Dow Tumbles Over 400 Points; Duckhorn Portfolio Shares Surge

U.S. stocks traded lower toward the end of trading, with the Nasdaq Composite falling more than 150 points on Monday.

The Dow traded down 0.97% to 41,940.43 while the NASDAQ fell 0.89% to 17,976.85. The S&P 500 also fell, dropping, 0.77% to 5,707.03.

Check This Out: Jim Cramer: AST SpaceMobile Is ‘Just Too Hot,’ Recommends Buying This Tech Stock

Leading and Lagging Sectors

Energy shares jumped by 0.6% on Monday.

In trading on Monday, utilities shares dipped by 1.7%.

Top Headline

AstraZeneca plc AZN entered into an exclusive license agreement with Hong Kong-based CSPC Pharmaceutical Group Ltd to advance the development of an early-stage, novel small-molecule lipoprotein (a) (Lp(a)) disruptor that has the potential to offer additional benefits for patients with dyslipidemia.

Equities Trading UP

- Scholar Rock Holding Corporation SRRK shares shot up 328% to $31.73 after the company announced topline results from the Phase 3 SAPPHIRE clinical trial evaluating the efficacy and safety of apitegromab in patients with SMA. The study achieved its primary endpoint.

- Shares of Arcadium Lithium PLC ALTM got a boost, surging 32% to $4.06 after the company announced that it has been approached by Rio Tinto regarding a potential acquisition.

- Duckhorn Portfolio Inc NAPA shares were also up, gaining 104% to $10.99 after the company reported better-than-expected fourth-quarter financial results. Also, the company announced it into a definitive agreement to be acquired by private equity funds managed by Butterfly Equity.

Equities Trading DOWN

- Trevena, Inc. TRVN shares dropped 46% to $2.50 after the company announced it received a Nasdaq delisting notification.

- Shares of Heritage Insurance Holdings, Inc. HRTG were down 25% to $9.09.

- Universal Insurance Holdings, Inc. UVE was down, falling 19% to $17.12.

Commodities

In commodity news, oil traded up 3.6% to $77.02 while gold traded down 0.1% at $2,666.10.

Silver traded down 1.1% to $32.035 on Monday, while copper fell 0.2% to $4.5635.

Euro zone

European shares closed mostly higher today. The eurozone’s STOXX 600 rose 0.18%, Germany’s DAX fell 0.09% and France’s CAC 40 climbed 0.46%. Spain’s IBEX 35 Index rose 0.50%, while London’s FTSE 100 rose 0.28%.

Retail sales in the Eurozone rose 0.2% month-over-month in August compared to a revised flat reading in the previous month. The Halifax House Price Index in the UK rose 4.7% year-over-year in September compared to a 4.3% gain in August. Factory orders in Germany declined by 5.8% month-over-month in August.

Asia Pacific Markets

Asian markets closed mixed on Monday, with Japan’s Nikkei 225 gaining 1.80%, Hong Kong’s Hang Seng Index gaining 1.60% and India’s BSE Sensex dipping 0.78%.

Foreign exchange reserves in Singapore fell to SGD 499.7 billion in September compared to SGD 501.3 billion a month ago. The index of leading economic indicators in Japan fell to 106.7 in August versus a final reading of 109.3 in the prior month, while index of coincident economic indicators declined to 113.5 in August compared to a final reading of 117.2 month ago.

Economics

Data on consumer credit for August will be released today.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bone Wax Market to Reach $73.0 Million, Globally, by 2033 at 3.2% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 07, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Bone Wax Market by Product (Absorbable Bone Wax and Non-Absorbable Bone Wax), by Application (Orthopedic Surgery, Thoracic Surgery, Neurosurgery and Others), and End User (Specialty Clinics, Hospitals and Ambulatory Surgery Centers): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the bone wax market was valued at $53.1 million in 2023, and is estimated to reach $73.0 million by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Request Sample of the Report on Bone Wax Market 2033 – https://www.alliedmarketresearch.com/request-sample/A324382

Prime Determinants of Growth

The bone wax market is primarily driven by the increasing prevalence of orthopedic surgeries and procedures, spurred by the rising incidence of bone fractures, orthopedic diseases, and conditions such as osteoporosis and arthritis. The aging global population contributes significantly to this trend, as elderly individuals are more prone to bone-related issues requiring surgical interventions. Technological advancements in surgical procedures, including minimally invasive techniques, further contribute to market growth.

In addition, the continuous advancements in bone wax formulations, enhancing their safety and efficacy profiles drives the growth of the market. The development of synthetic and bioresorbable bone wax alternatives addresses concerns related to inflammation and infection, expanding their adoption among healthcare professionals.

Report Coverage & Details

| Repot Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $53.1 million |

| Market Size in 2033 | $73 million |

| CAGR | 3.2% |

| No. of Pages in Report | 280 |

| Segments Covered | Product, Application, End User, and Region |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324382

Segment Highlights

The non-absorbable bone wax segment dominated market share in 2023.

By product, the non-absorbable bone wax segment dominated the market share in 2023. This is attributed to the fact that non-absorbable bone wax provides immediate and effective bleeding control by creating a mechanical barrier, which is crucial in complex surgeries where blood loss needs to be minimized. In addition, its stability and long-lasting properties ensure that it remains effective throughout the healing process without being absorbed or requiring frequent reapplication. This reliability is especially important in procedures involving large bone surfaces or areas prone to excessive bleeding.

The orthopedic segment dominated the market share in 2023.

By application, the orthopedic segment dominated the market share in 2023. This is attributed to rising incidence of orthopedic disorders, such as osteoarthritis and rheumatoid arthritis, has led to an increased number of surgical interventions, driving the demand for bone wax in this field. In addition, the growing aging population, which is more prone to bone-related ailments, further propels the need for orthopedic surgeries. Innovations in surgical techniques and the development of minimally invasive procedures have also contributed to the higher usage of bone wax, as these advancements often require precise and effective hemostatic agents to control bleeding during bone surgeries.

Hospital segment dominated market share in 2023

By end user, hospital segment dominated the market share in 2023. This is attributed to the fact that hospitals are the primary settings for surgical procedures, including orthopedic, neurosurgery, and dental surgeries, where bone wax is commonly used to control bleeding from bone surfaces. The high volume of surgeries performed in hospitals creates a consistent and substantial demand for bone wax. In addition, hospitals have the infrastructure and resources to stock and utilize advanced medical supplies, ensuring a steady supply and usage of bone wax.

Regional Outlook

North America dominated the market share in 2023 due to high adoption of bone wax during the surgeries, strong presence of major key players, and well-established healthcare infrastructure. However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period. This is attributed to expansion in healthcare infrastructure, surge in healthcare expenditure in countries such as China, India, & Japan, and rise in geriatric population.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324382

Key Players

- Zimmer Biomet Holdings, Inc

- Medline Industries, Inc

- Baxter International, Inc.

- Orion Sutures India Pvt. Ltd.

The report provides a detailed analysis of these key players in the global bone wax market. These players have adopted different strategies such as product approval, product launch, and acquisition to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to highlight the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A324382

Recent Developments in Bone Wax Market Worldwide

- In February 2022, Futura Surgicare Pvt. Ltd. launched a new brand, Dolphin Hemostats, for its absorbable hemostat, Hemostax. The product is designed to help surgeons control bleeding.

- In September 2023, Abyrx, Inc. announced that the United States Food and Drug Administration (FDA) has provided regulatory clearance for the company’s Montage Settable Bone Putty for use in cardiothoracic surgery following sternotomy.

- In April 2022, Medline Industries announced that it has entered into a definitive agreement to acquire 100% of shares of Asid Bonz, a leading German supplier of medical devices

Trending Reports in Healthcare Industry:

Biocompatible Coating Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Bilirubin Meters Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Bio Pharma Buffer Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Bio Decontamination Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

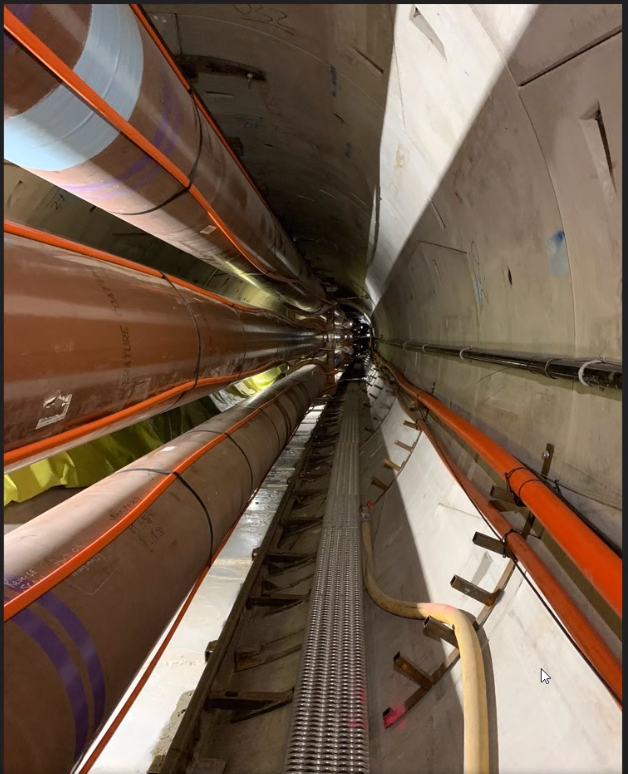

Trans Mountain Announces 10-Year Monitoring Agreement with Hifi Engineering

CALGARY, Alberta, Oct. 07, 2024 (GLOBE NEWSWIRE) — Trans Mountain has entered into an agreement with Hifi Engineering (Hifi) to deploy a High-fidelity Distributed Sensing (HDS™) fibre optic network for comprehensive monitoring and enhanced leak detection on the Trans Mountain Expansion Project. The hybrid fibre optic network consists of a telecommunications cable paired with Hifi’s specialized optical sensing fibre and dual micro duct conduit.

“Trans Mountain is committed to continuous improvement in all facets of our operation,” said Jason Balasch, Vice President Business Development and Commercial Services. “Our pipeline system was already monitored around the clock by two leak detection systems through our control centre in Edmonton. This agreement with Hifi provides our system another layer of leak detection and comprehensive monitoring utilizing their state-of-the-art technology.”

In addition to installing the fibre optic system for enhanced leak detection and intrusion monitoring, Trans Mountain and Hifi have signed a 10-year monitoring agreement. Under this agreement, Hifi will provide real-time monitoring support from its 24/7 operations centre.

“We are honoured to have this agreement with Trans Mountain to include 24/7 monitoring support of this multi-product infrastructure,” said Steven Koles, President and CEO, Hifi. “It represents a great showcase of the product agnostic distributed optical sensing and artificial intelligence and machine learning technology from Hifi which can be applied to all types of pipelines including conventional oil and gas, as well as carbon dioxide, hydrogen, and water.”

State-of-the-art fibre optic system deployed on pipeline for the Trans Mountain Expansion Project.

The Trans Mountain and Hifi initiative marks the world’s longest fully distributed fibre optic sensing deployment on a multi-product liquids pipeline.

Hifi’s HDS™ system, now substantially complete, has been under a progressive baselining and commissioning process since the completion of the Trans Mountain Expansion Project. This process leverages new automation and machine learning developed by Hifi to fully baseline normal pipeline operations.

The deployment includes surveillance support for leak detection, ground disturbance and security integrity risks, including right-of-way intrusion, strain monitoring, pig tracking and other operational applications. The fibre optic system can measure vibrations, temperature and pipe movement, continuously and accurately and can pinpoint the location of a suspected leak or other event within metres.

Trans Mountain’s pipeline system is also monitored by two computational systems, overseen by control centre operators and the leak detection group. Operators have the authority to shut down the pipeline in the event of a system alarm.

Trans Mountain and Hifi were recently recognized by the Fibre Optic Sensing Association (FOSA), receiving Project of the Year for this initiative.

State-of-the-art fibre optic system deployed on pipeline for the Trans Mountain Expansion Project.

About Trans Mountain

Trans Mountain Corporation operates Canada’s only pipeline system transporting oil products to the West Coast. We deliver approximately 890,000 barrels of petroleum products each day through a dual pipeline system of more than 1,150 kilometres of pipeline in Alberta, British Columbia and 111 kilometres of pipeline in Washington state.

Trans Mountain also operates a state-of-the-art loading facility, Westridge Marine Terminal, with three berths providing tidewater access to global markets.

As a federal Crown corporation, Trans Mountain continues to build on more than 70 years of experience delivering operational and safety excellence through our crude oil pipeline system.

With our expanded pipeline system now in place, Trans Mountain provides enhanced direct access for Canadian crude oil to world markets. The expansion realizes a world-class system for oil transport, developed to Canada’s high standards within one of the most stringent regulatory regimes in the world, creating long-term economic benefits, enhanced marine protection, enhanced safety and emergency management capabilities, and enhanced skilled-worker capacity building in communities and Indigenous groups.

About Hifi

Hifi is a privately held Canadian company, with minority ownership from Enbridge, Cenovus and BDC, specializing in the development, supply and commercial operation of next generation fiber optic sensing technologies and machine learning software primarily used for preventative monitoring of pipelines and other critical assets. Hifi’s technology is deployed across over 3.5 million meters of pipeline assets globally. Headquartered in Calgary, Alberta, Hifi currently has a number of commercialized service offerings based on its high fidelity distributed sensing (HDS™) technology platform, over 100 patents issued or pending, and was recently awarded 2023 Innovation award from Energy Connections Canada (ECC). Hifi was also named one of SDTC’s Sustainability Changemakers for both 2022 and 2023 in addition to winning awards from the Fiber Optic Sensing Association in 2023, 2022 and 2021 for Innovation and Project of the Year (for the 1,200 km Trans Mountain Expansion pipeline project). Hifi has ranked as one of the Fastest-Growing Companies in North America on the 2021 and 2023 Deloitte Technology Fast 500.

Media Contact

Trans Mountain Media Relations

(604) 908-9734 or (855) 908-9734

media@transmountain.com

Hifi Engineering

(403) 264-8930

info@hifieng.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f1c71da-554a-49b2-9a7c-53c138e89f54

https://www.globenewswire.com/NewsRoom/AttachmentNg/55b5ee87-bf52-4f13-8a0d-4210e18ac37b

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Don't Bet On China's Economic Stimulus Yet As Yuan Faces Volatility Amid US Election, Jobs Data: Analysts

China’s yuan is expected to experience fluctuations due to Beijing’s economic stimulus and pressures from the United States as its presidential election approaches on Nov. 5, analysts indicated.

What Happened: The yuan could appreciate against the U.S. dollar if Beijing implements significant fiscal policy easing as part of its stimulus efforts, the South China Morning Post reported on Monday. This could counteract depreciation pressures from potential U.S. trade tariff hikes.

Analysts from Goldman Sachs noted that rapid yuan appreciation might encourage exporters to settle more foreign exchange, potentially boosting the yuan against trading-partner currencies. However, this could negatively impact China’s export growth, which the People’s Bank of China aims to avoid. The central bank previously stated it would guard against exchange-rate overshooting.

Meanwhile, strong U.S. jobs data and the upcoming election could further support the dollar, according to Barclays analyst Mitul Kotecha. The U.S. dollar has already gained against the offshore yuan due to a broader rebound. If former President Donald Trump is re-elected, the yuan may face additional pressure from fears of tariffs and sanctions, as noted by ING economist Lynn Song.

See Also: What’s Going On With Futu Holdings’ Stock?

Why It Matters: China’s recent economic stimulus measures have been significant, with the country making substantial changes to its monetary policy. This includes adjustments to mortgage rates and other stimuli, which have led to increased flows into Chinese stocks. Notably, traders are showing confidence by holding risk in Chinese stocks over a longer period, indicating a positive outlook.

Before these stimulus announcements, China was on the brink of a Japan-style ‘lost decade’ of deflation and stagnation. The People’s Bank of China took decisive action by cutting its mandatory reserve ratio and reducing policy rates. These measures aim to counteract deflationary pressures and stimulate economic growth.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Gains Over 3%; Scholar Rock Shares Spike Higher

U.S. stocks traded lower midway through trading, with the Dow Jones index falling more than 200 points on Monday.

The Dow traded down 0.49% to 42,146.78 while the NASDAQ fell 0.36% to 18,073.37. The S&P 500 also fell, dropping, 0.32% to 5,732.84.

Check This Out: Jim Cramer: AST SpaceMobile Is ‘Just Too Hot,’ Recommends Buying This Tech Stock

Leading and Lagging Sectors

Energy shares jumped by 0.5% on Monday.

In trading on Monday, consumer discretionary shares dipped by 1.3%.

Top Headline

AstraZeneca plc AZN entered into an exclusive license agreement with Hong Kong-based CSPC Pharmaceutical Group Ltd to advance the development of an early-stage, novel small-molecule lipoprotein (a) (Lp(a)) disruptor that has the potential to offer additional benefits for patients with dyslipidemia.

Equities Trading UP

- Scholar Rock Holding Corporation SRRK shares shot up 310% to $30.44 after the company announced topline results from the Phase 3 SAPPHIRE clinical trial evaluating the efficacy and safety of apitegromab in patients with SMA. The study achieved its primary endpoint.

- Shares of Arcadium Lithium PLC ALTM got a boost, surging 41% to $4.34 after the company announced that it has been approached by Rio Tinto regarding a potential acquisition.

- Duckhorn Portfolio Inc NAPA shares were also up, gaining 102% to $10.88 fter the company reported better-than-expected fourth-quarter financial results. Also, the company announced it into a definitive agreement to be acquired by private equity funds managed by Butterfly Equity.

Equities Trading DOWN

- Trevena, Inc. TRVN shares dropped 48% to $2.4192 after the company announced it received a Nasdaq delisting notification.

- Shares of Heritage Insurance Holdings, Inc. HRTG were down 21% to $9.65.

- Universal Insurance Holdings, Inc. UVE was down, falling 18% to $17.12.

Commodities

In commodity news, oil traded up 3.4% to $76.99 while gold traded down 0.2% at $2,662.50.

Silver traded down 1.1% to $32.025 on Monday, while copper fell 0.5% to $4.5535.

Euro zone

European shares were mostly higher today. The eurozone’s STOXX 600 rose 0.26%, Germany’s DAX fell 0.09% and France’s CAC 40 climbed 0.48%. Spain’s IBEX 35 Index rose 0.80%, while London’s FTSE 100 rose 0.46%.

Retail sales in the Eurozone rose 0.2% month-over-month in August compared to a revised flat reading in the previous month. The Halifax House Price Index in the UK rose 4.7% year-over-year in September compared to a 4.3% gain in August. Factory orders in Germany declined by 5.8% month-over-month in August.

Asia Pacific Markets

Asian markets closed mixed on Monday, with Japan’s Nikkei 225 gaining 1.80%, Hong Kong’s Hang Seng Index gaining 1.60% and India’s BSE Sensex dipping 0.78%.

Foreign exchange reserves in Singapore fell to SGD 499.7 billion in September compared to SGD 501.3 billion a month ago. The index of leading economic indicators in Japan fell to 106.7 in August versus a final reading of 109.3 in the prior month, while index of coincident economic indicators declined to 113.5 in August compared to a final reading of 117.2 month ago.

Economics

Data on consumer credit for August will be released today.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Getting $3,000 a Month in Social Security? Strategies to Cut Your Taxes

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

When determining your income taxes in retirement and on your Social Security benefits, the IRS uses your “combined income” and filing status as the two main markers. At $36,000 a year from Social Security, none of your benefits would be taxable, since only half of your benefits are calculated into combined income. However most, if not all, retirees have additional income sources, such as retirement account withdrawals, a pension, part-time wages and more. When accounting for these as well, you may be subject to taxes on up to 85% of your total benefits. You may be able to manage this by using Roth accounts, getting income from non-taxable sources or reducing your income by working less or taking smaller withdrawals.

Are you looking for professional help with managing your retirement income and Social Security benefits? Speak with a financial advisor today.

How Social Security Benefits Are Taxed

If you receive Social Security retirement benefits, you may have to pay income taxes on them. To see whether you’ll need to, divide your Social Security income in half. Then add your adjusted gross income (AGI), plus any income from tax-exempt sources, such as municipal bonds. The result is called your “combined income” and it, along with your filing status, helps determine how much of your Social Security income is taxable.

For example, if you get $36,000 a year ($3,000 a month) from Social Security and have no other income, your combined income is $36,000 divided by 2, or $18,000. None of your benefits are taxable if your income is below $25,000 for a single filer or $32,000 for joint filers. So, in this case, you’d owe nothing to the federal government.

Odds are good, though, that you don’t rely only on Social Security. The Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2022 found 79% of retirees had one or more sources of private income. If you’re one of this majority, some of your Social Security could be taxable. Here’s how the brackets work:

-

Single Filers

-

Combined income is less than $25,000: none of your benefits may be taxable

-

Combined income is between $25,000 and $34,000: up to 50% of your benefits may be taxable

-

Combined income is above $34,000: up to 85% of your benefits may be taxable

-

-

Joint Filers

-

Combined income is less than $32,000: none of your benefits may be taxable

-

Combined income is between $32,000 and $44,000: up to 50% of your benefits may be taxable

-

Combined income is above $44,000: up to 85% of your benefits may be taxable

-

An Example of Social Security Benefit Taxes

To see how this works, consider a single filer who receives $36,000 in Social Security and withdraws $24,000 from their retirement account annually. For this person, their combined income would be half their Social Security income ($18,000), plus $24,000 in other income, for a grand total of $42,000.

At $42,000 in combined income for a single filer, up to 85% of their Social Security benefits are taxable. That doesn’t mean you have to pay an 85% tax rate on your $36,000 in Social Security benefits, nor does it mean all 85% will actually apply.

To calculate how much your taxes are on these Social Security benefits, you’ll want to follow the complex process of determining it via IRS Publication 915. Using this calculation method, the IRS document will help you whittle down your income following a 19-step process that’s too complex to review here. In short, when coming to the end of this calculation, this situation will work out to your taxable Social Security benefits equaling $11,300. This amount will then need to be added to your taxable income for the tax year.

If you need help with Social Security or other retirement benefits, a financial advisor could be helpful. Talk to an advisor today.

Strategies for Potentially Reducing Your Social Security Benefit Taxes

You may want to consider moves to potentially shrink the amount of your Social Security benefits that are taxed. One is to generate less income from sources that increase combined income, should you be able to afford it. Again, combined income is equal to your AGI (withdrawals from retirement accounts, wages etc.), tax-exempt income, etc. However, you may not be able to afford going this route.

You could take withdrawals from a Roth IRA, should you have one. Roth withdrawals are not included in combined income, as they feature tax-free benefits in retirement. You could take any amount of Roth withdrawals without exposing any of your Social Security benefits to taxation. If your retirement savings are in both Roth and pre-tax accounts, you can also take a blended approach to avoid emptying your Roth account too quickly, while still minimizing some taxable income increases.

Selling investments that have lost value can also allow you to write off up to $3,000 a year, further reducing your combined income. If you don’t have any such investments, you might use cash reserves to pay the bills Social Security can’t cover. That also won’t increase your combined income.

Finally, you can time withdrawals. For instance, let’s say in one year your combined income is already so high that the maximum 85% of your Social Security benefits will be taxed. You could take even more withdrawals than you need that year and bank them for next year’s expenses. Since 85% is the maximum, you won’t be exposing any more Social Security benefits to taxes this year. And then next year, you can withdraw less and again minimize taxation of Social Security dollars.

These simple examples for illustration purposes don’t include some potentially important considerations. For instance, some states tax Social Security benefits. And, while most of these follow the federal approach, some apply taxes differently. Also, individual details such as filing status and whether a spouse also has Social Security benefits can significantly affect these situations. For personalized advice and help navigating the nuances, consider speaking with a financial advisor.

Retirement Planning Tips

-

If you’re looking for ways to manage your Social Security benefits alongside your other sources of retirement income, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Social Security is a critical part of many retirees’ income plans. Estimate how much you’ll get from this important source of income using SmartAsset’s Social Security calculator.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/FatCamera, ©iStock.com/SrdjanPav

The post I’m Going to Get $3,000 Per Month From Social Security. How Can I Reduce My Taxes? appeared first on SmartReads by SmartAsset.

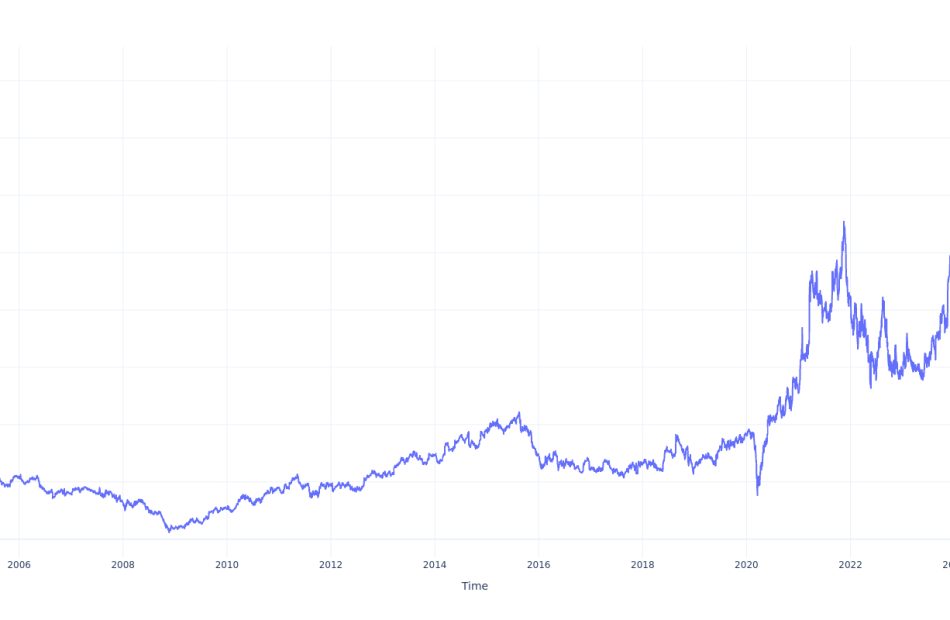

$100 Invested In Williams-Sonoma 20 Years Ago Would Be Worth This Much Today

Williams-Sonoma WSM has outperformed the market over the past 20 years by 2.71% on an annualized basis producing an average annual return of 11.23%. Currently, Williams-Sonoma has a market capitalization of $18.90 billion.

Buying $100 In WSM: If an investor had bought $100 of WSM stock 20 years ago, it would be worth $826.17 today based on a price of $149.62 for WSM at the time of writing.

Williams-Sonoma’s Performance Over Last 20 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Colorado Homes To Be Bulldozed After Developers Built Over Retention Pond – Families Left With No Choice But To Sell And Move Everything

Holly Sturgon never imagined that the home she thought would be her “forever home” would turn into a heartbreaking project of dismantling, piece by piece. Eleven years ago, when she first moved in, it felt like the start of a long, happy chapter.

But fast-forward to today, and that dream has crumbled – literally. Her once-beloved house now resembles more of a garage sale, with everything from toilets to pendant lights up for grabs. The reason? A devastating flood unearthed a secret that no homeowner should ever face.

Don’t Miss:

Sturgon’s home, along with a few others in her Colorado neighborhood, had been built on land that was never supposed to have homes on it in the first place. Beneath her house lay what used to be a retention pond, a safety net meant to catch excess water during floods. But decades ago, developers had filled in the retention pond and built homes without warning buyers of the looming risk.

In 2023, the reckoning came. An unprecedented flood rolled in, and the water returned to where it once belonged. Sturgon’s house, along with others, stood no chance. The flood wreaked havoc on the homes, revealing their fragile foundations.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

“People walking by must be thinking, ‘What in the world is happening here?'” Sturgon told 9News, visibly emotional as she recalled the day it all came crashing down. “It’s been an emotional roller coaster. For a while, I cried every day.”

The emotional weight of it all has been crushing. But Holly isn’t alone in her grief. Her story echoes across the country as natural disasters grow more frequent and fierce, from wildfires to hurricanes. Climate change is rewriting the rules, and places like Johnstown, Colorado, face the consequences head-on.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Here’s how you can earn passive income with just $100.

Once overlooked or repurposed, retention ponds are now seen as vital infrastructure to prevent future flooding. In Sturgon’s case, that meant the unthinkable – her home had to go. Officials decided that to protect the community from future floods, they needed to restore the land to its original purpose.

“I’m going to miss this place,” Sturgon said softly, her voice heavy with sadness. “What hurts the most is saying goodbye to the people we’ve grown close to. We didn’t just build a house here, we built relationships.”

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

The emotional toll doesn’t end there. Although the town agreed to repurchase the homes for a fair price, staying in Colorado is no longer an option for Sturgon’s family. With the average home price in the state at a staggering $514,618, finding another home within their budget is impossible.

For the Sturgons, affording another home in the state they love is simply impossible, thanks to the rising housing costs. “We’re being priced out,” Sturgon admitted. “It’s heartbreaking. We love Colorado, but staying here is no longer an option.” With no affordable alternatives, Holly and her family are making the difficult decision to relocate to Georgia, where home prices are more reasonable and they can be closer to family.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Open Lower; Dow Tumbles Over 150 Points

U.S. stocks traded lower this morning, with the Dow Jones falling more than 150 points on Monday.

Following the market opening Monday, the Dow traded down 0.38% to 42,192.55 while the NASDAQ fell 0.29% to 18,085.96. The S&P 500 also fell, dropping, 0.32% to 5,732.58.

Check This Out: Jim Cramer: AST SpaceMobile Is ‘Just Too Hot,’ Recommends Buying This Tech Stock

Leading and Lagging Sectors

Energy shares jumped by 0.5% on Monday.

In trading on Monday, consumer discretionary shares dipped by 1.2%.

Top Headline

AstraZeneca plc AZN entered into an exclusive license agreement with Hong Kong-based CSPC Pharmaceutical Group Ltd to advance the development of an early-stage, novel small-molecule lipoprotein (a) (Lp(a)) disruptor that has the potential to offer additional benefits for patients with dyslipidemia.

Equities Trading UP

- Scholar Rock Holding Corporation SRRK shares shot up 264% to $27.23 after the company announced topline results from the Phase 3 SAPPHIRE clinical trial evaluating the efficacy and safety of apitegromab in patients with SMA. The study achieved its primary endpoint.

- Shares of Algorhythm Holdings, Inc. RIME got a boost, surging 53% to $0.7174 after its subsidiary, SemiCab, secured a service contract with a $200 billion global consumer packaged goods company. Starting in mid-October 2024, SemiCab will provide AI-powered shipping services across major metro markets, with potential expansion after six months.

- LogicMark, Inc. LGMK shares were also up, gaining 47% to $0.1651.

Equities Trading DOWN

- Trevena, Inc. TRVN shares dropped 44% to $2.64 after the company announced it received a Nasdaq delisting notification.

- Shares of CNFinance Holdings Limited CNF were down 31% to $1.3601.

- Laser Photonics Corporation LASE was down, falling 29% to $5.01.

Commodities

In commodity news, oil traded up 1.4% to $75.40 while gold traded down 0.3% at $2,660.70.

Silver traded down 1.9% to $31.77 on Monday, while copper fell 0.7% to $4.5425.

Euro zone

European shares were mostly higher today. The eurozone’s STOXX 600 rose 0.2%, Germany’s DAX fell 0.1% and France’s CAC 40 climbed 0.4%. Spain’s IBEX 35 Index rose 0.9%, while London’s FTSE 100 rose 0.4%.

Retail sales in the Eurozone rose 0.2% month-over-month in August compared to a revised flat reading in the previous month. The Halifax House Price Index in the UK rose 4.7% year-over-year in September compared to a 4.3% gain in August. Factory orders in Germany declined by 5.8% month-over-month in August.

Asia Pacific Markets

Asian markets closed mixed on Monday, with Japan’s Nikkei 225 gaining 1.80%, Hong Kong’s Hang Seng Index gaining 1.60% and India’s BSE Sensex dipping 0.78%.

Foreign exchange reserves in Singapore fell to SGD 499.7 billion in September compared to SGD 501.3 billion a month ago. The index of leading economic indicators in Japan fell to 106.7 in August versus a final reading of 109.3 in the prior month, while index of coincident economic indicators declined to 113.5 in August compared to a final reading of 117.2 month ago.

Economics

Data on consumer credit for August will be released today.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analysts See 180% Upside for Rent the Runway: Should You Buy?

Rent the Runway RENT is a micro-cap stock whose price target was recently updated by Jefferies. This signals that the name could have nearly triple-bagger upside. According to MT Newswires, analysts at Jefferies updated their price target for the firm on Sept. 6. That target now sits at $26 per share, while the company trades at $9.31 per share. This implies that the analyst believes shares could rise 180% from their current level.

To understand this lofty target, I’ll examine the consumer discretionary firm’s operations, competitors, and financial situation.

Rent the Runway Aims to Offer Customers an “Unlimited Closet”

Rent the Runway (RTR) is a fashion company with a unique business model. The company is a platform where customers can rent pieces of clothing. It specifically caters to women, allowing them to rent high-priced designer garments. This allows its customers to access these garments for a much lower price than having to buy them.

This opens up the world of designer clothing to many more people, allowing many users to split the cost of those garments. RTR points out that its average customer wears clothes worth 25 times more than what they pay in subscription fees for the service annually. The company aims to provide its customers with an “unlimited closet” as they can swap out their garments for other ones whenever they like. It generates revenue mostly through subscriptions to this service, which cost between $94 and $235 per month.

RTR: Improving Profitability Big Time, But a Massive Competitor Is Stealing Growth

Looking at the financials of Rent the Runway, it is a mixed bag. On the positive side, the company is becoming more profitable. The company has increased its gross margin by nearly 600 basis points since fiscal year 2021. Last quarter, its adjusted EBITDA margin was over 17%. That’s a 700+ basis point increase from last year.

Additionally, its free cash flow has increased massively. The number through the first six months of 2024 sits at -$6 million, compared to -$30 million in the same 2023 period. The company says it expects to break even on cash flow in 2024.

Looking at cash flow is particularly important for a firm like RTR over net income, as product depreciation expense equals 21% of its revenue. Depreciation is a non-cash expense; it is an accounting expense. So, this isn’t cash that the company is spending. The company deducts it from its net income but not its cash flow.

The ultimate goal of a business is to generate positive cash rather than a positive accounting profit, i.e., net income. A company’s cash flow paints a better picture of its financial situation.

However, a big problem for RTR is the fact that its active subscribers are declining. The figure fell 3% year over year last quarter. Meanwhile, competitors like Nuuly saw active subscribers grow by 55% last quarter. Nuuly’s average active subscribers now sit at over 250,000, nearly double that of RTR. This is despite the fact that the company has only been active for around five years versus 15 years for RTR.

This difference signals growth in this industry, but it’s not going to RTR. This means that RTR’s offerings are likely viewed as inferior to Nuuly’s and do not give customers the items they want.

Nuuly, owned by the massive firm Urban Outfitters URBN, enjoys a big advantage in acquiring a variety of clothing to offer customers. This is very difficult for the small RTR to compete with. This difference in being able to offer a wider variety of options is a likely source of Nuuly’s superior growth. Nuuly also has a lower price point, offering more casual clothing that can appeal to a wider audience.

RTR’s Rock-Bottom Valuation Sparks Wall Street Interest

Despite its issues, it’s hard to dismiss RTR’s extremely low valuation. It is trading at nearly one-tenth of its projected sales over the next twelve months. This is assuredly a big reason why some Wall Street analysts place such large price targets on the firm.

Its increasing profitability is great to see, but it likely needs to see growth reaccelerate before the market will give it any credit. If it can’t, this indicates that RTR’s offerings to customers have fundamental issues, and the company can’t expect to succeed long term. Still, its valuation makes it an interesting name to watch if it can find a way to start growing again.

The article “Analysts See 180% Upside for Rent the Runway: Should You Buy?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.