Here's the Billionaire Investor You Should Be Following — and He's Not Warren Buffett or Bill Ackman

It’s always a good idea for individual investors to look at what institutional investors, also called the smart money, are choosing. You should never base your decisions solely on others without doing research, but institutional investors have been professionally trained, and they often have decades of experience and the returns to back it up.

Following these successful investors is also a good way to find new ideas and check your thesis. Still, too often, I feel like individuals are only looking at two or three of the best investors instead of casting a wider net.

Warren Buffett and Bill Ackman certainly come to mind. I have nothing against Buffett or Ackman, who are certainly two of the best ever, but here’s the billionaire I think people should be following.

A strong record despite fundamental shifts

David Einhorn manages hedge fund Greenlight Capital, which he launched at the age of 27 after raising about $900,000 from family and friends. Einhorn rose to prominence from betting against — or short-selling — Allied Capital in 2002 when he questioned the company’s accounting practices.

Years after he announced his short position, the Securities and Exchange Commission validated Einhorn’s thesis, finding that Allied did indeed break securities laws due to its accounting practices.

Einhorn also played a key role during the Great Recession when he shorted Lehman Brothers in 2007 due to the company’s underwater securities holdings.

But like many of the greats, Einhorn also is known for his value investing approach, in which he looks for stocks trading below their intrinsic value. Earlier this year, he said that he believes the practice of value investing might be dead due to the broken market structure and the rise of passive investing:

Value is just not a consideration for most investment money that’s out there. There’s all the machine money and algorithmic money, which doesn’t have an opinion about value, it has an opinion about price: “What is the price going to be in 15 minutes, and I want to be ahead of that.”

This shift in market structure has led him to change his investing philosophy for his larger company holdings. Now, he focuses on companies that look cheap in value and return capital to shareholders through repurchases or dividends. It’s always a good sign to see even the best investors adapt, even though Einhorn is probably frustrated by this shift in market structure.

Despite changing his strategy, he has generated strong long-term returns. Greenlight has average annual returns of 13.1% since its launch in 1996, compared to 9.5% for the broader benchmark S&P 500. That equates to a total return of over 2,900% compared to the S&P 500’s 1,117%.

Einhorn’s big winner

The largest position in Greenlight’s portfolio is a homebuilding company called Green Brick Partners (NYSE: GRBK). He founded Green Brick in 2006 with experienced real estate investor and homebuilder Jim Brickman.

In 2008, amid the housing market collapse, Einhorn and Brickman started a real estate equity fund, where they initially began buying land and lending to distressed builders. By 2013, the housing market had bounced back and their fund had amassed a lot of land. Needing capital to grow, the two took the fund public, and it became Green Brick Partners. Brickman became chief executive officer and Einhorn became chairman of the board.

Greenlight Capital began purchasing Green Brick shares in the fourth quarter of 2014 at an average price of $7.20. Its first purchases amounted to roughly $112 million. While Greenlight has been in and out of the stock over the years, the position is currently valued at about $950 million.

Einhorn and Greenlight still owned more than 25% of its shares, according to Green Brick’s most recent proxy. The stock has almost doubled in the past year and is up more than 670% during the past five years.

All of those land purchases since 2006 have been a differentiator for Green Brick in the homebuilding business. At the end of the second quarter of 2024, it owned more than 28,500 lots, most of which are in the growing market of Texas. As inventory and land have become more limited and competitive to acquire, especially in strong and desirable housing markets, this strategy has paid off handsomely.

A value investor with plenty of runway

When I look at Einhorn’s current holdings, I see that he still owns plenty of value stocks, which I always find to be the most interesting to evaluate because they trade at attractive valuations and their futures depend on their ability to pay down debt, generate cash flow, and transform the trajectory of their earnings.

However, Einhorn is cognizant of changing market dynamics and is willing to adapt, an important characteristic for any investor. At just 55 years old, he has plenty of runway left in his investing career, I believe, and is a smart person with a unique viewpoint that individual investors should watch and study.

Should you invest $1,000 in Green Brick Partners right now?

Before you buy stock in Green Brick Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Green Brick Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Green Brick Partners. The Motley Fool has a disclosure policy.

Here’s the Billionaire Investor You Should Be Following — and He’s Not Warren Buffett or Bill Ackman was originally published by The Motley Fool

I'm 60 with $1.2 Million in My Roth IRA – How Do I Keep It from Running Out?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Planning for a Roth IRA is a little different than with most other retirement assets. This tax-advantaged account generates entirely untaxed income, as long as effectively boosting the value of your withdrawals and your Social Security benefits.

That changes your options compared to having a pre-tax 401(k) or other non-Roth account.

For example, say that you have $1.2 million in a Roth IRA at age 60. The good news here is that, overall, you’re in a pretty good position. You probably don’t need to do much to make sure this portfolio generates a comfortable income in retirement, but it all depends on your personal circumstances.

Here’s how to think about it, and you can also get matched with and speak with a financial advisor about your personal situation.

What Will Your Total Income Be?

Retirement income for most households is a balance of portfolio earnings and Social Security.

First, Social Security. Without knowing more, let’s assume average benefits, which in 2024 come to $22,884 per year ($1,907 per month). Since the rest of your income comes from a Roth account, you will only calculate taxes based on those benefits. Taxes on these benefits will depend on how much other income you have, but you can expect 0%, 50% or 85% of your benefits to be taxed.

From there, we can look at your Roth IRA.

Most of your portfolio income will depend on your personal investment and retirement situation. For example, let’s say that you plan on retiring at full retirement age of 67. This gives you seven more years of portfolio growth for an already-solid Roth portfolio. How much you hold in this portfolio at retirement (and, as a result, your total income) will depend a lot on your investment choices and risk tolerance.

For example, let’s say that for the next 7 years you continue to contribute 10% of a median U.S. income ($7,500 per year in contributions). Based on your investment choices and rates of return your portfolio might grow to:

-

S&P 500 Average (10%, High volatility) – $2.4 million by age 67

-

Balanced Portfolio Average (8%, Moderate volatility) – $2.12 million by age 67

-

Corporate Bond Average (6%, Low volatility) – $1.86 million by age 67

-

10-Year Treasury Bond Current (4.63%, Lowest volatility) – $1.7 million by age 67

At a 4% withdrawal rate, starting at age 67, each of these portfolios could yield an annual combined (portfolio and Social Security) income of:

-

S&P 500 – $118,884

-

Balanced – $107,684

-

Corporate Bonds – $97,284

-

Treasury Bonds – $90,884

Or, alternatively, you could invest in an annuity. Say that you put your entire $1.2 million Roth IRA in an annuity right now, with a payout date seven years in the future. A representative lifetime annuity might yield $137,856, with a combined income of $160,740. While higher than any of your other options, unlike portfolio income your annuity payments likely will not adjust for inflation.

From there, the good news is that we can stop the analysis. Since this is a Roth IRA, your income will be entirely post-tax. So we can assume this income is complete as-is. What’s more, you will not have to plan for RMDs or other tax-related issues. In other words, these are the numbers you have to work with.

Need help crunching your own numbers? Get matched with a financial advisor for free.

What Will Your Expenses Be?

In all cases, even at a 4.63% Treasury bond rate, by age 67 your portfolio can yield an income significantly above the median. In fact, depending on your investment strategies during retirement, you may be able to collect even more than our assumed incomes.

However, the question is whether this portfolio can generate enough money to last for the rest of your life, not the median life. That depends entirely on your personal expenses, which means budgeting for your spending. Among other issues, consider:

-

Housing Expenses: Do you own your own home or rent? If you own, what does it cost to maintain, insure and otherwise keep up your house? If you rent, what kind of increases should you expect?

-

Medical Expenses: Medical and insurance expenses are particularly high in retirement. Make sure you budget for out-of-pocket spending, gap insurance, long term care insurance and other needs.

-

Lifestyle Expenses: Do you like to travel? What kind of hobbies do you have? Do you eat out? In general, what kind of lifestyle do you enjoy and what does that cost to maintain?

-

Estate Expenses: Do you have any specific estate wishes for (hopefully much) later? What would you like to leave behind, and what kind of assets will it require?

-

Basic Expenses: Finally, what are your basic bills? In other words, in addition to housing, what is your bottom line for each month?

All of these issues are specific to your personal situation. They’re also dispositive. Whether your portfolio can last the rest of your life will depend as much on your budget as your income. As long as you can build a long-term Roth portfolio that beats your spending, it will last. For a median household, your combined income should be more than sufficient. For your household, that depends on you.

Risks To Watch Out For

Finally, retirement brings its own set of risks and issues to keep an eye out for. Among others, keep an eye out for these three specific issues:

Inflation Risks

For retirees, inflation is a biggie. Even at the Federal Reserve’s target 2% rate, prices double roughly every 30 to 35 years. This can fluctuate significantly, and almost entirely unpredictably. So it’s important to prepare for this. This is even more important if you live in a city, and absolutely urgent if you rent, as those circumstances generate much higher-than-average inflation.

Social Security benefits receive an annual inflation-adjustment. Your portfolio is another thing. Make sure to invest appropriately, trying to achieve at least enough growth to keep pace with inflation. That’s particularly appropriate if you invest in high-security assets like bonds and annuities, which have low or no rates of growth.

Sequence of Returns Risks

Sequence risk is when you have to sell assets during a down market. For retirees, this is a danger. If the market declines, but you depend on selling assets for income, you can be forced to choose between taking a loss or cutting your income.

This can be managed with good financial planning and the right investments but you will need to plan ahead. Don’t discount sequence risk, otherwise it can cost you.

A financial advisor can help you with your investment portfolio and risk mitigation. Get matched with a financial advisor for free.

Health Risks

Health issues in retirement can take any number of forms. As noted above, make sure to plan for additional costs in retirement, as your medical needs will generally grow as you age.

You should also make sure to plan for more significant medical needs such as in-home care, residential care and mental decline. This can be managed through planning such as proper insurance and living wills, and it’s important to do so.

The Bottom Line

By letting you collect untaxed money, a Roth IRA effectively increases your retirement income, potentially by quite a lot. With $1.2 million in their Roth portfolio by age 60, a household would be in a good position for a comfortable retirement ahead.

Retirement Health Planning Tips

-

Health is often one of the biggest cost-surprises for retirees. Between costs of care and costs of insurance, medical issues can involve a lot of new spending that you may not have entirely prepared for. So let’s start preparing for that right now.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Portra

The post I’m 60 With $1.2 Million in a Roth IRA. How Do I Make Sure This Money Lasts the Rest of My Life? appeared first on SmartReads by SmartAsset.

Bio Decontamination Market to Reach $525.4 Million, Globally, by 2033 at 8.7% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 04, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Bio Decontamination Market by Product (Equipment and Consumables), by Agent (Hydrogen Peroxide, Chlorine Dioxide and Nitrogen Dioxide), Type (Chamber Decontamination and Room Decontamination), and End User (Pharmaceutical and Biotechnology Companies and Healthcare Facilities): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the bio decontamination market was valued at $229.5 million in 2023, and is estimated to reach $525.4 million by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Request Sample of the Report on Bio Decontamination Market 2033 – https://www.alliedmarketresearch.com/request-sample/A323971

Prime Determinants of Growth

Increase in awareness of the importance of maintaining sterile environments in healthcare and pharmaceutical industries is a major driver for the bio decontamination market. In healthcare settings, the rise of hospital-acquired infections (HAIs) has resulted in the critical need for stringent sterilization protocols to protect patients and healthcare workers. Pharmaceutical industries demand highly sterilized environments to ensure the safety and efficacy of their products, as any contamination leads to costly recalls and endangers public health. This heightened awareness has led to the adoption of advanced bio decontamination technologies, which effectively eliminate pathogens and ensure sterile conditions. The ongoing focus on improving infection control measures and maintaining high standards of cleanliness continues to propel the growth of the bio decontamination market, reflecting its essential role in safeguarding health and safety in these critical sectors. In addition, the growing pharmaceutical and biopharmaceutical industry is a major driver for the bio decontamination market. As these industries expand, the demand for stringent contamination control measures increases to ensure product safety and regulatory compliance. High standards in manufacturing environments necessitate effective bio decontamination solutions to eliminate microbial contamination.

Report Coverage & Details

| Repot Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $229.5 million |

| Market Size in 2033 | $525.4 million |

| CAGR | 8.7% |

| No. of Pages in Report | 280 |

| Segments Covered | Product, Agent, Type, End User, and Region |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A323971

Segment Highlights

The equipment segment dominated the market share in 2023

By product, equipment segment dominated the market share in 2023. This is attributed to there is a growing demand for sophisticated decontamination equipment in healthcare facilities, pharmaceutical industries, and research laboratories to ensure stringent infection control and sterile environments.

The hydrogen peroxide segment dominated the market share in 2023

By agent, hydrogen peroxide segment dominated the market share in 2023. This is attributed to the fact that hydrogen peroxide is highly effective as a broad-spectrum antimicrobial agent, capable of efficiently targeting a wide range of pathogens including bacteria, viruses, fungi, and spores. Its ability to disrupt cellular processes through oxidative damage makes it a potent choice for sterilization and decontamination processes in various industries, including healthcare facilities, pharmaceutical manufacturing, and food processing.

The chamber decontamination segment dominated the market share in 2023

By type, chamber decontamination segment dominated the market share in 2023. This is attributed to the fact that chambers, such as cleanrooms and biological safety cabinets, play a critical role in maintaining sterile environments necessary for research, production, and storage of sensitive biological materials.

The pharmaceutical and Biotechnology Companies segment dominated market share in 2023

By end user, pharmaceutical and biotechnology companies segment dominated the market share in 2023. This is attributed to the fact that pharmaceutical and biotechnology companies operate within highly regulated environments were maintaining sterility and preventing contamination is crucial to ensure product quality and compliance with regulatory standards. Bio decontamination technologies offer effective solutions to sterilize equipment, facilities, and cleanrooms, thereby minimizing the risk of microbial contamination during production processes.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323971

Regional Outlook

North America held a dominant position in the market in 2023 due to high adoption of the bio decontamination by biopharmaceutical companies, and well-established biopharmaceutical sector. However, the Asia-Pacific region is expected to register the highest CAGR in the forecast period. This is attributed to expanding healthcare infrastructure, increasing investments in biotechnology, and rising healthcare expenditure in countries like China, India, and Japan.

Key Players

- Fedegari Autoclavi SpA

- Steris PLC

- TOMI Environmental Solutions, Inc

- Ecolab Inc

- JCE Biotechnology

- DIOP GmbH & Co. KG

- Howorth Air Technology Ltd.

- Zhejiang TAILIN Bioengineering Co., LTD.

- AM Instruments SRL

- Solidfog Technologies

The report provides a detailed analysis of these key players in the global Bio Decontamination market. These players have adopted different strategies such as collaboration to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Developments in Bio Decontamination Market Worldwide

- In July 2023, BASF SE and Recipharm, announced a collaboration. The two companies joined forces to pioneer the development of innovative ibuprofen formulations. Leveraging BASF’s expertise in ibuprofen synthesis and Recipharm’s proficiency in drug formulation, the partnership aims to create formulations that are more effective, exhibit fewer side effects, and are easier to administer.

Trending Reports in Healthcare Industry:

Healthcare Biometrics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Bioreactors Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Computed Tomography (CT) Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Neonatal Ventilator Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can robotaxis turn a profit? Experts skeptical as Tesla prepares to unveil plans.

Tesla (TSLA) CEO Elon Musk has long touted autonomous vehicles as the future of the company.

At his shareholder meeting in June, Musk said the technology alone would boost the company’s value by at least tenfold.

But with Musk set to unveil details on Oct. 10 about an autonomous taxi fleet he has teased for years, skeptics caution that robotaxis may be years away from becoming a profitable venture.

“It might be a little difficult to get crazy excited,” RBC Capital Markets analyst Tom Narayan said about the potential stock reaction for Tesla. “This is far into the future, so we just don’t know how big it’s going to impact [the business].”

Tesla’s entry into the market would put the company in direct competition with Google’s (GOOG, GOOGL) Waymo, which has been operating its self-driving taxi fleet in Los Angeles, San Francisco, and Phoenix, with an expansion scheduled in Austin.

While the timeline for any autonomous taxi from Tesla remains uncertain, analysts point to Waymo’s business model as proof of challenging economics.

Unlike Uber (Uber) and Lyft (LYFT), which utilize vehicles owned and operated by individual drivers, autonomous taxi firms must own their entire fleet. That means overseeing the cost of maintenance, car insurance, charging infrastructure, and cleaning.

It all amounts to an operational cost of $0.42 per mile per vehicle, according to a report by Lux Research. Chris Robinson, senior director of the energy team and author of the report, said that amounts to two to three times the cost of car ownership.

“You need to drive down the cost of offering those services to be competitive with car ownership,” Robinson said. “That’s why I don’t think we’ll see car ownership fundamentally displaced more so than services like Uber and taxi drivers that would be displaced by robotaxis.”

Operational costs are compounded by the process of automating the vehicles. Waymo’s current fleet is made up of Jaguar I-PACE electric vehicles that are equipped for human drivers but retrofitted with high-tech sensors and computers to achieve full autonomy.

While parent company Alphabet doesn’t specifically break out revenue data for its self-driving service, its business unit that includes Waymo posted an operating loss of roughly $2 billion in the first half of the year. Robinson estimates that equipment costs alone surpass $40,000 per vehicle today.

Amazon’s (AMZN) Zoox is attempting to change that calculation with a vehicle built in-house specifically for autonomous use. The company’s vehicles, shaped like toasters, have no steering wheel, no pedals, and no driver’s seat. The ride operates bidirectionally, which means it can drive both ways.

The company is set to launch its service in Las Vegas next year. Co-founder and chief technical officer Jesse Levinson said Zoox would not have survived and made it to market without backing from Amazon, which acquired the company in 2020.

“Making a car is an expensive endeavor in general, but this is a new type of vehicle,” he said. “[You need to] build the autonomy stack, integrate it with this custom robotaxi, you need to collect many, many millions of miles of data. You need to do tons of simulation, you need to develop all kinds of firmware and AI algorithms and the glue to connect it all together. Then you have to validate it out in the field and prove that it’s actually safer than a human. Doing all that takes a lot of time and it takes a lot of capital.”

Consulting firm McKinsey & Co. estimated the global autonomous taxi market could generate as much as $1.3 trillion in revenue by 2030.

Tesla bulls argue that the company holds clear advantages as a proven carmaker armed with data from millions of drivers. But the company has yet to prove that its self-driving technology can operate on its own, and Musk has yet to provide details on how any autonomous fleet would work.

Regardless of a delayed timeline, Narayan said he expects Tesla’s autonomous fleet to contribute to the company’s revenue in a meaningful way. In his latest note, he said robotaxis and full self-driving subscriptions would account for half of Tesla’s valuation.

“I’m a big believer in the robotaxi concept,” he said.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Here Are My Top-3 Dividend Stocks to Buy in October

I’m a huge fan of dividend stocks. I love to collect the passive income they send me. On top of that, dividend stocks have historically outperformed non-payers by a wide margin (9.2% average-annual total return versus 4.3% since 1973, according to Ned Davis Research and Hartford Funds).

Dividend growers have delivered the best returns (10.2%). That’s why I focus on companies with excellent histories of dividend growth that seems highly likely to continue. Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), NextEra Energy (NYSE: NEE), and Prologis (NYSE: PLD) currently sit at the top of my buy list. Here’s why they’re great dividend stocks to buy this October.

An extremely attractive value proposition

Brookfield Infrastructure has been a terrific dividend stock over the years. The global-infrastructure operator has grown its payout at a 9% compound annual rate over its 15-year history. It currently offers a nearly 4%-yielding dividend covered by a conservative 67% dividend-payout ratio.

The company expects to continue growing its dividend. It’s targeting to increase it at a 5% to 9% annual rate. Supporting that view is its robust growth profile. Brookfield Infrastructure expects to grow its funds from operations (FFO) per share by more than 10% annually, fueled by organic growth and accretive acquisitions.

Investors are getting that strong growth profile at an attractive value this October. Brookfield Infrastructure currently trades at around 14.1 times its FFO. That’s well below its historical average of 15.5 times and the 16.5 times multiple it has traded at over the last five years. With a high yield, strong growth prospects, and a cheap price, Brookfield Infrastructure could produce robust total returns in the coming years.

High-powered dividend growth should continue

NextEra Energy is an elite dividend-growth stock. It has increased its payout for 30 straight years. The utility has grown its dividend at a roughly 10% annual rate over the last 20 years. It expects to increase its payout (which currently yields nearly 2.5%) by around 10% per year through at least 2026.

Two factors are powering NextEra’s dividend-growth plan. It has a low dividend-payout ratio (59% compared to a peer group average of 65%). On top of that, it expects its adjusted earnings-per-share (EPS) growth to be at or near the top end of its 6% to 8% annual range through 2027.

Several catalysts are helping drive the healthy earnings-growth outlook. It’s benefiting from operating the largest electric utility in Florida, which has abundant sunshine (great for solar energy) and a growing population. In addition, it’s investing heavily to expand its renewable-energy business outside the state, where it’s capitalizing on robust demand. As a leader in renewables, NextEra Energy should continue growing at a healthy rate for years to come.

Lots of built-in growth

Prologis has delivered above-average dividend growth over the years. The leading industrial real estate investment trust (REIT) has grown its dividend at a 13% compound annual rate during the last five years. That’s more than double the average of the S&P 500 (5%) and other REITs (5%).

The REIT should be able to continue increasing its more-than 3%-yielding dividend at an above-average rate. It’s capitalizing on robust demand for warehouse space, which is keeping occupancy levels high and driving up rental rates. The company expects that rent growth alone (annual rent escalations and higher market rates as existing leases expire) will drive high single-digit annual same-store income growth through 2026. Add in development projects (which include investments in data centers), and the REIT should grow its core FFO per share by 9% to 11% annually. Meanwhile, there’s additional upside potential from completing accretive acquisitions, which have added an average of 1.5% to its FFO per-share growth rate over the last few years.

Income and more

Brookfield Infrastructure, NextEra Energy, and Prologis all offer attractive dividends. On top of that, they all have strong growth prospects, which should enable them to continue increasing their payout at a healthy pace. That puts them in an excellent position to produce above-average total returns, making them great dividend stocks to buy this month.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Matt DiLallo has positions in Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, NextEra Energy, and Prologis. The Motley Fool has positions in and recommends NextEra Energy and Prologis. The Motley Fool recommends Brookfield Infrastructure Partners and recommends the following options: long January 2026 $90 calls on Prologis. The Motley Fool has a disclosure policy.

Here Are My Top-3 Dividend Stocks to Buy in October was originally published by The Motley Fool

Is Apple a Buy, Sell, or Hold in 2025?

Investors have a lot to celebrate this year, with the S&P 500 gaining 20%. While it’s nice to receive high returns, it’s also a good time to examine your holdings heading into the new year.

Apple‘s (NASDAQ: AAPL) stock has underperformed the market by 2 percentage points since the start of the year, increasing 18.3%. However, the company has had a lot of success in the past and richly rewarded shareholders. After all, the company has a $3.5 trillion market capitalization, one of the few that have crossed the trillion-dollar threshold.

Can Apple’s shares regain their market-beating ways? The answer lies in examining the company’s long-term prospects and valuation.

Can a new phone revitalize sales growth?

Apple’s iPhone accounts for a large portion of the company’s sales. During the first nine months of the fiscal year, which ended on June 29, the product represented 52% of Apple’s $296.1 billion top line.

Facing intensifying competition, including from China-based Huawei, iPhone sales have been dropping, In the most recent quarter, they were down 1% to $39.3 billion.

More troubling is that the product has also been losing market share. Apple’s iPhones accounted for 15.8% of smartphone shipments in the second quarter, down from 17.3% in the previous quarter. A year ago, it held a 16% share.

Apple recently released a new version of the iPhone that it hopes can reverse the trend. It has new features, including artificial intelligence (AI) capabilities. Whether that will cause existing customers to upgrade to the expensive models or cause users to switch to an iPhone remains unclear, however. It’s too early to make a judgment on how the new features will impact the top line. Although initial sales reportedly have been disappointing, investors should have more information when Apple reports quarterly earnings in about a month.

Can services sustain growth?

One bright spot for Apple remains sales from providing services. These include advertising, supporting products, cloud services, the App Store, and payments.

In the latest quarter, service sales grew 14.1% to $24.2 billion. And this category has a much higher gross margin than products, 74% versus 35.3%.

However, the U.S. government and several states have claimed Apple’s iPhone has an illegal monopoly that makes it too difficult for consumers to switch phones and develop apps. This could result in a drawn-out process, and the outcome remains uncertain. The cases have the potential to hurt Apple’s service business’ profitability.

Meanwhile, after a dearth of brand-new product categories, Vision Pro, its widely publicized product launched earlier this year, doesn’t seem to have gained much traction. With a high price tag for the combined augmented and virtual reality headset, sales seem to have been disappointing. Management now expects to sell 450,000 units in the first year, well below its initial 800,000 estimate.

The decision

The shares’ gain over the last year has led to a richer valuation. Apple’s stock has a price-to-earnings (P/E) ratio of 34 compared to about 28 a year ago.

The stock also sells at a higher multiple than the S&P 500‘s P/E of 30 , making it more expensive than the overall market. The S&P 500 makes a good comparison since it’s comprised of large-cap stocks.

A higher valuation might seem warranted if Apple had better-than-market growth expectations. However, its main product, the iPhone, has been slumping, and it’s unclear if its new phone version can stem this slide. The new AI feature doesn’t seem likely to provide a long-term competitive edge since others seem likely to quickly incorporate something similar.

Along with a government investigation and unclear prospects for its newest product, I’d steer clear and sell any Apple shares you may hold.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 781% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 30, 2024

Lawrence Rothman, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Is Apple a Buy, Sell, or Hold in 2025? was originally published by The Motley Fool

The big winner if OpenAI becomes a for-profit business? Microsoft.

OpenAI is considering transitioning from a nonprofit into a for-profit company, and its deep-pocketed benefactor, Microsoft (MSFT), has a lot to gain if the ChatGPT developer gets the green light to act more like a startup.

“Anything that frees up OpenAI to focus on profit is likely to benefit Microsoft’s investment in the company,” said Sarah Kreps, director of the Tech Policy Institute in the Brooks School of Public Policy at Cornell University.

A reconfigured business structure would give Microsoft an opportunity to renegotiate its already generous profit cap, as well as discard a provision that denies Microsoft an interest in OpenAI-created general artificial intelligence (GAI), according to another observer.

“[OpenAI] is clearly saying that the nonprofit will no longer be in control, so presumably that means Microsoft and other investors will have more say about what OpenAI does,” said Rose Chan Loui, founding executive director of the University of California Los Angeles’s Lowell Milken Center for Philanthropy and Nonprofits.

But there are potential snags for Microsoft as OpenAI attempts to shed its charitable cloak.

OpenAI’s huge valuation, labyrinth of for-profit subsidiaries, and potentially risky technology make a for-profit switch legally and publicly complicated — and could invite pushback from regulators.

Still, OpenAI’s investors see plenty of upside. On Wednesday, the company announced it raised some $6.6 billion in its latest funding round, valuing the Sam Altman-helped firm at $157 billion. However, that valuation is largely contingent on OpenAI becoming a for-profit entity.

Whirlwind of change

OpenAI is in the midst of a whirlwind of change.

It is experiencing an extended executive exodus including, most recently, the departure of chief technology officer Mira Murati. It also faces increased competition from rivals including Google (GOOG, GOOGL) and Amazon-backed (AMZN) Anthropic.

The reclassification to a for-profit structure would be yet another seismic shift for OpenAI, upending the way it was established nearly a decade ago.

It began in 2015 as a nonprofit under the name OpenAI Inc., a nod to its mission of advancing humanity instead of pursuing profits.

“The corporation is not organized for the private gain of any person,” OpenAI’s certificate of incorporation stated in its organizing documents, along with a promise to keep its technology as open source for public benefit.

Things evolved in 2019 when OpenAI CEO Sam Altman and his team created a for-profit subsidiary to raise outside venture capital — including billions from Microsoft.

It was structured in such a way that the for-profit subsidiary, technically owned by a holding company owned by OpenAI employees and investors, remained under the control of the nonprofit and its board of directors while giving its biggest backer (Microsoft) no board seats and no voting power.

The inherent tension between these two parts of the enterprise is what contributed to a dramatic boardroom clash in 2023, when Altman was ousted by the board and then brought back five days later.

In the aftermath, Microsoft took a non-voting observer position on OpenAI’s board, only to relinquish that seat this year as both OpenAI and Microsoft came under more regulatory scrutiny.

The idea of upending the current structure has already attracted interest from US and European regulators and exacerbated an ideological divide between scientific and business leaders who warn that machine learning technologies like those developed by OpenAI should remain accessible to the public.

The technology, they argue, poses an existential threat to humankind and, therefore, should be operated in a way that’s subject to public scrutiny.

OpenAI and Microsoft are also part of an ongoing inquiry by the US Federal Trade Commission over concerns that AI market consolidation is “distorting innovation and undermining fair competition.”

And multiple calls have been made for California’s attorney general to probe the legality of OpenAI’s business structure. One came from Elon Musk, who co-founded OpenAI with Altman. He sued OpenAI, Altman and 21 named OpenAI subsidiaries.

Musk said the defendants fraudulently promised that his $100 million in OpenAI investments would be used for public benefit.

A transition by OpenAI to for-profit status could also attract the attention of the Internal Revenue Service, given that OpenAI was granted tax-exempt status as a charitable organization.

‘Did they get fair market value?’

One unknown question is to what extent Microsoft will be able to directly extract profits from its investments.

By law, a nonprofit must use its assets only for its stated charitable purposes. And OpenAI’s assets, which include all of OpenAI’s subsidiaries, may not be sold for anything less than fair market value.

The question regulators will want to confirm is, “Did they get fair market value for the asset at the time?” said Gene Takagi, a principal at NEO Law Group.

Chan Loui added that regulators would require OpenAI to realistically value its assets, including residual interest. And she suspects that figure may be in excess of OpenAI’s latest valuation.

“I think the greatest sensitivity probably is with how they remove the nonprofit’s control,” she said. “And I think their best shot of avoiding conflict relating to restructuring is to compensate the nonprofit enough,” Chan Loui said.

“I think that’s the best way for them to get the public on their side, the states on their side, and the IRS on their side.”

What OpenAI is expected to do as part of its transition is register as a public benefit corporation.

Such entities are like traditional corporations but with more freedom to spend on civically minded initiatives, according to Rick Alexander, a veteran corporate structuring lawyer and founder of the Shareholder Commons,

“It’s a permission structure,” Alexander said.

Other public benefit corporations include Elon Musk’s xAI, Warby Parker (WRBY), Allbirds (BIRD), Lemonade (LMND), and Etsy (ETSY).

And based on the success of Musk’s xAI, OpenAI could benefit handsomely from the change. In May, xAI raised $6 billion.

“This type of transition can generate considerable investor interest quickly,” Kreps said. “This is such a capital-intensive industry, so anything OpenAI can do to attract investment will act as a positive feedback loop and accelerate its advantages.”

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance.

Broadcom, Cava Lead Five Stocks Near Buy Points

Artificial intelligence chip stalwart Broadcom (AVGO) and fast-casual pacesetter Cava Group (CAVA) lead this weekend’s watchlist of five stocks near buy points. In addition to AVGO and Cava, the group includes luxury cruise line IPO Viking Holdings (VIK), trading exchange operator Cboe Global Markets (CBOE) and insurance broker Brown & Brown (BRO).

The diverse group of technology, consumer and financial stocks all rallied over the past week as new jobs data appeared to confirm that the U.S. economy remains in good shape. Even as markets priced in fewer Federal Reserve rate cuts, investors pushed the S&P 500 up 0.2% for the week, finishing fractionally below Monday’s record closing high.

↑

X

Are These Stocks Set To Outperform The S&P 500? Earnings May Decide.

Brown & Brown and Viking are part of the IBD Leaderboard portfolio of elite stocks, while Cava stock is on the Leaderboard watchlist.

SwingTrader has open positions in CBOE stock and Cava.

Broadcom Stock

William Blair started coverage of Broadcom with an outperform rating, noting the fabless chipmaker’s $12 billion AI revenue target for fiscal 2024 and “a several-year runway for continued growth” in its networking and custom chip businesses. Tailwinds from AI include the build-out of massive AI data centers by the likes of Google and Meta and the ramping up of Ethernet networking as “the go-to networking protocol for AI data centers.”

The analysts also see a new upgrade cycle as being in the early innings for Broadcom’s traditional chip business focused on servers, storage, wireless and industrial markets. Finally, Broadcom’s software business, which accounts for nearly 40% of total revenue, is set for strong growth as its VMware acquisition pays off.

Broadcom rose 2.3% to 176.64 on the week, rebounding mid-week from its 21-day line. AVGO stock has a 180.25 buy point from a handle on the end of a 16-week consolidation.

Stocks Strong But These Are Scarce; Tesla Robotaxi, Taiwan Semi Due

CAVA Stock

Cava’s same-store sales jumped 14.4% in the second quarter, crushing analyst forecasts of 8.2%. That built in a 9.5% traffic increase and a 4.9% rise in the average ticket, which included a 3% price hike. Customer traffic got a lift from the June 3 launch of grilled steak as a menu item.

Cava opened 18 locations in the quarter, including its first two Chicago units, bringing the total to 341. CEO Brett Schulman told CNBC on Sept. 12 that Cava has a target of 1,000 restaurants by 2032, with a 15% compound growth rate.

In an Aug. 23 note, William Blair analyst Sharon Zackfia detailed initiatives that should boost sales and profit margins, including a revamped loyalty program that will debut in October and a new labor deployment model to improve the speed of service that will be rolled out in early 2025.

Cava stock rose 2.3% to 126.60 on the week. The action included a successful test of its 21-day exponential average. However, Friday’s move crested two possible entry points before finishing a tad below one of them.

Cava rose as high as 128.59 intraday on Friday, which carried the stock past a 128.18 entry based on the Aug. 26 high that preceded the recent consolidation.

Also, investors could have scooped up Cava shares with Friday’s move above the Oct. 1 high of 125.66, roughly coinciding with the 10-day moving average. That also broke a trendline sloping down from the Sept. 23 peak.

However, Friday’s move came on volume that was 43% below average, suggesting a lack of conviction.

Viking Stock

On Tuesday, Viking said it had swept cruise line rankings from Conde Nast Traveler for the second year in a row, voted No. 1 for rivers, oceans and expeditions.

The company is in growth mode following its May 1 IPO. Last month, Viking celebrated its return to China with a Shanghai to Hong Kong trip. It also touted new itineraries along China’s coast to “rarely-visited destinations and ports to which only Viking has access.” In August, Viking took delivery of its new 82-guest ship for the Nile River and its 12-day Pharaohs & Pyramids itinerary.

On Sept. 4, Wells Fargo raised its price target for VIK stock to 39 from 35, keeping an overweight rating. The firm cited demand visibility, with 2025 voyages already 55% booked and prices running 10% higher than a year ago.

VIK stock rose 5.95% to 37.03 on the week. Thursday’s 1.4% move cleared an early entry just above 35 as VIK broke above a trend line from the Aug. 20 rally high. VIK still has an official 37.25 buy point from an 11-week consolidation, according to MarketSurge.

CBOE Stock

Friday’s strong jobs data diminishes risk of a recession. While good news for the stock market, it’s not necessarily great for Cboe, which thrives on volatility. Cboe gives U.S. and global investors tools to hedge risk via its S&P 500 Volatility Index, or VIX.

Cboe’s SPX index options are the mostly actively traded index options in the U.S., providing exposure to the large-cap index as well as options for managing risk.

Volatility soared when the August jobs report came in unexpectedly soft. On Thursday, Cboe said 62.7 million VIX contracts traded hands in the third quarter, the second-best on record.

Still, even if the U.S. economy is on a firmer footing, volatility probably isn’t going away. The Middle East conflict keeps escalating and the U.S. election could throw some curveballs as well.

CBOE rose 3.9% to 210.42 on the week. Tuesday’s 2.5% move — coinciding with Iran’s missile attack on Israel — flashed an early entry opportunity as the rebound off key support at the 50-day moving average also save CBOE break above a trendline sloping down from its Sept. 17 recent high-water mark.

CBOE still has an official 216.14 buy point from a six-week flat base. The latest base is just above a prior consolidation, forging a bullish base-on-base pattern that is clear in a weekly MarketSurge chart.

BRO

Brown & Brown is the sixth-largest independent insurance brokerage in the U.S. On Aug. 12, Wells Fargo upgraded BRO stock to overweight, while raising its price target to 112. The research firm cited the broker’s exposure to middle-market companies, where pricing has held up better. Further, insurance brokers generally don’t face underwriting risk from hurricanes and other disasters.

The attractiveness of the business was highlighted by Monday’s news that saw Marsh McLennan (MMC) acquire McGriff Insurance Services for $7.75 billion in cash.

Brown & Brown has been an aggressive acquirer. Revenue grew 12.5% in Q2, with 2.5 percentage points coming from 10 acquisitions during the quarter.

BRO stock rose 2.9% to 105.65 for the week, rebounding from the 10-week line and clearing some short-term highs, offering an early entry. The stock closed the week just below a 106.02 buy point from a flat base.

Brown & Brown has a stellar 98 IBD Composite Rating on a scale of 1-99, based on a broad range of technical and fundamental factors, according to IBD Stock Checkup.

Be sure to read IBD’s The Big Picture column after each trading day to get the latest on the prevailing stock market trend and what it means for your trading decisions.

YOU MIGHT ALSO LIKE:

These Are The Best 5 Stocks To Buy And Watch Now

Join IBD Live Each Morning For Stock Tips Before The Open

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

AI News: Artificial Intelligence Trends and Top AI Stocks To Watch

Trump's Dark Rhetoric: Migrants Portrayed As Criminals Amid Election Heat

Donald Trump’s Michigan event on Friday, framed as an address on the local economy amid inflation concerns, shifted focus to border security and rampant criticism of migrants.

For 25 minutes, he criticized migrants, using increasingly graphic language, despite the manufacturing backdrop and audience of workers, reported Reuters.

Trump made unfounded claims that migrants crossing the U.S. border were responsible for widespread violence, asserting that they engage in horrific acts without remorse.

Not to forget that Trump’s general disdain for migrants has been a central theme of his campaign this election season.

In fact, recent research by the Axios suggests that he has focused on Venezuelan and Congolese individuals labeled as criminals. Trump labeled migrants from Mexico as criminals 13 times and those from Guatemala 10 times from Sept. 1, 2023, to Oct. 2, 2024.

Also Read: VC Ben Horowitz First Endorsed Donald Trump, Now Pledges Support For Kamala Harris

His increasingly apocalyptic rhetoric includes unfounded claims about migrants’ criminal backgrounds and dire consequences, all while he pushes for mass deportations.

He also suggested that these individuals commit brutal crimes in front of families.

Critics argue this strategy aims to amplify racist stereotypes and exploit Republican fears about the influx of border crossers into the U.S.

This shift in language comes despite the White House implementing new restrictions that have significantly reduced migrant entries. Earlier this year, Trump also played a role in derailing a bipartisan bill in Congress designed to enhance border security.

However, Reuters highlighted that Trump’s message linking migrants to crime appears to be resonating.

A recent KFF poll revealed that 80% of Americans surveyed had encountered false claims about migrants causing an increase in violent crime, while 74% had heard that immigrants were taking jobs from citizens and contributing to rising unemployment, Reuters mentioned in its report.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Artificial Intelligence (AI) Is Set to Drive Solid Growth in This Market: 1 No-Brainer Stock to Buy Hand Over Fist Before That Happens

Goldman Sachs recently released a report estimating that the global cloud computing market could generate a whopping $2 trillion in revenue in 2030. The report projects this market will see a compound annual growth rate of 22% through the end of the decade, with new catalysts such as artificial intelligence (AI) set to play a central role in its growth.

Plenty of companies are already making the most of the surge in spending by cloud service providers. Chipmakers like Nvidia, Broadcom, and Marvell Technology reported impressive growth in their data center revenue, thanks to the robust demand for their AI accelerators. Memory specialist Micron Technology (NASDAQ: MU) also joined the party as AI servers require faster memory chips and more storage capacity, and a similar trend is unfolding in AI-enabled edge devices such as smartphones and personal computers (PCs).

Another company that seems set to jump on the AI bandwagon thanks to the potentially lucrative growth in the global storage market is Seagate Technology (NASDAQ: STX).

Here are some reasons why Seagate is positioned to benefit long-term from the big AI-fueled surge in the storage market.

Seagate Technology is sitting on a huge addressable market

Fortune Business Insights estimates the data storage market was worth $217 billion in 2022, and it could clock an annual growth rate of 18% through 2030 to generate $778 billion in revenue at the end of the forecast period. Additionally, Micron Technology’s recent results have made it clear that AI’s proliferation is driving growth in data center storage.

More specifically, Micron’s revenue from sales of data center solid-state drives (SSDs) more than tripled in the previous fiscal year. Micron also points out that traditional storage markets such as PCs are set to get a nice boost thanks to AI. As CEO Sanjay Mehrotra remarked on the latest earnings conference call:

As an example, leading PC OEMs have recently announced AI-enabled PCs with a minimum of 16GB of DRAM for the value segment and between 32GB to 64GB for the mid and premium segments, versus an average content across all PCs of around 12GB last year.

Seagate Technology is one of the ways investors can capitalize on this massive opportunity. The company sells hard disk drives (HDDs) and SSDs for data centers and PCs, and its recent results show that it has started benefiting from the growth of the storage market.

Seagate’s revenue in the fourth quarter of fiscal 2024 (which ended on June 28) increased 18% year over year to $1.89 billion. The company’s gross margin improved to 30.9% from 19.5% in the same quarter last year. As a result, Seagate swung to a non-GAAP profit of $1.05 per share, compared to a loss of $0.18 per share in the prior-year period.

Analysts were expecting Seagate to post earnings of $0.76 per share on $1.87 billion in revenue. However, a favorable pricing environment in the memory market worked in Seagate’s favor, and it crushed Wall Street’s earnings expectations. Even better, the company’s guidance for the first quarter of fiscal 2025 points toward a significant acceleration in its growth.

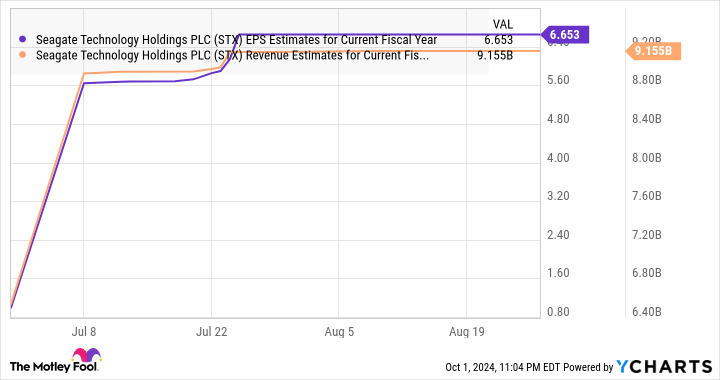

Seagate guided for $2.1 billion in revenue for fiscal Q1, which would be a 45% increase over the year-ago period. Additionally, the company expects to report a profit of $1.40 per share for the quarter, compared to a loss of $0.22 per share in the year-ago quarter. The good part is that Seagate is expected to maintain its outstanding growth throughout fiscal 2025, as per analysts’ estimates.

The top line would be a big improvement from fiscal 2024 levels of $6.5 billion, translating into a potential jump of 40%. For comparison, Seagate’s revenue fell 11% in fiscal 2024, while it reported adjusted earnings of $1.29 per share. So, the company’s earnings are on track to jump 5x in the current fiscal year.

More importantly, Seagate is also likely to sustain its healthy growth levels in the long run, since it has already started benefiting from the AI-driven growth in demand for storage solutions. On its July earnings conference call, Seagate CEO William Mosley remarked:

We’ve also started to see incremental demand for higher-density storage-specific solutions, due in part to enterprises putting storage capacity in place, either on-prem or in private clouds, as they prepare for future AI applications.

As such, it won’t be surprising to see Seagate stock heading higher following the 27% gains it has already had in 2024.

The valuation and the potential stock upside make buying this stock a no-brainer

As already noted, Seagate’s earnings are expected to multiply significantly this year. Analysts forecast that the company’s bottom line will jump another 36% in the next fiscal year, to $9.09 per share. Seagate stock currently trades at 17 times forward earnings, a discount to the Nasdaq-100 index’s price-to-earnings ratio of 32 (using the index as a proxy for tech stocks).

Assuming Seagate trades at 17 times forward earnings after a couple of years and indeed generates $9.09 per share in earnings as analysts expect it to, its stock price could hit $154. That points toward a potential upside of 42% over the next couple of years. This makes Seagate an attractive stock to buy right now to capitalize on the secular growth of the storage market, thanks to catalysts like AI.

Should you invest $1,000 in Seagate Technology Plc right now?

Before you buy stock in Seagate Technology Plc, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Seagate Technology Plc wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

Artificial Intelligence (AI) Is Set to Drive Solid Growth in This Market: 1 No-Brainer Stock to Buy Hand Over Fist Before That Happens was originally published by The Motley Fool