Nutanix Shares Up 26% YTD: How Should Investors Play the Stock?

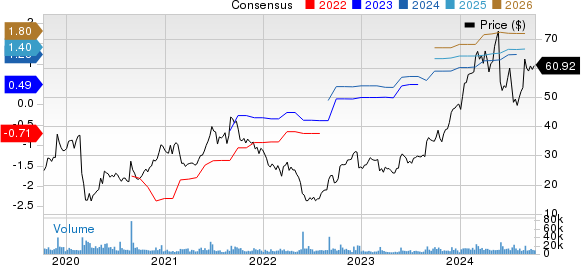

Nutanix NTNX shares have returned 26.2% year to date, outperforming the broader Zacks Computer and Technology sector’s appreciation of 23.4%.

NTNX shares have also outperformed the Zacks Computer – IT Services industry and its peers like Unisys UIS, Evolv Technologies EVLV and Cerence CRNC.

Over the same time frame, Unisys has appreciated 0.2%, while Evolv Technologies and Cerence have declined 19.7% and 86.3%, respectively. The industry has appreciated 9.2% YTD.

NTNX’s outperformance can be attributed to the steady adoption of hybrid cloud solutions, an increase in renewal and subscription business, and an expanding clientele.

Does Strong Clientele Justify NTNX’s Premium Valuation?

In fiscal 2024, approximately 76% of NTNX’s end customers who have been its clients for 18 months or longer made a repeat purchase, reflecting a loyal customer base. Nutanix’s total revenues for fiscal 2024 were $2.14 billion, of which 93.8% was from subscriptions.

NTNX stacks are usable with a vast library of operating systems like Microsoft and SAP, and existing customers have benefited from the hyper-converged infrastructure market.

However, NTNX shares are overvalued, as suggested by a Value Score of F.

In terms of the forward 12-month Price/Earnings ratio, NTNX is trading at 178.5X, higher than the Zacks Computer & Technology sector’s 26.83X.

So, the question for investors is – does an expanding clientele make Nutanix shares attractive despite a stretched valuation? Let’s analyze.

NTNX’s Cloud Innovation Aids Prospects

Nutanix is focusing on new releases and enhancements to the Nutanix Cloud Platform to aid long-term opportunities and to become a leader in modern application and data management platforms.

NTNX expanded its 14-year partnership with Dell Technologies to announce innovations like Dell XC Plus and Dell PowerFlex.

Nutanix Cloud Platform enables businesses to modernize IP footprints, integrate hybrid cloud models, and accelerate migration of workload to the public cloud to enhance cost-effectiveness and efficiency.

NTNX recently launched GPT-in-a-Box to aid in streamlining the adoption of GenAI by enterprises. It also launched Nutanix Data Services for Kubernetes, to provide consistent data services across virtual machines and container assets, and Nutanix Kubernetes Platform to allow simplification in the management of modern applications on-premise and in native public cloud service.

Nutanix announced a collaboration with NVIDIA to aid enterprises adopt GenAI easily.

Nutanix Cloud Clusters enable workloads to run seamlessly in private and public clouds while increasing automation and reducing the dependency on expensive proprietary solutions.

Elongated Sales Cycle Concern for Nutanix

In fiscal 2024, Nutanix’s land and expand revenues suffered due to longer sales cycles, which have been elongated compared to historical levels.

NTNX’s average contract term length in the fiscal fourth quarter was 3.1 years, 0.1 years higher than the fiscal third quarter.

Nutanix’s customer base is increasing but is largely constituted of large deals leading to variability of timing and outcome.

As NTNX targets its sales efforts for large enterprises, it faces higher costs, greater competition, stiff price pressure, customization challenges, and lower predictability in its ability to complete the sale.

NTNX’s operating expense for fiscal 2024 was $1.51 billion, up 7% over fiscal 2023. This increase can be attributed to an increase in research and development (increased 19% to $638 million) and sales and marketing expenses (increased 6% to $977 million). Higher operating expenses are likely to negatively impact bottom-line results in fiscal 2025.

NTNX’s Fiscal 2025 Outlook Positive

For fiscal 2025, NTNX revenues are estimated in the range of $2.435-$2.465 billion, indicating year-over-year growth of 14% at the mid-point.

The Zacks Consensus Estimate for revenues is pegged at $2.45 billion, indicating year-over-year growth of 14.24%.

NTNX expects a non-GAAP operating margin in the band of 15.5-17%.

The consensus mark for fiscal 2025 earnings is pegged at $1.40 per share, up 2.9% in the past 30 days. The figure indicates a 6.87% year-over-year increase.

Nutanix expects free cash flow in the range of $540-$600 million, suggesting a free cash flow margin of 23% at the midpoint.

NTNX Shares – To Buy, Hold or Sell?

Macroeconomic challenges, including persistent inflation, are a concern for NTNX’s prospects.

Stretched valuation, elongated sales cycle duration, and increasing operating expenses are concerns for investors.

Nutanix currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable entry point into the stock.

Leave a Reply