Humana Stock Getting Closer to 52-Week Lows: A Buying Opportunity?

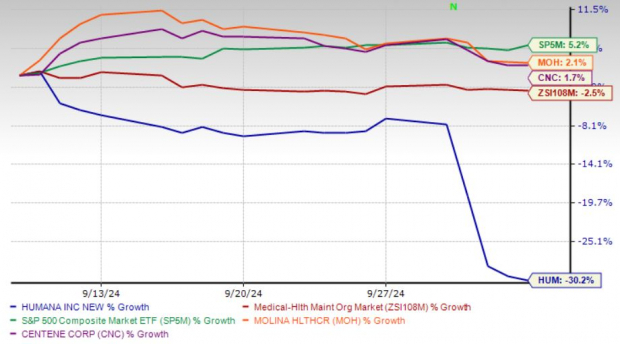

Shares of Humana Inc. HUM have dropped 30.2% over the past month to close at $240.03 on Friday. The steep declines last week have pushed the stock’s price closer to the lower end of its 52-week range of $213.31-$530.54. Having underperformed its peers like Molina Healthcare, Inc. MOH and Centene Corporation CNC, the overall industry, and the S&P 500, the company’s current share price seems an excellent opportunity to build a position in a renowned HMO company. After all, you would much rather buy closer to the low than the high, right?

One-Month Price Performance

Image Source: Zacks Investment Research

HUM is trading below its 50 and 200-day moving averages, indicating a bearish outlook. Buying closer to the low can be attractive, but context matters – let’s explore further.

HUM’s Falling Stars

HUM experienced its worst share price fall since the financial crisis due to losing high-quality ratings on its major Medicare Advantage plans, which generate substantial revenue. The news slashed its star-rated membership from 94% to around 25%, triggering a selloff that wiped out a massive chunk of its market value.

This has not only affected Humana but also rippled through the broader health insurance sector. The health insurer, like many others, is already facing growing medical costs and tighter reimbursements from the government. This latest development is bound to affect its profit levels.

Analysts Downgrade HUM’s Earnings Estimates

Reflecting the negative sentiment around Humana, the Zacks Consensus Estimate for earnings per share has seen downward revisions. The consensus estimate for 2024 adjusted earnings for HUM is currently pegged at $16.12 per share, indicating a 38.2% year-over-year decline. Over the past four quarters, its average earnings surprise is at negative 2.5%.

Image Source: Zacks Investment Research

HUM’s Headwinds

With a sharp decline expected in Humana’s top-rated Medicare Advantage plan enrollments next year, its revenues are likely to take a hit. This drop is expected to ripple through its partner network, affecting them depending on payment structures. The company has already been dealing with an anticipated membership decline, and this new development further hinders its member growth strategies.

In addition, Humana has been grappling with rising operating expenses. Over the past few years, operating costs surged 10.7% in 2021, 11.5% in 2022, and 14.9% in 2023. The trend has continued, with a 12.8% increase in operating expenses reported in the first half of 2024. The rise is attributed to higher benefits and operating costs, which are likely to pressure profit margins moving forward. Moreover, as senior citizens continue to resume elective procedures post-pandemic, medical costs are set to escalate further, adding to the company’s financial challenges.

Also, its rising debt level is a concern. Long-term debt amounted to $11.7 billion at second-quarter end, up 15% from the figure as of Dec. 31, 2023. Its long-term debt to capital of 41.25% is higher than the industry average of 38.26%.

Final Words: Steer Clear of HUM Stocks

Humana is facing significant challenges, including membership decline, rising costs and debt burden. The stock is trading below key moving averages, signaling a bearish trend. With analysts downgrading earnings estimates, investors should approach HUM stock with caution as it shows serious downside potential. It currently carries a Zacks Rank #4 (Sell).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply