MRNA DEADLINE TUESDAY: ROSEN, A LEADING LAW FIRM, Encourages Moderna, Inc. Investors with Losses in Excess of $100K to Secure Counsel Before Important October 8 Deadline in Securities Class Action – MRNA

NEW YORK, Oct. 06, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Moderna, Inc. MRNA between January 18, 2023 and June 25, 2024, both dates inclusive (the “Class Period”), of the important October 8, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Moderna securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Moderna class action, go to https://rosenlegal.com/submit-form/?case_id=27873 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 8, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) mRNA-1345, an mRNA respiratory syncytial virus (“RSV”) vaccine intended to protect adults aged 60 and above from lower respiratory tract disease cause by RSV infection, was less effective than defendants had led investors to believe; (2) accordingly, mRNA-1345’s clinical and/or commercial prospects were overstated; and (3) as a result, the Company’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Moderna class action, go to https://rosenlegal.com/submit-form/?case_id=27873 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Self-Storage Facilities Offer One Month Free Helene Relief Assistance

Memphis, TN October 04, 2024 –(PR.com)– Properties managed by Absolute Storage Management and located in the path of Hurricane Helene are extending a helping hand to those affected by Hurricane Helene. To support communities in impacted regions, properties managed by Absolute Storage Management are offering One Month Free Storage with No Hidden Fees. This offer includes one month of storage, tenant insurance, a lock, and no administrative fees.

This special promotion is available to anyone in need of storage as a result of Hurricane Helene. No proof of impact is required to take advantage of this offer, making it accessible to all.

The offer is valid through October 7th, and exclusions apply based on availability. Residents seeking more information about rental availability and the discount should contact their nearest participating facility, which are listed alphabetically by city.

For further details, please reach out to the nearest Absolute Storage Management location.

Participating Facilities

Boxville Storage

Athens, GA

BoxvilleStorage.com

Crawford Storage

Crawford, GA

storagecrawford.com

Arnoldsville Storage

Crawford, GA

ArnoldsvilleStorage.com

Watkinsville Storage

Watkinsville, GA

watkinsvillestorage.net

Silo Self Storage

Monroe, GA

siloselfstorage.com

Chase St Self Storage

Athens, GA

ugastorage.com

Walton Security Storage

Monroe, GA

waltonsecuritystorage.com

Commerce Storage

Commerce, GA

CommerceStorageGA.com

Covington Stor It

Covington, GA

covingtonstorit.com

Budget of Covington Storage

Covington, GA

budgetcovington.com

All Season Storage

Morristown, TN

allseasonstoragemorristown.com

All Season Storage

Kingsport, TN

allseasonstoragekingsport.com

Princeton Self Storage

Johnson City, TN

princetonselfstorage.net

Pikeville Mini Storage

Pikeville, KY

pikevilleministorage.com

Pleasantdale Storage of Doraville

Doraville, GA

doravillestorage.com

McFarland Parkway Storage

Alpharetta, GA

mcfarlandpkwystorage.com

Star Storage

Cumming, GA

starstoragebuford.com

Star Storage

Cumming, GA

starstorage.com

Peachtree Parkway Self Storage

Cumming, GA

peachtreePkwy.com

Star Storage

Cumming, GA

starstoragecoalmt.com

Matt Highway Storage

Cumming, GA

MattHighwayStorage.com

Flakes Mill Storage

Decatur, GA

flakesmillstorage.com

Kennesaw Self Storage

Kennesaw, GA

kennesawstorage-ga.com

Milton Self Storage

Milton, GA

selfstoragemilton.com

Ellenwood’s Best Storage

Ellenwood, GA

ellenwoodsbeststorage.com

Atlanta’s Best Storage

Atlanta, GA

atlantasbeststorage.com

Hillcrest Storage

Mableton, GA

hillcreststorage.org

East Cherokee Storage

Woodstock, GA

eastcherokeess.com

Lithia Springs Self Storage

Lithia Springs, GA

lithiaspringsstorage.com

Premier Storage Hamilton Mill

Buford, GA

premierathamiltonmill.com

Woodruff Lakeside Storage

Midland, GA

WoodruffStorageLakeside.com

Woodruff Storage

Columbus, GA

storagewoodruff.com

All Season Storage

Mobile, AL

storageseasons.com

Lumpkin 400 Storage

Dahlonega, GA

lumpkin400selfstorage.com

Storage Box

Phenix City AL

storageboxphenixcity.com

All Season Storage

Mobile, AL

allseasonstoragewestmobile.com

Freeway Self Storage

Phenix City, AL

freewayselfstorage.com

Crestview Storage

Crestview, FL

Crestview-Storage.com

The Storage Inn

Lynn Haven, FL

TheStorageInn.com

Magnolia Self Storage

Sanford, FL

sanfordselfstorage.com

Flying Tiger Storage

Valdosta, GA

FlyingTigerStorage.com

The Storage Place

Niceville, FL

thestorageplacefl.com

Augusta’s Best Storage

Augusta, GA

augustasbeststorage.com

Attic Nook

Augusta, GA

atticnook.com

AAA Self Storage

Augusta, GA

aaamilledgeville.com

AAA Dean’s Bridge Storage

Augusta, GA

aaadeans.com

Absolute Storage of Aiken

Aiken, SC

absoluteaiken.com

Hub City

Spartanburg, SC

hubcitystorage.net

Pelham Road Storage

Greenville, SC

pelhamroadstorage.com

All About Storage

Monroe, NC

aaslynn.com

All About Storage

Concord, NC

aasconcord.com

Optimist Club Road Storage

Denver, NC

optimiststorage.com

Absolute Storage Management

Absolute Storage Management (Absolute) is a leading provider of private, third-party self-storage management. Founded in 2002, Absolute’s headquarters are in Memphis, TN with regional offices in Atlanta, GA; Charlotte, NC; Nashville, TN; and Tampa, FL. The company’s mission is to grow successful partnerships with customers, team members, and investors by delivering excellence in service.

For further information and news about Absolute Storage Management, please go to the Absolute website at www.AboutASM.com. Contact Jasmin Jones at jasmin.jones@absolutemgmt.com.

Contact Information:

Absolute Storage Management

Jasmin Jones

901-737-7336

Contact via Email

AboutASM.com

Read the full story here: https://www.pr.com/press-release/922196

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 FAANG Stocks That Could Crush the S&P 500 Through 2030

Building wealth in the stock market is not complicated. It simply involves holding shares of consistently growing companies over many years. In the last decade, a small group of elite growth stocks became the default choice for investors looking to earn above-average returns. These became known as FAANG stocks, which include the following:

You can make a case for buying all of these stocks. They all have solid competitive advantages and favorable long-term prospects, although some offer more compelling return potential than others.

If you’re looking for the best FAANG stocks to beat the historical 10% return of the S&P 500 index, here are two I’d put my money on.

1. Amazon

Amazon is a large business with $604 billion in trailing-12-month revenue, but the company continues to grow at rates that can support market-beating returns.

Trailing-12-month revenue is up 12% year over year through the company’s second quarter (ended June 30), with the highest rates of growth coming from non-retail services like advertising and cloud computing. While revenue from online stores grew only 6%, Amazon’s efforts to lower costs, improve fulfillment efficiency, and speed up delivery could translate to further share gains in the e-commerce market.

Year to date, Amazon has delivered more than 5 billion units within one day. Faster shipping speed appears to be leading to the desired outcome, which is increasing order frequency, as management reported an acceleration in its everyday essentials business in the second quarter. This shows Amazon strengthening its competitive advantage in retail.

The efficiency gains in fulfillment are also leading to higher profits. Operating income nearly doubled in Q2 to $14.7 billion over the year-ago quarter. There are still plenty of opportunities to reduce costs, including expanding the use of automation and robotics and consolidating multiple orders to one box. The company could expand margins for several years, considering the growth opportunities in lucrative non-retail businesses like Amazon Web Services and advertising.

Analysts expect Amazon’s earnings to grow at an annualized rate of 22% in the coming years. Even allowing for a lower price-to-earnings (P/E) ratio over the next six years, Amazon investors could potentially double their money by 2030 and beat the S&P 500.

2. Netflix

Netflix has grown into a large entertainment business over the last decade with 277 million subscribers. But this doesn’t mean its return potential is over. The company is still growing revenue at double-digit rates and opportunities to grow profits by expanding margins make it a great stock to hold for the next six years.

Netflix turned in stellar results in Q2 (ended June 30), with revenue and global paid memberships up nearly 17% year over year. The company continues to see a positive impact on subscriber growth from paid sharing, which is putting an end to password sharing among members and boosting revenue.

Netflix already earns industry-leading margins in entertainment, with an operating margin of 27% in Q2. Management is committed to increasing margins every year, but considering it’s very early in scaling its advertising business, there is a long runway of opportunity to grow profits.

Moreover, Netflix still has an attractive revenue growth opportunity. There are more than 1 billion broadband users worldwide, and more than 5 billion basic internet users. Netflix still has a small share of connected TV penetration, which could provide years of gradual growth in subscribers globally.

All told, Netflix can deliver solid growth for many years. Analysts expect Netflix’s earnings to grow 27% on an annualized basis, yet the stock trades at a forward P/E of 31 on 2025 earnings estimates — a reasonable valuation for this much earnings potential. Investors can expect Netflix stock to climb along with earnings, which should easily lead to market-beating returns through 2030.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Ballard has positions in Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, and Netflix. The Motley Fool has a disclosure policy.

2 FAANG Stocks That Could Crush the S&P 500 Through 2030 was originally published by The Motley Fool

Palantir Stock vs. Nvidia Stock: Wall Street Says Sell One and Buy the Other

Palantir Technologies (NYSE: PLTR) and Nvidia (NASDAQ: NVDA) are two of the hottest artificial intelligence (AI) stocks on Wall Street. In fact, with year-to-date returns of 132% and 150%, respectively, they rank among the five best-performing components of the S&P 500.

However, Wall Street expects the stocks to move in opposite directions over the next year.

-

Among the 23 analysts who follow Palantir, the median price target is $27 per share, which implies 32% downside from its current share price of $40.

-

Among the 65 analysts following Nvidia, the median price target is $150 per share, which implies 20% upside from the current share price of $125.

Furthermore, Palantir is the most overvalued stock in the S&P 500 based on the difference between its current price and median price target. Meanwhile, according to FactSet Research, Nvidia ranks among the most highly recommended stocks in the S&P 500 in terms of its percentage of buy ratings.

Suffice it to say Wall Street is overwhelmingly bearish on Palantir but very bullish on Nvidia. Here are the most important details for investors.

Palantir Technologies: 32% downside implied by the median price target

Palantir has deep roots in counterterrorism and clandestine military operations. The company spent its earliest days building analytics software for federal agencies in the U.S. intelligence community. But it has since expanded its customer base to include international governments and commercial organizations.

Palantir’s data operations platforms, Foundry and Gotham, let customers incorporate data and machine learning models into analytical applications that improve decision-making. And its AI platform, AIP, allows commercial and government clients to use large language models and generative AI within Foundry and Gotham.

Some analysts have lauded Palantir for its sophisticated technology. For instance, it was a top-ranked vendor in Dresner Advisory Services’ 2024 market study on artificial intelligence, data science, and machine learning platforms. Forrester Research recently recognized its leadership in AI and machine learning platforms.

Other analysts are less impressed. Gartner scored Palantir below a dozen other vendors in data integration capabilities, citing overreliance on consulting services. That means some clients find Palantir’s software so complex that they struggle to use it independently. Gartner also omitted Palantir in its latest report on data science and machine learning platforms.

Palantir reported second-quarter financial results that exceeded expectations on the top and bottom lines. Revenue rose 27% to $678 million, the fifth consecutive acceleration in sales growth. Meanwhile, non-GAAP (generally accepted accounting principles) net income increased by 80% to $0.09 per diluted share. And management provided better-than-expected guidance for the third quarter.

The only real problem with the stock is its valuation. Wall Street expects Palantir’s earnings to increase at 21% annually through 2026. That estimate makes the present valuation of 125 times adjusted earnings look absurdly expensive. As mentioned, Palantir is the most overvalued stock in the S&P 500 based on the discrepancy between its median price target and current price.

So, either Wall Street analysts have grossly underestimated Palantir, or shares are headed for a significant correction in the future. Either way, investors can save themselves a lot of trouble by avoiding Palantir stock right now, and shareholders should at least consider trimming their positions.

Nvidia: 20% upside implied by the median price target

Nvidia is best known for inventing graphics processing units (GPUs), semiconductors that perform technical calculations much faster and more efficiently than central processing units (CPUs). Nvidia GPUs are the gold standard in accelerating computationally demanding data center workloads like AI training and inference.

Last year, Nvidia accounted for 98% of data center GPU shipments, and the company currently has more than 80% market share in AI chips, according to analysts. That dominance is partially due to superior hardware. But it’s also a product of the company’s broad portfolio that spans adjacent hardware, like networking gear and server processors, as well as software and cloud infrastructure services designed to support AI workflows.

To quote Zoe Thomas of The Wall Street Journal, “Nvidia already dominates the market for chips powering the artificial intelligence boom. Now the company is playing a growing role in designing AI data centers.” That affords Nvidia an important competitive advantage. The company not only monetizes AI in multiple ways but can also provide customers with a complete AI system rather than individual components.

Nvidia reported strong financial results in the second quarter of fiscal 2025 (ended July 2024). Revenue increased 122% to $30 billion on strong demand for AI hardware and software. Meanwhile, non-GAAP earnings increased 152% to $0.68 per diluted share. Only one metric was moderately disappointing. Gross profit margin declined 3.3 percentage points sequentially, which may signal a slight weakening in pricing power due to increased competition from other chipmakers.

Going forward, Wall Street expects Nvidia’s adjusted earnings to increase at 35% annually through fiscal 2027 (ends January 2027). Compared to that estimate, the current valuation of 56.6 times adjusted earnings is fair and certainly much more reasonable than Palantir’s price tag. Patient investors should consider buying a small position in Nvidia stock today and building a slightly larger position if shares fall 10% to 20% in the future.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Trevor Jennewine has positions in Nvidia and Palantir Technologies. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Palantir Stock vs. Nvidia Stock: Wall Street Says Sell One and Buy the Other was originally published by The Motley Fool

FLUX POWER HOLDINGS, INC. ANNOUNCEMENT: If You Have Suffered Losses in Flux Power Holdings, Inc. (NASDAQ: FLUX), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Oct. 06, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of Flux Power Holdings, Inc. FLUX resulting from allegations that Flux Power may have issued materially misleading business information to the investing public.

So What: If you purchased Flux Power securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=28783 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On September 5, 2024, after the market closed, Flux Power Holdings, Inc. filed a current report on Form 8-K with the SEC, in which it announced “[o]n August 30, 2024, the Board of Directors of Flux Power Holdings, Inc. (the “Company”) including its audit committee members, concluded that the previously issued audited consolidated financial statements as of and for the fiscal year ended June 30, 2023 and the unaudited consolidated financial statements as of and for the quarters ended September 30, 2023, December 31, 2023, and March 31, 2024 (collectively, the “Prior Financial Statements”), which were filed with the Securities and Exchange Commission (“SEC”) on September 21, 2023, November 9, 2023, February 8, 2024 and May 13, 2024, respectively, should no longer be relied upon because of errors in such financial statements relating to the improper accounting for inventory and a restatement should be undertaken.”

On this news, Flux Power’s common stock fell $0.17 per share, or 5.36%, to close at $3.00 per share on September 6, 2024. The next trading day, it fell a further $0.12 per share, or 4%, to close at $2.88 per share on September 9, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lincoln Avenue Communities Hosts Family Resource Day for Affordable Housing Residents in Everett, Washington

Residents of Bluffs at Evergreen Apartments engaged with local organizations that offer social services, community programs and other resources.

EVERETT, Wash., Oct. 4, 2024 /PRNewswire/ — Lincoln Avenue Communities (LAC), a mission-driven acquirer and developer of affordable housing, hosted a Family Resource Day event for Bluffs at Evergreen Apartments residents. Bluffs at Evergreen Apartments provides one-to-two-bedroom units to low-income residents in Snohomish County.

“Our Family Resources Days build a strong sense of community and provide residents with essential resources,” said Jeremy Bronfman, founder and CEO of LAC. “We are proud to partner with leading service providers in Everett to support our residents.”

Representatives from Connect Casino Road, Casino Road Kids Ministries, Evergreen Goodwill, Guardian Patrol, Spectrum Wifi, Pim Savvy, Snohomish County Legal Services, Everett Police Department and Everett Community College engaged and spoke with the Bluffs at Evergreen community. The Family Resource Day provided residents the opportunity to learn about educational and professional development opportunities and other community aid resources.

“We are determined to support our residents through Family Resource Days,” said Rebecca Shultz, LAC Vice President of Asset Management. “LAC’s community events enhance the overall welfare of our residents by connecting them to local resources in the broader community.”

LAC regularly hosts Family Resource Days at its affordable housing properties across the country in conjunction with Fairview Housing Partners, a national nonprofit affordable housing organization.

About LAC: Lincoln Avenue Communities (LAC) is one of the nation’s fastest-growing developers, investors, and operators of affordable and workforce housing, providing high-quality, sustainable homes for lower- and moderate-income individuals, seniors, and families nationwide. A subsidiary of Lincoln Avenue Capital, LAC is a mission-driven organization with a presence in 28 states and a portfolio of 155 properties comprising 27,000+ units.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lincoln-avenue-communities-hosts-family-resource-day-for-affordable-housing-residents-in-everett-washington-302267949.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lincoln-avenue-communities-hosts-family-resource-day-for-affordable-housing-residents-in-everett-washington-302267949.html

SOURCE Lincoln Avenue Communities

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

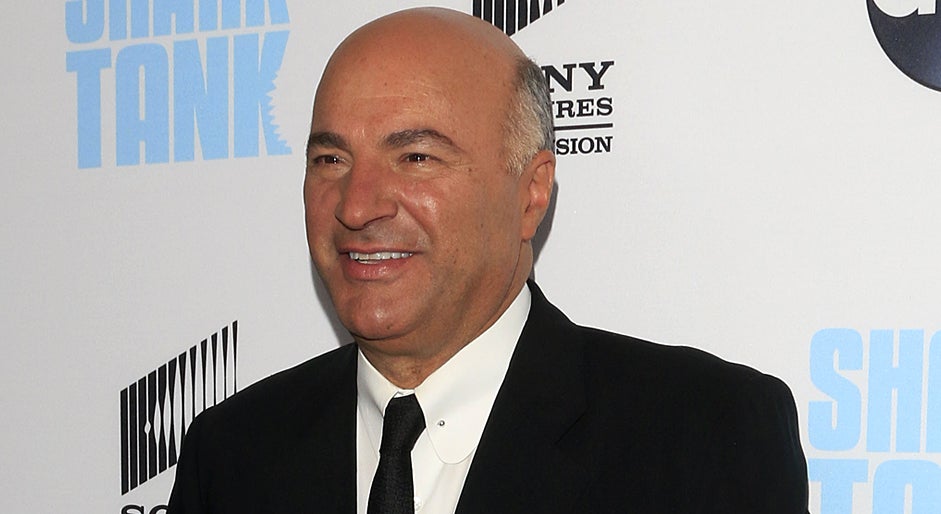

Kevin O'Leary Says Port Automation Won't Hurt Wages

With a major dockworkers’ strike on hold for now, entrepreneur Kevin O’Leary highlights the outdated infrastructure and rising tensions over union demands.

On Fox Business’ Varney & Co. on Friday, O’Leary remarked that East Coast ports are outdated and inefficient, reported Fox Business.

A major strike by the International Longshoremen’s Association halted trade at East and Gulf Coast ports, affecting billions in commerce. The union has agreed to continue under an expired contract through mid-January.

Also Read: Beer Shortage Ahead? 3 Products That Will Be Most Impacted By Port Strike

Leary went on to explain that when comparing East Coast ports to international ones like those in Singapore and other Asian locations, they fall short, which negatively impacts productivity.

O’Leary noted that studies on port automation reveal no negative impact on wages on the East and West Coasts. In fact, he argued that automation could enhance wages for employees skilled in using robotic systems, fostering job creation and promoting wage growth.

The strike ended Thursday night this week following the USMX’s offer to increase pay by 62%.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Huntington Ingalls Lands $9.5 Billion in New Navy Warship Orders

One for you, two for me. $6.75 billion for you … $9.5 billion for me.

For the longest time, the U.S. Navy has been dependent upon just two large military shipbuilders to build the bulk of its fleet: General Dynamics (NYSE: GD) and Huntington Ingalls (NYSE: HII). Essentially every submarine and destroyer in active service in the Navy today came from one of these companies. Beyond those two classes, General Dynamics also builds fuel replenishment ships and various other support vessels for the Navy, while Huntington Ingalls handles the construction of aircraft carriers and amphibious assault ships.

But while the Navy tries to divide its shipbuilding contracts between these two giant defense contractors roughly down the middle, sometimes it doesn’t work out that way.

A shipbuilding duopoly for Uncle Sam

Last month, for example, the U.S. Navy awarded General Dynamics a sole-source contract to build it eight John Lewis-class fleet replenishment oilers — vessels that refuel and resupply other ships while they are underway. All of those new oilers, hull numbers T-AO 214 through T-AO 221, are scheduled to be delivered by January 2035. The total value of that contract ran to $6.8 billion — and Huntington Ingalls wasn’t so much as asked to submit a bid on it. As the Pentagon explained in its contract announcement, “this contract was not competitively procured” — they just handed it to General Dynamics on a silver platter.

Some Huntington Ingalls shareholders might have been a bit miffed at that, but they shouldn’t have been. Just a couple of weeks later, Huntington Ingalls got two construction contracts of its own. At least one of these was also “not competitively procured,” and when combined, they add up to much more money than General Dynamics will get for the oilers.

Huntington Ingall’s new contracts

Valued at $5.8 billion, the first contract tasks Huntington Ingalls with designing and building three “Flight II” amphibious transport dock ships for the Navy, with hull numbers LPD 33, LPD 34, and LPD 35. Also known as landing platform docks (hence the “LPD” designation), these vessels specialize in transporting troops, landing vessels, and helicopters to theaters of conflict, there to disgorge them upon hostile shores.

Each Flight II vessel will be able to carry hundreds of marines and their equipment, along with a combination of up to four helicopters or V-22 Osprey vertical take-off and landing aircraft, as well as a combination of up to two “LCAC” landing hovercraft and or up to 14 amphibious assault vehicles.

Separately, Huntington Ingalls was awarded a $3.7 billion contract to begin work on building a new Flight I America-class amphibious assault ship. Also known as a landing helicopter assault ship (and LHA), this type of warship resembles a small aircraft carrier in appearance. According to Huntington Ingalls, in addition to carrying a Marine complement nearly three times as large as that on an LPD, a typical LHA might be equipped with five F-35B short take-off and landing stealth fighter jets, a dozen V-22s, a half dozen attack helicopters, and a half dozen search and rescue and transport helicopters.

What it means to investors

Armaments aside, what’s most interesting about these contracts to investors is the fact that, combined, Huntington Ingalls has just been awarded contracts worth about 50% more than those that General Dynamics won two weeks earlier.

That alone sounds pretty good, but the news gets even better when you realize that Huntington Ingalls is a much smaller (and more maritime-focused) company than General Dynamics, which is more of a defense contracting conglomerate, with businesses operating on land, air, and sea. This magnifies the importance of a large contract win for a (relatively) small company.

Huntington Ingalls carries a market capitalization of just $10.2 billion — a small fraction of General Dynamics’ $83.4 billion-plus market cap. What’s more, Huntington Ingalls’ has $11.8 billion in annual revenue, which makes it comfortably cheaper than my usual target valuation for defense contractors of 1.0 times sales. Huntington Ingalls is, in fact, valued at a bit less than 0.9 times sales — while General Dynamics today has a valuation of 1.9 times sales.

And now, in a single day, Huntington Ingalls has gained contracts worth nearly a full year of revenue.

Suffice it to say that, when evaluating defense stocks for future investment, Huntington Ingalls stock just moved to the top of my list. I’ve got nothing to say against General Dynamics as a company, but HII stock just looks like a better value to me.

Should you invest $1,000 in Huntington Ingalls Industries right now?

Before you buy stock in Huntington Ingalls Industries, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Huntington Ingalls Industries wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Huntington Ingalls Lands $9.5 Billion in New Navy Warship Orders was originally published by The Motley Fool

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against AMMO and Terran and Encourages Investors to Contact the Firm

NEW YORK, Oct. 05, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of AMMO, Inc. POWW and Terran Orbital LLAP. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

AMMO, Inc. POWW

Class Period: August 19, 2020 – September 24, 2024

Lead Plaintiff Deadline: November 29, 2024

On September 24, 2024, after the market closed, AMMO announced that its Chief Financial Officer had resigned “at the request of the Board.” Further, the Company disclosed that it is conducting an independent investigation into its “internal control over financial reporting for the fiscal years 2020 through 2023.” The Company further disclosed that it had retained a law firm to conduct an independent investigation into whether the Company and its management control persons at the time: “(i) accurately disclosed all executive officers, members of management, and potential related party transactions in fiscal years 2020 through 2023; (ii) properly characterized certain fees paid for investor relations and legal services as reductions of proceeds from capital raises rather than period expenses in fiscal years 2021 and 2022; and (iii) appropriately valued unrestricted stock awards to officers, directors, employees and others in fiscal years 2020 through 2022.”

On this news, the Company’s share price fell $0.08, or 5.26%, to close at $1.44 per share on September 25, 2024, on unusually heavy trading volume.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that the company lacked adequate internal controls over financial reporting; (2) that there was a substantial likelihood the Company failed to accurately disclose all executive officers, members of management, and potential related party transactions in fiscal years 2020 through 2023; (3) that there was a substantial likelihood the Company failed to properly characterize certain fees paid for investor relations and legal services as reductions of proceeds from capital raises rather than period expenses in fiscal years 2021 and 2022; (4) there was a substantial likelihood the Company failed to appropriately value unrestricted stock awards to officers, directors, employees and others in fiscal years 2020 through 2022; and (5) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

For more information on the AMMO class action go to: https://bespc.com/cases/POWW

Terran Orbital Corporation LLAP

Class Period: August 15, 2023 – August 14, 2024

Lead Plaintiff Deadline: November 26, 2024

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, the Complaint alleges that Defendants made false and/or misleading statements and/or failed to disclose that: (1) it would take much longer than Defendants had represented to investors and analysts for Terran to convert its contracts with its customers (collectively, “Customer Contracts”) into revenue and free cash flow; (2) Terran did not have adequate liquidity to operate its business while waiting for the Customer Contracts to generate revenue and free cash flow; (3) Terran had concealed the true scope and severity of its dire financial situation; and (4) as a result of the foregoing, Terran’s public statements were materially false and misleading at all relevant times.

For more information on the Terran class action go to: https://bespc.com/cases/LLAP

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Did Argentina's President Javier Milei Plagiarize 'The West Wing' In UN Speech?

In his debut address to the United Nations General Assembly, Argentine President Javier Milei delivered a speech that raised eyebrows for its striking resemblance to a key scene from the popular TV show “The West Wing.”

The similarities between Milei’s words and a monologue delivered by the fictional President Josiah Bartlet in the fourth season of the political drama have sparked discussions on whether the president’s speech was plagiarism or intentional homage, as reported by La Nación.

See Also: ‘Incestuous Milei’: Donald Trump’s Digital Slip With Javier Milei Parody Accounts Goes Viral On X

Prominent Argentine journalist Carlos Pagni was one of the first to point out the connection, highlighting the close alignment between Milei’s speech and Bartlet’s monologue.

Milei’s Speech At The UN

During his 15-minute address, Milei delivered a passage that many have noted bears an uncanny resemblance to Bartlet’s speech from “The West Wing.”

“We believe in freedom of speech for all; we believe in freedom of worship for all; we believe in free trade for all, and we believe in limited governments, all of them,” Milei said during last week’s speech. “And since in these times what happens in one country quickly impacts others, we believe that all peoples should live free from tyranny and oppression, whether it takes the form of political oppression, economic slavery, or religious fanaticism. That fundamental idea must not remain mere words; it must be supported by deeds, diplomatically, economically, and materially.”

This echoes a near-verbatim passage from the series’ 15th episode of season four.

“We’re for freedom of speech everywhere. We’re for freedom of worship everywhere. We’re for freedom to learn… for everybody. And as in our time, you can build a bomb in your country and bring it to mine, what happens in your country is my business.,” President Bartlet, played by Martin Sheen, said to his team in the Oval Office.

“That’s why we’re for freedom from tyranny everywhere, whether it takes the form of political oppression, Toby, or economic slavery, Josh, or religious fanaticism, C.J. That fundamental idea can’t be met simply with our support. It has to be met with our strength. Diplomatically, economically, materially.”

A Strategic Choice Or Plagiarism?

The resemblance between the two speeches is hard to ignore. Santiago Caputo, Milei’s controversial communications advisor, actively embraces his dedication to “The West Wing.”

As Argentine journalist Hugo Alconada Mon recently pointed out, Caputo has reportedly watched the entire series between seven and nine times. Caputo even suggested that new employees at his consulting firm, Move Group, watch the show as a condition for joining the company.

This isn’t the first time Milei’s speeches have raised suspicions. His inaugural address on December 10th also featured rhetoric that bore a resemblance to Bartlet’s character.

Standing before the Argentine Congress, Milei said: ·The challenges we face are enormous, but so is our capacity to overcome them,” words eerily similar to Bartlet’s famous line, “Every time we think we’ve measured our capacity to meet a challenge, we look up and realize that capacity may well be limitless.”

In another instance, Milei’s national broadcast on April 22, where he proclaimed: “The era of the present State is over,” echoes a line from the show in which Bartlet’s speechwriter Toby Ziegler says: “The era of big government is over.”

Milei’s West Wing-Inspired Style

Milei’s reliance on “The West Wing” may extend beyond mere rhetoric. Observers have noted aesthetic similarities between Milei’s public appearances and the institutional style portrayed in the series, particularly the podiums used for his speeches—an element that his predecessors have largely avoided.

The president’s admiration for the fictional Nobel laureate economist Bartlet is also worth noting, as both share a professional background in economics.

Yet, the parallels end there. Bartlet embodies a progressive Democrat with strong support for public institutions, while Milei’s libertarian views stand in stark contrast, advocating for minimal government intervention.

The Shadow Of Plagiarism Accusations Loom Over Argentina’s President

This is not the first time the Argentinian president has faced plagiarism accusations.

Critics attacked Milei’s book “Pandenomics” for including several uncredited passages from authors like Gita Gopinath and Antonio Guirao Piñera.

They also accused him of copying ideas from Austrian School economists like Ludwig von Mises and Murray Rothbard without proper citation in his columns.

Milei defended himself arguing that as a “communicator” he isn’t obligated to cite sources in his writings.

Read Next:

Image credits: Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.