Shiba Inu's Shytoshi Kusama Calls This Nation 'Crypto Capital' After It Makes Digital Asset Transactions Tax Free

Shytoshi Kusama, the mysterious lead developer at the helm of the Shiba Inu SHIB/USD ecosystem, praised the UAE administration for exempting cryptocurrency transactions from value-added tax (VAT).

What happened: In an X post on Sunday, Kusama responded to news of the exemption with a GIF of Vegeta, a character in the popular anime series Dragon Ball. The pseudonymous personality dubbed the UAE the “cryptocurrency capital.”

Last week, the UAE’s Federal Tax Authority amended the country’s VAT laws, which, according to accounting giant PricewaterhouseCoopers (PwC), will eliminate taxes on the transfer and conversion of virtual assets.

Pwc added that the exemptions would be applied retroactively from Jan.1, 2018.

Note that the UAE does not levy federal-level income tax on individuals. However, it levies a 5 % value-added tax on the purchase of goods and services.

See Also: Bitcoin ‘Not A Safe Haven’ But Rising Trump Odds Could Fuel A Rally: Standard Chartered

Why It Matters: The exemption was the latest in a series of active steps taken by the UAE administration to pitch the country as a cryptocurrency-friendly destination.

Earlier this year, the world’s largest cryptocurrency exchange, Binance BNB/USD secured a full regulatory license in Dubai, paving the way for the juggernaut to offer virtual asset-related services to a broader range of customers.

Last week, Ripple Labs XRP/USD got an in-principle approval to offer blockchain-enabled payment services from the Dubai International Financial Centre (DIFC).

Interestingly, Kusama has been impressed by the UAE’s cryptocurrency landscape in the past and expressed admiration for the culture and his connections there.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Hot Tech Stocks Poised to Crush the Market in 2025

With multiple Wall Street indexes trading near all-time highs, the opportunities to find deals are getting harder. In some ways, it’s a fun problem to have, but it’s also a challenge for those pondering where to deploy fresh funds. Ultimately, the stock market is exactly what its name implies — a market of stocks. Just because some of those stocks are more expensive doesn’t necessarily mean there aren’t still deals to be had.

After an exhaustive search, SentinelOne (NYSE: S), Netflix (NASDAQ: NFLX), and Sea Limited (NYSE: SE) jumped out to three Fool.com contributors as hot stocks with market-beating upside for next year.

SentinelOne is outperforming in 2024, and it may not stop

Justin Pope (SentinelOne): SentinelOne combines cybersecurity and artificial intelligence (AI), two of Wall Street’s hottest themes. The company’s autonomous security platform uses AI to provide cutting-edge protection against cyber threats, garnering high praise from third-party testing throughout the industry. The expensive consequences of breaches have companies seeking high-end solutions like SentinelOne’s, resulting in some of the best revenue growth you’ll find on the market.

Not only did SentinelOne grow revenue by 33% year over year in the second quarter of its fiscal year, which ended July 31, but the company is also making strides toward profitability, which has made investors bullish on the stock and helped it soar nearly 40% over the past year. However, there could be more big returns on the way.

SentinelOne recently announced a deal with Lenovo, the world’s largest PC manufacturer, to include its security software on new PC shipments. Since striking a similar partnership with Dell Technologies last year, CrowdStrike has added over $50 million in revenue thus far. Achieving similar results would move the needle for SentinelOne, which analysts estimate will generate $815 million in revenue this year and approximately $1 billion next year. These estimates could rise once SentinelOne speaks to the Lenovo partnership in future earnings calls.

For all the good stuff happening at SentinelOne and its stellar investment returns, the stock can still outperform the broader market. SentinelOne’s valuation became so suppressed over the past few years that it still trades at a lower enterprise value-to-sales ratio than high-tech peers, including CrowdStrike, Zscaler, and Palo Alto Networks. So no, it’s not too late to buy SentinelOne despite its meteoric rise this year.

The SentinelOne party started in 2024, but I expect this momentum to continue next year.

Netflix may have already won the streaming wars

Jake Lerch (Netflix): Up over 45% year to date, there’s no doubt Netflix is currently a hot stock. However, I think 2025 could be an even better year for the streaming giant. Here’s why.

The streaming wars aren’t over, but it’s clear that Netflix is gaining the upper hand.

For example, According to data compiled by Nielsen during June, streaming video now accounts for about 40% of total TV usage, with cable (27%) and broadcast (20%) trailing far behind.

And when you drill down on the streaming component, it’s clear who the big winners are. Alphabet‘s YouTube leads the way with 9.9% of streaming usage, while Netflix is second with 8.4%.

The next closest streamers are Amazon‘s Prime Video (3.1%), followed by Disney-owned Hulu (3%) and Disney+ (2%), and Tubi (2%). None of the other major streamers, including Paramount+, Comcast‘s Peacock, and Warner Bros. Discovery‘s Max, crack the 2% mark.

In short, Netflix has maintained its competitive edge in the streaming market. Not only that, but the overall streaming market continues to take share from traditional sources of viewership, such as cable and broadcast television.

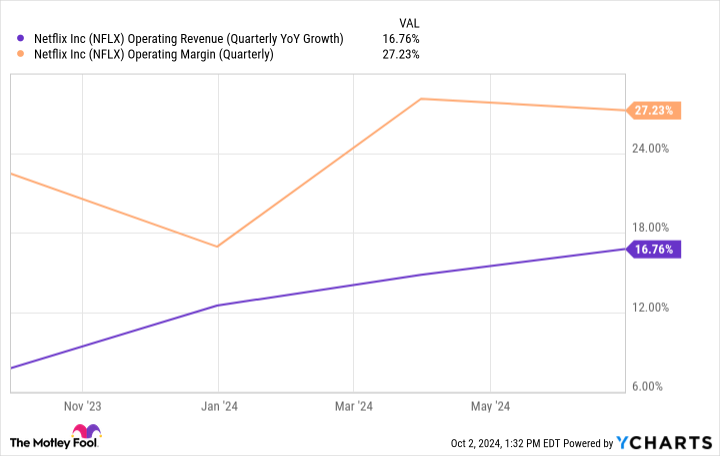

As a result, Netflix’s fundamentals continue to shine. In its most recent quarter (the three months ending on June 30, 2024), Netflix reported year-over-year revenue growth of 17% and an operating margin of 27%. Both figures are up significantly from a year earlier.

In summary, Netflix has not only survived a serious challenge to its business model, but it has also come through the streaming wars stronger than ever and is well-positioned to build on its past success. 2025 could prove to be an excellent year for Netflix as the company ramps up its ad-tier business. Investors would be wise to consider Netflix now, ahead of what could be a banner year.

The recovery is well underway in this pandemic stock

Will Healy (Sea Limited): After a brutal sell-off in the 2022 bear market, it might finally be time to pivot back to Sea Limited. The Singapore-based conglomerate prospered during the pandemic as its retail, gaming, and fintech segments served its locked-down customer base.

However, conditions turned negative as the lockdowns ended and economies reopened. Its formerly No. 1 smartphone game, Free Fire, lost some of its popularity after 2021, and it was banned in India over national security concerns. Moreover, instead of investing in logistics in its Southeast Asian markets, where it is the leading online retailer, its retail arm, Shopee, entered markets in Europe and Latin America, where it held no competitive advantage.

All of these factors led to the stock falling 91% between the fall of 2021 and the beginning of 2024.

Fortunately for Sea Limited shareholders, Shopee exited most of its non-Asian markets and has invested heavily in logistics infrastructure in its home region. Moreover, Free Fire experienced a resurgence in popularity, and Garena continues to work with the Indian government to bring Free Fire back to that country.

Additionally, fintech arm Sea Money has continued to prosper, and in the first half of 2024, it was a contributing factor in Sea Limited’s revenue rising 23% year over year to over $7.5 billion.

However, a 73% increase in sales and marketing expenses sent net income plunging. The majority of that increased spending pertained to e-commerce investments, while it also spent heavily on its Sea Money operations. Still, these investments should lead to higher revenue and profits longer-term.

Investors seem to have taken to the company’s new strategy, as the stock is up over 115% over the last year. Also, while the lower net income skewed the P/E ratio, its price-to-sales (P/S) ratio of 3.8 is not far above a much larger e-commerce conglomerate, Amazon, at 3.3 times sales. When considering that the stock is still 75% below its 2021 high, such a valuation should position Sea Limited for significant gains in 2025.

Should you invest $1,000 in Sea Limited right now?

Before you buy stock in Sea Limited, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sea Limited wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, and Walt Disney. Justin Pope has positions in SentinelOne. Will Healy has positions in CrowdStrike, Sea Limited, and Zscaler. The Motley Fool has positions in and recommends Alphabet, Amazon, CrowdStrike, Netflix, Palo Alto Networks, Sea Limited, Walt Disney, Warner Bros. Discovery, and Zscaler. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.

3 Hot Tech Stocks Poised to Crush the Market in 2025 was originally published by The Motley Fool

Bitcoin, Ethereum, Dogecoin Spike As Market Stays Upbeat After Better-Than-Expected Jobs Report: Analyst Says Every Bull Run Started In October — Will 2024 Follow The Trend?

Leading cryptocurrencies rallied Sunday overnight as investors remained optimistic following a healthy employment report.

| Cryptocurrency | Gains +/- | Price (Recorded at 8:45 p.m. EDT) |

| Bitcoin BTC/USD | +2.51% | $63,448.35 |

| Ethereum ETH/USD |

+3.17% | $2,485.32 |

| Dogecoin DOGE/USD | +3.53% | $0.113 |

What Happened: Bitcoin steadily inched upward throughout the day, before a sharp breakout to nearly $64,000 late evening. The world’s largest cryptocurrency attempted to recover from last week’s losses, exacerbated by geopolitical tensions.

The late-hour surge also saw Ethereum spike to $2,490, up from a loss of more than 5% the previous week.

Total cryptocurrency liquidations hit nearly $112 million in the last 24 hours, with downside bets getting the most affected.

Bitcoin’s Open Interest soared 5.83% in the last 24 hours, indicating a sharp surge in speculative interest for the leading cryptocurrency.

The Cryptocurrency Fear & Greed entered the “Neutral” zone after languishing in “Fear” last week.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 8:45 p.m. EDT) |

| Popcat (POPCAT) | +18.22% | $1.44 |

| dogwifhat (WIF) | +16.52% | $2.60 |

| BIttensor (TAO) | +15.41% | $645.02 |

The global cryptocurrency stood at $2.2 trillion, following an increase of 2.35% in the last 24 hours.

Stock futures were little changed overnight. The Dow Jones Industrial Average Futures fell 6 points, or 0.01%, as of 8:50 p.m. EDT. Futures tied to the S&P 500 were down 0.06%, while Nasdaq 100 Futures lost 0.1%.

Major averages ended last week on a high after healthy labor market signs emerged from the September jobs report released Friday. Nonfarm payrolls rose from 159,000 in August to 254,000 in September, bettering economists’ forecasts.

This week, investors would watch for the minutes of FOMC from September’s policy meeting, due for release on Wednesday, and the Consumer Price Index data, slated for Thursday.

See More: Best Cryptocurrency Scanners

Analyst Notes: Widely-followed cryptocurrency analyst Kyle Chassé attributed Bitcoin’s latest rally to whale demand, noting a sharp surge in accumulation by wealthy investors.

“This is proof of demand. We know the supply is starting to dwindle. This is how it starts,” the analyst stated.

Another noted cryptocurrency researcher, 0xNobler, drew attention to the historical tendency of a Bitcoin bull run in October.

“The next target for $BTC is ~$260,000 and many altcoins will follow the lead. Every $100 today = $10,000 in Q1 2025,” the analyst predicted.

Photo by CMP_NZ on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Smartest Electric Vehicle (EV) Stocks to Buy With $1,000 Right Now

With proper insight and timing, an investor could have profited mightily from electric vehicle (EV) sector in recent years. For instance, had you invested $1,000 into Tesla (NASDAQ: TSLA) when its shares went public in June 2010, you’d have more than $156,000 today. Nowadays, many investors are looking for the next Tesla. If that’s your goal, pay attention to the two companies on this list.

Looking for the next Tesla? Here it is.

While many investors are looking for the next Tesla, it’s fair to mention that it’s still possible to invest in the original Tesla today. The company has a gargantuan $850 billion market value, but that shouldn’t stop you from jumping in.

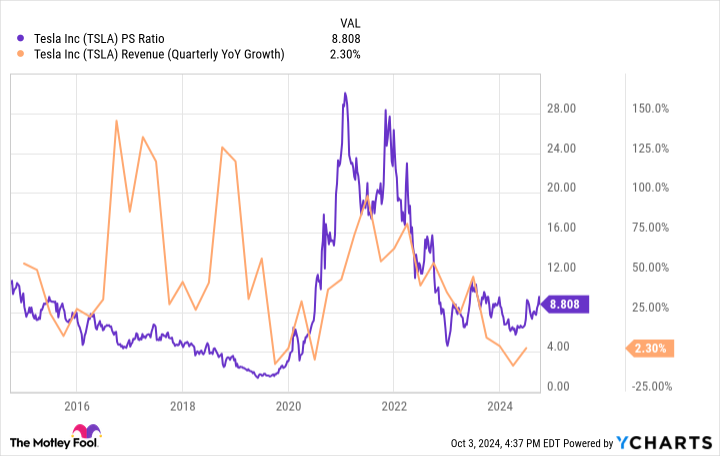

There are two reasons to believe the stock still has plenty of long-term upside. First, shares are cheaper today than they have been in years. That’s due to a massive dip in revenue growth. Earlier this year, Tesla actually experienced a decline in companywide revenue. As a result, Tesla’s price-to-sales ratio has fallen from the mid 20s to under 10. To be sure, that’s still expensive, but it’s a bargain relative to the company’s history.

A cheap valuation on paper, however, is only attractive if you believe the company is about to turn the corner. Take note of the chart below. Tesla has experienced massive dips in revenue growth before, with its valuation usually following suit. A huge reason that things turned around was a jump in electric vehicle sales, as well as the introduction of new models like the Model 3 and Model Y — both of which resulted in sales spikes that persisted for several years.

According to Bloomberg, “Electric vehicle deliveries have been essentially flat since early 2023, and that’s not likely to change anytime soon.” But fortunately, Tesla has something else up its sleeve. “Tesla’s robotaxi event next week,” Bloomberg reports, “will see Musk lean even harder into the narrative of self-driving vehicles, artificial intelligence and robots.”

Am I buying into Tesla’s robotaxi hype? Not just yet. But Musk has dreamed big before. Sometimes he delivers, and sometimes he doesn’t, but it’s often a smart move to back the horse with a winning track record. And despite the company’s recent missteps, Tesla is still the company to bet on if you’re bullish on EV stocks in general. But if you’re looking for the most upside potential possible, the next stock on this list is for you.

This EV stock has huge growth potential

While Tesla is still a great stock to bet on for those bullish on the EV space, its shares are still expensive and the company’s biggest days of growth are likely behind it. Rivian Automotive (NASDAQ: RIVN) is in the opposite situation. Its biggest days of growth are very much ahead of it, and shares aren’t as expensive as you’d think.

Earlier this year, for example, Rivian was posting revenue growth rates above 80% year over year. Those growth rates came at a time when Tesla’s revenue base was actually shrinking. And while Rivian’s growth rates have converged with Tesla’s more recently, most of that has come from industry pressure and the maturation of its models.

This year, EV sales forecasts have been repeatedly trimmed industrywide, and Rivian’s two existing models, the R1T and R1S, have already been on the market for several years. But that’s all about to change.

Earlier this year, Rivian announced three new models: the R2, R3, and R3X. All are expected to be priced under $50,000 — the magic price point that EV makers need to sell beneath in order to market to mass audiences. Also, while EV sales in general have slowed this year, most long-term forecasts still predict massive growth in the years to come. Passenger EV sales are expected to surpass 30 million by 2027, according to a recent report from Bloomberg. And this figure should grow further to 73 million per year by 2040.

Rivian’s new models aren’t expected to hit the streets until 2026. That gives plenty of time for market conditions to improve as most forecasts predict. And in the meantime, investors can lock in a market capitalization of just $11 billion. That results in a price-to-sales (P/S) ratio of only 2.1 for Rivian versus Tesla’s premium P/S multiple of 8.8.

You’ll need to be comfortable with volatility as Rivian attempts to ramp up its manufacturing capabilities, as well as market new models to a consumer base still skeptical of EVs. But if you truly want to invest in the next Tesla, Rivian has all the characteristics you’d want to see.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The Smartest Electric Vehicle (EV) Stocks to Buy With $1,000 Right Now was originally published by The Motley Fool

Len Sassaman Is Bitcoin Creator Satoshi Nakamoto In HBO Documentary? Polymarket Punters See High Probability

Bettors at Polymarket are eyeing a strong possibility of Len Sassaman getting identified as Bitcoin BTC/USD creator Satoshi Nakamoto in the keenly awaited HBO documentary.

What happened: Gambles favoring Sassaman were at 39% as of this writing on the cryptocurrency-based prediction market, the highest in the list that included names of famous people believed to be pseudonymous creators at different times in the past.

A cypherpunk and developer of the PGP encryption and privacy technology, Sassaman’s name has been frequently thrown around in the mystery saga. His death in July 2011 was preceded by Nakamoto’s final communication to Bitcoin developers, an eerie coincidence that strengthened the theory.

Next on the list was Blockstream CEO Adam Back, with more than 11% odds in favor. Back was supposedly one of the first two people to receive an email from Satoshi before Bitcoin’s whitepaper was formally published.

Late American software developer Hal Finney, who was the recipient of the first Bitcoin transaction from Satoshi, had 3% of the total bets in favor.

About $4.5 million have been wagered on the outcome of the event as of this writing.

Why It Matters: The documentary titled ‘Money Electric: The Bitcoin Mystery,” claiming to unravel the “internet’s biggest mystery,” is slated to premiere on Tuesday.

A 2:30-minute trailer dropped last week piqued the interest, not just of cryptocurrency enthusiasts but also of other followers who wanted to discover the true identity of the cult figure.

Nakamoto purportedly holds around 1.1 million Bitcoin, according to on-chain analytics platform Arkham Intelligence, making him one of the richest people in the world.

Price Action: At the time of writing, Bitcoin was exchanging hands at $63,630.34, up 2.76% in the last 24 hours, according to data from Benzinga Pro.

Image Courtesy: Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan Chief Global Strategist Warns Investors On Risk In Current Environment: Increasingly Queasy That Market Keeps Pricing In A Soft Landing

David Kelly, the chief global strategist at JPMorgan Asset Management, has issued a warning to investors, urging them to exercise caution and reduce risk in the current market environment.

What Happened: Kelly expressed his concerns about the market’s current state, despite the recent surge in stock indexes driven by robust economic data and a significant rate cut from the Federal Reserve, reported Business Insider. He emphasized that the potential for a soft landing could lead to increased risk for investors.

“I will say that although I think this is positive for the equity market, I am getting increasingly queasy about the fact that the equity market keeps on pricing in a soft landing,” Kelly said.

He cautioned that as the market continues to anticipate a soft landing, valuations rise, making asset prices more vulnerable to market shocks. Kelly suggested that investors should reduce risk and shift their funds from growth stocks to value stocks.

He also noted that the average American’s wealth has surged, which may prompt some investors to take on more risk than necessary. Kelly advised against this, suggesting that investors should only take on the risk required to achieve their financial goals.

Why It Matters: The warning from Kelly comes at a time when the market is experiencing significant highs. The S&P 500 Index, tracked by the SPDR S&P 500 ETF Trust SPY, has been hitting all-time highs, sparking optimism among investors.

However, the market is facing a complex economic landscape, with various factors such as labor disputes and natural disasters complicating the interpretation of economic data. Renowned economist Claudia Sahm has highlighted the potential impact of labor market data, adding to the uncertainty.

Despite these challenges, Bank of America has identified crucial dates for the stock market leading up to the November Presidential election. The bank used options prices to predict potential movements in the S&P 500 index. The most significant date is Nov. 6, the day after the election, with an estimated 2.5% move in either direction.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis-Based Dronabinol Could Transform Alzheimer's Care, New Study Finds

A recent study has found that dronabinol, a synthetic version of THC (the primary psychoactive component in cannabis), effectively reduces agitation in Alzheimer’s patients.

Presented at the International Psychogeriatric Association conference in Buenos Aires, Argentina, the study reveals that dronabinol can decrease agitation symptoms by an average of 30%, offering a promising alternative to current treatments, Earth.com reported.

See Also: Could CBD Revolutionize Alzheimer’s Treatment? New Study Explores Its Neuroprotective Properties

Understanding Agitation In Alzheimer’s

Alzheimer’s disease is the most prevalent neurodegenerative disorder in the United States, impacting around 6.7 million people aged 65 and older. Experts expect this number to rise to 13.8 million by 2060.

Among the challenging symptoms of Alzheimer’s is agitation, which affects about 40% of patients. This can include excessive movements, verbal outbursts and physical aggression.

“Agitation is one of the most distressing symptoms of Alzheimer’s dementia, and we are pleased to make positive strides forward in treatment of these patients,” said Dr. Paul Rosenberg, a professor at Johns Hopkins University and a co-principal investigator for the study.

Examining The Treatment

Current treatments for agitation often involve antipsychotics, which can lead to serious side effects like delirium and seizures.

For this clinical trial, researchers recruited 75 patients experiencing severe agitation due to Alzheimer’s from five different sites, including 35 patients admitted to Johns Hopkins Hospital between March 2017 and May 2024. To qualify for the study, participants had to exhibit significant symptoms of agitation for at least two weeks.

Researchers randomly assigned participants to receive either five milligrams of dronabinol in pill form or a placebo twice daily for three weeks.

After the treatment period, those taking dronabinol showed a notable reduction in agitation symptoms, with Pittsburgh Agitation Scale (PAS) scores dropping from an average of 9.68 to 7.26 — a 30% decrease. In contrast, the placebo group did not show any change.

Impact On Caregivers

Agitation not only affects patients but also puts immense pressure on caregivers, often resulting in emergency room visits and long-term care placements.

Dr. Brent Forester, chairman of the Department of Psychiatry at Tufts Medical Center and a co-principal investigator on the study, explained. “It is the agitation, not the memory loss, that often drives individuals with dementia to the emergency department and long-term-care facilities.” He added that dronabinol could lower healthcare costs and improve the well-being of caregivers.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A GE spinoff's stock is surging as it positions itself as the 'supermarket' for AI energy demand

The massive demand for energy as Big Tech races to build its AI infrastructure has been a tailwind for GE Vernova (GEV), the power equipment maker that spun out of iconic GE earlier this year.

Shares of the Cambridge, Mass.-based company have been hovering near all-time highs, along with the broader S&P 500 Industrial ETF (XLI), as investors look to play off the electrification and artificial intelligence theme led by AI chip heavyweight Nvidia (NVDA).

“[Vernova] seems to be caught up in the broader trade of AI and power demand,” Daniel Rich, analyst at CFRA, told Yahoo Finance. The firm has a Buy rating and a price target of $230 on the stock.

Much of Wall Street’s bullishness stems from expectations of power demand growth stemming from Big Tech’s commitment to record infrastructure technology investments.

Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT), and Meta (META) are expected to spend a combined $200 billion this year on cloud and AI investments, including building and maintaining data centers.

Power demand from infrastructure technologies in the US is expected to more than double by 2030 thanks to use of AI, according to consulting firm McKinsey & Co.

“Because of how much more power we’re going to need —if the projections are accurate to power data centers — to power AI applications, Vernova is definitely a winner,” he added.

One Wall Street analyst dubbed the $72 billion company the “supermarket” for the electric power industry — from natural gas turbines used to generate electricity to servicing of power plants, modernizing electric grids, and building wind turbines.

“This company does everything,” Raymond James managing director Pavel Molchanov told Yahoo Finance in an interview this week.

“Because the buildout of electric power infrastructure is an all-of-the-above story, that means all of these solutions are going to be needed,” he added.

The analyst notes Vernova’s reach is global, with roughly 30% of its revenue stemming from the US. Some of its big competitors, like Siemens Energy, Schneider Electric, and ABB, are based abroad.

Vernova expects to deliver 70 to 80 heavy-duty gas turbines per year in 2026, up from roughly 55 for the last few years. Servicing those units is also expected to grow substantially.

“We’re seeing increasing demand for power generation, driven by manufacturing growth, industrial electrification, EVs, and emerging data center needs,” Vernova CEO Scott Strazik said during the company’s latest earnings call over the summer.

The recent deal between software giant Microsoft and nuclear power provider Constellation Energy (CEG) to restart a reactor at Pennsylvania’s Three Mile Island is one recent example of the growing energy demand among Big Tech.

The partnership has made Morgan Stanley analysts more bullish on the prospects of gas-powered plants adjacent to data centers.

“We believe a co-located data center and gas-fired power plant utilizing GEV’s gas-turbine equipment could be announced in 2025,” Morgan Stanley analyst Andrew Percoco wrote in a note last week.

The analyst reiterated an Overweight rating and increased his bull case scenario price target on the stock to $397 from $371.

Vernova stock is up more than 100% since its spinoff, compared to the S&P 500’s (^GSPC) 21% year-to-date gain. That’s despite negative headlines in the company’s most challenged unit — its wind turbines — after incidents of blades breaking off in key offshore projects.

Molchanov from Raymond James cautions the strong run-up means there could be little room to run, though.

“It’s an S&P 500 stock that has doubled in the last six months. If that sounds a little bit like certain other AI-related companies that people are familiar with, well, that’s not a coincidence,” said Molchanov.

Calling the AI-fueled rally “overstretched,” the analyst and his team downgraded the stock from Outperform to Market Perform based on valuation. Much of the enthusiasm over AI is already baked into Vernova’s share price, he said.

“The bottom line is that we think the stock could use a period of consolidation after its sentiment-driven gains, and we look forward to revisiting our rating if and when the trade becomes less crowded,” he said.

The stock has 19 Buy, six Hold, and two Sell analyst recommendations.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on Twitter at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Stocks Rise on Optimism Over ‘No-Landing’ Scenario: Markets Wrap

(Bloomberg) — European equities erased gains and US equity futures dipped as tension in the Middle East tempered optimism about the US economy following Friday’s stronger-than-expected jobs data.

Most Read from Bloomberg

The Stoxx 600 index was little changed. Treasury 10-year yields rose to hover just shy of the key 4% threshold as investors trimmed bets on big Federal Reserve interest-rate cuts. The euro, pound and most Asian currencies weakened against the dollar. Crude oil drifted lower.

Trading is being shaped by signs of resilience in the world’s largest economy after employers added the most US jobs in six months in September. Wagers on a “no landing” scenario — where US growth momentum remains intact and inflation reignites — stand to boost the greenback while triggering a drop in haven assets.

Still, investors are wary about rising geo-political risks as the world awaits Israel’s potential response to Iran’s missile attack last week. Israel bombed Hamas targets across Gaza on Monday to prevent what it said was an “immediate” threat of rocket fire the group was planning to mark its devastating attack a year ago.

The US jobs report Friday pointed to an unexpectedly strong employment situation, which leaves a soft landing still on the cards, Michael Brown, a senior research strategist at Pepperstone, wrote in a note.

“Sentiment and conviction are still somewhat capped by ongoing tensions in the Middle East,” Brown added. “So long as geopolitical tensions continue to simmer, conviction among equity bulls may be a little lower than usual, with many preferring to take trades over a shorter time horizon.”

US futures were pointing to a lower open, after the S&P 500 Index jumped 0.9% on Friday thanks to the stronger-than-expected jobs report.

Goldman Sachs Group Inc. economists have cut the probability for a US recession to the long-term average of 15% after the strong payrolls report on Friday, and now expect that the Fed will cut rates 25 basis points in November.

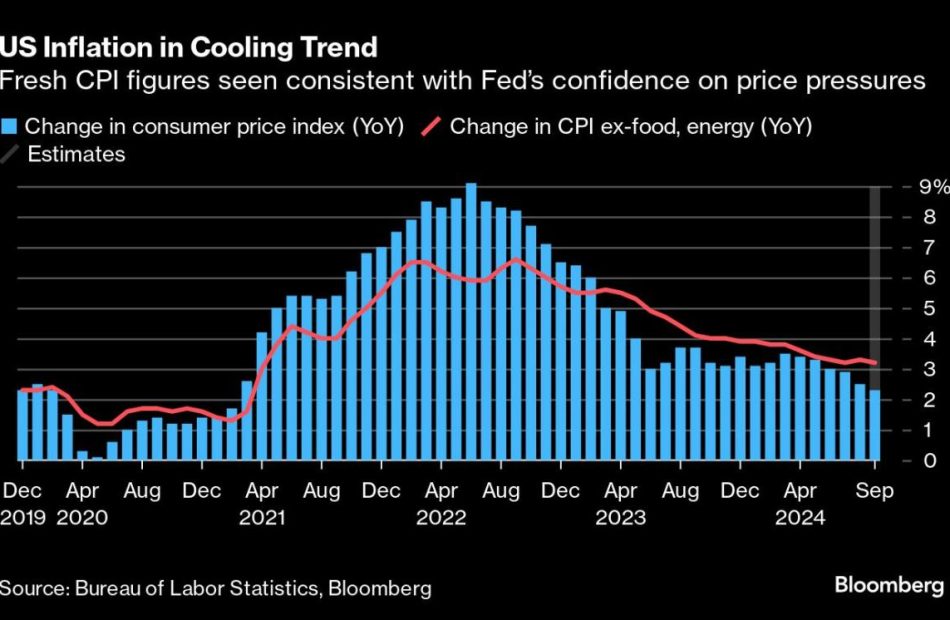

On the US agenda this week are minutes from the Fed’s September policy meeting, as well as consumer-price data. US inflation probably moderated at the end of the third quarter, which suggests policymakers will opt for a smaller interest-rate cut when they next meet on Nov. 6-7.

Here are some key events this week:

-

Euro-area finance ministers meet in Luxembourg on Monday. ECB President Christine Lagarde will participate

-

Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic, St. Louis Fed President Alberto Musalem and Fed Board member Michele Bowman speak at different events on Monday as investors listen for any clues to policymakers’ thinking ahead of next month’s meeting

-

Brazil and Mexico publish CPI data, New Zealand, Israel and India hold interest rate decisions

-

US CPI for September, the final inflation print before the presidential election, is due Thursday

-

President Biden embarks on a trip to Germany and Angola, through Oct. 15, his first trip abroad since withdrawing from the presidential race, on Thursday

-

New York Fed President John Williams gives keynote remarks at Binghamton University in New York. Richmond Fed President Thomas Barkin speaks in a fireside chat on the economic outlook on Thursday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:18 a.m. London time

-

S&P 500 futures fell 0.3%

-

Nasdaq 100 futures fell 0.3%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index rose 0.9%

-

The MSCI Emerging Markets Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0966

-

The Japanese yen rose 0.2% to 148.33 per dollar

-

The offshore yuan rose 0.3% to 7.0773 per dollar

-

The British pound was little changed at $1.3115

Cryptocurrencies

-

Bitcoin rose 1.5% to $63,551.21

-

Ether rose 1.9% to $2,486.09

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.99%

-

Germany’s 10-year yield advanced three basis points to 2.24%

-

Britain’s 10-year yield advanced four basis points to 4.17%

Commodities

-

Brent crude was little changed

-

Spot gold fell 0.3% to $2,645.44 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess and Tania Chen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Chinese Chip Stocks Gain $13 Billion on Talk of Beijing Stimulus

(Bloomberg) — Top Chinese chipmaker Semiconductor Manufacturing International Corp. led a $13 billion sector rally, after investors bet that Beijing will declare more policy or financial support for an industry central to its geopolitical ambitions.

Most Read from Bloomberg

Shares of SMIC, which Washington has blacklisted over allegations it aids China’s military, climbed as much as 28% Monday to their highest in four years. That took its gain since Thursday’s close to 65%, or roughly $10.7 billion of market value at the peak. Smaller competitors Hua Hong Semiconductor Ltd. and Shanghai Fudan Microelectronics Group Co. also managed a combined gain of more than $2 billion over the period.

The sector rally mirrored a broad market revival since late September, when pledges of policy support helped reinvigorate confidence in the world’s No. 2 economy. Many investors expect Beijing — as it tries to jumpstart the property and financial sector — to also extend a helping hand to semiconductors. Chips, the basic building block of technologies from AI to EVs, are at the heart of a longer-term conflict with the US for geopolitical supremacy.

Investors are watching for additional policy measures after Chinese leaders signaled their intent to reverse the nation’s growth slowdown. Just before a week-long holiday, the government unleashed stimulus measures from interest rate cuts to a pledge of as much as $340 billion to support the stock market. China’s top economic planner is slated to brief the public Tuesday on a package of policies aimed at boosting economic growth.

Hong Kong-listed shares have for a week been the only way to trade Chinese chip firms, because mainland markets remain closed until Tuesday. Representatives of SMIC didn’t respond to a request for comment outside of normal business hours.

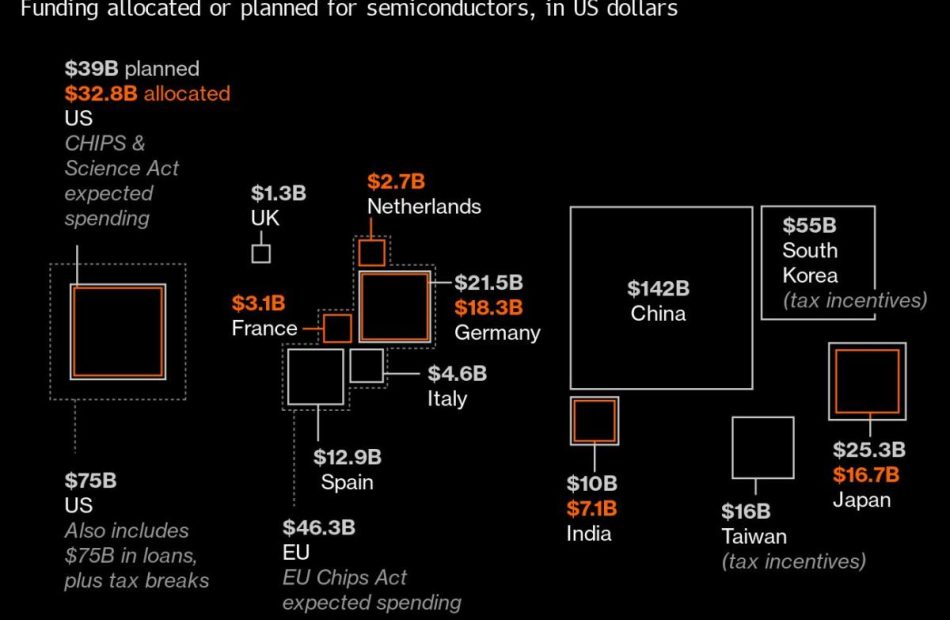

China, which is years behind in chipmaking versus its Western rivals, is pouring enormous amounts of capital into the sector. It’s on track to spend more than $142 billion, the Washington-based Semiconductor Industry Association estimated in mid-2024. As part of that effort, the government has been raising another $27 billion for what’s known as the Big Fund to oversee state investments in scores of companies, including local chipmaking champions SMIC and Huawei Technologies Co.

Beijing and local governments don’t disclose overall semiconductor funding, though certain companies reveal some of the subsidies they get. Estimates vary widely because money comes from state-backed funds, local government financing and an array of incentives and tax breaks.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.