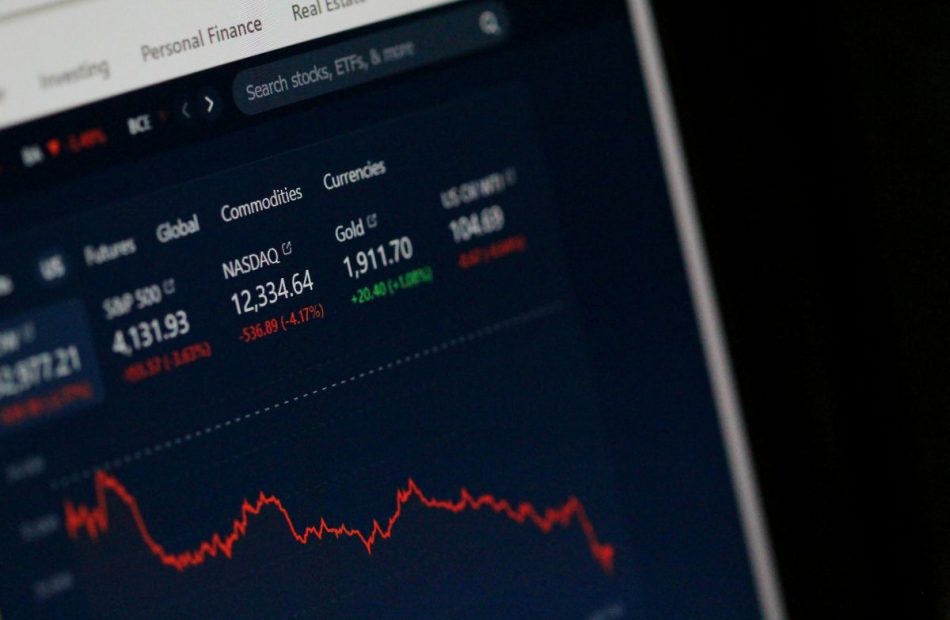

Higher Fee Income to Aid BNY Mellon's Q3 Earnings, Subdued NIR to Hurt

The Bank of New York Mellon Corporation BK is scheduled to report third-quarter 2024 results on Oct. 11, before market open. The company’s revenues and earnings are expected to have increased on a year-over-year basis.

In the last reported quarter, BK’s earnings surpassed the Zacks Consensus Estimate. Results were primarily aided by a rise in fee revenues and lower expenses. The assets under custody and/or administration (AUC/A) and assets under management balances grew on a solid market rally. However, a decline in net interest revenues (NIR) acted as a headwind.

BNY Mellon has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 9.92%.

Key Factors to Impact BK’s Q3 Results

Fee Revenues: The Zacks Consensus Estimate for total investment services fees (comprising more than 50% of the company’s total revenues) is pegged at $2.34 billion, suggesting a rise of 5% from the year-ago quarter. Our estimate for the same is $2.39 billion.

The consensus mark for financing-related fees stands at $52.5 million, which suggests a 16.6% year-over-year rise. Our estimate for financing-related fees is $55.9 million.

The consensus estimate for distribution and servicing fees is pegged at $41.7 million, implying a 6.8% increase. Our estimate for the same is pegged at $42.7 million.

In the third quarter, foreign exchange (FX) trading activity was driven by heightened market volatility and increased hedging demand amid global economic uncertainties. Nonetheless, the implementation of the rate cut weakened the dollar to some extent. Thus, increased FX trading volumes are likely to have had a modest impact on BNY Mellon’s FX revenues. The consensus estimate for foreign exchange revenues is pegged at $179.6 million, suggesting a rise of 16.6%. Our estimate for the same is $165.5 million.

The consensus estimate for total fees and other revenues is $3.55 billion, suggesting a rise of 5.6%. We project the metric to be $3.59 billion.

Net Interest Revenues: On Sept. 18, the Federal Reserve implemented a 50-basis point rate cut for the first time since March 2020. Nonetheless, the impact on BK’s NIR during the third quarter is unlikely to have been significant.

Further, the inverted yield curve for most of the quarter and high funding costs are expected to have weighed on interest income.

Yet, indications of future rate cuts by the Fed and a stabilizing macroeconomic backdrop are likely to have supported the overall lending scenario. Per the latest Fed data, overall loan demand remained decent for the first two months of the quarter.

The consensus mark for NIR is pegged at $967.8 million, indicating a 4.8% year-over-year decline. Our estimate for NIR is $898.3 million.

Expenses: Because of higher restructuring charges, BNY Mellon’s expenses have been elevated over the past few years. Nevertheless, overall costs are expected to have been manageable in the quarter under review, given the elimination of unnecessary management layers.

Our estimate for non-interest expenses is $3.12 billion, suggesting a marginal year-over-year fall.

What the Zacks Model Unveils for BNY Mellon

According to our quantitative model, the chances of BNY Mellon beating the Zacks Consensus Estimate this time are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or better.

Earnings ESP: The Earnings ESP for BNY Mellon is +0.14%.

Zacks Rank: The company currently carries a Zacks Rank #2 (Buy).

Other Bank Stocks That Warrant a Look

A couple of other bank stocks that have the right combination of elements to post an earnings beat in their upcoming releases are First Community Corporation FCCO and 1st Source Corp SRCE.

FCCO has an Earnings ESP of +1.12% and it carries a Zacks Rank of 2 at present. The company is slated to report third-quarter 2024 results on Oct. 16.

SRCE is scheduled to release third-quarter 2024 earnings on Oct. 24. The company, which sports a Zacks Rank of 1 (Strong Buy) at present, has an Earnings ESP of +4.80%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood's Ark Invest Trades: Bets $14M On Amazon Shares — Dumps Robinhood Stock Worth $36M, Embraces Coinbase And Meta

Cathie Wood’s Ark Invest made significant trades in Amazon.com Inc AMZN, Robinhood Markets Inc HOOD, and Coinbase Global Inc COIN.

The Amazon Trade: Ark Invest purchased 76,505 shares of Amazon, despite recent concerns about the company’s growth trajectory. The trade was executed through its flagship ARK Innovation ETF ARKK.

This move came after Wells Fargo downgraded Amazon from Overweight to Equal-Weight, citing slowing growth and stiffer competition. The value of this trade, based on the closing price of $182.72, is approximately $13.98 million.

Amazon shares dropped Monday after Wells Fargo downgraded the stock, citing slowing growth and competition. The sell-off was also fueled by a federal judge’s ruling allowing the FTC’s antitrust lawsuit against Amazon to proceed.

The Robinhood Trade: Ark Invest sold a total of 1,421,431 shares of Robinhood across three of its ETFs i.e. ARKK, ARK Next Generation Internet ETF ARKW and Ark Fintech Innovation ETF ARKF. This decision came despite Robinhood’s recent announcement of its first investor day and the introduction of new trading features. The value of this trade, based on the closing price of $25.61, is approximately $36.4 million.

The Coinbase Trade: Ark Invest bought 12,994 shares of Coinbase through its ARKF ETF. This move aligns with the recent surge in Coinbase shares following the company’s announcement to adjust its service offerings in response to new European regulatory requirements. The value of this trade, based on the closing price of $167.69, is approximately $2.18 million.

See Also: This Alibaba Analyst Turns Bullish; Here Are Top 5 Upgrades For Monday

Other Key Trades:

- Ark purchased 2,365 shares of Meta Platforms Inc META through its ARKW ETF. The Meta trade was valued at $1.4 million. On Tuesday, Meta shares closed 1.4% higher at $592.89.

- Ark Invest sold shares of Veeva Systems Inc (VEEV) and shares of Vertex Pharmaceuticals Inc VRTX through its ARKG ETF. It bought shares of Recursion Pharmaceuticals Inc (RXRX) and shares of 10X Genomics Inc (TXG).

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

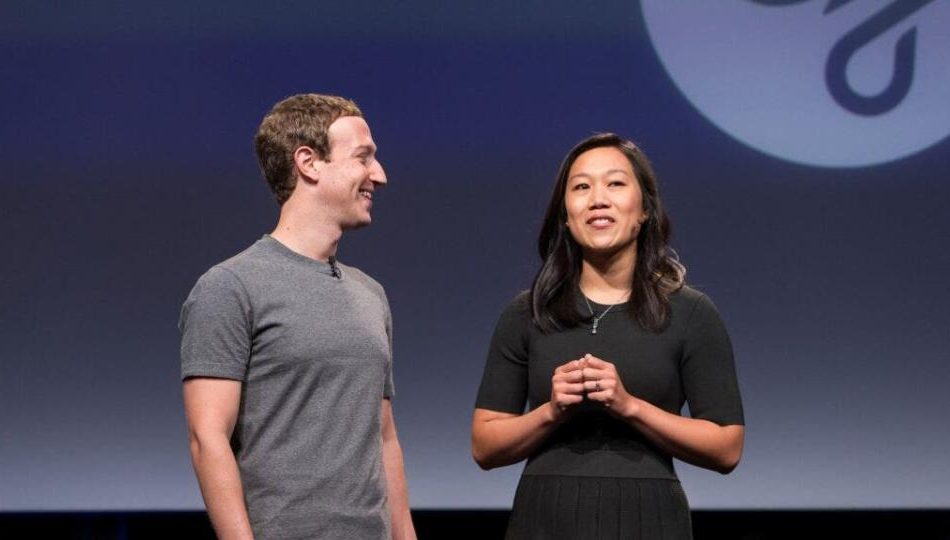

Mark Zuckerberg Redesigns Porsche Cayenne Turbo GT Into A Minivan For Wife Priscilla Chan, Gets A 911 GT3 For Himself

Meta Platforms CEO Mark Zuckerberg is getting a Porsche Cayenne Turbo GT four-seater Coupé customized to be a minivan for his wife Priscilla Chan, the CEO revealed.

What Happened: “New side quest. Priscilla wanted a minivan, so I’ve been designing something I’m pretty sure should exist: a Porsche Cayenne Turbo GT Minivan,” Zuckerberg said in a post on Instagram on Sunday. The billionaire partnered with California-based auto shop West Coast Customs to make the coupe-to-minivan transition.

Don’t Miss:

The CEO also got a Porsche 911 GT3 with a Touring package in the same gray shade as Chan’s Cayenne to complement the minivan.

“Threw in a manual GT3 Touring to make it his and hers,” Zuckerberg wrote in his Instagram post. The post was accompanied by pictures of the vehicles at West Coast Customs and also a selfie of the couple with the two Porsche vehicles.

The CEO also shared a short video of the customised vehicle which seems to sport sliding doors and an elongated body.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

Why It Matters: The Cayenne Turbo GT starts at about $200,000 in the U.S. The 911 GT3 sports car, likewise, is priced to the higher end.

Zuckerberg has previously shared a similar picture featuring two classic Ford Bronco vehicles, one belonging to Chan and the other to him.

“His and hers,” Zuckerberg captioned the photograph from June 2022.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo courtesy: Chan Zuckerberg Initiative

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Mark Zuckerberg Redesigns Porsche Cayenne Turbo GT Into A Minivan For Wife Priscilla Chan, Gets A 911 GT3 For Himself originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Melmed Law Group Secures Number 1 Wage & Hour Settlement in Santa Barbara County | Top Employment Law Firm in California

LOS ANGELES, Oct. 08, 2024 (GLOBE NEWSWIRE) — We are proud to announce that Melmed Law Group has been recognized for obtaining the Number 1 Settlement in Santa Barbara County for 2023 in the Wage & Hour Violation category. This prestigious acknowledgment highlights the firm’s continued success in advocating for employee rights and securing significant settlements for workers who have experienced wage theft and other employment violations.

This recognition reinforces Melmed Law Group’s reputation as a leading employment law firm in California. The firm remains committed to delivering justice for workers across the state and holding employers accountable for violations of labor laws.

Jonathan Melmed, Founder and Managing Partner of Melmed Law Group, commented on the recognition, “We are honored to receive this acknowledgment. It underscores our firm’s dedication to achieving favorable outcomes for our clients and our commitment to ensuring employees’ rights are upheld.”

The full list of recognized settlements for Santa Barbara County in 2023 can be found at Top Verdict, which highlights the most significant settlements and verdicts from across the nation.

For more information about Melmed Law Group or to schedule a consultation, please visit melmedlaw.com.

About Melmed Law Group: Melmed Law Group is a leading employment law firm based in Los Angeles, California. The firm specializes in representing employees in cases involving workplace harassment, discrimination, wrongful termination, wage theft, and other employment-related matters. Founded by Jonathan Melmed, the firm is committed to protecting the rights of workers and achieving justice for those who have been wronged by their employers.

Media Contact: Paniz Rad

Email: paniz@melmedlaw.com

Website: www.melmedlaw.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f42cce8e-206a-4690-8cea-cd4ca1f945da

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Accruit, National 1031 Exchange Qualified Intermediary, Team Members Achieve Prestigious CES® Certification

Accruit celebrates the professional milestones of two members in Exchange Operations with their new certifications.

DENVER, Oct. 8, 2024 /PRNewswire/ — Accruit is proud to announce that two of our esteemed team members, Maritza Castillo and Dina Bardakh, have successfully earned their Certified Exchange Specialist® (CES®) designations. This significant achievement underscores their expertise and dedication to the field of 1031 exchanges.

To receive the CES® designation, Maritza and Dina had to meet specific work experience criteria and pass a rigorous exam covering 1031 exchange rules, critical activities of an exchange facilitator, and ethical issues that may arise during a 1031 exchange. Their success in attaining this certification demonstrates their high level of knowledge and competency, reinforcing their ability to provide exceptional service to our clients.

The CES® Certification Council within the Federation of Exchange Accommodators (FEA) administers the CES® exam, which was first conducted in May 2003. Since then, the CES® designation has become a mark of excellence within the industry, signifying that the holder possesses extensive knowledge and experience in 1031 exchanges.

“We are thrilled to celebrate Maritza’s and Dina’s accomplishment and proud to have them as part of the Accruit team,” said Brent Abrahm, President and CEO of Accruit. “Their dedication to professional development and excellence reflects our company’s commitment to providing the highest quality service to our clients.”

Maritza and Dina join a distinguished group of professionals who have earned the CES® designation, showcasing their commitment to upholding the highest standards in the industry. Accruit is proud to now boast eight total CES® on staff, in addition to the rest of highly qualified team.

About Accruit

Accruit, an Inspira Financial Solution, is a leading full service Qualified Intermediary and developer of the industry’s only patented 1031 Exchange technology. Founded in 2000 and acquired by Inspira Financial in 2023, Accruit has gained the trust of thousands of clients and become a leader in the industry through its highly credentialed experts, consistent delivery of service, innovative technologies, robust security protocols and financial strength.

Press Contact:

Karlee Kilbey

3038657321

http://www.accruit.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/accruit-national-1031-exchange-qualified-intermediary-team-members-achieve-prestigious-ces-certification-302270513.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/accruit-national-1031-exchange-qualified-intermediary-team-members-achieve-prestigious-ces-certification-302270513.html

SOURCE Accruit

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massive Potential: 3 Tech Stocks Positioned for Breakout Success

Investors may be worried about the future of the computer and technology sector, especially now that the former darling in the space, NVIDIA Co., is threatening to go into a correction in potentially the coming months. However, recent economic data suggests that there are other names in the space that are still worth taking another look into.

These stocks share the same characteristics that the manufacturing PMI index reported in its latest issue, so the odds are in favor of bulls in MicroStrategy Inc. MSTR, SAP SAP, and even PTC Inc. PTC. These names would expose investors to the potential bull runs that could be seen in the cryptocurrency space as interest rate cuts work their way through Bitcoin and give it a run higher.

More than that, finance is now relying on software applications and increased technology implementation in daily operations, and this portfolio aligns investors with that rising demand trend as well. Not to mention the artificial intelligence capabilities needed in the product development and visualization space. Here are some of the fundamental and technical factors that place the odds in favor of these companies this cycle.

Key Fundamental Drivers Fueling the Computer Software Industry

The main drivers in the manufacturing PMI index are new orders, production, and inventories. Both new orders and output moved significantly over the last report, with inventories contracting aggressively, which signals upcoming demand across the sector.

But not all industries are made equal. The computer and electronics industries share the same dynamics, meaning investors can expect to see added and accelerating demand in the space. Even then, not all stocks are made equal, so ideally, those with premium forward P/E valuations and above-average earnings per share (EPS) growth will make for better candidates.

Long Candidate #1: MicroStrategy’s Bitcoin

The last time the Federal Reserve (the Fed) cut interest rates, the price of Bitcoin more than doubled. This time, history could repeat itself, which is why MicroStrategy is increasing its balance sheet Bitcoin holdings so that the stock’s book value will rise with it.

Even though the stock trades at 82% of its 52-week high, Wall Street analysts still believe it could reach a new high before the year ends. Benchmark leads the way with a price target set at $215 a share for MicroStrategy stock, which calls for a net upside of 30% from where the stock trades today.

Moreover, bearish traders have been forced to cover their short positions over the past quarter. MicroStrategy’s short interest fell from $5.3 billion last quarter to $3.6 billion today, with a 2.9% contraction in the past month alone. Replacing these bears were some institutional buyers that were added recently.

Leading the buying were those at Park Avenue Securities, boosting their holdings by over 1,000% as of October 2024, bringing their net investment to $1.2 million today.

Long Candidate #2: Banks Need SAP

The financial sector is now increasingly dependent on technology and software for operations and risk management processes, and SAP stock is a major provider of these processes.

Since the stock has traded up to 95% of its 52-week high, investors can start to see the market reward the name with bullish momentum.

As of September 2024, analysts at Barclays decided to boost their price target on SAP stock to $252 a share and keep their “Overweight” ratings. To prove these analysts right, the stock would need to rally by 14.5% from its current level.

Wall Street analysts think that there will be additional demand for SAP’s services in the coming months, so they forecast up to 52.7% EPS growth for the next 12 months. Based on these expectations, the market is now willing to pay a 34.5x forward P/E ratio over the industry’s average of 28.4x.

Long Candidate #3: Labor Costs Aided By PTC’s AI

Now that inflation is pushing the price of everything higher, especially labor, some companies may look to artificial intelligence to help them lower their costs and expand their margins and net profits. This is where the PTC expertise comes into play.

The stock is currently trading at 92% of its 52-week high, making for another bullish momentum play favoring investors. Based on the consensus price target, current analyst ratings suggest the stock could have a valuation as high as $200.2 a share, or a 12% upside from today’s stock price.

With Wall Street EPS growth forecasts set at 19.8% for the next 12 months, investors now can see why the market is willing to pay a premium forward P/E valuation of up to 30.0x over the industry’s average, as stocks that tend to grow above peers command these higher multiples.

The article “Massive Potential: 3 Tech Stocks Positioned for Breakout Success” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

It's Your Constitutional Right: How You Can Break The Senate's Block On Cannabis Legalization

As the 2024 elections approach, the Marijuana Policy Project (MPP) released its annual voter guide to inform citizens about where their gubernatorial and Senate candidates stand on cannabis policy reform.

With over 70% of Americans supporting cannabis legalization, the stakes are high for federal and state-level reform, especially as 11 states will vote for their next governor and 34 Senate seats are up for grabs.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Why These Elections Matter

Governors and senators hold significant power over cannabis policy. At the state level, governors can veto or sign cannabis reform bills and direct agencies to either implement or block regulations. Meanwhile, at the federal level, the U.S. Senate is the critical battleground for national reform.

Bills like the MORE Act (which seeks to federally legalize cannabis) and the SAFE Banking Act (which would grant cannabis businesses access to financial services) have garnered bipartisan support but face a major hurdle: the Senate’s filibuster rules.

The filibuster requires 60 votes to move legislation forward, creating a significant barrier to cannabis reform, even though a supermajority of Americans support legalization. With the balance of power in the Senate up for grabs in the November election, the composition of the next Senate will determine whether federal cannabis reform finally has a path forward.

What The MPP Voter Guide Covers And How You Can Use It

The MPP voter guide is more than just an overview of candidate positions, it’s a tool for shaping the future of cannabis legalization. By breaking down public statements, voting records and policy positions, the guide allows voters to see clearly where candidates stand on cannabis reform.

Voters can use this information to not only make informed choices at the polls but also target advocacy efforts. If a candidate in your state supports cannabis reform, your vote could help secure their seat and advance legalization.

If they oppose it, now is the time to make your voice heard through petitions, letters and calls to ensure elected officials know how important cannabis reform is to their constituents.

Filibuster Schmilibuster: Why Your Vote Can Smoke Out Senate Stalling

At the federal level, the filibuster has stalled cannabis reform despite growing public support. The MORE Act and SAFE Banking Act are key pieces of legislation that have struggled to gain enough momentum to overcome the 60-vote filibuster threshold in the Senate. That’s why understanding your senators’ positions is critical.

The MPP guide helps voters determine which senators are blocking reform and which ones are pushing it forward. By using the guide, you can strategically advocate for reform by contacting your senators and urging them to support cannabis legalization. In a closely divided Senate, every vote and every voice matters. This election is an opportunity to break through the Senate’s block and make real progress on cannabis reform.

Key Races To Watch

With 24 states and Washington D.C. already legalizing adult-use cannabis, this election could see further expansion in states like Florida, North Dakota, and South Dakota, where voters will decide on cannabis reform initiatives.

Several key races stand out this year.

Arizona

In Arizona, Ruben Gallego (D) has been a consistent advocate for federal cannabis legalization, supporting both the MORE Act and the SAFE Banking Act. His opponent, Kari Lake (R), has opposed cannabis reform, providing a clear contrast for voters who support legalization.

Florida

In Florida, Debbie Mucarsel-Powell (D) backs Amendment 3, which seeks to legalize adult-use cannabis and has highlighted the barriers Black farmers face in the cannabis industry. Meanwhile, Rick Scott (R) has remained firmly against adult-use legalization and has opposed the SAFE Banking Act, making this race pivotal for cannabis reform in the state.

North Dakota

In North Dakota, while voters will consider adult-use legalization, candidates like Kelly Armstrong (R) have voiced opposition to broader cannabis reform, though he has supported banking-related measures. This reflects the divided stance on cannabis issues in the state.

D.C.

At the federal level, Sherrod Brown (D-OH) has been a supporter of cannabis reform, consistently advocating for federal legalization and expanded banking access for cannabis businesses. In contrast, figures like Rick Scott (R) and Ted Cruz (R) of Texas remain staunchly opposed to broader cannabis reforms, including the SAFE Banking Act.

If you’re serious about being part of this green wave, the MPP voter guide is your ticket to the insider knowledge that can make a difference. Who’s ready to call their senator? Visit www.mpp.org to explore the full guide.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Nu Holdings Overvalued or Primed for More Growth?

Brazilian fintech Nu Holdings Ltd. NU has only been trading publicly for under three years, but it has already managed to accumulate over 100 million customers in Latin America. The company, which offers digital banking solutions without brick-and-mortar locations through its NuBank platform, has also drawn the interest of Warren Buffett, instantly catapulting it into must-watch lists of investors everywhere as a newly popular bank stock. Buffett’s Berkshire Hathaway Inc. held over 107 million shares of NU stock as of the end of the second quarter.

Nu shares fell by about 8% in the last week but remain up a whopping 86% over the past year. Based on analyst ratings, the company is currently categorized as a Moderate Buy and has a consensus price target of $14.08, representing 7.2% upside potential. Given that this increase would only roughly get the stock to where it was in mid-September, and particularly in light of how far it has risen in the last several months, investors may be wondering whether the time to get in on Nu Holdings has passed.

Earnings Performance Excels

Nu has a strong history of earnings performance in the last six quarters, including net income of $487 million for the most recent quarter. This represented EPS of 12 cents per share, topping analyst predictions of 10 cents. Revenue has also surged in recent quarters; in the second quarter of the year, Nu posted revenue of $2.8 billion, a full two-thirds higher than it was at the same time in 2023.

The company’s return on equity has also been impressive, as it is currently annualized to 27%. It maintains a debt-to-equity ratio of 0.25, uncommonly low for a financial institution and perhaps indicating that has over-relied on equity to finance growth.

It appears that Nu is showing no signs of slowing its earnings growth. Analysts project that the company will see earnings climb by more than 51% this year.

Nu Holdings’ Customer Base Is Skyrocketing

What is behind Nu’s rapid top- and bottom-line improvement? A key factor is the rapid increase to size of the company’s customer base as it has expanded within and outside of Brazil. Two years ago the firm had about 65 million customers, and today it has well over 100 million. About one out of every five adults in Brazil—some 34 million people—have not typically had access to traditional banking. Nu’s easy-to-access digital platform has rapidly opened up access to many of these individuals.

Nu is a leader in the fast-growing digital banking space in Latin America. In the last year, its customer growth has outpaced the five largest Brazilian incumbent banks combined. The company’s international expansion is also accelerating. At the midpoint of the year, it had nearly 8 million customers in Mexico and 1.3 million Colombian customers.

Engaged Customers With Room to Expand

On top of a rapidly growing base of customers, Nu has managed to engage those customers in multiple ways. By midway through the year, customers had, on average, 4.1 products active simultaneously. This helped to drive an increase in monthly average revenue per active customer to $11.20.

Besides increasing the number of customers it serves, Nu has room to expand in loans and credit cards, two of its least-utilized products. Fewer than one in 10 Brazilian adults uses the company’s loan products, and only about one in six has a Nu-branded credit card. This contrasts with the company’s traditional bank account services, which include about a third of all Brazilians among account holders.

Nu Stock: Overvalued or Space to Grow?

Given its rapid growth in the last year, it’s certainly possible that Nu Holdings’ most significant rally has already come and gone. The recent dip in stock price could be an indication of a larger trend to come, and the firm’s forward P/E ratio of 32.0 is high.

However, the company’s fundamentals—its earnings growth and expanding customer base in particular—show no signs of slowing as it picks up its international expansion. It’s up to investors, then, to determine whether they feel continued growth in these areas might be reflected in a continued increase in share prices going forward.

The article “Is Nu Holdings Overvalued or Primed for More Growth?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese Stocks Plunge As Hang Seng Drops 1.39%, Extending Volatile Streak — Tech Giants JD.com, Alibaba, Baidu Tread Red Waters

Chinese stocks experienced a sharp selloff on Wednesday, continuing a volatile trend across Asia-Pacific markets. The Hang Seng Index (HSI) in Hong Kong dropped 1.39% to 20,635.11, following Tuesday’s devastating 9.41% plunge—its worst single-day loss since the 2008 financial crisis.

What Happened: The mainland CSI 300 index also suffered, dropping 5.39%. This sharp reversal comes after weeks of robust performance that had positioned Chinese stocks among the top global performers year-to-date.

Tech giants bore the brunt of the downturn:

- JD.com JD plummeted 7.52% on the Hong Kong stock exchange.

- Alibaba BABAF fell 2.78%

- Baidu BIDU lost 1.65% on HKEX

- Tencent TCEHY declined 1.32%

Analysts attribute the selloff to investors locking in profits and growing disappointment over the lack of aggressive fiscal stimulus from Beijing.

The contrast was stark in Japan, where the Nikkei 225 climbed 0.6%, highlighting the divergent market sentiments across the region.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Magnificent Dividend Stock Has Delivered a 3,880% Total Return Since 1994 (and Could Make You Richer in the Future)

Mid-America Apartment Communities (NYSE: MAA) has been a fantastic investment over the years. The apartment-focused real estate investment trust (REIT) has delivered a 3,880% total return since its initial public offering (IPO) 30 years ago (nearly 12.8% annualized).

Its magnificent record of paying dividends is a big factor driving those strong returns. It recently declared its 123rd consecutive-quarterly payment. The residential REIT has never reduced or suspended its dividend. While it hasn’t increased its payment every year, its current streak is up to 14 consecutive years.

With more growth ahead, the REIT should be able to continue growing its investors’ wealth in the future.

Focused on where people are moving

Mid-America Apartment Communities, or MAA, owns over 100,000 apartment units in 16 states across the Southeast, Southwest, and Mid-Atlantic regions. It owns properties in large and mid-tier markets like Atlanta, Dallas, Nashville, and Charleston. It focuses on these markets because they are where people are migrating due to abundant employment, better weather, and more affordable housing options.

Those factors keep occupancy levels high and drive healthy rent growth. MAA has delivered an average of 4.3% same-store net-operating income (NOI) growth over the past decade. That has outperformed its peer average of 3.6%.

While rent growth has slowed to a crawl this year due to a surge in new apartments in many of its markets, the REIT expects that headwind to fade. CEO Eric Bolton noted in the second-quarter earnings release:

New supply delivering into several of our markets continues to be absorbed in a steady manner as the demand for apartment housing remains strong. We continue to believe that we will begin to see a decline in new apartment deliveries over the back half of this year and into 2025.

Because of that, the REIT should see a re-acceleration in rent growth in the coming quarters.

Multiple additional-growth catalysts

Rent growth is only one catalyst for the REIT. MAA also invests in development projects, spends money on renovations and redevelopments, and makes acquisitions. Those investments further enhance its ability to grow its earnings, dividend, and shareholder value.

MAA is currently investing $866.2 million across seven active development projects to add 2,617 new apartment units across several markets. Those projects should stabilize over the next three years and add $55 million to $65 million to its annual NOI. In addition, the company expects to start four to six more development projects over the next 18 to 24 months.

The REIT also routinely invests money to upgrade existing properties to drive higher rent. It has about 9,000 units across its portfolio that it could redevelop in the future by updating the kitchens and bathrooms. These high-return projects have historically driven high-single to low-double-digit rental increases.

MAA will also make acquisitions as compelling opportunities arise. For example, the REIT bought a 366-unit multifamily community in the lease-up phase for $81 million in the second quarter. That’s one of three recently completed communities it recently purchased from developers. The company has an elite balance sheet, giving it ample financial flexibility to continue acquiring properties as it finds attractive investments. It will also buy land for future developments and fund development projects it will purchase from builders.

The REIT aims to grow its core funds from operations (FFO) per share over the long term. That should enable it to continue increasing its dividend and deliver superior shareholder returns. That strategy has paid dividends for shareholders over the years, given the REIT’s rising payout and strong total returns (its total returns over the last five-, 10-, 15-, and 20-year periods have all exceeded the average of its multifamily peers).

Well-positioned to continue enriching investors

MAA has done a magnificent job growing value for its shareholders over the last 30 years. It has done that by focusing on owning apartments where people want to live, which has driven above-average rent growth and abundant opportunities to expand its portfolio. The REIT still has a lot of growth ahead, which suggests that it can continue enriching investors in the future. Add in its attractive dividend yield (nearly 4%) and cheaper valuation (17.6 times FFO multiple versus 19 times peer average), and MAA is a potentially very enriching investment opportunity these days.

Should you invest $1,000 in Mid-America Apartment Communities right now?

Before you buy stock in Mid-America Apartment Communities, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Mid-America Apartment Communities wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in Mid-America Apartment Communities. The Motley Fool has positions in and recommends Mid-America Apartment Communities. The Motley Fool has a disclosure policy.

This Magnificent Dividend Stock Has Delivered a 3,880% Total Return Since 1994 (and Could Make You Richer in the Future) was originally published by The Motley Fool