What's Next: Intrusion's Earnings Preview

Intrusion INTZ is gearing up to announce its quarterly earnings on Wednesday, 2024-10-09. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Intrusion will report an earnings per share (EPS) of $-0.42.

Intrusion bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

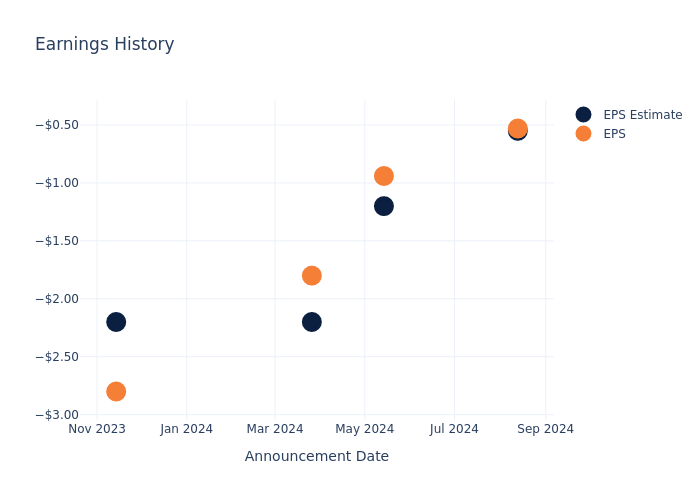

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.02, leading to a 19.17% increase in the share price on the subsequent day.

Here’s a look at Intrusion’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.55 | -1.20 | -2.2 | -2.2 |

| EPS Actual | -0.53 | -0.94 | -1.8 | -2.8 |

| Price Change % | 19.0% | -26.0% | -9.0% | -23.0% |

Market Performance of Intrusion’s Stock

Shares of Intrusion were trading at $0.8801 as of October 07. Over the last 52-week period, shares are down 87.34%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

To track all earnings releases for Intrusion visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Down -14.68% in 4 Weeks, Here's Why Genmab Looks Ripe for a Turnaround

Genmab A/S Sponsored ADR GMAB has been beaten down lately with too much selling pressure. While the stock has lost 14.7% over the past four weeks, there is light at the end of the tunnel as it is now in oversold territory and Wall Street analysts expect the company to report better earnings than they predicted earlier.

How to Determine if a Stock is Oversold

We use Relative Strength Index (RSI), one of the most commonly used technical indicators, for spotting whether a stock is oversold. This is a momentum oscillator that measures the speed and change of price movements.

RSI oscillates between zero and 100. Usually, a stock is considered oversold when its RSI reading falls below 30.

Technically, every stock oscillates between being overbought and oversold irrespective of the quality of their fundamentals. And the beauty of RSI is that it helps you quickly and easily check if a stock’s price is reaching a point of reversal.

So, by this measure, if a stock has gotten too far below its fair value just because of unwarranted selling pressure, investors may start looking for entry opportunities in the stock for benefitting from the inevitable rebound.

However, like every investing tool, RSI has its limitations, and should not be used alone for making an investment decision.

Why GMAB Could Bounce Back Before Long

The heavy selling of GMAB shares appears to be in the process of exhausting itself, as indicated by its RSI reading of 22.22. So, the trend for the stock could reverse soon for reaching the old equilibrium of supply and demand.

The RSI value is not the only factor that indicates a potential turnaround for the stock in the near term. On the fundamental side, there has been strong agreement among the sell-side analysts covering the stock in raising earnings estimates for the current year. Over the last 30 days, the consensus EPS estimate for GMAB has increased 5.3%. And an upward trend in earnings estimate revisions usually translates into price appreciation in the near term.

Moreover, GMAB currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. This is a more conclusive indication of the stock’s potential turnaround in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: When My Spouse Dies, Do I Get a Full Step-Up in Basis on My Home or Only the $250k Capital Gains Exemption?

What if a husband and wife own a home together that increases in value by $500,000. When one spouse dies and the other owns the property themselves, do they receive a step-up in basis? Or do they only receive a $250,000 capital gains exemption when they sell the property?

– Samuel

Your question deals with the rules surrounding both a step-up in basis of an inherited asset and the capital gain exclusion on the sale of a primary residence. These rules are independent of each other, so both are true: the surviving spouse receives a step-up in basis and they only receive a $250,000 exemption. That may sound a little confusing so let’s unpack it below.

If you have similar tax-planning questions or need help managing your investments, consider speaking with a financial advisor to see how they can help.

About the Step-Up in Basis

In finance, the term “basis” generally refers to the amount you pay for something. Basis matters because it’s the starting point from which you calculate taxable gains. For example, assume you buy something for $100,000 – that’s your basis. If the value of the asset grows to $150,000 and you decide to sell it, you’ll owe taxes on the $50,000 capital gain.

A step-up in basis occurs when the basis of an inherited asset is reset to its market value at the time the original (or co-owner’s) owner’s death. In other words, when a person inherits assets like stocks or real estate, the tax basis is adjusted to reflect the asset’s worth at the time of the owner’s passing, rather than the amount initially paid for it.

Returning to the example above, suppose you have an asset with a basis of $100,000, and by the time of your death, its value has increased to $150,000. Instead of inheriting your original basis, your heir receives a “stepped-up” basis. In this case, their new basis is $150,000, and they won’t realize a gain unless the property appreciates further.

(Accounting for the step-up in basis is an important component of tax planning and estate planning. A financial advisor with expertise in either area may be able to help you put this tax loophole to use.)

Capital Gains and the Sale of a Primary Residence

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

The tax code allows you to reduce or avoid capital gains tax on the sale of a primary residence, provided that you’ve lived in it for two of the previous five years. This tax break is known as the Section 121 exclusion.

There are parameters you need to stay within to qualify for this tax break, but the broad strokes are as follows:

-

Individuals can exclude up to $250,000 of gains from the sale of a primary residence

-

Married couples that file a joint return can exclude up to $500,000 from the sale of a primary residence

So, assume the basis on your primary home is $300,000. If you’re single, you could sell it for up to $550,000 without incurring a capital gains tax obligation. A married couple could sell it for up to $750,00. This example ignores transaction costs to provide a simplified illustration. You’ll want to work closely with your tax professional to make sure you calculate your basis correctly. (And if you need help finding a financial professional, this free tool can connect you with you to three fiduciary advisors who serve your area.)

Combining the Two Rules

Samuel, to see how both rules apply in the situation you’re asking about, we need to think of them in order:

-

First, determine the stepped-up basis

-

Second, calculate the taxable gain considering the Section 121 exclusion

Step 1: Establish Basis

The surviving spouse receives a step-up in basis when the first spouse dies. However, the value of that adjustment depends on whether they live in a community property state. In a community property state, the surviving spouse receives a full step-up in basis. Meaning their basis becomes the fair market value of the asset at the time their spouse passed.

In a non-community property (common law) state, the surviving spouse only receives a step-up in basis for half of the property’s appreciation. For example, the couple’s joint basis is $300,000 but the home is worth $500,000 when the first spouse dies. Half of that $200,000 gain is added to the surviving spouse’s basis so they have a $400,000 basis on a home that’s worth $500,000.

Step 2: Calculate the Capital Gain and Apply the Exclusion

After the surviving spouse has determined the stepped-up basis of the inherited home, they can then calculate how much the taxable gain would be if they were to sell the property. And remember, they would only owe capital gains tax on the portion of that gain that exceeds the Section 121 exclusion.

Here’s a final example to tie it all together:

A couple that lives in a community property state owns a home that’s worth $500,000 after originally paying $300,000 for it. The first spouse dies and the surviving spouse’s tax basis is stepped up to $500,000. The surviving spouse can then sell the home for up to $750,000 without recognizing a taxable gain because of the $250,000 exclusion.

One last bit of nuance here: The exclusion amount depends on tax filing status. The “married filing jointly” status receives a $500,000 exclusion while “single” status receives a $250,000 exclusion. Widows and widowers are allowed to maintain their married filing jointly status in the year of death. So, the surviving spouse may still be able to exclude the full $500,000 if they sell the property in the same calendar year that their spouse dies. (But if you need additional help with your tax strategy, consider working with a financial advisor with tax expertise.)

Bottom Line

When one spouse dies and the surviving spouse decides what to do with their jointly owned home, it’s important to understand the rules for the stepped-up basis and capital gains tax exclusion. A surviving spouse will receive a step-up in basis that could adjust the inherited home to its fair market value at the time of their spouse’s death. If they were to sell it, they could still apply the Section 121 exclusion and avoid paying taxes on up to $250,000 in capital gains – and in some cases, $500,000 – on the home sale.

Tax Planning Tips

-

If possible, consider delaying the sale of appreciated investments until you’re in a lower income tax bracket, like after retirement. Long-term capital gains are taxed more favorably, and if your income is low enough, you may qualify for a 0% capital gains tax rate. To see how much you may owe when you sell your assets, try our capital gains tax calculator.

-

A financial advisor with tax planning and/or financial planning expertise can potentially help you determine the best time to sell assets to minimize the tax implications of the sale. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not an employee of SmartAsset and is not a participant in SmartAsset AMP. He has been compensated for this article. Some reader-submitted questions are edited for clarity or brevity.

Photo credit: ©iStock.com/skhoward, ©iStock.com/LumiNola

The post Ask an Advisor: When My Spouse Dies, Do I Get a Full Step-Up in Basis on My Home or Only the $250k Capital Gains Exemption? appeared first on SmartReads by SmartAsset.

ACM Research Is Considered a Good Investment by Brokers: Is That True?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

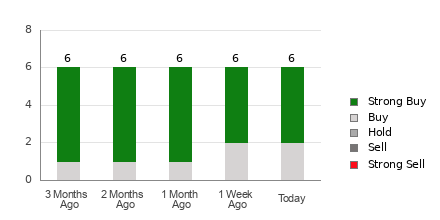

Let’s take a look at what these Wall Street heavyweights have to say about ACM Research, Inc. ACMR before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

ACM Research currently has an average brokerage recommendation of 1.25, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by six brokerage firms. An ABR of 1.25 approximates between Strong Buy and Buy.

Of the six recommendations that derive the current ABR, four are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 66.7% and 33.3% of all recommendations.

Brokerage Recommendation Trends for ACMR

While the ABR calls for buying ACM Research, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

On the other hand, earnings estimate revisions are at the core of the Zacks Rank. And empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Should You Invest in ACMR?

Looking at the earnings estimate revisions for ACM Research, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $1.63.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for ACM Research.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for ACM Research.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At Lamb Weston Hldgs's Recent Unusual Options Activity

High-rolling investors have positioned themselves bullish on Lamb Weston Hldgs LW, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LW often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 23 options trades for Lamb Weston Hldgs. This is not a typical pattern.

The sentiment among these major traders is split, with 65% bullish and 26% bearish. Among all the options we identified, there was one put, amounting to $90,100, and 22 calls, totaling $5,227,841.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $75.0 for Lamb Weston Hldgs over the last 3 months.

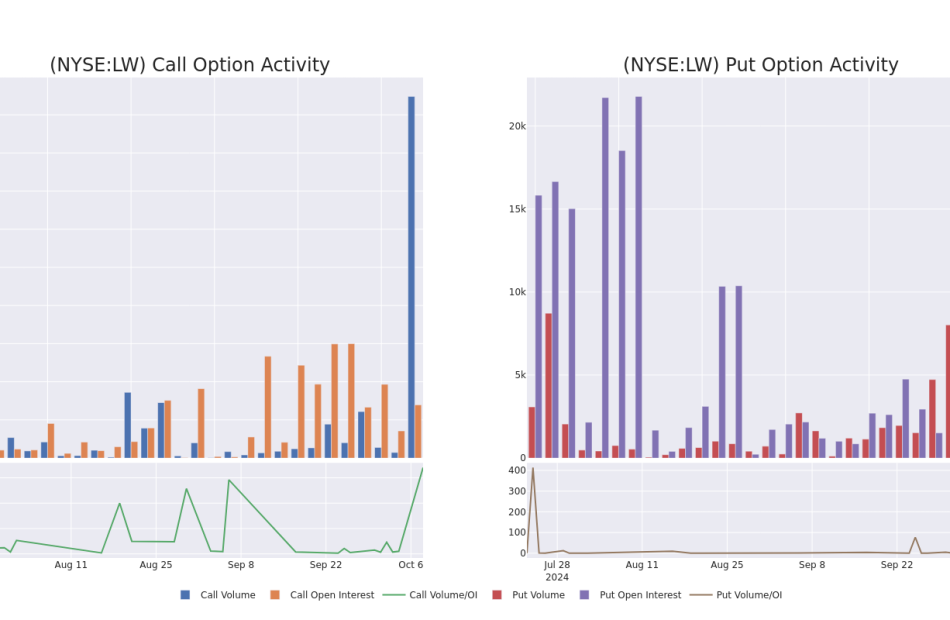

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Lamb Weston Hldgs options trades today is 931.33 with a total volume of 47,409.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lamb Weston Hldgs’s big money trades within a strike price range of $55.0 to $75.0 over the last 30 days.

Lamb Weston Hldgs Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LW | CALL | SWEEP | NEUTRAL | 11/15/24 | $2.8 | $2.5 | $2.65 | $70.00 | $2.0M | 291 | 7.7K |

| LW | CALL | TRADE | BEARISH | 11/15/24 | $3.1 | $3.0 | $2.65 | $70.00 | $1.8M | 291 | 8.3K |

| LW | CALL | SWEEP | BULLISH | 12/20/24 | $3.6 | $3.6 | $3.6 | $70.00 | $256.3K | 2.5K | 911 |

| LW | CALL | TRADE | BULLISH | 01/16/26 | $21.3 | $21.1 | $21.3 | $55.00 | $178.9K | 207 | 84 |

| LW | PUT | SWEEP | BEARISH | 12/20/24 | $1.7 | $1.55 | $1.7 | $65.00 | $90.1K | 1.4K | 10 |

About Lamb Weston Hldgs

Lamb Weston is North America’s largest and the world’s second-largest producer of branded and private-label frozen potato products, both by volume and value. The company’s portfolio is anchored by French fries, but it also sells sweet potato fries, tater tots, diced potatoes, mashed potatoes, hash browns, and chips. Roughly two-thirds of revenue comes from its home market of North America, with none of the other 100 countries the company sells into representing a significant share. McDonald’s is Lamb Weston’s single largest customer at 14% of fiscal 2024 sales, with no other company representing more than 10%. Lamb Weston became an independent company in 2016 when it was spun off from Conagra.

Current Position of Lamb Weston Hldgs

- Currently trading with a volume of 1,253,454, the LW’s price is up by 2.01%, now at $70.62.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 86 days.

What Analysts Are Saying About Lamb Weston Hldgs

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $68.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities has decided to maintain their Neutral rating on Lamb Weston Hldgs, which currently sits at a price target of $68.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Lamb Weston Hldgs with a target price of $74.

* Consistent in their evaluation, an analyst from Stifel keeps a Hold rating on Lamb Weston Hldgs with a target price of $65.

* An analyst from JP Morgan has revised its rating downward to Neutral, adjusting the price target to $68.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Hold rating for Lamb Weston Hldgs, targeting a price of $65.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lamb Weston Hldgs options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese ETFs Fizzle During Pre-Market Despite US Investors Pouring $5.2B Last Week: Here's What Happened

The much-anticipated announcement of plans to stimulate China’s flagging economy failed to meet investor expectations, causing a short-lived stock market rally.

What Happened: After the Golden Week holiday, shares surged by over 10% as trading resumed. However, the excitement was fleeting. The Shanghai Composite Index in mainland China ended the day 4.6% higher, while the Hang Seng in Hong Kong fell by 9.4% after a press conference by China’s economic planners, as per a report by the BBC on Tuesday.

Investors were left seeking more specifics on how the government plans to stimulate economic growth.

This comes after investors poured $5.2 billion in new assets last week following Beijing’s announcement of stimulus measures, Reuters reported on Tuesday

Data from Morningstar reveals that the $5.2 billion inflow for the week ending Oct. 4 contrasts sharply with an average weekly outflow of $83 million in 2024. This also marked the largest one-day rally in Chinese stocks since 2008.

Funds like Blackrock’s iShares China Large-Cap ETF FXI and KraneShares CSI China Internet ETF KWEB saw significant inflows. However, as per Benzinga Pro, on Tuesday during the pre-market hours, FXI was trading 8.37% lower while KWEB was down by 10.14%.

Similarly, iShares MSCI China ETF MCHI was down by 10.59% while Franklin FTSE China ETF FLCH was 9.26% down.

See Also: What’s Going On With Futu Holdings’ Stock?

Why It Matters: The recent surge in Chinese stocks has been described as a “fast and furious rally,” with the MSCI China Index climbing over 35% between Sep. 24 and Oct. 7. This rally has outpaced other major global markets and more than doubled the year-to-date gains of the S&P 500. The rise has been fueled by aggressive monetary easing policies and renewed government efforts to stabilize the property sector.

However, the Chinese government’s recent announcement of a 200 billion yuan ($28 billion) stimulus aimed at local investment projects fell short of market expectations, leading to a sharp sell-off in major tech stocks. Despite this, officials remain confident in achieving economic and social development goals, as stated by Zheng Shanjie, chairman of the National Development and Reform Commission.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXCLUSIVE: Cannabis Rescheduling Is Not Cure-All For Industry Problems: Experts Explain How Tax Tactics Could Hurt Marijuana Businesses In Long Run

Rescheduling is “not a Panacea to all the problems of the industry” and would not make the issue of oversaturation and lack of investor capital go away, Frank Segall, co-chair of cannabis practice at Blank Rome, told the crowd gathered at the Benzinga Cannabis Capital Conference in Chicago on Tuesday. He was part of the panel, “Consolidation Trends in the Wake of Cannabis Rescheduling: Identifying Winners and Losers.”

While it would impact positively the balance sheets of many operators by eradicating restrictions of Section 280E of the Internal Revenue Code and attracting some capital, the shift of cannabis to Schedule III would not result in big players like Wells Fargo crossing over to the marijuana industry, Segall said.

“Legalization is what they’re mandating for them to cross over,” he added.

Segall, alongside three other experts, joined the panel moderated by Scott Greiper, founder and president at Viridian Capital Advisors, to discuss broader market consolidation trends following cannabis’s shift to Schedule III.

Alongside Segall, Pablo Zuanic, managing partner at Zuanic & Associates LLC; Barbara Webb, tax partner at MGO and Laura Bianchi, co-founder of Bianchi & Brandt discussed which types of companies are positioned to thrive and which are not, as well as how investors can identify solid bets in the new regulatory landscape while avoiding pitfalls in a competitive market.

Zuanic & Associates’ Zuanic said that even though two presidential candidates favor rescheduling and a DEA hearing on the horizon — with signals the policy shift could happen next year — there’s a drop in investor interest in the space. That’s compared to the past four years.

“I think that we are getting all a bit ahead of ourselves in terms of optimism here,” he said.

Zuanic added the reason why consolidation is not taking place is that valuations are depressed in addition to uncertainty around what rescheduling would really bring. He said the main benefit of rescheduling is making 280E go away.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

That said, MGO’s Webb highlighted many cannabis companies are not paying their taxes, which could be counterproductive for operators if cannabis rescheduling takes place. “It’s a temporary survival tactic, but you can’t do that forever,” she said, adding “the IRS eventually catches up.”

Consequences could seriously affect business growth in the long run.

“You might be able to get an installment plan once they do catch up with you,” Webb explained. “However, once on an installment plan, a cannabis business not only have to regularly, never miss a payment pay, but also stay current on your current year’s estimated taxes, which is a huge cash commitment.”

Webb added companies that are going to be “superstars” post-rescheduling are cash flow positive with 280E.

The tactic of not paying taxes will have serious consequences when it comes to M&A activity in the space, Bianchi & Brandt’s Bianchi said. “That’s going to have a drastic effect on M&A in the future because it’s already been an issue,” she said.

Speaking of acquisition targets, Bianchi said some buyers are looking at distressed assets, mainly businesses that have difficulties operationally and are not avoiding paying taxes.

She also said the trend of huge deals is over. “We’re dealing with more creative companies coming together and maybe joint ventures,” Bianchi added.

Zuanic & Associates’ Zuanic said that “there’s too much overlap” in deals where one multi-state operator is buying another one. Instead, he proposes brands as acquisition targets.

Brands are and will be a key point of M&A activity, especially in the scenario where interstate commerce is legal, he continued.

Read Next:

Photo: Benzinga Cannabis Conference “Consolidation Trends in the Wake of Cannabis Rescheduling: Identifying Winners and Losers,” Photo by Wendy Davis.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'I Make $180,000 A Month off Properties I Don't Even Own' – Airbnb Arbitrage Is A Golden Goose For Many Young Hustlers

Making $180,000 a month without owning a single property? That’s what some young entrepreneurs are pulling off, thanks to an Airbnb arbitrage strategy. It’s a trend quickly catching on with Gen Z and young millennials who see real estate as a way to escape the traditional 9-to-5 grind without needing massive startup cash. Here’s how it works, why it’s attracting so many and why it’s not without risks.

Don’t Miss:

What Is Airbnb Arbitrage?

The basic idea behind Airbnb arbitrage is to rent a home from a landlord long term and then rebook it for a higher nightly rate on short-term websites like Airbnb ABNB. The key to making money is the difference between what you pay the landlord each month and what you make from short-term renters. You’re essentially running a hotel business without actually buying any real estate.

Hailie Anderson, a 21-year-old TikTok influencer, has become the face of this trend, making as much as $180,000 a month by renting out nearly 50 properties she doesn’t own. She’s part of a group of young hosts who not only leverage arbitrage to earn big but also flaunt it on social media, showing off their lavish lifestyles and selling courses on how others can do the same.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Why Young People Love This Strategy

The biggest reason Airbnb arbitrage is booming is that it’s much cheaper to get started than buying a house. You usually just need to cover the first and last month’s rent and a security deposit to rent a property. Let’s say that’s around $6,000 – way less than a down payment to buy a house, which could cost tens of thousands of dollars.

As Hailie puts it simply: “I make $180,000 a month off properties I don’t even own.” For people like her, this was the ticket. According to Business Insider, she started when she was just 19, renting three apartments in Austin.

With sleek furniture, clever photos and smart marketing, she quickly expanded her business to almost 50 properties in multiple cities. She made enough to pocket big monthly bucks while traveling the world and working from poolside cabanas.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

The Golden Goose … But At What Cost?

Of course, this “golden goose” strategy has some serious downsides. Tony and Sarah Robinson, real estate investors who run their own YouTube channel, have doubts about arbitrage. They own all their short-term rentals and believe that’s the better approach in the long run.

For instance, you don’t have full control if you don’t own the property. Landlords can decide not to renew your lease or sell the property, leaving you scrambling. You’re building a business on someone else’s property, which is risky.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

In their video, the Robinsons explain that when you own property, you get various tax perks, like mortgage interest deductions, cost segregation and even tax deferral when you sell and reinvest. With Airbnb arbitrage, you don’t get these benefits because you’re just renting.

There’s also the question of equity. Real estate owners build wealth through equity – the difference between what they owe and what the property is worth. When you arbitrage, all that equity goes to the landlord.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Despite the downsides, Airbnb arbitrage can be an attractive option for young people looking to build cash flow quickly without huge upfront investments. It’s a great way to get into real estate if you don’t have the money to buy. But it’s not without its challenges – you must be comfortable with the idea that you’re always one landlord or regulation change away from having to pack up your entire business.

That said, Hailie acknowledges that she’s in a great spot to buy real estate now, saying, “Because I started Airbnb arbitrage, I am now in a position to be able to afford to buy real estate … which is obviously the end goal.”

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Rally As Oil Prices Tumble; Tech, Chipmakers Lead As Traders Focus On AI Winners Before Earnings Season: What's Driving Markets Tuesday?

After starting the week with a negative session, U.S. markets rebounded on Tuesday, driven by falling oil prices, which helped alleviate concerns about a potential resurgence in inflation.

Crude oil dropped as much as 5% on the day, weighed down by China’s lack of additional fiscal stimulus and a de-escalation in geopolitical tensions between Israel and Iran.

At the same time, Treasury yields paused their recent climb, offering further relief to investors.

Optimism surrounding the upcoming earnings season also buoyed traders, leading to renewed buying in tech stocks and key AI-linked companies. The S&P 500 gained 0.8%, the Nasdaq 100 rallied 1.3% on the back of semiconductor strength, while the Russell 2000 posted a more modest 0.4% rise.

The Magnificent Seven stocks—Microsoft Corp. MSFT, Apple Inc. AAPL, NVIDIA Corp. NVDA, Alphabet Inc. GOOG GOOGL, Amazon Inc. AMZN, Meta Platforms Inc. META and Tesla, Inc. TSLA—were all in the green, collectively adding around $250 billion in market capitalization and inching closer to a combined market value of $16 trillion.

Meanwhile, the CBOE Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” fell 6%, reversing a sharp 17% spike from Monday.

Commodity markets weren’t spared from the broader Chinese-led sell-off, with metal prices taking a hit. Gold dropped 1.2%, while silver plunged over 4%, both reacting to China’s underwhelming stimulus news.

In the crypto space, Bitcoin BTC/USD rose 0.5%, trading at $62,479.

Tuesday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Nasdaq 100 | 20,051.16 | 1.3% |

| S&P 500 | 5,742.69 | 0.8% |

| Russell 2000 | 2,201.50 | 0.4% |

| Dow Jones | 42,017.06 | 0.1% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY edged 0.7% higher to $571.68.

- The SPDR Dow Jones Industrial Average DIA inched 0.1% up to $420.10.

- The tech-heavy Invesco QQQ Trust Series QQQ rose 1.2% to $487.35.

- The iShares Russell 2000 ETF IWM rose 0.3% to $218.07.

- The Technology Select Sector SPDR Fund XLK outperformed, up 1.6%. The Energy Select Sector SPDR Fund XLU lagged, down 2.9%.

Tuesday’s Stock Movers

- Palo Alto Networks Inc. PANW rallied 5% after Goldman Sachs raised its price target from $376 to $425.

- Lower oil prices triggered rallies in cruise lines and airlines. Carnival Corp. CCL rose 4.5%, Norwegian Cruise Line Holdings Ltd. NCLH gained 3.8%, American Airlines Group Inc. AAL climbed 3.7%, and Delta Air Lines Inc. DAL added 2.8%.

- The energy and materials stocks that fell the most on Tuesday included Marathon Petroleum Corp. MPC, down 7.8%, Freeport McMoRan Inc. FCX, down 5.2%, and Valero Energy Corp. VLO, down 4.9%.

- Docusign Inc. DOCU rallied 8.3% after it was announced that it would join the S&P MidCap 400.

- PepsiCo Inc. PEP rose 0.6% in reaction to its quarterly earnings.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Deferiprone Market to Reach $45.9 Million, Globally, by 2033 at 3.2% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 08, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Deferiprone Market by Form (Tablets and Others), Application (Transfusional Iron Overload and NTDT Caused Overload.), and Distribution Channel (Hospital Pharmacies, Drug store & retail pharmacies and Online providers): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the deferiprone market was valued at $33.4 million in 2023, and is estimated to reach $45.9 million by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

The global deferiprone market is experiencing growth due to an increase in the iron load disorders population and R & D investments.

Request Sample of the Report on Deferiprone Market 2033 – https://www.alliedmarketresearch.com/request-sample/A324401

Prime determinants of growth

The global deferiprone market is experiencing growth due to several factors such as increasing incidence of iron overload disorders, such as thalassemia major and sickle cell disease, which require regular blood transfusions leading to iron overload, is rising. This drives the demand for effective iron chelation therapies such as deferiprone. Continued research and development in iron chelation have enhanced the efficacy and safety profiles of deferiprone, making it a preferred choice for managing iron overload. In addition, recent regulatory approvals and expanded indications for deferiprone in various regions have broadened its availability and application, contributing to market growth.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2035 |

| Base Year | 2023 |

| Market Size in 2023 | $33.37 million |

| Market Size in 2033 | $45.90 million |

| CAGR | 3..2% |

| No. of Pages in Report | 280 |

| Segments Covered | Form, Application, Distribution Channel, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324401

Segment Highlights

Tablets segment dominated the market in 2023

The tablets segment is expected to dominate the global deferiprone market due to several compelling reasons. Tablets are easy to administer and consume, making them a preferred choice for both patients and healthcare providers. Further, the convenience of tablets improves patient compliance, as they are easier to handle, store, and transport compared to other forms of medication. Tablets provide a stable dosage form that ensures the correct and consistent delivery of medication, which is crucial for managing chronic conditions. Many patients prefer tablets over other forms such as injections or liquid formulations due to ease of use and minimal discomfort.

Transfusional Iron Overload is expected to be lucrative by 2033

The segment is indeed a lucrative segment within the global deferiprone market due to high prevalence of iron overload disorders. This widespread prevalence creates a large and consistent demand for effective treatments like deferiprone. Conditions like thalassemia major, sickle cell disease, and certain types of anemia often require frequent blood transfusions, leading to iron overload. This large patient population drives demand for effective treatments. Patients with these conditions need regular iron chelation therapy to prevent complications from iron accumulation, creating a sustained demand for effective treatments like deferiprone.

Online Pharmacies is expected to be lucrative by 2033

The online pharmacies segment is indeed a lucrative segment within the global deferiprone market due to increased adoption of digital health solutions, convenience, cost savings, and advancements in technology. As consumer preferences shift towards online purchasing and as the sector evolves with improved regulations and infrastructure, online pharmacies are set to become a major player in the healthcare and pharmaceutical industries.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324401

Regional Outlook

By region, North America held the largest share in terms of revenue in 2023 and is expected to dominate the deferiprone market during the forecast period. This is attributed to its advanced technology, strong demand & availability of deferiprone, supportive regulatory environment, and collaborative ecosystem fostering innovation and market growth in the deferiprone market. However, the Asia-Pacific region is expected to witness rapid industrialization in countries like China and India has led to the establishment and expansion of manufacturing facilities, including advancements and accessibility of such deferiprone products, is expected to drive the market growth during the forecast period.

Key Players: –

- Mylan Pharmaceuticals Inc.

- GlaxoSmithKline plc,

- Teva Pharmaceuticals Industries Ltd.

- Bristol-Myers Squibb Company

The report provides a detailed analysis of these key players in the global deferiprone market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Healthcare Industry:

Cancer Gene Therapy Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Vascular Graft Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Automated Liquid Handling Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Hearing Care Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.