Bruker Stock Gains From Its Latest Acquisition of Dynamic Biosensors

Bruker Corporation BRKR recently announced the acquisition of Dynamic Biosensors GmbH, or DBS, a pioneering company known for its development in biosensors. The acquisition is aimed at boosting Bruker’s biophysical portfolio, which is used for analyzing molecular interactions and kinetics. Financial details of the transaction were not disclosed.

Hence, the latest strategic acquisition is expected to strengthen Bruker’s position in the pharma and biotech industries. The acquisition will leverage Bruker’s leading high-throughput Surface Plasmon Resonance (“SPR”) portfolio and Dynamic Biosensors’ unique instruments.

BRKR’s Likely Stock Trend Following the News

Subsequent to the news, the share price of BRKR moved north 1% to $67.46 on Wednesday. The company is gaining a high level of synergies from its continuous effort to reinforce its leading position within the pharma and biotech industries. Given the latest acquisition announcement, we expect market sentiment toward BRKR stock to continue to remain positive.

BRKR currently has a market capitalization of $9.97 billion. The company has a trailing four-quarter average earnings surprise of 10.09%.

Significance of Bruker’s Latest Acquisition

DBS develops and markets innovative technologies for studying complex molecular interactions and kinetics to support drug discovery in the pharma and biotech industries, as well as in basic and medical research. The new Dynamic Biosensor heliX instrument performs single-cell Interaction Cytometry (scIC) for kinetic measurements directly on cells, retaining the molecules’ native membrane environment. Bruker’s SPR portfolio includes all new SPR #64 ‘Triceratops’, and the 24 and 32-spot Sierra-Pro SPR systems.

The Bruker SPR portfolio is a great match for DBS’s products. Hence, following the acquisition, the combined Bruker Biosensors business will offer one of the most innovative ranges of instruments, workflows, and consumables for studying intermolecular and molecule-cell interactions in the drug discovery pipeline. The acquisition should help Bruker establish itself as a new technology leader in biosensors with a differentiated offering.

In fiscal 2025, Bruker expects its Biosensors business to have an additional revenue gain of more than $5 million from the DBS acquisition, with no material EPS impact.

Other Recent Developments by Bruker

In August, Bruker completed the installation and acceptance of a 1.2 GHz Avance NMR spectrometer at the Korea Basic Science Institute (“KBSI”). As the first 1.2 GHz NMR system in the Asia-Pacific region, it sets a new benchmark for molecular, cell biology and disease research using ultra-high-field NMR.

Image Source: Zacks Investment Research

The same month, the company announced a strategic investment in NovAliX — a preclinical Contract Research Organization specializing in expert drug discovery services. Bruker’s partnership with NovAliX should enable both companies to accelerate the development, incubation, deployment and support of advanced biophysical methods. The collaboration will leverage Bruker’s leading post-genomic solutions competencies, combined with NovAliX’s expert services and innovation.

Industry Prospects Favor Bruker

Per a Grand View Research report, the global biosensors market was valued at $28.9 billion in 2023 and is expected to witness a compound annual growth rate of 8.0% from 2024 to 2030. The demand for biosensors is increasing due to the diversity of medical applications, the increasing number of diabetic patients, the high demand for compact diagnostic devices and rapid technological improvement.

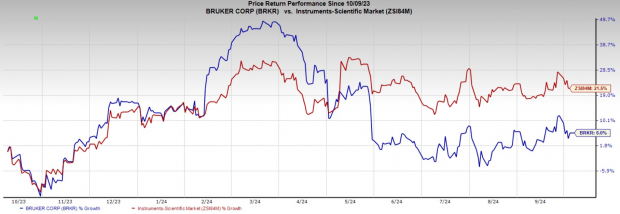

BRKR’s Price Performance

In the past year, BRKR’s shares have risen 6% compared with the industry’s 23.8% growth.

BRKR’s Zacks Rank and Key Picks

BRKR currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are TransMedics Group TMDX, AxoGen AXGN and OrthoPediatrics KIDS. While TransMedics sports a Zacks Rank #1 (Strong Buy) at present, AxoGen and OrthoPediatrics carry a Zacks Rank #2 (Buy) each.

Estimates for TransMedics’ 2024 earnings per share have moved up 0.8% to $1.22 in the past 30 days. Shares of the company have soared 189.3% in the past year compared with the industry’s 20.7% growth. TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for AxoGen’s 2024 loss per share have remained constant at 1 cent in the past 30 days. Shares of the company have surged 212.1% in the past year compared with the industry’s 20.7% growth. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.5%. In the last reported quarter, it delivered an earnings surprise of 200%.

Estimates for OrthoPediatrics’ 2024 loss per share have declined to 92 cents from 96 cents in the past 30 days. In the past year, shares of KIDS have lost 5.8% against the industry’s 20.7% growth. In the last reported quarter, it delivered an earnings surprise of 25.81%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 26.81%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply