If I Could Buy Only 1 Warren Buffett Stock in October, This Would Be It

Imagine having one of the greatest investors of all time send you a list of the stocks he likes the most. The good news is that you don’t have to use your imagination. In a real sense, it happens every three months.

Warren Buffett unquestionably qualifies as a legendary investor. Although Buffett doesn’t personally email a list of his favorite stocks to you, he does the next best thing. Every quarter, the company he runs, Berkshire Hathaway, reveals its stock holdings to the U.S. Securities and Exchange Commission (SEC). Any investor seeking ideas from the so-called Oracle of Omaha only needs to scan Berkshire’s latest 13-F filing.

Granted, some of the stocks on this list were better picks when Buffett first bought them than they are now. However, others remain great candidates for investors. Which Buffett stock would I buy in October if I could choose only one?

Several good options

Before I get to my top pick among the stocks Buffett owns, I’ll readily admit that it’s not an easy decision. Considering Buffett’s acumen in selecting stocks, that shouldn’t be surprising.

For example, I’m pretty much on the same page with Buffett about Apple. He thinks it has a great business, and so do I.

Sure, Buffett slashed his stake in the stock in recent quarters. However, Apple remains Berkshire’s top holding by far. It’s my top stock holding, too (although I have more invested in ETFs). I expect Apple’s generative AI initiatives will lead to increased iPhone sales over the next few years and propel the stock higher.

Even though Buffett didn’t personally make the call to buy shares of Amazon, it’s one of his best stocks in my view. Amazon’s investments in technology should boost profitability. Its Amazon Web Services unit has a huge growth opportunity as organizations migrate to the cloud.

I also agree with Buffett’s bullish take on Occidental Petroleum. He likes the company’s leadership, oil and gas reserves, and focus on carbon capture technology. Tensions in the Middle East could serve as a tailwind for the stock over the near term.

Buffett’s best bet

But if I could buy only one Buffett stock in October, I’d go with Lennar (NYSE: LEN). The company is one of the largest homebuilders in the U.S. (Berkshire also owns another top homebuilder — NVR.)

I think now is the perfect time to buy Lennar stock, in part because of the Federal Reserve’s interest rate cut. Lennar executive chairman and co-CEO Stuart Miller said in his company’s third-quarter earnings press release that the Fed’s moves “should start to enhance affordability and accelerate the already strong demand for both new and existing homes.”

Miller’s optimism is fully warranted, in my view. I picture a row of dominoes, where one falling leads to a ripple of others falling. Lower interest rates should lead to lower mortgage rates, which lead to increasing homebuying, which lead to greater revenue and profits for Lennar.

Lennar isn’t just poised for a short-term boost, though. The U.S. has an ongoing, chronic housing shortage. Miller spoke about this shortage several times in his comments during Lennar’s Q3 earnings call. He noted that it is “well-documented” and is “a result of years of underproduction.” Of course, the solution to a problem caused by underproduction is more production — great news for Lennar’s long-term prospects.

Those prospects aren’t fully reflected in Lennar’s valuation. The stock’s price-to-earnings ratio is only 12.4, well below the 18.3 earnings multiple of the SPDR S&P Homebuilders ETF.

One wild card

Lennar could also benefit from a wild card. Miller alluded to it in the Q3 earnings call, saying, “[E]ven the national narrative has begun to acknowledge the need for programs that activate supply.”

The presidential nominees of both major political parties have spoken about the need for more homes. Vice President Kamala Harris wants to offer financial assistance to first-time homebuyers and tax credits to homebuilders. Meanwhile, former President Donald Trump wants to make more federal land available for housing development.

It’s possible that new federal policies could be enacted in the next presidential term that directly help Lennar. This isn’t a sure thing, but it’s a wild card that makes this Buffett stock even more attractive.

Should you invest $1,000 in Lennar right now?

Before you buy stock in Lennar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lennar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon, Apple, and Berkshire Hathaway. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Lennar, and NVR. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

If I Could Buy Only 1 Warren Buffett Stock in October, This Would Be It was originally published by The Motley Fool

Coinbase, Nike And Moderna Are Among Top 11 Large Cap Losers Last Week (Sept 30-Oct 4): Are The Others In Your Portfolio?

These eleven large-cap stocks were the worst performers in the last week. Are they in your portfolio?

- Humana Inc. HUM stock tumbled 24.89% after the company updated investors on the decline in Stars’ performance for 2025 and how it will impact quality bonus payments in 2026. Several analysts lowered the stock’s price forecast.

- Stellantis N.V. STLA stock fell 17.06% last week after Chrysler Parent’s U.S. sales nosedived 20% in the third quarter. Several analysts downgraded the stock.

- Coinbase Global, Inc. COIN shares dipped 10.63%. The company announced it will restrict services tied to Stablecoins that do not meet MICA European regulations.

- Mobileye Global Inc. MBLY shares were down 10.15%.

- Rivian Automotive, Inc. RIVN shares fell 10% last week after the company lowered its annual production guidance due to a supply shortage of shared components on the R1 and RCV platforms.

- First Solar, Inc. FLSR stock lost 9.63% last week.

- ConAgra Brands, Inc. CAG stock declined 9.12% after the company reported worse-than-expected Q1 financial results.

- Floor & Decor Holdings Inc FND stock declined 8.81% last week.

- Summit Therapeutics Inc. SMMT shares plummeted 8.59%. The company announced the completion of enrollment in its Phase III HARMONi trial in 2L+ EGFRm NSCLC.

- Moderna, Inc. MRNA stock fell 8.44%. The company reached a stipulation in its ongoing patent infringement litigation with Alnylam Pharmaceuticals, Inc. ALNY.

- Nike, Inc. NKE stock fell 8.04% after multiple firms cut their respective price targets following a first-quarter revenue miss.

Also Read:

Photo by rafapress via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Top Energy Stocks to Buy in October

With October now underway, there isn’t one single way to play the energy sector, but that’s not new. There have always been different tactics for investing in this volatile niche of Wall Street. The question is, which tactic is right for you?

Here are three of the top energy stocks to consider as you try to answer that query: Devon Energy (NYSE: DVN), Chevron (NYSE: CVX), and Enbridge (NYSE: ENB). Let’s see what makes them potential investments this month.

1. Devon Energy is like jumping in with both feet

Devon Energy operates exclusively in the upstream segment of the energy sector. That means that it produces oil and natural gas. There are very big implications in this focus, the most notable being that Devon’s top and bottom lines are almost entirely dependent on the price of the commodities it sells. Don’t underestimate how much effect this can have on the company’s stock price, financial performance, and dividend. Oil and natural gas are known for their dramatic, and often swift, price swings.

Devon exacerbates the effect by having a variable dividend policy. So when energy prices are high, the dividend will be high, but when energy prices are low, the dividend will be low. It is an elegant way of making sure that shareholders benefit directly from high oil prices. But it is not something that an investor looking to live off their dividend checks will probably appreciate.

In fact, investors shouldn’t really look at the dividend yield (currently at around 5%) as a reliable indication of the income this stock will generate over time. This stock is most appropriate for investors who believe oil prices will increase, or at least remain at about their current levels.

That said, Devon is a well-respected energy producer. It has an investment grade-rated balance sheet and exceeded its volume guidance in the second quarter of 2024. It’s expanding via acquisition, has a fairly low breakeven point (roughly $40 per barrel of oil), and has over a decade of drilling inventory. There’s a lot to like, but be prepared to ride the ups and downs of energy prices.

2. Chevron is like slowly wading into the water

Chevron also operates in the upstream, but that’s just one part of its business. As an integrated energy company, it operates in the midstream (pipelines) and downstream (chemicals and refining), as well. This diversification, along with a global footprint, helps to soften the peaks and valleys in oil and natural gas prices. Energy prices are still the driving force of Chevron’s top and bottom lines, but the business just won’t be subject to quite the severe performance swings a pure-play producer would be.

But what really sets Chevron apart from other choices in the energy sector is its balance sheet. The company’s debt-to-equity ratio is the lowest among its closest peers at roughly 0.15 times. That gives it the leeway to add leverage during energy downturns, so it can continue to invest in its business and pay shareholder dividends. Notably, the dividend has been increased for 37 consecutive years. Now add in the fact that the yield is roughly 4.3% today, and you can see why Chevron would be a good option for dividend investors looking to add a permanent position in the energy patch to their portfolios.

3. Enbridge is like only dipping your toes in

The last stock to consider is Enbridge, which is a giant North American midstream company. Midstream companies own vital energy infrastructure, which they charge their customers fees to use. There are some important facts to consider here. The energy sector can’t operate without the pipelines, storage, and transportation assets that Enbridge owns. Demand for energy is more important than the price of the commodities flowing through Enbridge’s system. And energy demand tends to remain robust even when oil prices are low. Overall, Enbridge has a long history of producing reliable cash flows.

Those cash flows support the stock’s attractive 6.5% dividend yield. That dividend has been increased annually for 29 consecutive years. If you are looking for a large and reliable income stream, Enbridge has you covered.

There’s another interesting story here, because one of the company’s main goals is to provide the world with the energy it needs. To that end, it has been expanding into the regulated natural gas utility and clean energy sectors, which together make up around 25% of earnings before interest, taxes, depreciation, and amortization (EBITDA). So not only is Enbridge a solid high-yield option in the energy patch, it’s also a hedge of sorts as the world moves toward cleaner energy options.

There are multiple ways to play the energy sector

As the trio of stocks here shows, the energy sector is not a one-size-fits-all affair. There are different ways you can invest, depending on how you want to add energy exposure to your portfolio.

The most aggressive option here is Devon Energy, the pure-play producer. Chevron is something of a middle-ground option that should hold up well throughout the energy cycle, likely continuing to pay you a reliable dividend even during industry downturns. Enbridge is a reliable cash flow generator with a big dividend yield for investors who are trying to maximize their income stream. One of these top energy picks should fit your needs if you are looking for an energy stock in October.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Chevron and Enbridge. The Motley Fool has a disclosure policy.

3 Top Energy Stocks to Buy in October was originally published by The Motley Fool

US Job Growth Surges, Market Euphoria Predicted To Top, And Musk Foresees Bankruptcy: This Week In Economics

The past week has been a rollercoaster ride for the U.S. economy. From a surprising surge in job growth to predictions of market euphoria topping soon and Elon Musk’s alarming bankruptcy prediction for the U.S., there’s a lot to unpack.

Let’s dive into the top stories of the week.

US Economy Adds 254,000 New Jobs In September

The U.S. labor market showed signs of robust health as it added 254,000 nonfarm payroll jobs in September, a significant improvement over August’s revised figure of 159,000. This pace of job creation exceeded economist forecasts, sparking fresh optimism for the labor market’s resilience.

Billionaire Investor Predicts Market Euphoria Will Top Soon

Mark Spitznagel, co-founder of Universa Investments, warns that the current market euphoria, spurred by the Federal Reserve’s rate cuts and China’s stimulus measures, won’t last. He predicts a looming recession and believes the current rally is only temporary. Spitznagel also foresees a future stagflation where the Fed’s actions won’t be enough to save the economy.

‘Blowout’ September Jobs Report Spurs Reactions

The September jobs report came in hotter than predicted, with U.S. payrolls increasing by 254,000 and the unemployment rate surprisingly slipping to 4.1%. These robust numbers have sparked a fresh debate among economists about the Federal Reserve’s next move, with many leaning toward a more gradual approach to rate cuts.

Elon Musk Says America ‘Headed For Bankruptcy’

Elon Musk expressed concerns over the financial trajectory of the U.S., suggesting the nation is on the brink of bankruptcy. This comes after Federal debt increased by $204 billion on the first day of the new fiscal year, jumping to a new record of $35.669 trillion.

Larry Summers Slams Fed’s September Rate Cut

Larry Summers, former Treasury Secretary, has expressed disapproval of the Federal Reserve’s decision to cut interest rates last month, terming it a misstep in the face of the latest U.S. job growth data.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Ananya Gairola

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Microsoft's Landmark Deal With Constellation Energy, Could This Little-Known Stock Be the Next Big Opportunity in Nuclear Power?

Data centers house IT architecture such as server racks that store advanced chipsets called graphics processing units (GPU) — a critical piece of infrastructure for AI development.

One drawback of data centers, however, is power consumption. Since GPUs are running sophisticated algorithms around the clock, data centers experience high levels of heat and consume a lot of energy. At the moment, some of the most common pieces of equipment outfitting data centers include air conditioning units, fans, and generators.

While these products work, there are questions about their long-term viability. For this reason, nuclear power is emerging as an alternative and more efficient solution over traditional data center energy solutions.

Just a couple of weeks ago, Microsoft signed a deal with Constellation Energy, and the two companies are looking to restart nuclear power plants on Three Mile Island in Pennsylvania. Shares of Constellation have been surging on the news of this partnership. Naturally, investors are now looking for the next big opportunity at the intersection of AI and nuclear power.

Below, I’ll explore a little-known nuclear power company called Oklo (NYSE: OKLO) and assess if the stock could be a lucrative opportunity.

What is Oklo?

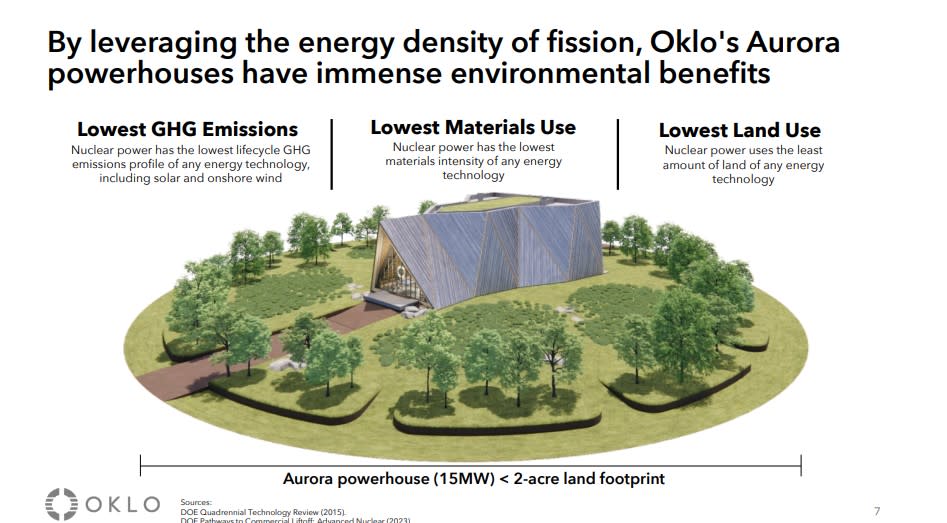

According to its website, Oklo is a “fission technology and nuclear fuel recycling company.” Its core project is called the Aurora powerhouse, which is essentially a fission reactor that leverages recycled nuclear waste. This technology could revolutionize data center operations, making them less reliant on traditional power grids.

Oklo looks impressive on the surface, but…

Before going public, Oklo received funding from a number of high-profile venture capital firms. Among its more notable investors are OpenAI CEO Sam Altman and billionaire Silicon Valley legend Peter Thiel. Moreover, the company has received interest for its reactors from the likes of Diamondback Energy, Equinix, Centrus Energy and the United States Air Force.

On the surface, Oklo looks pretty impressive. But smart investors know there is always more to uncover when assessing smaller businesses. Oklo is no exception, and I’ve found some important things to keep in mind with this under-the-radar energy stock.

…investors should keep the following in mind

Oklo started trading on the New York Stock Exchange back in May after merging with a special purpose acquisition company (SPAC). SPACs are a somewhat unusual way of going public, as they circumvent traditional underwriting processes at investment banks. Over the last couple of years, SPACs have risen in popularity.

Here’s the inconvenient reality of SPAC stocks. Many market themselves as cutting-edge businesses, but have yet to show tangible results. As a result, after an initial surge fueled by investor euphoria, SPAC stocks often wind up selling off as a more sober assessment sets in.

According to a study at the University of Florida, renewable energy SPACs have a median return of negative 84% between 2009 and 2024. It’s too early to tell where Oklo’s share price will end up, but I see some reasons why the stock could begin to decline.

While the Aurora powerhouse carries some allure, Oklo’s first plant isn’t expected to be functional until 2027. Until then, the company will likely remain a pre-revenue business that requires ongoing investment in capital expenditures (capex). As a result, I would not be surprised to see the company pressed for liquidity and potentially dilute shareholders in an effort to keep the operation afloat.

I find Oklo’s nuclear power solutions intriguing, but I have my doubts about how investable the business is at its current stage. For now, I see Oklo as quite risky and, at best, a speculative opportunity.

I think the more prudent strategy is to invest in higher-quality businesses that are already making moves at the crossroads of nuclear power and AI. In addition to Microsoft and Constellation Energy, Amazon and Vistra are some big names worth keeping an eye on. As far as Oklo goes, I think it’s best to sit on the sidelines and monitor the company’s progress over time.

Should you invest $1,000 in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Microsoft. The Motley Fool has positions in and recommends Amazon, Constellation Energy, Equinix, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

After Microsoft’s Landmark Deal With Constellation Energy, Could This Little-Known Stock Be the Next Big Opportunity in Nuclear Power? was originally published by The Motley Fool

3 Top Utility Stocks to Buy in October

Normally, utility stocks aren’t very exciting. But, after a magnificent 35% rally over the past year, well, the utility sector is no doubt exciting right now. In fact, some investors might be thinking that the sector isn’t worth looking at anymore. That isn’t really true if you spend a little time examining utilities like Constellation Energy (NASDAQ: CEG), NextEra Energy (NYSE: NEE), and Black Hills (NYSE: BKH) as October gets underway.

1. Constellation Energy is leading the nuclear renaissance

Clean energy is all the rage, with solar and wind power investment expanding at a rapid clip. But there’s another clean energy option that often gets forgotten, nuclear power. Constellation Energy is a competitive power company (which means it sells electricity outside of the traditional regulatory framework) with ownership stakes in 14 nuclear power stations which contain 25 nuclear power units. This is important because nuclear power is in the news, for good reasons, right now.

A private company has just been awarded government funding to reopen a shuttered nuclear power plant. Now, Constellation Energy has begun the process of reopening a nuclear power plant at Three Mile Island, with Microsoft (NASDAQ: MSFT) agreeing to buy all of the power it produces for the next 20 years. To be fair, the stock shot up after management announced the news. But if nuclear power is about to become a more important energy source, Constellation Energy is probably one of the best ways to invest directly in the future of nuclear power. If you’re interested in investing in popular trends, you should take a closer look at this utility right away.

2. NextEra Energy is growing its dividend very quickly

NextEra Energy isn’t exactly a new story on Wall Street. In fact, the story behind this stock is so well known that the shares usually trade at a premium relative to peers. But if you are a dividend growth investor, that premium could be worth paying. Why? Because NextEra Energy’s dividend has grown at a 10% annualized clip over the past one-, three-, five-, and 10-year periods.

The company is projecting that earnings growth of 6% to 8% through 2027 will keep the 10% dividend growth streak alive until at least 2026. Half that rate would be considered pretty good for a utility, so NextEra Energy truly stands out from the pack.

The reason NextEra Energy has been able to grow so quickly is twofold. First, it owns the largest regulated utility in Florida, Florida Power & Light. This foundational business has benefited from the long migration trend to the Sunshine State. More customers means more revenue and profits. On top of this solid core, NextEra Energy has built one of the world’s largest solar and wind companies. That’s the growth engine, and given the ongoing shift toward renewable power, there’s likely to be a long runway ahead for additional growth.

If you have a value bias, you won’t like NextEra Energy. But it is hard to beat when it comes to dividend growth.

3. Tiny Black Hills is a King when it comes to dividends

There’s a good chance you have at least heard the names Constellation Energy and NextEra Energy. But you may not have heard of Black Hills, which wouldn’t be shocking given its tiny $4 billion market cap. However, if you are a dividend investor trying to live off of the income your portfolio generates, you need to dig into Black Hills’ story.

It is a fairly boring regulated natural gas and electric utility that serves 1.3 million customers in parts of Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Notably, its customer base is growing nearly three times faster than the overall U.S. population. Black Hills expects this customer growth to support earnings growth of between 4% and 6% a year over the foreseeable future. As a result, the dividend should grow along with earnings over time.

This is where the story gets interesting because Black Hills has increased its dividend annually for 54 consecutive years. That makes this small fry a Dividend King, one of the few utilities to have achieved this impressive feat. Now add in a dividend yield of 4.2%, which is above the roughly 2.9% average for the utility sector and near the stock’s highest yield levels over the past decade.

Black Hills stock has rallied, just like other utility stocks have. But it still looks like this reliable dividend payer is on sale. If you rely on the income your portfolio generates, this boring Dividend King could be a great addition to your portfolio in October.

There are still interesting options in the utility patch

To be fair, the utility sector’s rally has reduced the attractiveness of the sector from a big-picture perspective. But that doesn’t mean there aren’t interesting opportunities if you dig a little deeper. Constellation Energy could be a huge beneficiary of what seems like a burgeoning nuclear renaissance, while NextEra Energy remains a dividend growth machine.

And Dividend King Black Hills is still adding years to its incredible dividend streak despite having a yield that is attractive compared to the utility sector and its own history. One of these unique stories is likely to tickle your fancy if you are looking for a utility stock to buy right now.

Should you invest $1,000 in Constellation Energy right now?

Before you buy stock in Constellation Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Constellation Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Reuben Gregg Brewer has positions in Black Hills. The Motley Fool has positions in and recommends Constellation Energy, Microsoft, and NextEra Energy. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Top Utility Stocks to Buy in October was originally published by The Motley Fool

This Could Be the Next Big Artificial Intelligence (AI) Stock Split. Here's Why You Should Buy It Before It Happens.

The biggest winners in the stock market over the last two years have all been great companies fueling the biggest innovations in artificial intelligence (AI).

Nvidia is the poster child of big AI stock winners. Its GPUs are essential equipment for training and running large language models. It has seen its stock climb 865% over the last 24 months, leading to a 10-for-1 stock split in June.

Nvidia was far from the only AI-fueled stock to split shares this year. It was joined by Broadcom, Super Micro Computer, and Lam Research, which all executed splits.

A stock split isn’t necessarily a catalyst for a stock to zoom higher. The fundamental value of a company doesn’t change when management decides to split its shares. And in today’s age of fractional shares, it only has a minor impact on making the stock more accessible to small investors.

But a stock split is a sign of confidence from management that shares will continue to climb, and few people have more insights into the future of a company and its stock than management.

So, investors are rightly interested in what could be the next stock to undergo a split. One company essential to the supply of AI semiconductors looks like a great candidate: ASML Holding (NASDAQ: ASML). And at today’s share price, investors should be looking to buy the stock before it announces a split.

An essential part of the supply chain

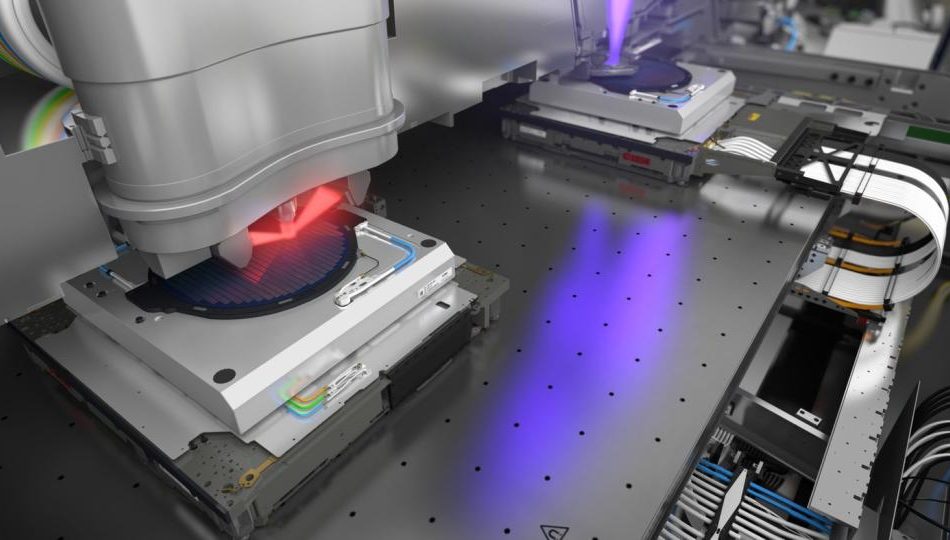

ASML builds and services photolithography machines, which semiconductor manufacturing companies use to produce the chips designed by companies like Nvidia. Basically, without ASML’s machines, there are no AI chips.

It’s the only supplier of extreme ultraviolet lithography (EUV) machinery, a necessary technology for printing the most advanced chips, such as those used in AI data centers for training and running large language models. If a manufacturer is printing a high-end semiconductor, it’s using ASML’s machines.

Customers include Taiwan Semiconductor Manufacturing, Intel, and Samsung. All three revamped their foundries about a decade ago to accommodate ASML’s machinery.

But the company isn’t reliant on selling more machines every year to fuel revenue growth. It receives ongoing revenue from servicing machines already in use and selling replacement parts. The recurring revenue from servicing should grow as more machines are installed in chipmakers’ foundries.

ASML’s revenue from its installed base has grown significantly faster than its system sales over the last 15 years as foundries add more of its equipment to their operations while maintaining and updating old equipment. And given the long lifespans of ASML’s machines (25 to 30 years), that’s a steady and growing source of high-margin revenue.

Newer machines using the latest EUV technology will go into service next year. And the increased complexity of the high-end machines could result in even greater revenue from service and replacement parts relative to older machines.

The future looks bright

ASML referred to 2024 as a transition year. It doesn’t expect any revenue growth, and it forecasts gross margin contraction this year as it gears up to sell its latest EUV machines.

That stands in stark contrast to a company like Nvidia, which has seen revenue and profits continue to soar in 2024. So it’s no wonder investors haven’t been nearly as excited about ASML as they are about big-name chipmakers.

But that could be an opportunity for patient long-term investors. ASML expects 2025 to be a big year. Management’s outlook calls for between 30 billion and 40 billion euros ($33.17 billion to $44.2 billion) in revenue next year as foundry openings using its newest machines go into service. At its midpoint, that represents a 27% increase from 2023.

At its investor day in 2022, management provided an outlook for sales in 2030 of between $48.65 billion and $66.34 billion. Considering that was before the AI boom really took off, it’s a good bet that revenue will come in on the high end. Management might update that outlook to a higher or narrower range at its next investor day in November.

Along with sales growth, management expects strong margin expansion. It sees gross margins between 54% and 56% in 2025 and 56% and 60% by 2030. And while it hasn’t explicitly forecast operating margin expansion, it should see good operating leverage from its research-and-development and selling, general, and administrative expenses as its revenue scales up toward the $66 billion mark.

All of that should translate into very strong profit growth. And considering the technology lead and relationships ASML already has with the largest foundries in the world, there shouldn’t be much standing in the way of achieving those numbers.

Will this be the next big stock split?

ASML currently trades around $835 per share. While that’s well off its all-time high of around $1,100, it’s still quite a lofty price. Stocks have split with far lower prices.

The company last executed forward splits in the late 1990s and the year 2000 amid the dot-com boom. With a strong outlook based on the ongoing spending to build the next generation of AI chips, ASML could be motivated to split its shares in the near future as it sees significant growth ahead.

Even without a stock split, you should consider adding shares to your portfolio. The stock currently trades around 26 times forward earnings expectations. Given the potential for strong and predictable revenue increases and margin expansion for years to come, the company should be able to produce earnings growth that more than justifies that slight premium to the overall S&P 500. And when you compare ASML’s price to other AI stocks, it’s an absolute bargain.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Adam Levy has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Lam Research, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

This Could Be the Next Big Artificial Intelligence (AI) Stock Split. Here’s Why You Should Buy It Before It Happens. was originally published by The Motley Fool

Nvidia's AI summit, Tesla's robotaxi, Amazon Prime Day, inflation: What to watch in the markets this week

Last week closed on a positive note, with two key developments easing concerns about the economy. A strong jobs report helped calm fears of a weakening labor market, while the resolution of the dockworkers’ strike alleviated worries about supply chain disruptions. In addition, oil prices, which had surged early in the week due to Middle East tensions, saw a welcome pullback by the weekend.

This week promises to be action-packed, with plenty on the horizon. With this wave of optimism, let’s dive into what the coming week has in store.

Three-day Nvidia AI summit

NVIDIA’s AI Summit kicks off Monday, running from Oct. 7-9 in Washington, D.C. The three-day event will bring together industry leaders to explore how AI can tackle some of society’s biggest challenges. With a focus on healthcare, cybersecurity, manufacturing, and more, the summit will highlight AI’s potential to drive innovation across key sectors.

Amazon’s two-day Prime Day sale

Amazon’s (AMZN) highly anticipated two-day Prime Day sale event kicks off Tuesday, offering a valuable glimpse into consumer behavior and e-commerce trends. The sale will provide key insights into what products shoppers are prioritizing, as well as into the broader state of consumer demand. This event is expected to highlight popular categories and pricing strategies and could serve as a bellwether for the coming holiday shopping season.

Amazon’s recruitment strategy is partly driven by expectations that e-commerce spending will surpass overall holiday sales in the fourth quarter. The company’s Prime Day event earlier this year generated over $14.2 billion in online sales, marking one of the biggest e-commerce events of the year.

Musk will finally unveil robotaxi

Tesla (TSLA) CEO Elon Musk will finally unveil the highly anticipated Robotaxi on Thursday at Warner Bros. Studios (WBD) in Los Angeles, California. Dubbed “We, Robot,” the event will show the first look at the prototype and the booking platform for owners and riders. There will be also an update to the company’s Full Self-Driving (FSD) technology, which powers the robotaxis, along with a production timeline and the service launch date.

Beginning of the financial giants’ earnings

PepsiCo (PEP) is set to report its earnings ahead of the closing bell Tuesday. Then, Thursday, Delta Air Lines (DAL), Infosys (INFY), and Domino’s Pizza (DPZ) are scheduled to release their earnings before the market opens. The week will close with major banks taking center stage Friday, as JPMorgan Chase (JPM), Wells Fargo (WFC), BlackRock (BLK), and the BNY Mellon (BK) lead off the quarterly earnings season for the financial sector.

Inflation data due this week

The Consumer Credit report for September is set to be released Monday. Midweek (on Wednesday), investors will keep an eye on the Wholesale Inventories data for August, along with the minutes from the Federal Reserve’s September FOMC meeting, which could provide insights into the central bank’s next moves.

Thursday will bring a trio of key data releases, including initial jobless claims, the consumer price index (CPI), and core CPI, offering a detailed look at inflation and labor market trends. Finally, on Friday, the producer price index (PPI) and core PPI will be released alongside preliminary consumer sentiment data for October, rounding out the week with a comprehensive view of inflationary pressures and consumer outlooks.

– Francisco Velasquez contributed to this article

Prediction: 2 Stocks That Will Be Worth More Than Nvidia 5 Years From Now

Nvidia achieved a $3 trillion market cap earlier this year, an impressive achievement considering that it was approximately one-tenth that size two years ago. The advent of generative artificial intelligence (AI) has drawn investors to the stock amid its lead in graphics processing units, which are essential to AI.

However, slowing growth could set Nvidia up for a fall due to its massive valuation. Such a drop would open the door for other stocks to achieve higher market caps five years from now. Considering the trends across the tech sector, these two stocks could certainly surpass it.

Taiwan Semiconductor

My choice of Taiwan Semiconductor Manufacturing (NYSE: TSM) might raise some eyebrows, given its relationship with Nvidia and its peers. As the leading manufacturer of advanced semiconductors, TSMC (as it’s known for short) plays an indispensable role in bringing AI to the world.

Unfortunately for TSMC shareholders, it has so far not benefited from the premiums that have helped its clients, such as Nvidia. The reasons are not clear although fab companies typically have not traded at high valuations. Also, TSMC operates in the geopolitically contentious Taiwan region, leading some investors to avoid it for fear of an invasion of the island.

Nonetheless, the market might not have properly assessed this risk. For one, China also depends on TSMC chips, which should make an invasion less likely. And since TSMC produces chips in Taiwan, it stands to reason that its largest clients would also face this risk, yet the market seems to overlook such possibilities in Nvidia’s case.

Moreover, if investors start discounting Nvidia, valuations could turn in TSMC’s favor. Right now, the former sells at a price-to-sales (P/S) ratio of 31, well above TSMC’s multiple of 12.

Still, TSMC also makes AI chips for companies such as Advanced Micro Devices and Qualcomm. Hence, even if Nvidia remains dominant, this competition could hurt its pricing, leading to lower revenue and multiple compression.

In contrast, TSMC’s market capitalization is around $900 billion. Hence, a doubling of its P/S ratio and a halving of Nvidia’s would give TSMC a larger market capitalization. This does not factor in the revenue growth that should benefit both companies over the next five years. However, it shows how Nvidia might not be as far ahead of TSMC as it appears.

Once Nvidia feels more of the effects of its likely unsustainable valuation, TSMC could easily be well-positioned to surge ahead of its high-profile client.

Tesla

Investors likely know electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) best for its cars or possibly its battery technology. At a market capitalization of $835 billion, it is currently the smallest of the “Magnificent Seven” stocks.

The Tesla Solar Roof and the Powerwall hold potential for growth, but that product category made up less than 12% of revenue in the second quarter of 2024. And the more than 830,000 vehicles the company sold in the first half of 2024 represented a 7% drop from 2023.

Its savior could be Autopilot, its self-driving technology that continues to make significant strides. It still requires human supervision for now, but Tesla and its supporters envision turning it into a lucrative subscription business once it achieves full autonomy.

So powerful is this potential that Cathie Wood of ARK Invest believes this technology will make up around 90% of earnings by 2029. By her calculations, that would take the price for Tesla stock to $2,600 per share, an approximate tenfold increase that would put the market cap at $8.4 trillion!

In such a scenario, it likely makes the valuation comparisons between Tesla and Nvidia irrelevant — the EV maker’s P/E of 73 is higher than the chipmaker’s 57 earnings multiple. Still, even if Tesla stock pulled back to Nvidia’s P/E, a tenfold increase would take the market cap to $6.5 trillion, far surpassing Nvidia’s current size.

Lastly, as previously mentioned, Nvidia could experience multiple compression as competitors eat away at some of its market share in the AI chip market. Tesla’s self-driving opportunity has yet to take off in earnest, so even partial success could supercharge the stock enough to overtake Nvidia.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Will Healy has positions in Advanced Micro Devices and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.

Prediction: 2 Stocks That Will Be Worth More Than Nvidia 5 Years From Now was originally published by The Motley Fool

US Inflation Is Set to Reassure a Labor Market-Focused Fed

(Bloomberg) — US inflation probably moderated at the end of the third quarter, reassuring a Federal Reserve that’s shifting more of its policy focus toward shielding the labor market.

Most Read from Bloomberg

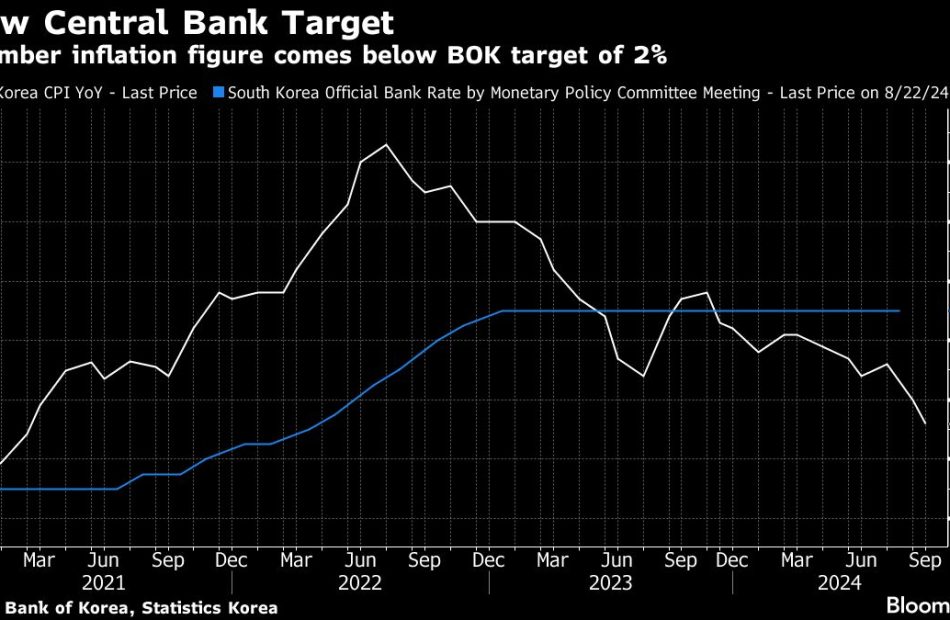

The consumer price index is seen rising 0.1% in September, its smallest gain in three months. Compared with a year earlier, the CPI probably rose 2.3%, the sixth-straight slowdown and the tamest since early 2021. The Bureau of Labor Statistics will issue its CPI report on Thursday.

The gauge excluding the volatile food and energy categories, which provides a better view of underlying inflation, is projected to rise 0.2% from a month earlier and 3.2% from September 2023.

In the wake of surprisingly strong job growth for September reported on Friday, the gradual slowdown in inflation suggests policymakers will opt for a smaller interest-rate cut when they next meet on Nov. 6-7.

Fed Chair Jerome Powell has said projections issued by officials alongside their September rate decision point toward quarter-point rate cuts at the final two meetings of the year.

The CPI and producer price index are used to inform the Fed’s preferred inflation measure, the personal consumer expenditures price index, which is set for release later this month.

What Bloomberg Economics Says:

“We expect a subdued headline CPI in September, though a more robust core reading. Mapped into PCE inflation — the Fed-preferred price gauge — core inflation likely grew at a pace consistent with the 2% target. Altogether, we don’t think the report will do much to sway the FOMC’s confidence that inflation is on a durable downtrend.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

Friday’s report on producer prices — a gauge of inflationary pressures faced by businesses — is also projected to show tamer inflation. The same day, the University of Michigan issues its preliminary October consumer sentiment index. The Fed will also release minutes of the central bank’s September meeting on Wednesday.

Neel Kashkari, Alberto Musalem, Adriana Kugler, Raphael Bostic and Lorie Logan are among an array of Fed officials speaking in the coming week.

In Canada, officials will release the final jobs report before the next Bank of Canada rate decision, a crucial input for Governor Tiff Macklem, who expects to see further loosening of the labor market. The central bank will also publish surveys of business and consumer expectations for economic growth and inflation.

Elsewhere, central banks from New Zealand to South Korea may cut rates, France will reveal its budget, and the European Central Bank will publish minutes of its September policy meeting.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

It’s a big week for monetary policy in Asia, with two central banks likely to cut rates and another inching closer to doing so.

The Reserve Bank of New Zealand is expected to follow its August pivot to an easing cycle by trimming rates by a half percentage point, to 4.75%, when the board meets on Wednesday, as weakness in payroll data kindles labor market concerns.

The Bank of Korea will probably trim its benchmark by a quarter point on Friday after inflation decelerated to the slowest pace in more than three years, with the decision hinging on whether conditions in the housing market have cooled enough.

The Reserve Bank of India is seen holding its repurchase rate and cash reserve ratio steady, with many economists looking for a quarter-point cut to the repo rate by year-end. And Kazakhstan’s central bank will decide on Friday whether to resume its easing campaign.

On Tuesday, the Reserve Bank of Australia releases minutes from its September meeting that may shed light on the deliberations that led to its hawkish hold, and the RBA’s No. 2, Andrew Hauser, speaks the same day.

Japan gets wage statistics and household spending data, both of which are of interest to the newly installed government ahead of a general election at the end of the month.

Singapore is set to report third-quarter gross domestic product some time between Thursday and Monday — with the consensus estimate looking for an acceleration of growth year on year.

Data published Sunday showed that Vietnam’s economic growth unexpectedly accelerated last quarter, boosted by manufacturing and exports before a super typhoon in September caused widespread damage and halted farm and factory output.

Consumer inflation data are due from Thailand and Taiwan, while the Philippines and Taiwan publish trade figures.

Europe, Middle East, Africa

Germany’s manufacturing woes will be in focus with the release of factory orders on Monday and industrial production on Tuesday, followed by government economic forecasts on Wednesday.

Officials are poised to abandon hope of achieving any expansion at all this year, according to people familiar with the matter. Sueddeutsche Zeitung reported over the weekend that Berlin now expects a 0.2% contraction for 2024.

In France, Prime Minister Michel Barnier’s government is set to present its 2025 budget bill on Thursday, at a time when the country is struggling to tame its deficit. Fitch Ratings has scheduled the possible release of an assessment on the country for after the market close on Friday.

For the European Central Bank, Wednesday is the final day for officials to speak publicly on monetary policy before a blackout period kicks in ahead of the Oct. 17 decision, at which a rate cut seems a near certainty.

Chief economist Philip Lane, Bundesbank President Joachim Nagel, and Bank of France Governor Francois Villeroy de Galhau are among those scheduled to make appearances. An account of the previous meeting will be published on Thursday, providing possible clues on the upcoming judgment.

In the UK, meanwhile, in the wake of remarks by Bank of England Governor Andrew Bailey that opened the door to more aggressive easing, GDP data on Friday will point to the health of the economy in August.

Two Riksbank officials are scheduled to speak after the Swedish central bank delivered a third rate cut in September. Sweden’s monthly growth indicator will be published on Thursday.

Turning south, authorities in Egypt will hope inflation resumed its slowdown in September after a slight acceleration the prior month. The last reading was 26%, slightly below the central bank’s base rate of 27.25%.

Three central bank decisions are scheduled around the region:

-

On Tuesday, Kenya’s monetary policy committee is set to reduce its key rate for a second straight meeting by a quarter point, to 12.25%. Inflation is expected to remain below its 5% target in the near term after slowing to a 12-year low in September.

-

On Wednesday, Israeli officials are likely to keep their rate on hold again at 4.5%, even as peers start or continue easing cycles. The war against Hamas in Gaza and escalating conflicts with Hezbollah and Iran are weighing on the shekel, which is near a two-month low. The country’s credit rating was recently cut by Moody’s and S&P.

-

Serbia’s central bank makes its monthly decision on Thursday, possibly continuing with monetary easing after a quarter-point cut in September.

Latin America

By the end of the week, third-quarter consumer price data for all five of Latin America’s big inflation-targeting economies will be in the books.

Lower readings can be expected in Chile, Colombia and Mexico, while the unmistakable heating up of Brazil’s economy and prices likely continued in September. All four central banks target inflation of 3%.

In Brazil, aside from the central bank’s expectations survey posted Monday, the August retail sale report may show a slight cooling from what’s been a brisk set of 2024 readings.

The minutes of Banxico’s Sept. 26 meeting will be the highlight out of Mexico. Policymakers sounded a dovish tone in their post-decision statement’s forward guidance after a second-straight 25 basis point rate cut to 10.5%.

In Peru, September’s month-on-month deflation and a below-target 1.78% annual print likely greenlights a third straight central bank rate reduction from the current 5.25%.

After rapidly reining in overheated consumer price increases, Argentine President Javier Milei’s inflation fight appears stalled, with successive monthly prints near 4%. Economists surveyed by the central bank see modest slowing ahead under the current policy mix.

–With assistance from Robert Jameson, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek and Paul Wallace.

(Updates with Germany in EMEA section)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.