2 Ultra-High-Yield Dividend Stocks Are Near 52-Week Lows. Is It Time to Buy the Dips?

If you’re an investor looking for stocks that can produce giant streams of passive income, you may have noticed a couple of well-established dividend payers have been beaten down a long way over the past 12 months.

The past year has been a lousy time for holding shares of Walgreens Boots Alliance (NASDAQ: WBA) and Western Union (NYSE: WU). Both of these dividend payers have been beaten down to near 52-week lows. At their beaten-down prices, it’s only natural for everyday investors to wonder if they could be a bargain.

Here’s a closer look at why these stocks are under pressure to see if they could be bargains now.

1. Walgreens Boots Alliance

Shares of Walgreens Boots Alliance are down by about 62% over the past 12 months. Investors reacted harshly to a dividend reduction the company announced in January from $0.48 per share down to $0.25 per share, and the stock hasn’t stopped falling since.

The stock has fallen so low that its reduced quarter dividend payout can produce an eye-popping 11.5% yield for investors who buy at recent prices. With such a high yield, long-term investors could realize market-beating gains if the company can just maintain its payout at its present level.

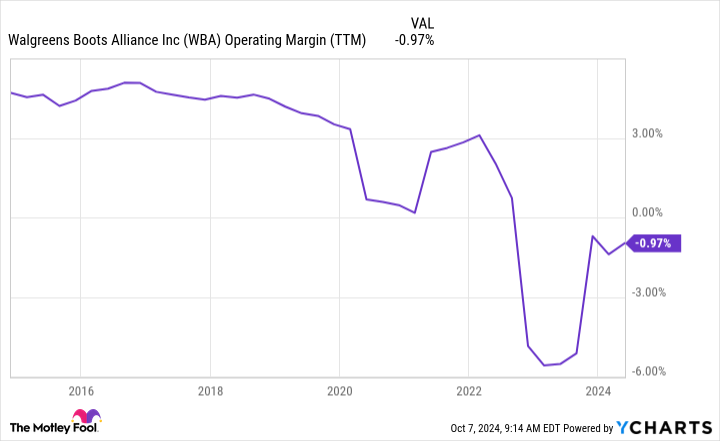

With more than 8,700 retail locations, Walgreens is one of the world’s largest purchasers of prescription drugs. Economies of scale gave the company a strong advantage, but it isn’t enough anymore to produce strong profits. Over the past few years, Walgreens Boots Alliance’s operating margin has dwindled from reliably positive to disturbingly negative.

These days, pharmacy benefit managers (PBMs) run by just three companies, CVS Health, UnitedHealth Group, and Cigna, process nearly 80% of all U.S. prescriptions. These three PBMs are vertically integrated with their own retail, specialty, and mail order pharmacies. Without a big PBM of its own, Walgreens’ pharmacy operation is unlikely to become a reliable source of profits again.

A declining retail pharmacy business isn’t Walgreens’ only problem. An attempt to become a leading provider of primary care services has been a disaster. Earlier this year, the company’s joint venture with Cigna, VillageMD, recorded a $12.4 billion impairment charge.

Walgreens stock might seem like a bargain at a recent price of about 4.6 times forward-looking earnings expectations. Without a clear plan to combat the powerful PBM industry, though, earnings and its dividend payout will likely continue declining. It’s probably best to avoid this falling knife until it has a plan to address challenges facing all retail pharmacies not integrated with the big three PBMs.

2. Western Union

Shares of Western Union have lost more than half their value since reaching an all-time high in 2020. The beaten-down provider of remittance services started to recover this spring, but disappointing quarterly results have pushed it back down to near a 52-week low. At recent prices, the stock offers an 8% yield.

With roots that go back to 1851, Western Union is arguably the world’s most recognized provider of international remittance services. Unfortunately, brand recognition hasn’t prevented a slew of competing remittance providers from gaining market share.

In the first half of 2024, Western Union reported revenue that declined by 4% year over year. The company isn’t necessarily lowering prices, but it had to improve the exchange rates it offers to compete with upstarts that don’t mind racing the 173-year-old company to the bottom.

Remitly (NASDAQ: RELY) is a 13-year-old provider of remittance services that is beating the pants off of Western Union. Revenue in the first half is up 31% year over year, and it isn’t the only remittance service gaining market share. Wise (LSE: WISE) reported total sales that grew 24% during its fiscal year that ended March 31.

Remitly is still losing money, but Wise can easily apply even more pressure to Western Union’s profit margins if it wants to. The British company generated about $636 million in free cash flow in fiscal 2024. That was an impressive 46% of total revenue.

Western Union hasn’t raised its quarterly dividend payout since 2021. It’s hard to imagine the company increasing dividend payments while its share of the international remittance market is shrinking.

Western Union shares have been trading for about 6.7 times forward-looking earnings expectations. While this is an extremely low valuation, competing with Wise and Remitly will probably get more difficult as customers become more familiar with the younger services. It’s probably best to watch this stock from a safe distance.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,006!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,905!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $388,128!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Cory Renauer has positions in CVS Health. The Motley Fool has positions in and recommends Wise Plc. The Motley Fool recommends CVS Health and UnitedHealth Group. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks Are Near 52-Week Lows. Is It Time to Buy the Dips? was originally published by The Motley Fool

Wall Street Analysts See Seanergy Maritime Holdings as a Buy: Should You Invest?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let’s see what these Wall Street heavyweights think about Seanergy Maritime Holdings Corp SHIP.

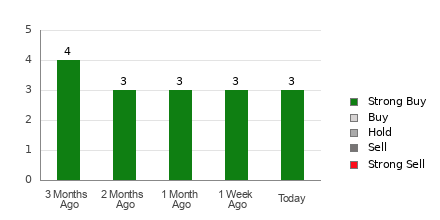

Seanergy Maritime Holdings currently has an average brokerage recommendation of 1.00, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by three brokerage firms. An ABR of 1.00 indicates Strong Buy.

Of the three recommendations that derive the current ABR, three are Strong Buy, representing 100% of all recommendations.

Brokerage Recommendation Trends for SHIP

The ABR suggests buying Seanergy Maritime Holdings, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company’s changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Should You Invest in SHIP?

In terms of earnings estimate revisions for Seanergy Maritime Holdings, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $2.38.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Seanergy Maritime Holdings.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for Seanergy Maritime Holdings.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

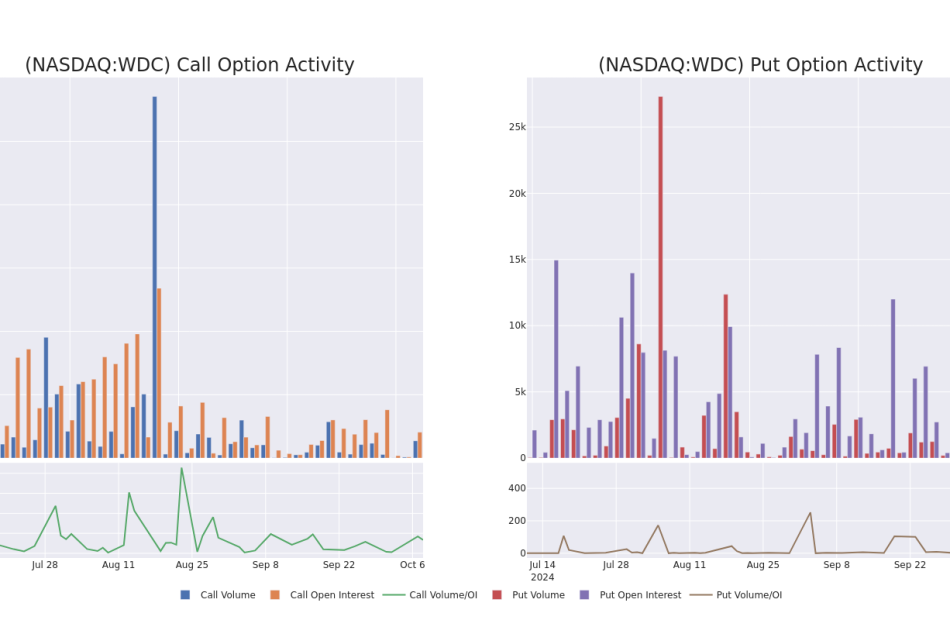

Behind the Scenes of Western Digital's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards Western Digital WDC, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WDC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 11 extraordinary options activities for Western Digital. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 63% leaning bullish and 18% bearish. Among these notable options, 3 are puts, totaling $173,535, and 8 are calls, amounting to $838,808.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $85.0 for Western Digital, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Western Digital’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Western Digital’s whale activity within a strike price range from $60.0 to $85.0 in the last 30 days.

Western Digital Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDC | CALL | SWEEP | NEUTRAL | 01/16/26 | $11.75 | $11.4 | $11.7 | $70.00 | $327.4K | 2.1K | 280 |

| WDC | CALL | SWEEP | BEARISH | 02/21/25 | $9.2 | $9.15 | $9.2 | $62.50 | $183.9K | 635 | 200 |

| WDC | CALL | SWEEP | BULLISH | 02/21/25 | $9.25 | $9.05 | $9.1 | $62.50 | $182.0K | 635 | 400 |

| WDC | PUT | TRADE | BULLISH | 04/17/25 | $9.5 | $9.35 | $9.4 | $70.00 | $93.0K | 44 | 106 |

| WDC | PUT | SWEEP | BEARISH | 04/17/25 | $7.75 | $7.65 | $7.75 | $67.50 | $53.4K | 39 | 1 |

About Western Digital

Western Digital is a leading vertically integrated supplier of data storage solutions, spanning both hard disk drives and solid-state drives. In the HDD market it forms a practical duopoly with Seagate, and it is the largest global producer of NAND flash chips for SSDs in a joint venture with competitor Kioxia.

Having examined the options trading patterns of Western Digital, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Western Digital Standing Right Now?

- With a volume of 2,216,198, the price of WDC is down -0.92% at $65.83.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 20 days.

What The Experts Say On Western Digital

In the last month, 4 experts released ratings on this stock with an average target price of $84.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from TD Cowen has decided to maintain their Buy rating on Western Digital, which currently sits at a price target of $80.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $80.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Western Digital with a target price of $85.

* In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $92.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Western Digital options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Antibody Production Market Expected to Reach USD 30.7 Billion by 2031, Growing at a CAGR of 7.8% from 2023 to 2031: Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 08, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global antibody production market (항체 생산 시장) was worth US$ 15.6 Bn in 2022 and is expected to reach US$ 30.7 Bn by the year 2031 at a CAGR of 7.8 % between 2023 and 2031.

Antibody production refers to the biotechnological process of generating antibodies for various applications, including research, diagnostics, and therapeutic purposes. Antibodies, also known as immunoglobulins, are proteins the immune system produces to identify and neutralize foreign objects like bacteria, viruses, or the other pathogens.

In the biotechnology and pharmaceutical industries, antibody production involves the artificial creation of monoclonal or polyclonal antibodies in laboratory settings to target specific antigens for therapeutic or diagnostic use.

Antibody Production Market Scenario

Antibodies can be used for both – diagnostic and therapeutic purposes. The main application of antibodies in medicine is the treatment of a variety of illnesses and ailments, including cancer, autoimmune diseases, infectious diseases, and other ailments. Both – upstream and downstream processes are involved in the synthesis of antibodies. Among the other things, mice and rabbits can be used as sources of antibodies.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4560

The increasing frequency of cancer and autoimmune disorders, the rising use of immunoassays, the growing need for tailored antibodies, the rise in R&D spending by pharmaceutical and biotech businesses, and the development of bioprocessing technologies are all factors contributing to the expansion of this industry.

Moreover, the constantly growing prevalence and rising risk of outbreaks of infectious diseases is expected to bolster the adoption of antibodies for immunization, thereby boosting their production.

The article from the United Nations’ Africa Renewal magazine in July 2022 highlighted a significant increase in zoonotic outbreaks in Africa. According to the World Health Organization (WHO), there has been a 63% rise in zoonotic disease outbreaks in the region over the past decade as compared to the previous one. This includes diseases like Ebola and monkeypox, which originate in animals and can infect humans.

Antibody Production Market Key Takeaways

- Rise in Prevalence of Autoimmune Diseases and Cancer Boosting the Adoption of Antibody Production

The need for the production of antibodies, especially monoclonal antibodies (mAbs), is expanding due to the growing global burden of cancer and autoimmune illnesses. Globally, cancer is a serious health concern, and the number of new cases is predicted to rise significantly. The International Agency for Research on Cancer projects that by 2030 there will be 24.6 million new cases of cancer, up from 19.3 million in 2020. Millions of people’s lives are becoming less fulfilling and their mortality rates are rising as a result of this worrying development.

Monoclonal antibodies have emerged as a key therapeutic tool in cancer treatment due to their ability to target specific proteins in cancer cells, inhibiting their growth and spread. Modern cancer treatment regimens require targeted medicines as they provide a more specific treatment strategy than standard chemotherapy.

Governments, medical institutions, and pharmaceutical firms are collaborating to create new mAbs as well as the other cancer treatments. The importance of this therapeutic class in oncology is highlighted by the Antibody Society’s 2020 report, which states that 43 monoclonal antibodies were either licensed or undergoing regulatory assessment in the United States and the European Union for the treatment of cancer.

Similar to this, the need for monoclonal antibodies is being driven by the rising incidence of autoimmune illnesses. When the immune system unintentionally targets the body’s own tissues, it can lead to autoimmune illnesses, which result in tissue damage and persistent inflammation. Tumor necrosis factor (TNF) inhibitors, for example, are monoclonal antibodies that are commonly used to treat autoimmune diseases like rheumatoid arthritis, which are characterized by inflammation brought on by certain proteins.

The global impact of autoimmune diseases is substantial and expected to rise. For instance, an estimated 8.4 million people were living with Type 1 Diabetes (T1D) across the globe in 2021, according to the results of a new modeling study published in The Lancet Diabetes & Endocrinology. Moreover, this number is predicted to increase to 13.5-17.4 million people living with T1D by 2040.

Similarly, according to studies about 1 in 133 people in the United States have celiac disease. That is 1% of the total population, or 2 million people. However, over 80% of people with celiac disease are undiagnosed or misdiagnosed, particularly those who are socioeconomically deprived.

Hence, as these diseases become more prevalent, the need for effective treatments, particularly monoclonal antibodies, continues to grow. This rising demand is expected to further stimulate antibody production, as pharmaceutical and biopharmaceutical companies invest in research, development, and regulatory approvals to bring new mAb therapies to market. This trend positions antibody production as a critical component of the global healthcare landscape in addressing both – cancer and autoimmune diseases.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4560

Antibody Production Market Report Scope:

| Report Coverage | Details |

| Forecast Period | 2023-2031 |

| Base Year | 2017-2022 |

| Size in 2022 | US$ 15.6 Bn |

| Forecast (Value) in 2031 | US$ 30.7 Bn Bn |

| Growth Rate (CAGR) | 7.8 % |

| No. of Pages | 175 Pages |

| Segments covered | Antibody Type, Process, End-user |

Antibody Production Market Regional Insights

- North America dominated the market in 2022

North America accounted for the largest market value in 2021. The region is likely to maintain its dominant position during the forecast period.

North America faces a rising incidence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases. According to the American Cancer Society, the U.S. alone reported an estimated 1.9 million new cancer cases in 2022.

Monoclonal antibodies (mAbs) are increasingly being used in the treatment of these conditions, particularly in oncology and immunology. The high disease burden in the region is a primary factor boosting the demand for antibody production.

Moreover, North America is home to some of the world’s leading biotechnology and pharmaceutical companies, which have significantly invested in antibody research and development.

Companies such as Amgen, Pfizer, and Merck, as well as a robust network of smaller biotech firms, are continuously developing new therapeutic antibodies and biologics. The region’s advanced R&D infrastructure, strong industry-academic collaborations, and ample funding resources contribute to the growth of the antibody production market.

Prominent Key Players Operating in the Antibody Production Industry

Danaher Corporation, Merck KGaA, Sartorius, Thermo Fisher Scientific Inc., Eppendorf AG, INTEGRA Biosciences AG, Genetix Biotech Asia Pvt Ltd., Solaris Biotech, Grifols, F. Hoffmann-La Roche AG and FiberCell Systems Inc. are some of the leading key players operating in the industry.

Latest Developments

In August 2022, the FDA approved Enhertu for the treatment of unresectable or metastatic HER2-low breast cancer

Antibody Production Market Segmentation

Antibody Type

- Monoclonal Antibodies

- Polyclonal Antibodies

- Other Antibody Types

Process

- Upstream Processing

- Bioreactors

- Large-scale Bioreactors

- Single-use Bioreactors

- Consumables

- Bioreactors

- Downstream Processing

- Chromatography Systems

- Chromatography Resins

- Filtration

- Filtration Systems

- Filtration Consumables & Accessories

End-user

- Pharmaceutical and Biotechnology Companies

- Research Laboratories

- Other End-users

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=4560<ype=S

More Trending Reports by Transparency Market Research –

Pigmentation Disorder Treatment Market (色素沈着障害治療市場): The global industry was valued at US$ 6.8 Bn in 2022, t is estimated to grow at a CAGR of 5.2% from 2023 to 2031 and reach US$ 10.6 Bn by the end of 2031.

Sterile Injectable Drugs Market (Markt für sterile injizierbare Medikamente): The global sterile injectable drugs market size stood at US$ 584.6 Bn in 2022, It is estimated to increase at a CAGR of 4.9% from 2023 to 2031 and reach US$ 909.4 Bn by the end of 2031.

Human Papillomavirus Vaccine Market (Mercado de vacunas contra el virus del papiloma humano): The industry was valued at US$ 4.0 Bn in 2022, It is projected to grow a CAGR of 9.4% from 2023 to 2031 and reach US$ 9.1 Bn by the end of 2031.

Brain Health Supplements Market (سوق المكملات الغذائية لصحة الدماغ): The industry was valued at US$ 6.6 Bn in 2022, It is projected to grow at a CAGR of 6.4% from 2023 to 2031 and reach more than US$ 11.4 Bn by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Is Selling Bank of America Stock and Buying This High-Yield Investment Instead

Warren Buffett is one of the most widely respected investors in the world. And there’s a good reason. With nearly 70 years investing in the public eye, he’s produced incredible returns for anyone willing to invest alongside him. He recently saw the value of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) surpass $1 trillion. It’s come a long way from the $22 million company Buffett took over in 1965, largely on the back of Buffett’s investment prowess.

Today Buffett and his fellow investment managers oversee about $600 billion in investable assets for Berkshire Hathaway shareholders. And when Buffett makes a move in Berkshire’s portfolio, the entire investing world pays attention.

The Oracle of Omaha’s most recent move is to sell off a portion of Berkshire’s investment in Bank of America (NYSE: BAC). The bank stock was once Berkshire’s second-largest position after Apple (NASDAQ: AAPL), but Buffett is selling it and likely buying this high-yield investment instead.

Buffett’s taking cash out of the bank

Investors typically have to wait until institutional investors like Berkshire Hathaway file form 13F with the Securities and Exchange Commission (SEC) to see what changes they made in their portfolios during the previous quarter. But since Berkshire Hathaway owns more than 10% of Bank of America’s outstanding shares, it’s required to report any changes in its ownership within three business days. That’s how we know Buffett sold over $9.6 billion worth of Bank of America stock during the third quarter and an additional $140 million in the first two days of October.

Bank of America is far from the only company Buffett’s been cutting down on. He sold over half of Berkshire’s position in Apple between Q4 of 2023 and Q2 of this year. While Apple remains Berkshire’s largest position, the sales in Q2 represent the largest in Berkshire’s history.

In fact, Buffett’s been a net seller of stocks for seven consecutive quarters beginning with Q4 2022. Considering the size of his Bank of America stock sale, Berkshire will likely confirm an eighth-straight quarter when it reports its earnings next month.

There’s a simple explanation for why Buffett has felt compelled to sell off significant portions of Berkshire’s largest holdings: taxes and valuation.

Buffett expects the current tax rate on corporate earnings to move higher after the current tax laws expire in 2025. They could revert to 35% from the current 21% rate if nothing happens. Kamala Harris has proposed a 28% corporate tax rate. Donald Trump would likely push for a continuation of the 21% rate instituted under his previous administration. But given the current government deficit, Buffett sees the current rate as unsustainable.

What Buffett hasn’t said explicitly, though, is that selling now to save on taxes later only makes sense if he also feels the stocks he’s selling are trading near or above their intrinsic value. Buffett wouldn’t sell a stock trading well below its real value just to save on taxes. And given his lack of investments in other companies, it’s clear Buffett doesn’t see a lot of opportunities to invest Berkshire Hathaway’s funds in right now.

But Buffett has consistently taken the opportunity to buy one high-yield investment, and that’s likely where most of Berkshire’s cash from stock sales is headed.

The ultrasafe, high-yield investment on Berkshire’s balance sheet

Over the last two years, Buffett has been piling money into U.S. Treasury bills. As of the end of Q2, Berkshire Hathaway held $238.7 billion worth of U.S. Treasury bills. It also had about $38.2 billion in cash. That total of $276.9 billion is up from $109 billion as of the end of Q3 2022.

These short-term Treasury bonds mature within 12 months. Buffett prefers short-term government bonds as they provide the highest level of safety. They’re more insulated from interest-rate risk, which could cause the value of the bonds to decline, resulting in a loss in value if Buffett needed liquidity.

Over the last two years Buffett’s gotten the dual benefits of safety and yield, as short-term bonds paid more in interest than long-term bonds. That’s because many expect interest rates to move lower over the long run as the Fed cuts rates and aims to keep them stable. But Buffett has said he’d be happy to keep much of Berkshire’s assets in Treasury bonds even if they didn’t pay nearly as much.

The reason Buffett’s flocked to the safe investment isn’t the high yield he can get in today’s market. The reason is simple: He doesn’t think there’s a more effective use for the money.

While that may sound like a stark warning for most investors, the truth is it only applies to the portion of the market Berkshire can operate in. The universe of stocks Buffett could possibly buy is limited to the biggest companies in the world. That makes it harder to earn market-beating returns. “I would not like to be running $10 billion now,” Buffett said at the Berkshire shareholder meeting in May. “$10 million I think Charlie or I could earn high returns on,” he noted.

That suggests that he doesn’t recommend the average investor pile their money into Treasury bills. There are plenty of opportunities out there for small investors with “just” $10 million or less. But if you need a place to park your cash while you look for them, short-term Treasuries still offer an attractive yield for now.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Is Selling Bank of America Stock and Buying This High-Yield Investment Instead was originally published by The Motley Fool

Here's How Much $100 Invested In Reliance 5 Years Ago Would Be Worth Today

Reliance RS has outperformed the market over the past 5 years by 9.06% on an annualized basis producing an average annual return of 23.2%. Currently, Reliance has a market capitalization of $15.59 billion.

Buying $100 In RS: If an investor had bought $100 of RS stock 5 years ago, it would be worth $278.89 today based on a price of $283.46 for RS at the time of writing.

Reliance’s Performance Over Last 5 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

REAI REdefines The Real Estate Buyer's Journey With Advanced AI Services

REAI, Inc., an innovative company with a portfolio of patented artificial intelligence (AI) technologies designed for real estate applications, reshapes the buyer’s journey with cutting-edge tools that provide the best matching property to buyers and automate/streamline transactions. With one awarded utility patent and three more pending, the company empowers consumers to make smarter, faster, and more informed decisions.

This leading innovator in real estate has made it its mission to deliver a stress-free real estate experience. Its proprietary AI technologies can match buyers to their perfect home, secure a mortgage, run through transactions, or even manage renovation projects effortlessly. For instance, REbot, one of REAI’s offerings, is a one-stop solution for all real estate-related inquiries. The AI-powered assistant allows users to input questions about properties, transactions, or home renovations and receive instant, customized answers.

Buyers no longer need to scan through endless online resources for advice as REbot delivers the information they need, from making an offer to understanding the closing process. Premium users can utilize advanced features, such as personalized guidance on renovation projects, sales strategies, and transaction management. These make REbot a valuable tool for anyone going through real estate processes.

REAI empowers buyers with its super efficient AiMatch®, one of its innovations that revolutionizes how buyers find their dream homes. It is partially based upon REAI’s utility patent, ‘Smart Matching for Real Estate Transactions.’ It has totally revolutionized the traditional method of property search, which can be time-consuming and frustrating. AiMatch® uses AI algorithms to analyze and project consumer preferences, property information, and market trends to provide the best matches instantly. With this, buyers can look through properties that meet their needs instead of spending hours searching through listings on real estate platforms.

AiMatch® further stands out for not only matching buyers to the right homes. It also helps buyers connect with the best mortgage providers, real estate agents, and insurance options. Essentially, customers receive a full-service solution that allows them to enjoy the process rather than scrambling through the logistics.

Consumers seeking to remodel their new home or simply find inspiration can rely on REAI’s REimagine™. This tool offers a virtual platform where users can experiment with different designs, styles, and layouts instantly. A brief description suffices to turn home design concepts into visually stunning creations. REimagine™ is also helpful for buyers who want to see the potential of a property before purchasing.

“In the past, buyers had to spend hours searching for the perfect home and doing complex paperwork. Digesting vast information to make a wise decision can be overwhelming. We developed AI-powered technologies to address these pain points. Now, consumers can be quickly matched with their dream home without the stress,” CEO James Wang remarks.

REAI partnered with Ocusell, a leading property compliance and listing technology company, to bring its AI Services to a broader audience. This collaboration has allowed the REAI’s proprietary technologies to be integrated into the latter’s platform, enabling enterprise-level real estate groups, such as brokerages and multiple listing services (MLS), to offer state-of-the-art AI features to their enterprise clients. And by opening up directly to consumers, REAI enables general buyers and homeowners to efficiently run their real estate journey with peace of mind.

The real estate industry has already felt the impact of REAI’s technologies. The former CTO of the National Association of Realtors (NAR) says: “REAI is bringing innovative AI technology breakthroughs into the real estate industry with unique AI products that can boost the industry and help consumers and professionals with super efficient transaction processes.” Meanwhile, a high-ranking MLS director remarks, “REAI’s AI technologies, including its listing generation and image/video captioning, can solve real compliance problems for all.” These testimonials highlight the company’s ability to enhance the efficiency of the sector’s transactions while adhering to compliance and maintaining security.

REAI continues to transform the real estate industry with its innovative solutions. Besides AI, the company also focuses on paving the way for integrating blockchain technology in the sector. REAI offers transparency and security by ensuring that all transaction data is immutable and accessible with its proprietary multi-layer blockchain structure. This technology also supports private, off-chain tasks, combining openness and confidentiality. “We believe this is the future of real estate transactions, and we’re proud to lead the way,” Wang states.

Image Credit: REAI

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice. Benzinga does not make any recommendation to buy or sell any security or any representation about the financial condition of any company.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jeffrey Westphal Implements A Sell Strategy: Offloads $48.29M In Vertex Stock

Revealing a significant insider sell on October 7, Jeffrey Westphal, 10% Owner at Vertex VERX, as per the latest SEC filing.

What Happened: Westphal’s decision to sell 1,225,000 shares of Vertex was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $48,289,500.

During Tuesday’s morning session, Vertex shares down by 0.02%, currently priced at $40.98.

Get to Know Vertex Better

Vertex Inc is a provider of tax technology and services. Its software, content, and services help customers stay in compliance with indirect taxes that occur in taxing jurisdictions all over the world. Vertex provides cloud-based and on-premise solutions to specific industries for every line of tax, including income, sales, consumer use, value-added, and payroll. The company offers solutions such as tax determination, Tax Data Management, document management, and compliance and reporting among others. The company derives revenue from software subscriptions.

Understanding the Numbers: Vertex’s Finances

Revenue Growth: Vertex displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 15.33%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Key Profitability Indicators:

-

Gross Margin: The company maintains a high gross margin of 63.74%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Vertex’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.03.

Debt Management: With a high debt-to-equity ratio of 1.51, Vertex faces challenges in effectively managing its debt levels, indicating potential financial strain.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: Vertex’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 315.31.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 10.4 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 75.72, Vertex demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Exploring Key Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Vertex’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

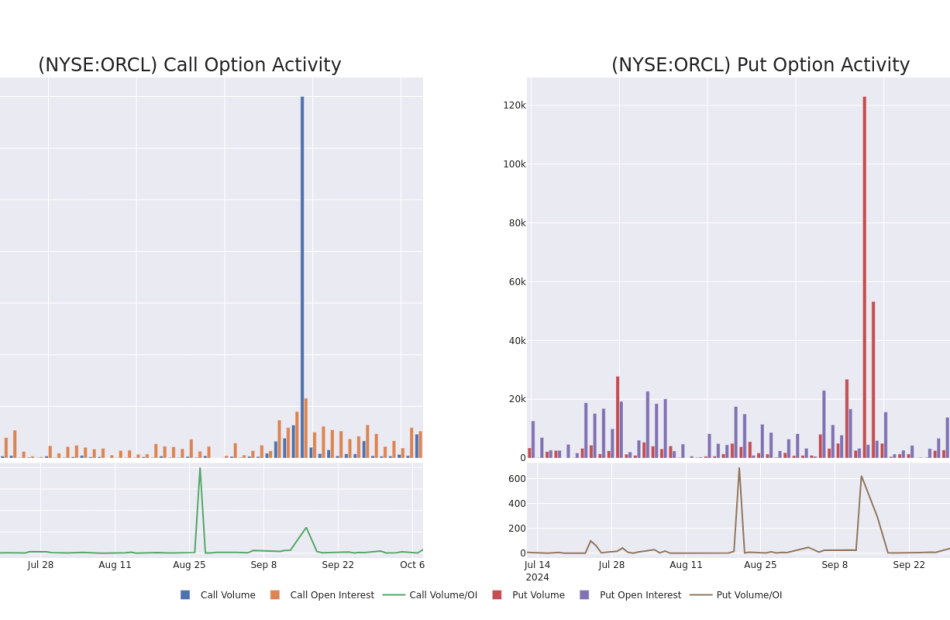

Decoding Oracle's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Oracle. Our analysis of options history for Oracle ORCL revealed 31 unusual trades.

Delving into the details, we found 54% of traders were bullish, while 32% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $496,018, and 26 were calls, valued at $2,152,301.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $240.0 for Oracle over the last 3 months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 2580.0 with a total volume of 47,926.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oracle’s big money trades within a strike price range of $105.0 to $240.0 over the last 30 days.

Oracle Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BULLISH | 12/20/24 | $7.5 | $7.45 | $7.5 | $180.00 | $375.0K | 6.7K | 862 |

| ORCL | CALL | TRADE | BEARISH | 10/18/24 | $2.98 | $2.94 | $2.94 | $172.50 | $362.2K | 2.0K | 5.4K |

| ORCL | PUT | TRADE | BEARISH | 01/17/25 | $6.9 | $6.8 | $6.9 | $165.00 | $345.0K | 807 | 517 |

| ORCL | CALL | TRADE | BULLISH | 10/18/24 | $3.05 | $2.92 | $3.05 | $172.50 | $152.1K | 2.0K | 6.6K |

| ORCL | CALL | TRADE | BULLISH | 01/16/26 | $19.75 | $19.6 | $19.75 | $190.00 | $98.7K | 289 | 51 |

About Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company’s own performance.

Oracle’s Current Market Status

- With a trading volume of 3,778,763, the price of ORCL is up by 1.84%, reaching $173.09.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 62 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Agriculture Market to Witness Massive Growth at $29.65 Billion by 2031, Report by SkyQuest Technology

Westford, USA, Oct. 08, 2024 (GLOBE NEWSWIRE) — Global Smart Agriculture Market size is poised to grow from USD 14.34 Billion in 2023 to USD 29.65 Billion by 2031, growing at a CAGR of 9.51% in the forecast period 2024 to 2031. The smart agriculture market has huge potential in affecting the agriculture industry. Farmers can enhance productivity, reduce costs, and ensure food security by using advanced technologies to optimize resource usage and make better decisions. Real-time data on crop health, soil and weather conditions and pest infestations enables farmers to act in a timely manner, optimize resource usage, and reduce losses. The data-driven approach enhances productivity and reduces waste, contributing to more sustainable farming. Moreover, the market for smart agriculture is highly affected by regulation. Different regulations in various regions and countries affect how smart agriculture technologies are used and implemented.

However, the role of regulation in the smart agriculture market seems to be beneficial. Government regulations impact and encourages the use of smart agriculture that can be highly beneficial for the industry players and the consumers of technology alike. Often, big initial costs required to invest in smart agriculture technologies can be offset by the government through financial arrival or subsidies. Thus, the role of regulation can be beneficial in the smart agriculture market.

Request Sample of the Report: https://www.skyquestt.com/sample-request/smart-agriculture-market

Smart Agriculture Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $14.34 Billion |

| Estimated Value by 2031 | $29.65 Billion |

| Growth Rate | Poised to grow at a CAGR of 9.51% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Agriculture Type, Offering, Firm Size, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, and the Rest of the world |

| Report Highlights | Rise of holographic communication to get better immersive interaction |

| Key Market Opportunities | Growing Acceptance of Data Driven Decision Taking in Agriculture Sector |

| Key Market Drivers | Progressive Government Initiative and Legislature |

Increasing Initiatives of Government to Encourage Agricultural Modernization to Rise Acceptability for Smart Agriculture

Governmental authorities worldwide incentivize smart farming with subsidies and grants, which encourage agricultural modernization and, consequently, food security. The worldwide trend of modernizing the agriculture sector has resulted in the creation of numerous policies, subsidies, tax incentives, and grants aimed at stimulating agricultural activities and shedding light on farmers’ financial burdens. These measures stimulate utilization and financing of advanced technologies and result in sustainable and efficient farming. Innovations are essential as governmental organizations pursue increased productivity and resilience in agriculture, as well as ensuring food sustainability. Government initiatives in developing countries cater to maximize the productivity of the farming sector, which in turn is expected to drive smart agriculture market trends.

Rising Adoption of Big Data to Gain Better Agricultural Information to Rise Demand for Smart Agriculture Market

As smart farming utilizes big data for analysing different processes such as crop growth, soil quality and condition, pests, and even yield forecasting, operations are performed with the help of big data analytics. With the help of analytical tools, various data is gathered, and decisions are made. Farmers strategically run their operations using data-driven insights and, as a result, operations are optimized and improved, bringing higher efficiency and, therefore, greater profitability. Additionally, it ensures that resources are allocated more adequately as well as properly managing farming, avoiding the risks, and driving better agricultural outcomes. Currently, manufacturers are focusing on promoting sensors of the highest technological characteristics to support the most efficient monitoring and decision-making processes. In addition, many farmers choose to use precision farming, and many technology developers form alliances to help farmers get more devices and applications that are effective for their work.

Collaboration Between Private Players and Government Facilities to Improve Smart Agriculture to Propel Market Growth on North America

North America is dominating the global smart agriculture market. The growing government initiatives and the regulations that are imposed for improving the agriculture industry in the region are anticipated to drive the North American regional demand. Various agricultural organizations have come together to form North America Climate Smart Agriculture Alliance. It serves as a platform for educating and equipping the cultivators for sustainable productivity in agriculture. Water conservation is a concern, and the governments in North America are providing subsidies to enhance the smart irrigation application. Another driving factor for growth in this region is the increasing agreements and partnerships among several market players and government agencies to deploy the concept of smart agriculture. Additionally, this region’s governments are offering subsidies and tax incentives to develop the market for smart agriculture. All these factors drive the growth of the market for smart agriculture in North America.

Is this report aligned with your requirements? Connect for Purchase Related Inquiry: https://www.skyquestt.com/buy-now/smart-agriculture-market

Smart Agriculture Market Insights

Drivers

- Growing adoption of technology in the farming sector

- Progressive government initiatives

- High demand for sustainable agriculture

Restraints

- High initial cost of implementation

- Lack of skilled labour

- Poor infrastructure and connectivity

Key Players Operating in the Smart Agriculture Market

- CropMetrics

- CLAAS KGaA

- Ag Leader Technology

- AgJunction, Inc.

- Autonomous Solutions, Inc.

- BouMatic Robotic B.V.

- Deere & Company

- DroneDeploy

- Farmers Edge Inc

- Topcon Corporation

- Raven Industries

- Trimble Inc.

Key Questions Answered in Smart Agriculture Market Report

- What are the major driving factors of smart agriculture market?

- Which is the fastest growing region in the smart agriculture market report?

- Who are the key players in smart agriculture market?

This report provides the following insights:

Analysis of key drivers (Growing adoption of technology in the farming sector and Progressive Government Initiatives), restraints (High initial cost of implementation and Poor Infrastructure and Connectivity), opportunities (Growing Acceptance of Data Driven Analysis and Decision Implementation in Agriculture Sector), and challenges (Concerns Lack of Skilled Labour) influencing the growth of Smart Agriculture market

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/smart-agriculture-market

- Market Penetration: Comprehensive information on the product offered by the top players in the Smart Agriculture market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the Smart Agriculture market

- Market Development: Comprehensive information on emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Report:

Electronic Chemicals and Materials Market: Global Opportunity Analysis and Forecast, 2024-2031

Polymer Foam Market: Global Opportunity Analysis and Forecast, 2024-2031

Fly Ash Market: Global Opportunity Analysis and Forecast, 2024-2031

Agricultural Surfactants Market: Global Opportunity Analysis and Forecast, 2024-2031

Green Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia-Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.