Billionaires Are Loading Up on This High-Yield Dividend Stock. Should You?

Dividend stocks aren’t just for folks who want to build up a stream of passive income. Billionaire investors who don’t need any more income to retire comfortably regularly invest in businesses that pay dividends because they tend to outperform their non-dividend-paying cousins over time.

Non-dividend-paying stocks in the S&P 500 index produced an average annual return of just 4.27% during the 50 years between 1973 and 2023. Dividend payers in the same benchmark index performed more than twice as well by delivering a 9.17% average annual return.

In the second quarter, hedge funds managed by billionaire investors Israel Englander and Igor Tulchinsky bought shares of AbbVie (NYSE: ABBV), a dividend-paying pharmaceutical giant, with both hands. Englander’s Millennium Management fund raised its AbbVie holdings by 682% by acquiring about 854,846 shares. Tulchinsky’s Worldquant Millennium Advisors bought 229,419 shares to open a new position.

With net worth values that exceed $1 billion, Tulchinsky and Englander don’t need to take the same precautions as everyday investors. Let’s weigh some reasons to buy AbbVie against the risks it presents to see if following these billionaires is a smart move for your portfolio.

Reasons to buy AbbVie stock now

AbbVie is a leading pharmaceutical company that markets several increasingly popular drugs with blockbuster sales. For example, Skyrizi is an injection for the treatment of psoriasis, Crohn’s disease, and ulcerative colitis that launched in 2019.

Second-quarter Skyrizi sales rocketed up 45% year over year to an annualized $10.9 billion, and the main U.S. patent that protects Skyrizi’s market exclusivity doesn’t expire until 2033.

AbbVie also has a huge growth driver in Rinvoq. This is a tablet for the treatment of arthritis that launched in 2019, and it’s already generating an annualized $5.7 billion in sales. Qulipta is a pill that the Food and Drug Administration (FDA) approved last year to prevent chronic migraines. Second-quarter sales of the headache-preventing treatment rocketed up to an annualized $600 million in the second quarter and could exceed $2 billion in a couple of years.

AbbVie has raised its dividend payout at a blazing-fast 13.1% average annual rate since spinning off from Abbott Laboratories in 2013. At recent prices, the stock offers a 3.2% yield. With still-young blockbusters like Skyrizi, Rinvoq, and Qulipta pushing up profits, the yield you receive on your original investment could rise a great deal by the time you’re ready to retire.

Reasons to remain cautious

AbbVie raised its dividend payout rapidly in the past, but investors expecting big payout bumps over the next few years could be disappointed. In the first half of 2024, AbbVie reported total sales that grew by just 2.6% year over year.

On its bottom line, AbbVie expects adjusted earnings to land in a range between $10.67 and $10.87 per share this year. The midpoint of this range implies a 3% year-over-year decline.

AbbVie’s former lead product, Humira, delivered $14.4 billion in revenue to the company’s top line last year. Those sales sank to an annualized $11.3 billion in the second quarter of this year because it’s competing with new lower-cost biosimilar versions that entered the U.S. market in 2023.

Humira isn’t the only major blockbuster in AbbVie’s lineup that is losing ground to competition. Imbruvica is a blood cancer drug with second-quarter sales that sank 8% year over year to an annualized $3.3 billion. Imbruvica still has patent-protected exclusivity, but it’s losing ground to Brukinsa, a next-generation drug from BeiGene that works along similar lines.

A buy now?

At recent prices, you can buy AbbVie for about 17.9 times the midpoint of management’s earnings estimate for 2024. That’s a fair valuation if you expect it to repeat its recent performance for several more years.

AbbVie looks like a great stock to buy now because the heaviest losses for Humira and Imbruvica are already in AbbVie’s rearview mirror. Without these headwinds, a return to rapid growth that the market isn’t anticipating could be around the corner.

With Skyrizi and Rinvoq leading the charge, AbbVie’s bottom line and dividend payout could start growing rapidly again in another year or two. Buying some shares now and holding on for the long run looks like a very smart move for everyday investors.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie and Abbott Laboratories. The Motley Fool has a disclosure policy.

Billionaires Are Loading Up on This High-Yield Dividend Stock. Should You? was originally published by The Motley Fool

Wood Coatings Market Size Projected to Surge to USD 30.1 Billion by 2034, Growing at an 8.5% CAGR: Transparency Market Research

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 07, 2024 (GLOBE NEWSWIRE) — The wood coatings industry (صناعة الطلاءات الخشبية) generated a value of US$ 12.3 billion in 2023. A CAGR of 8.5% is expected between 2024 and 2034, and it is expected to reach US$ 30.1 billion by 2034. As advancements in wood furniture coatings continue, new curing technologies are becoming popular, especially UV and waterborne UV. These technologies are more durable and more productive than previous technologies.

Recent advances in superhydrophobic surfaces have improved dimensional stability, crack resistance, and decay resistance. A considerable amount of research has been conducted in this area with promising results and prospects.

Environment-related factors also contribute to the advancement of wood coatings. As technology advances in the development of environmentally friendly coatings, new opportunities are emerging for coatings with low or no volatile organic compounds (VOCs).

Download Sample PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=12161

A variety of technological advances is influencing the design, application, and specification of wood coatings. It is becoming more common on the market to see coatings that are solvent-based and free from formaldehyde, with the regular introductions of new finishes.

Key Findings of the Market Report

- The stains & varnish market will likely create a demand for wood coatings.

- During the next few years, demand is likely to be boosted by water-based technologies.

- The demand for furniture and aesthetics in modern homes is driving the market for wood coatings.

- In Asia Pacific, construction activities are expected to boost demand for wood coatings.

- Over the next decade, Europe is expected to experience a steady growth rate between 2024 and 2034.

Global Wood Coatings Market: Growth Drivers

- The need for wood coatings is mostly driven by the construction sector, especially in projects involving both residential and commercial buildings. Various renovation and remodeling projects are being undertaken in both the commercial and residential sectors, which lead to the need for wood treatments. As more individuals spend money renovating older buildings, coatings are needed in order to preserve and enhance their appearance.

- Consumer preferences for eco-friendly products and environmental restrictions are progressively influencing the market for wood coatings. Manufacturers have begun creating low- and zero-VOC coatings due to stricter regulations on emissions of volatile organic compounds (VOCs) across the globe. Environmentally friendly formulations are driving innovations in the industry.

- Innovations in technology are predominantly responsible for the growth of the wood coatings market. Technological advances in nanotechnology, water-based formulations, UV curing, and powder coatings have led to enhanced performance, durability, and environmental sustainability.

- Changing consumer tastes and interior design trends influence the types of wood treatments that are in demand. A consumer’s desire for aesthetic and protective coatings such as stains, varnishes, and ornamental finishes is great.

- Water-based coatings have gradually replaced solvent-based coatings as awareness of their environmental impact grows. Both regulatory requirements and consumer preferences are met with water-based paints due to their reduced VOC emissions, reduced toxicity, and ease of cleanup.

Global Wood Coatings Market: Regional Landscape

- Manufacturers in the Asia-Pacific area are investing in research and development to create cutting-edge wood coatings as the emphasis on sustainability and performance grows. Technological developments include powder coatings, UV-curable coatings, and sophisticated application methods to meet the changing demands of businesses and customers.

- Global changes, urbanization, and shifting lifestyles all affect consumer choices in the Asia Pacific. Large-scale infrastructure projects, such as transit networks and public facilities, fuel the demand for wood coatings for flooring, decking, architectural woodwork, and commercial complexes. Increasing foreign investment in Asia-Pacific countries is contributing to the growth of wood coatings used across a wide range of applications.

- China, India, Vietnam, and Indonesia play a major role in the furniture manufacturing industry in the Asia-Pacific region. Wood coatings are needed for all kinds of furniture, from residential to commercial to hospitality applications.

- Environmental laws may not be as stringent in Asia-Pacific nations as in Western countries, but eco-friendly products are adopted, and environmental awareness is growing. As a result, industry innovation is spurred to use water-based and low-VOC finishes.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=12161

Global Wood Coatings Market: Competitive Landscape

Companies that manufacture wood sealants and hardwood coatings are increasing their investments to meet the growing demand for waterproof and aesthetically pleasing furniture.

In a competitive landscape, prominent companies maintain a stronghold by collaborating closely with each other and outsourcing manufacturing. A number of dominant players in this sector have also been involved in mergers and acquisitions.

Key Players

- Akzo Nobel N.V.

- Asian Paints

- BASF SE

- Berger Paints India Ltd

- Kansai Nerolac Paints Limited

- Nippon Paint Holdings Co., Ltd

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Teknos Group

- Dow

- Ashland

Key Developments

- In August 2023, AkzoNobel, a global leader in industrial wood coatings, announced a new campaign to help EMEA businesses become more sustainable and improve their environmental performance.

- In January 2024, Sherwin-Williams introduced a revolutionary new waterborne wood coating that is environmentally adaptable (EA) Hydroplus. It can be applied in a wide range of conditions without sacrificing performance typically associated with waterborne coatings due to their productivity-sapping characteristics.

Global Wood Coatings Market: Segmentation

Resin Type

- Polyurethane

- Acrylics

- Melamine Formaldehyde

- Nitrocellulose

- Others

Product Type

- Stains & Varnishes

- Shellacs

- Lacquers

- Others

Technology Type

- Oil-based

- Water-based

- Solvent-based

Application Type

- Furniture

- Cabinets

- Sides & Decks

- Others

Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Purchase the Report for Market-Driven Insights: https://www.transparencymarketresearch.com/checkout.php?rep_id=12161<ype=S

Have a Look at More Valuable Insights of Chemicals And Materials

- Chloromethane Market: The chloromethane market was valued at US$ 3.5 billion in 2021. A CAGR of 4.4% is predicted from 2022 to 2031, reaching US$ 5.4 billion.

- High Purity Alumina Market: The high purity alumina market is anticipated to rise at a CAGR of 15.1% during 2022 to 2031. In 2021, the market was valued at US$ 2 Bn.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Reasons to Buy Realty Income Stock Like There's No Tomorrow

Realty Income (NYSE: O) has long been an income-focused investor favorite given its monthly dividend payout that rises quite regularly. However, the stock’s price performance has been a bit of a dud over the past five years, falling more than 15% over that stretch.

More recently, though, Realty Income stock started to regain some momentum, and it is up more than 25% over the past year. With this momentum likely set to continue, let’s look at three reasons you should be choosing this name.

1. Realty Income offers a steady and rising dividend

When it comes to paying higher dividends each year, Realty Income is a star performer. The real estate investment trust (REIT) has raised its dividend for 29 straight years and seen 108 consecutive quarterly increases.

Over the past decade, its dividend has had a 4.3% compound annual growth rate, from $0.90 per share in 2014 to a $3.156 yearly run rate as of the end of July. Its current monthly dividend was just increased to $0.2635 per share in October, good for a forward yield of about 5.1%.

Its ability to consistently increase its dividend stems from its steady, predictable business model. How a REIT like Realty Income makes money is from the difference between the rental income it generates from the properties it owns and the interest expense to fund those properties. It uses what are known as triple net leases, whereby its tenants are responsible for utilities, property taxes, and maintenance (along with the rent).

The triple net leases help Realty Income avoid any unexpected expense increases, while it generally signs up tenants to long-term leases with 10- to 20-year initial terms and yearly rent escalators. This, along with acquiring new properties, creates a nicely steady and increasing rise in its adjusted funds from operations (AFFO), which it then uses to boost its dividend.

2. Realty Income’s portfolio increased its diversity

Traditionally, Realty Income has focused on the retail sector, preferring to lease to what it deems as less economically sensitive retailers such as grocery stores, dollar stores, and pharmacies, which are better insulated from e-commerce pressures. However, the REIT has diversified its business in recent years.

First, it expanded into Europe, where it now has an approximately $11 billion real estate portfolio. Recently, this has been the company’s biggest area of new investment, where it has been able to get higher capitalization rates (caps) than in the U.S. Cap rates are basically a lease’s yield, which is calculated using a property’s net operating income and dividing it by its purchase price.

Meanwhile, the company has increased its exposure to industrial properties through its acquisition of Spirit Realty earlier this year. These properties now account for about 14.5% of its annualized contractual rent.

Realty Income has also begun to make investments in other verticals, such as casinos and data centers. It entered the gambling industry in 2022 with a $1.7 billion sale-leaseback deal with the Encore Boston Harbor Casino, and later it bought a nearly 22% equity stake in the property of The Bellagio Las Vegas operated by MGM Resorts.

Last year, the company invested about $200 million to acquire an 80% equity interest in two data centers being built by Digital Realty, forming a joint venture with the data center REIT.

This diversification comes at a good time because the retail pharmacy and dollar store businesses have come under pressure, as have home furnishing and home decor stores. Walgreens is one of Realty Income’s largest tenants, and the pharmacy chain plans to close about 25% of its locations. However, the REIT said that only 26 basis points of its total portfolio annualized contractual rent expires over the next 2 1/2 years with Walgreens.

On its last earnings call, the REIT’s management said that it estimated the rent at risk associated with Rite Aid, Red Lobster, Walgreens, Dollar Tree, At Home, and Big Lots was only 2.3% of its total portfolio annualized contractual rent through year-end 2026.

Management said if it can achieve the 84% long-term average recapture rate it typically gets with bankruptcies, the potential risk to its AFFO is only $0.02 per share. Meanwhile, it said any advanced notice of store closures provides value since it typically gives the company years to plan for an optimal outcome.

3. Lower interest rates will help Realty Income

Realty Income’s lackluster stock performance over the past few years largely stemmed from higher interest rates. Commercial properties are generally valued based off the aforementioned cap rates, which are highly influenced by interest rates. As cap rates follow interest rates up, the value of properties purchased at lower cap rates declines to reflect the current higher cap rate.

For example, if a REIT buys a commercial property for $5 million at a cap rate of 4%, it would be generating $200,000 in net operating income a year at the start of its lease. If after five years, rent escalators pushed its net operating income up to $220,000, but cap rates increased to 6%, the REIT would be earning more income, but the present value of the property would now be closer to $3.7 million ($220,000 in operating income/6% cap rate = $3.67 million property value). With the Fed previously pushing up interest rates, this is why Realty Income’s stock struggled.

However, the Fed recently cut rates by 50 basis points in what is expected to be the start of a decline in interest rates over the next few years. Cap rates, meanwhile, have also begun to fall in the U.S. and Europe after what had been a steady climb since the start of 2022. If this is the start of a trend, Realty Income should see the value of its real estate portfolio rise, and with it, its stock.

Time to buy Realty Income stock?

While Realty Income does have some tenant headwinds, they appear very manageable, and the company has a long history of dealing with stressed tenants and rent recapture. More importantly, though, the REIT market appears to be at the beginning of a lower cap-rate cycle, which will help reverse some of the reduced value the company saw in the past few years. As such, I would be a buyer of the stock since it looks poised to be a big rate-cut winner.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Digital Realty Trust and Realty Income. The Motley Fool has a disclosure policy.

3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow was originally published by The Motley Fool

Welltower Announces Date of Third Quarter 2024 Earnings Release, Conference Call and Webcast

TOLEDO, Ohio, Oct. 7, 2024 /PRNewswire/ — Welltower® Inc. WELL today announced it will release third quarter 2024 financial results after the close of trading on the New York Stock Exchange on Monday, October 28, 2024. The Company will host a conference call and webcast on Tuesday, October 29, 2024, at 9:00 a.m. ET to discuss these results. The Company’s earnings release will be available in the Investors section of the Company’s website.

Investors and other interested parties may access the conference call in the following ways:

- At the Company’s website: www.welltower.com.

- Via webcast: https://events.q4inc.com/attendee/656396744. A webcast replay will be available approximately two hours after the conclusion of the conference call and will be available for 90 days. Joining via webcast is recommended for those who will not be asking questions.

- By telephone: The participant toll-free dial-in number is (888) 340-5024. The international dial-in is (646) 960-0135. The conference ID number is 8230248. All phone participants are asked to dial in 15 minutes prior to the start of the call to ensure connectivity.

A replay of the conference call will be available beginning at approximately 1:00 p.m. ET on October 29, 2024 and ending on November 5, 2024. The dial-in number for United States participants is (800) 770-2030. For international participants, the replay dial-in number is (609) 800-9909. The replay conference ID number is 8230248.

About Welltower

Welltower® Inc. WELL, an S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. The Company invests with leading seniors housing operators, post-acute providers, and health systems to fund the real estate infrastructure needed to scale innovative care delivery models and improve people’s wellness and overall health care experience. Welltower, a real estate investment trust (“REIT”), owns interests in properties concentrated in major, high-growth markets in the United States, Canada, and the United Kingdom, consisting of seniors housing, post-acute communities and outpatient medical properties. More information is available at www.welltower.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/welltower-announces-date-of-third-quarter-2024-earnings-release-conference-call-and-webcast-302268609.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/welltower-announces-date-of-third-quarter-2024-earnings-release-conference-call-and-webcast-302268609.html

SOURCE Welltower Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oil prices dip after strongest weekly rise in over one year

By Paul Carsten

LONDON (Reuters) -Oil prices extended gains on Monday, with Brent nearing $80 to build on last week’s steepest weekly jump since early 2023, driven by fears of a wider Middle East conflict and potential disruption to exports from the major oil-producing region.

Brent crude futures rose $1.30, or 1.7%, to $79.35 a barrel by 1201 GMT. U.S. West Texas Intermediate (WTI) crude futures jumped $1.40, or 1.9%, to $75.78. WTI had earlier risen by more than $2.

Brent climbed by more than 8% last week while WTI soared by 9.1% on the possibility that Israel could strike Iranian oil infrastructure in response to an Iran’s Oct. 1 missile attack on Israel.

The potential escalation of the conflict has countered mounting demand-side pressures, said Priyanka Sachdeva, analyst at Phillip Nova.

Rockets fired by Iran-backed Hezbollah hit Israel’s third-largest city, Haifa, early on Monday. Israel, meanwhile, looked poised to expand ground incursions into southern Lebanon on the first anniversary of the Gaza war, which has spread conflict across the Middle East.

That spread has raised fears that the United States, Israel’s superpower ally, and arch-foe Iran will be sucked into a wider war.

ANZ Research, however, expects any immediate on supply to be relatively small.

“We see a direct attack on Iran’s oil facilities as the least likely response among Israel’s options,” it said, noting the buffer provided by producer group OPEC’s 7 million barrels per day of spare capacity.

The Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, known collectively as OPEC+, are due to start raising production from December after cutting in recent years to support prices because of weak global demand.

OPEC+ has enough spare oil capacity to offset Israel knocking out Iranian supply, but it would struggle if Iran retaliates by attacking installations of neighbouring Gulf nations, analysts have said.

When the Middle East conflict began a year ago, Brent stood at $88.15, but prices are now about $10 lower.

“While nothing can touch the emotion that the conflict has brought to the oil community, it has been well and truly smothered by macroeconomic considerations that have thwarted any idea of an increase in global demand,” said John Evans of oil broker PVM.

(Reporting by Paul Carsten in London and Gabrielle Ng and Emily ChowEditing by David Goodman)

PulseSight Therapeutics to Present Data on PST-611 at EVER Congress 2024

PARIS, Oct. 07, 2024 (GLOBE NEWSWIRE) — PulseSight Therapeutics SAS, an ophthalmology biotech company developing disruptive non-viral vectorized therapies with minimally-invasive delivery technology, is pleased to confirm that it will be presenting data on its lead program PST-611, expressing human transferrin, in dry age-related macular degeneration (AMD)/geographic atrophy (GA) at the European Association for Vision and Eye Research 27th EVER Congress, being held in Valencia, Spain, November 3rd – 5th 2024.

Presentations have been accepted for an oral and a poster presentation:

- Oral Presentation by Dr Thierry Bordet (CSO): Transferrin is a drug candidate for the treatment of geographic atrophy (GA)/dry age-related macular degeneration (AMD)

Presentation on November 5th, 2024, 09:20-10:35 CET (ID# T.129)

- Poster Presentation by Dr Karine Bigot (Head Pharmacology & Toxicology): Non-clinical safety of PST-611, non-viral vectorized human transferrin, for the treatment of geographic atrophy (GA)

Presentation on November 5th, 2024, 11:05-12:05 CET (ID# T.063)

Thierry Bordet, CSO of PulseSight Therapeutics, said, “EVER attracts top European researchers and the most innovative industry players, and I am delighted that we have been accepted to present our recent promising data on PST-611, our pioneering, first-in-class non-viral vectorized gene therapy for the treatment of dry AMD/GA.

PST-611 is a DNA plasmid encoding human transferrin, a highly potent iron chelator. Excess iron is known to be highly toxic to retinal cells, leading to oxidative stress, inflammation, and ferroptosis. By restoring normal iron homeostasis, transferrin mitigates these toxic effects and protects retinal cells, offering the potential to slow GA lesions growth and improve patient’s visual function.

Additionally, PST-611 benefits from a very good safety profile, as will be presented by my colleague Karine, further supported by the safety data from an earlier clinical trial with our previous candidate (PST-606 in uveitis).”

The company is planning to submit a phase I clinical trial authorization (CTA) by end October, to be closely followed by a phase II proof-of-concept to demonstrate the efficacy and the safety of its drug candidate by end 2027.

Media contact

Sue Charles, Charles Consultants

T: +44 (0)7968 726585

E: sue@charles-consultants.com

About age-related macular degeneration (AMD)

AMD is a disease with progressive, painless loss of central vision with a strong burden on patients’ everyday life, impacting their ability to read, recognize faces, and see objects and, ultimately, leading to irreversible vision loss in the elderly. After reaching an intermediate stage, AMD can progress to either ‘Wet AMD’ or ‘Dry AMD’, which can then evolve into GA (geographic atrophy), leading to irreversible blindness. In all its forms, AMD represents a compelling unmet need for more effective and durable treatment options, with a large and growing market, estimated to reach $27.5 Billion by 2031.

About PulseSight Therapeutics

PulseSight is clinical-stage biotech company committed to developing disruptive non-viral vectorized therapies with minimally-invasive delivery technology to protect and improve the vision of patients with retinal disease with a focus on age-related macular degeneration (AMD) including wet AMD and geographic atrophy (GA) secondary to dry AMD.

Already clinically validated for its safety and sustained activity, PulseSight’s technology platform delivers DNA plasmids encoding therapeutic proteins into the ciliary muscle using an electro-transfection system. The ciliary muscle cells act as biofactories, expressing therapeutic proteins that reach the retina with high distribution, providing a safe and long-lasting treatment for major eye diseases.

About PST-611 for GA

PST-611 encodes the human transferrin protein, a crucial regulator of iron homeostasis and holds the potential to effectively address key pathological mechanisms in GA, whilst requiring re-treatment only every six months. This program is ready to enter the clinic by the end of 2024.

About PST-809 for Wet AMD

PST-809 is a dual-gene plasmid encoding for anti-VEGF aflibercept and decorin, an anti-angiogenic and anti-fibrotic native protein, showing superior efficacy against anti-VEGF gold standard while limiting the need for frequent reinjection. PST-809 is at the very late stage of preclinical IND-enabling studies.

Based in Paris, France, the company’s investors are Pureos Bioventures, ND Capital and Korea Investment Partners (KIP).

For more information visit www.PulseSightTherapeutics.com

Follow us on LinkedIn – https://www.linkedin.com/company/pulsesight-therapeutics/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China Stock Skepticism Gets Louder as World-Beating Run Extends

(Bloomberg) — The world-beating rally in Chinese stocks is failing to convince many global fund managers and strategists.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

Invesco Ltd., JPMorgan Asset Management, HSBC Global Private Banking and Wealth, and Nomura Holdings Inc. are among those viewing the recent rebound with skepticism and waiting for Beijing to back up its stimulus pledges with real money. Some are also concerned many stocks are already reaching overvalued levels.

Chinese shares have skyrocketed since late-September as a barrage of economic, financial and market-support measures reinvigorated investor confidence and prompted the likes of Goldman Sachs Group Inc. to upgrade the nation’s stocks to overweight. The Hang Seng China Enterprises Index, which comprises Chinese stocks listed in Hong Kong, has jumped more than 35% over the past month, making it the best performer among more than 90 global equity gauges tracked by Bloomberg, while raising concern it may be too far, too fast.

“In the short term, sentiment could overshoot but people will go back to fundamentals,” said Raymond Ma, Invesco’s chief investment officer for Hong Kong and Mainland China. “Because of this rally, some stocks have become really overvalued” and they lack a clear value proposition based on their likely earnings performance, he said.

Stimulus announced by Beijing has included interest-rate cuts, freeing-up of cash at banks, billions of dollars of liquidity support for stocks, and a vow to end the long-term slide in property prices. The China National Development and Reform Commission will host a press conference Tuesday to discuss implementation of a package of incremental economic policies.

While there’s plenty of optimism that could underpin a sustainable equity rally, there have been a number of false dawns before, most recently a rally in February that completely unwound.

Ma at Invesco, who was one of relatively few China bulls coming into this year, said he’s in no rush to add to his investments now.

“There are a group of stocks whose share prices are up by 30% to 40% and almost at historical highs,” he said. “Whether in the next 12 months the fundamentals will be as good as before their peak, that’s more uncertain to me. That would be the category we would like to trim.”

The surge in the past two weeks has seen Chinese equities reassert their influence over broader emerging-market gauges, and dented the performance of fund managers who had been running underweight positions in the biggest developing-nation economy. The durability of the rebound will not only matter for the year-end performance of index-tracking funds, but also have direct implications for nations that have trading and investment links with China.

More Needed

JPMorgan Asset Management is just as cautious.

“Additional policy steps would be needed to boost economic activity and confidence,” said Tai Hui, Asia Pacific chief market strategist in Hong Kong. “The policies announced so far can help to smoothen out the de-leveraging process, but the balance-sheet repairing would still need to take place.”

Hui also pointed to global uncertainties that may crimp the nascent stock rally.

“With the U.S. elections only a month away, many investors would argue that the U.S. view of China as an economic and geopolitical rival is a bipartisan consensus,” he said. Moreover, “foreign investors may choose to wait for economic data to bottom out and for this new policy direct to solidify,’ he said.

Slowing Growth

HSBC Global Private Banking remains concerned the steps China has taken aren’t enough to reverse the nation’s slowing long-term growth outlook.

“More significant fiscal easing is still needed to sustain the recovery momentum and shore up growth to achieve the 5% 2024 GDP growth target,” said Cheuk Wan Fan, chief investment officer for Asia at the private bank in Hong Kong. “For now, we stay neutral on mainland China and Hong Kong equities based on our expectation of China’s GDP growth decelerating from 4.9% in 2024 to 4.5% in 2025.”

Goldman Positive

Some are predicting further gains.

Goldman Sachs Group Inc. has upgraded its call on Chinese stocks to overweight, and said indexes tracking the nation’s equities may rise another 15%-to-20% if authorities deliver on policy measures.

Beijing’s recent stimulus announcements “have led the market to believe that policy makers have become more concerned about taking sufficient action to curtail left-tail growth risk,” strategists including Tim Moe wrote in a note dated Oct. 5.

Bond ‘Challenges’

Some investors and strategists are also wary about what the stimulus blitz means for the nation’s bonds and currency.

China’s bonds have dropped since the stock rally started, ending at least temporarily a period in which yields set successive record lows as investors bought haven assets.

“There are still major challenges to be resolved, and it’s not an easy road,” said Lynn Song, chief economist for Greater China at ING Bank in Hong Kong. “We need to ensure that this policy blitz is effective in stabilizing the downward trajectory of the housing market and not just result in a rush of hot money to equities.”

Bonds may become a beneficiary if the stock market cools, Song said. “There’s certainly a risk we could revert back to the previous months’ environment if anything goes wrong in the next steps ahead.”

Yuan traders will be watching out on Tuesday for the central bank’s daily reference rate, the level around which the currency is allowed to trade. The onshore yuan has strengthened more than 1% in the past month to approach the key level of 7 per dollar. A break of that barrier may trigger a further rally.

What to Watch

-

China publishes FX reserves data for September

-

A swath of countries release inflation data, including Thailand, Brazil, Mexico, Chile and Argentina

-

Central banks in India, Peru and South Korea announce interest-rate decisions

-

Mexico and India release industrial production data

–With assistance from Shulun Huang and Carolina Wilson.

(Updates to add view from Goldman in the third paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Cathie Wood Predicts Trillion Dollar Revenue Opportunity For Tesla In Autonomous Vehicles: 'Winner-Takes-Most' In AI And Driving Tech

ARK Invest CEO Cathie Wood painted a bullish picture for Tesla Inc‘s TSLA future in the autonomous vehicle market, while also sharing insights on the booming artificial intelligence sector and the potential for companies like OpenAI to go public.

What Happened: Wood, known for her optimistic tech forecasts and her company’s flagship ARK Innovation ETF ARKK, sees a “winner-takes-most” scenario unfolding in the autonomous driving space. Wood in an interview with Yahoo Finance predicts this could translate into a staggering “trillion-dollar-plus revenue opportunity for Tesla in the next five years.”

“The company that gets people from point A to point B the fastest, safest, and with the least wait time is going to dominate the market,” Wood explained, emphasizing the high stakes in the race for autonomous technology supremacy.

Her comments come as OpenAI, the company behind ChatGPT, raised $6.6 billion in a recent funding round, achieving a valuation of approximately $157 billion. ARK Invest has been among the firms investing in OpenAI, signaling Wood’s broader bet on the AI sector.

Wood identified OpenAI, Anthropic, xAI, Alphabet Inc‘s GOOGL GOOG Google, and Meta Platforms Inc. META as companies “stealing the march” in the AI space.

She expressed optimism about the development of agentic AI, which she believes will pave the way for increased profitability as companies can charge premium rates for more advanced AI capabilities.

Tesla’s “We, Robot” event is scheduled for Thursday at 10 p.m. EDT, with investors hoping that the event will give a lift to the stock.

Why It Matters: Addressing concerns about OpenAI’s recent executive departures, Wood praised the leadership of CEO Sam Altman and CFO Sarah Friar. She noted that rapid growth often necessitates management changes, stating, “What we witness in companies that are growing very quickly from startup into scaling is you need a different kind of management team.”

On the topic of AI companies potentially going public, Wood observed a trend of firms staying private longer. She cited regulatory burdens and short-term investor mindsets in public markets as deterrents. However, she suggested that lower interest rates and increased investor patience for long-term strategies could make public offerings more attractive in the future.

Turning back to Tesla, Wood addressed the company’s long-promised autonomous driving capabilities. “It’s no longer a question of if, but when, for Tesla,” she said, pointing to Google-owned Waymo’s progress as evidence that autonomous driving is becoming a reality.

Wood’s firm has published a model on its website and GitHub, allowing investors to explore various scenarios for the autonomous vehicle market’s growth. According to their research, the platform opportunity for companies hosting autonomous networks could represent a “$4 to $5 trillion revenue opportunity over the next 5 to 10 years.”

The ARK Venture Fund agreed to invest at least $250 million in OpenAI’s historic funding round. This investment marks ARK’s second in the AI firm, which has been pivotal in the generative AI space since launching ChatGPT.

Read Next:

Image via Ark Invest

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's the Average Stock Market Return With Democratic and Republican Presidents in the White House

The S&P 500 (SNPINDEX: ^GSPC) is one of three major U.S. financial indexes. It measures the performance of 500 large domestic companies that cover about 80% of domestic equities by market value. Its scope and diversity make it the best gauge for the overall U.S. stock market.

In 2024, the S&P 500 advanced more than 20% through the end of the third quarter, the strongest year-to-date performance of the 21st century, according to JPMorgan Chase. That momentum has been driven by economic resilience and euphoria about artificial intelligence, as well as excitement about the Federal Reserve’s recent interest rate cuts.

However, the next presidential election is just one month away, and many investors are curious about the potential implications. Read on to learn how the S&P 500 has performed with Democratic and Republican presidents in the White House.

The average stock market return under Democratic and Republican presidents

Since its inception in 1957, the S&P 500 has increased 12,950% in value, compounding at 7.4% annually. That compound annual growth rate (CAGR) is based on the price return of the index, meaning it does not account for dividend payments doled out along the way. The total return, including dividend payments, would be higher.

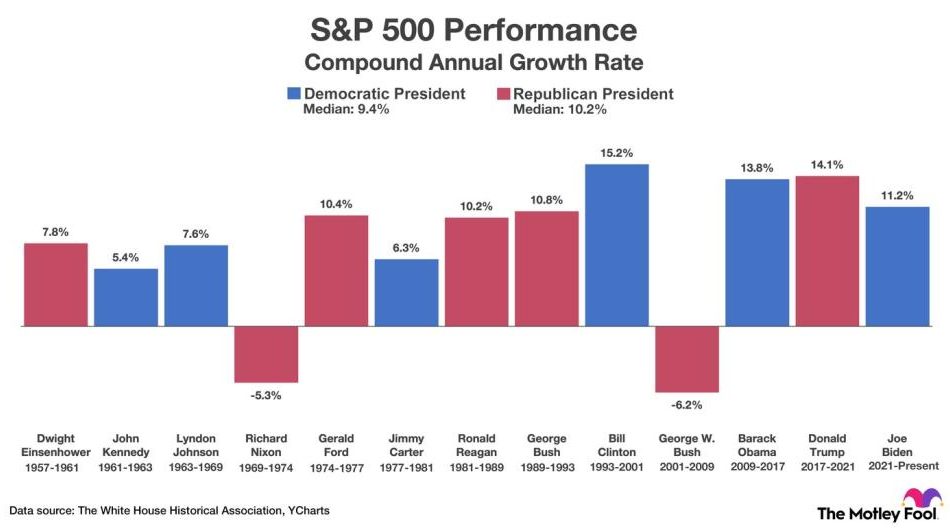

The chart below shows the S&P 500’s CAGR during each presidency since the index was created. It also shows the median CAGR under Democratic and Republican presidents.

As shown in the chart, the S&P 500 has achieved a median CAGR of 10.2% under Republican presidents and 9.4% under Democratic presidents. In that sense, the U.S. stock market has performed a little better during periods when Republicans have controlled the White House.

However, we can also look at the problem from a different perspective. Specifically, instead of analyzing the CAGR during entire presidencies, we can examine the return in each individual year. The chart below shows the S&P 500’s return in each individual year since March 1957. It also shows the median annual return when Democrats and Republicans held the presidency.

As shown above, the S&P 500 has achieved a median annual return of 12.9% under Democratic presidents and 9.9% under Republican presidents. In that sense, the U.S. stock market has done a little better during periods when Democrats have controlled the White House.

Bear in mind that presidents control neither the stock market nor the economy. Their influence is limited to nominations and budget proposals. For instance, the president nominates the seven members of the Federal Reserve’s Board of Governors, but those candidates must be confirmed by lawmakers in the Senate.

Additionally, Kamala Harris has proposed raising the corporate tax rate, and Donald Trump has proposed the opposite. Both changes could impact the stock market and the economy. However, Congress has the final say regarding budget proposals, and lawmakers have no obligation to approve specific policies.

Furthermore, some events that influence the stock market and economy are beyond the control of any elected or appointed official. Consider the dot-com bubble, the global financial crisis, and the COVID-19 pandemic. All those events influenced the stock market and economy, and no single person could have prevented them.

History says patient investors will be well rewarded regardless of who wins the presidential election

There are two key takeaways for investors. First, statistics can be manipulated to achieve a desired outcome. As discussed, the stock market has performed better under Republicans in terms of the median CAGR across entire presidencies, but it has performed better under Democrats in terms of median return across individual years. Both statements are true, but they arrive at opposite conclusions.

Second, avoiding the stock market because one political party controls the White House would be a mistake. After examining returns since the 1950s, analysts at Goldman Sachs concluded: “Investing in the S&P 500 only during Republican or Democratic presidencies would have resulted in major shortfalls versus investing in the index regardless of the political party in power.”

Here’s the bottom line: The S&P 500 achieved a total return of 2,090% over the last 30 years, which equates to an annual return of 10.8%. That period encompasses such a broad range of economic and market conditions that investors can expect similar returns over the next three decades. In that context, the U.S. stock market is a smart place to invest money regardless of which party wins the presidential election in November.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and JPMorgan Chase. The Motley Fool has a disclosure policy.

Here’s the Average Stock Market Return With Democratic and Republican Presidents in the White House was originally published by The Motley Fool

Popcat, Dogwifhat Chart Toppers In Memecoin Tsunami; Dogecoin, Shiba Inu Rise As Broader Sentiment Improves

Memecoins erupted Sunday, with major coins topping the daily cryptocurrency gainers list.

What happened: Dog-themed token dogwifhat soared more than 16%, becoming the second-best performing cryptocurrency in the last 24 hours. The Solana SOL/USD-based coin spiked to its highest level since July 23, witnessing a significant 75% jump in trading volume.

Cat-themed Popcat followed suit, gaining more than 15% to set a new all-time high. The cryptocurrency surged more than 40% in the last week and has been the market’s top gainer this year, with a staggering 15398% increase.

| Cryptocurrency | Gains +/- | Price (Recorded at 10:45 p.m. EDT) |

| dogwifhat WIF/USD | +16.82% | $2.66 |

| Popcat (POPCAT) | +15.61% | $1.41 |

| Bonk BONK/USD | +12.79% | $0.00002323 |

Yet another Solana-based memecoin, Bonk, rose 12.79%, moving up to fifth place among top market performers.

Blue-chip coins like Dogecoin DOGE/USD and Shiba Inu SHIB/USD surged 4.47% and 6.63%, respectively, as the overall meme coin market capitalization spiked more than 9% in the last 24 hours.

Why It Matters: The jump followed a broader market rally that saw bellwethers like Bitcoin BTC/USD and Ethereum ETH/USD make significant advances overnight.

The optimism could be attributable to Friday’s better-than-expected jobs report, indicating a healthy economy and allaying fears of a recession.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.