After Microsoft's Landmark Deal With Constellation Energy, Could This Little-Known Stock Be the Next Big Opportunity in Nuclear Power?

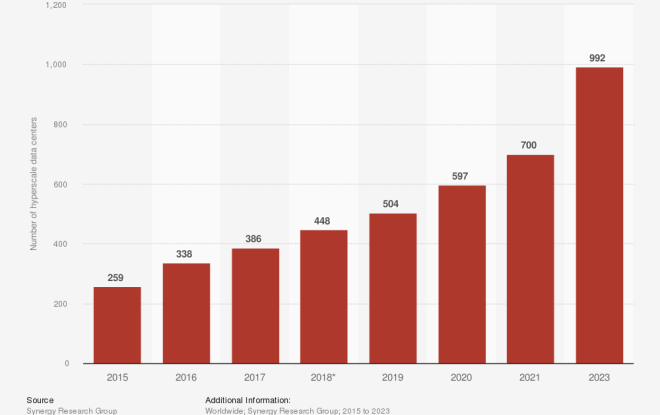

Data centers house IT architecture such as server racks that store advanced chipsets called graphics processing units (GPU) — a critical piece of infrastructure for AI development.

One drawback of data centers, however, is power consumption. Since GPUs are running sophisticated algorithms around the clock, data centers experience high levels of heat and consume a lot of energy. At the moment, some of the most common pieces of equipment outfitting data centers include air conditioning units, fans, and generators.

While these products work, there are questions about their long-term viability. For this reason, nuclear power is emerging as an alternative and more efficient solution over traditional data center energy solutions.

Just a couple of weeks ago, Microsoft signed a deal with Constellation Energy, and the two companies are looking to restart nuclear power plants on Three Mile Island in Pennsylvania. Shares of Constellation have been surging on the news of this partnership. Naturally, investors are now looking for the next big opportunity at the intersection of AI and nuclear power.

Below, I’ll explore a little-known nuclear power company called Oklo (NYSE: OKLO) and assess if the stock could be a lucrative opportunity.

What is Oklo?

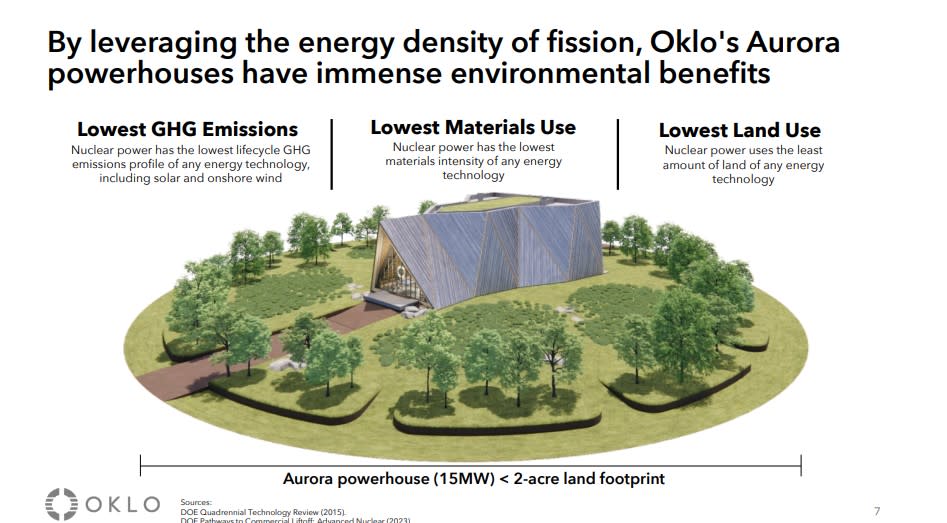

According to its website, Oklo is a “fission technology and nuclear fuel recycling company.” Its core project is called the Aurora powerhouse, which is essentially a fission reactor that leverages recycled nuclear waste. This technology could revolutionize data center operations, making them less reliant on traditional power grids.

Oklo looks impressive on the surface, but…

Before going public, Oklo received funding from a number of high-profile venture capital firms. Among its more notable investors are OpenAI CEO Sam Altman and billionaire Silicon Valley legend Peter Thiel. Moreover, the company has received interest for its reactors from the likes of Diamondback Energy, Equinix, Centrus Energy and the United States Air Force.

On the surface, Oklo looks pretty impressive. But smart investors know there is always more to uncover when assessing smaller businesses. Oklo is no exception, and I’ve found some important things to keep in mind with this under-the-radar energy stock.

…investors should keep the following in mind

Oklo started trading on the New York Stock Exchange back in May after merging with a special purpose acquisition company (SPAC). SPACs are a somewhat unusual way of going public, as they circumvent traditional underwriting processes at investment banks. Over the last couple of years, SPACs have risen in popularity.

Here’s the inconvenient reality of SPAC stocks. Many market themselves as cutting-edge businesses, but have yet to show tangible results. As a result, after an initial surge fueled by investor euphoria, SPAC stocks often wind up selling off as a more sober assessment sets in.

According to a study at the University of Florida, renewable energy SPACs have a median return of negative 84% between 2009 and 2024. It’s too early to tell where Oklo’s share price will end up, but I see some reasons why the stock could begin to decline.

While the Aurora powerhouse carries some allure, Oklo’s first plant isn’t expected to be functional until 2027. Until then, the company will likely remain a pre-revenue business that requires ongoing investment in capital expenditures (capex). As a result, I would not be surprised to see the company pressed for liquidity and potentially dilute shareholders in an effort to keep the operation afloat.

I find Oklo’s nuclear power solutions intriguing, but I have my doubts about how investable the business is at its current stage. For now, I see Oklo as quite risky and, at best, a speculative opportunity.

I think the more prudent strategy is to invest in higher-quality businesses that are already making moves at the crossroads of nuclear power and AI. In addition to Microsoft and Constellation Energy, Amazon and Vistra are some big names worth keeping an eye on. As far as Oklo goes, I think it’s best to sit on the sidelines and monitor the company’s progress over time.

Should you invest $1,000 in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Microsoft. The Motley Fool has positions in and recommends Amazon, Constellation Energy, Equinix, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

After Microsoft’s Landmark Deal With Constellation Energy, Could This Little-Known Stock Be the Next Big Opportunity in Nuclear Power? was originally published by The Motley Fool

Leave a Reply