Labcorp Stock Gains From Biopharma Business Amid FX Woe

Labcorp Holdings, Inc. LH or Labcorp benefits from the solid execution of its strategic priorities. Investment in targeted high-growth areas should drive the momentum. The company faces headwinds from macroeconomic uncertainties and growing foreign exchange issues. The stock carries a Zacks Rank #3 (Hold) currently.

Factors Driving LH Stock

LabCorp is well-placed for long-term success in Cell & Gene Therapy, expanding into the consumer market and international growth through the specialty testing and biopharma business. In June 2024, Labcorp Tissue Complete comprehensive genomic profiling (CGP) service was availed in Geneva and Shanghai to support global clinical trials. The integration of OmniSeq INSIGHT circulating tumor DNA expanded Labcorp’s leadership in liquid biopsy comprehensive genomic profiling for solid tumors.

LabCorp’s Biopharma business is benefiting from collaborations with leading pharmaceutical and biotechnology companies with whom it started to work on potential antivirals, treatments and vaccines. Revenue-wise, Biopharma’s growth continues to be driven by strength in central laboratories, its largest part, which improved by 9% in the second quarter of 2024. The Early Development business is also recovering sequentially, led by reduced cancellations and booking improvement, and is expected to generate higher revenues in the second half of the year.

Labcorp has been focused on expanding its margins though the LaunchPad initiative. The company’s 2024-2026 guidance includes a savings target range of $100 million-$125 million annually. The benefits will be driven by rationalizing the geographic location of facilities and talent, leveraging technological advancements and structural enhancements, integrating acquisitions and re-engineering the company’s systems and processes. In the second quarter, the rise in operating income and margin was fueled by the strong demand and LaunchPad savings.

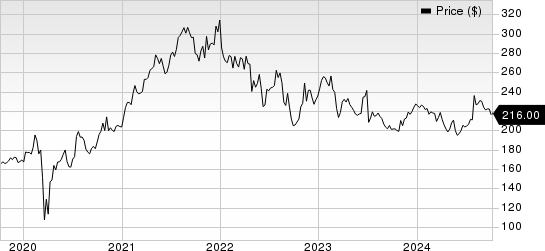

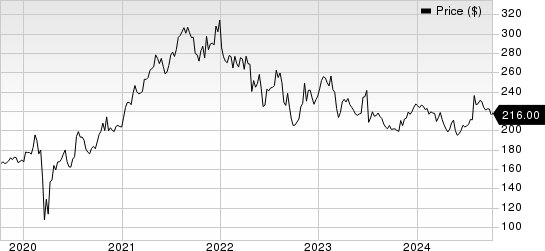

The stock has risen 11.1% in the past three months against the industry’s 2.7% decline. With the company strategically expanding in the high-growth areas, as well as putting focus on cost saving initiatives, we expect the stock to continue its upward movement in the coming days.

Factors Weighing on LH Stock

Labcorp’s operation is heavily dependent on the demand for diagnostic testing and drug development services from patients, physicians, hospitals, medical device companies and others. Volatilities in global economic conditions, including inflation and the risk of short or long-term recessions, could reduce the demand for these services, affecting the customers’ ability to pay and, consequently, the profitability of the company.

Added to this, the escalation of the present geopolitical situations in Ukraine and the Middle East can potentially decrease testing volumes, cause disruptions in the supply chain and services and increase the prices of offerings. In the second quarter, the cost of revenues went up by 4.7% year over year. SG&A expenses increased 10.3%, mainly from higher personnel costs.

Labcorp’s huge exposure in international markets makes it vulnerable to currency fluctuations. In 2023, the BLS segment derived nearly 58% of its revenues from overseas, while Dx also earned a modest portion in Canada and a relatively small amount in the rest of the world. An approximate 13.7% of the company’s revenues were denominated in currencies other than the U.S. dollar in the first half of 2024. With the recent upward trend observed in the value of the U.S. dollar, further acceleration expected by analysts in this value will cause the company’s revenues to face a tough situation overseas. In the second quarter, BLS and Dx revenue growth was partially offset by unfavorable foreign currency translation of 0.1%.

Key Picks

Some better-ranked stocks in the broader medical space are Intuitive Surgical ISRG, TransMedics Group and Quest Diagnostics. While Intuitive Surgical and TransMedics currently sport a Zacks Rank #1 (Strong Buy) each, Quest Diagnostics carries a Zacks Rank #2 (Buy).

Intuitive Surgical’s shares have surged 60.5% in the past year. Estimates for the company’s earnings have moved 5.1% north to $1.65 per share for 2024 in the past 30 days.

ISRG’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 8.97%. In the last reported quarter, it posted an earnings surprise of 16.34%.

Estimates for TransMedics’ 2024 EPS have moved up 125% to 27 cents in the past 30 days. Shares of the company have soared 135.2% in the past year compared with the industry’s 14.9% growth.

TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for Boston Scientific’s 2024 EPS have increased 1.7% to $2.40 in the past 30 days. In the past year, shares of BSX have risen 55.5% compared with the industry’s 17.9% growth.

In the last reported quarter, BSX delivered an earnings surprise of 6.90%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.18%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply