NICE Plunges 14% Year to Date: How Should Investors Play the Stock?

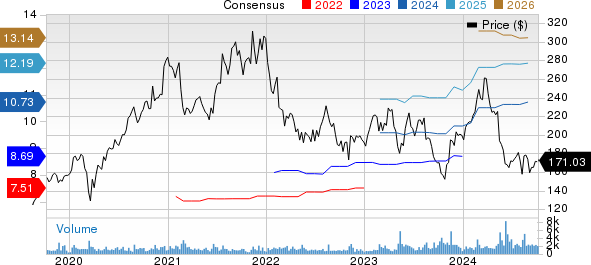

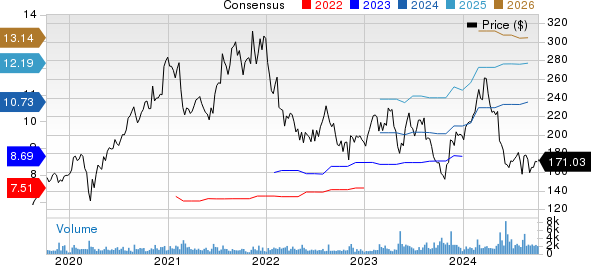

Nice‘s NICE shares have declined 14.2% in the year-to-date period compared with the Zacks Internet-Software industry’s growth of 25.3% and the broader Zacks Computer & Technology sector’s return of 24.2%.

The underperformance can be attributed to strong competition from other industry players like Five9 FIVN, Salesforce and 8X8, who are expanding their portfolio in the CX market.

In June, Five9 announced an enhanced collaboration with Salesforce, integrating AI-powered solutions to enhance customer experiences in contact centers through real-time agent guidance and conversation intelligence.

However, NICE’s growing client base and increased demand for its solutions will help the company fend off competition from other industry players who are also fortifying their presence in the CX market.

Can Strong Product Portfolio Aid NICE’s Customer Base?

NICE’s diverse portfolio, featuring solutions like Actimize, Evidencentral, CXone, and Inform Elite, has been gaining popularity. The company’s focus on its cloud offerings, particularly its CXone platform, has been a major growth driver.

During the second quarter of 2024, it reported cloud revenues of $482 million, up 26% year over year. The uptick reflects the growing demand for cloud-native solutions, which are being adopted across various industries.

NICE recently announced that Banco PAN, a digital banking platform in Brazil, achieved a 25% improvement in first-call resolution and a 20% reduction in operational costs by implementing the NICE CXone cloud-native platform.

The company’s diverse portfolio is also helping it attract new customers. Its partnerships with AT&T T and Microsoft have been a key catalyst.

In August, NICE expanded its collaboration with AT&T to offer a unified incident capture and data analytics solution for NextGen 9-1-1 centers, showcasing it at APCO 2024.

A deepening partnership with Microsoft is noteworthy. The collaboration has led to the integration of its NTR-X Compliance Recording and Assurance Solution into the Microsoft Azure Marketplace, providing a robust, cloud-ready compliance platform within the NICE Compliancentral suite.

Estimate Revisions Are Positive

Nice’s efforts to enhance its customer experience with its robust cloud solutions are expected to drive top-line growth.

For third-quarter 2024, NICE projects non-GAAP revenues to be between $676 million and $686 million, indicating 13% year-over-year growth at the midpoint. Non-GAAP earnings are estimated in the $2.62-2.72 per share band, suggesting 18% year-over-year growth at the midpoint.

The Zacks Consensus Estimate for revenues is pegged at $682.67 million, indicating 13.52% growth year over year. The consensus mark for earnings is pegged at $2.68 per share, unchanged in the past 30 days. The figure calls for a year-over-year increase of 18.06%.

Here’s What Investors Should do With NICE Stock

Despite a strong pipeline of its solutions, NICE has been suffering from the foreign exchange headwinds in the APAC market. The stiff competition is also expected to hurt the company’s top-line growth.

The forward 12-month Price/Sales ratio for Nice stands at 4.42, higher than its Zacks Internet-Software industry’s 3.35, reflecting a stretched valuation.

Nice currently carries a Zacks Rank #3 (Hold), which suggests that it may be wise to wait for a more favorable entry point in the stock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply