conflict in East Asia. There are no doubt risks on each of those fronts, but the overall outlook is promising right now.

TSMC’s market cap is nearly $930 billion, so it’s already worth more than Tesla. The chip foundry overtook the EV maker earlier this year, and it’s in a strong position to maintain that position.

TSMC’s compound annual growth rate has been around 17% over the past five years, with cash flow expanding even more rapidly. It’s not fair to assume that this rate will be sustained for the next decade, but that stellar performance combined with the semiconductor industry outlook make it unlikely that the company will slow to a crawl.

TSMC’s forward P/E ratio is under 25, so it has much lower hurdles to clear than Tesla to meet investor expectations. This makes it a strong candidate to remain more valuable than the dynamic EV maker.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Downie has positions in Nvidia and Visa. The Motley Fool has positions in and recommends Nvidia, PayPal, Taiwan Semiconductor Manufacturing, Tesla, and Visa. The Motley Fool recommends Broadcom and recommends the following options: short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Prediction: 2 Stocks That’ll Be Worth More Than Tesla 10 Years From Now was originally published by The Motley Fool

US Supreme Court to decide if white, straight workers face higher bar in bias lawsuits

By Daniel Wiessner

(Reuters) – The U.S. Supreme Court agreed on Friday to decide whether it should be more difficult for workers from “majority backgrounds,” such as white or heterosexual people, to prove workplace discrimination claims.

The justices took up an appeal by Marlean Ames, a heterosexual woman, seeking to revive her lawsuit against the Ohio Department of Youth Services in which she said she lost her job to a gay man and was passed over for a promotion in favor of a gay woman in violation of federal civil rights law.

The Cincinnati, Ohio-based 6th U.S. Circuit Court of Appeals decided last year that she had not shown the “background circumstances” that courts require to prove that she faced discrimination because she is straight, as she alleged.

She brought her lawsuit under Title VII of the Civil Rights Act of 1964, the landmark federal law banning workplace discrimination based on traits including race, sex, religion and national origin.

Since the 1980s, at least four other U.S. appeals courts have adopted similar hurdles to proving discrimination claims against members of majority groups, largely in cases involving white men. Those courts have said the higher bar is justified because discrimination against those workers is relatively uncommon.

But other courts have said that Title VII does not distinguish between bias against minority and majority groups.

A Supreme Court ruling in favor of Ames could provide a boost to the growing number of lawsuits by white and straight workers claiming they were discriminated against under company diversity, equity and inclusion policies.

The court will hear arguments in the case in its new term, which begins on Monday, and a decision is expected by the end of June.

Lawyers for Ames and the Ohio agency, which oversees the confinement and rehabilitation of juvenile felony offenders, did not immediately respond to requests for comment.

Ames was in charge of ensuring the agency’s compliance with a federal law designed to deter sexual assaults in prisons. She has said that despite receiving positive feedback for her job performance, she was demoted to her old job in 2019 and had her pay cut by nearly $20 an hour.

Ames has said she was replaced by a younger gay man, and that later in 2019 she was denied a promotion she had sought that went to a gay woman.

She sued the department in 2020. An Ohio federal judge dismissed the case last year, saying she had not shown the “background circumstances” to support her discrimination claim.

The 6th Circuit upheld that decision last December. The 6th Circuit said that background circumstances can include evidence that a member of a minority group, such as a gay person, made the challenged employment decision, or data showing a larger pattern of discrimination by an employer against members of a majority group.

(Reporting by Daniel Wiessner in Albany, New York; Editing by Will Dunham)

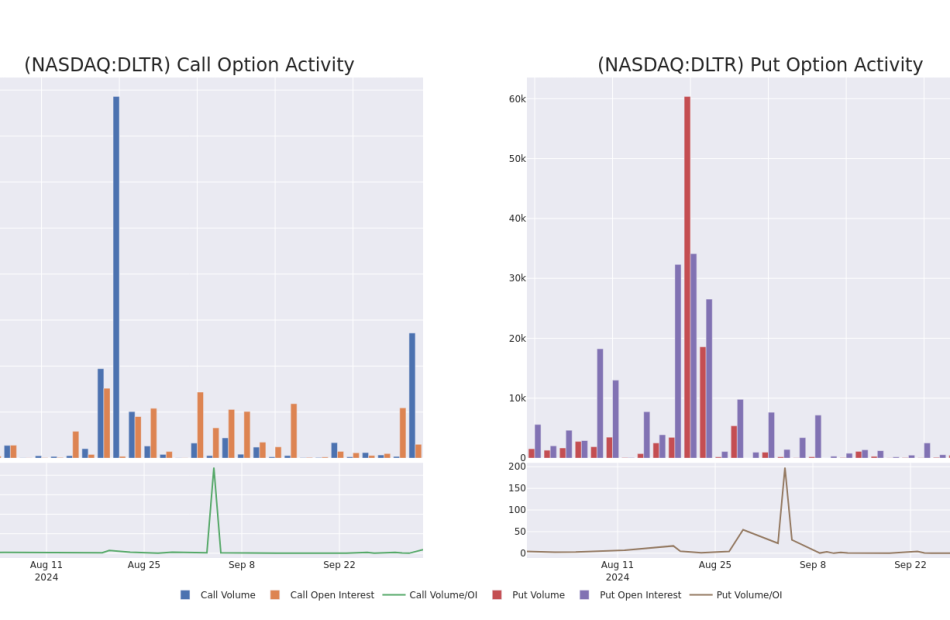

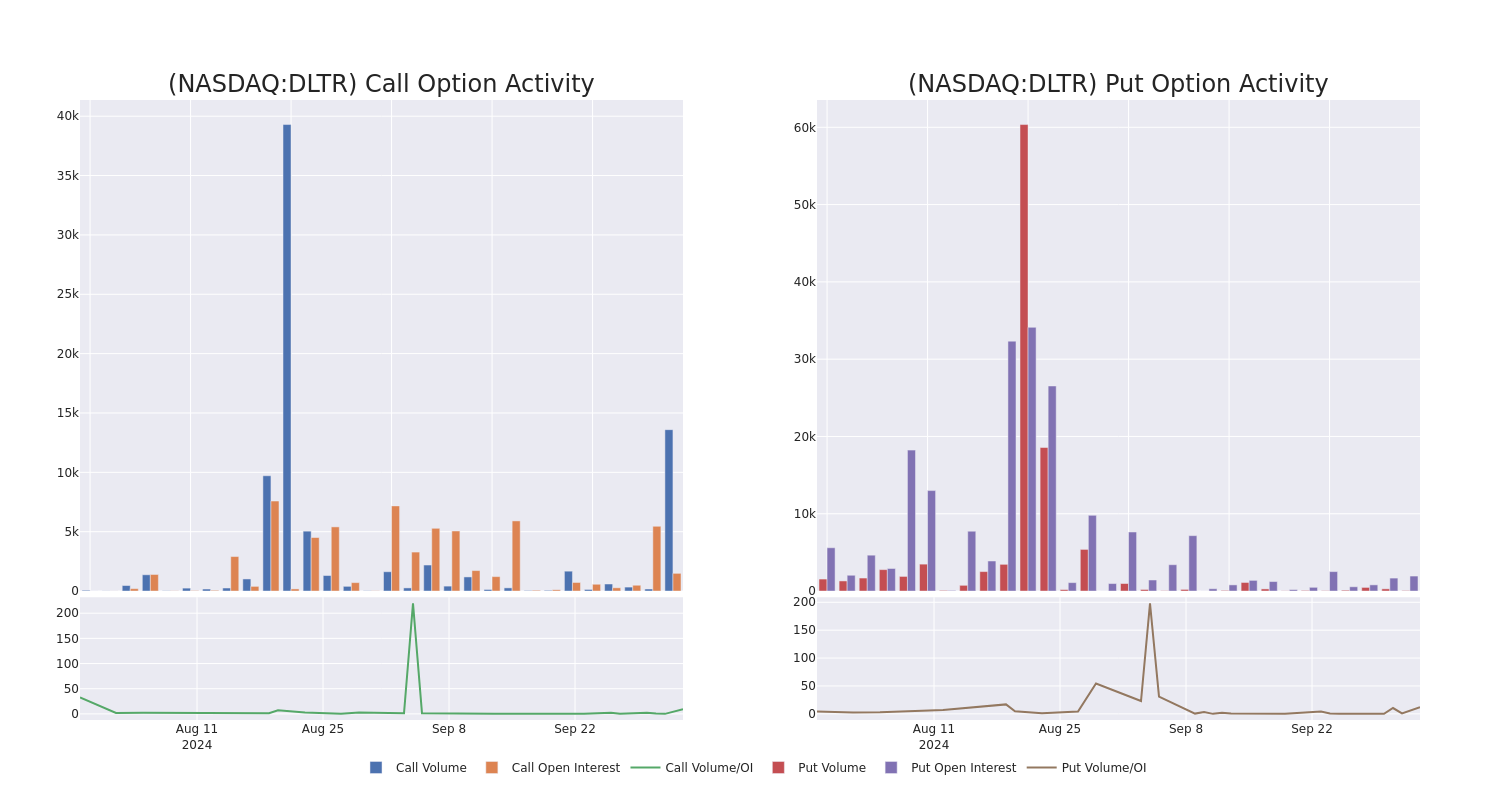

This Is What Whales Are Betting On Dollar Tree

Financial giants have made a conspicuous bearish move on Dollar Tree. Our analysis of options history for Dollar Tree DLTR revealed 9 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $60,260, and 7 were calls, valued at $925,315.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $100.0 for Dollar Tree over the last 3 months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Dollar Tree stands at 686.0, with a total volume reaching 13,653.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dollar Tree, situated within the strike price corridor from $55.0 to $100.0, throughout the last 30 days.

Dollar Tree 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DLTR | CALL | TRADE | BEARISH | 12/20/24 | $2.83 | $2.65 | $2.69 | $85.00 | $416.9K | 730 | 1.5K |

| DLTR | CALL | TRADE | BEARISH | 12/20/24 | $2.81 | $2.67 | $2.69 | $85.00 | $269.0K | 730 | 2.5K |

| DLTR | CALL | SWEEP | BULLISH | 03/21/25 | $9.3 | $9.2 | $9.25 | $75.00 | $71.2K | 240 | 79 |

| DLTR | CALL | SWEEP | BEARISH | 12/20/24 | $2.8 | $2.78 | $2.77 | $85.00 | $65.9K | 730 | 2.9K |

| DLTR | CALL | SWEEP | BULLISH | 12/20/24 | $2.81 | $2.75 | $2.78 | $85.00 | $45.1K | 730 | 2.7K |

About Dollar Tree

Dollar Tree operates discount stores across the United States and Canada, with over 8,600 shops under its namesake banner and nearly 7,800 under Family Dollar. About 47% of Dollar Tree’s sales in fiscal 2023 were composed of consumables (including food, health and beauty, and cleaning products), around 45% from variety items (including toys and homewares), and over 5% from seasonal items. The Dollar Tree banner sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. Conversely, Family Dollar primarily sells consumable merchandise (80% of the banner’s sales) at prices below $10. About two-thirds of Family Dollar’s stores are located in urban and suburban markets, with the remaining one-third located in rural areas.

After a thorough review of the options trading surrounding Dollar Tree, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Dollar Tree’s Current Market Status

- With a trading volume of 3,407,814, the price of DLTR is up by 2.63%, reaching $70.9.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 54 days from now.

What Analysts Are Saying About Dollar Tree

In the last month, 5 experts released ratings on this stock with an average target price of $80.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from BMO Capital has revised its rating downward to Market Perform, adjusting the price target to $68.

* An analyst from Melius Research downgraded its action to Hold with a price target of $70.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Dollar Tree with a target price of $78.

* An analyst from Loop Capital downgraded its action to Hold with a price target of $65.

* An analyst from Guggenheim persists with their Buy rating on Dollar Tree, maintaining a target price of $120.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dollar Tree with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Reasons to Buy Nvidia Stock Before October 7

It’s no secret that Artificial Intelligence (AI) stocks have dominated the market for the last few years. With firms like PwC — one of the “big four” accounting firms — making claims that AI could add $15.7 trillion to the global economy by 2030 — the hype makes sense.

The revolution’s poster child, Nvidia (NASDAQ: NVDA), saw its stock skyrocket nearly 1000% from late 2022 to today, but the last few months have not been as kind. After reaching its highest peak in June, shares of Nvidia are down about 10%. More significant market fears mixed with slower growth have caused some to cool on the once red-hot stock. So, where to go from here?

Nvidia’s AI Summit is a big day for the company and the industry

As the de facto leader of the entire industry, Nvidia needs to continue to do just that: lead. The 2024 AI Summit, which begins October 7, is a chance for the company to bring together some of the biggest faces and best minds in the industry to help push AI forward, all while keeping itself front and center. It’s a chance to communicate Nvidia’s vision not just to other industry leaders, but to the public at large.

One of the primary questions investors have for the company — and it’s a very legitimate one — is: Are the real-world applications of AI that impactful? Is the incredible cost of AI hardware worth the investment? The summit will be a chance for Nvidia to showcase the myriad ways AI can be used to return real value. It’s a chance to justify the enormous cost of its chips and, ultimately, the price of its shares.

The event in and of itself is unlikely to move the needle, but it may help ease some fears and get investors thinking about the possibilities and power of AI. Luckily, the event isn’t happening in a vacuum. Here are a few reasons why Nvidia is in a prime position to capitalize on the event.

1. Nvidia’s Blackwell chips are coming

In Nvidia’s only major snafu since the AI boom took off, the company announced its latest line of chips, dubbed Blackwell, was delayed. Issues in its manufacturing meant they wouldn’t be shipped on time. Nvidia assured that shipments would only be delayed a quarter. Despite these reassurances, some investors worried the issues were more fundamental and the delay would be longer.

It seems those fears were unfounded. According to a recent report by Tom’s Hardware, the company is ready to ship the first batch as early as December, only about six weeks behind the original schedule, although these reports have yet to be confirmed by Nvidia. If true, it would do a lot to ease investors’ fears and show that the company went above and beyond in fixing its mistake.

Still, even if they don’t ship until later in the quarter, the rollout will be huge for the company regardless. Their impact will be felt immediately, with billions in sales expected before the end of its Q4.

2. Nvidia’s vision is its greatest asset

It’s easy to get bogged down in numbers and fixate on balance sheets and income statements, and while these are extremely important when evaluating a business, certain intangibles are often what makes a company great, like vision. Nvidia has it in spades. Under the leadership of CEO Jensen Huang, the company has been at the forefront of several macro movements in tech. Huang saw back in the early 90s that computer graphics would be huge. The company’s GPUs — graphics processing units — are a big part of what enabled the video game industry to evolve to where it is today.

This vision is why the company controls roughly 90% of today’s AI chip market. Nvidia saw that its GPUs could do much more than push the bounds of computer graphics; they could power a new technological revolution. It’s why the company caught its competition sleeping. Since the current AI boom took off in late 2022, Nvidia’s chips have consistently been miles ahead. Other chipmakers have been playing catch-up ever since.

There was relative parity between Nvidia and its longtime rival AMD for decades. Not so anymore; last year, Nvidia made more in profit than AMD made in total revenue. The difference right now is stark, but remember, if Nvidia is profiting much more than its rival, it can then afford to spend more on research and marketing to widen its moat and fend off competitors.

3. Considering its prospects, Nvidia is reasonably priced

I know I just said not to get bogged down in the numbers, but they are still important. How is the market valuing Nvidia right now? At a price-to-earnings ratio (P/E) of 56, Nvidia isn’t cheap, but given its current pace of growth, a trailing P/E isn’t really the best metric for us. Its forward P/E — that is, a P/E that accounts for its expected earnings in the next 12 months rather than the last 12 — is just above 30. That’s not bad in the world of tech. It’s just about where Apple and Amazon sit.

Another useful valuation is the PEG ratio, which you get by dividing a company’s P/E by its expected earnings growth. This is an excellent metric for companies with a lot of growth potential. As a very general rule, a PEG under 1 is what we’re looking for. Nvidia’s is 0.94.

Nvidia has plenty of room to deliver the kind of growth that can justify its current valuation. To be sure, metrics are not the be-all and end-all. They are imperfect instruments, and of course, metrics that rely on expected earnings are especially imperfect — the future is anything but guaranteed. I believe Nvidia will continue to outperform the market for some time.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, and Nvidia. The Motley Fool has a disclosure policy.

3 Reasons to Buy Nvidia Stock Before October 7 was originally published by The Motley Fool

ADM to idle Iowa soy facility during record US harvest

By Julie Ingwersen and Karl Plume

CHICAGO (Reuters) – Archer-Daniels-Midland Co is idling its only soybean processing plant in Iowa for weeks in the thick of a record U.S. harvest, the grain merchant told Reuters, tightening supplies of soymeal fed to livestock.

The temporary closure eliminates a market for farmers to sell their soy as low crop prices slash incomes and removes a source of livestock feed for buyers in the U.S. and overseas. Expectations for the shutdown helped push cash soymeal prices at the Gulf export terminal to their highest level in a decade.

ADM’s facility in Des Moines will close for maintenance work from mid-October through November, the company said in response to a query by Reuters this week.

“We forecasted for this project and have plans in place to ensure we can meet customer needs throughout this time frame.”

The facility in the No. 2 U.S. soybean state crushes about 5 million bushels of soybeans a month on average, brokers said. That figure would represent about 12% of Iowa’s monthly soybean crush, according to U.S. government data.

“It’s an odd one,” Don Roose, president of Iowa-based U.S. Commodities, said of the shutdown during harvest. “Some guys are afraid: what if it doesn’t come back up?”

ADM did not comment on the reason for the closure but agreed to upgrade the plant this year to resolve alleged air quality violations under a 2023 consent decree with the Iowa Department of Natural Resources. In August, firefighters were called to the site for a blaze that was extinguished in about an hour, local news reports said.

The U.S. soybean crushing sector has expanded in recent years as processors opened new plants to capitalize on rising demand for vegetable oils from renewable fuels producers. The facilities crush soybeans into soyoil and soymeal, a key source of protein in livestock feed.

Despite the added capacity, the monthly soybean crush fell to a near three-year low in August as numerous U.S. facilities were idled for seasonal maintenance and repairs ahead of the massive harvest.

The extent of the downtime surprised traders and contributed to a soymeal shortfall at a time when traders had already struck deals for domestic and U.S. export sales based on faulty expectations for stronger production, brokers said.

“The trade anticipated the new crush capacity coming online and did not hold back when the consumer came calling,” said Kent Woods of CrushTraders, an analytical firm. “Then came the delays in the new crush capacity relative to expectations.”

Chicago Board of Trade October soymeal futures surged to three-month highs this week as exporters scrambled to cover sales commitments. Cash basis bids for prompt soymeal shipments into the U.S. Gulf export terminal soared to 10-year highs.

Hurricane Helene prompted ADM to close another crushing plant in Valdosta, Georgia, on Monday, according to the facility’s website.

(Reporting by Julie Ingwersen; Editing by Richard Chang)

Day Trader Says He Made $306 Million on Tesla, Then Lost It All

(Bloomberg) — Christopher DeVocht, a carpenter from Vancouver Island, Canada, says he started out like a lot of day traders. After work, he’d read about trading on forums. His favorite things to trade were options on Tesla Inc. stock.

Most Read from Bloomberg

Then he went on what has to be one of the hottest hot streaks in the history of financial markets, according to a legal filing. At the end of 2019, his account, with the brokerage division of Royal Bank of Canada, was worth C$88,000. Within two years, he’d turned that into C$415 million ($306 million), he says.

Some people would have cashed out. DeVocht didn’t. And when Tesla stock fell in 2022, he lost it all, according to a lawsuit he filed this week against RBC Dominion Securities, RBC Wealth Management and accounting firm Grant Thornton LLP. The filing, which is an initial notice of claim that doesn’t require evidence to be provided at this stage, didn’t include brokerage statements or other proof of his gains or losses.

DeVocht now claims that the advice he received, geared mainly toward minimizing taxes, was negligent and failed to take into account his level of financial sophistication. His Tesla investment strategy involved loans from a Royal Bank margin account.

“RBC considered Mr. DeVocht to be a sophisticated investor,” according to the complaint. “While this was true in respect of his strategies for put and call options in the trading of Tesla shares, RBC failed to appreciate that Mr. DeVocht’s knowledge of investing more generally, of financial planning, and of tax was in fact limited.”

Royal Bank had no immediate comment Friday and hasn’t yet filed a defense in the case. DeVocht’s lawyer, Sean Hern, declined to comment beyond the complaint. Grant Thornton said it doesn’t comment on matters before the court.

“The only statement we can provide at this time is that we’re committed to providing quality services to all our clients in accordance with professional standards,” Grant Thornton said in an emailed statement.

DeVocht was good at trading Tesla shares and options, he said in the lawsuit, but he was in his 20s, struggling with “significant respiratory and other health issues” and had limited understanding of financial issues. When he first went to Royal Bank in July 2020, he wanted a loan so he could move out of his rental apartment and buy a home. At the time, his portfolio was worth about C$26 million “and rising rapidly,” according to the notice of civil claim, filed with the Supreme Court of British Columbia in Vancouver.

He was soon referred to a “coach and coordinator” within the bank who then connected him with an accountant at Grant Thornton, according to the complaint.

The assembled team of professionals advised him to incorporate a company, roll all of his securities into it and conduct trades within the company “with a strategy of accumulating as many Tesla shares as possible and holding them for as long as possible,” DeVocht claims in the lawsuit.

The idea was to convince Canadian tax authorities to view it as an investment holding company, not an active trading business, because he’d pay lower taxes that way, according to the complaint.

This led to an “extreme concentration in Tesla” that came with corresponding risks, DeVocht claims. When the stock soared in 2021, it paid off — his portfolios surged to C$415 million from C$186 million in the span of about eight months that year, according to the lawsuit — before collapsing.

‘Worth Nothing’

Tesla shares suffered a series of declines and periodic rallies throughout 2022 and DeVocht tried to recoup some of the losses by borrowing C$20 million from the corporation and using it to make shorter-term trades in his personal account. That strategy failed, and the money was lost, he said in the complaint. When Tesla shares saw even steeper declines in October 2022, DeVocht’s corporation had to sell its Tesla holdings to repay loans from a margin account it held with Royal Bank, according to the suit.

DeVocht and his corporation tried to mitigate these losses but, in time, their “securities holdings were worth nothing,” he said in the complaint. If not for the “inadequate advice” DeVocht received, he and his corporation “would have preserved a substantial portion of their wealth and implemented financial planning that would not have resulted in the loss of their entire net worth.”

DeVocht and his corporation are seeking general damages for breach of contract and negligence. His claim also alleges that Royal Bank’s recommendations to make C$25.5 million in charitable donations further eroded a significant chunk of his wealth.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against Symbotic, PDD Holdings, Extreme Networks, and Sprinklr and Encourages Investors to Contact the Firm

NEW YORK, Oct. 04, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of Symbotic Inc. SYM, PDD Holdings Inc. PDD, Extreme Networks, Inc. EXTR, and Sprinklr, Inc. CXM. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

Symbotic Inc. SYM

Class Period: May 6, 2024 – July 29, 2024

Lead Plaintiff Deadline: October 15, 2024

According to the complaint, on July 29, 2024, Symbotic announced their 3Q24 financial results and then lowered its revenue guidance for the fourth quarter and full fiscal year 2024. Symbotic attributed their change in guidance to “schedule growth and higher labor costs during the quarter.” Analysts commenting on the stock questioned when management first knew and responded to the issues.

Following this news, Symbotic’s stock price opened at $26.36 per share or approximately 25% below the previous day’s close of $35.63 per share.

For more information on the Symbotic class action go to: https://bespc.com/cases/SYM

PDD Holdings Inc. PDD

Class Period: April 30, 2021 – August 23, 2024

Lead Plaintiff Deadline: October 15, 2024

According to the complaint, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose, among other things, that: (1) PDD Holdings’ applications contained malware, which was designed to obtain user data without the user’s consent, including reading private text messages; (2) PDD Holdings has no meaningful system to prevent goods made by forced labor from being sold on its platform, and has openly sold banned products on its Temu platform; (3) the foregoing subjected PDD Holdings to a heightened risk of legal and political scrutiny; and (4) as a result, defendants’ statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

For more information on the PDD Holdings class action go to: https://bespc.com/cases/PDD

Extreme Networks, Inc. EXTR

Class Period: July 27, 2022 – January 30, 2024

Lead Plaintiff Deadline: October 15, 2024

The Complaint alleges that throughout the class period, Defendants made false and misleading statements to the market. Specifically, the Complaint alleges that: (1) Extreme Networks suffered from weak client demand trends due to customers ordering more product than necessary in the wake of the COVID-19 pandemic; (2) the Company attempted to offset the negative organic demand trends with backlog orders exceeding the proportion it represented to investors; (3) based on these facts, the Company’s public statements were false and materially misleading throughout the class period; and (4) when the market learned the truth about Extreme Networks, investors suffered damages.

For more information on the Extreme Networks class action go to: https://bespc.com/cases/EXTR

Sprinklr, Inc. CXM

Class Period: March 29, 2023 – June 5, 2024

Lead Plaintiff Deadline: October 14, 2024

According to the complaint, on December 6, 2023, Sprinklr announced strong 3Q 2024 results and then reduced its estimated growth for the 4Q and full year 2025. The Company blamed it on “subscription renewal pressures” caused by macro headwinds and the “over-rotation” of sales to its Contact Center as a Service (“CCaaS”) market. On an earnings call in September 2023, CEO Ragy Thomas stated that the Company’s investments in AI and the CCaaS opportunity were main contributors to its customer growth. Subsequently, in March several changes were made to the Company’s C-level positions. Analysts commenting on the reduced estimates mention surprise at the timing and shift in the Company’s sales strategy. Following this news, Sprinklr’s stock price fell by $5.59 per share, or approximately 34% to close at $11.11 per share.

On June 5, 2024, Sprinklr again announced significantly reduced growth expectations, this time cutting fiscal year 2025 projections another three percent, down to a mere 7% annual growth, again attributing the losses to reduced customer retention in Sprinklr’s core business and macro headwinds. The price of Sprinklr’s common stock declined dramatically. From a closing market price of $10.84 per share on June 5, 2024 Sprinklr’s stock price fell to $9.20 per share on June 6, 2024, a decline of more than 15% in the span of one day.

For more information on the Sprinklr class action go to: https://bespc.com/cases/CXM

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's 1 Incredibly Cheap Semiconductor Stock to Buy Following Micron Technology's Latest Results

Micron Technology (NASDAQ: MU) released its results for fiscal 2024 on Sept. 25. The data released offers a clear indication that the memory chip market is hot thanks to favorable supply/demand dynamics.

Micron reported $7.75 billion in fiscal Q4 revenue, a stunning increase of 93% year over year. Additionally, the company’s operating income margin swung to a positive 22.5% from a negative reading of 30.1% in the same quarter last year thanks to the recovery in memory prices. The improvements helped Micron report non-GAAP (generally accepted accounting principles) earnings of $1.18 per share for the quarter, as compared to a loss of $1.07 per share in the year-ago period.

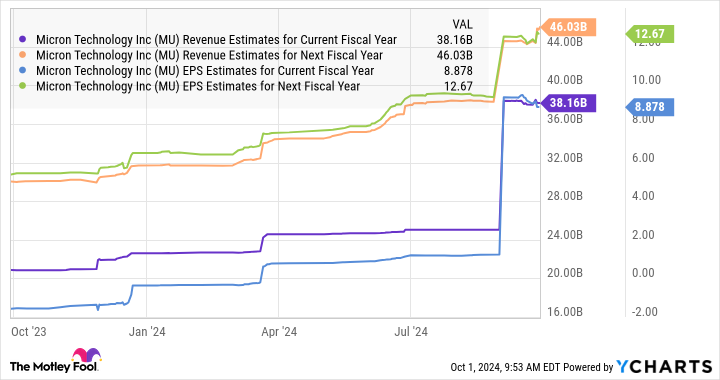

The company’s revenue for the entire fiscal year jumped 61% to $25 billion. Its adjusted earnings came in at $1.30 per share, as compared to a loss of $4.45 per share in the prior year period. Even better, analysts expect Micron to sustain this impressive level of growth over the next couple of fiscal years as well.

The growth forecast isn’t surprising as the memory market got a terrific boost thanks to the growing interest in all things artificial intelligence (AI). The rapid adoption of this technology created the need for more memory chips across different applications, ranging from data centers to smartphones to vehicles to personal computers (PCs).

Memory manufacturers such as Micron say they plan to spend more money to boost their production capacities. This is good news for Lam Research (NASDAQ: LRCX), a semiconductor equipment supplier that relies on the memory market for a significant chunk of its revenue.

Let’s look at the reasons why buying Lam Research stock could turn out to be a smart move following Micron’s impressive results.

Increasing memory capex will be a tailwind for Lam Research

Micron management pointed out on the company’s latest earnings conference call that its capital expenditures stood at $8.1 billion in fiscal 2024. That was an increase of 16% from the previous fiscal year. The company plans to spend $3.5 billion in capex in the first quarter of fiscal 2025, which points toward a much higher run rate than last year.

For the full year, Micron says that it expects “capex to be around the mid-30s percentage range of revenue.” Based on the $38 billion revenue estimate for the company, as seen in the chart earlier, its capex could jump to $13.3 billion in fiscal 2025 (at 35% of the top line). That would be a 64% increase from the preceding year.

Lam Research gets 36% of its revenue from selling memory manufacturing equipment. This explains why the company’s outlook for fiscal 2025 (which started in July this year) is much better than its performance last year. Lam Research’s fiscal 2024 revenue fell 14% from the previous year to $14.9 billion on account of a glut in the memory market due to weak demand from PCs and smartphones.

The company’s adjusted earnings also fell to $29 per share from $33.21 per share in fiscal 2023. However, the improved capital spending by memory specialists such as Micron is set to drive solid growth in Lam’s top line in the current fiscal year and beyond.

The improved top-line performance is set to filter down to the bottom line as well.

These improvements are not surprising, as Lam points out that memory demand is on track to improve on account of the growing need for high-bandwidth memory (HBM) chips used in data center graphics cards to train AI models. Additionally, Lam CEO Timothy Archer remarked on the company’s August earnings conference call that:

However, as AI use cases expand, we believe inferencing at the edge will spur content growth of low-power DRAM and NAND storage in enterprise PCs and smartphones. Investments for AI-enabled edge devices play particularly well to Lam’s strengths.

These AI-related catalysts are expected to send the memory chip market’s revenue to $260 billion in 2029 from just $89 billion last year. This explains why other memory manufacturers such as Samsung and SK Hynix also forecast huge increases in their capex. SK Hynix’s capex, for instance, is expected to jump a whopping 75% next year as the company ramps up HBM production capacity to meet the booming end-market demand.

Samsung’s dynamic random-access memory (DRAM) capex, on the other hand, is expected to increase 9% this year to $9.5 billion, followed by a stronger jump to $12 billion next year. Lam Research mentioned in its annual filing that Micron, Samsung, SK Hynix, and Taiwan Semiconductor Manufacturing are its “most significant customers.”

So, the increase in capital spending by these companies is going to be a robust growth driver for Lam Research, which explains why its revenue and earnings could increase nicely going forward.

The stock’s attractive valuation makes it worth buying

With a trailing price-to-earnings (P/E) ratio of 28 and forward earnings multiple of 22, investors are getting a good deal on Lam Research stock right now, considering the projected healthy increase in its top and bottom lines. These multiples represent a discount to the Nasdaq-100 index’s earnings multiple of 32 (using the index as a proxy for tech stocks).

At the same time, Lam’s price/earnings-to-growth ratio (PEG ratio), which is a forward-looking valuation measure that takes into account the company’s growth potential, makes buying this semiconductor stock a no-brainer.

A PEG ratio of less than 1 means that a stock is undervalued with respect to the earnings growth that it is set to deliver. And, as the chart tells us, Lam Research is indeed undervalued on this front. That’s why investors looking to add an AI stock to their portfolios would do well to buy Lam Research before it starts soaring.

Should you invest $1,000 in Lam Research right now?

Before you buy stock in Lam Research, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Here’s 1 Incredibly Cheap Semiconductor Stock to Buy Following Micron Technology’s Latest Results was originally published by The Motley Fool

How To Earn $500 A Month From Phillips 66 Stock Ahead Of Q3 Earnings

With the recent buzz around Phillips 66, some investors may be eyeing potential gains from the company’s dividends, too. The company currently offers an annual dividend yield of 3.31% — a quarterly dividend of $1.15 per share ($4.60 a year).

Want to earn $500 monthly from Phillips 66? Start with the yearly target of $6,000 ($500 x 12 months).

Next, take that amount and divide it by Phillips 66’s $4.60 dividend: $6,000 / $4.60 = 1,304 shares

So, an investor would need to own approximately $181,165 worth of Phillips 66, or 1,304 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $3.12 = 261 shares, or $36,261 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

Price Action: Shares of Phillips 66 gained by 3.3% to close at $138.93 on Thursday.

On Oct. 2, JPMorgan analyst John Royall maintained Phillips 66 with an Overweight rating and lowered the price target from $160 to $141.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.