Here's Why SL Green Stock is an Apt Portfolio Pick for Now

SL Green Realty Corp. SLG has a portfolio of high-quality and well-amenitized office properties in New York City, which positions it well for growth.

This New York-based office real estate investment trust (REIT) primarily acquires, manages, develops and leases commercial (mainly office) and residential real estate properties. It has been witnessing healthy demand for its properties amid the growing need for premier office spaces.

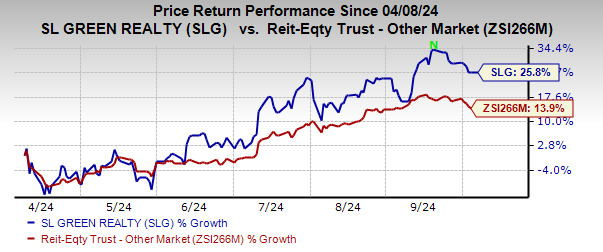

Shares of this currently Zacks Rank #2 (Buy) company have rallied 25.8% over the past six months, outperforming its industry’s growth of 13.9%. Given the strength in its fundamentals, there seems additional room for growth of this stock.

Image Source: Zacks Investment Research

Factors That Make SL Green a Solid Pick

Healthy Leasing: Despite the negative effects of the remote-working dynamics that have been hindering the U.S. office real estate sector, SL Green signed 38 office leases for its Manhattan office portfolio, encompassing 420,513 square feet during the second quarter of 2024.

Office space demand in the upcoming period is likely to be driven by de-densification efforts, allowing higher square footage per office worker. Moreover, with well-located properties offering top-notch amenities, SLG’s leasing pipeline is expected to be healthy despite the present challenging environment.

Strong Tenant Base: This office REIT enjoys a diversified tenant base to hedge the risk associated with dependency on single-industry tenants. As a result, its largest tenants include renowned firms from different industries. Moreover, with tenants’ long-term leases with a strong credit profile, it is well-poised to generate stable rental revenues over the long term.

Opportunistic Investment Policy: To improve the overall quality of its portfolio, SL Green has been following an opportunistic investment policy. This entails divesting its mature and non-core assets, including residential properties, in a tax-efficient manner and using the proceeds to fund development projects and share buybacks. These match-funding initiatives will ease the strain on the company’s balance sheet and demonstrate its prudent capital-management practices.

In the second quarter through July 17, 2024, SL Green has completed the sale of three properties for a total of $691.4 million. The company received net proceeds of $222.7 million from the transactions, which were utilized for corporate debt repayment. The company also unveiled the sellout of the exclusive Giorgio Armani Residences on Manhattan’s Upper East Side. All 10 residential units in this luxury condominium project are now under contract for a gross consideration of $168.2 million. The sales are scheduled to be concluded in the fourth quarter of 2024.

Over the years, the large-scale sub-urban asset sale has helped its narrow focus on the Manhattan market, as well as retain premium and highest-growth assets in the portfolio.

FFO Growth: Analysts seem bullish regarding SLG’s funds from operations (FFO) per share growth prospects. The Zacks Consensus Estimate for the company’s 2024 FFO has been revised marginally upward over the past two months to $7.58.

SL Green has increased its 2024 FFO per share outlook and now expects it in the range of $7.45-$7.75 compared with $7.35-$7.65 guided earlier.

Other Stocks to Consider

Some other top-ranked stocks from the broader REIT sector are Cousins Properties CUZ and Four Corners Property Trust FCPT, each carrying a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Cousins Properties’ 2024 FFO per share is pegged at $2.67, which suggests year-over-year growth of 1.9%.

The Zacks Consensus Estimate for Four Corners’ full-year FFO per share stands at $1.73, which indicates an increase of 3.6% from the year-ago period.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply