Super Micro Computer's big stock split, Costco rises, and Bitcoin falls: Markets news roundup

Super Micro Computer’s big stock split: What to know

Super Micro Computer (SMCI) is set to undergo a stock split after the market closes on Monday, aligning itself with other prominent AI-driven companies like Nvidia and Broadcom, which also executed stock splits earlier this year. Following the split, the stock will begin trading Tuesday at its adjusted—and substantially lower—price.

A ton of people are now underwater on their car loans

Americans have a huge automotive debt problem right now. A new survey shows that 31 percent of American drivers who financed their car are underwater on their loans. The problem is even worse for EV owners – 46 percent of those folks have negative equity in their electric cars. Furthering the issue is the fact that over half of the drivers surveyed overestimated their vehicle’s value. Rough.

Dogecoin, Shiba Inu, Pepe, Solana, and more: Cryptocurrencies to watch this week

The cryptocurrency market is poised to enter the new quarter with renewed optimism, fueled by recent interest rate cuts and the anticipation surrounding the upcoming November election. Regardless of the outcome, both major political sides have hinted at policies that could be favorable to the crypto industry, further boosting investor confidence.

Bitcoin drops to $60,000 as escalating Middle East tensions rattle the crypto market

Bitcoin fell to $60,000 on Tuesday evening as tensions in the Middle East worsened due to Iran’s attack on Israel. The leading cryptocurrency dropped nearly 5%, trading at $60,834.

Miami might be in a real estate bubble, UBS says

If you’re thinking about buying a condo in Miami, you might want to hold off.

According to a new report from UBS, Miami has the highest bubble risk among all the cities it surveyed globally.

UBS (UBS) said that while the boom in Miami housing has “somewhat” cooled thanks to higher mortgage rates, prices in the city have risen by almost 50% since the end of 2019. Seven percent of that growth happened in the last four quarters.

Donald Trump and Kamala Harris are neck-and-neck with crypto voters, Coinbase poll says

A new survey suggests cryptocurrency owners are equally likely to vote for Kamala Harris and Donald Trump

Buy Costco and American Express stock as inflation cools, analyst says

Nvidia and Microsoft earnings will move markets, but Shelby McFaddin of Motley Fool Asset Management sees opportunity in inflation plays like Costco

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against Orthofix, Spire Global, DexCom, and Methode Electronics and Encourages Investors to Contact the Firm

NEW YORK, Oct. 05, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of Orthofix Medical Inc. OFIX, Spire Global, Inc. SPIR, DexCom, Inc. DXCM, and Methode Electronics Inc. MEI. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

Orthofix Medical Inc. OFIX

Class Period: October 11, 2022, and September 12, 2023

Lead Plaintiff Deadline: October 21, 2024

According to the Complaint, the Company made false and misleading statements to the market. Orthofix failed to disclose that certain members of its membership team engaged in repeated instances of offensive and inappropriate conduct. The Company’s failure to inform investors of the truth became apparent on September 12, 2023, when its Board of Directors decided to terminate the offending members of the management team. Based on these facts, the Company’s public statements were false and materially misleading throughout the class period. When the market learned the truth about Orthofix, investors suffered damages.

For more information on the Orthofix class action go to: https://bespc.com/cases/OFIX

Spire Global, Inc. SPIR

Class Period: March 6, 2024 – August 14, 2024

Lead Plaintiff Deadline: October 21, 2024

On August 14, 2024, after the market closed, the Company announced it would be unable to timely file its second quarter 2024 financial report as the Company was “reviewing its accounting practices and procedures with respect to revenue recognition” regarding certain Space Services contracts and “related internal control matters.” The Company disclosed the “type of Contracts that the Company has identified for re-evaluation resulted in recognized revenue of $10 to $15 million on an annual basis” and “additional financial measures such as gross profit could also be impacted.”

On this news, the Company’s share price fell $3.41 or 33.56%, to close at $6.75 per share on August 15, 2024, on unusually heavy trading volume.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that there were embedded leases of identifiable assets and pre-space mission activities for certain Space Services contracts; (2) that Spire Global lacked effective internal controls regarding revenue recognition for these contracts; (3) that, as a result, the Company overstated revenue for certain Space Services contracts; and (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

For more information on the Spire Global class action go to: https://bespc.com/cases/SPIR

DexCom, Inc. DXCM

Class Period: January 8, 2024 – July 25, 2024

Lead Plaintiff Deadline: October 21, 2024

According to the complaint, on July 25, 2024, DexCom announced its financial results for the second quarter of fiscal 2024 and reduced its revenue guidance for the full fiscal year 2024. The Company attributed its results and lowered guidance on their execution of “several key strategic initiatives” which “did not meet [their] high standards.” Investors and analysts reacted immediately to DexCom’s revelation. The price of DexCom’s common stock declined dramatically. From a closing market price of $107.85 per share on July 25, 2024, DexCom’s stock price fell to $64.00 per share on July 26, 2024, a decline of about 40.66% in the span of just a single day.

For more information on the DexCom class action go to: https://bespc.com/cases/DXCM

Methode Electronics Inc. MEI

Class Period: June 23, 2022 – March 6, 2024

Lead Plaintiff Deadline: October 25, 2024

According to the Complaint: (i) Methode Electronics had lost highly skilled and experienced employees during the COVID-19 pandemic necessary to successfully complete Methode Electronics’ transition from its historic low mix, high volume production model to a high mix, low production model at its Monterrey facility; (ii) Methode Electronics’ attempts to replace its General Motors center console production with more diversified, specialized products for a wider array of vehicle manufacturers and OEMs, in particular in the electric vehicle (“EV”) space, had been plagued by production planning deficiencies, inventory shortages, vendor and supplier problems, and, ultimately, botched execution of Methode Electronics’ strategic plans; (iii) Methode Electronics’ manufacturing systems at its critical Monterrey facility suffered from a variety of logistical defects, such as improper system coding, shipping errors, erroneous delivery times, deficient quality control systems, and failures to timely and efficiently procure necessary raw materials; (iv) Methode Electronics had fallen substantially behind on the launch of new EV programs out of its Monterrey facility, preventing Methode Electronics from timely receiving revenue from new EV program awards; and (v) as a result, Methode Electronics was not on track to achieve the 2023 diluted earnings-per-share guidance or the 3-year 6% organic sales compound annual growth rate represented to investors and such estimates lacked a reasonable factual basis.

For more information on the Methode Electronics class action go to: https://bespc.com/cases/MEI

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Homeowners hit by Hurricane Helene face the grim task of rebuilding without flood insurance

A week after Hurricane Helene overwhelmed the Southeastern U.S., homeowners hit the hardest are grappling with how they could possibly pay for the flood damage from one of the deadliest storms to hit the mainland in recent history.

The Category 4 storm that first struck Florida’s Gulf Coast on September 26 has dumped trillions of gallons of water across several states, leaving a catastrophic trail of destruction that spans hundreds of miles inland. More than 200 people have died in what is now the deadliest hurricane to hit the mainland U.S. since Katrina, according to statistics from the National Hurricane Center.

Western North Carolina and the Asheville area were hit especially hard, with flooding that wiped out buildings, roads, utilities and land in a way that nobody expected, let alone prepared for. Inland areas in parts of Georgia and Tennessee were also washed out.

The Oak Forest neighborhood in south Asheville lives up to its name, with trees towering over 1960s era ranch-style houses on large lots. But on Sept. 27, as Helene’s remnants swept through western north Carolina, many of those trees came crashing down, sometimes landing on houses.

Julianne Johnson said she was coming upstairs from the basement to help her 5-year-old son pick out clothes that day when her husband began to yell that a giant oak was falling diagonally across the yard. The tree mostly missed the house, but still crumpled part of a metal porch and damaged the roof. Then, Johnson said, her basement flooded.

On Friday, there was a blue tarp being held on the roof with a brick. Sodden carpet that the family torn out lay on the side of the house, waiting to go to the landfill. With no cell phone service or internet access, Johnson said she couldn’t file a home insurance claim until four days after the storm.

“It took me a while to make that call,” she said. “I don’t have an adjuster yet.”

Roof and tree damage are likely to be covered by the average home insurance policy. But Johnson, like many homeowners, doesn’t have flood insurance and she’s not certain how she’ll pay for that part of the damage.

Those recovering from the storm may be surprised to learn flood damage is a completely separate thing. Insurance professionals and experts have long warned that home insurance typically does not cover flood damage to the home, even as they espouse that flooding can happen anywhere that rains. That’s because flooding isn’t just sea water seeping into the land – it’s also water from banks, as well as mudflow and torrential rains.

But most private insurance companies don’t carry flood insurance, leaving the National Flood Insurance Program run by the Federal Emergency Management Agency as the primary provider for that coverage for residential homes. Congress created the federal flood insurance program more than 50 years ago when many private insurers stopped offering policies in high-risk areas.

North Carolina has 129,933 such policies in force, according to FEMA’s latest data, though most of that protection will likely be concentrated on the coast rather than in the Blue Ridge Mountains area where Helene caused the most damage. Florida, in comparison, has about 1.7 million flood policies in place statewide.

Charlotte Hicks, a flood insurance expert in North Carolina who has led flood risk training and educational outreach for the state’s Department of Insurance, said the reality is that many Helene survivors will never be made whole. Without flood insurance, some people may be able to rebuild with the help of charities but most others will be left to fend for themselves.

“There will absolutely be people who will be financially devasted by this event,” Hicks said. “It’s heartbreaking.”

Some may go into foreclosure or bankruptcy. Entire neighborhoods will likely never be rebuilt. There’s been water damage across the board, Hicks said, and for some, mudslides have even taken the land upon which their house once stood.

Meanwhile, Helene is turning out to be a fairly manageable disaster for the private home insurance market because those plans generally only serve to cover wind damage from hurricanes.

That’s a relief for the industry, which has been under increasing strain from other intensifying climate disasters such as wildfires and tornadoes. Nowhere is the shrinking private market due to climate instability more evident than in Florida, where many companies have already stopped selling policies — leaving the state-backed Citizens Property Insurance Corporation now the largest home insurer in the state.

Mark Friedlander, spokesman for the Insurance Information Institute, an industry group, said Helene is a “very manageable loss event,” and estimates insurer losses will range from about $5 billion to $8 billion. That’s compared to the insured losses from the Category 4 Hurricane Ian in September 2022 that was estimated in excess of $50 billion.

Friedlander and other experts point out that less than 1% of the inland areas that sustained the most catastrophic flood damage were protected with flood insurance.

“This is very common in inland communities across the country,” Friedlander said. “ Lack of flood insurance is a major insurance gap in the U.S., as only about 6% of homeowners carry the coverage, mostly in coastal counties.”

Amy Bach, executive director of the consumer advocacy group United Policyholders, said the images of the flood destruction in North Carolina shook her despite decades of seeing challenging recovery faced by victims of natural disasters.

“This is a pretty serious situation here in terms of people disappointed. They are going to be disappointed in their insurers and they are going to be disappointed in FEMA,” Bach said. “FEMA cannot match the kind of dollars private insurers are supposed to be contributing to the recovery.”

This week, FEMA announced it could meet the immediate needs of Helene but warned it doesn’t have enough funding to make it through the hurricane season, which runs June 1 to Nov. 30 though most hurricanes typically occur in September and October.

Even if a homeowner does have it, FEMA’s National Flood Insurance Program only covers up to $250,000 for single-family homes and $100,000 for contents.

Bach said that along with homeowners educating themselves about what their policies do and don’t cover, the solution is a national disaster insurance program that does for property insurance what the Affordable Care Act did for health insurance.

After Hurricane Floyd in 1999, the state of North Carolina started requiring insurance agents to take a flood insurance class so they could properly advise their clients of the risk and policies available, Hicks said. The state also requires home insurance policies to clearly disclose that it does not cover flood.

“You can’t stop nature from doing what nature is going to do,” Hicks said. “For us to think it’s never going to be this bad again would be a dangerous assumption. A lot of people underestimate their risk of flooding.”

___

Associated Press Staff Writers Jeff Amy in Asheville, North Carolina, Lisa Leff in London and Paul Wiseman in Washington contributed to this report.

Retirement in America is a disaster for many. Is there hope?

For 72-year-old Jacqueline Withers, retirement has been rocky. And she’s not alone, as it turns out.

Eight years ago, the Jacksonville, N.C. resident stepped away from her job as a home healthcare aide because of a heart condition. She tapped into her Social Security. But it was not — then or now — enough to make ends meet. Her $1,700 monthly check only covers 90% of her very basic living costs. The remaining 10%? A measly pension takes care of that.

The trouble is, she said, “I don’t have enough income to pay my medical bills and buy decent food to live on.”

Retirement in America is a disaster for many like Withers. And no one — politicians, financial planners, pick your own expert — seems to know what exactly to do about it.

I have been covering all this for years as a journalist, book author, and public speaker. Trust me, the state of retirement in America has never been this bad since the federal law that molded the majority of today’s retirement landscape, the Employee Retirement Income Security Act, or ERISA, was signed into law 50 years ago.

Of course, the system has worked for many of us. Especially if you’ve been lucky enough to have worked for a company with an old-timey pension, received a match-enhanced 401(k) plan, and/or are a close relative of a Connecticut hedge fund guy.

And, for sure, there’s hope for the current generation of workers if there’s a will to fix the system and educate the masses. (Spoiler: It will be a tough slog to change things.)

Read more: Retirement planning: A step-by-step guide

The heart of the matter is this: ERISA, which was designed to protect our interests by overseeing things like 401(k) and pension plans, only works for some of us. It sets minimum standards for retirement plans in the private sector and requires plan administrators to act in your best interest. It does not, however, require any employer to establish a retirement plan.

There are reasons behind this mess.

Many small businesses, for instance, steer clear of the plans; owners claim they are too costly and complex to navigate. Another reason: Employers have slashed traditional pension plans over the years, partly because of those stricter ERISA rules and costs associated with those plans.

Those who won that traditional pension plan lottery were guaranteed lifetime income streams. Today, just 11% of private employees participate in traditional, or so-called defined-benefit, pensions, compared with around 35% in the early ’90s, according to Mark Miller, a retirement expert and author of “Retirement Reboot.”

It also doesn’t help that many Americans are nearing retirement or are in retirement with massive amounts of credit card and medical debt, according to Federal Reserve data. Debt for households headed by people aged 65 to 74 has more than quadrupled since 1992, from $10,150 to $45,000 per household in 2022 (the most recent figures). For those 75 and up, debt has increased sevenfold.

Anatomy of a crisis

If you don’t believe me about the sorry state of retirement in America, maybe some of the more than two dozen retirement experts I interviewed can convince you.

They’ll tell you that millions of seniors are living in poverty, and many millions more lack the savings or retirement plans needed to survive comfortably in old age. That’s even before massive healthcare expenses like assisted-care facilities and nursing homes, which is a retirement killer in and of itself. (An assisted-living facility had an average rate of $72,000 a year as of December 2023, according to the National Investment Center for Seniors Housing & Care. For a memory care unit, the average rate is $94,788 annually.)

“Few people are well-prepared for these expenses,” said Edward A. Miller, Department of Gerontology chair at The University of Massachusetts Boston. “Denial is common — or they feel, … erroneously, that Medicare covers long-term care or that Medicaid will do so without them having to impoverish themselves first.”

Others agree we’re in real trouble.

The retirement crisis “is not overblown,” said Richard Johnson, director of the Program on Retirement Policy at the Urban Institute. “We see a large number of people struggling to make ends meet … or [having experienced] a substantial decline in living standards.”

“Undersaving for retirement is a big problem,” said Alicia H. Munnell, the legendary director of the Center for Retirement Research at Boston College.

And this from Surya Kolluri, head of the TIAA Institute: The retirement crisis “is even more severe if you start disaggregating the data by gender, by race, by ethnicity, by geography. Based on our research, over 40% of all US households might expect to run out of money in retirement.”

Here’s some more data to chew on.

According to a simulated model that factors in things like changes in health, nursing home costs, and demographics, about 45% of Americans who leave the workforce at 65 are likely to run out of money during retirement, per Morningstar’s Center for Retirement and Policy Studies. The risk is higher for single women, who had a 55% chance of running out of money versus 40% for single men and 41% for couples.

Read more: Yahoo Finance marks 50 years of the Equal Credit Opportunity Act

Boston College’s National Retirement Risk Index, which is based on the Federal Reserve’s Survey of Consumer Finances, shows that 39% of today’s working-age households will not be able to maintain their standard of living in retirement.

Meanwhile, an analysis by the National Council on Aging and the LeadingAge LTSS Center at UMass Boston shows a little over 27 million households with adults aged 60 and up cannot afford basic living needs.

Even more worrisome, more than 12 million American seniors are already in poverty, per the Schwartz Center for Economic Policy analysis. Measured by global standards, one-fourth of Americans aged 65 or older (23%) are poor.

Americans 65 and older are the fastest-growing group of the homeless population in the US, and by 2030, their numbers are expected to triple, according to Dr. Margot Kushel, a professor of medicine at the University of California at San Francisco and director of the UCSF Center for Vulnerable Populations. Among single homeless adults, approximately half are aged 50 and older.

“It’s chilling,” Ramsey Alwin, chief executive of the National Council on Aging, told Yahoo Finance, and “unacceptable.”

‘A generational cycle of falling short’

Expenses are a killer.

The Elder Index, created by gerontologists at the University of Massachusetts Boston, calculates how much older adults need to meet their basic needs. For example, in the Los Angeles Metropolitan area last year, a single renter over the age of 65 in good health needed $2,997 per month for housing, healthcare, food, transportation, and other expenses, according to the calculator. The same renter in Pittsburgh, Pa., needed $2,194. Nationally, the average Social Security retirement benefit in August came to about $1,784 monthly.

Read more: How to find out your 2024 Social Security COLA increase

All of those factors are already whacking retirement for many Americans. “This is a substantial portion of the population that may have to downsize,” said Anqi Chen, a senior research economist and the assistant director of savings research at the Center for Retirement Research at Boston College.

“And the fallout from not having ‘enough’ or having to cut back in retirement can also include relying on your children to cover shocks, like long-term healthcare, when they should be saving, accumulating assets, and earning returns for their own retirement,” Chen said.

“This,” she added, “creates a generational cycle of falling short in retirement.”

In other words: Ugh.

Solutions?

I’m afraid to say it is what it is in the short term. Long term? There are ways to make some progress, but we need the political will — and would likely have to pay the price in taxes.

Let’s start with AARP Public Policy Institute’s senior strategic policy adviser, David John.

“We need to have a universal retirement savings system,” he said. “It doesn’t necessarily mean a government system. It could be a series of state-facilitated systems. But one way or the other, every American has to have the ability to save for the future from the day they start work until the day they retire.”

There are glimmers of hope here for folks without an employer-provided plan.

A growing number of states have passed laws in recent years to help. These include Oregon, Colorado, Connecticut, Maryland, Illinois, California, and Virginia.

As of June 30, 20 states have enacted new programs for private sector workers, and 17 of these states are auto-IRA programs. They require most private employers that don’t sponsor a savings plan of their own to enroll workers in a state-facilitated individual retirement account (IRA) at a preset savings rate — usually 3% to 5% of earnings — which is automatically deducted from paychecks. The plans typically ramp up their employee’s contribution by 1% each year until it reaches 10% unless an employee opts out.

“While these workers can set up any kind of IRA, there are a lot of choices to make in the private market,” said John Scott, director of Pew Charitable Trusts‘ retirement savings project. “In contrast, the state programs provide a simple, easy option so they can start saving quickly.”

Beginning this year, eligible businesses with 50 or fewer employees can qualify for a credit equal to 100% of the administrative costs for establishing their own workplace retirement plan.

Said Teresa Ghilarducci, a labor economist at the New School and the author of “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy,” “Every worker should be covered by a retirement plan, in addition to Social Security, and enrolled automatically as they are in Social Security.”

Where’s the money?

David John of AARP also said it is important for people to be able to keep track of their savings. And for the most part, “that means having their savings balances move with them, unless they decide otherwise, from job to job,” he said. “Auto portability is a good first step towards that.”

A new law, in fact, aims to keep workers from cashing out their 401(k) retirement savings accounts when they move from one job to another, building on a similar effort launched last year by the private sector. It paves the way for employer retirement plans to provide automatic portability services, so funds can be transferred seamlessly into a new employer plan unless the worker opts out. (The limit for automatic rollovers is $7,000.)

Pulling money out of a tax-deferred retirement fund before you’re 59 and a half is costly. The IRS levies a 10% penalty on distributions taken before the account holder is 59 and a half. And income taxes are due on the funds that are withdrawn. Ultimately, you lose out on the compounding effects if the balance remains untouched.

I admit I did this myself when I was 30 and changing jobs, and it pains me to think what it might have been worth today. Back then, retirement seemed so far away that it never even occurred to me that I would regret that decision.

Turning 401(k)s into old-fashioned pensions

John also believes “we need to have a simple low-cost way of helping people to actually use their retirement savings effectively once they retire.”

What he is talking about is creating some organized way to help people pull money from their retirement accounts to, in essence, predictably pay themselves in retirement without all the angst of deciding which accounts to pull from and navigating the tax implications.

People freeze for fear of running out of money if they spend too much or for not understanding the mechanics of pulling money out of these accounts.

“Perhaps the hardest problem to solve is helping people to convert their savings into retirement income,” John said. “Everyone’s circumstances are at least slightly different, and all too often, people are just handed their money and told they have to make the decisions about how to use it.”

Read more: Here’s what to do with your retirement savings in a market sell-off

This leads some people to spend too quickly and others to hoard their savings so the money will be available when a future crisis appears, he added.

There are new ideas coming on board all the time to solve this roadblock. A rising number of employers are offering annuities in their 401(k) plans. And more people, for example, are building their own do-it-yourself income stream with a single-premium immediate annuity (or SPIA). SPIA sales are on track to meet or exceed the record sales this year, according to LIMRA.

Currently, a $100,000 SPIA would pay $709 a month for a single 70-year-old man in Washington, D.C., according to immediateannuities.com. You can tack on special terms, called riders, but you’ll generally get smaller monthly payments.

These annuities are the most basic plans: You pass along a chunk of your retirement savings to an insurer, and presto, you begin receiving a guaranteed paycheck until you die. The amount you get paid each month is calculated based on a variety of factors including the amount you put into the annuity, your age, gender, and the current interest rate.

There are a few drawbacks. There are typically no refunds, so once you make that choice, you can’t go back or change the amount you get each month. You can’t have a beneficiary named to them, which means that when you die, the income screeches to a halt. Another niggle is that with SPIAs your payments will not be adjusted upward for inflation.

“Some level of guidance, probably through a flexible default solution, would help new and future retirees to effectively use their savings and have a better retirement,” John said. More widespread use of annuities could be a retirement life preserver, but for now, too many of them are baffling and costly.

Fix Social Security and Medicare?

The 2024 Social Security and Medicare Trustees Reports projected that in nine years Social Security’s key reserve will run low. The upshot is that unless Congress figures out a way to fix it before we hit that flashing light, benefits would potentially get slashed by 20% for seniors.

For years, there have been droves of solutions spinning about what could and should be done to prevent the shortfall, including ratcheting up payroll taxes that fund the program, currently 12.4% split evenly by employees and employers.

But tweaking Medicare is another issue and perhaps as urgent given the health care needs of boomers.

Remember those big long-term care bills I was talking about? This is a big one. Currently, Medicare does not pay for such care, so older adults and their families bear this financial risk directly. Medicaid covers nursing homes, but only after older adults spend down their assets to less than $2,000. This is probably a pipe dream, though, because it would be expensive to pay for it.

Another idea: Earlier coverage for Medicare benefits before age 65, the current age to enroll, would help folks save more for the future. It would also prevent them from draining their finances for medical bills.

A lot of people lose their jobs or take early retirement between the ages of 50-65 and don’t get full-time jobs with health benefits. If you’re self-employed, you can use the individual health insurance marketplace to enroll in health coverage, but I’ve been down that road in my 50s, and it isn’t cheap. My premiums topped $1,200 a month for a high-deductible plan, and I had no health issues.

Money 101

But the biggest long-term solution of them all might be this: Educate kids early on about how to manage money and save — and on the importance of participating in retirement plans.

Let’s have John Scott, director of Pew’s retirement savings project, tell us why.

“We need more financial education,” he told me. “If it’s delivered at the right point in time and in the right dose to use a medical term, it can be very helpful to people. So, for example, when people are retiring, it is good to know, you know, what is an annuity? You know, or get some information about what are my options for taking money out of my company retirement plan, or, or how should I be taking Social Security?”

It’s too late for Withers, but just in time for younger generations who may be about to fall into the same traps as their parents.

Finding a fiduciary financial adviser doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 financial advisers that serve your area in 5 minutes.

Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist, and the author of 14 books, including “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Get Rich.” Follow her on X @kerryhannon.

Read the latest financial and business news from Yahoo Finance

23andMe's future prompts more worries, as genomic data analysis improves

Customers of genetic data outfit 23andMe may be at greater risk than they realize, suggests a New York Times story that argues the company’s woes could be short-lived compared to the longer-term threats facing those roughly 15 million people if 23andMe can’t continue as a going concern.

Certainly, the hope of founder and CEO Anne Wojcicki to turn around 23andMe seems increasingly unreachable. Following a major breach and resignation en mass of its independent directors, the company, once valued at $6 billion, is now valued at $150 million. It’s poised to be delisted next month. Press stories aren’t helping. (Would you buy one of its DNA kits?)

The company says it remains committed to “follow laws that regulate the data we collect,” but if at some point soon it can’t, that’s worrisome, says a Yale biomedical professor to the Times. He notes that hacked credit cards can be replaced, while a genome cannot. Meanwhile, he adds, the tech that analyzes genomes is advancing. Chances are it will become more revealing, too.

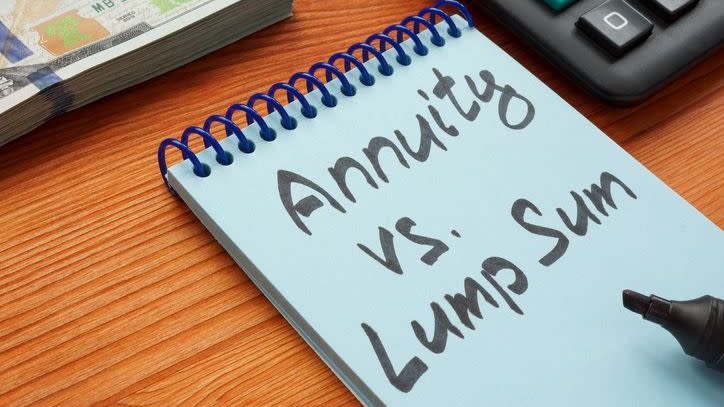

$250k Lump Sum vs. $2,750 Monthly Pension: What's the Smarter Move?

Workers with defined benefit pensions may be offered the chance to collect a one-time, lump sum payment instead of monthly pension benefits for life.

Making this decision involves evaluating a number of factors, including the lump sum amount, the amount of the monthly payments and the age of the recipient when the offer is made. Other factors to consider include the recipient’s health, whether the pension will pay benefits to a surviving spouse, as well as the recipient’s level of financial literacy, self-discipline and need for financial flexibility. When faced with a choice like this, a financial advisor can help you evaluate your options and make an informed decision.

Lump Sum vs. Monthly Payments

A pension beneficiary who is offered $250,000 in a single payment in lieu of $2,750 monthly payments for life can start by calculating the potential cumulative value of the monthly payments. To do this, they need to estimate how long they will likely live.

According to Social Security’s life tables, a 60-year-old male has an average life expectancy of about 20 years. If the pension will begin making payments at age 65 and continue making them until the beneficiary dies in 15 years at age 80, he’ll collect approximately 180 monthly payments for a total of $495,000.

If the beneficiary instead opts for the lump sum, he can immediately begin investing it at age 60, When he retires five years later, he can start taking $2,750 monthly withdrawals. In order for the $250,000 to last until he reaches 80, his investments would have to generate an average annual return of at least 5.9%.

Now assume the pension beneficiary is a 55-year-old woman and that her monthly payments will begin at age 65. According to the Social Security Administration, she can expect to live to age 83. In this case, the monthly payments have a somewhat higher value, adding up to $594,000. However, because the lump sum would be invested for a longer period before she starts her withdrawals, her investments only need to grow at an average rate of 4.84% per year for the money to last until age 83.

In both these scenarios, the required return for the lump sum payment to at least match the value of the monthly payments is not unreasonable. It’s possible that a well-managed portfolio could exceed these average returns, making the value of the lump sum option greater than the monthly payments.

As you can see, decisions like this one often require some calculations and assumptions. A financial advisor can help you run the numbers and weigh your options.

Other Considerations

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

In reality, deciding between a lump sum or monthly benefit is likely to be somewhat more complicated than these simplified scenarios. For instance, many pensions have a survivor benefit that will pay all or a portion of the retiree’s benefits to a surviving spouse after the retiree’s death. If a spouse survives the original pension recipient, this can add significantly to the value of the monthly benefit option.

Ultimately, of course, longevity is not assured. If a monthly benefit recipient dies earlier than expected, it reduces the value of the monthly benefits. If they live longer than expected, it increases the value. For this reason, details about the recipient’s health can be important considerations. Someone in good health with a family history of living to an older-than-average age might assign a greater value to the monthly payments.

Inflation and investment returns are two other unpredictable factors. While 7% can be seen as a reasonable expectation for average annual return based on historical investment records, there’s no guarantee that future performance will match that. Similarly, if inflation increases, this will reduce the purchasing power of a monthly benefit unless the pension has a cost of living adjustment. Investing a lump sum provides the opportunity for returns that might help overcome the purchasing power erosion of a spell of rapid inflation.

Safety is a key concern when it comes to paying for retirement. Pensions are guaranteed, but investment returns are not. A recipient who lacks the financial literacy to invest a lump sum wisely may be better off with a monthly benefit. Similarly, it’s possible for someone who comes into a large sum of money to spend it frivolously rather than investing it wisely to pay for living expenses in retirement.

While a taking lump sum may be inherently riskier, it also provides flexibility that may be an advantage in some situations. For example, if someone has significant debt, it may make more sense to take the lump sum and pay off what’s owed rather than continue servicing the debt while receiving monthly benefits.

If you’re facing a similar decision or scenario, consider talking it over with a financial advisor first.

Bottom Line

When faced with a choice between taking a lump sum or receiving monthly pension payments, key factors to consider include the age of the pension beneficiary when the offer is made, the beneficiary’s life expectancy and the size of the lump sum and the amount of the monthly payment. Other factors to consider include details about the pension, including whether it offers spousal benefits or inflation adjustments.

Retirement Planning Tips

-

A financial advisor can bring objectivity, experience and insight to the task of evaluating a choice between monthly pension benefits and a lump sum. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

SmartAsset’s Investment Return and Growth Calculator offers a quick, simple and free way to see how much your portfolio could be worth in the future. This can come in handy if you take a lump sum pension payout and want to reinvest it in the stock market for a number of years.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/skynesher, ©iStock.com/designer491, ©iStock.com/vorDa

The post Should I Take a $250,000 Lump Sum or $2,750 Monthly Payments for My Pension? appeared first on SmartReads by SmartAsset.

Kim Jong Un And Xi Jinping Vow To 'Write A New Chapter' In China-North Korea Cooperation: 'Develop The Friendly And Cooperative Relations…As Required'

The leaders of China and North Korea have pledged to enhance their bilateral cooperation on the occasion of the 75th anniversary of their diplomatic relations.

What Happened: Chinese President Xi Jinping has expressed his commitment to the development of China-DPRK relations in a message to North Korean leader Kim Jong Un. Xi highlighted the significance of their relationship, referring to several meetings, personal letters, and messages exchanged over the years, the state news agency KCNA reported.

Xi conveyed that China is ready to “write a new chapter” in their relations through increased communications and cooperation. China is North Korea’s largest trading partner, with a shared history that traces back to Beijing’s support of Pyongyang during the Korean War (1950-1953).

Despite this, China has been cautious about North Korea’s growing ties with Russia, especially after the signing of a strategic treaty that includes mutual defense elements.

Kim, in his message to Xi, also pledged to “steadily strive to consolidate and develop the friendly and cooperative relations between the DPRK and China as required by the new era.”

On the eve of the anniversary, Kim oversaw a live artillery firing by graduates of the O Jin U Artillery Academy, a facility that trains the backbone of North Korea’s artillery force. He also reiterated the country’s willingness to use all available offensive forces, including nuclear weapons, to defend its sovereignty.

Why It Matters: The recent pledge of enhanced cooperation between China and North Korea comes at a time of heightened tensions in the region. Just last month, Kim’s sister, Kim Yo Jong, publicly denounced the United States’ decision to supply $8 billion in military aid to Ukraine, describing it as “an incredible mistake” and a perilous provocation against Russia, a nation armed with nuclear weapons.

Kim’s recent pledge to further develop friendly and cooperative relations with China also follows his stark warning to South Korea, threatening nuclear retaliation if North Korea’s sovereignty is compromised. These developments indicate a complex geopolitical landscape in the region, with China and Russia playing significant roles.

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Executive Office of the President of the United States

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Construction of 24 social and affordable housing units for seniors in La Minerve

LA MINERVE, QC, Oct. 4, 2024 /CNW/ – Today, the governments of Quebec and Canada and the Municipality of La Minerve marked the launch of a 24-unit social and affordable housing project for semi-independent seniors. The project, spearheaded by the organization Résidence La Minerve, represents a total investment of more than $15.7 million.

The event was attended by Chantale Jeannotte, Member of the National Assembly for Labelle and Parliamentary Assistant to the Quebec Minister Responsible for Housing, on behalf of the Quebec Minister Responsible for Housing, France-Élaine Duranceau; by Johnny Salera, Mayor of La Minerve; and by Suzanne Sauriol, President of Résidence La Minerve.

The Government of Quebec is contributing more than $6.2 million in subsidies to the project, primarily through the Société d’habitation du Québec (SHQ), which is also guaranteeing the mortgage loan obtained by Résidence La Minerve. The Government of Canada is contributing nearly $6 million through the third Canada-Quebec Rapid Housing Initiative Agreement.

The Municipality of La Minerve is granting a 25-year tax credit to Résidence La Minerve to support the residence’s operations.

Quotes:

“Our investments in new affordable housing extend to all regions of Quebec and all low-income groups. This financial assistance will provide semi-independent seniors with a place to live that’s adapted to their needs. This is another concrete example of our government’s efforts to ensure that more Quebecers have access to a quality living environment.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“The federal government will continue to work hard toward ensuring that everyone in Quebec and across Canada has a safe and stable place to call home. We’re quickly providing new affordable housing to those who need it most across the country, thanks to the third Canada-Quebec Rapid Housing Initiative Agreement and collaboration from all levels of government.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“I would like to thank all those who are contributing to the success of this project, which will enable our seniors to enjoy a new living environment and remain right here in La Minerve, close to their loved ones. The outcome of the combined efforts of many partners will ensure that these individuals benefit from a healthy, affordable, safe and supervised environment.”

Chantale Jeannotte, Member of the National Assembly for Labelle and Parliamentary Assistant to the Quebec Minister Responsible for Housing

“Congratulations to everyone who has stepped up and believed in this project since day one. Soon, our seniors will have a beautiful place to live that will enable them to stay right here in La Minerve. Many people have dreamed of this residence, and now it’s a reality!”

Johnny Salera, Mayor of La Minerve

“This is a great day for Résidence La Minerve, whose team is delighted to see this project break ground. Thank you to all members of the non-profit organization’s board of directors, who believed in the project from the very beginning and spared no effort in making it a reality. Our seniors will finally be able to stay in the community they love and appreciate so much! Thank you to all the partners who worked with us on the project. It was a fantastic team effort, and we’re very proud of it.”

Suzanne Sauriol, President, Résidence La Minerve

Highlights:

- Some 19 of the 24 households in the future building could be eligible for the Société d’habitation du Québec’s (SHQ’s) Rent Supplement Program, ensuring that they spend no more than 25% of their income on housing. This additional assistance of more than $325,000 over five years is being covered by the SHQ (90%) and the Municipality of La Minerve (10%).

- This project also received financial support from the Fondation du Centre hospitalier des Laurentides et Centre de réadaptation des Hautes-Vallées and from Caisse Desjardins de la Rouge.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

SocietehabitationQuebec

HabitationSHQ

LinkedIn

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, Canada Mortgage and Housing Corporation (CMHC) contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/04/c1032.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/04/c1032.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Stock Could Soar Another 561%, According to a Wall Street Analyst

If you invested $100 in Nvidia (NASDAQ: NVDA) at the beginning of 2023, you would now have $830 thanks to the remarkable surge in the company’s shares fueled by artificial intelligence (AI). Even so, the stock could jump from about $120 now to around $800 by 2030, according to one analyst.

Phil Panaro, a former senior advisor at the Boston Consulting Group, believes that the continuing growth of AI and the arrival of Nvidia’s next-generation Blackwell processors could lead to annual revenue of $600 billion in 2030 from $61 billion in fiscal 2024.

Let’s look at the catalysts mentioned by Panaro and check if they are strong enough to help Nvidia sustain its phenomenal growth in the long run.

The increasing demand for accelerated computing

Nvidia CEO Jensen Huang said on his company’s August earnings conference call that accelerated computing is going to be a long-term growth driver. Huang said the transition from general-purpose computing — using central processing units (CPUs) — to accelerated computing based on graphics processing units (GPUs) could help reduce computing costs by 90%.

Because GPUs speed up demanding workloads in data centers that would have otherwise taken longer using CPUs, Nvidia says, accelerated computing is not only faster, but it is also more sustainable because of its smaller energy footprint.

Huang projected “$1 trillion worth of data centers in a few years will be all accelerated computing” based on their energy efficiency.

Data centers are estimated to account for 1% to 2% of global energy consumption, a figure expected to double by the end of the decade. So the much faster pace of GPUs compared to CPUs is expected to help reduce energy consumption long term.

The demand for data center accelerators is forecast to have a compound annual growth rate (CAGR) of 28% through the next five years. And the massive end market that the transition to accelerated computing is likely to create, Huang said, could mean that his company is at the beginning of a phenomenal growth curve.

That’s because Nvidia is the dominant player in the data center GPU market. It reportedly controlled 98% of this space at the end of last year, so it stands to win big from the secular growth in accelerated computing even if it loses some of that market share.

The outlook for Nvidia’s upcoming Blackwell AI GPUs seems to be solid, with the company saying demand is tracking ahead of supply, a trend that’s likely to continue next year as well.

Why a $600 billion top line seems achievable

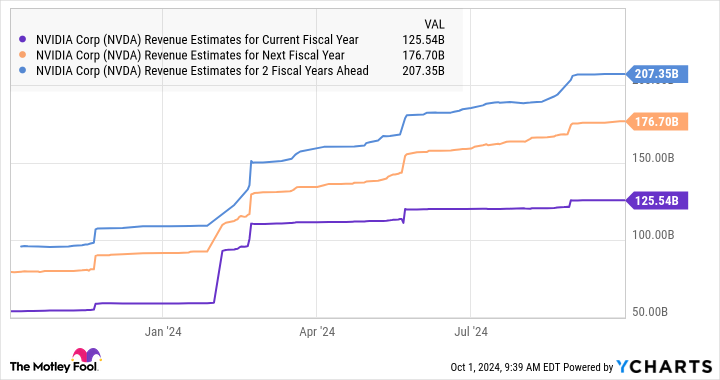

Nvidia’s solid prospects discussed above help explain why the company’s revenue estimates have received a nice bump for the next three fiscal years.

As shown in the chart above, Nvidia’s top line is expected to cross $207 billion in fiscal 2027, more than triple its fiscal 2024 revenue. The company’s fiscal 2027 will coincide with the majority of calendar year 2026. So to hit $600 billion in revenue by calendar year 2030 (Nvidia’s fiscal 2031), it will need an annual growth rate of 30% over a four-year period.

Nvidia serves multiple fast-growing markets such as AI chips (expected to grow at an annual pace of 41% through 2032), digital twins, and cloud gaming, so there is a good chance that it could indeed hit $600 billion in revenue by the 2030 calendar year. But it remains to be seen if that growth translates into the potential upside that Panaro predicts for the stock.

Assuming Nvidia does reach $600 billion in sales in 2030, the stock will have to maintain its current price-to-sales ratio (P/S) of 32 to generate 561% returns from this level. That would translate into a market cap of $19.2 trillion, compared to the current level of just under $3 trillion.

If we don’t give Nvidia such a rich sales multiple and assume that it is trading at a P/S of 8 (in line with the U.S. technology sector’s average) by 2030, its market cap would jump to $4.8 trillion.

So, Nvidia could deliver 61% gains from current levels assuming it trades at a more reasonable valuation. But if the market decides to keep rewarding the company with a rich multiple because of its healthy growth, there is a good chance that it could deliver a much stronger upside in the long run — and might even get close to Panaro’s ambitious estimate.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Stock Could Soar Another 561%, According to a Wall Street Analyst was originally published by The Motley Fool

Legendary Apple Co-Founder Steve Jobs Once Said, 'Being The Richest Man In The Cemetery Doesn't Matter To Me:' Maybe That's Why His Impact Transcends Financial Success For iPhone-Maker And Beyond

It’s been over a decade since legendary Apple Inc. co-founder Steve Jobs left us, but his impact on the world of technology and beyond continues to resonate.

On Oct. 5, the anniversary of his passing, it’s worth taking a moment to reflect on the journey of this tech visionary who transformed not just how we use computers, but how we live our daily lives.

The Early Days: A Spark Of Genius

Jobs’ story begins in San Francisco, where he was born in 1955 and later adopted by Paul and Clara Jobs. From an early age, he showed a keen interest in electronics, tinkering with gadgets in his family’s garage.

As a teenager, Jobs’ rebellious spirit and thirst for knowledge led him to Reed College. Though he dropped out after just one semester, he continued to audit classes that piqued his interest.

One of these was a calligraphy course, which might seem like an odd choice for a future tech mogul. But Jobs later credited this class with influencing Apple’s groundbreaking approach to typography and design.

Most Valuable Company Today Had Humble Beginnings

The story of Apple’s humble beginnings in a garage has become the stuff of Silicon Valley legend.

In 1976, Jobs and his friend Steve Wozniak founded Apple Computer Company. Their first product, the Apple I, was essentially a circuit board that hobbyists could use to build their own computers.

However, the Apple II, released in 1977, really put them on the map.

The Apple II wasn’t just a computer for geeks – it was a machine that regular people could use.

Apple today has a market capitalization of $3.448 trillion, making it the most valuable company in the world.

The Macintosh Revolution

Fast forward to 1984, and Apple was ready to change the world again with the Macintosh.

This was the first commercially successful computer to feature a graphical user interface (GUI) and a mouse.

If you’ve ever used a computer with icons and windows (which, let’s face it, is pretty much every computer nowadays), you can thank Jobs and his team for pushing this revolutionary idea into the mainstream.

But It Was Not Always Smooth Sailing

In 1985, after a power struggle with then-CEO John Sculley, Jobs left Apple, the company he had co-founded. It was a huge blow, but Jobs wasn’t one to sit idle.

He went on to found NeXT, a company that aimed to create high-end computers for the education market. While NeXT didn’t achieve the commercial success Jobs had hoped for, it would later play a crucial role in Apple’s future.

From Side Project To Animation Powerhouse

During his time away from Apple, Jobs also bought a little computer graphics division from Lucasfilm. This would become Pixar Animation Studios.

Under Jobs’ guidance, Pixar went from a tech company to an animation powerhouse, releasing groundbreaking films like “Toy Story” and forever changing the landscape of animated storytelling.

…And Then The Prodigal Son Returns

By the mid-90s, Apple was struggling. The company that had once been at the forefront of personal computing was floundering, with a confusing product line and declining sales.

In a twist of fate, Apple announced that it was acquiring NeXT in 1996, bringing Jobs back into the fold as an advisor.

He quickly became interim CEO (or “iCEO” as he jokingly called himself) and set about turning the company around.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

The Apple Renaissance

Jobs’ return to Apple marked the beginning of one of the greatest comebacks in business history. He streamlined the product line, focusing on simplicity and design.

The result? A string of iconic products that would redefine entire industries:

- The iMac (1998): A colorful, all-in-one computer that made technology fun and accessible.

- The iPod (2001): Not the first MP3 player, but the one that made digital music mainstream.

- The iPhone (2007): A device that put the internet, a music player, and a phone in your pocket, changing the way we communicate forever.

- The iPad (2010): Bridging the gap between smartphones and laptops, creating a new category of device.

The Jobs Philosophy

What set Jobs apart wasn’t just his ability to create great products, but his unwavering commitment to certain principles:

Simplicity: Jobs believed that technology should be intuitive and easy to use.

Design: He saw beauty in minimalism and insisted that even the parts users couldn’t see should be well-designed.

Integration: Jobs pushed for seamless integration between hardware and software, creating ecosystems that just worked.

He once said, “Being the richest man in the cemetery doesn’t matter to me. Going to bed at night saying we’ve done something wonderful [at Apple], that’s what matters to me.”

The Final Chapter

In 2003, Jobs was diagnosed with a rare form of pancreatic cancer. Despite this setback, he continued to lead Apple, overseeing some of the company’s most innovative years.

However, his health struggles eventually led to him stepping down as CEO in Aug. 2011.

On Oct. 5, 2011, he passed away, leaving behind a legacy that had fundamentally changed multiple industries – computing, music, movies, telecommunications, and retail.

The Legacy Lives On

Today, Apple continues to be one of the world’s most valuable and influential companies. While it has evolved under the leadership of Tim Cook, many of Jobs’ core principles still guide the company.

But Jobs’ influence extends far beyond Apple. His vision of technology as a tool to enrich our lives has shaped the entire tech industry. From the smartphones we carry in our pockets to the way we consume media, Jobs’ fingerprints are everywhere.

He once said, “The people who are crazy enough to think they can change the world are the ones who do.” He was certainly one of those people, and the world is all the richer for it.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.