Forum Investment Group Announces the Closing of its Private Credit Strategy at $226M

DENVER, Oct. 7, 2024 /PRNewswire/ — Forum Investment Group (“Forum” or the “Firm”), a private real estate investment management firm specializing in the multifamily sector, announced the final close on September 30, 2024, of one of its investment vehicles specializing in multifamily private credit. Forum exceeded its target raise by 2.2x, firmly establishing the Firm’s multifamily private credit strategy.

This investment vehicle focuses on providing gap financing in the form of mezzanine debt, preferred equity, participating preferred equity, and joint-venture equity to qualified third-party sponsors supporting their ground up developments, value-add repositioning, and acquisitions of multifamily properties in targeted high-growth markets across the United States.

“I am proud of the team and this final close, which represents a significant milestone for the Firm’s multifamily private credit strategy,” remarked Forum Founder & Chief Executive Officer, Darren Fisk. “We are grateful to all of our investors for their trust in and support of Forum.”

Jay Miller, Chief Investment Officer of Forum, commented, “We are pleased to have completed the raise of our first private credit strategy investment vehicle. I am delighted that we exceeded our target allowing us to deploy additional capital into the market. We believe this capital raising success underscores the growing demand for private, non-bank financing to multifamily developers and we look forward to continuing to do what we can to provide these kinds of creative, gap financing opportunities to qualified sponsors in the future.”

Forum’s private credit investment team is led by seasoned professionals and co-Portfolio Managers, Tom McCahill and Joe Chickey, who, together, bring over 50 years of combined experience in the field. “Tom and I are proud of the proprietary and extensive network we have cultivated and believe it is because of our relationships with our various partners that we are able to directly source over 88%[1]of the private credit strategy’s investment portfolio,” said Joe Chickey.

About Forum

Forum is a private real estate investment management firm specializing in the multifamily sector. With assets in over 20 states, Forum built a foundation specifically in development and evolved into acquisition and financing. In 2018, the Firm established its investment management platform to offer institutions and financial intermediaries access to multifamily debt, private credit, and equity exposure. For more information, please visit ForumRE.com.

Contacts

Edward Lopez

Prosek Partners

Elopez@prosek.com

1 Figure reflects the percentage of multifamily private credit investments that were directly sourced off-market through Forum’s private credit investment team’s network of relationships (e.g sponsors, banks, or capital partners) and exclude opportunities presented by intermediaries or brokers for the period August 31, 2021 through September 30, 2024. More information about this figure is available upon request by contacting info@forumig.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/forum-investment-group-announces-the-closing-of-its-private-credit-strategy-at-226m-302267117.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/forum-investment-group-announces-the-closing-of-its-private-credit-strategy-at-226m-302267117.html

SOURCE Forum Investment Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

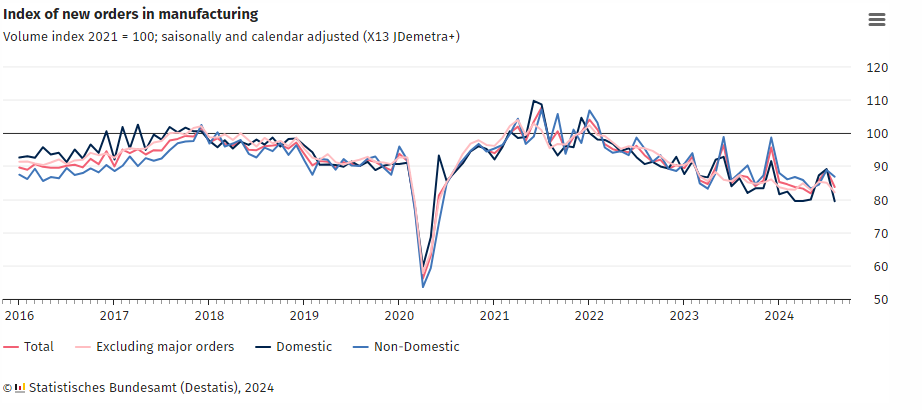

German Recession Fears Rise After Factory Orders Drop

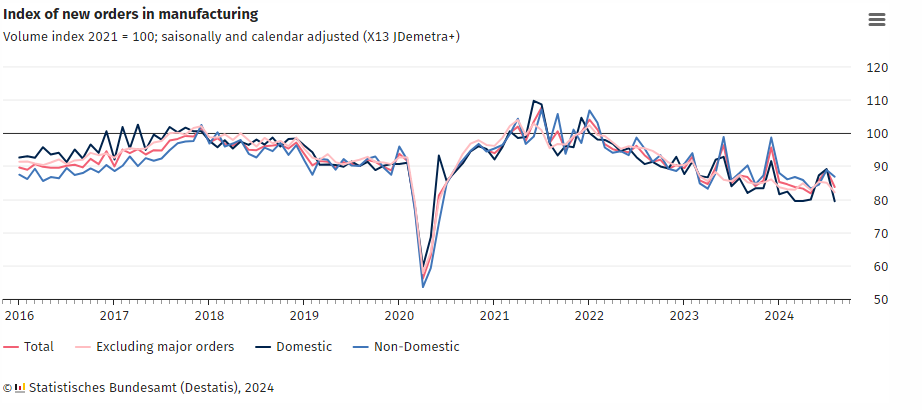

German recession concerns increased after factory orders declined more than expected in August, adding concerns about Europe’s largest economy.

New orders dropped 5.8% month-on-month in August, the Federal Statistical Office (Destatis) said today. Economists had forecast a decline of 2%, making it the steepest fall since January, according to Bloomberg.

Factory orders dropped after “very large orders” for aircraft, ships, trains, and military vehicles were placed in July, Destatis said. When large-scale orders are excluded, new orders in August fell 3.4% lower than in July 2024, it said.

Germany’s economy ministry will downgrade its 2024 economic forecast, expecting gross domestic product (GDP) to shrink by 0.2%, newspaper Sueddeutsche Zeitung reported.

A recovery in the industrial economy in the second half “is unlikely,” the ministry said in a statement. It pointed to “persistently weak demand and continued deterioration in corporate sentiment.”

DAX fell 170 points following the news, finding its footing around the 19,000 level. The index remained down 0.3% at 12 PM CET. However, as the price failed to reach lows from Friday, the technical thesis of a short-term pullback at the beginning of Q4 remains intact.

German Recession Appears More Likely

Germany is facing an increasing number of economic headwinds.

The country may feel the impact of trade tensions after the European Union imposed tariffs against China’s electric vehicle makers. Germany vetoed the decision after pressure from Mercedes-Benz Group MBGAF and BMW BMWYY.

Volkswagen VWAGY warned that it is considering closing factories amid increased competition with rival Chinese car makers.

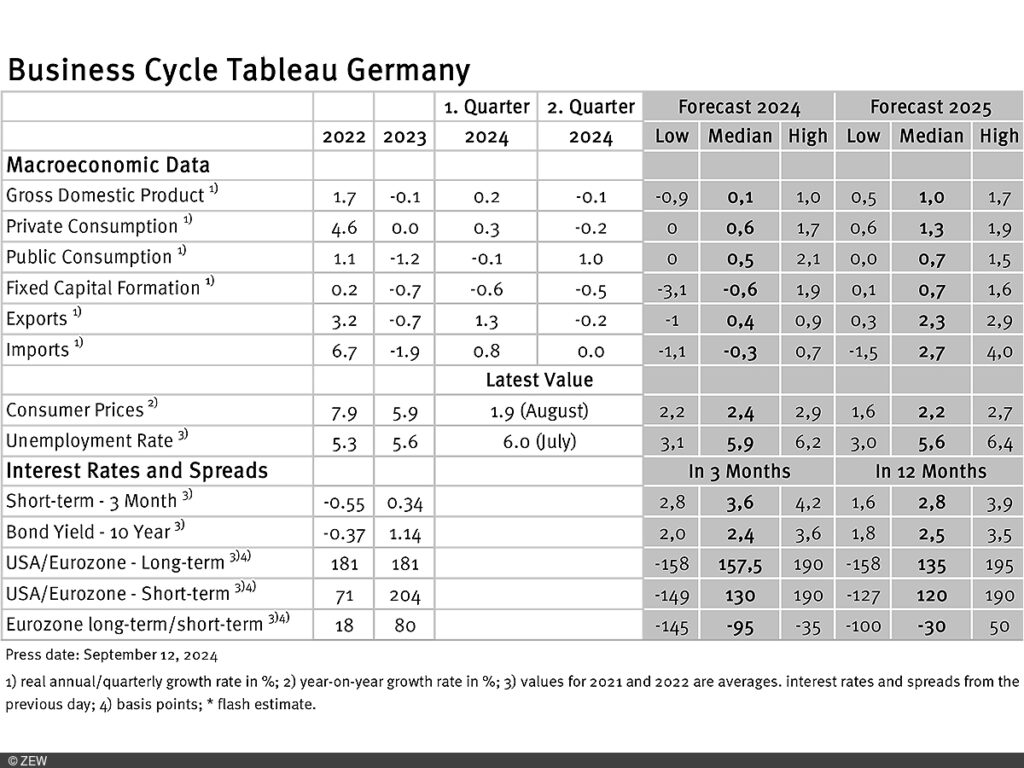

The recessionary outlook adds to growing concerns about the German economy. GDP shrank by 0.1% in the second quarter of this year.

Experts are now signaling economic stagnation this year, the ZEW Institute said on September 23. They lowered their 2024 growth forecast by 0.1 percentage points to just 0.1%.

Germany is falling behind the rest of the eurozone in terms of “both actual growth and growth expectations,” ZEW said.

Germany releases industrial production data on Tuesday, which is forecast to increase by 1%.

In July, industrial production declined by 2.4%, with the automotive industry having “a particularly negative impact,” Destatis said.

New orders in the capital and intermediate goods sectors in Germany fell 8.6% and 2.2%, respectively, Destatis said. New orders for consumer goods declined by 0.9%.

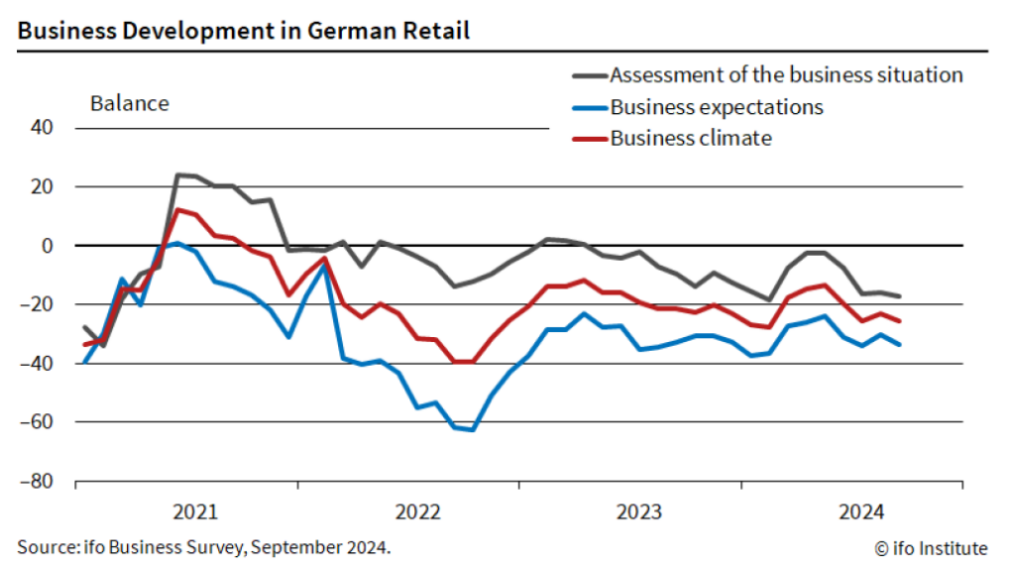

German Business, Consumer Sentiment Sours

Business and consumer sentiment in Germany has soured as well.

The ifo Institute’s expectations gauge fell in September to 86.3, the lowest since February.

The Ifo expectation index for German retail “clouded over” in September. It fell to -25.6 points, down from -23.1 points in August. Retailers assessed their current situation as slightly worse and have become more pessimistic about the coming months, ifo said today.

“Consumers are unsettled about the economic policy environment,” ifo expert Patrick Höppner, said. “No further dynamic growth in private consumer spending can be expected for the rest of 2024.”

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Reasons to Retain Cardinal Health Stock in Your Portfolio Now

Cardinal Health Inc. CAH is well-poised for growth, given its acquisition-driven strategy, a diversified product portfolio and a robust pharmaceutical segment. However, inflationary pressure remains a concern.

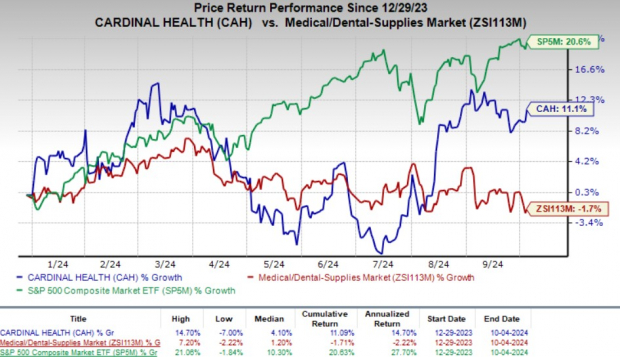

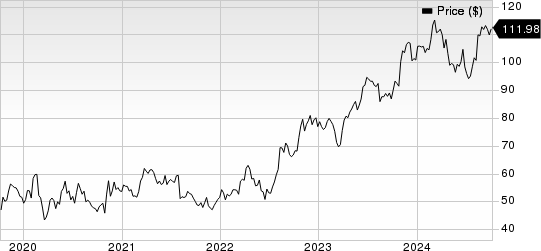

Shares of this Zacks Rank #3 (Hold) company have risen 11.1% in the year-to-date period against the industry’s 1.7% decline. The S&P 500 Index has gained 20.6% in the same time frame.

CAH, with a market capitalization of $27.09 billion, is a nationwide drug distributor and service provider to pharmacies, healthcare providers and manufacturers. The company has an earnings yield of 6.8% compared with the industry’s 5.3%. It anticipates earnings to improve 9.6% over the next five years.

Image Source: Zacks Investment Research

What’s Driving CAH’s Performance?

Strength in Pharmaceutical Segment: Investors are upbeat about Cardinal Health’s Medical and Pharmaceutical offerings, which provide the company with a competitive edge in the niche space.

The segment’s products and services comprise pharmaceutical distribution, manufacturer and specialty services, and nuclear and pharmacy services, which are expected to majorly drive the quarters ahead. For the past few quarters, the segment has been acting as a key catalyst when it comes to driving growth.

In the fourth quarter of fiscal 2024, pharmaceutical revenues amounted to $55.6 billion, up 13% on a year-over-year basis. The performance reflects branded pharmaceutical sales growth from Pharmaceutical Distribution and Specialty Solutions customers.

The company expects revenues from its Pharmaceutical segment to decline 4-6% year over year in fiscal 2025. The anticipated decline reflects a $39 billion revenue headwind due to the OptumRx contract expiration in June 2024. Segmental profit is likely to increase 1-3% from the previous guidance of at least 1%.

Long-term Supply Agreements: Cardinal Health is also pursuing growth via joint ventures and long-term supply agreements with several firms, which have likely kept the investors interested. The company entered into a long-term strategic agreement with Henry Schein. Under this deal, Henry Schein purchased Cardinal Health’s medical supplies for physician practices. The collaboration is expected to drive core sales and prove accretive to CAH’s earnings in the long term.

The signing of a 15-year agreement with Bayer Healthcare for the contract manufacturing of Xofigo is significantly positive. In our opinion, this should help CAH leverage its expertise in the nuclear pharmacy industry to expand access to a therapeutic agent and increase the use of radiopharmaceuticals in the United States and Canada.

Strong Q4 Results: Cardinal Health’s impressive fourth-quarter fiscal 2024 results buoy optimism. The company’s robust top-line results and solid performance in the Pharmaceutical segment were encouraging. Per management, the segmental performance was driven by brand and specialty pharmaceutical sales growth from existing customers.

Gross profit increased 5% year over year, driven by segmental growth.

Notable Developments

Last month, CAH announced an agreement to acquire Integrated Oncology Network (“ION”) for $1.115 billion in cash. ION will enhance CAH’s oncology strategy, adding value for providers and patients. The partnership aims to equip community practices with advanced tools and technology, along with expertise from Specialty Networks’ PPS Analytics and SoNaR technology, enabling the company to deliver high-quality, patient-centered care close to home, ultimately improving patient outcomes and strengthening CAH’s leadership in healthcare.

Cardinal Health signed a distribution agreement with Australia-based Telix to become the commercial radiopharmaceutical distributor to supply finished unit doses of Telix’s PET agent, Zircaix, for the imaging of kidney cancer in the United States, subject to regulatory approval.

In August, Cardinal Health announced the opening of a new distribution center in Greenville, SC. The distribution center is dedicated to the company’s at-Home Solutions business, which is also expected to add roughly 200 jobs to the region over time. The opening of the new distribution center is likely to provide a boost to CAH’s at-Home Solutions business and generate additional revenues to support the growing market for at-home solutions.

What’s Weighing on the Stock?

Cardinal Health faces the risk of losing considerable business in case of loss of a major customer, which, in turn, can severely impair its future revenues. In this regard, post the establishment of a generic sourcing joint venture with CVS Caremark in 2014, Cardinal Health largely depends on the former for more than 20% of its revenues.

Collectively, five of Cardinal Health’s main customers, including CVS, accounted for as much as 40% of its revenues. Meanwhile, the company’s pharmaceutical distribution contracts with OptumRx ended in June 2024. These represented 17% of total revenues in fiscal 2023. The non-renewal of the contracts is likely to adversely impact CAH’s sales in fiscal 2025.

In July, the FDA issued a warning for Cardinal Health’s Presource kit plastic syringe makers, Jiangsu Shenli Medical Production Co. Ltd and Jiangsu China, who have been facing FDA investigation. Recent inspections have unveiled multiple quality system violations, leading to warning letters and import alerts. CAH has recalled the affected products to ensure patient safety and compliance with the FDA regulations.

Estimate Trend

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $215.84 billion, indicating a 4.9% decline from the previous year’s level.

The Zacks Consensus Estimate for adjusted earnings per share is pinned at $7.61, indicating a 1.1% increase from the year-ago reported numbers. The consensus estimate for adjusted EPS has improved 1 cent over the past 30 days.

Stocks to Consider

Some better-ranked stocks in the broader medical space are Universal Health Service UHS, Quest Diagnostics DGX and Baxter International BAX, each carrying a Zacks Rank #2 (Buy) at present.

Universal Health Service has an estimated long-term growth rate of 19%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 14.58%.

Universal Health Service has gained 17.9% compared with the industry’s 19.8% growth in the past six months.

Quest Diagnostics has an estimated long-term growth rate of 6.2%. DGX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 3.31%.

Quest Diagnostics’ shares have risen 14.3% in the past six months compared with the industry’s 8% growth.

Baxter’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 3.74%.

BAX’s shares have lost 17.9% in the past six months against the industry’s 5.8% growth.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Organic Baby Formula Market to Reach $17.7 Billion, Globally, by 2033 at 9.5% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 07, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Organic Baby Formula Market by Ingredient Type (Organic Cow’s Milk-based Formulas, Organic Soy-based Formulas and Organic Plant-based Formulas), and Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Department Stores, e-Commerce and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the organic baby formula market was valued at $7.2 billion in 2023, and is estimated to reach $17.7 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A236855

Prime determinants of growth

The growth of the Organic baby formula market is primarily driven by increasing consumer awareness of the health benefits and safety associated with organic products, including concerns over pesticides, additives, and GMOs. Rising health consciousness among parents, combined with stringent government regulations and certifications, builds consumer trust and fuels demand. Additionally, the expansion of distribution channels through supermarkets, specialty stores, and online platforms makes organic baby food more accessible. Higher disposable incomes allow parents to invest in premium products, while continuous product innovation caters to evolving preferences. Effective marketing and educational efforts further boost awareness, and urbanization coupled with lifestyle changes shifts focus towards convenience and quality. Environmental concerns also play a role, as parents increasingly choose eco-friendly options perceived as more sustainable.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2035 |

| Base Year | 2023 |

| Market Size in 2023 | $7.2 billion |

| Market Size in 2035 | $17.7 billion |

| CAGR | 9.5% |

| No. of Pages in Report | 255 |

| Segments Covered | Ingredient types, Distribution Channel and Region. |

| Drivers | Rising Parental Health Awareness |

| Growing Urbanization and Female Workforce Participation | |

| Opportunity | Expansion into Emerging Markets |

| Restraints | High Cost of Baby Formula Products |

| Strict Regulatory Environment |

Segment Highlights

By ingredient type, the Organic Cow’s Milk-Based Formula segment is having high demand in the organic baby food market. The high demand for Organic Cow’s Milk-Based Formulas in the Organic baby formula market is largely driven by its convenience, offering busy parents ready-to-serve options that save time and effort. These products are valued for their consistency and quality, providing assurance of safety and nutritional benefits. The variety and balanced nutrition available in prepared baby foods help introduce babies to a range of tastes while supporting a well-rounded diet. Additionally, the extended shelf life of these products reduces waste and enhances meal planning flexibility. As lifestyles become increasingly fast-paced, the preference for convenient, high-quality organic options grows.

Procure Complete Report (255 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/organic-baby-formula-market

By distribution channel, the supermarket/ Hypermarket segment is having high demand in the organic baby formula market. The high demand for organic baby formula in supermarkets and hypermarkets is driven by several factors. These retail formats offer a wide range of organic baby food products, allowing consumers to choose from various brands, flavors, and formulations in one convenient location. Their accessibility and extended operating hours make shopping easier for busy parents. Additionally, the competitive pricing and promotional offers provided by these stores attract budget-conscious consumers. The one-stop shopping experience, which includes all grocery needs in one place, is highly valued.

Regional Outlook

North America is experiencing high demand in the Organic baby formula market due to a combination of factors. The region’s increasing awareness and concern about the health and safety of baby food among parents have led to a growing preference for organic products free from pesticides, additives, and GMOs. The presence of stringent regulations and certifications in North America further reinforces consumer trust in the quality and safety of organic baby food. Additionally, the region’s high disposable income levels enable parents to invest in premium organic products. The well-established retail infrastructure, including supermarkets, hypermarkets, and online platforms, provides easy access to a wide variety of organic baby food options. Moreover, the trend towards healthier lifestyles and the increasing number of working parents seeking convenient, nutritious options for their children contribute to the rising demand in this market.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A236855

Players: -

- The Hein celestial group

- North Castle Partners, LLC

- Baby Gourmet formulas Inc

The report provides a detailed analysis of these key players in the Organic baby formula market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Developments

- In 2023, Danone launched a new line of organic baby formulas under its brand, focusing on improved nutritional benefits and sustainable packaging.

- In 2022, Nestlé introduced a new organic formula designed to enhance infant digestion and support gut health with added probiotics.

Trending Reports in Industry:

Baby Food Market Analysis and Industry Forecast, 2022-2031

Baby Infant Formula Marke Analysis and Industry Forecast, 2022-2031

Baby Drinks Market Analysis and Industry Forecast, 2022-2031

Infant Nutrition Ingredients Market Analysis and Forecast, 2022-2031

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Blog: https://www.alliedmarketresearch.com/resource-center/trends-and-outlook/food-and-beverages

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After a Nearly 30% Sector Rally, Are There Any High-Yield Utility Stocks Left? (YES, and Here Are 3 of the Best!)

Utility stocks have surged this year. As measured by the Utilities Select Sector SPDR ETF, the average utility has gained nearly 30%. Add in dividends, and the total return is well over 30%.

As utility stock prices have risen, their dividend yields have declined. However, there are still some very attractive options out there if you know where to look. Black Hills (NYSE: BKH), Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), and Brookfield Renewable (NYSE: BEPC)(NYSE: BEP) stand out to a few Fool.com contributors right now as three of the best higher-yielding options in the utility space. That makes them great options for those seeking to generate some dividend income.

The mighty little dividend utility

Reuben Gregg Brewer (Black Hills): The average utility, using Utilities Select Sector SPDR ETF as an industry proxy, has a dividend yield of about 2.9%. Black Hills is offering 4.25%. If you are looking for a high yield, you’ve found it right here. But that’s not the only thing to like about Black Hills’ dividend. The regulated natural gas and electric utility has also increased the dividend for 54 consecutive years. You don’t build a track record like that by accident, which is why there are so few Dividend Kings like Black Hills in the utility sector.

Don’t feel bad if you’ve never heard of Black Hills. It is a relatively small company. With a market capitalization of roughly $4 billion, it isn’t half the size of the smallest utility in the S&P 500 Index. But this is a net benefit for small investors who do know about Black Hills (which now includes you). While everyone else is focusing on industry giants, you can spend your time getting to know a high-yield utility that’s a “giant” when it comes to dividend consistency.

Backing the dividend at Black Hills is a customer base that’s growing roughly three times faster than the U.S. population. And while earnings growth is targeted to fall between just 4% and 6% a year, with the dividend likely to track that number, that’s more than enough to not only keep up with inflation but also grow the buying power of the dividend over time.

Sure, you’ll have to dig a little deeper if you want to track Black Hills. But the extra yield and dividend consistency will likely be well worth the effort.

A historically cheap valuation

Matt DiLallo (Brookfield Infrastructure): Brookfield Infrastructure has underperformed compared to other utility stocks this year. The corporate shares (BIPC) have rallied 17%, while the limited partnership units (BIP) have gained only 8%. Because of that (and the company’s strong growth), it trades at a very compelling valuation these days, especially compared to other utilities.

The company trades at 14.1 times its adjusted funds from operations (FFO). That’s below its historical average of 15.5 and its average over the past five years of 16.5. That low valuation is why Brookfield Infrastructure currently offers such an attractive yield (4.8% for BIP and 3.9% for BIPC), more appealing than the average utility, which yields around 3% these days.

Brookfield also offers better dividend growth potential (5%-9% annually compared to around 4% for other utilities). Meanwhile, it provides a greater degree of diversification (it operates utilities and other utility-like businesses in the transportation, energy, and data infrastructure sectors) with lower risk, given its low exposure to consumers.

The company also has strong overall growth potential. It expects to grow its FFO at a 10%-plus annual rate in the future. Its significant exposure to the digitalization megatrend (more than 60% of its FFO) is a big factor powering that view.

Brookfield’s utilities and gas infrastructure assets should benefit from surging power demand. Meanwhile, its utility-like data infrastructure platforms (semiconductor manufacturing, data centers, towers, and fiber) will benefit from the expected growth in computing power and data demand from megatrends like artificial intelligence (AI).

This is one of the more compelling investment opportunities in the utility space these days. The company offers high growth potential and a high-yielding dividend at a historically low valuation. Because of that, it could produce powerful total returns in the coming years, making it a great stock to buy right now.

Renewable-powered growth

Neha Chamaria (Brookfield Renewable): Climate change adds to energy security risk, one of the biggest reasons why nations across the globe are adopting clean energy. Renewable energy sources, like wind, solar, and water, are readily available and aplenty with little or no greenhouse gas emissions.

Therefore, companies generating electricity from renewable energy sources have strong growth potential. One such company is Brookfield Infrastructure’s renewables-focused sibling, Brookfield Renewable. The company yields 5.3% for units of the partnership and 4.5% for its corporate shares.

Brookfield Renewable has a massive portfolio of hydro, wind, and solar assets and huge utility-scale solar and wind development platforms with a presence in more than 20 countries. As is typical for most utilities, Brookfield sold a major chunk, nearly 90%, of the renewable power it generated under long-term, fixed-price contracts with an average contractual life of 13 years last year.

The company acquires renewable assets, operates them commercially with a focus on cash flow and dividend growth, and periodically divests some assets to fund growth. It plans to invest $8 billion to $9 billion over the next five years into growth opportunities, aiming to grow its annual FFO by more than 10%. Importantly, Brookfield is also targeting annual dividend growth of 5% to 9% during the period.

With Brookfield Renewable on track to deliver a record year but the stock barely gaining 2% so far this year, it looks like one of few dividend stocks you could even double up on now. Since its cash flows back dividends, investors can expect bigger dividends year after year, which should further boost their total returns from the stock over time.

Should you invest $1,000 in Brookfield Renewable Partners right now?

Before you buy stock in Brookfield Renewable Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Matt DiLallo has positions in Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, Brookfield Renewable, and Brookfield Renewable Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Black Hills. The Motley Fool has positions in and recommends Brookfield Renewable. The Motley Fool recommends Brookfield Infrastructure Partners and Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

After a Nearly 30% Sector Rally, Are There Any High-Yield Utility Stocks Left? (YES, and Here Are 3 of the Best!) was originally published by The Motley Fool

Rivian Shares Fall 3% After It Slashes 2024 Production Guidance

Shares of Rivian Automotive, Inc. RIVN fell 3.2% to $10.44 after it announced third-quarter 2024 production and delivery results and lowered its 2024 production guidance. The electric vehicle maker produced 13,157 vehicles at its manufacturing facility in Normal, IL, down from 16,304 units in the same quarter of 2023.

It delivered 10,018 vehicles, down from 15,564 units in the same period last year. Deliveries also missed expectations. FactSet’s compiled analyst estimates anticipated third-quarter deliveries of 13,000 vehicles.

The company is facing production issues due to a component shortage on the R1 and RCV platforms. The supply shortage, which started in the third quarter, has worsened in recent weeks. As a result, Rivian now expects its annual vehicle production in the range of 47,000-49,000 units, down from the previous projection of 57,000 units. However, it maintains its annual delivery estimate in the range of 50,500-52,000 vehicles.

In June, Rivian announced a $5 billion joint venture with Volkswagen AG VWAGY, a global automotive giant. The collaboration will focus on software and electrical architecture design and development. However, the partnership will not cover battery technology, propulsion systems, high-voltage platforms, or autonomous driving. Per the JV, Volkswagen will initially invest $1 billion, followed by an additional $4 billion. Rivian anticipates finalizing the JV in the fourth quarter.

RIVN Applies for Federal Loan to Fund Factory Construction

The EV maker has applied for a federal loan to help fund the construction of an EV factory in Georgia, per a filing with the U.S. Department of Energy. Although Rivian has submitted the application, the department has not made a final call and the filing did not specify the loan amount or terms.

The factory is expected to begin partial operations in the third quarter of 2027, with full operation of its first production capacity block by 2028. Rivian had paused construction of the $5 billion Georgia plant to expedite the production of vehicles on the R2 midsize platform and to conserve cash. To save $2.25 billion and boost production, Rivian shifted manufacturing of the R2 midsize SUV, which will compete with Tesla’s Model Y, to its Illinois facility. The production of R2 is scheduled to begin in 2026.

Rivian had secured $827 million in incentives from the State of Illinois to expand its Normal facility, where it also produces electric delivery vans for Amazon. In 2022, the company secured $1.5 billion in state and local incentives for the Georgia plant.

Rivian’s Zacks Rank & Key Picks

RIVN currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto space are Blue Bird Corporation BLBD and BYD Company Limited BYDDY, each sporting a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for BLBD’s 2024 sales and earnings suggests year-over-year growth of 17.58% and 215.89%, respectively. EPS estimates for 2024 and 2025 have improved by 65 cents and 80 cents, respectively, in the past 60 days.

The Zacks Consensus Estimate for BYDDY’s 2024 sales and earnings suggests year-over-year growth of 21.88% and 17.12%, respectively. EPS estimates for 2024 and 2025 have each improved by a penny in the past 30 days.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

One of Wall Street's Cheapest Tech Stock-Split Stocks Is Ready to Take Center Stage This Week

For a majority of the last two years, no trend has excited the investing community quite like the rise of artificial intelligence (AI). But in 2024, the euphoria surrounding stock splits has, arguably, played an equally critical role in lifting stock valuations.

A stock split is a mechanism publicly traded companies have available that allows them to adjust their share price and outstanding share count by the same factor. What’s worth noting about stock splits is that they’re entirely cosmetic. Adjusting a company’s share price and share count has no impact on market cap or operating performance.

Though there are two types of stock splits — forward and reverse — investors overwhelmingly favor companies conducting forward splits. This is the type of split designed to reduce a company’s share price to make it more nominally affordable for everyday investors, and it’s almost always undertaken by businesses that are handily out-innovating and out-executing their peers.

In 2024, more than a dozen prominent companies have announced or completed stock splits, and all but one have been of the forward-split variety.

This week, one of the cheapest tech stock-split stocks of 2024 will have its moment in the sun as it readies for its first split in nearly a quarter of a century.

AI stock-split stocks have hogged the spotlight for much of the year

With high-flying stocks often drawing the attention of Wall Street and investors, it should come as little surprise that much of the focus this year has been on artificial intelligence-driven companies completing stock splits. Although Super Micro Computer and Lam Research effected respective 10-for-1 forward splits of their own last week, I’m primarily talking about the buzz AI leaders Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) have created.

Nvidia was the first top-tier AI stock to complete a forward split in 2024, with the company’s historic 10-for-1 split taking effect after the close of trading on June 7.

The need for Nvidia to split — its shares topped $1,200 the day its split went into effect — is a direct reflection of its dominance in high-compute enterprise data centers. Demand is off the charts for the company’s H100 graphics processing unit (GPU) and next-generation Blackwell GPU platform, which have sent sales, profits, and gross margin soaring. Nvidia’s exceptional pricing power has allowed it to charge between a 100% and 300% premium to competing AI-GPUs.

Meanwhile, Broadcom followed in Nvidia’s footsteps five weeks later by completing its first-ever stock split, also 10-for-1, following the close of trading on July 12.

Even though Broadcom has a considerably more diverse revenue stream than Nvidia, it’s Broadcom’s AI networking solutions that have driven investor interest in the company. Broadcom’s networking solutions are responsible for connecting GPUs in AI-accelerated data centers in order to reduce tail latency and maximize their computing potential.

But while Nvidia and Broadcom have been the talk of Wall Street, and are, without question, the highest-profile stock-split stocks of 2024, they’re no longer the fundamental bargains they once were. The tech goliath set to complete its stock split later this week certainly fits the definition of cheap.

Wall Street’s newest tech stock-split stock is a bargain

In mid-May, consumer electronics juggernaut Sony Group (NYSE: SONY) unveiled plans to conduct a 5-for-1 forward split — its first split since May 2000. Though the effective date for this split was Oct. 1 in its home market of Japan, it’s Oct. 8 for the company’s American depositary receipts (ADRs) listed in the U.S. Long story short, when Sony Group opens for trading on Oct. 9, its New York Stock Exchange-listed shares should be closer to $19.

Most consumers are probably familiar with Sony because of its gaming division. The PlayStation 5 is the top-selling ninth-generation video game console and made its debut in late 2020. Even though it’s been almost four years since it hit retail shelves, Sony recently increased the price of PlayStation 5 by a double-digit percentage in Japan as a way to boost sales.

With new gaming consoles typically coming out every six or seven years, excitement is starting to build for Sony’s next successor. Though we’re still, presumably, at least two years away from the company recognizing sales from its next-gen gaming system, it’s not uncommon for investors to somewhat front-run an expected boost in sales and profits.

Additionally, Sony is enjoying meaningful sales growth from PlayStation Plus. This is the subscription service that allows users to game with their friends, access exclusive games, and store their data in the cloud.

But the sum of Sony’s parts includes more than just gaming. It’s also a major player in music, movies, and Imaging and Sensing Solutions (ISS). The latter is particularly important, with Sony being one of the key suppliers of image sensors used in next-generation smartphones. ISS sales surged 21% in the company’s fiscal first quarter (ended June 30), with operating income from this segment nearly tripling.

Japan’s largest businesses are also known for their capital-return programs — and Sony is no exception. On the same day its 5-for-1 split was announced, Sony’s board authorized the repurchase of up to 30 million shares, representing 2.46% of the company’s outstanding count. Buybacks have the ability to increase earnings per share (EPS) for companies with steady or growing net income. Over time, share repurchases can make Sony’s stock even more attractive to fundamentally focused investors.

Last but not least, Sony Group’s stock is reasonably cheap in a generally pricey tech sector. Its forward price-to-earnings (P/E) ratio of 15 is considerably lower than Nvidia (forward P/E of 30) and Broadcom (forward P/E of 28), as well as the benchmark S&P 500 (forward P/E of 24). With a new console looming and high-margin PlayStation Plus revenue rising, Sony Group has the traits of a cheap stock-split stock that can be bought with confidence by opportunistic long-term investors.

Should you invest $1,000 in Sony Group right now?

Before you buy stock in Sony Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sony Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

One of Wall Street’s Cheapest Tech Stock-Split Stocks Is Ready to Take Center Stage This Week was originally published by The Motley Fool

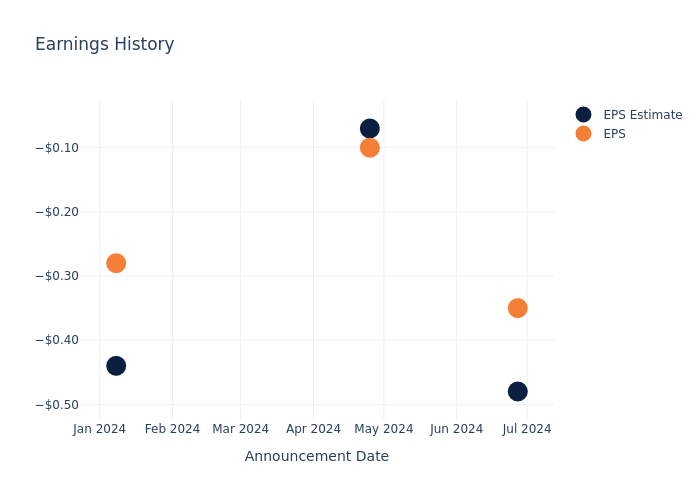

Uncovering Potential: Accolade's Earnings Preview

Accolade ACCD will release its quarterly earnings report on Tuesday, 2024-10-08. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Accolade to report an earnings per share (EPS) of $-0.44.

Accolade bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

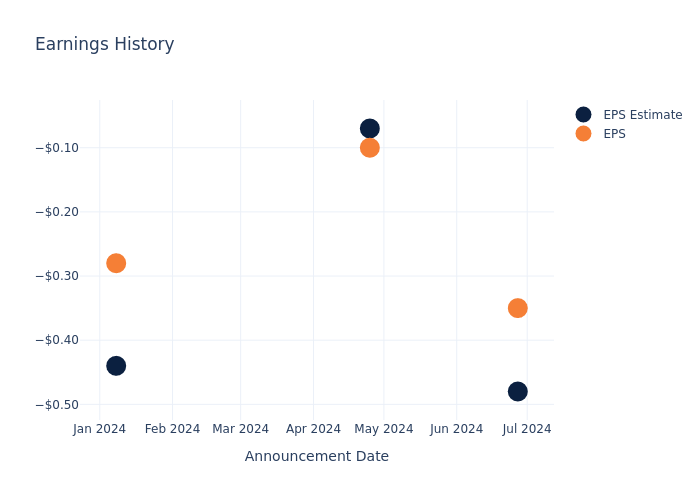

Historical Earnings Performance

The company’s EPS beat by $0.13 in the last quarter, leading to a 43.97% drop in the share price on the following day.

Here’s a look at Accolade’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.48 | -0.07 | -0.44 | -0.54 |

| EPS Actual | -0.35 | -0.10 | -0.28 | -0.43 |

| Price Change % | -44.0% | -14.000000000000002% | 28.999999999999996% | -13.0% |

Performance of Accolade Shares

Shares of Accolade were trading at $3.75 as of October 04. Over the last 52-week period, shares are down 55.34%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Accolade visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

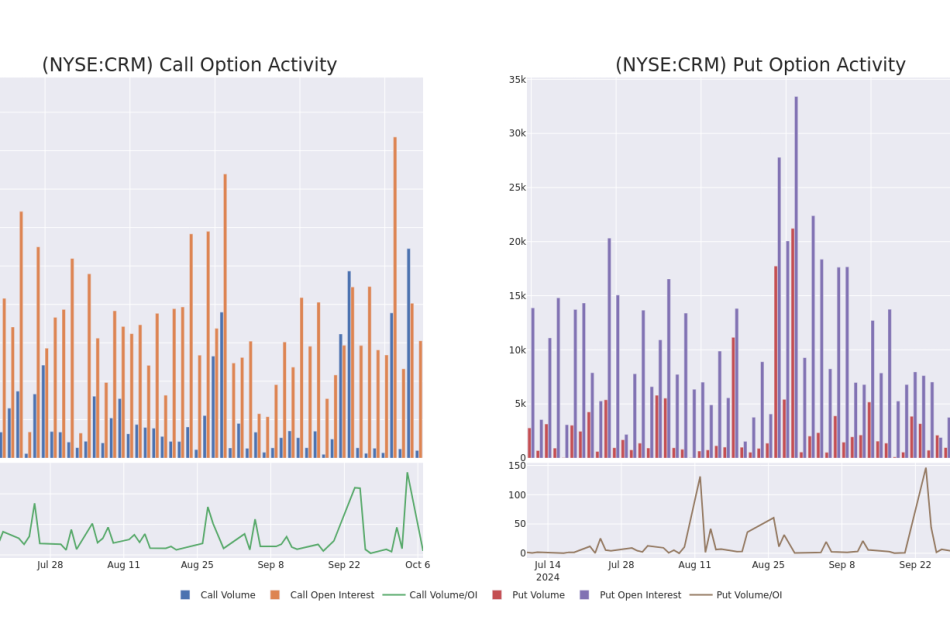

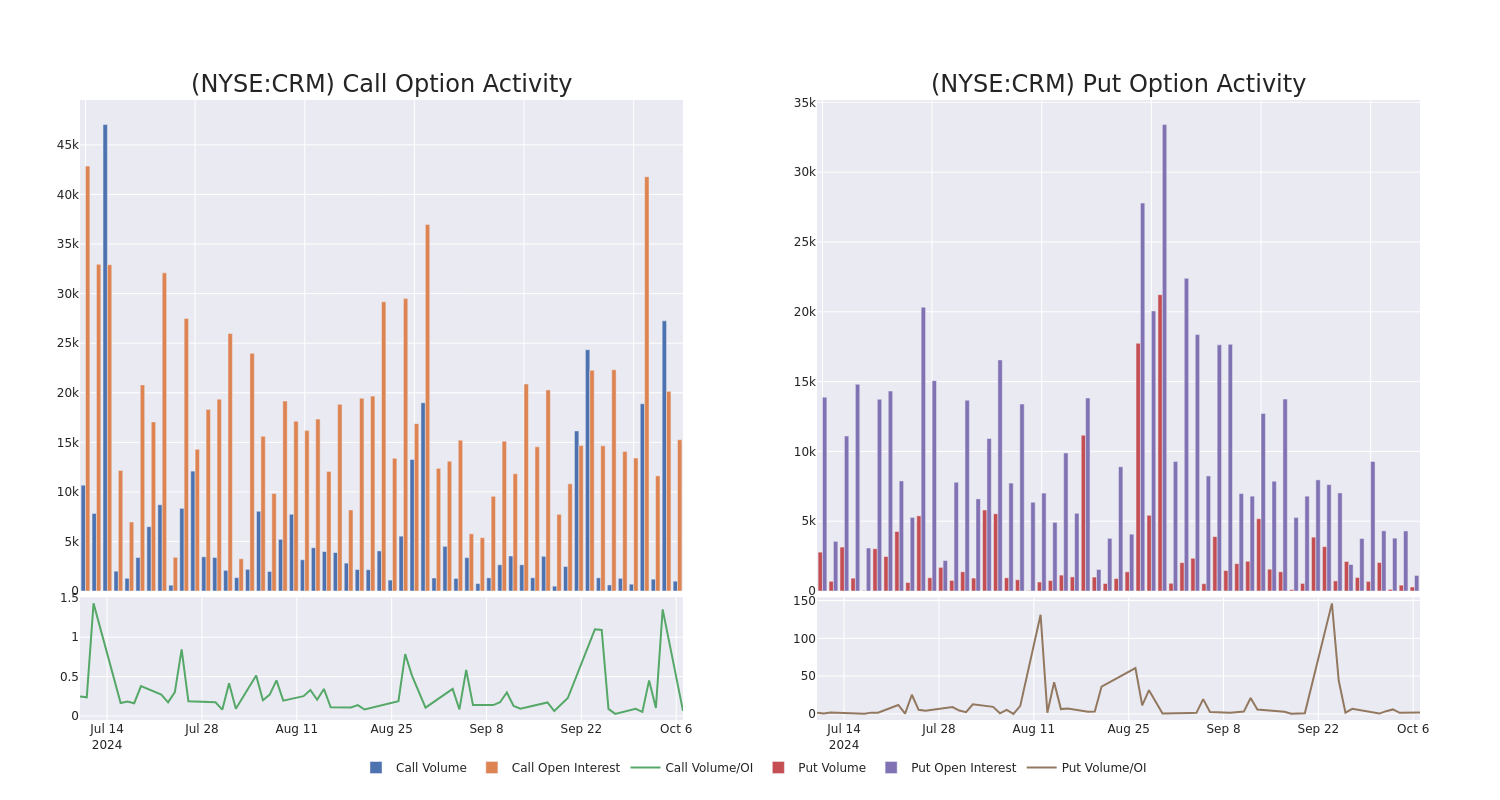

A Closer Look at Salesforce's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Salesforce CRM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 17 uncommon options trades for Salesforce.

This isn’t normal.

The overall sentiment of these big-money traders is split between 41% bullish and 52%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $204,941, and 14 are calls, for a total amount of $681,129.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $330.0 for Salesforce during the past quarter.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Salesforce’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Salesforce’s substantial trades, within a strike price spectrum from $240.0 to $330.0 over the preceding 30 days.

Salesforce Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | PUT | TRADE | BULLISH | 11/15/24 | $6.9 | $6.85 | $6.85 | $280.00 | $123.9K | 753 | 258 |

| CRM | CALL | TRADE | BEARISH | 12/20/24 | $43.25 | $42.8 | $42.91 | $250.00 | $107.2K | 740 | 27 |

| CRM | CALL | SWEEP | BEARISH | 11/08/24 | $3.9 | $3.25 | $3.25 | $305.00 | $96.8K | 10 | 405 |

| CRM | CALL | TRADE | BULLISH | 01/17/25 | $37.55 | $37.35 | $37.55 | $260.00 | $75.1K | 2.1K | 30 |

| CRM | CALL | TRADE | BULLISH | 01/17/25 | $53.5 | $53.45 | $53.5 | $240.00 | $53.5K | 1.6K | 13 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Following our analysis of the options activities associated with Salesforce, we pivot to a closer look at the company’s own performance.

Present Market Standing of Salesforce

- With a trading volume of 1,761,496, the price of CRM is down by -0.59%, reaching $286.05.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 51 days from now.

Professional Analyst Ratings for Salesforce

In the last month, 5 experts released ratings on this stock with an average target price of $322.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $300.

* An analyst from Truist Securities downgraded its action to Buy with a price target of $315.

* An analyst from Piper Sandler has elevated its stance to Overweight, setting a new price target at $325.

* Consistent in their evaluation, an analyst from Wedbush keeps a Outperform rating on Salesforce with a target price of $325.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $345.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Salesforce options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Grant Cardone Says 'You Need $10 Million To Be Considered Rich' – $1 Million in Retirement Won't Cut It If You Want To Afford Anything

Grant Cardone isn’t one to shy away from making bold statements, especially when it comes to money. He feels $10 million is the new $1 million.

In a TikTok video titled “If You’re A Millionaire You’re Broke – Get To $10 Million To Be Considered Rich,” Cardone breaks down his belief that having a million dollars in 2024 is barely enough to keep you afloat, much less make you rich.

Don’t Miss:

“If you have a million dollars and you want to buy a house, well then you’re down to $200k,” Cardone explains, highlighting just how quickly money can disappear when faced with life’s big expenses. He takes it a step further, saying, “Your mom has cancer, you’re out of $200k in 45 days. You’re back to zero again.” His point? A million dollars isn’t what it used to be.

See Also: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

Cardone even dives into some historical context, noting, “A million was a lot of money in 1960. If money deflated at the rate that it has in my 65 years, money is worth 10% of what it was then. So, if a millionaire was rich in 1960, you need $10 million in 2024 to be considered rich.” According to him, if you’re still using the idea of $1 million as a benchmark for wealth, you’re behind the times.

His math is correct. According to inflation calculators, $1 million in 1960 is actually equivalent to $10,635,000.00 in 2024.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Is $1 Million Still Enough?

In his book The Wealth Creation Formula, Grant Cardone states, “A million dollars isn’t enough” and “$10 million is the new $1 million.”

In a GoBankingRates interview, Cardone explains what life is like for someone who retires with $1 million. He says that if you stretch that money over 35 years of retirement, it equals about $28,571 per year or roughly $2,381 a month.

As Cardone told GoBankingRates, “The average rent in America is $2,000. You have $500 a month left over. You haven’t eaten, you haven’t gone out, you haven’t bought one pair of shoes, you don’t have health care, you don’t have insurance and you definitely don’t have a car payment. You have one car payment, you’re negative $200 a month. So you’re the millionaire that can’t afford anything.”

Trending: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

Building Wealth Beyond $1 Million

So, what is Cardone’s solution to this problem? Building passive income. In his eyes, the key to long-lasting wealth is finding ways to make money while you sleep. Whether investing in real estate or creating other income streams, he focuses on ensuring your money works for you – not the other way around.

He emphasizes creating enough passive income to match or exceed your earned income, ideally between $400,000 and $500,000 annually. That’s a tall order for most people, but it’s the kind of financial security Cardone says you need to live comfortably today.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Here’s how you can earn passive income with just $100.

Criticism and Realities

Of course, not everyone agrees with Cardone. Plenty of people think $1 million is still a solid goal, with some surveys suggesting a net worth of around $2.2 million is enough to feel wealthy. However, Cardone’s point is that aiming for $1 million might leave you struggling to keep up in the long run.

Whether you agree with his $10 million target or not, financial security looks a lot different now than it did in 1960.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Grant Cardone Says ‘You Need $10 Million To Be Considered Rich’ – $1 Million in Retirement Won’t Cut It If You Want To Afford Anything originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.