Exelixis Gains 20.7% in Three Months: Is This the Right Time to Buy?

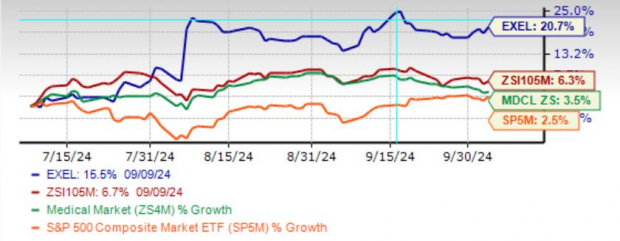

Shares of Exelixis, Inc. EXEL have risen 20.7% in the past three months compared with the industry’s growth of 6.3%. The stock has also outperformed the sector and the S&P 500 Index.

Exelixis has been a consistent outperformer in the year so far on the back of the strong performance of its lead drug Cabometyx and encouraging pipeline progress.

EXEL Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Cabometyx Boosts EXEL

Cabometyx maintained its status as the leading tyrosine kinase inhibitor (TKI) for the treatment of renal cell carcinoma (RCC) in 2023. This was mainly attributable to its use in combination with Bristol Myers’ Opdivo in the first-line setting. The drug also maintained growth in the hepatocellular carcinoma indication.

BMY’s Opdivo is one of the leading immuno-oncology drugs, approved for various oncology indications.

Management is also focused on the label expansion of Cabometyx. The FDA accepted EXEL’s supplemental new drug application (sNDA) for cabozantinib for patients with previously treated advanced pancreatic neuroendocrine tumors (pNET) and those with previously treated advanced extra-pancreatic NET (epNET). The FDA assigned a standard review with a target action date of April 3, 2025. The FDA also granted the orphan drug designation to cabozantinib for the treatment of pNET.

A potential label expansion should further propel its growth prospects.

Exelixis also intends to submit an sNDA with the FDA later this year for cabozantinib, in combination with Tecentriq (atezolizumab), for metastatic castration-resistant prostate cancer.

EXEL Makes Encouraging Pipeline Progress

The pipeline progress has been impressive as well, as Exelixis looks to expand its oncology portfolio beyond Cabometyx.

Other promising candidates in Exelixis’ pipeline zanzalintinib, a next-generation oral TKI and XL309. In the first half of 2025, Exelixis intends to initiate a phase III study, STELLAR-311, to evaluate zanzalintinib compared with everolimus as a first oral therapy in patients with pNET and epNET.

The company also plans to advance phase I efforts for XL309 and XB010.

EXEL decided to discontinue the development of XB002. It plans to reallocate resources to new pivotal trials with zanzalintinib, advancing XL309 and its growing pipeline.

The successful development of additional drugs should broaden its portfolio and reduce its dependence on its lead drug, Cabometyx.

Exelixis’ Efforts to Boost Shareholder Value

Exelixis is also making efforts to increase shareholder value through repurchases. At the end of the second quarter, Exelixis completed its 2024 share repurchase program, having repurchased 20.3 million shares of the company’s common stock for a total of $450 million.

Consequently, the company returned $1 billion to shareholders since the initial $550 million stock repurchase program was authorized in March 2023.

The board of directors has authorized the repurchase of up to an additional $500 million of the company’s common stock through the end of 2025.

Valuation & Estimates

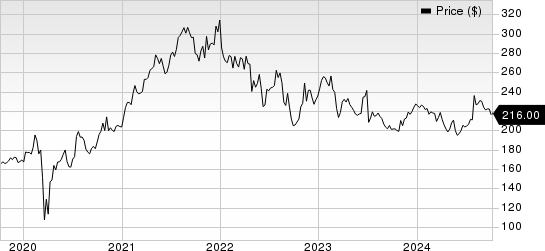

Going by the price/sales ratio, EXEL’s shares currently trade at 3.64x forward sales, higher than its mean of 3.34x and the biotech industry’s 1.79x.

Image Source: Zacks Investment Research

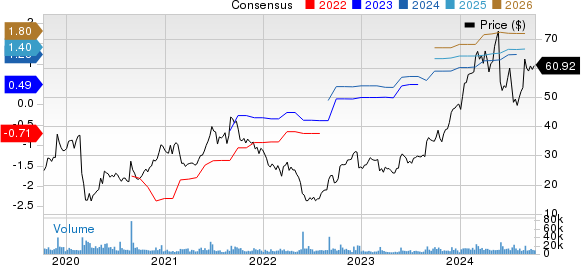

The Zacks Consensus Estimate for 2024 earnings per share has increased to $1.83 from $1.79 over the past 30 days.

Image Source: Zacks Investment Research

Conclusion

Large biotech companies are generally considered safe havens for investors interested in this sector. EXEL is a good stock to buy now, with good fundamentals and growth prospects.

The stock has performed well this year. Potential label expansion of Cabometyx should boost its growth. The company’s efforts to expand its portfolio are encouraging as well. The successful development of additional drugs should broaden its portfolio and reduce its dependence on its lead drug, Cabometyx.

Zacks Rank & Other Key Picks

EXEL currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the biotech sector are Alnylam Pharmaceuticals ALNY and Krystal Biotech KRYS, both carrying a Zacks Rank #1 (Strong Buy) at present.

ALNY’s loss per share estimate for 2024 has narrowed from $1.20 to 63 cents in the past 60 days and the same for 2025 has narrowed from 34 cents to 27 cents.

Krystal Biotech’s earnings per share for 2024 have increased to $2.38 from $1.98 in the past 90 days. Shares of KRYS have surged 42.8% year to date.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Trader's Wild Bet On Elon Musk's Company Ends In A $306M Lawsuit Spiral

A Canadian trader, Christopher DeVocht, turned a modest investment into a staggering $306 million by betting on Elon Musk‘s Tesla Inc. TSLA stock. However, he lost it all during the 2022 bear market and is now suing the Royal Bank of Canada (RBC) and Grant Thornton, alleging “inadequate advice.”

What Happened: DeVocht, a carpenter from Vancouver Island, Canada, capitalized on the pandemic-induced stock surge, turning his C$88,000 (approximately $65,000) investment with RBC into a C$415 million (about $306 million) fortune by November 2021, reported Business Insider.

However, DeVocht and his advisors chose to hold onto the stocks, resulting in significant losses during the 2022 bear market. DeVocht alleges that the advice he received from RBC and Grant Thornton was negligent and “inadequate,” contributing to his account’s staggering decline.

DeVocht’s advisors suggested incorporating a company and rolling his securities into it to reduce his tax liabilities from the massive gains he had on paper.

He was also advised to make charitable donations to lower his tax liability, which further eroded his wealth. RBC also set up margin loan accounts for DeVocht to borrow against his concentrated Tesla stock position for spending purposes.

DeVocht’s lawsuit filing is an initial notice of claim and did not include evidence like brokerage account statements to prove his gains or losses.

Why It Matters: The Tesla stock has been a subject of significant market activity in recent times. In September, traders were looking at the next big catalyst for a bullish thesis, with three major events coming up in early October, including the Fed’s meeting and first rate cut.

Despite the stock’s plunge in October, Tesla’s third-quarter deliveries exceeded consensus and grew year-over-year. The company also dropped the rear-wheel drive (RWD) variants of the Model 3 and Model Y in Canada, following a similar move in the U.S.

Analysts believe that Tesla’s highly anticipated Robotaxi Day could be a significant catalyst for the stock, with several unannounced items potentially driving the stock even further.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Commercial Lawn Mower Market Size Hit USD 10.49 billion by 2033 | Straits Research

New York, United States, Oct. 07, 2024 (GLOBE NEWSWIRE) — Commercial lawn mowers are a highly advantageous investment for the upkeep of expansive properties or facilities and may also be deemed vital for professional lawn care. Commercial lawn mowers can mow two to twenty times daily or operate continuously for 12 hours. Commercial mowers are also designed with enhanced speed to increase output. Commercial-grade lawnmowers are the most effective, durable, and well-equipped in terms of features that facilitate the mowing process.

Download Free Sample Report PDF @ https://straitsresearch.com/report/commercial-lawn-mower-market/request-sample

Market Dynamics

Growing Demand from Golfing Sector Drives the Global Market

Globally, golf participation has increased substantially year-over-year and is gaining in popularity. Following the 2020 pandemic, there was a significant surge in golf participation. In 2020, it is projected that the population of golf enthusiasts in the United States reached an estimated 25 million individuals. This represents a growth rate of around 2%, resulting in an increment of nearly 500,000 individuals compared to the previous year, 2019. The increasing number of public golf clubs encourages more individuals to participate. As a result, the increasing number of golfers is fueling the construction of new courses, increasing the demand for commercial lawn mowers.

Rising Demand for Robotic Lawn Mowers Creates Tremendous Opportunities

Multiple end-users’ demand for convenience, effectiveness, and efficiency is propelling the exponential growth of commercial robotic lawnmowers. It is also tiresome for a single individual to mow expansive commercial properties, which is anticipated to push consumers towards robotic technology over conventional ones.

In addition, the rising labor cost in the United States and several European countries encourages deploying autonomous technology to reduce long-term expenditures. In China, the market for mechanized lawnmowers is projected to expand at a CAGR of 13.76 percent over the next five years, while in the United Arab Emirates and Australia, it is anticipated to expand at a CAGR of 8.88 percent. These factors create opportunities for robotic commercial lawn mowers.

Regional Analysis

North America is the most significant global commercial lawn mower market shareholder and is anticipated to exhibit a CAGR of 4.66% during the forecast period. The increasing number of policies and programs encouraging vegetation growth in public spaces is projected to significantly impact the North American commercial lawnmower market. Various commercial consumers choose eco-friendly practices to support their sustainability initiatives. Several industry participants emphasize the implementation of environmentally sustainable alternatives that generate fewer toxic emissions and superior and enhanced efficiency. In addition, North America is responsible for approximately fifty percent of the world’s golf courses. There are over 16,000 golf courses in the United States, ranging from family-friendly public greens to private country estates. Therefore, market expansion is anticipated to accelerate during the forecast period.

Europe is predicted to exhibit a CAGR of 6.18% over the forecast period. The high market share of Europe can be attributed to the widespread adoption of equipment in various industries, including hospitality, education, and others. Rising business investments, commercial spaces, and government spending on infrastructure are expected to increase demand for the product in the region over the coming years. In addition, market players such as Husqvarna have introduced new product variants of robotic lawnmowers and conventional lawnmowers with increased battery support and enhanced mowing efficiency. These products were more technologically advanced than their predecessors and are, therefore, widely embraced by end-users. These factors contribute to expanding the commercial robotic lawnmower market in this region.

To Gather Additional Insights on the Regional Analysis of the Commercial Lawn Mower Market @ https://straitsresearch.com/report/commercial-lawn-mower-market/request-sample

Key Highlights

- Based on product, the global commercial lawn mower market is bifurcated into ride-on, walk-behind, and robotic commercial lawn mowers. The ride-on segment dominates the global market and is projected to exhibit a CAGR of 4.90% over the forecast period.

- Based on end-user, the global commercial lawn mower market is segmented into professional landscaping services, golf courses and other sports arenas, and government and others. The professional landscaping services segment owns the highest market share and is estimated to exhibit a CAGR of 5.14% during the forecast period.

- Based on fuel type, the global commercial lawn mower market is divided into gas-powered, electric cordless, electric corded, and propane-powered. The gas-powered segment is the most significant contributor to the market and is estimated to exhibit a CAGR of 4.78% over the forecast period.

- Based on blade type, the global commercial lawn mower market is divided into standard blades, mulching blades, lifting blades, and cylinder blades. The standard blades segment is the largest revenue contributor to the market and is expected to exhibit a CAGR of 4.60% over the forecast period.

- Based on drive type, the global commercial lawn mower market is divided into RWD, FWD, AWD, and manual drive. The RWD segment owns the highest market and is estimated to exhibit a CAGR of 4.77% over the forecast period.

- Based on start type, the global commercial lawn mower market is bifurcated into key start, push start, and recoil start. The key start segment dominates the global market and is projected to exhibit a CAGR of 4.73% over the forecast period.

- Based on distribution channels, the global commercial lawn mower market is divided into offline and online channels. The offline segment contributed the highest market share and is predicted to exhibit a CAGR of 4.57% over the forecast period.

- North America is the most significant global commercial lawn mower market shareholder and is anticipated to exhibit a CAGR of 4.66% during the forecast period.

Competitive Players

- Deere & Company

- Honda Motor Company

- MTD Products

- Husqvarna Group

- Kubota Corporation

- Robert Bosch

- STIGA Group

- Toro Company

- AGCO

- AL-KO Gardentech

Recent Developments

- February 2023- John Deere announced that they are entering the electric market alongside other American legacy brands, including Ford and General Motors. The company has announced intentions to increase the number of electric mowers in both its residential and commercial product lines.

- March 2023- Stiga, a European maker and supplier of garden machinery and equipment, released the Stiga A1500 Autonomous Robot Mower. Stiga asserts it is the “world’s smartest” autonomous lawn mower and the first mower to combine RTK GPS with Stiga’s patented Active Guidance System (AGS) technology.

Segmentation

- By Product

- Ride-On

- Walk-Behind

- Robotic

- By End-User

- Professional Landscaping Services

- Golf Courses and Other Sports Arenas

- Government and Others

- By Fuel Type

- Gas-Powered

- Electric Cordless

- Electric Corded

- Propane-Powered

- By Blade Type

- Standard Blades

- Mulching Blades

- Lifting Blades

- Cylinder Blades

- By Drive Type

- RWD

- FWD

- AWD

- Manual Drive

- By Start Type

- Key Start

- Push Start

- Recoil Start

- By Distribution Channel

- Offline

- Online

- By Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Get Detailed Market Segmentation @ https://straitsresearch.com/report/commercial-lawn-mower-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

For more information on your target market, please contact us below:

Phone: +1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Labcorp Stock Gains From Biopharma Business Amid FX Woe

Labcorp Holdings, Inc. LH or Labcorp benefits from the solid execution of its strategic priorities. Investment in targeted high-growth areas should drive the momentum. The company faces headwinds from macroeconomic uncertainties and growing foreign exchange issues. The stock carries a Zacks Rank #3 (Hold) currently.

Factors Driving LH Stock

LabCorp is well-placed for long-term success in Cell & Gene Therapy, expanding into the consumer market and international growth through the specialty testing and biopharma business. In June 2024, Labcorp Tissue Complete comprehensive genomic profiling (CGP) service was availed in Geneva and Shanghai to support global clinical trials. The integration of OmniSeq INSIGHT circulating tumor DNA expanded Labcorp’s leadership in liquid biopsy comprehensive genomic profiling for solid tumors.

LabCorp’s Biopharma business is benefiting from collaborations with leading pharmaceutical and biotechnology companies with whom it started to work on potential antivirals, treatments and vaccines. Revenue-wise, Biopharma’s growth continues to be driven by strength in central laboratories, its largest part, which improved by 9% in the second quarter of 2024. The Early Development business is also recovering sequentially, led by reduced cancellations and booking improvement, and is expected to generate higher revenues in the second half of the year.

Labcorp has been focused on expanding its margins though the LaunchPad initiative. The company’s 2024-2026 guidance includes a savings target range of $100 million-$125 million annually. The benefits will be driven by rationalizing the geographic location of facilities and talent, leveraging technological advancements and structural enhancements, integrating acquisitions and re-engineering the company’s systems and processes. In the second quarter, the rise in operating income and margin was fueled by the strong demand and LaunchPad savings.

The stock has risen 11.1% in the past three months against the industry’s 2.7% decline. With the company strategically expanding in the high-growth areas, as well as putting focus on cost saving initiatives, we expect the stock to continue its upward movement in the coming days.

Factors Weighing on LH Stock

Labcorp’s operation is heavily dependent on the demand for diagnostic testing and drug development services from patients, physicians, hospitals, medical device companies and others. Volatilities in global economic conditions, including inflation and the risk of short or long-term recessions, could reduce the demand for these services, affecting the customers’ ability to pay and, consequently, the profitability of the company.

Added to this, the escalation of the present geopolitical situations in Ukraine and the Middle East can potentially decrease testing volumes, cause disruptions in the supply chain and services and increase the prices of offerings. In the second quarter, the cost of revenues went up by 4.7% year over year. SG&A expenses increased 10.3%, mainly from higher personnel costs.

Labcorp’s huge exposure in international markets makes it vulnerable to currency fluctuations. In 2023, the BLS segment derived nearly 58% of its revenues from overseas, while Dx also earned a modest portion in Canada and a relatively small amount in the rest of the world. An approximate 13.7% of the company’s revenues were denominated in currencies other than the U.S. dollar in the first half of 2024. With the recent upward trend observed in the value of the U.S. dollar, further acceleration expected by analysts in this value will cause the company’s revenues to face a tough situation overseas. In the second quarter, BLS and Dx revenue growth was partially offset by unfavorable foreign currency translation of 0.1%.

Key Picks

Some better-ranked stocks in the broader medical space are Intuitive Surgical ISRG, TransMedics Group and Quest Diagnostics. While Intuitive Surgical and TransMedics currently sport a Zacks Rank #1 (Strong Buy) each, Quest Diagnostics carries a Zacks Rank #2 (Buy).

Intuitive Surgical’s shares have surged 60.5% in the past year. Estimates for the company’s earnings have moved 5.1% north to $1.65 per share for 2024 in the past 30 days.

ISRG’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 8.97%. In the last reported quarter, it posted an earnings surprise of 16.34%.

Estimates for TransMedics’ 2024 EPS have moved up 125% to 27 cents in the past 30 days. Shares of the company have soared 135.2% in the past year compared with the industry’s 14.9% growth.

TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for Boston Scientific’s 2024 EPS have increased 1.7% to $2.40 in the past 30 days. In the past year, shares of BSX have risen 55.5% compared with the industry’s 17.9% growth.

In the last reported quarter, BSX delivered an earnings surprise of 6.90%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.18%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global Nanomaterials Market Size to Worth USD 54.55 Billion by 2033 | Straits Research

New York, United States, Oct. 07, 2024 (GLOBE NEWSWIRE) — Nanomaterials are substances between one and one hundred nanometers in size and at least one spatial dimension. It is possible to create nanomaterials with different modulation dimensionalities. Atomic clusters, quantum dots, nanocrystals, nanowires, and nanotubes are examples of individual nanostructures. Collections include superlattices, arrays, and assemblages of different nanostructures. Bulk or atomic-molecular materials with the same composition may have physical and chemical properties that are very different from nanoparticles.

Download Free Sample Report PDF @ https://straitsresearch.com/report/nanomaterials-market/request-sample

Market Dynamics

Rapid Technological Progress in the Medical Sector Drives the Global Market

The global medical industry is anticipated to expand due to several factors, including a growing aging population, advances in technology, and an increase in chronic illnesses globally. Additionally, the market for cardiology equipment is predicted to profit from an increase in cardiovascular problems attributable to developments in electrocardiographic technology. The global medical industry is revamping its research and subsequent products in light of current nanoparticle developments. This led to the development of advanced medical diagnostic systems.

Nanoparticles are used by medical equipment to identify several diseases. Magnetic resonance imaging (MRI) is one of the most popular scanning applications for magnetite nanoparticles (MRI). Nanomaterials also offer great functionality in nanomedicine applications since they can deliver accurate and effective medication administration. Nanomaterials have helped develop a wide range of drug carriers for the targeted and controlled delivery of therapeutic agents in various chronic diseases like diabetes, pulmonary TB, atherosclerosis, asthma, and others.

Growing Applications in Different Sectors Creates Tremendous Opportunities

Nanomaterials, nanodevices, and nanotools are the three subfields of nanotechnology. Numerous industries stand to gain from the technology’s vast array of applications, which is anticipated to hasten the growth of the nanoparticles market. Numerous industries use nanotechnology in diverse ways, including electronics, healthcare, defense, agriculture, and energy. The nanotechnology industry is developing significantly due to increased funding for R&D initiatives in the public and private sectors, technical alliances, and the rising need for potent and small devices at affordable prices.

Nanotechnology is widely used in the electronics industry to make nanosensors, nanofibers, and nanotubes and is also used in 3-D printed batteries, biodegradable electrodes, and highly flexible semiconductors that can envelop a hair strand. This technology is also used for wastewater treatment and removing suspended metal particles from water systems. One of the more recent applications of nanotechnology is in agriculture, where it can be used to protect plants, detect animal and plant diseases, track plant growth, increase food output, improve food quality, and decrease waste.

Regional Analysis

Asia-Pacific is the most significant shareholder in the global nanomaterials market and is expected to grow at a CAGR of 17.40% during the forecast period. The market for nanomaterials in Asia-Pacific is anticipated to increase due to the region’s rapid expansion in the electronics, medical equipment, aerospace and military, textiles, and automotive industries. Numerous global corporations are investing in the market for nanomaterials. For instance, in September 2020, Birla Carbon, a top-tier manufacturer and developer of advanced proprietary materials hybridized at the nanoscale, and CHASM Advanced Materials, Inc., a top-tier developer and supplier of carbon black on the global market, formed a strategic alliance to commercialize novel nanomaterials for a variety of market segments, such as high-performance tires, conductive plastics, novel coatings, and next-generation batteries.

North America is expected to grow at a CAGR of 13.10%, generating USD 9,529.28 million during the forecast period. The nanomaterials industry in North America has matured, consolidated, and liberalized its approach to incorporating new technologies to boost the efficacy of finished products. The region’s growth is primarily due to North America’s position as a global leader in manufacturing. The regional market is predicted to be driven during the projection period by continued efforts in nanomaterials and nanotechnology R&D to look into potential applications in various end-use sectors.

The development of nanotechnologies is essential for Europe’s economy to grow and for its innovative potential to be realized. The pharmaceutical industry has played a significant role in the growth of the area’s economy. This industry is a crucial resource and a significant employer in Europe due to the sizeable investments made in research and development operations by various economies in the area, including Germany, France, Italy, and the UK. However, due to the UK’s exit from the European Union, it is projected that the pharmaceutical industry will considerably impact growth. The use of nanomaterials in the healthcare sector, which has the potential to address the unmet medical requirements of the general public, is driving biomedical developments in Europe.

To Gather Additional Insights on the Regional Analysis of the Nanomaterials Market @ https://straitsresearch.com/report/nanomaterials-market/request-sample

Key Highlights

- Based on product, the global nanomaterials market is bifurcated into gold, platinum, titanium, nickel, aluminum oxide, copper, and others. The copper segment owns the highest market share and is expected to grow at a CAGR of 12.70% during the forecast period.

- Based on application, the global nanomaterials market is bifurcated into aerospace, automotive, medical, energy and power, electronics, paints and coatings, and others. The medical segment is the highest contributor to the market and is expected to grow at a CAGR of 15.60% during the forecast period.

- Asia-Pacific is the most significant shareholder in the global nanomaterials market and is expected to grow at a CAGR of 17.40% during the forecast period.

Competitive Players

- American Elements

- Nanocomposix, Inc.

- SkySpring Nanomaterials, Inc

- Frontier Carbon Corporation

- Nanoshel LLC

- Strem Chemicals, Inc.

- SkySpring Nanomaterials Inc

- Nanophase Technologies Corporation

- Cytodiagnostics, Inc

- Quantum Materials Corp

Recent Developments

- January 2022- The Society of Chemical Manufacturers & Affiliates (SOCMA), the top trade association for specialty and fine chemical manufacturers and service providers, recognized Ascensus Specialties with the Silver Performance Improvement Award for outstanding efforts in improving environmental, health, safety, and security (EHS&S).

- December 2021- Wychem Limited (“Wychem”), a renowned UK-based maker of fine chemicals for pharmaceutical and specialty applications, was acquired by Ascensus Specialties (“Ascensus” or the “Company”), a major U.S. distributor of specialty materials for the life sciences and advanced technology markets. Ascensus’s current capabilities are enhanced by this deal, strengthening the company’s commitment to serving the pharmaceutical industry.

Segmentation

- By Product

- Gold

- Silver

- Iron

- Copper

- Platinum

- Titanium

- Nickel

- Aluminum Oxide

- Antimony Tin Oxide

- Bismuth Oxide

- Carbon Nanotubes

- Others

- By Applications

- Aerospace

- Automotive

- Medical

- Energy and power

- Electronics

- Paints and Coatings

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Get Detailed Market Segmentation @ https://straitsresearch.com/report/nanomaterials-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

For more information on your target market, please contact us below:

Phone: +1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 High-Yield Dividend Stocks That Are Screaming Buys Right Now

The Federal Reserve’s pivot to lower interest rates will have ripple effects throughout the economy and send investors looking for passive income to new places. As yields fall in vehicles like high-yield savings accounts, investors could turn to high-quality, high-yield dividend stocks. Consumer spending and healthcare are two pillars of the U.S. economy, and great places to look for such stocks.

I’ve identified three stocks with generous yields and the financials to afford their payouts. These companies also boast durable business models that should thrive through recessions, giving income-focused investors peace of mind.

1. Pfizer

Current yield: 5.8%

Pharmaceutical giant Pfizer (NYSE: PFE) was a big winner during COVID-19’s height due to its vaccine and treatment products, which created a temporary growth wave. However, the tide has gone out over the past couple of years, and the stock has plunged to multi-year lows as revenue and earnings contract.

But the company is poised to resume growth, with analysts anticipating 8% to 9% annual earnings growth for the next three to five years. Pfizer has pivoted its business to focus on oncology, using its pandemic profits to acquire Seagen for $43 billion last year.

Management raised Pfizer’s dividend by 2.4% last December, a sign of confidence the payout is safe. The payout ratio is also getting healthier. The dividend is approximately 64% of estimated 2024 earnings, so Pfizer seems poised to continue extending its streak of 15 years of increases. The stock trades at only 11 times its estimated 2024 earnings, a sharp discount to the broader market and an attractive price for a business with high single-digit earnings growth.

Pfizer represents a rock-solid income investment with the potential for capital appreciation ahead.

2. Altria

Current yield: 8%

Tobacco companies are renowned dividend stocks, and Altria (NYSE: MO) is an excellent example, having showered shareholders with cash for decades. The company sells Marlboro cigarettes and leading brands of cigars, chewing tobacco, and smokeless products in the United States. The company is also a Dividend King, meaning that it has raised its dividend for more than five decades, a testament to how durable the tobacco industry is despite declining smoking rates.

The dividend remains in good financial health, with a payout ratio of 80% of estimated 2024 earnings. That dividend is backed by an investment-grade balance sheet and a multi-billion-dollar stake in Anheuser-Busch, which the company could liquidate as needed.

Altria’s cigarette shipments decline almost annually, but a combination of price increases and share repurchases continues inching earnings higher. Analysts estimate that the company will grow earnings by an average of 3% to 4% over the next three to five years, which means the dividend will continue inching higher, too.

Shares trade at 10 times Altria’s estimated 2024 earnings, but I’d hesitate to call the stock a bargain due to its low growth. However, you don’t need much when getting an 8% dividend yield. Those ultimately concerned with investment income will struggle to find a similarly safe yield this high.

3. Realty Income

Current yield: 5%

Real estate is one of society’s oldest industries, and real estate investment trusts (REITs) like Realty Income (NYSE: O) enable people to invest in real estate without directly owning property. REITs acquire and lease real estate, and then distribute most of their income to shareholders. That makes Realty Income an excellent dividend stock.

The company has paid and raised its dividend for 29 consecutive years, and the payout ratio is still just 75% of this year’s estimated funds from operations (FFO). Plus, Realty Income pays a monthly dividend, a perk for investors who want regular cash flow to help pay their bills.

Realty Income has thrived through economic ups and downs because it focuses on renting to retail businesses that people use regardless of what the economy is doing. Think grocery stores, restaurants, convenience stores, and pharmacies. Realty Income leases over 15,000 properties, so it’s a vast and diverse portfolio that generates steady rental income for the company.

Lower interest rates are a bonus for REITs like Realty Income because they often borrow to fund their property acquisitions. Cheaper borrowing costs should make Realty Income more profitable.

Realty Income trades at almost 15 times its estimated 2024 FFO, a fair price given the company’s bright outlook and reliable and growing dividend.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer and Realty Income. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks That Are Screaming Buys Right Now was originally published by The Motley Fool

Super Micro Computer stock surges 15% on big AI demand

Server company Super Micro Computer (SMCI) unveiled a new liquid cooling solution for AI data centers on Monday, while also revealing it’s shipping over 100,000 graphics processing units (GPUs) quarterly — news that sent its stock climbing more than 15% in midday trading.

Based on current market prices for high-end AI GPUs, which can range from $10,000 to $40,000 each, Super Micro’s quarterly GPU shipments could represent a potential revenue stream of $1 billion to $4 billion. The server company’s shares are up 65.43% so far this year.

This significant GPU shipment volume dovetails with Super Micro’s advancements in cooling technologies for AI infrastructure. The company’s cooling solutions are “reducing costs and improving performance” at “state-of-the-art AI factories,” Charles Liang, chief executive of Super Micro, said in a statement. The company also said it has “recently deployed” over 100,000 GPUs with its liquid cooling solution to “some of the largest AI factories ever built.”

“The combination of Supermicro deployment experience and delivering innovative technology is resulting in data center operators coming to Supermicro to meet their technical and financial goals for both the construction of greenfield sites and the modernization of existing data centers,” Liang said.

In August, Super Micro’s shares fell 22% after it was accused of accounting manipulation and other questionable business deals by short-seller Hindenburg Research. The three month investigation found “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues,” the report said.

Super Micro saw its shares fall over 13% in May after it missed analysts’ expectations for revenue in the third quarter. The company reported revenue of $3.85 billion in the fiscal third quarter, falling below Wall Street’s expectations of $3.95 billion. However, its revenue was more than double revenue of $1.28 billion from the previous year.

Nutanix Shares Up 26% YTD: How Should Investors Play the Stock?

Nutanix NTNX shares have returned 26.2% year to date, outperforming the broader Zacks Computer and Technology sector’s appreciation of 23.4%.

NTNX shares have also outperformed the Zacks Computer – IT Services industry and its peers like Unisys UIS, Evolv Technologies EVLV and Cerence CRNC.

Over the same time frame, Unisys has appreciated 0.2%, while Evolv Technologies and Cerence have declined 19.7% and 86.3%, respectively. The industry has appreciated 9.2% YTD.

NTNX’s outperformance can be attributed to the steady adoption of hybrid cloud solutions, an increase in renewal and subscription business, and an expanding clientele.

Does Strong Clientele Justify NTNX’s Premium Valuation?

In fiscal 2024, approximately 76% of NTNX’s end customers who have been its clients for 18 months or longer made a repeat purchase, reflecting a loyal customer base. Nutanix’s total revenues for fiscal 2024 were $2.14 billion, of which 93.8% was from subscriptions.

NTNX stacks are usable with a vast library of operating systems like Microsoft and SAP, and existing customers have benefited from the hyper-converged infrastructure market.

However, NTNX shares are overvalued, as suggested by a Value Score of F.

In terms of the forward 12-month Price/Earnings ratio, NTNX is trading at 178.5X, higher than the Zacks Computer & Technology sector’s 26.83X.

So, the question for investors is – does an expanding clientele make Nutanix shares attractive despite a stretched valuation? Let’s analyze.

NTNX’s Cloud Innovation Aids Prospects

Nutanix is focusing on new releases and enhancements to the Nutanix Cloud Platform to aid long-term opportunities and to become a leader in modern application and data management platforms.

NTNX expanded its 14-year partnership with Dell Technologies to announce innovations like Dell XC Plus and Dell PowerFlex.

Nutanix Cloud Platform enables businesses to modernize IP footprints, integrate hybrid cloud models, and accelerate migration of workload to the public cloud to enhance cost-effectiveness and efficiency.

NTNX recently launched GPT-in-a-Box to aid in streamlining the adoption of GenAI by enterprises. It also launched Nutanix Data Services for Kubernetes, to provide consistent data services across virtual machines and container assets, and Nutanix Kubernetes Platform to allow simplification in the management of modern applications on-premise and in native public cloud service.

Nutanix announced a collaboration with NVIDIA to aid enterprises adopt GenAI easily.

Nutanix Cloud Clusters enable workloads to run seamlessly in private and public clouds while increasing automation and reducing the dependency on expensive proprietary solutions.

Elongated Sales Cycle Concern for Nutanix

In fiscal 2024, Nutanix’s land and expand revenues suffered due to longer sales cycles, which have been elongated compared to historical levels.

NTNX’s average contract term length in the fiscal fourth quarter was 3.1 years, 0.1 years higher than the fiscal third quarter.

Nutanix’s customer base is increasing but is largely constituted of large deals leading to variability of timing and outcome.

As NTNX targets its sales efforts for large enterprises, it faces higher costs, greater competition, stiff price pressure, customization challenges, and lower predictability in its ability to complete the sale.

NTNX’s operating expense for fiscal 2024 was $1.51 billion, up 7% over fiscal 2023. This increase can be attributed to an increase in research and development (increased 19% to $638 million) and sales and marketing expenses (increased 6% to $977 million). Higher operating expenses are likely to negatively impact bottom-line results in fiscal 2025.

NTNX’s Fiscal 2025 Outlook Positive

For fiscal 2025, NTNX revenues are estimated in the range of $2.435-$2.465 billion, indicating year-over-year growth of 14% at the mid-point.

The Zacks Consensus Estimate for revenues is pegged at $2.45 billion, indicating year-over-year growth of 14.24%.

NTNX expects a non-GAAP operating margin in the band of 15.5-17%.

The consensus mark for fiscal 2025 earnings is pegged at $1.40 per share, up 2.9% in the past 30 days. The figure indicates a 6.87% year-over-year increase.

Nutanix expects free cash flow in the range of $540-$600 million, suggesting a free cash flow margin of 23% at the midpoint.

NTNX Shares – To Buy, Hold or Sell?

Macroeconomic challenges, including persistent inflation, are a concern for NTNX’s prospects.

Stretched valuation, elongated sales cycle duration, and increasing operating expenses are concerns for investors.

Nutanix currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable entry point into the stock.

The Loren at Turtle Cove and Marina – A New Benchmark in Luxury and Success

PROVIDENCIALES, Turks and Caicos Islands, Oct. 7, 2024 /PRNewswire/ — In the sun-soaked paradise of the Turks and Caicos Islands, where the azure waters of the Caribbean meet pristine white sands, a new icon of luxury living is rising. The Loren at Turtle Cove and Marina, an ambitious and breathtakingly beautiful enclave of condos, hotel suites, and villas, has just reached two significant milestones that underscore its place as a future landmark in luxury real estate.

“The Loren at Turtle Cove is not just another luxury development; it is a signature property for The Loren Hotel Group”,

The first milestone is completing the foundation slab for the main hotel condo. This critical phase sets the stage for accelerated progress across the remaining phases of the development. This achievement signifies the project’s steady march toward completion and highlights the meticulous planning and execution driving this venture. With this solid foundation now laid, The Loren at Turtle Cove is poised to see rapid advancement, bringing closer the day when it will open its doors to discerning owners and guests who seek nothing less than the epitome of refined island living.

Simultaneously, The Loren at Turtle Cove has also celebrated a remarkable milestone in sales, reaching an astonishing $78,000,000 in volume ahead of schedule. This impressive figure reflects the market’s confidence in the project and the allure of The Loren brand, which has already established its prestige with properties in Bermuda and Austin, Texas. This early success is particularly noteworthy in a market known for its discerning clientele.

Among the sales highlights are three stunning beachfront villas, each a masterpiece of architectural design and luxury, and one of the two majestic penthouses, offering unparalleled views and luxury. Additionally, a variety of stunning one, two, and three-bedroom units are now under contract, underscoring the broad appeal of this development. These sales figures, achieved well before projections, speak volumes about the demand for such high-caliber properties in the Turks and Caicos Islands.

Robert Greenwood, Broker of Record for the development and a Senior Broker and Director of Christie’s International Real Estate-Turks and Caicos, says: “The Loren at Turtle Cove is not just another luxury development; it is a signature property for The Loren Hotel Group, marking one of the region’s first ventures of this kind. This project is poised to redefine luxury living in the Caribbean, offering a unique blend of world-class amenities, impeccable service, and stunning natural beauty. The Loren’s commitment to excellence, already demonstrated in their other properties, ensures that this enclave will be nothing short of extraordinary.”

Christie’s International Real Estate, Turks and Caicos, one of the world’s leading global luxury real estate brands, exclusively represents this project. Their involvement guarantees that The Loren at Turtle Cove and Marina will be marketed to the world’s elite, attracting buyers who demand the very best in luxury, privacy, and location.

As The Loren at Turtle Cove and Marina progresses, it is clear that this development is set to become a crown jewel in the Turks and Caicos Islands. The combination of strategic planning, exceptional sales performance, and the backing of globally recognized luxury brands positions The Loren as more than just a residential option; it is an investment in an unparalleled lifestyle. This enclave represents the future of luxury in the Caribbean, where every detail is crafted to perfection, and every resident is part of something extraordinary.

As the sun sets over Turtle Cove, one can only imagine the lifestyle awaiting those fortunate to call this place home. The Loren at Turtle Cove and Marina is not merely a development but a legacy in the making.

Contact Information:

Robert Greenwood – Broker of Record for The Loren At Turtle Cove

Email: sales@thelorentci.com

Phone: +1 (649) 432-7653

One Season Plaza Suite, 7 Grace Bay Rd, Grace Bay TKCA 1ZZ, Turks & Caicos Islands

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the-loren-at-turtle-cove-and-marina–a-new-benchmark-in-luxury-and-success-302268994.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-loren-at-turtle-cove-and-marina–a-new-benchmark-in-luxury-and-success-302268994.html

SOURCE Christie’s International Real Estate, Turks and Caicos

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.