‘I’m scared to death’: My wife asked for a divorce after 21 years. She wants to buy a house with our savings, but promises to help pay my mortgage.

Dear Quentin,

My wife of 21 years informed me that she wants to divorce. We jointly own a home with nine years left on the mortgage. Our savings account contains a large sum of readily available cash that we use for emergency funds, college tuition and living expenses for our son — and as a hedge should one of us lose our job.

She says she wants to use all of the savings to buy her own place and that she would help me continue to pay the mortgage on our current home should I choose to continue to live there (and I do plan to stay put). I will have to fully cover all the household expenses and, since her salary is higher than mine, this leaves me barely covering expenses on my own.

Most Read from MarketWatch

She would cover half of our son’s college expenses (for two more years until he graduates). There is more than enough money in the savings to completely pay off the current mortgage. I’m scared to death of losing my job and having nothing to fall back on without savings and am three years away from full retirement.

What — in your opinion — would be the better use of the savings? I don’t see that she can take the whole amount since it is in both our names. Should the savings account be split 50/50 or is it better to eliminate the current mortgage and defer her getting her half when the current home is sold sometime in the future?

Soon-to-be Single

Dear Soon-to-be,

Her plan sounds messy, and it leaves too much up to chance.

Your joint savings account does not go to your wife: No-one gets to plunder all these accounts, and make promises for what will happen after you’re divorced. This is where codependency ends and a new life of independence begins. You don’t have to manage your wife’s expectations, you only have to manage your own, and she may or may not agree with you. If she doesn’t? That’s too bad (for her).

Maryland is not a community property state, meaning the assets may not be distributed 50/50; consult a lawyer, but if you earn less than your wife, you may be entitled to a higher settlement. Just keep in mind that if your wife wants to empty that joint savings account, there’s nothing to stop her doing it while you were both married. A judge may not look kindly upon such actions, but it’s better to safeguard your assets now.

There may be lots of room for compromise when it comes to paying for tuition for your son, or how long you decide to hang onto the family home, or whether you should use the savings account to sell the house now. But if you feel like your savings provide you with peace of mind, especially as you earn less than your wife, stick to that. (Americans should have around six months of emergency savings in the event that something bad happens, yet most do not. Don’t be part of that 63%.)

There’s a lot you can do to prepare for this split. First off, hire your own lawyer and let them be bad cop to your good cop. Be civil, polite, kind and stick to your goals. While you await the negotiations, take an inventory of your life insurance policies and retirement accounts (including IRAs and 401(k)s) and think about who you might want as a beneficiary in lieu of your soon-to-be ex-spouse.

In addition to the divorce decree when you or your wife decide to file papers, you may need a “Qualified Domestic Relations Order” — a court order that requires workplace retirement benefits or IRAs to be split. You’re not alone. More baby boomers are getting divorced, studies show — one-third of boomers are now single — and will likely be more concerned about retirement given they are closer to retirement age, currently 66.

When you consult a divorce lawyer, think creatively. Will you be doing any renovations on the home? If so, that should be deducted from any final sale. If you alone are paying the mortgage and your wife does receive some amount of money to put a down payment on her own home, then your wife shouldn’t benefit from the full sale price either. If you cannot agree to an amicable split of assets, the court will intervene on both your behalf.

Your wife has very clear ideas about what she wants from this divorce, so it may be wise to freeze any joint bank accounts before your divorce is finalized. It may not be what she gets, but you should also know exactly where you draw the line and areas that are open for negotiation. You can only succeed in these negotiations if you know what you want before you enter them, and realize what’s at stake.

You need a clean split: 50/50.

More columns from Quentin Fottrell:

Most Read from MarketWatch

Wall Street Strategists Say Jobs Surprise Bodes Well for Stocks

(Bloomberg) — Two of Wall Street’s top strategists have turned more optimistic about US stocks on signs of a robust labor market, economic resilience and easing interest rates.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

Morgan Stanley’s Michael Wilson — among the most bearish voices on equities until mid-2024 — raised his view on so-called cyclical stocks relative to safer defensive peers, noting Friday’s blowout payrolls data and expectations of more interest-rate cuts from the Federal Reserve.

His peer at Goldman Sachs Group Inc., David Kostin, also boosted his expectations for S&P 500 earnings growth next year as a solid macro outlook drives margins. The strategist upgraded his 12-month target for the benchmark to 6,300 points from 6,000, implying gains of about 10% from current levels.

“We continue to believe we’re in a ‘good is good’ environment in terms of the equity market’s response to the labor/economic growth data,” Wilson wrote in a note. “The bond market is becoming less skeptical on the soft landing outcome, an important signal for equity investors.”

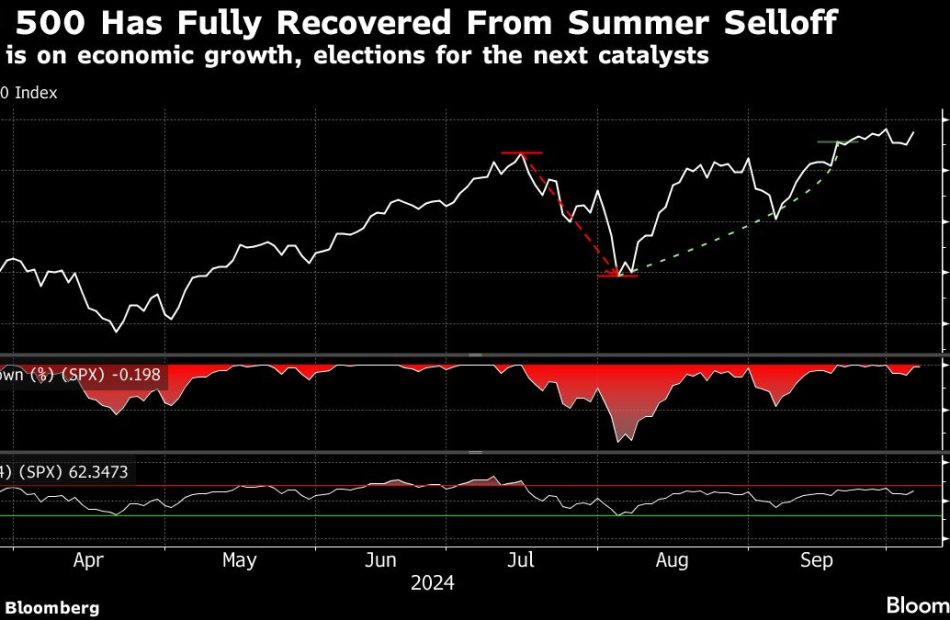

US stocks have rebounded after a selloff over the summer on fading recession concerns and the Fed’s policy easing. Traders expect the central bank to reduce rates by another 100 basis points by May, according to swaps data. Sentiment was also boosted Friday as the payrolls figure came in much stronger than expected.

Wilson said the setup bodes well for smaller US stocks, which stand to benefit from improving business activity and sentiment, as well as lower investor positioning. The strategist eased his long-standing bet on large caps, citing a dimmer risk-reward over the short term.

Among sectors, Wilson upgraded his view on financials to overweight, and downgraded health care and consumer staples.

JPMorgan Chase & Co. reports earnings on Friday, providing an update on the profitability of lenders and officially kicking off the earnings season.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Dominion Energy, American Electric Power, FirstEnergy reach joint planning agreement to propose regional transmission projects across PJM footprint

- Companies jointly propose electric transmission projects to serve region’s growing power demand through PJM’s competitive planning process

- Collaboration leverages expertise of industry leaders to propose comprehensive, cost-effective solutions that promote regional grid reliability

RICHMOND, Va., Oct. 7, 2024 /PRNewswire/ — Dominion Energy Virginia, American Electric Power and FirstEnergy Corp. have entered into an innovative joint planning agreement to propose several new regional electric transmission projects across multiple states within the PJM footprint.

The innovative collaboration comes at a time when efficient and cost-effective regional transmission development is essential and encouraged by the Federal Energy Regulatory Commission (FERC), the independent federal agency that regulates the interstate transmission of electricity.

Power demand in the PJM region is growing at an unprecedented pace due to rapid expansion of energy-intensive industries such as data centers, the electrification of transportation and heating, and increased manufacturing onshoring. At the same time, the region’s power generation mix is changing as legacy generation is retired and more renewables are added to the grid.

“This dynamic environment requires more regional collaboration to develop large-scale ‘backbone’ transmission infrastructure that spans across the areas served by our three companies,” said Ed Baine, President of Dominion Energy Virginia. “By leveraging the expertise and resources of three industry leaders whose transmission zones border one another, we’re better able to develop superior and more cost-effective solutions required to effectively resolve reliability issues across the PJM region. These projects are more comprehensive and will be more effective than what each of our companies would be able to develop individually.”

“Energy-intensive industries, electrification and the energy transition all rely on a robust power grid,” said Mark Mroczynski, President, FirstEnergy Transmission. “By drawing upon the combined experience of three leading transmission developers, we can take the proactive steps needed to build new infrastructure that will ensure our communities have the power they need for sustained health and economic growth in the future.”

“AEP operates the largest transmission network in the nation and has more experience building 765 kV infrastructure than any other company in the U.S.,” said Bob Bradish, senior vice president, Regulated Infrastructure Investment Planning for AEP. “The solutions we have proposed to address the rapidly evolving energy demand we are seeing across the region will enable us to continue providing reliable service and drive economic growth.”

The companies jointly proposed the projects through PJM’s Regional Transmission Expansion Plan (RTEP) Open Window process in September. PJM is the regional transmission organization that coordinates the transportation of wholesale electricity across the 13-state region that includes Virginia. The proposed projects include several new 765-kV, 500-kV and 345-kV transmission lines in Virginia, Ohio and West Virginia.

The projects remain in the early stages of development. If selected by PJM, the companies would then undertake an extensive, multi-year process to select routes, perform environmental studies, engage with communities, obtain state and local permitting and build the projects.

In addition to the joint proposals, each of the three companies have also submitted individual proposals for other transmission projects consistent with how each company has participated in past PJM open windows.

About Dominion Energy

Dominion Energy D, headquartered in Richmond, Va., provides regulated electricity service to 3.6 million homes and businesses in Virginia, North Carolina, and South Carolina, and regulated natural gas service to 400,000 customers in South Carolina. The company is one of the nation’s leading developers and operators of regulated offshore wind and solar power and the largest producer of carbon-free electricity in New England. The company’s mission is to provide the reliable, affordable, and increasingly clean energy that powers its customers every day. Please visit DominionEnergy.com to learn more.

About AEP

AEP, headquartered in Columbus, OH, owns and operates more than 40,000 miles of transmission lines, the nation’s largest electric transmission system, and more than 225,000 miles of distribution lines to deliver power to 5.6 million customers in 11 states. AEP also is one of the nation’s largest electricity producers with approximately 29,000 megawatts of diverse generating capacity. AEP is investing $43 billion over the next five years to make the electric grid cleaner and more reliable. AEP participates in the competitive transmission space through Transource, a jointly owned transmission company with Evergy, headquartered in Kansas City, Missouri.

About FirstEnergy

FirstEnergy Corp. FE, is dedicated to integrity, safety, reliability and operational excellence. Its electric distribution companies form one of the nation’s largest investor-owned electric systems, serving more than six million customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York. The company’s transmission subsidiaries operate approximately 24,000 miles of transmission lines that connect the Midwest and Mid-Atlantic regions. Follow FirstEnergy online at firstenergycorp.com and on X @FirstEnergyCorp.

Forward-Looking Statements

This release contains certain forward-looking statements that are subject to a variety of factors that could cause actual events or results to differ from those included in these statements. These factors are identified in Dominion Energy’s Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission. Dominion Energy refers readers to those discusses for further information. Any forward-looking statement speaks only as of the date on which it is made, and Dominion Energy undertakes no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/dominion-energy-american-electric-power-firstenergy-reach-joint-planning-agreement-to-propose-regional-transmission-projects-across-pjm-footprint-302269132.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/dominion-energy-american-electric-power-firstenergy-reach-joint-planning-agreement-to-propose-regional-transmission-projects-across-pjm-footprint-302269132.html

SOURCE Dominion Energy

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

September LightBox CRE Activity Index Reflects Strong Early Response to First Interest Rate Cut

IRVINE, Calif., Oct. 7, 2024 /PRNewswire/ — LightBox, a leading provider of commercial real estate (CRE) information and technology, released its Monthly CRE Activity Index for September, showing a modest increase in transaction velocity.

This aggregate measure of activity in commercial property listings, environmental due diligence, and appraisals collectively tracks shifts in the velocity of key functions that support CRE transactions. After August’s Index of 89.9 ended a five-month streak of increases that took root in March, the September CRE Activity Index rebounded sharply, rising to 98.2. This is 8.3 points higher than August, and a notable 10.3 points above the 87.9 recorded one year ago, when the dearth of properties listed for sale and the bid-ask gap between buyers and sellers hindered transaction volume.

The increase was fueled by an uptick in commercial property listings, which typically happens after Labor Day as the market settles into the final months of the year. September’s biggest development was the Federal Reserve’s first interest rate cut since 2020, which spurred a positive reaction from the CRE lending and investment markets. “The 50-bps cut was an unexpected but welcome surprise for CRE, providing a psychological boost,” said Manus Clancy, LightBox head of Data Strategy. “Even a 25-bps cut would have signaled to the market that a new era of capital deployment has finally begun,” Clancy said.

Declining rates will lower costs for borrowers with maturing loans, many of which were extended in hopes of refinancing under better conditions. As debt costs fall and buyer interest grows, CRE activity is expected to gain momentum, leading to more property sales—both traditional and forced.

However, the young recovery could be impacted by recent macro events like the devastation from Hurricane Helene, the escalating conflict in the Middle East, and the upcoming November election. “All of these pose the risk of dampening positive momentum for CRE activity in October and the rest of the 4th quarter,” Clancy noted.

Despite the market’s challenges and risks, the rate cut triggers the start of a new growth cycle for CRE. According to the report commentary, as clarity on future interest rates improves, the market should expect stronger transaction and lending velocity, lower cap rates, and rising property valuations—bringing a resurgence of market enthusiasm that has been largely absent for several years.

About LightBox

At LightBox, we are at the forefront of delivering advanced and precise solutions for commercial real estate intelligence. Our dedication to innovation propels real estate professionals forward by providing them with the essential tools required to navigate complex decisions, minimize risk, and boost productivity across the spectrum of real estate operations. LightBox is renowned for its commitment to promoting excellence and fostering connections in the industry, serving an extensive clientele of over 30,000 customers. Our diverse client base spans commercial and government sectors, including but not limited to brokers, developers, investors, lenders, insurers, technologists, environmental advisors, appraisers, and other businesses that depend on geospatial information. To discover more about how LightBox can illuminate the path to informed real estate solutions, visit us at: www.LightBoxRE.com

Media inquiries: media@lightboxRE.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/september-lightbox-cre-activity-index-reflects-strong-early-response-to-first-interest-rate-cut-302268777.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/september-lightbox-cre-activity-index-reflects-strong-early-response-to-first-interest-rate-cut-302268777.html

SOURCE LightBoxRE

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Visteon to Announce Third Quarter 2024 Results

VAN BUREN TOWNSHIP, Mich., Oct. 07, 2024 (GLOBE NEWSWIRE) — Visteon Corporation VC, a global technology company serving the mobility industry, will release its third quarter 2024 financial results before the market opens on Thursday, Oct. 24. The company will host a conference call for the investment community at 9 a.m. ET to discuss the results and related matters. The conference call is also available to the public via a live audio webcast.

The dial-in numbers to participate in the call are:

- U.S./Canada Participants Toll-Free Dial-In Number: 1-888-330-2508

- International Participants Toll Dial-In Number: 1-240-789-2735

- Conference ID: 8897485

(Dial-in approximately 10 minutes before the start of the conference.)

The conference call and live audio webcast, related presentation materials, news release and other supplemental information will be accessible in the Investors section of Visteon’s website. Shortly after the call, a replay of the webcast will be available on the company’s website.

About Visteon

Visteon is advancing mobility through innovative technology solutions that enable a software-defined and electric future. With next-generation digital cockpit and electrification products, Visteon leverages the strength and agility of its global network with a local footprint to deliver a cleaner, safer and more connected vehicle experience. Headquartered in Van Buren Township, Michigan, Visteon operates in 17 countries worldwide, recorded approximately $3.95 billion in annual sales and booked $7.2 billion of new business in 2023. Learn more at investors.visteon.com.

Follow Visteon:

https://www.linkedin.com/company/visteon

https://twitter.com/visteon

https://www.facebook.com/VisteonCorporation

https://www.youtube.com/user/Visteon

https://www.instagram.com/visteon/

https://mp.weixin.qq.com/?lang=en_US

https://m.weibo.cn/u/6605315328

http://i.youku.com/u/UNDgyMjA1NjUxNg==?spm=a2h0k.8191407.0.0

Media: Media@Visteon.com Investors: Investor@Visteon.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Thompson Thrift Hosts Ribbon Cutting for Premier at West Park, a Luxury Apartment Community near Denver

GREELEY, Colo., Oct. 7, 2024 /PRNewswire/ — Thompson Thrift, a full-service nationally recognized real estate company and one of the nation’s leading multifamily developers, hosted a ribbon cutting for Premier at West Park, a 336-unit Class A multifamily community 50 miles from Denver in Greeley, on Wednesday, September 18. The first residents began moving in during early summer of 2024 and the community is nearly 30% leased.

“Our communities are thoughtfully designed to create the perfect living environment for our residents to call home,” said Angie Atkins, senior vice president of community management for Thompson Thrift. “From the moment residents step into Premier at West Park, they are met with details specifically designed with their experience in mind, from signature scents to luxury amenities and community events.”

Located at 3800 Centerplace Drive, Premier at West Park spans approximately 21 acres and consists of 10 three-story garden-style buildings, plus an additional 133 detached garages. The one-, two- and three-bedroom apartment homes include many of the luxury finishes that Thompson Thrift communities are known for including, gourmet bar-kitchens with elegant quartz countertops, timeless tile backsplash, stainless steel appliances, an Alexa-compatible smart hub to integrate all smart devices, walk-in closets, full-size washers and dryers, as well as patio, balcony and private yard options.

At the ribbon cutting, visitors were able to view model tours and preview the community amenities including a professionally decorated clubhouse, resort-style heated swimming pool, 24-hour fitness center, outdoor game area, gas firepits with seating area, a dog park, pet spa with grooming station and pickleball court, to name a few.

Thompson Thrift expects construction to conclude in early 2025. Additionally, in support of Thompson Thrift’s commitment to community outreach, they presented a check to local non-profit Weld Food Bank. Thompson Thrift’s donation will provide 6,000 meals to aid Weld Food Bank’s efforts in addressing food insecurity in Weld County.

Premier at West Park is just three miles from downtown Greeley and offers residents convenient access to U.S. Highway 34 with an easy commute to several of the area’s major employers. Directly adjacent to the community is Centerplace of Greeley, a major retail and dining destination which consists of national and local retailers such as Target, Safeway, Best Buy and T.J. Maxx.

Thompson Thrift is a full-service real estate development company focused on multifamily, ground-up commercial and mixed-use development across the Midwest, Southeast and Southwest. For nearly 40 years, Thompson Thrift has invested more than $6 billion into local communities and has become known as a trusted partner committed to developing high-quality, attractive multifamily, commercial and industrial projects.

About Thompson Thrift Real Estate Company

Thompson Thrift is an integrated full-service real estate company with offices in Indianapolis and Terre Haute, Indiana; Denver; Houston and Phoenix. Three business units drive Thompson Thrift’s success—Thompson Thrift Residential which is focused on upscale Class A multifamily communities and luxury leased homes, Thompson Thrift Commercial which is focused on ground-up commercial development, and Thompson Thrift Construction, a full-service construction company. Through these business units, Thompson Thrift is engaged in all aspects of development, construction, leasing, and management of quality commercial real estate projects across the country. The company earned national recognition from Energage as a winner of a 2024 Top Workplaces USA award and five Culture Excellence awards, the latest accolades that reflect the company’s ongoing commitment to excellence in the community and workplace. For more information, please visit www.thompsonthrift.com.

Contact:

Jennifer Franklin

Spotlight Marketing Communications

949.427.1385

jennifer@spotlightmarcom.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thompson-thrift-hosts-ribbon-cutting-for-premier-at-west-park-a-luxury-apartment-community-near-denver-302266712.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thompson-thrift-hosts-ribbon-cutting-for-premier-at-west-park-a-luxury-apartment-community-near-denver-302266712.html

SOURCE Thompson Thrift

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Netflix Analysts Turn More Optimistic Ahead Of Earnings: 'Expensive For A Reason'

A pair of Netflix Inc NFLX analysts are out with positive updates ahead of the entertainment giant’s earnings report next week. The calls focused on valuation, with one analyst being notably more optimistic than the other.

What To Know: Goldman Sachs analyst Eric Sheridan maintained a neutral rating on Netflix on Monday and raised the price target from $659 to $705 ahead of earnings next week.

Sheridan remains positive on Netflix, but continued stock outperformance has raised valuation questions. Netflix has significantly outperformed the S&P 500 over the past year, up 87% versus 27% for the broader market, he said in a new note to clients.

The Goldman analyst noted that much of the outperformance is warranted given that the company remains the market leader in streaming, has made further progress on its ad-supported tier and has seen competition continue to moderate as other streaming players focus on profits over growth.

Sheridan highlighted recent third-party data showing that Netflix maintains a strong market leader position, giving the company pricing power and lower competitive intensity.

“Our Neutral rating is a factor of stock performance (NFLX shares +45% vs the SPX +20% YTD) and the forward multiple to growth already reflecting a host of positive operating cadence in 2025 and 2026 at current levels,” the Goldman Sachs analyst said.

Check This Out: Apple TV+ Scores Biggest Streaming Movie In History Thanks To George Clooney, Brad Pitt

Sheridan is positive on Netflix, but he’s hung up on valuation. That’s where Piper Sandler, who also released a new note on Netflix on Monday, differs.

“Notably, our prior Neutral stance was centered around valuation, but now, we appreciate the company is expensive for a reason,” Piper Sandler analyst Matt Farrell said in a new note.

Piper Sandler upgraded Netflix from Neutral to Overweight and raised the price target from $650 to $800 to reflect the company’s clear leadership in the streaming space.

Farrell believes positive earnings revisions could be on the horizon as Netflix’s ad-tier business has been de-risked. The analyst also said the company still has levers it can pull in its ads-free business, particularly around pricing. He further noted that consensus estimates for margins could prove to be conservative.

Netflix is due to report third-quarter financial results after the market close on Oct. 17. The company is expected to report earnings of $5.11 per share on revenue of $9.762 billion, according to estimates from Benzinga Pro.

The Piper Sandler analyst highlighted recent channel checks showing that streaming now represents about 41% of all television viewing in the U.S. According to Farrell, Netflix has about 20% share of streaming viewership and about 8% share of overall television viewing.

“As the pivot to streaming continues, we expect the company to maintain its leadership position, particularly as it adds more and more live content,” the analyst said.

NFLX Price Action: Netflix shares were down 1.76% at $707.00 at the time of publication Monday, according to Benzinga Pro.

Read Next:

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Constellation Brands' Latest Quarter Shows Wine And Spirits Business Continue To Fall From Glory

Constellation Brands STZ issued a mixed August quarter results lasy week, posting better than expected earnings as it continues to navigate a tough market.

Highlights Of The Second Quarter Of Fiscal 2025

Fueled by strong demand for its beer brands, especially Corona and Modelo, Constellation Brands reported net sales grew by 3% YoY to $2.92 billion.

Sales revenues increased by 6% while shipments grew by 4.6%.

Having already issued an alarm for its declining wines and spirits business whose sales dropped 12% to $388.7 million, Constellation reported a $2.5 billion write down. Wine and spirits were dragged down by a 9.8% drop in shipment volumes. The division’s operating income contracted 13% YoY to $70.5 million.

For the quarter ended on August 31st, adjusted earnings per share amounted to $4.32, surpassing LSEG’s average estimate of $4.08.

Constellation can rely on its beer brands.

Beers have been the driver of Constellations’ success even before the pandemic lockdowns. Even in the post-pandemic era, consumers are turning to them, but doing so, they are also leaving behind wines and spirits. The latest quarter shows that Constellation continues to benefit from premium prices. While the industry continues being cautious in an uncertain macroeconomic environment, Constellation’s beers were the biggest gainers for the twelfth successive quarter.

Yet, demand for spirits continues to fall.

But CEO Bill Newlands admitted the challenging macroeconomic backdrop has weighed on demand for beverage alcohol. Constellation gudied for full-year net sales growth between 4% and 6%, while expecting beer sales to go up from 6% to 8% and wine and spirits sales dropping 4% to 6%.

On the other hand, the wner of Guiness and Johnnie Walker, Diageo, is optimistic about spirits growth returning in the future. Diageo CEO Debra Crew believes that alcohol sales growth will return with the improving consumer environment. There’s also increasing support from A list celebrities who are lending their influence to liquor brands. Among celebrities helping liquor brands become big businesses are Matthew McConaghew launched an organic tequilla brand, while Ryan Reynlods became a co-owner of Aviation Gin that was scooped up by Diageo in 2020, with George Clooney leading the way back in 2013 by co-founding Casamigos Tequilla, that was also sold to Diageo. But the reality is that Diageo plc DEO posted bleak quarterly results in September, reflecting a weak macroenvironment in North America. After another lacluster quarter for wine and spirits, Constellation is expecting a ‘sequential’ improvement over the second half of fiscal 2025.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From PepsiCo Stock Ahead Of Q3 Earnings

Analysts expect the Purchase, New York-based company to report quarterly earnings at $2.29 per share, up from $2.25 per share in the year-ago period. PepsiCo is projected to report revenue of $23.82 billion, up from $23.45 billion, according to data from Benzinga Pro.

Some investors may be eyeing potential gains from PepsiCo’s dividends. The company currently offers an annual dividend yield of 3.23%. That’s a quarterly dividend amount of $1.3550 per share ($5.42 a year).

So, how can investors exploit its dividend yield to pocket a regular $500 monthly?

To earn $500 per month or $6,000 annually from dividends alone, you would need an investment of approximately $185,943 or around 1,107 shares. For a more modest $100 per month or $1,200 per year, you would need $37,121 or around 221 shares.

To calculate: Divide the desired annual income ($6,000 or $1,200) by the dividend ($5.42 in this case). So, $6,000 / $5.42 = 1,107 ($500 per month), and $1,200 / $5.42 = 221 shares ($100 per month).

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

How that works: The dividend yield is computed by dividing the annual dividend payment by the stock’s current price.

For example, if a stock pays an annual dividend of $2 and is currently priced at $50, the dividend yield would be 4% ($2/$50). However, if the stock price increases to $60, the dividend yield drops to 3.33% ($2/$60). Conversely, if the stock price falls to $40, the dividend yield rises to 5% ($2/$40).

Similarly, changes in the dividend payment can impact the yield. If a company increases its dividend, the yield will also increase, provided the stock price stays the same. Conversely, if the dividend payment decreases, so will the yield.

Price Action: Shares of PepsiCo fell 0.3% to close at $167.97 on Friday.

On Oct. 4, RBC Capital analyst Nik Modi maintained PepsiCo with a Sector Perform and lowered the price target from $177 to $176.

Barclays analyst Lauren Lieberman cut the price target from $187 to $186.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Polyamide Market to Reach $55.1 Billion, Globally, by 2033 at 5.7% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 07, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Polyamide Market by Polyamide Types (Polyamide (PA6), Polyamide (PA11), Polyamide (PA12), Polyamide (PA66), Others), End-Use Industry (Textiles, Packaging Materials, Electrical Insulation, Automotive and Pharmaceutical): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the polyamide market was valued at $31.6 billion in 2023, and is estimated to reach $55.1 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Prime determinants of growth

Polyamides are among the most important and useful technical thermoplastics due to their outstanding wear resistance, good coefficient of friction, and very good temperature and impact properties. In addition, nylon polyamide exhibits very good chemical resistance and is a special oil resistant plastic. This excellent balance of properties makes the PA polymer an ideal material for metal replacement in applications, such as automotive parts, industrial valves, railway tie insulators and other industry uses, whose design requirements include high strength, toughness and weight reduction. All these factors are expected to drive the demand for polyamide market growth.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A11472

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $31.6 billion |

| Market Size in 2033 | $55.1 billion |

| CAGR | 5.7% |

| No. of Pages in Report | 340 |

| Segments Covered | Polyamide Type, End-use industry, and Region. |

| Drivers | Demand for sustainable and bio-based polyamides Advancements in polyamide composite materials |

| Opportunity | Innovations in polyamide production technologies. |

| Restraint | Fluctuating raw material prices. |

Polyamide (PA6) segment is expected to experience the fastest growth throughout the forecast period.

By polyamide type, the polyamide (PA6) segment held the highest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. Polyamide 6 (PA6) plays a pivotal role in driving the demand for the polyamide market due to its unique combination of properties, cost-effectiveness, and versatility. PA6 is increasingly used for manufacturing lightweight, durable components.

The textiles segment is expected to experience the fastest growth throughout the forecast period.

By end-use industry, the textiles segment held the highest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. Polyamides, commonly known as nylons, are highly valued in the textile industry for their exceptional properties such as high strength, elasticity, abrasion resistance, and chemical resistance. These characteristics make polyamides ideal for a wide range of textile applications, such as apparel, industrial fabrics, and home textiles.

Procure Complete Report (340 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/polyamide-market

Asia-Pacific is expected to experience fastest growth throughout the forecast period

Based on region, Asia-Pacific is the fastest growing region in terms of revenue in 2023. Rapid expansion of polyamide market in automotive industry in various countries such as China, Japan, South Korea, and India. Polyamides, known for their lightweight, durability, and excellent mechanical properties, are increasingly being used in automotive applications to improve fuel efficiency and reduce emissions. With the automotive industry shifting towards electric vehicles (EVs), the need for lightweight materials to offset the weight of batteries is further propelling the demand for polyamides.

Leading Market Players:

- Mitsubishi Chemical Group Corporation.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/polyamide-market/purchase-options

The report provides a detailed analysis o f these key players in the global polyamide market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.