German Recession Fears Rise After Factory Orders Drop

German recession concerns increased after factory orders declined more than expected in August, adding concerns about Europe’s largest economy.

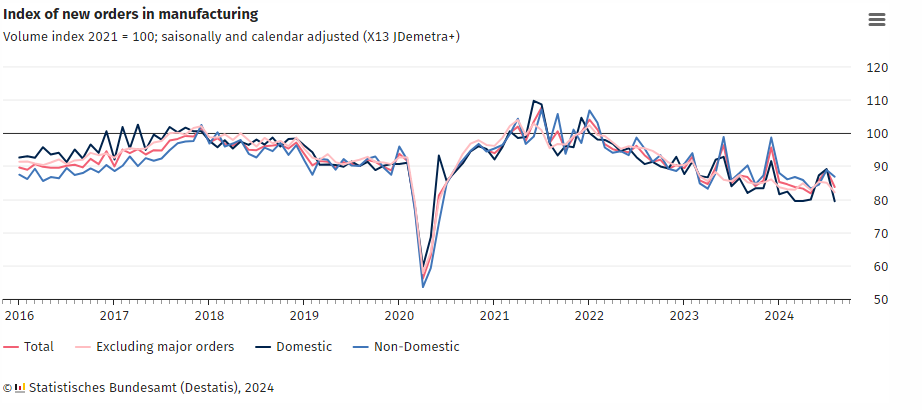

New orders dropped 5.8% month-on-month in August, the Federal Statistical Office (Destatis) said today. Economists had forecast a decline of 2%, making it the steepest fall since January, according to Bloomberg.

Factory orders dropped after “very large orders” for aircraft, ships, trains, and military vehicles were placed in July, Destatis said. When large-scale orders are excluded, new orders in August fell 3.4% lower than in July 2024, it said.

Germany’s economy ministry will downgrade its 2024 economic forecast, expecting gross domestic product (GDP) to shrink by 0.2%, newspaper Sueddeutsche Zeitung reported.

A recovery in the industrial economy in the second half “is unlikely,” the ministry said in a statement. It pointed to “persistently weak demand and continued deterioration in corporate sentiment.”

DAX fell 170 points following the news, finding its footing around the 19,000 level. The index remained down 0.3% at 12 PM CET. However, as the price failed to reach lows from Friday, the technical thesis of a short-term pullback at the beginning of Q4 remains intact.

German Recession Appears More Likely

Germany is facing an increasing number of economic headwinds.

The country may feel the impact of trade tensions after the European Union imposed tariffs against China’s electric vehicle makers. Germany vetoed the decision after pressure from Mercedes-Benz Group MBGAF and BMW BMWYY.

Volkswagen VWAGY warned that it is considering closing factories amid increased competition with rival Chinese car makers.

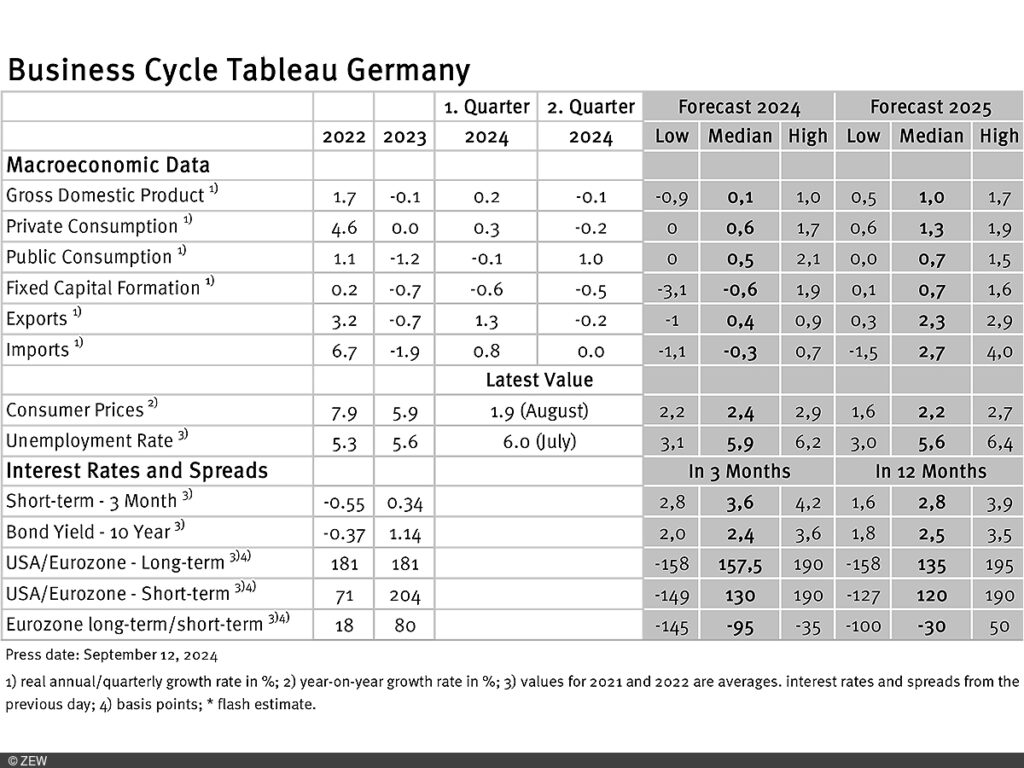

The recessionary outlook adds to growing concerns about the German economy. GDP shrank by 0.1% in the second quarter of this year.

Experts are now signaling economic stagnation this year, the ZEW Institute said on September 23. They lowered their 2024 growth forecast by 0.1 percentage points to just 0.1%.

Germany is falling behind the rest of the eurozone in terms of “both actual growth and growth expectations,” ZEW said.

Germany releases industrial production data on Tuesday, which is forecast to increase by 1%.

In July, industrial production declined by 2.4%, with the automotive industry having “a particularly negative impact,” Destatis said.

New orders in the capital and intermediate goods sectors in Germany fell 8.6% and 2.2%, respectively, Destatis said. New orders for consumer goods declined by 0.9%.

German Business, Consumer Sentiment Sours

Business and consumer sentiment in Germany has soured as well.

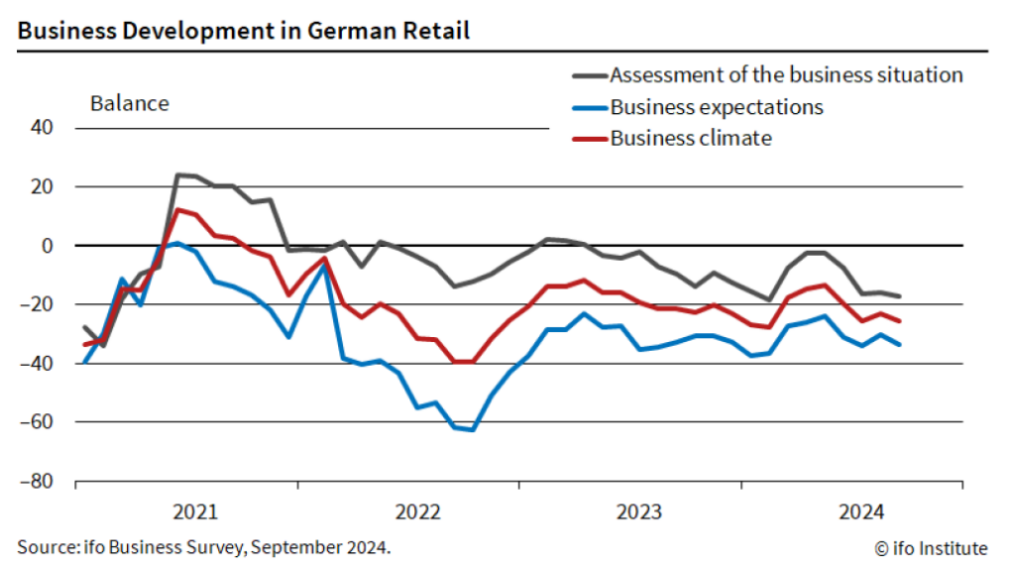

The ifo Institute’s expectations gauge fell in September to 86.3, the lowest since February.

The Ifo expectation index for German retail “clouded over” in September. It fell to -25.6 points, down from -23.1 points in August. Retailers assessed their current situation as slightly worse and have become more pessimistic about the coming months, ifo said today.

“Consumers are unsettled about the economic policy environment,” ifo expert Patrick Höppner, said. “No further dynamic growth in private consumer spending can be expected for the rest of 2024.”

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply