Stocks Rise on Optimism Over ‘No-Landing’ Scenario: Markets Wrap

(Bloomberg) — European equities erased gains and US equity futures dipped as tension in the Middle East tempered optimism about the US economy following Friday’s stronger-than-expected jobs data.

Most Read from Bloomberg

The Stoxx 600 index was little changed. Treasury 10-year yields rose to hover just shy of the key 4% threshold as investors trimmed bets on big Federal Reserve interest-rate cuts. The euro, pound and most Asian currencies weakened against the dollar. Crude oil drifted lower.

Trading is being shaped by signs of resilience in the world’s largest economy after employers added the most US jobs in six months in September. Wagers on a “no landing” scenario — where US growth momentum remains intact and inflation reignites — stand to boost the greenback while triggering a drop in haven assets.

Still, investors are wary about rising geo-political risks as the world awaits Israel’s potential response to Iran’s missile attack last week. Israel bombed Hamas targets across Gaza on Monday to prevent what it said was an “immediate” threat of rocket fire the group was planning to mark its devastating attack a year ago.

The US jobs report Friday pointed to an unexpectedly strong employment situation, which leaves a soft landing still on the cards, Michael Brown, a senior research strategist at Pepperstone, wrote in a note.

“Sentiment and conviction are still somewhat capped by ongoing tensions in the Middle East,” Brown added. “So long as geopolitical tensions continue to simmer, conviction among equity bulls may be a little lower than usual, with many preferring to take trades over a shorter time horizon.”

US futures were pointing to a lower open, after the S&P 500 Index jumped 0.9% on Friday thanks to the stronger-than-expected jobs report.

Goldman Sachs Group Inc. economists have cut the probability for a US recession to the long-term average of 15% after the strong payrolls report on Friday, and now expect that the Fed will cut rates 25 basis points in November.

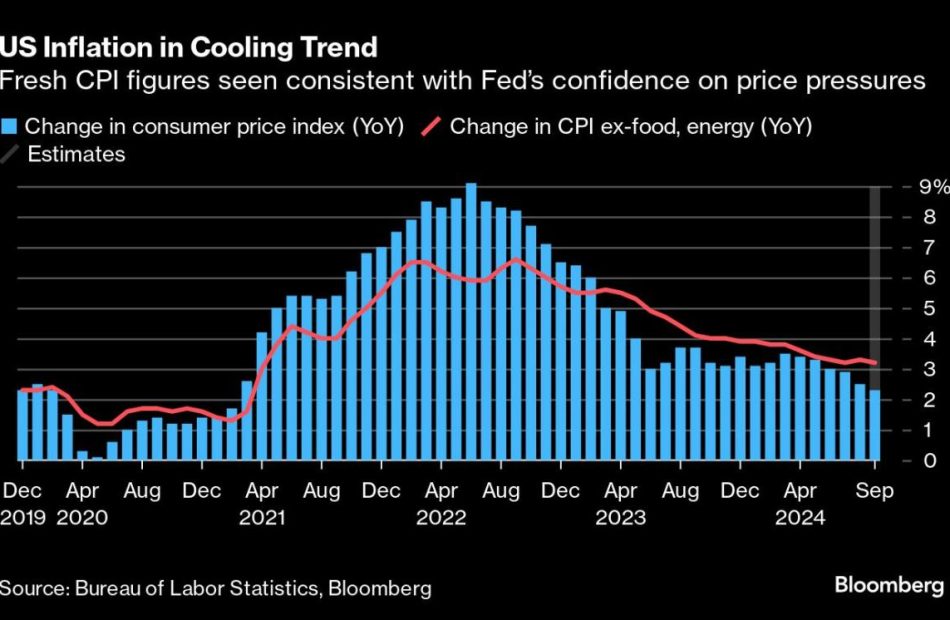

On the US agenda this week are minutes from the Fed’s September policy meeting, as well as consumer-price data. US inflation probably moderated at the end of the third quarter, which suggests policymakers will opt for a smaller interest-rate cut when they next meet on Nov. 6-7.

Here are some key events this week:

-

Euro-area finance ministers meet in Luxembourg on Monday. ECB President Christine Lagarde will participate

-

Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic, St. Louis Fed President Alberto Musalem and Fed Board member Michele Bowman speak at different events on Monday as investors listen for any clues to policymakers’ thinking ahead of next month’s meeting

-

Brazil and Mexico publish CPI data, New Zealand, Israel and India hold interest rate decisions

-

US CPI for September, the final inflation print before the presidential election, is due Thursday

-

President Biden embarks on a trip to Germany and Angola, through Oct. 15, his first trip abroad since withdrawing from the presidential race, on Thursday

-

New York Fed President John Williams gives keynote remarks at Binghamton University in New York. Richmond Fed President Thomas Barkin speaks in a fireside chat on the economic outlook on Thursday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:18 a.m. London time

-

S&P 500 futures fell 0.3%

-

Nasdaq 100 futures fell 0.3%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index rose 0.9%

-

The MSCI Emerging Markets Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0966

-

The Japanese yen rose 0.2% to 148.33 per dollar

-

The offshore yuan rose 0.3% to 7.0773 per dollar

-

The British pound was little changed at $1.3115

Cryptocurrencies

-

Bitcoin rose 1.5% to $63,551.21

-

Ether rose 1.9% to $2,486.09

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.99%

-

Germany’s 10-year yield advanced three basis points to 2.24%

-

Britain’s 10-year yield advanced four basis points to 4.17%

Commodities

-

Brent crude was little changed

-

Spot gold fell 0.3% to $2,645.44 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess and Tania Chen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply