Wall Street Strategists Say Jobs Surprise Bodes Well for Stocks

(Bloomberg) — Two of Wall Street’s top strategists have turned more optimistic about US stocks on signs of a robust labor market, economic resilience and easing interest rates.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

Morgan Stanley’s Michael Wilson — among the most bearish voices on equities until mid-2024 — raised his view on so-called cyclical stocks relative to safer defensive peers, noting Friday’s blowout payrolls data and expectations of more interest-rate cuts from the Federal Reserve.

His peer at Goldman Sachs Group Inc., David Kostin, also boosted his expectations for S&P 500 earnings growth next year as a solid macro outlook drives margins. The strategist upgraded his 12-month target for the benchmark to 6,300 points from 6,000, implying gains of about 10% from current levels.

“We continue to believe we’re in a ‘good is good’ environment in terms of the equity market’s response to the labor/economic growth data,” Wilson wrote in a note. “The bond market is becoming less skeptical on the soft landing outcome, an important signal for equity investors.”

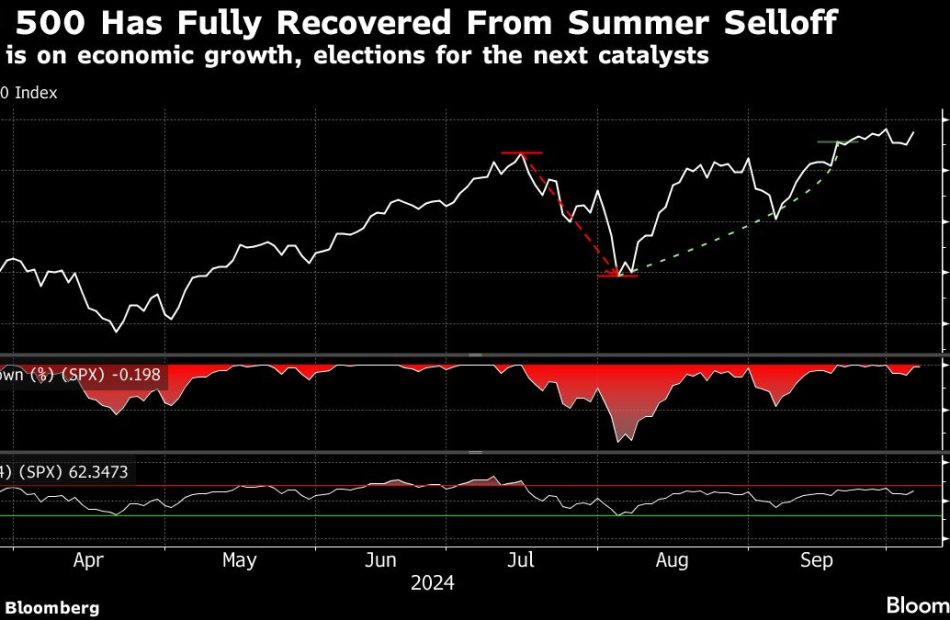

US stocks have rebounded after a selloff over the summer on fading recession concerns and the Fed’s policy easing. Traders expect the central bank to reduce rates by another 100 basis points by May, according to swaps data. Sentiment was also boosted Friday as the payrolls figure came in much stronger than expected.

Wilson said the setup bodes well for smaller US stocks, which stand to benefit from improving business activity and sentiment, as well as lower investor positioning. The strategist eased his long-standing bet on large caps, citing a dimmer risk-reward over the short term.

Among sectors, Wilson upgraded his view on financials to overweight, and downgraded health care and consumer staples.

JPMorgan Chase & Co. reports earnings on Friday, providing an update on the profitability of lenders and officially kicking off the earnings season.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply