Activated Carbon Market to Boom: SkyQuest Projects $13.87 Billion Valuation by 2031

Westford, USA, Oct. 07, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the global activated carbon market will reach a value of $13.87 Billion by 2031, with a CAGR of 9.3% during the forecast period (2024-2031). The activated carbon market has been witnessing remarkable growth owing to its escalating applications in air purification, water treatment, and several industrial processes. The leading drivers of the global market comprise rising concerns regarding water quality, growing environmental regulations, and the progress of the food and healthcare industries. Overall, the market is poised for continued growth supported by growing awareness of health standards and environmental issues.

Request Sample of the Report on Activated Carbon Market 2031 – https://www.skyquestt.com/sample-request/activated-carbon-market

Activated Carbon Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6.23 Billion |

| Estimated Value by 2031 | USD 13.87 Billion |

| Growth Rate | Poised to grow at a CAGR of 9.3% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, End Use, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Growing number of patent filings by major market players |

| Key Market Opportunities | Growing Emphasis of Activated Carbon Producers on Reactivated Carbon |

| Key Market Drivers | Growing Industrialization in Emerging Nations with Heavy Investments in Infrastructure |

Browse in-depth TOC on the “Activated Carbon Market” Pages – 197, Tables – 95, Figures – 76

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/activated-carbon-market

Powdered Segment to Hold Notable Market Share Owing to its Versatility and Effectiveness

By type, the powdered segment led the activated carbon market with maximum share and will continue dominance over the forecast period owing to its effectiveness and versatility. PAC or powdered activated carbon is commonly used in air purification, water treatment, and food industry due to its quick absorption qualities and high surface area. Also, it can be easily used, mainly to remove pollutants, thus increasing its preference in broader applications. Moreover, the growing demand for strict ecological regulations and clean water is considerably impacting the adoption of powdered activated carbons.

However, the granular segment is the fastest-growing segment observed in the activated carbon market owing to its efficiency in continuous flow applications, mainly in air purification and water treatment. Precisely, GAC is largely preferred due to its larger particle size, durability, and low pressure drop, which increases its application in fixed-bed systems. Also, it can be easily reused and regenerated, which improves its cost-effectiveness, hence, the segment’s growth.

Mounting Demand for Safe and Clean Drinking Water to Fuel Water and Wastewater Treatment Segment

By end use, the water and wastewater treatment segment are projected to lead the market owing to the rising demand for safe and clean drinking water, supported by the ever-increasing population and rising urbanization. Activated carbon is prominent for its effectiveness at removing contaminants and odors, increasing its significance in industrial and municipal water treatment processes. Furthermore, the capability of activated carbons in eliminating the progressing pollutants in personal care and pharmaceutical products increases its role in water treatment.

Nonetheless, the automotive segment is observed to be the fastest-growing owing to its increased focus on improvement of air quality and emission control. Activated carbon holds key applications in air filters in vehicle cabins and fuel vapor recovery systems to eliminate unsafe pollutants and gases. This improves environmental compliance and passenger comfort. Moreover, inclination towards electric vehicles which demands reliable air filtration solutions impacts the segment’s growth.

Remarkable Industrial Growth and Urbanization to Drive the Market in Asia-Pacific

Asia-Pacific held a larger share of the market owing to heavy industrial growth and growing urbanization. Speedy industrialization in key developing nations like India and China is fueling the need for activated carbon in diverse manufacturing processes, water treatment, and air purification. Ever-growing urban population increases the demand for clean air and water, triggering investments in ecological technologies that use activated carbon.

North America is the fastest-growing region and is projected to lead the market over the forecast period owing to the strong regulatory environment and availability of advanced technology. Strict environmental standards and regulations for water and air quality considerably fuel the need for activated carbon in different applications. Moreover, North America is the center for several innovations and advanced technologies which improve its efficiency and effectiveness.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/activated-carbon-market

Activated Carbon Market Insight

Drivers:

- Strict Environmental Regulations About Water and Air Quality

- Growing Demand for Clean Water

- Mounting Applications in Healthcare Industry

Restraints:

- Significant Production Costs of Activated Carbon

- Wide Availability of Substitutes

- Low Awareness in Developing Nations

Prominent Players in Activated Carbon Market

- Osaka Gas Chemicals Co., Ltd.

- Silcarbon Aktivkohle GmbH

- Calgon Carbon Corporation

- Cabot Corporation

- Kuraray Co., Ltd.

- Donau Carbon GmbH

- Kureha Corporation

- ADA-ES, Inc.

- Carbon Activated Corporation

- Haycarb PLC

Key Questions Answered in Global Activated Carbon Market Report

- What is the growth rate and size of the Activated Carbon Market, according to SkyQuest Technology?

- What are the main trends and advancements reshaping the Activated Carbon Market?

- What are the key opportunities observed in the Activated Carbon Market?

This report provides the following insights:

Analysis of key drivers (growing technological advancements, rising sustainability trends, growing concerns for air quality), restraints (disturbances in raw materials supply, intensifying market competition, growing environmental concerns), opportunities (growth in developing economies, growth of healthcare sector, introduction of eco-friendly products), and challenges (disposal and regeneration issues, economic instability, strict regulations for production) influencing the growth of activated carbon market

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the activated carbon market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the activated carbon market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Heat Pump Market: Global Opportunity Analysis and Forecast, 2024-2031

Graphene Market: Global Opportunity Analysis and Forecast, 2024-2031

Ammonia Market: Global Opportunity Analysis and Forecast, 2024-2031

Aluminum Market: Global Opportunity Analysis and Forecast, 2024-2031

Biopesticides Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Drops 400 Points, But Super Micro Soars As Nvidia Clears Entry; Cathie Wood Sells AI Chipmaker After 74% Gain (Live Coverage)

The Dow Jones Industrial Average and other indexes on Monday gave back all their gains from the previous session, as the weight of rising yields and tensions in the Middle East made investors wary. But Super Micro Computer (SMCI) managed to buck the trend on the stock market today with a double-digit gain by the closing bell.

↑

X

From Artificial Intelligence To Interest Rate Cuts, Here’s How Investors Can Win Big In 2024

The Dow dropped 1%, falling 401 points, while losses for the S&P 500 amounted to 1% as well. The Nasdaq traded 1.2% lower. All three indexes are hugging their 10-day moving averages.

Volume appeared to be slightly higher on the New York Stock Exchange and the Nasdaq compared with the same time on Friday. Decliners outnumbered advancers by more than 3-to-1 on the NYSE and nearly that same ratio on the Nasdaq.

The small-cap Russell 2000 fell 1%, and the Innovator IBD 50 (FFTY) exchange traded fund reversed 0.8% lower.

Crude oil rose nearly 4% to $77.33 a barrel amid rising tensions in the Middle East.

Further, the yield on the benchmark 10-year Treasury note surged four basis points to 4.02%, which helped dampen stocks Monday. It is the first time since Aug. 8 that the 10-year yield topped the 4% level.

Super Micro Computer Stock Soars

Also on the stock market today, shares of Super Micro Computer soared nearly 16%. But Supermicro’s chart remains weak as the 50-day moving average languishes below the longer 200-day line. Its Relative Strength Rating is a paltry 15 out of a possible 99.

Supermicro’s Composite Rating also lags at 50, but its EPS Rating is an ideal 99. The stock holds a beta of 3.54, based on chart analysis and data from IBD MarketSurge that reflects its high level of volatility.

3:08 p.m. ET

CPI Due, Amazon Falls

In economic news, Thursday’s consumer price index report for September could move markets. Economists expect a 0.1% increase in CPI from August, with core inflation rising 0.2%.

Amazon (AMZN) fell after a downgrade from Wells Fargo. Amazon stock dropped 3%, pushing shares close to their 50-day moving average.

1:54 p.m. ET

Stock Market Today: Nvidia Gains

Artificial intelligence leader Nvidia (NVDA) also bucked Monday’s selling trend and headed for its fourth straight day of gains since it rebounded from the 50-day moving average on Wednesday. The stock cleared a trendline entry at around 127 in early action and gained more than 3% in afternoon trades.

One of the Magnificent Seven stocks, Nvidia sits on the IBD 50, IBD Leaderboard and IBD SwingTrader lists. Recent gains have lifted the stock back to a market capitalization of $3 trillion.

Shares rose after the company announced that it was currently shipping more than 1000 graphic processing units each quarter and that it had a new liquid-cooling offering. Super Micro Computer stock was the best S&P 500 performer on the stock market today.

Fellow Magnificent Seven stock Tesla (TSLA) fell more than 2% ahead of its robotaxi event on Thursday. The stock has been forming a cup base and now shows a handle entry at 264.86.

Warren Buffett And Cathie Wood Both Own These Two Hot Stocks

Cathie Wood Sells Taiwan Semi

Cathie Wood’s ARK Autonomous Tech ETF (ARKQ) sold shares of Nvidia AI chipmaker Taiwan Semiconductor (TSM). Chart analysis also shows that the stock is in a buy zone from a buy point of 175.45.

As of Friday’s closing price, the stock had gained 74% year to date. Third-quarter results are due on Oct. 17.

Meanwhile, Intapp (INTA) triggered a round-trip sell signal by falling below its buy point of 45.43 after a 14% gain.

And shares of Vista Outdoor (VSTO) gapped up and broke out from a flat base with a buy point at 41.11 on news that the sports products maker is selling two of its businesses units.

12:22 p.m. ET

Insurance Stocks Sell Off

Viking (VIK) broke out at a buy point of 37.25 in higher-than-average volume. But shares dipped below the entry at midday in the stock market today.

In building and heavy construction, Fluor (FLR) is breaking out at a 50.48 buy point from a double-bottom base. Volume was 50% above average.

In the insurance sector — one of the worst performing on Monday — Kinsale Capital (KNSL) and Hamilton Insurance (HG) sold off and plunged below their 50-day moving averages in heavy volume.

10:40 a.m. ET

Dow Jones Stocks

Apple (AAPL) fell more than 1% after Jefferies analysts downgraded the stock from a buy rating to hold, saying the hardware has some catching up to do for iPhones to be able to handle AI tasks. Shares are testing the 21-day exponential moving average.

Fellow Dow Jones component Chevron (CVX) rose 0.5% as oil stocks got a boost on Monday. JPMorgan Chase (JPM) held to its support level at the 50-day moving average in the stock market today, ahead of its earnings report later this week.

Tech and health care stocks gave up early gains on the Dow Jones index.

Stocks Fall But Hold Key Levels; Nvidia Flashes Buy Signal

Stock Market Today: Marathon Breaks Out

Oil stocks rose. Marathon Oil (MRO) broke out from a double-bottom base at 29.05, according to the daily chart on IBD MarketSurge.

Delta Air Lines (DAL) has its third-quarter results scheduled for Thursday. The stock is forming a cup-with-handle base with a 52.45 buy point.

Banks also kick off third-quarter earnings this week. JPMorgan Chase and Wells Fargo (WFC) report on Friday.

China stocks have been rallying amid news of more anticipated stimulus from the National Development and Reform Commission due Tuesday. Those stocks may have more room for growth, according to Goldman Sachs strategists.

China internet stock Baidu (BIDU) and retailer Alibaba (BABA) rose 1% to 2.3%, although PDD (PDD) and JD (JD) reversed slightly lower.

Pfizer (PFE) gapped above its 50-day moving average the after reports that activist investor Starboard Value has a $1 billion stake in the drugmaker with plans to “make changes to turn its performance around.” Pfizer is forming a flat base with a 31.54 buy point.

Please follow VRamakrishnan on X/Twitter for more news on the stock market today.

YOU MAY ALSO LIKE:

IBD Live: Learn And Analyze Growth Stocks With The Pros

Learn How To Time The Market With IBD’s ETF Market Strategy

Find The Best Long-Term Investments With IBD Long-Term Leaders

MarketSurge: Research, Charts, Data And Coaching All In One Place

How To Research Growth Stocks: Why This IBD Tool Simplifies The Search For Top Stocks

Earnings Preview: Saratoga Investment

Saratoga Investment SAR is gearing up to announce its quarterly earnings on Tuesday, 2024-10-08. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Saratoga Investment will report an earnings per share (EPS) of $0.94.

Investors in Saratoga Investment are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

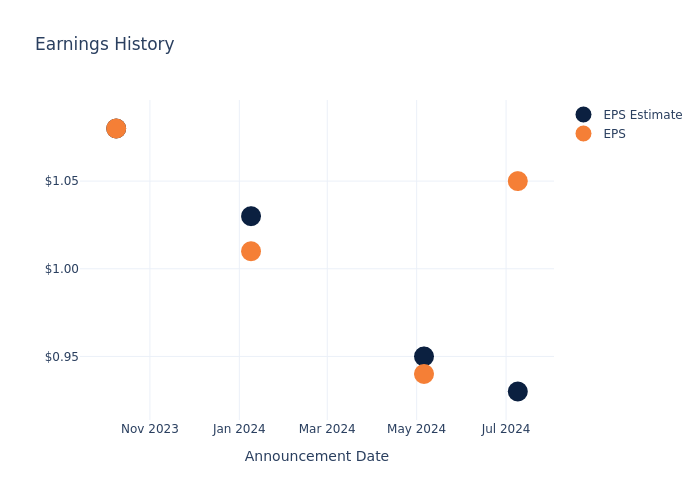

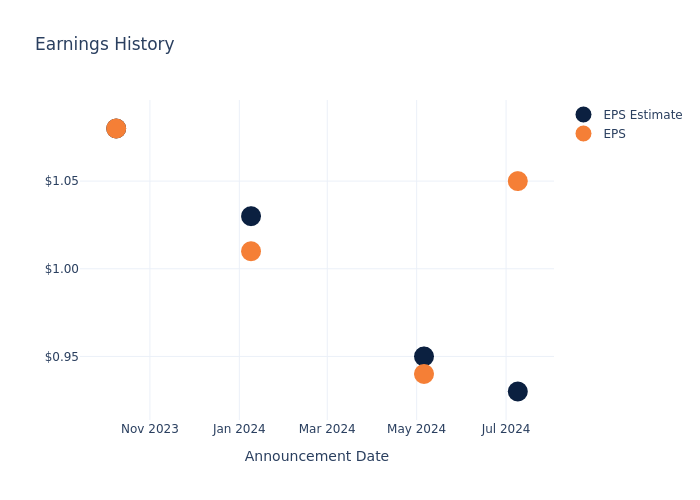

Historical Earnings Performance

The company’s EPS beat by $0.12 in the last quarter, leading to a 2.72% increase in the share price on the following day.

Here’s a look at Saratoga Investment’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.93 | 0.95 | 1.03 | 1.08 |

| EPS Actual | 1.05 | 0.94 | 1.01 | 1.08 |

| Price Change % | 3.0% | -1.0% | -10.0% | -2.0% |

Market Performance of Saratoga Investment’s Stock

Shares of Saratoga Investment were trading at $23.24 as of October 04. Over the last 52-week period, shares are down 1.86%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Saratoga Investment visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AZZ Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

AZZ Inc. AZZ will release earnings results for its second quarter, after the closing bell on Wednesday, Oct. 9.

Analysts expect the Fort Worth, Texas-based company to report quarterly earnings at $1.32 per share, up from $1.27 per share in the year-ago period. AZZ is projected to post quarterly revenue of $411.8 million, according to data from Benzinga Pro.

On Sept. 24, AZZ announced the successful completion of term loan B repricing in leverage-neutral transaction.

AZZ shares gained 2.8% to close at $82.50 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Wolfe Research analyst Timna Tanners initiated coverage on the stock with a Peer Perform rating on July 31. This analyst has an accuracy rate of 67%.

- B. Riley Securities analyst Lucas Pipes maintained a Buy rating and raised the price target from $89 to $99 on July 17. This analyst has an accuracy rate of 68%.

- Evercore ISI Group analyst Stephen Richardson initiated coverage on the stock rating with an Outperform rating and a price target of $90 on June 14. This analyst has an accuracy rate of 66%.

- Noble Capital Markets analyst Michael Heim upgraded the stock from Market Perform to Outperform with a price target of $95 on June 11. This analyst has an accuracy rate of 73%.

- Jefferies analyst Laurence Alexander initiated coverage on the stock with a Buy rating and a price target of $105 on May 20. This analyst has an accuracy rate of 77%.

Considering buying AZZ stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biomass Power Generation Market to Reach $124.5 Billion, Globally, by 2033 at 3.2% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 07, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Biomass Power Generation Market by Feedstock (Forest Waste, Agriculture Waste, Animal Waste and Municipal Waste), Fuel (Solid, Liquid and Gaseous), Technology (Gasification, Combustion, Anaerobic Digestion and Pyrolysis): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the biomass power generation market was valued at $91.3 billion in 2023, and is estimated to reach $124.5 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A08334

Prime determinants of growth

The global biomass power generation market is experiencing growth due to increase in demand for stable baseload or dispatchable power systems. However, high initial setup costs for biomass power plants is expected to hamper the market. Moreover, innovations in biomass conversion technologies, such as gasification and anaerobic digestion are expected to offer lucrative opportunities in the market during the forecast period.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $91.3 billion |

| Market Size in 2033 | $124.5 billion |

| CAGR | 3.2% |

| No. of Pages in Report | 300 |

| Segments Covered | Feedstock, Fuel, Technology, and Region |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

The agriculture waste segment is expected to remain the largest type throughout the forecast period

By feedstock, harnessing agricultural waste for biomass power generation offers a compelling solution to these challenges. By converting these residues into energy, biomass power plants can produce electricity, heat, or biofuels. The process typically involves combustion, gasification, or anaerobic digestion, depending on the feedstock and desired end product.

Procure Complete Report (300 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/biomass-power-generation-market

The solid segment dominated the market throughout the forecast period

By fuel, biomass power generation utilizing solid biomass holds significant promise as a sustainable alternative to fossil fuels, contributing to renewable energy targets globally. Solid biomass refers to organic materials derived from plants and animals that are used directly as fuel or converted into biofuels. This biomass can include wood, agricultural residues, forestry residues, and dedicated energy crops like switchgrass or miscanthus. Harnessing solid biomass for power generation involves several processes, each crucial to its efficiency, environmental impact, and economic feasibility.

The combustion segment is expected to lead throughout the forecast period

By technology, biomass combustion involves burning organic materials directly to generate heat, which can be used to produce steam to drive turbines and generate electricity. Crop residues such as straw and husks, as well as wood waste, are commonly used in combustion-based biomass power plants. This method is straightforward and well-established but requires careful management to minimize emissions and ensure efficient energy conversion.

Asia-Pacific to maintain its dominance by 2033

Region wise, biomass power generation in the Asia-Pacific region has seen significant growth and adoption in recent years, driven by various factors including environmental concerns, energy security, and economic development. This renewable energy source utilizes organic materials such as agricultural residues, wood waste, and municipal solid waste to produce electricity and heat, making it a versatile and sustainable option for many countries in the region.

China has emerged as a leader in biomass power generation in Asia-Pacific. The country’s vast agricultural sector provides ample feedstock for biomass plants, including crop residues like rice husks and straw. India is another prominent player in the biomass power sector. With a large agricultural base and significant biomass resources, India has leveraged these advantages to expand its renewable energy portfolio. Biomass power plants in India utilize a variety of feedstocks, including agricultural residues, forestry residues, and organic municipal waste.

For Purchase Inquiry: https://www.alliedmarketresearch.com/biomass-power-generation-market/purchase-options

Players: –

- Drax Global

- ENGIE

- Babcock & Wilcox Enterprises, Inc

- Xcel Energy Inc.

- Ørsted A/S

- Ameresco

- Vattenfall AB

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Sumitomo Corporation

- Hurst Boiler & Welding Co, Inc

The report provides a detailed analysis of these key players in the global biomass power generation market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Energy & Power Industry:

Biomass Heating Plant Market Global Opportunity Analysis and Industry Forecast, 2024-2033

Biomass Market Analysis and Industry Forecast, 2024-2033

Biomass Briquette Fuel Market Opportunity Analysis and Forecast, 2024-2033

Biomass Gasification Market Analysis and Industry Forecast, 2021-2031

Biopower Market Opportunity Analysis and Forecast, 2021-2031

Clean Energy Infrastructure Market Size, Share, Trend Analysis Report, 2024-2033

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Blog: https://www.alliedmarketresearch.com/resource-center/trends-and-outlook/energy-and-power

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Two Marijuana Giants Will Soon Report Earnings, Hear From CEOs At Benzinga Cannabis Conference

Curaleaf

Curaleaf Holdings, Inc. CURA CURLF will report its financial and operating results for the third quarter that ended Sept. 30, 2024 after market close on Nov. 6, 2024.

The cannabis giant said it would host a conference call and audio webcast on the same day at 5:00 pm Eastern Time.

Curaleaf reported its second-quarter financials in August, revealing revenue of $342 million, up by 2% from the same quarter of the previous year. The company also reported a net loss of $48.9 million for the quarter, marking a per-share loss of $0.06.

Nevertheless, the company has continued to actively expand its global and domestic footprint. Internationally, revenue surged by 78% for the second quarter, driven by robust performance in the UK and Germany.

The company has also recognized the potential of Poland’s medical marijuana market, as its subsidiary, Curaleaf International, expanded in the European country this year via the acquisition of Can4Med, a pharmaceutical wholesaler specializing in cannabinoid medication.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Curaleaf named its executive chairman Boris Jordan as the new CEO in August, after Matt Darin announced his retirement plans.

Jordan is one of the keynote speakers at the upcoming Benzinga event in Illinois. Come, join us at the 19th Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9. Get your tickets now before prices surge by following this link.

Curaleaf’s shares traded 0.67% lower at $2.96 per share at the time of writing on Monday morning.

MariMed

MariMed Inc. MRMD MRMD will report third-quarter financial results on Nov. 6, 2024, after the markets close. Management will host a conference call the next day at 8:00 am Eastern Time.

The multi-state cannabis operator disclosed its financial results for the second quarter, which ended June 30, 2024, in August, revealing revenue of $40.4 million, compared to $36.5 million in the same period last year.

Jon Levine, who is also among the slew of experts and entrepreneurs slated to speak at this week’s Benzinga Cannabis Conference in Chicago, said at the time that MariMed management team is “confident we will realize margin expansion and increased cash flow long-term as our new assets deliver their full revenue potential.”

During the second quarter, the company closed the acquisition of Allgreens Dispensary, its fifth dispensary in Illinois.

MariMed’s shares traded 4.40% lower at $0.152 per share at the time of writing on Monday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hydrogel Market to Reach $45.7 Billion, Globally, by 2033 at 6.9% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 07, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Hydrogel Market by Raw Material Type (Synthetic, Natural and Hybrid), Composition (Polyacrylate, Polyacrylamide, Silicone-modified hydrogels, Agar and Others), Form (Amorphous and Semicrystalline), Product (Semicrystalline buttons, Amorphous Gels, Impregnated Gauze, Films and Matrices and Hydrogel Sheets), and Application (Contact Lenses, Hygiene Products, Wound Care, Drug Delivery, Tissue Engineering and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the hydrogel market was valued at $23.4 billion in 2023, and is estimated to reach $45.7 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Prime determinants of growth

The global hydrogel market is experiencing growth due to several factors such as rise in demand for hydrogels in the personal care and hygiene sector and the increasing use of hydrogels in drug delivery systems, tissue engineering, and wound healing applications. However, high production costs associated with hydrogel hinder market growth. Moreover, the rise in consumer awareness and the rise in demand for environmentally friendly products present opportunities for the hydrogel market.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/1399

Report coverage and details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $23.4 billion |

| Market Size in 2033 | $45.7 billion |

| CAGR | 6.9% |

| No. of Pages in Report | 300 |

| Segments Covered | Raw Material, Composition, Form, Product, Application, and Region. |

| Drivers | Rise in demand in personal care and hygiene products Increase in demand in medical and healthcare applications |

| Opportunity | Agriculture and environmental applications |

| Restraint | Limited biodegradability and environmental concerns |

Synthetic segment to maintain its dominance by 2033

By raw material, the synthetic segment held the highest market share in 2023 and is likely to retain its dominance during the forecast period. Rise in demand for synthetic raw materials in the hydrogel market is driven by their superior properties, such as high absorbency, durability, and customizable functionality. These materials offer consistent quality and performance, essential for applications in medical devices, personal care products, and agriculture. In addition, advancements in polymer chemistry enable the development of innovative hydrogel formulations, meeting specific industry requirements. The scalability and cost-effectiveness of synthetic raw materials further boost their preference over natural alternatives in the expanding hydrogel market.

Others segment to maintain its dominance by 2033

Based on composition, the others segment held the highest market share in 2023 and is estimated to dominate during the forecast period. The demand for polyethylene glycol (PEG), polyvinyl pyrrolidone (PVP), polyvinyl alcohol (PVA), and gelatin in the hydrogel market is increasing due to their versatile properties. These materials enhance hydrogel performance through improved biocompatibility, water solubility, and mechanical strength. Their use in medical, pharmaceutical, and personal care products, such as wound dressings, drug delivery systems, and hygiene items, is expanding. In addition, their role in developing environmentally friendly and biodegradable hydrogels is further driving adoption in various applications.

Procure Complete Report (300 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/hydrogel-market

Semicrystalline segment to maintain its dominance by 2033

Based on form, the semicrystalline segment held the highest market share in 2023 and is estimated to dominate during the forecast period. Increase in demand for the semicrystalline form in the hydrogel market is driven by its superior mechanical properties, thermal stability, and controlled swelling behavior. These attributes make semicrystalline hydrogels ideal for applications requiring durability and precision, such as in medical devices, drug delivery systems, and tissue engineering. In addition, their enhanced structural integrity and responsiveness to environmental stimuli cater to advanced technological and biomedical applications, further boosting their popularity in the market.

Films and Matrices segment to maintain its dominance by 2033

Based on product, the films and matrices segment held the highest market share in 2023 and is estimated to dominate during the forecast period. Rise in demand for films and matrices in the hydrogel market is driven by their extensive applications in the medical and pharmaceutical sectors. These hydrogel products offer excellent wound-healing capabilities, controlled drug delivery, and biocompatibility. In addition, their use in transdermal patches and tissue engineering scaffolds is expanding due to advancements in biomedical research. The growing focus on minimally invasive treatments and the development of advanced therapies further boost their demand, making films and matrices integral to modern healthcare solutions.

Contact lenses segment to maintain its dominance by 2033

Based on application, the contact lenses segment held the highest market share in 2023 and is estimated to dominate the market during the forecast period. Rise in demand for contact lenses is boosting the hydrogel market due to several factors. Hydrogels provide superior comfort and hydration, essential for extended wear, making them ideal for contact lens production. Advances in hydrogel technology enhance oxygen permeability and durability, meeting consumer preferences for high-performance lenses. In addition, the growing prevalence of vision correction needs, and aesthetic use of colored contact lenses further drive demand, positioning hydrogels as a key material in the expanding contact lens market.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/hydrogel-market/purchase-options

Asia-Pacific is expected to experience the fastest growth during the forecast period.

Based on region, Asia-Pacific was the fastest-growing region in terms of revenue in 2023. Increase in demand for hydrogels in the Asia-Pacific region can be attributed to several factors. The growing population and urbanization are driving the demand for personal care products, where hydrogels are extensively used in items such as diapers and sanitary napkins. In addition, advancements in healthcare infrastructure and rise in disposable incomes are boosting the adoption of hydrogel-based medical devices and wound care products. Furthermore, the expanding agricultural sector is fueling demand for hydrogels in soil moisture retention and crop protection applications.

Leading Market Players: –

- 3M Company

- Procyon Corporation

- Essity Aktiebolag AB

- PAUL HARTMANN AG

- Ashland Global Holdings Inc

- Medline Industries, Inc.

- Smith & Nephew plc

- The Cooper Companies, Inc.

- B. Braun Holding GmbH & Co. KG

- Cardinal Health, Inc

The report provides a detailed analysis of these key players in the global hydrogel market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Catheter Introducer Sheaths Market Size on Track to Expand at 6.1% CAGR, Reaching USD 1.7 Billion by 2031| States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 07, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global catheter introducer sheaths market was worth US$ 1.0 Bn in 2022 and is expected to reach US$ 1.7 Bn by the year 2031 at a CAGR of 6.1 % between 2023 and 2031.

Catheter introducer sheaths are specialized medical devices used in various procedures to facilitate the insertion of catheters into the body. They serve as a protective and guiding channel for the catheter, allowing for more controlled and less traumatic entry into the vascular system or other target areas. Typically made of flexible and biocompatible materials, these sheaths are designed to minimize the risk of vessel damage and provide a pathway for the catheter to advance smoothly.

Catheter introducer sheaths are crucial in enhancing the safety and efficiency of catheterization procedures by providing a stable and controlled environment for catheter insertion and minimizing potential complications.

For More Details, Request for a Sample of this Research Report:

https://www.transparencymarketresearch.com/catheter-introducer-sheaths-market.html

The introducer sheath is usually placed in a blood vessel, such as the femoral or radial artery, through a small incision or puncture. Once the sheath is in position, the catheter can be inserted through it, allowing for precise delivery of the catheter to the desired location. This technique is commonly used in various procedures, including angiography, catheter-based interventions, and electrophysiology studies. After the procedure, the sheath is typically removed, and a hemostatic device or manual pressure is applied to ensure that bleeding is controlled.

Catheter Introducer Sheaths Market Overview

Catheter introducer sheaths (카테터 삽입기 외장 시장) offer several benefits that contribute to their significant role in medical procedures. These sheaths enhance procedural efficiency by providing a stable and controlled pathway for catheter insertion, which minimizes trauma to blood vessels and surrounding tissues. This reduces procedural complications, facilitates shorter recovery times, and improves patient outcomes. Additionally, introducer sheaths can accommodate various catheter types and sizes, making them versatile tools in both – diagnostic and therapeutic interventions. Their design often incorporates features such as hemostatic valves and radiopaque markers, further facilitating precise placement and enhancing overall procedural safety.

Several factors are driving the growth of the catheter introducer sheaths market. Firstly, the increasing prevalence of cardiovascular diseases and the rising number of minimally invasive procedures are significant contributors. As these conditions become more common, the demand for reliable and effective catheterization tools grows, boosting market demand. Technological advancements in medical devices, including the development of more flexible and durable sheaths, are also propelling market expansion. These innovations improve procedural outcomes and patient comfort, thereby increasing adoption rates.

Additionally, the growing focus on patient safety and the adoption of advanced healthcare technologies across various regions further stimulate market growth. The expanding healthcare infrastructure in emerging economies, coupled with increased investments in medical research and development, also plays a crucial role.

Moreover, the rise in elderly population, who are more likely to require catheter-based interventions, contributes to a higher demand for these devices. Collectively, these factors drive the expansion of the catheter introducer sheaths market, reflecting their essential role in modern medical procedures.

For Complete Report Details, Request Sample Copy from Here –

https://www.transparencymarketresearch.com/catheter-introducer-sheaths-market.html

Catheter Introducer Sheaths Market Regional Insights

- Europe generated the largest market value in 2023. The region is also expected to maintain its dominance during the forecast period.

In Europe, several key factors are driving the growth of the catheter introducer sheaths market. One of the primary factors is the increasing prevalence of cardiovascular diseases and chronic conditions that necessitate catheter-based interventions. As Europe’s aging population grows, there is a higher incidence of conditions such as heart disease, stroke, and diabetes, which require frequent use of catheterization techniques. This rising demand for diagnostic and therapeutic procedures fuels the need for advanced catheter introducer sheaths.

Technological advancements also play a significant role in boosting the market in Europe. Continuous innovation in catheter introducer sheath design and materials enhances their functionality, safety, and patient comfort. European healthcare providers benefit from the latest developments, including sheaths with improved flexibility, durability, and hemostatic features. These advancements contribute to better procedural outcomes and increased adoption rates across medical facilities.

Additionally, Europe’s robust healthcare infrastructure supports market growth. The presence of advanced hospitals and specialized medical centers that prioritize high-quality patient care drives the demand for sophisticated medical devices. Furthermore, favorable regulatory environments and government initiatives aimed at improving healthcare services and investing in medical technologies bolster the adoption of catheter introducer sheaths.

The emphasis on minimally-invasive procedures, which offer benefits such as reduced recovery times and lower risk of complications, also supports market expansion. European healthcare systems increasingly favor such approaches, leading to greater utilization of catheter introducer sheaths. Moreover, the growing focus on patient safety and the push for more efficient and effective medical solutions align with the increasing use of these devices.

In summary, the combination of an aging population, technological innovation, advanced healthcare infrastructure, and a shift towards minimally-invasive procedures are key factors driving the catheter introducer sheaths market in Europe. These elements collectively contribute to the market’s expansion and the increasing adoption of these essential medical tools.

Prominent Players Operating in Catheter Introducer Sheaths Market

Abbott, Boston Scientific Corporation, Stryker Corporation, Teleflex Incorporated, Merit Medical Systems, Inc., Terumo Corporation, Medtronic plc, W. L. Gore & Associates, Inc., Lepu Medical Technology(Beijing) Co., Ltd., Becton, Dickinson, and Company (BD), Cardinal Health, Inc., B. Braun SE, ICU Medical, Inc., Cook Medical and BIOTRONIK SE & Co KG are some of the leading players operating in the industry.

Buy this Premium Research Report from Here: https://www.transparencymarketresearch.com/checkout.php?rep_id=85444<ype=S

Catheter Introducers Sheaths Market Segmentation

Product Type

- Integrated Introducer Sheaths

- Separate Introducer Sheaths

French Size

- Cardiovascular

- Peripheral Vascular

- Neurovascular

- Others

- Cardiovascular

- Peripheral Vascular

- Neurovascular

- Others

- Cardiovascular

- Peripheral Vascular

- Neurovascular

- Others

End-user

- Hospitals

- Ambulatory Surgical Centers

- Presence

- Others (research & academic institutes, specialty clinics, etc.)

More Trending Reports by Transparency Market Research –

- Optical Microscopes Market – The global optical microscopes market (광학 현미경 시장) was valued at US$ 2.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2031.

- Polymerase Chain Reaction (PCR) Consumables Market – Valued at US$ 520.5 million in 2022, the global polymerase chain reaction (PCR) consumables market (중합효소연쇄반응(PCR) 소모품 시장) is expected to grow at a CAGR of 4.3% from 2023 to 2031.

- Pharmaceutical Robots Market – The pharmaceutical robots market (제약 로봇 시장) was valued at US$ 177.9 million in 2022 and is set to advance at a CAGR of 10.3% from 2023 to 2031, reaching US$ 426.8 million by the end of 2031.

- Medical Imaging Phantoms Market – The global medical imaging phantoms market(의료 영상 팬텀 시장) was valued at US$ 188.3 million in 2022 and is expected to grow at a CAGR of 3.6% from 2023 to 2031, reaching US$ 257.7 million by the end of the forecast period.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AstraZeneca and Gilead Sciences merger would be the biggest in the pharma history

The Speculation Around an AstraZeneca-Gilead Merger

AstraZeneca, the UK’s largest drugmaker valued at $140bn, has reportedly contacted Gilead Sciences, an American biopharmaceutical company with a market value of approximately $96bn, regarding a possible merger deal. The approach was supposedly informal and aimed at testing its US rivals interest in the deal.

Gilead has previously focused on acquiring smaller pharmaceutical companies and has formerly shifted away from large merger deals with Big Pharma companies.

However, a successful merger would be the largest in the industries history and would produce the world’s largest pharmaceutical company in terms of market value. The deal would surpass previous deals such as the recent $87.6bn valued deal between Bristol-Myers Squibb and Celgene Corporation, completed November 2019.

AstraZeneca, Gilead merger could be motivated by the demand for Covid-19 treatments

The disruption caused around the globe by the Covid-19 pandemic is difficult to ignore. By June 2020, the virus had infected over 7 million people and killed over 400,000. The Pharmaceutical industry has accelerated efforts to develop treatments and vaccines for the disease.

Gilead Sciences is a front runner in the provision of Covid-19 therapies. antiviral treatment, Remdesivir has been proven to shorten the recovery time of patients infected with the novel coronavirus. Remdesivir, could bring in more than $7bn in annual sales by 2022 if governments decide to stockpile the drug to prevent future outbreaks.

Meanwhile, AstraZeneca is migrating into the final phases of a possible Covid-19 vaccine. Therefore, a merger with Gilead would strengthen both companies influence in the treatment of coronaviruses.

A successful merger will be difficult to achieve

Gilead has performed well in recent years and is considered a more profitable business than most big Pharma companies. The group achieved a net income of $5.4bn in 2019. The success of remdesivir is expected to increase profits for 2020, the group’s revenues growing 5% year-on-year during the first quarter.

Large pharma deals are usually completed when one party is financially distressed. As this is not the case an agreeable merger seems unlikely.

“AstraZeneca and Gilead Sciences merger would be the biggest in the pharma history” was originally created and published by Pharmaceutical Technology, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Charles & Colvard, Ltd. Comments on a Letter from Riverstyx Capital Management to Charles & Colvard Shareholders

Notes that Purported Nomination of Director Candidates by a Riverstyx Principal Is Invalid and that the Nominations Will Not be Recognized

RESEARCH TRIANGLE PARK, N.C., Oct. 7, 2024 /PRNewswire/ — Charles & Colvard, Ltd. (“Charles & Colvard” or the “Company”) CTHR today commented on a letter sent to the Company’s shareholders and released publicly by Riverstyx Capital Management, LLC (“Riverstyx”). The Company provided the following statement in response:

On August 27, Charles & Colvard received a purported notice (the “Notice”) from Ben Franklin, a principal of Riverstyx Capital Management, indicating his intention to nominate three candidates to stand for election to Charles & Colvard’s Board of Directors (the “Board”) at the Company’s upcoming Annual Meeting (the “Annual Meeting”).

Like most public companies, Charles & Colvard’s Bylaws require a shareholder that wishes to nominate candidates for election to provide the Company with advance notice and relevant information regarding the shareholder and its candidates. The aim of such provisions, which numerous courts have recognized as valid, is to ensure that the Board and shareholders have adequate information with which to evaluate candidates and make an informed decision about the nomination and election of directors.

The Notice failed to comply with the clear requirements of the Company’s 2011 Amended and Restated Bylaws (the “Bylaws”), which are consistent with the Bylaws of the majority of public companies in relevant respects. Among many other deficiencies, the Notice omitted basic and critical information required by the Bylaws, such as:

-

- The biographies and work histories of the candidates;

- The ownership stakes of the candidates and of the nominating person (Mr. Franklin) and his affiliates and associates, which appear to include various entities that own the Company’s stock that are not even mentioned in the Notice; and

- The consent of each candidate to serve as a director.

After a comprehensive review of the Notice and its deficiencies, and with input from its advisors, the Board today notified Mr. Franklin that the Notice is invalid. Mr. Franklin waited until the day before the last day of the nomination window to deliver the deficient Notice. Accordingly, the Company will not recognize Mr. Franklin’s nominations. Any proxies submitted, or votes cast, for the election of Mr. Franklin’s candidates will be disregarded.

Charles & Colvard’s Board is committed to acting in the best interests of all shareholders and has invited Mr. Franklin to share his perspectives on the Company’s business and strategy directly with the Board. The Board and management team look forward to constructively engaging with Mr. Franklin.

Charles & Colvard’s Board will make a recommendation to shareholders with respect to the upcoming Annual Meeting and director elections in due course. Charles & Colvard shareholders are not required to take any action at this time.

About Charles & Colvard, Ltd.

Charles & Colvard, Ltd. CTHR believes that fine jewelry should be as ethical as it is exquisite. Charles & Colvard is the original creator of lab grown moissanite (a rare gemstone formed from silicon carbide). The Company brings revolutionary gems and fine jewelry to market by using exclusively Made, not Mined™ above ground gemstones and a dedication to 100% recycled precious metals. The Company’s Forever One™ moissanite and Caydia® lab grown diamond brands provide exceptional quality, incredible value and a conscious approach to bridal, high fashion, and everyday jewelry. Charles & Colvard was founded in 1995 and is based in North Carolina’s Research Triangle Park region. For more information, please visit https://www.charlesandcolvard.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements expressing expectations regarding our future and projections relating to our products, sales, revenues, and earnings are typical of such statements and are made under the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about our plans, objectives, representations, and contentions and are not historical facts and typically are identified by use of terms such as “may,” “will,” “should,” “could,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” and similar words, although some forward-looking statements are expressed differently.

All forward-looking statements are subject to the risks and uncertainties inherent in predicting the future. You should be aware that although the forward-looking statements included herein represent management’s current judgment and expectations, our actual results may differ materially from those projected, stated, or implied in these forward-looking statements as a result of many factors including, but not limited to, some anti-takeover provisions of our charter documents may delay or prevent a takeover of our Company; risks related to our ongoing confidential arbitration and relationship with Wolfspeed, Inc.; our business and our results of operations could be materially adversely affected as a result of general economic and market conditions; the execution of our business plans could significantly impact our liquidity; negative or inaccurate information on social media could adversely impact our brand and reputation; our failure to maintain compliance with The Nasdaq Stock Market’s continued listing requirements, including filing our U.S. Securities and Exchange Commission (“SEC”) reports on a timely basis, could result in the delisting of our common stock; and the other risks and uncertainties described in more detail in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and subsequent reports filed with the SEC. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur except as required by the federal securities laws, and you are urged to review and consider disclosures that we make in the reports that we file with the SEC that discuss other factors relevant to our business.

Important Additional Information Regarding Proxy Solicitation

Charles & Colvard intends to file a proxy statement and WHITE proxy card with the SEC in connection with the solicitation of proxies for the Company’s upcoming Annual Meeting. Charles & Colvard, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the Annual Meeting. Information regarding the names of Charles & Colvard’s directors and executive officers and their respective interests in the Company’s securities or otherwise is set forth in the Company’s proxy statement for the 2024 Special Meeting of Shareholders, filed with the SEC on April 8, 2024 (the “Special Meeting Proxy Statement”), and the proxy statement for the 2023 Annual Meeting of Shareholders, filed with the SEC on October 27, 2023 (together with the Special Meeting Proxy Statement, the “Prior Proxy Statements”). To the extent holdings of such participants in Charles & Colvard’s securities have changed since the amounts described in the Prior Proxy Statements, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information can also be found in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023, filed with the SEC on October 12, 2023, and subsequent reports filed by the Company with the SEC. Details concerning the nominees of the Charles & Colvard Board of Directors for election at the upcoming Annual Meeting will be included in the proxy statement to be filed for the Annual Meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF CHARLES & COLVARD ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND SUPPLEMENTS THERETO ONCE AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. These documents, including the definitive proxy statement (and any amendments or supplements thereto) and other documents filed by Charles & Colvard with the SEC, are or will be available for no charge at the SEC’s website at http://www.sec.gov and at Charles & Colvard’s investor relations website at https://ir.charlesandcolvard.com/.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/charles–colvard-ltd-comments-on-a-letter-from-riverstyx-capital-management-to-charles–colvard-shareholders-302269147.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/charles–colvard-ltd-comments-on-a-letter-from-riverstyx-capital-management-to-charles–colvard-shareholders-302269147.html

SOURCE Charles & Colvard, Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.