3 Magnificent S&P 500 Dividend Stocks Down 11% to 18% to Buy and Hold Forever

It’s difficult to find many people complaining about the S&P 500‘s strong performance in 2024. Extending the 24% climb that it recorded in 2023, the index has soared about 20% year to date.

But not every member of the index has fared so well. PPG Industries (NYSE: PPG), SJW Group (NYSE: SJW), and Archer-Daniels-Midland (NYSE: ADM) have all dipped lower since the start of the year. PPG and SJW are down 14% and 11%, respectively, while Archer-Daniels-Midland has sunk 18%. Consequently, all three dividend stocks — Dividend Kings, in fact — are trading at attractive valuations, providing great buying opportunities for both value and income investors alike.

PPG painted a less pretty picture for 2024, but don’t let that distract you

A provider of paints, coatings, and other specialty materials, PPG frustrated investors in July when it slashed its 2024 profitability outlook. During its second-quarter 2024 earnings presentation, PPG provided a less-robust adjusted earnings-per-share (EPS) outlook of $8.15 to $8.30 than its original adjusted EPS guidance of $8.34 to $8.59. Further motivating investors to click the sell button on PPG, several analysts slashed their price targets in July.

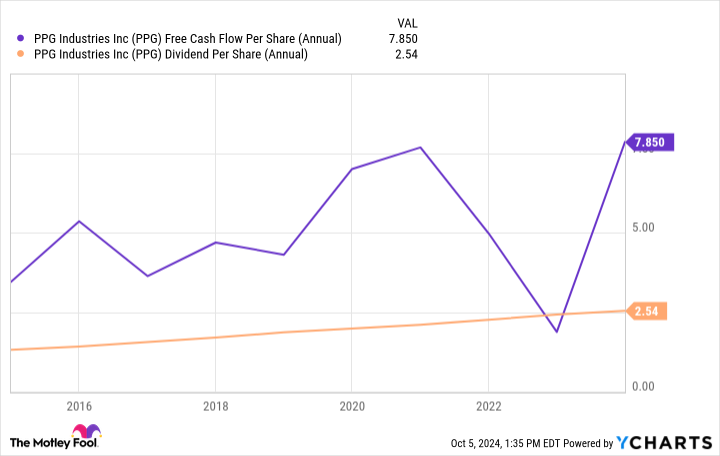

While the dog days of summer took a bite out of PPG stock, its allure for long-term investors is undeniable. For one, the company has amassed a string of 52 consecutive years of dividend increases — that’s no small accomplishment. And it’s not as if the company has jeopardized its financial health while boosting its payout. PPG consistently generates strong free cash flow from which it can source its dividend.

The company’s five-year average payout ratio of 44% further suggests that management takes a judicious approach to returning capital to shareholders.

Dip your toes in a water utility investment with SJW

Accruing even a little investing experience will likely provide some excitement. Will that excitement come from water utility stocks like SJW Group? Probably not. And that’s just fine for patient investors looking to build reliable passive income streams. There’s nothing glamorous like leading tech stocks or thrilling like innovative pharmaceutical treatments with SJW Group, which simply provides water and wastewater treatment. The water utility primarily operates in regulated markets, which represented about 95% of net income in 2023. As such, the company enjoys guaranteed rates of returns, providing management with excellent foresight into future cash flows — foresight which helps to plan for capital expenditures like acquisitions and dividend increases. SJW Group’s commitment to growth through acquisitions is clear. From 2010 to 2023, SJW Group completed more than 25 acquisitions, which led to 72% growth in its customer base.

With 80 consecutive years of dividend payments under its belt and 56 consecutive years of dividend increases, it’s undeniable that rewarding shareholders is inherent in the company culture, and the increases aren’t nominal. Over the past five years, SJW Group has raised its dividend at a compound annual growth rate of more than 6%.

Time to feast on Archer-Daniels-Midland stock

It wasn’t a very auspicious start to the new year for Archer-Daniels-Midland thanks, in part, to a shake-up in the C-suite, yet shares have pared back some of their losses from a 23% decline in January. Unsurprisingly, the turmoil resulting from the removal of the CFO and the accounting investigation eroded some investor confidence in the company, but it hardly indicates that the stock cannot see a return to growth. With a history that stretches 122 years, Archer-Daniels-Midland has overcome its share of challenges and emerged as a leading agriculture stock, which addresses the nutrition needs of both people and pets alike.

There’s no guarantee the company will continue to prosper solely based on its lengthy history, but it certainly provides investors with some confidence that it has the resilience to surmount the challenges it has recently encountered. Meanwhile, the appointment of a new CFO should also help the company to regain investor confidence after the recent accounting investigation.

Projecting 2024 adjusted EPS of $5.25 to $6.25, management is guiding for a year-over-year decline in profitability since the company booked adjusted EPS of $6.98 in 2023. While this may scare short-term investors away, those committed to buying and holding the stock for the long term shouldn’t be frightened.

Should you embrace these dividend darlings today?

Currently, PPG, SJW, and Archer-Daniels-Midland all feature attractive valuations, trading at discounts to their five-year operating-cash-flow multiples. For the most conservative investors, SJW and its 2.8% forward dividend yielding stock is a great choice considering its sizable operations in regulated markets. Those who can stomach some near-term volatility and have an appetite for higher yield will want to look at Archer-Daniels-Midland with its 3.4% forward dividend yield. While those interested in a specialty materials stock will want to dig into PPG and its 2.1% forward yielding stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,579!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,710!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,239!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

3 Magnificent S&P 500 Dividend Stocks Down 11% to 18% to Buy and Hold Forever was originally published by The Motley Fool

Three-Wheeler Market Size to Reach USD 24,695.23 Million by 2033 | Straits Research

New York, United States, Oct. 09, 2024 (GLOBE NEWSWIRE) — Three-wheelers are automobiles with three wheels. Some are tricycles with motors, technically considered motorbikes, while others are unpowered tricycles, some of which are animal- and human-powered. Typically, three-wheelers are used as commercial transportation for both persons and goods. Maneuverability, cost, and delivery to the door determine mobility on three wheels. In many developing nations, especially Asia-Pacific and LAMEA, three-wheeled vehicles are the most cost-effective and time-efficient option for public and goods transportation.

Download Free Sample Report PDF @ https://straitsresearch.com/report/three-wheeler-market/request-sample

Market Dynamics

The Adoption of Electric Three-Wheelers and Trend of Last Mile Connectivity to Drive the Global Three-Wheeler Market

For the past years, one of the primary concerns of governments and environmentalists has been the continuously increasing global carbon emissions from fossil fuels. This, in turn, raises the global demand for electric three-wheelers, contributing to the market’s growth. Additionally, the global popularity of electric three-wheelers has increased due to the increase in global fuel prices, pollution, and urban traffic congestion.

In March 2019, the taxi industry behemoth Ola debuted an entire fleet of Bajaj and Piaggio autorickshaws in the Liverpool area to rival Uber. Moreover, the relatively higher operating and maintenance expenses of gasoline/compressed natural gas (CNG) and diesel-powered three-wheelers lead to a shift in preference for electric three-wheelers for shorter transits, stimulating market expansion. As the last mile connection solution, many e-commerce, pharmaceutical, textile, retail, FMCG, and other utility categories, such as dairy, poultry, and gas, favor three-wheelers due to their exceptional agility and inexpensive cost.

An Indian company, for example, employs electric three-wheelers to deliver goods to e-commerce and food tech companies such as Amazon, Swiggy, and Bigbasket. In addition, governments in several nations are eager to electrify their last-mile delivery fleets due to their extra benefits. In 2018, the Delhi Metro launched electric vehicles to boost the last-mile connection between metro stations. Electric cars are more cost-effective than conventional three-wheelers in terms of overall maintenance and operating costs. As a result, the demand for electric three-wheelers is expanding. Numerous leading companies are attempting to minimize the initial cost of electric three-wheelers through the efficient integration of modern technology, design, and workflow. This also predicts the need for three-wheelers as a last-mile connection option.

The trend of Shared Mobility to Create Global Three-Wheeler Market Opportunities

Shared mobility services reduce traffic in metropolitan areas and automotive emissions overall. Therefore, digitally enabled ride-hailing and car sharing efficiently manage transportation needs and provide a convenient and environmentally friendly alternative to private vehicle ownership. This sharing and ride-hailing activity may be managed through a single mobile application, from trip planning to payment. Ride-hailing services are anticipated to play a crucial role in this industry in the coming years because they minimize manual work and reduce total time and cost. Due to this trend, it is anticipated that the market for three-wheeled vehicles will continue to expand.

Regional Insights

The Asia Pacific will likely command the regional market while developing at a CAGR of 10.75%. The increasing need for inexpensive commercial vehicles with low production costs, an expansion in production capacity, and an increase in demand for actual light cars are some factors driving the growth of the three-wheeler market in this region. Automakers are actively involved in producing innovative products to meet consumer expectations in this region. As a result of increased auto sales and fast industrialization, the three-wheeler market is anticipated to expand.

Electric three-wheelers are becoming more popular in Asia than conventional three-wheelers due to their lightweight, environmental friendliness, reduced electricity use, and affordability. In addition, the region’s demand for electric three-wheelers is anticipated to increase due to initiatives for environmentally friendly automobiles and the building of related infrastructure by several governments, including India. China has reinforced its industry by earning a profit on the supply side of present and projected three-wheeler output. The region’s growing reliance on electric mobility will impact both the supply and demand sides of the electric three-wheeler market.

The increasing use of electric three-wheelers in Europe is due to their popularity as recreational vehicles and exceptional maneuverability. In response to growing environmental concerns, the European government and environmental authorities are enacting stringent emission regulations and laws, raising the market for electric three-wheelers in Europe. The European Union (EU) promised to reduce greenhouse gas emissions by 20% by 2020 as part of the second phase of the Kyoto Protocol. In addition, the EU intends to achieve its objective of zero greenhouse gas emissions by 2050.

In addition, many taxi companies are replacing their fleets with electric three-wheeled vehicles. In March 2019, the taxi operator Ola debuted an entire fleet of Bajaj and Piaggio autorickshaws in the Liverpool area to rival Uber. Plans call for these activities to increase the region’s demand for three-wheelers. France is one of the best investment areas for automobile manufacturers and their suppliers. The rise of the three-wheeler sector in France, which now accounts for 20% of all light cars built in Europe and is forecast to produce nearly half as many vehicles annually as the United States, is facilitated by solid infrastructure and government spending.

To Gather Additional Insights on the Regional Analysis of the Three-Wheeler Market @ https://straitsresearch.com/report/three-wheeler-market/request-sample

Competitive Players

- Bajaj Auto Ltd

- Piaggio & C. SpA

- Atul Auto Limited

- Chongqing Zongshen Tricycle Manufacture Co. Ltd

- JS Auto Pvt Ltd

- Kinetic Green Energy & Power Solutions Ltd

- Mahindra & Mahindra Ltd

- Scooters India Limited

- Terra Motors Corporation

- TVS Motor Company

- Euler Motors

- Others

Recent Developments

- March 2024 – Tanzania marked the introduction of TRí’s next-generation electric three-wheeler. In Tanzania, three-wheelers with internal combustion engines are a common form of transportation. Tanzania is home to an estimated 250,000 ICE three-wheelers, and TRí aims to spearhead the sector’s electric transition.

- August 2024 – Mahindra launched a new electric three-wheeler – Mahindra E-Alpha Plus. The new E-Alpha Plus electric three-wheeler has been designed to run on both urban and rural roads. The new Mahindra E-Alpha Plus has been designed for daily use. A 150-ampere lead acid battery has been added to this electric motor.

Analyst Opinion

As per our analyst, companies should emphasize the development of electric vehicles (EVs) to match global sustainability trends and government incentives to effectively traverse the global three wheeler industry. It is imperative to focus on developing markets in Asia-Pacific, Africa, and Latin America due to the swift urbanization and increasing need for reasonably priced transportation options in these countries.

For example, forming local alliances will help enter the market and build community trust, and tailoring cars to fit local requirements will make them more appealing. Ensuring operational efficiency and fostering client loyalty requires a strong after-sales service network.

Moreover, businesses that invest in battery technology and charging infrastructure will be well-positioned to benefit from the rapid shift to electric mobility, which will ultimately spur sustainable growth and competitiveness in this rapidly growing sector.

Segmentation

- By Fuel Type

- Petrol/ CNG

- Diesel

- Electric

- By Vehicle Type

- Passenger Carrier

- Load Carrier

- By Configuration

- Two Front Wheels

- Two Rear Wheels

- By Engine Location

- Front Engine

- Rear Engine

- By Region

- North America

- Europe

- APAC

- LATAM

- MEA

Get Detailed Market Segmentation @ https://straitsresearch.com/report/three-wheeler-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

For more information on your target market, please contact us below:

Phone: +1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

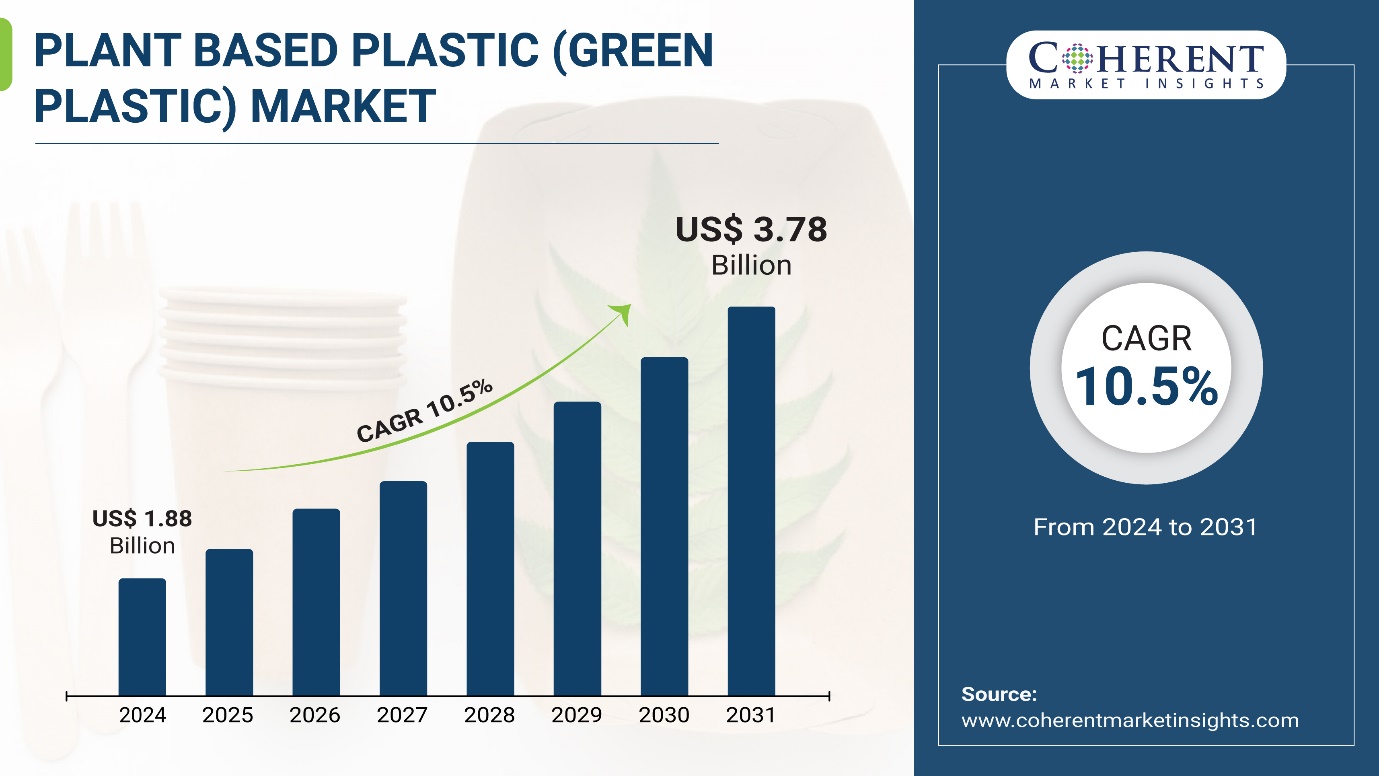

Plant-Based Plastic Market to hit $3.78 billion by 2031, growing at a CAGR of 10.5%, says Coherent Market Insights

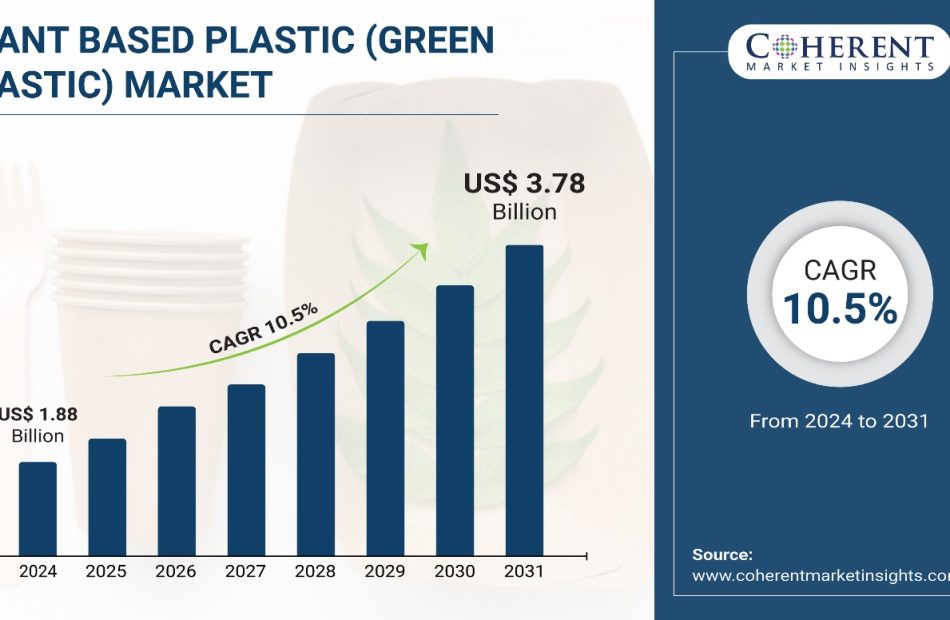

Burlingame, Oct. 09, 2024 (GLOBE NEWSWIRE) — The global plant-based plastic Market, valued at 1.88 billion dollars in 2024, is on a trajectory of rapid expansion, with projections indicating it will soar to 3.78 billion dollars by 2031, as per a recent report by Coherent Market Insights. Plant-based plastics help reduce plastic pollution and carbon footprint as they are derived from renewable plant sources like sugarcane, cassava, corn, etc. through fermentation process. Furthermore, leading companies are increasingly investing in R&D to develop novel plant-based biomaterials with properties comparable to petroleum-based plastics in order to replace fossil fuel-based plastics.

Request Sample of the Report on Plant-Based Plastic Market Forecast 2031: https://www.coherentmarketinsights.com/insight/request-sample/7368

Market Dynamics

There is a big problem with plastic pollution hurting to our planet. To help, people are looking for alternatives to plastics made from oil. Plant-based plastics are a great solution to this problem. Companies can use natural sources such as sugarcane, cassava, corn starch, and wood. These plastic are good for the Earth because they break down easily and can be reused.

The government is also helping by making rules to reduce plastic use and promote eco-friendly plastics. For instance, as per Library of Congress, in July 2021, European Union banned some single use plastics. This means companies will make more plant-based plastics, which is great news for the environment.

Plant-Based Plastic (Green Plastic) Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $1.88 billion |

| Estimated Value by 2031 | $3.78 billion |

| Growth Rate | Poised to grow at a CAGR of 10.5% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Source of Raw Material, By Type, By End-use Industry |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing environmental awareness • Increasing concern about plastic waste and pollution |

| Restraints & Challenges | • High production costs • Limited availability of raw materials |

Market Trends

Rising regulation on single use plastic will increase the demand for biodegradable and compostable plastic. Many companies use plastics to package food, drinks, medicines, and personal care products. But the extensive use of plastic will lead to hurt the planet. The government is framing various policies to decrease the usage of single use plastic.

Companies like Coca-Cola, Pepsi, and Unilever are using these plant-based plastic. They are using plant based plastics like PHA and PLA. These plastics comes from natural sources and can be break down easily.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7368

Automotive industry is going green! They are using plant based plastics to make cars more eco-friendly. Plant-based plastics are super lightweight, strong, and flexible. This helps car be more fuel-efficient and reduce pollution. Car parts like dashboard, door panels, and seats are made from these plastics. Even EV are using bio-based plastics to reduce waste and help environment to go green.

Corn Starch segment currently dominates the source of raw material segment in the market. Corn starch is widely available and the production process using is relatively simple compared to other sources. Sugarcane, cassava and other raw materials segments to witness notable growth from 2024-2031.

PLA or polylactic acid currently dominates the type segment for plant based plastics. Good mechanical strength and biodegradability make PLA a preferred alternative to fossil fuel-based plastics. The PHA or polyhydroxyalkanoates segment to emerge as a high growth segment in upcoming decades. Other types such as starch-based plastic are also gaining traction in the market.

The packaging industry dominates the end-use segment for plant based plastics. Growing consumer demand for sustainable and environment-friendly packaging solutions driving demand. The textile and automotive & transport industries also account for notable share over the forecast period. Other end-use industries such as electronics, coatings & adhesives and agriculture & horticulture offer promising growth prospects.

North America currently holds the leading share in the global plant based plastic market. Stringent environmental regulations about waste management and use of conventional plastics in the US and Canada are driving market growth. Europe and Asia Pacific also provide considerable growth opportunities. This is owing to supportive government policies encouraging use of bio-based and biodegradable materials in these regions.

Key Market Takeaways

Rapid shift towards sustainable material alternatives to mitigate environmental concerns drives market growth.

By source of raw material, corn starch segment to hold a dominant position, owing to its plenty and simpler production process.

By type, PLA segment will hold a dominant position over the forecast period,. This due to its favorable mechanical and biodegradable properties.

By end-use industry, the packaging segment will dominate the market. This is owing to growing demand for sustainable packaging solutions.

Regionally, North America will take dominant position over the forecast period. It backed by supportive environmental regulations.

Key players in the market include Corbion, BASF, TotalEnergies Corbion, Mitsubishi Chemical Corporation among others. They are focusing on new product launches and capacity expansions to merge their market positions.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7368

Plant-Based Plastic Industry News

In March 2024, Beyond Plastic, manufacturer of biodegradable plastic, announced partnership with CJ Biomaterials.

In February 2024, Balrampur Chinni Mills Ltd., a major India based sugar and ethanol producer, announced a significant investment of US$ 267 million in bioplatics industry.

Detailed Segmentation

Source Of Raw Material Insights (Revenue, USD Bn, 2019 – 2031)

- Corn Starch

- Sugarcane

- Cassava

- Others (Soy, Potato, Algae, etc.).

Type Insights (Revenue, USD Bn, 2019 – 2031)

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Starch-Based Plastics

- Other

End-use Industry Insights (Revenue, USD Bn, 2019 – 2031)

- Packaging

- Textile

- Automotive & Transport

- Electronics & Electricals

- Coatings & Adhesives

- Agriculture & Horticulture

- Others (Building & Construction, etc.)

Regional Insights (Revenue, USD Bn 2019 – 2031)

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Polymers and Resins Domain:

Global Biodegradable Plastics Market size was valued at US$ 2.23 Billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 13.4% from 2023 to 2030.

Global BRIC automotive plastics market was valued at US$ 23,642.09 Mn in 2021 in terms of revenue, exhibiting a CAGR of 8.5% during the forecast period (2022 to 2030).

Global polycaprolactone market is projected to reach around US$ 402.7 million by the end of 2027, in terms of revenue, growing at CAGR of 11.2% during the forecast period (2019-2027).

Global recycled plastic granules market is expected to reach US$ 3.96 Billion by the end of 2030, in terms of revenue, exhibiting a CAGR of 3.3% during the forecast period (2022 to 2030).

Global plastic resins market is estimated to be valued at USD 833.98 Bn in 2024 and is expected to reach USD 1,127.35 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 4.4% from 2024 to 2031.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Examining the Future: Aehr Test Systems's Earnings Outlook

Aehr Test Systems AEHR will release its quarterly earnings report on Thursday, 2024-10-10. Here’s a brief overview for investors ahead of the announcement.

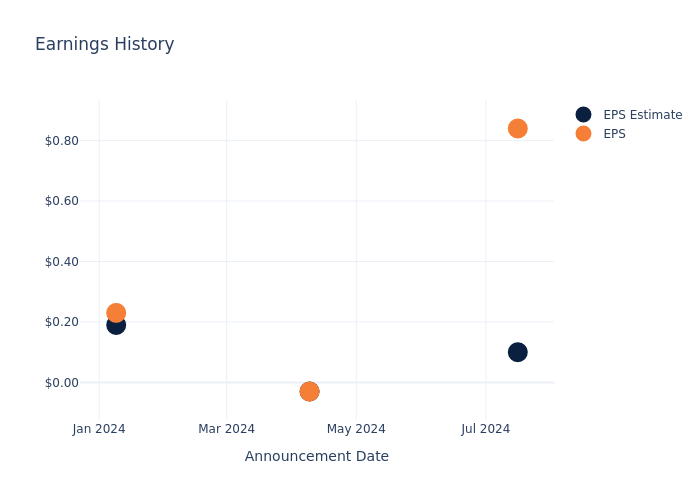

Analysts anticipate Aehr Test Systems to report an earnings per share (EPS) of $0.01.

Aehr Test Systems bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

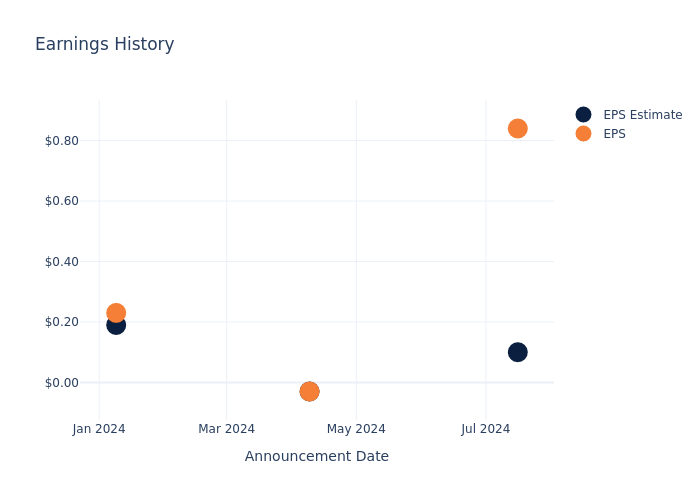

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.74, leading to a 22.39% increase in the share price on the subsequent day.

Here’s a look at Aehr Test Systems’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.10 | -0.03 | 0.19 | 0.16 |

| EPS Actual | 0.84 | -0.03 | 0.23 | 0.18 |

| Price Change % | 22.0% | -2.0% | -17.0% | -13.0% |

To track all earnings releases for Aehr Test Systems visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Americans Expected to Reduce Calorie Intake by Trillions as GLP-1 Usage Rises, According to New Study

NEW YORK, Oct. 09, 2024 (GLOBE NEWSWIRE) — Calorie consumption is expected to decline by approximately 10 trillion kcal annually across the US’s adult population by 2030, according to a new report by Impact Analytics™, the pioneer in AI-powered planning, promotional, and pricing solutions for the retail, grocery, manufacturing, and CPG industries. The study also finds that healthy food categories have increased by 5-8.7% in overall unit sales across the U.S. year-over-year (2022-2023, 2023-2024). Regionally, stores in states across the Midwest have seen the highest growth in healthy food sales, between 10 and 22% on average, while the Northeast has shown the most pronounced shift away from unhealthy options, with a reduction by between 0.5 and 5%.

Demand is forecast to increase for fresh produce and organic products, plant-based offerings, dairy alternatives, and protein substitutes and has already shown growth in sales. Fresh fruits have seen a 12.4% increase in unit sales growth year-over-year (2023-2024), while fresh vegetables have seen a 9.2% increase in sales growth over the same period.

“With GLP-1 usage for weight loss rising rapidly and calorie consumption in the U.S. expected to decline for the first time since the 1960s, healthier food sales will continue to accelerate,” said Prashant Agrawal, Founder and CEO, Impact Analytics. “Many grocers are already seeing these shifts with higher revenue growth and increased unit sales. As many industries and sectors across the country grapple in various ways with GLP-1-driven changes in both the sizes and appetites of Americans, grocers will be on the front line of this transformation and should be prepared with new buying, pricing, and inventory strategies. This trending shift towards healthier options and distaste for unhealthy, processed foods will change the way grocers merchandise their shelf space.”

As more people adopt a healthier lifestyle, total calorie consumption is expected to decline for the first time since the 1960s. Today, the average person in the U.S. consumes 3,600 calories per day. According to the forecast by Impact Analytics, that number is expected to decrease by 2030 to between 2,800 and 3,500, resulting in a nearly 10 trillion kcal reduction across most of the adult population in the U.S.

For more information or to download the full report, please click here.

ABOUT IMPACT ANALYTICS

Impact Analytics offers a holistic suite of solutions to help retailers and brands future-proof their businesses using predictive analytics. With tools for planning, forecasting, merchandising and pricing, Impact Analytics enables retailers to make smart data-based decisions rather than relying on last year’s figures to forecast and plan this year’s business. The company also offers tools to automate functions the industry has long managed manually by spreadsheet and to unify and streamline reporting, so executives can rely on a single source of truth when making decisions. The company has been pioneering and perfecting the use of AI in retail forecasting, planning and operations for nearly a decade. Impact Analytics was founded and is led by Prashant Agrawal, a former senior consultant at McKinsey and Boston Consulting Group and current Adjunct Professor at Columbia University who teaches about the use of AI in retail.

To learn more, visit Impact Analytics and follow us on LinkedIn.

Media Contact

Berns Communications Group

Danielle Poggi

dpoggi@bcg-pr.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

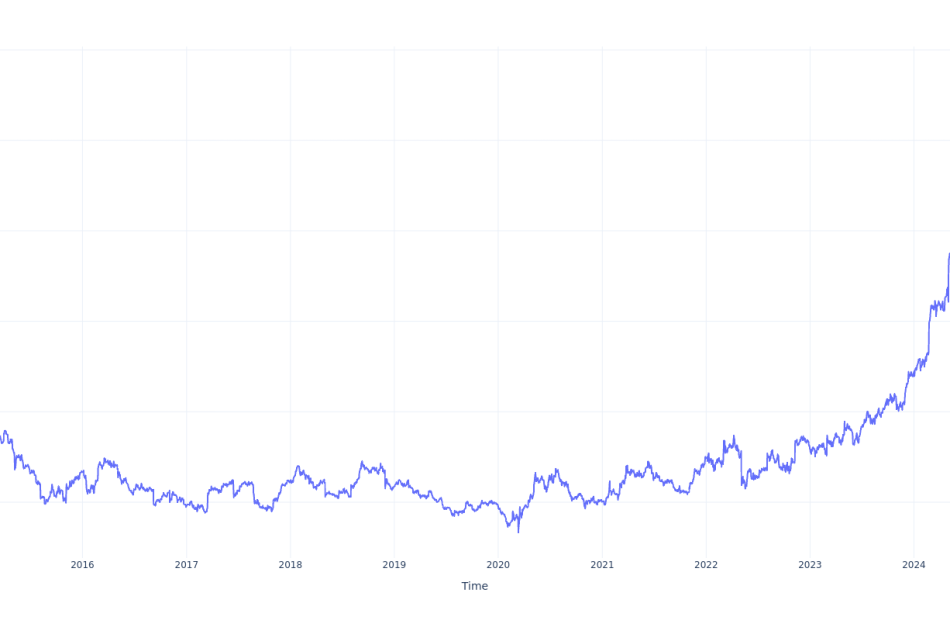

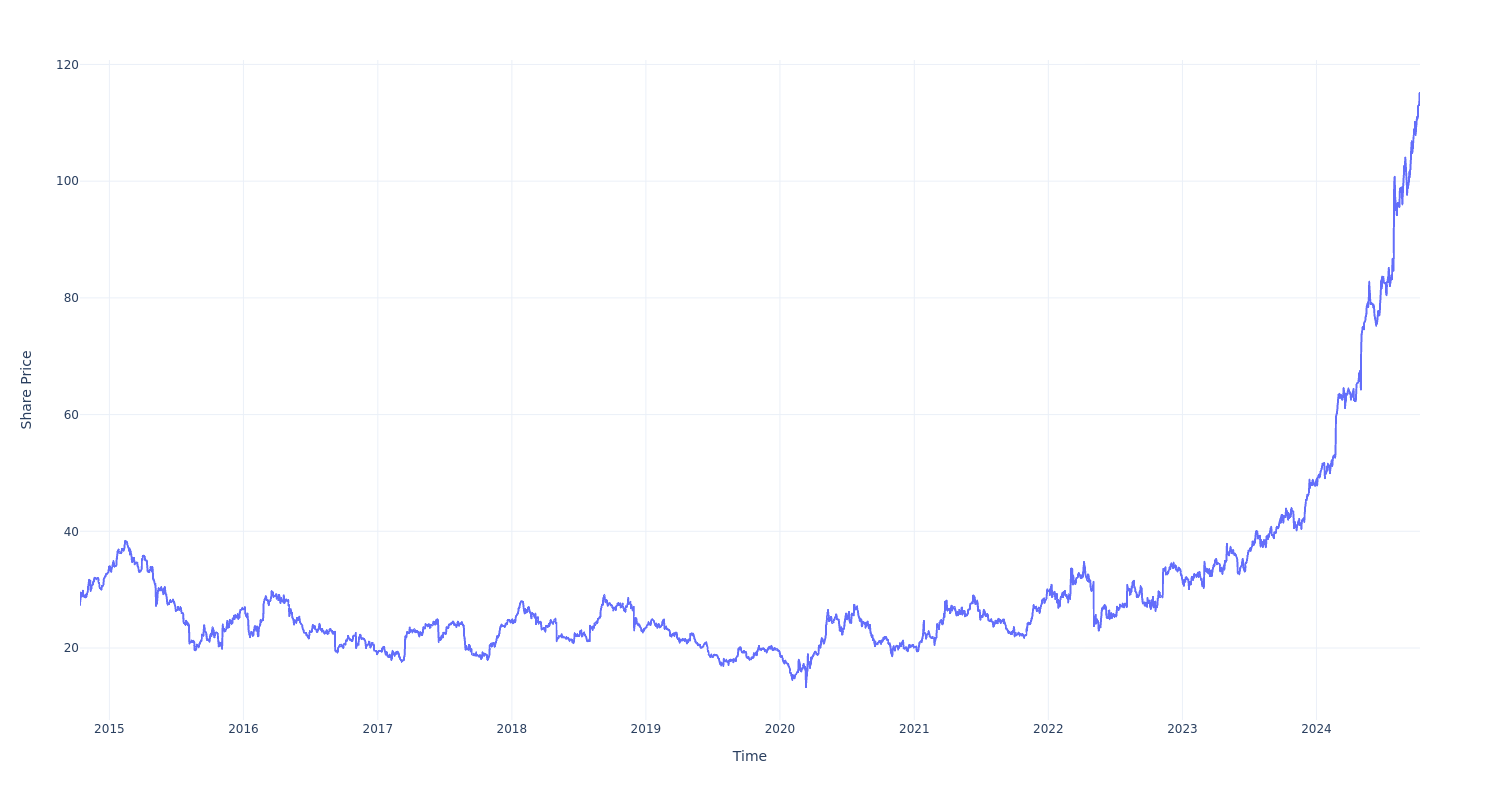

Here's How Much You Would Have Made Owning Sprouts Farmers Market Stock In The Last 10 Years

Sprouts Farmers Market SFM has outperformed the market over the past 10 years by 3.05% on an annualized basis producing an average annual return of 14.93%. Currently, Sprouts Farmers Market has a market capitalization of $11.39 billion.

Buying $1000 In SFM: If an investor had bought $1000 of SFM stock 10 years ago, it would be worth $4,153.28 today based on a price of $113.80 for SFM at the time of writing.

Sprouts Farmers Market’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMERICAS GOLD AND SILVER TO CONSOLIDATE THE GALENA COMPLEX IN TRANSACTION WITH ERIC SPROTT;PAUL ANDRE HUET TO BE APPOINTED CHAIRMAN AND CHIEF EXECUTIVE OFFICER

/FOR DISTRIBUTION IN THE UNITED STATES/

TORONTO, Oct. 9, 2024 /PRNewswire/ – Americas Gold and Silver Corporation USA USAS (“Americas” or the “Company”) is pleased to announce that it has entered into a binding agreement (the “Definitive Agreement”) with an affiliate of Eric Sprott (“Sprott”) and Paul Andre Huet under which Americas will acquire the remaining 40% interest in the Galena Complex (“Galena”) in Idaho, USA to consolidate the current Galena joint venture (the “Acquisition”).

Upon the closing of the Acquisition, Paul Andre Huet will be appointed Chairman and Chief Executive Officer of the Company. Darren Blasutti will remain as President.

The Company also announces that it has entered into an agreement to complete a bought deal private placement financing of subscription receipts of the Company (the “Subscription Receipts”) to raise gross proceeds of approximately C$40 million at an issue price of C$0.40 per Subscription Receipt (the “Concurrent Financing”).

The Company is also in advanced discussions with numerous lenders with respect to a debt financing to restructure Americas balance sheet and is in the process of evaluating indicative terms received. It is anticipated that the Company will enter into exclusive negotiations in the near-term with the intention of replacing existing debt facilities.

Key Transaction Highlights:

- Consolidation of Galena: Galena is located within the prolific Silver Valley in Idaho and is one of the largest underground, high-grade, operating silver mines in North America, having produced over 240 million ounces of silver with peak production in excess of five million ounces of silver per annum in the early 2000s. Consolidation of the joint venture will streamline operational and financial decision making, providing for a focused vision at Galena centered around optimizing and expanding the operation through the utilization of existing infrastructure. Galena is expected to be a long-term cornerstone asset supported by a robust reserve and resource base, excess mill capacity, and opportunity to grow through future exploration success both underground and potentially at surface where limited exploration drilling has been completed.

- Improved balance sheet: Proceeds from the Concurrent Financing and anticipated debt refinancing are expected to be utilized to deleverage the Company’s balance sheet, replace higher cost debt instruments, improve the Company’s overall cost of capital, cover transaction expenses, and importantly, advance a fully-funded plan to optimize and expand the Galena mining operations.

- Expanded leadership: Paul Andre Huet will be appointed Chief Executive Officer and Chairman of the Company following the close of the Acquisition. Mr. Huet has a proven track record, particularly in optimizing underground mines, and was most recently Chair and Chief Executive Officer of Karora Resources Inc. (“Karora”) prior to its business combination with Westgold Resources Limited, which valued Karora at over A$1.3 billion. Prior to Karora, he transformed Klondex Mines Ltd. (“Klondex”) from a single asset producer with no milling infrastructure to a multi-mine, multi-mill producer which was eventually sold to Hecla Mining Company for over C$600 million.

- Enhanced leverage to silver: With the recently announced project funding for the EC120 Project at the Cosalá Operations in Mexico and the consolidation of Galena, the Company’s production, operating margins and near-term growth potential are expected to steadily increase. Americas anticipates that approximately 80% of its revenue will be generated from silver starting in the second half of 2025, providing investors with an attractive North American-focused silver investment vehicle with leading exposure to silver.

- Eric Sprott to become cornerstone investor: Eric Sprott will become the largest shareholder of the Company, continuing his long-term support and endorsement of the substantial value potential of Galena. Eric Sprott was a cornerstone investor in Karora during the successful turnaround of operations by Mr. Huet through to the eventual sale of the Company.

- Attractive value proposition: Future execution related to the operational improvement and expansion at Galena as well as the development of EC120 at the Cosalá Operations are expected to enhance the value proposition of the Company and support a future re-rating of its shares.

“I am excited to consolidate the Galena Complex and want to thank Mr. Eric Sprott for his partnership in growing Galena to one of the largest, high-grade, silver mines in North America,” stated Darren Blasutti, Americas’ President and CEO. “I believe Paul Huet is the perfect executive to lead the Company during the exciting phase of growth. Mr. Huet has a proven track record as a mining executive having successfully delivered considerable shareholder value in his previous roles at both Karora and Klondex.”

“Americas represents a tremendous opportunity based on its impressive portfolio of assets in North America and I am excited for the opportunity to optimize these assets and deliver meaningful value to Americas shareholders,” stated Paul Andre Huet. “For the past nine months, I have acted as Sprott’s technical representative for the Galena JV and have witnessed firsthand both a tremendous team and resource base that has been undercapitalized due to a difficult silver price environment. I am confident that based on my team’s track record of unlocking the full potential of mining operations, we can accomplish this again and deliver significant value to Americas’ shareholders. I look forward to working with the Americas team to continue to build the Company into a leading North American-focused primary silver producer.”

“I remain confident in the value of the Galena Complex and look forward to continued exposure to this tremendous asset through my equity ownership in Americas Gold and Silver,” stated Eric Sprott. “I see substantial potential at the Galena Complex, particularly given the robust reserve and resource base, established infrastructure, and embedded growth potential. I have a long-standing respect and high regard for Paul, who has represented my interests in the Galena JV for the previous nine months. I believe Mr. Huet’s mining acumen and expertise in underground operations makes him the perfect leader to surface the inherent value of the Galena Complex, Cosalá Operations and other assets for the shareholders of Americas.”

Transaction Details

Under the terms of the Definitive Agreement, the owners of Sprott will receive 170 million common shares of Americas (the “Americas Shares”) (the “Share Consideration”) and US$10 million in cash (the “Cash Consideration”) on closing of the Acquisition. Based on the price of the Subscription Receipts (as defined below) of C$0.40, the Share Consideration represents C$68 million. In addition, Americas will provide owners of Sprott with monthly silver deliveries of 18,500 ounces for a period of 36 months starting in or around January 2026.

Americas also intends to issue up to C$4,000,000 of Americas Shares at a price of C$0.40 per Americas Share, on a non-brokered private placement basis, to one or more of the vendors in the Acquisition in conjunction with the Concurrent Financing and the Acquisition for bridge financing purposes (the “Concurrent Private Placement”). Closing of the Concurrent Private Placement is not conditional on closing of the Concurrent Financing or the Acquisition and closing of the Concurrent Financing or the Acquisition is not conditional on closing of the Concurrent Private Placement.

The Acquisition and the Concurrent Financing will be subject to the approval by a simple majority of the votes cast by shareholders of the Company. The Acquisition and the Concurrent Financing will also be subject to applicable regulatory approvals, including approvals from the Toronto Stock Exchange and NYSE American Exchange.

Upon completion of the Acquisition and the Concurrent Financing, existing Americas shareholders will own approximately 53% of the shares outstanding, Eric Sprott will own approximately 22%, Concurrent Financing participants will own approximately 19% and management and directors will own approximately 6%.

The Company expects to call a shareholder meeting in October/November for a meeting in December 2024.

Closing of the Acquisition is currently expected to occur prior to the end of the year.

Leadership and Governance

Capabilities of the key senior management team and Board of Directors of Americas will be enhanced by the addition of new members from the previous Karora senior executive team and Board of Directors, who have significant capabilities in underground mining operations and a proven track record of shareholder value creation. The new Board of Directors of the Company will consist of 50% new directors and 50% existing directors of Americas.

Board of Directors’ Recommendation and Voting Support

The Acquisition has been unanimously approved by the Board of Directors of Americas upon the recommendation of special committee of independent directors. The Board of Directors of Americas has recommended that shareholders of the Company vote in favour of the Acquisition. TD Securities Inc. (“TD Securities”) has provided an opinion to the Board of Directors of Americas, stating that, as of the date of its opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be paid under the Acquisition is fair, from a financial point of view, to Americas.

Directors and senior officers of Americas have entered into voting support agreements pursuant to which they have agreed, among other things, to vote their Americas Shares in favour of the Acquisition. Voting support agreements have also been received from several key Americas shareholders. These support agreements represent over 13% of the outstanding shares of the Company.

Concurrent Financing

Americas has entered into an agreement with a syndicate of underwriters (collectively, the “Underwriters”), in connection with a bought deal private placement offering of 100,000,000 Subscription Receipts at a price of C$0.40 per Subscription Receipt (the “Issue Price”) for gross proceeds to the Company of C$40 million. Americas has also granted the Underwriters an option to purchase up to an additional 10,000,000 Subscription Receipts at the Issue Price for additional gross proceeds of up to C$4 million (the “Option”) which will be exercisable, in whole or in part, at any time prior to closing of the Concurrent Financing. If the Option is exercised in full, the total gross proceeds of the Concurrent Financing will be C$44 million.

Each Subscription Receipt shall entitle the holder thereof to receive, upon satisfaction or waiver of the Escrow Release Conditions (as defined below), without payment of additional consideration, one Americas Share, subject to adjustments and in accordance with the terms and conditions of a subscription receipt agreement to be entered into upon closing of the Concurrent Financing (the “Subscription Receipt Agreement”). For the purposes of the Concurrent Financing and pursuant to the Subscription Receipt Agreement, the escrow release conditions include: (a) the satisfaction or waiver of all conditions precedent to the completion of the Acquisition in accordance with the Definitive Agreement, other than the issuance of the Share Consideration and the Cash Consideration; and (b) the receipt of all required board, shareholder, regulatory and exchange approvals in connection with the Concurrent Financing and Acquisition (the “Escrow Release Conditions”).

The gross proceeds from the sale of the Subscription Receipts, less certain expenses and fees of the Underwriters, will be deposited and held in escrow pending the satisfaction or waiver of the Escrow Release Conditions by the Company’s escrow agent, as subscription receipt and escrow agent under the Subscription Receipt Agreement.

If a Termination Event (as defined below) occurs, the escrowed proceeds of the Concurrent Financing will be returned on a pro rata basis to the holders of Subscription Receipts, together with the interest earned thereon, and the Subscription Receipts will be cancelled and have no further force and effect, all in accordance with the terms of the Subscription Receipt Agreement. For the purposes of the Concurrent Financing and pursuant to the Subscription Receipt Agreement, a “Termination Event” includes: (a) the Escrow Release Conditions having not been satisfied or waived prior to 5:00 p.m. (Toronto time) on February 27, 2025; and (b) the termination of the Definitive Agreement in accordance with its terms.

The Concurrent Financing is currently expected to close on or about October 30, 2024 and is subject to TSX, NYSE American and other necessary regulatory approvals. Following completion of the Acquisition, the net proceeds from the Concurrent Financing are expected to be used for growth initiatives at the Galena Complex, the payment of the Cash Consideration to Sprott, the repayment of certain of the Company’s existing indebtedness, the payment of transaction expenses and for working capital and general corporate purposes.

The Subscription Receipts will be offered by way of: (a) private placement in each of the provinces of Canada pursuant to applicable prospectus exemptions under applicable Canadian securities laws; (b) in the United States or to, or for the account or benefit of U.S. persons, by way of private placement pursuant to the exemptions from registration provided for under Rule 506(b) and/or Section 4(a)(2) of the U.S. Securities Act; and (c) in jurisdictions outside of Canada and the United States as are agreed to by Americas and the Underwriters on a private placement or equivalent basis.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States, Canada or in any other jurisdiction where such offer, solicitation or sale is unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or under any securities laws of any state of the United States, and may not be offered or sold, directly or indirectly, or delivered within the United States or to, or for the account or benefit of, a U.S. person or person in the United States, except in certain transactions exempt from the registration requirements of the U.S. Securities Act and any applicable securities laws of any state of the United States. “United States” and “U.S. person” are as defined in Regulation S under the U.S. Securities Act.

Advisors

Edgehill Advisory Ltd. and TD Securities Inc. are acting as financial advisors to Americas, and Torys LLP is acting as legal counsel to Americas in connection with the Acquisition.

Cormark Securities Inc. is acting as financial advisor to Sprott, and Bennett Jones LLP is acting as legal counsel to Sprott in connection with the Acquisition.

Conference Call and Webcast

Americas will host a conference call and webcast on Wednesday October 9, 2024 at 10:00 am EDT.

Conference Dail-in:

- Toll-Free: 1-888-788-0099;

- International: +1 (647) 374-4685

- Meeting ID: 889 7906 0120

Audio webcast:

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company owns and operates the Cosalá Operations in Sinaloa, Mexico, manages the 60%-owned Galena Complex in Idaho, USA, and is re-evaluating the Relief Canyon mine in Nevada, USA. The Company also owns the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR+ or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the Company’s material mining properties contained herein has been reviewed and approved by Chris McCann, P.Eng., Vice President, Technical Services of the Company. The Company’s current Annual Information Form and the NI 43-101 Technical Reports for its mineral properties, all of which are available on SEDAR+ at www.sedarplus.ca, and EDGAR at www.sec.gov, contain further details regarding mineral reserve and mineral resource estimates, classification and reporting parameters, key assumptions and associated risks for each of the Company’s material mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under SEC standards. Accordingly, information contained in this news release may not be comparable to similar information made public by companies subject to the SEC’s reporting and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but is not limited to, the terms and expected timing of the Acquisition, Concurrent Financing, Concurrent Private Placement, and the Debt Financing; Americas’ expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated and targeted production rates and results for gold, silver and other metals, the expected prices of gold, silver and other metals, as well as the related costs, expenses and capital expenditures; production from the Galena Complex and Cosalá Operations, including the expected number of producing stopes and production levels; the expected timing and completion of required development and the expected operational and production results therefrom, including the anticipated improvements to production rates and cash costs per silver ounce and all-in sustaining costs per silver ounce; and statements relating to Americas’ EC120 Project, including expected approvals, execution and timing and capital expenditures required to develop such project and reach production thereat, and expectations regarding its ability to rely in existing infrastructure, facilities, and equipment. Guidance and outlook references contained in this press release were prepared based on current mine plan assumptions with respect to production, development, costs and capital expenditures, the metal price assumptions disclosed herein, and assumes no further adverse impacts to the Cosalá Operations from blockades or work stoppages, and completion of the shaft repair and shaft rehab work at the Galena Complex on its expected schedule and budget, the realization of the anticipated benefits therefrom, and is subject to the risks and uncertainties outlined below. The ability to maintain cash flow positive production at the Cosalá Operations, which includes the EC120 Project, through meeting production targets and at the Galena Complex through implementing the Galena Recapitalization Plan, including the completion of the Galena shaft repair and shaft rehab work on its expected schedule and budget, allowing the Company to generate sufficient operating cash flows while facing market fluctuations in commodity prices and inflationary pressures, are significant judgments in the consolidated financial statements with respect to the Company’s liquidity. Should the Company experience negative operating cash flows in future periods, the Company may need to raise additional funds through the issuance of equity or debt securities. Forward-looking information is based on the opinions and estimates of Americas as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak, actions that have been and may be taken by governmental authorities to contain such epidemic or pandemic or to treat its impact and/or the availability, effectiveness and use of treatments and vaccines (including the effectiveness of boosters); interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; potential litigation; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to operate the Company’s projects; risks associated with the closing and implementation of the Acquisition, Concurrent Financing, Concurrent Private Placement, and the Debt Financing; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions, illegal blockades and other factors limiting mine access or regular operations without interruption, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments, risks associated with generally elevated inflation and inflationary pressures, risks related to changing global economic conditions, and market volatility, risks relating to geopolitical instability, political unrest, war, and other global conflicts may result in adverse effects on macroeconomic conditions including volatility in financial markets, adverse changes in trade policies, inflation, supply chain disruptions and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas’ filings with the Canadian Securities Administrators on SEDAR+ and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, including regarding the closing and implementation of the Acquisition, Concurrent Financing, Concurrent Private Placement, and the Debt Financing, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

SOURCE Americas Gold and Silver Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Has Costco Stock Run Its Course for Now?

Costco COST has been a big winner so far this year. Consumer staples stocks have generally had a good year, with the Consumer Staples Select Sector SPDR Fund XLP providing a total return of 15%. However, that still lags the over 20% return of the S&P 500.

Costco has particularly impressed. Its 33% total return this year surpasses its sector and the industry by a wide margin. So, what has been driving Costco’s recent success, and is there still room for this stock to run?

Breaking Down Costco’s Revenue Streams

Most everyone knows about Costco’s business model. The company buys and sells items in massive bulk quantities, allowing it to give customers volume discounts. Particularly for large families, this makes Costco an attractive place to buy groceries.

On top of selling goods, the company also charges annual fees that allow its members to shop at the store. However, these fees make up a small amount of the company’s revenue, at around 2% of the total. Food makes up the majority of the company’s revenue at 53% in 2023, followed by non-food goods like appliances and electronics at 25%.

The last 20% comes from its “warehouse ancillary and other business” segment. This includes things like gasoline, pharmacy, and food court sales. It derives revenue primarily from the United States, which made up 73% of total revenue by geography in 2023.

Costco is Beating the Competition in Core Sales Growth

One of the biggest reasons for Costco’s strong returns this year has to be the company’s comparable store sales growth. This measurement excludes sales from newer stores, as opening a new store is an easy way to boost sales. Looking at this figure shows a more sustainable measurement of the company’s ability to increase revenue.

In comparison to its rivals, Costco is winning on this front in 2024. Target TGT has overall seen a sizable decline in same-store sales this year, and Kroger KR has managed to achieve just slightly positive growth. Walmart WMT is doing well, with low double-digit growth. However, Costco’s mid-teens growth is the strongest of these firms, and growth has especially picked up in the last two quarters. However, Costco’s stock price has only risen slightly since mid-Aug., while Walmart’s is up another 20%.

Walmart’s 52% price appreciation this year leads the group. Part of this divergence may be the fact that Walmart has increased its margins in a much stronger way amid its sales growth. The firm improved operating margin and gross margin by 45 basis points and 30 basis points last quarter, respectively. Those increases for Costco were just 7 and 13 basis points.

Analysts are Mixed On Costco, but Aren’t Signaling Near-Term Concern

Looking at analyst ratings and price targets on Costco, the views are mixed. Its 23 buy ratings outpace its 13 hold and one sell rating, but the average price target isn’t all that inspiring. The figure indicates just around 6% implied upside in the stock, a number that suggests the company is within the fairly valued range at this point.

However, it’s interesting to note that at least 10 Wall Street analysts raised their price targets after the company’s Sept. 27 earnings report, and none appear to have lowered their target. Yet, shares are down 3% since the release as the company missed on sales growth estimates. This comes despite knowledge that the dockworkers’ strike was imminent and has now begun. These signals analysts aren’t too worried about the strike having a negative impact on the company.

Overall, Costco remains a company with strong fundamentals that has shown it can thrive while some of its competitors face slow or declining growth. Its membership-based business model keeps customers coming back, and the firm should be able to realize benefits from its increased membership prices in late 2025.

Another plus for Costco is that it can significantly grow its e-commerce business. E-commerce makes up a smaller portion of the company’s business compared to Walmart. The e-commerce part of the business is growing at a solid rate of around 20% over the last two quarters.

What will happen in the short term for the company is hard to predict but estimates of earnings growth over the mid-term are strong. Over the next five years, analysts expect the company to grow adjusted earnings per share by over 10% annually.

The article “Has Costco Stock Run Its Course for Now?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Digest: NVDA, GEV

Summary

Talk about an undecided market. As of the close on Monday, October 7, in four of the past five days, the closing range of the S&P 500 (SPX) was 13.6 points. That is two-tenths of 1% based on the price of the index. For the Nasdaq, the range in four out of five days was 14.76 points or eight one-hundredths of 1%. The Nasdaq 100’s (QQQ) range was 0.83 points or two-tenths of 1%. The Nasdaq and the QQQ tested their 21-day exponential a few times and remain perilously close to breaking that average, while the SPX has come close to the average on several occasions intraday. Third-quarter EPS season is now underway and the next three weeks will be very heavy with earnings reports. Just prior to and just after earnings reports, companies are in a blackout period. During that time, a company cannot repurchase its stock. So in April/early May, July/early August, October/early November, and January/early February, there is an absence of demand that can create weakness in the overall market. First-quarter 2024 share buybacks on the S&P 500 were $237 billion and for the 12-months ending March 2024, buybacks were $817 billion. C

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level