Simon Property Soars 17.4% Year to Date: Will the Trend Last?

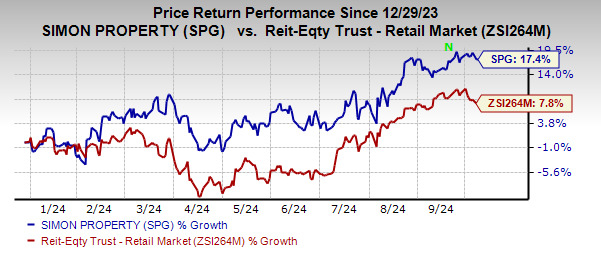

Shares of Simon Property Group SPG have soared 17.4%% in the year-to-date period compared with its industry’s growth of 7.8%.

This retail real estate investment trust’s (REITs) portfolio of premium retail assets in the United States and abroad, the adoption of omnichannel retailing, focus on mixed-use developments and healthy balance sheet strength have enabled it to ride the growth curve so far.

Image Source: Zacks Investment Research

Let us now decipher the factors behind the increase in the stock price and check whether the trend will last.

Simon Property enjoys a wide exposure to retail assets across the United States. Moreover, the company’s international presence fosters sustainable long-term growth as compared with its domestically-focused peers. Its ownership stake in Klépierre facilitates the expansion of its global footprint, which gives it access to premium retail assets in the high barrier-to-entry markets of Europe. We believe that diversification, with respect to both product and geography, will help it grow over the long term.

In the first half of 2024, it signed 572 new leases and 1,251 renewal leases (excluding mall anchors and majors, new development, redevelopment and leases with terms of one year or less) with a fixed minimum rent across its U.S. Malls and Premium Outlets portfolio.

Given the favorable retail real estate environment, this leasing momentum is expected to continue in the upcoming quarters. As of June 30, 2024, the ending occupancy for the U.S. Malls and Premium Outlets portfolio came in at 95.6%, up 90 basis points from 94.7% as of June 30, 2023. We project the 2024 year-end occupancy for this portfolio to be 95.7%.

Simon Property’s adoption of an omni-channel strategy and successful tie-ups with premium retailers have paid off well. Its online retail platform, coupled with an omnichannel strategy, is likely to be accretive to its long-term growth. The company is also focused on tapping its growth opportunities by assisting digital brands enhance their brick-and-mortar presence.

Also, its efforts to explore the mixed-use development option, which has gained immense popularity in recent years, has enabled it to tap the growth opportunities in areas where people prefer to live, work and play.

SPG’s Balance Sheet & ROE

The retail REIT maintains a healthy balance sheet position and has $11.2 billion of liquidity as of the end of the second quarter of 2024. As of June 30, 2024, Simon Property’s total secured debt to total assets was 17%, while the fixed-charge coverage ratio was 4.3, ahead of the required level.

SPG also enjoys a corporate investment-grade credit rating of A- from Standard and Poor’s and a senior unsecured rating of A3 from Moody’s, rendering it favorable access to the debt market. The company’s solid financial footing with ample financial flexibility is likely to support its growth endeavors going forward.

In addition, SPG’s trailing 12-month return on equity is 78.14% compared with the industry’s average of 6.28%. This reflects that the company is more efficient in using shareholders’ funds than its peers.

SPG’s Dividend Payments

Solid dividend payouts are a massive enticement for REIT investors, and SPG has remained committed to boosting shareholder wealth. Encouragingly, the company has raised its dividend payout 11 times in the last five years, with the latest hike being announced in August 2024, concurrent with the second-quarter 2024 earnings release.

Given SPG’s solid operating platform, opportunities for growth, and decent financial position compared with the industry, we expect the dividend rate to be sustainable in the upcoming period.

Risks Likely to Affect SPG’s Positive Trend

rowing e-commerce adoption is likely to adversely impact the market share for brick-and-mortar stores and affect retail REITs including Simon Property. Limited consumers’ willingness to spend amid macroeconomic uncertainty poses key near-term concerns for the company.

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Brixmor Property Group BRX and Tanger, Inc. SKT, each carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Brixmor’s 2024 FFO per share is pinned at $2.13, suggesting year-over-year growth of 4.4%.

The Zacks Consensus Estimate for Tanger’s 2024 FFO per share stands at $2.09, indicating an increase of 6.6% from the year-ago reported figure.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Torque Sensor Market Size to Surpass USD 12.07 Billion by 2033 | Straits Research

New York, United States, Oct. 08, 2024 (GLOBE NEWSWIRE) — A torque sensor, also called a torque cell, is a device that measures, records, and controls the torque of rotating systems using mechanical processes. The torque sensor has numerous applications in the global mining, agriculture, defense, and healthcare industries due to its small size, precision, consistency, durability, and resistance to high temperatures. It can measure rotating forces in either a clockwise or counterclockwise direction and is typically available in static or dynamic forces.

The increase in the sales of hybrid and electric vehicles (EVs) due to urbanization and rising incomes are among the most important factors favoring the use of torque sensors in the automotive industry. It can also be attributed to the increased demand for high-performance, fuel-efficient automobiles, and worldwide petroleum prices.

Download Free Sample Report PDF @ https://straitsresearch.com/report/torque-sensor-market/request-sample

Market Dynamics

Rise in Demand for High-Performance Vehicles Drives the Global Market

According to several experts in the automotive industry, there is no reason to be concerned that the demand for high-performance vehicles will decrease shortly. This is a tremendously uplifting new development. Customers are encouraged to spend more on luxury automobiles by increasing their disposable income after taxes and enhancing their already high quality of life. In other words, the increase in after-tax income encourages consumers to spend more on luxury vehicles. As an outcome of automation’s increased precision and productivity, sensors have become indispensable to manufacturing. This is because sensors can monitor and analyze data in real-time.

One of the causes is that sensors contribute to the growth of automation. Due to their myriad benefits to the automotive industry, torque sensors are becoming increasingly prevalent. These benefits include increased vehicle safety and fuel efficiency. As a result of these benefits, torque sensors are becoming more and more pervasive. Automobiles are increasingly implementing torque sensors for various reasons, including the one stated here.

Emerging Application of Torque Sensor in the Healthcare Vertical Creates Tremendous Opportunities

Recent advancements in torque sensor technology have enabled the incorporation of cutting-edge functionality into various medical devices and other types of equipment. The newest technological advancements are responsible for making this possibility a reality. In addition, the medical industry is the one that benefits the most from the torque sensor, making it the industry sector that is expanding at the fastest rate. This is because various applications, including manufacturing pharmaceutical tablets, testing surgical staplers, evaluating fitness and rehabilitation apparatus, and many others, can utilize the torque sensor to produce accurate results. This is the justification for the current circumstance.

Torque sensors, when combined with telemedicine technology, have the potential to provide access to medical care in areas with less-developed infrastructure and greater geographical isolation. Something similar can be extremely advantageous in developing nations. It is predicted that these factors will result in the formation of opportunities, which are desirable because they facilitate market growth.

Regional Analysis

Asia-Pacific is the most significant global torque sensor market shareholder and is estimated to exhibit a CAGR of 8.8% over the forecast period. One of the most significant regions for this industry is the Asia-Pacific region, which has a sizable portion of the global market share for torque sensors. It might be related to a quickening of technology development and a rise in automotive standards in underdeveloped nations. The region known as “Asia-Pacific” includes, but is not limited to, China, Japan, India, South Korea, and other nations. Japan and China, two countries with among the most advanced technological infrastructures in the world, have a significant need for torque sensors.

Additionally, the numerous governmental organizations based in the Asia-Pacific region are engaged in various projects to expedite the growth of the automotive sensor market. For instance, the national governments of the Asia-Pacific region’s economies prioritize the domestic production of autos and the components that go into them. Through the “Made in China 2025” project, the Chinese government supports local enterprises to help them compete more effectively with foreign automakers.

LAMEA is anticipated to exhibit a CAGR of 7.9% over the forecast period. Technological developments in South America and the Middle East are expected to supplement the market growth in LAMEA. Moreover, rapid developments in the Middle East in terms of technological developments and medical facilities fuel the growth of the LAMEA market. Many countries in LAMEA are emerging economies. LAMEA holds a relatively smaller market share of the global torque sensor market. The growth of the torque sensors market in LAMEA is attributed to infrastructural developments and technological innovations. Torque sensors are widely used in the Middle East for controlling, measuring, and monitoring the performance of electric and hybrid car engines, medical prosthetics, and robotics.

To Gather Additional Insights on the Regional Analysis of the Torque Sensor Market @ https://straitsresearch.com/report/torque-sensor-market/request-sample

Key Highlights

- Based on the type, the global torque sensor market is bifurcated into Dynamic and static Torque Sensors. The Static Torque Sensor segment dominates the global market and is projected to exhibit a CAGR of 6.8% over the forecast period.

- Based on application, the global torque sensor market is bifurcated into Automotive, Industrial, Aerospace and Defense, Healthcare, and Others. The automotive segment owns the highest market share and is predicted to exhibit a CAGR of 9.2% over the forecast period.

- Asia-Pacific is the most significant global torque sensor market shareholder and is estimated to exhibit a CAGR of 8.8% over the forecast period.

Competitive Players

- ABB

- Honeywell International

- Infineon Technologies

- Crane Electronics

- Applied Measurements

- Kistler Holding

- Norbar Torque Tools

- Sensor Technology

- Hottinger Baldwin Messtechnik

- FUTEK Advanced Sensor Technology

Recent Developments

- November 2023- With the purchase of Vourity, ABB E-mobility streamlines the payment for electric car charging.

- October 2023- Sensor Technology’s new torque sensors have capabilities ranging from 0.2Nm to 1Nm, for a total range of 0.2Nm to 13,000Nm.

Segmentation

- By Type

- Rotary Torque Sensor

- Reaction Torque Sensor

- By Application

- Automotive

- Industrial

- Test and Measurement

- Aerospace and Defense

- Others

- By Region

- North America

- Europe

- APAC

- LAMEA

Get Detailed Market Segmentation @ https://straitsresearch.com/report/torque-sensor-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

For more information on your target market, please contact us below:

Phone: +1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This 28-Year-Old's Dividend Income Jumped from '$15 to $1,000' in Just Two Years – Top 11 Dividend Stocks In His Portfolio

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

As inflation continues to decline and the Fed’s rate-cut cycle is rolling, investors are looking for reliable dividend stocks to grow their wealth. But making decent money with dividends on a limited budget is not easy. Let’s look at a success story where a young investor started with small investments and reached a reasonable income goal in just two years.

About two years ago, an investor shared his story on r/Dividends, a discussion board on Reddit with more than 580,000 members interested in dividend investing. He started investing during the pandemic with just $100 deposits.

Check It Out:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Powell’s moves don’t have to doom your high yields. You can still make great returns in private credit. Find out how.

“Then I decided to take things seriously and started to invest a reasonable (percentage) from my income,” he said.

According to the portfolio screenshots he shared publicly, the investor made as little as $15 in dividends in 2020, and his annual income soared to $966 in 2022. In 2021 his dividend income stood at $305. This shows the power of compounding and letting money work for you.

The investor, who said he was 28 years old, was asked how much he invested to reach this income level. Here is what he said:

“50k invested, 2-3k per month in 2022, previous years less.”

While $1,000 a year is not much, it’s a nice start for those looking to get into income investing with small contributions from their salary or savings.

The Redditor also shared his stock portfolio with fellow investors. Let’s take a look at the biggest holdings in his portfolio.

Realty Income

Realty Income Corp (NYSE:O) was the biggest position in the Redditor’s portfolio, earning about $1,000 in dividends per year. According to the screenshots shared by the investor, Realty Income Corp (NYSE:O) accounted for about 9.9% of the total portfolio. Realty Income Corp (NYSE:O) yields about 5% and pays monthly dividends.

Apple

With over $160 billion in cash and over a decade of consecutive dividend increases, Apple Inc. (NASDAQ:AAPL) has become a significant dividend-paying stock investors pay attention to. The stock, however, yields just 0.44%. It has gained about 297% over the past five years.

Microsoft

Last month, Microsoft Corp (NASDAQ:MSFT) increased its quarterly dividend by 10%. It pays a per-share dividend of $0.83. Microsoft Corp (NASDAQ:MSFT) is one of the best stocks for dividend income and capital gains through stock price appreciation. MSFT is up 32% over the past year.

Stag Industrial

Stag Industrial (NYSE:STAG) is an industrial REIT that pays monthly dividends. Its dividend yield is about 3.6%. The Redditor said that about 7.5% of his dividend portfolio is allocated to this stock.

JPMorgan Chase

One of the biggest banks in the world, JPMorgan Chase & Co (NYSE:JPM) has a dividend yield of about 2.4% and has raised its payouts every year since 2009. It was among the biggest holdings of the Redditor, earning about $1,000 in dividends.

Trending: Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

Visa

Payments giant Visa Inc (NYSE:V) is another dividend stock that investors eye for both dividend income and share price gains. Visa Inc (NYSE:V) has increased its payouts for 16 consecutive years. The stock is up 21% over the past year. Last month, BNP Paribas upgraded Visa (NYSE:V) to Outperform, citing free cash flow and valuation.

Costco Wholesale

Costco Wholesale Corporation (NASDAQ:COST) is another low-yield, safe dividend stock in the Redditor’s portfolio. The retailer has increased its payouts for two decades in a row. It recently posted quarterly results with earnings beating estimates while revenue fell short of market expectations. Comparable sales rose 6.9% in the quarter, better than market estimates of 6.4%. COST is up 54% over the past year.

Johnson & Johnson

About 7.8% of the Redditor’s portfolio was allocated to Johnson & Johnson (NYSE:JNJ). The company has increased its dividends without a break for over six decades.

VICI Properties

Casino and entertainment REIT VICI Properties Inc (NYSE:VICI) was among the high-yield dividend stocks in the portfolio. The stock has a dividend yield of 5.3%. Last month, VICI Properties Inc (NYSE:VICI) raised its dividend by about 4%.

McDonald’s

Last month, McDonald’s Corp (NYSE:MCD) raised its dividend, marking its 48th consecutive year of dividend increases. The news was welcomed by investors amid growing concerns about slowing traffic at the fast-food chain due to rising inflation. McDonald’s Corp (NYSE:MCD) launched $5 meals to woo customers. BTIG analyst Peter Saleh recently noted that these initiatives are working as the company’s comparable sales moved into positive territory in August and September.

AbbVie

With over 50 years of consecutive dividend increases and a more than 3% dividend yield, AbbVie Inc (NYSE:ABBV) was an important stock in the portfolio of the 28-year-old Redditor. AbbVie Inc (NYSE:ABBV) accounted for about 7.1% of the total portfolio.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Allocating just 5% of your portfolio to this asset class could bring you big returns. Should you be invested in fine art?

This article This 28-Year-Old’s Dividend Income Jumped from ‘$15 to $1,000’ in Just Two Years – Top 11 Dividend Stocks In His Portfolio originally appeared on Benzinga.com

Wall Street Analysts Think Booking Holdings Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

Let’s take a look at what these Wall Street heavyweights have to say about Booking Holdings BKNG before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

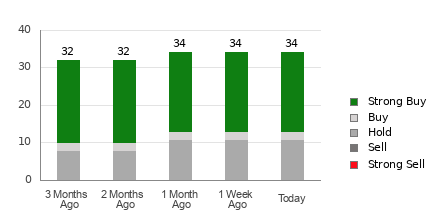

Booking Holdings currently has an average brokerage recommendation of 1.71, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 34 brokerage firms. An ABR of 1.71 approximates between Strong Buy and Buy.

Of the 34 recommendations that derive the current ABR, 21 are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 61.8% and 5.9% of all recommendations.

Brokerage Recommendation Trends for BKNG

While the ABR calls for buying Booking Holdings, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

On the other hand, earnings estimate revisions are at the core of the Zacks Rank. And empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Should You Invest in BKNG?

Looking at the earnings estimate revisions for Booking Holdings, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $176.92.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Booking Holdings.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for Booking Holdings.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

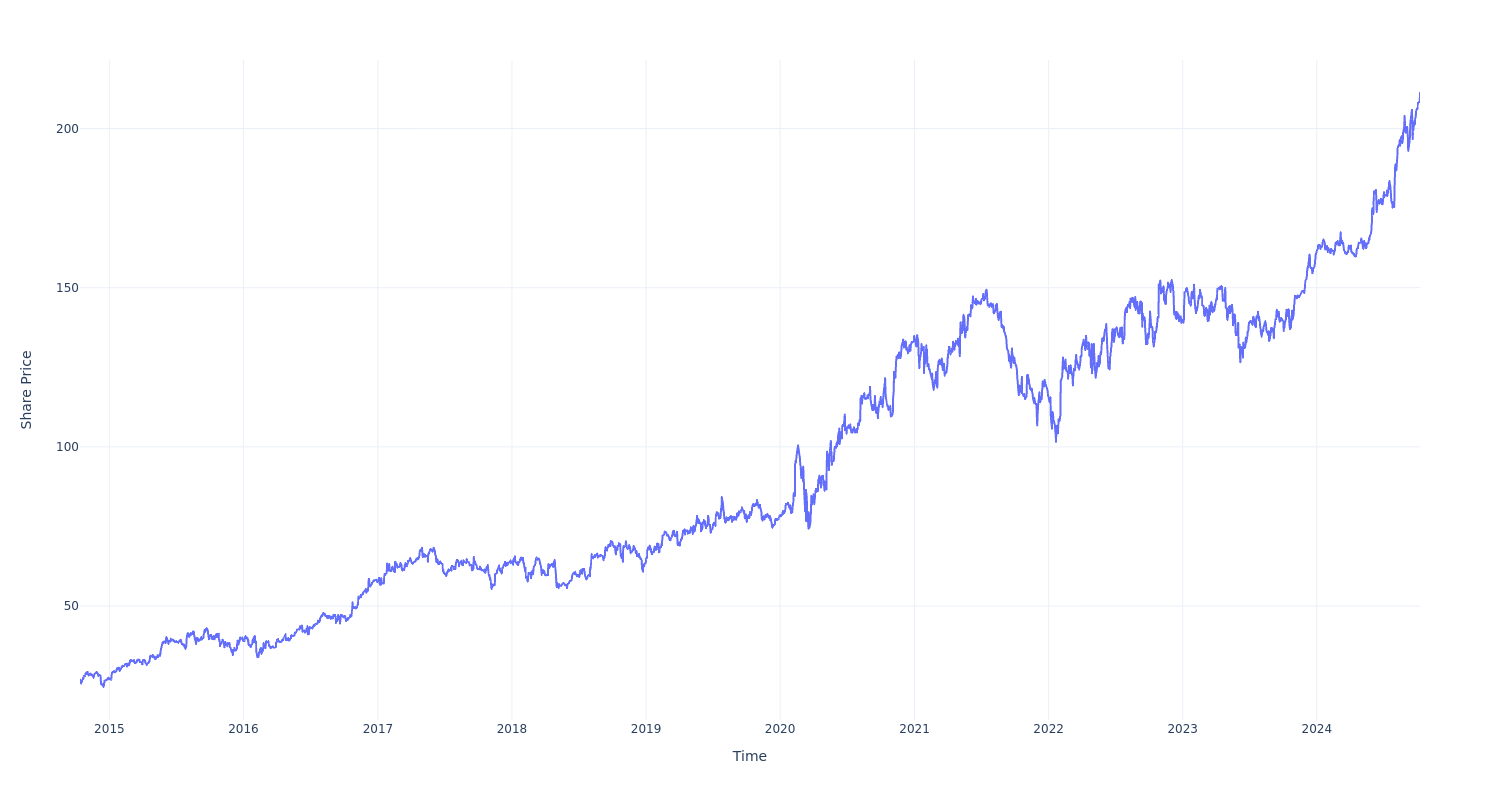

If You Invested $1000 In This Stock 10 Years Ago, You Would Have $7,800 Today

T-Mobile US TMUS has outperformed the market over the past 10 years by 11.3% on an annualized basis producing an average annual return of 23.11%. Currently, T-Mobile US has a market capitalization of $246.63 billion.

Buying $1000 In TMUS: If an investor had bought $1000 of TMUS stock 10 years ago, it would be worth $7,844.35 today based on a price of $211.38 for TMUS at the time of writing.

T-Mobile US’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

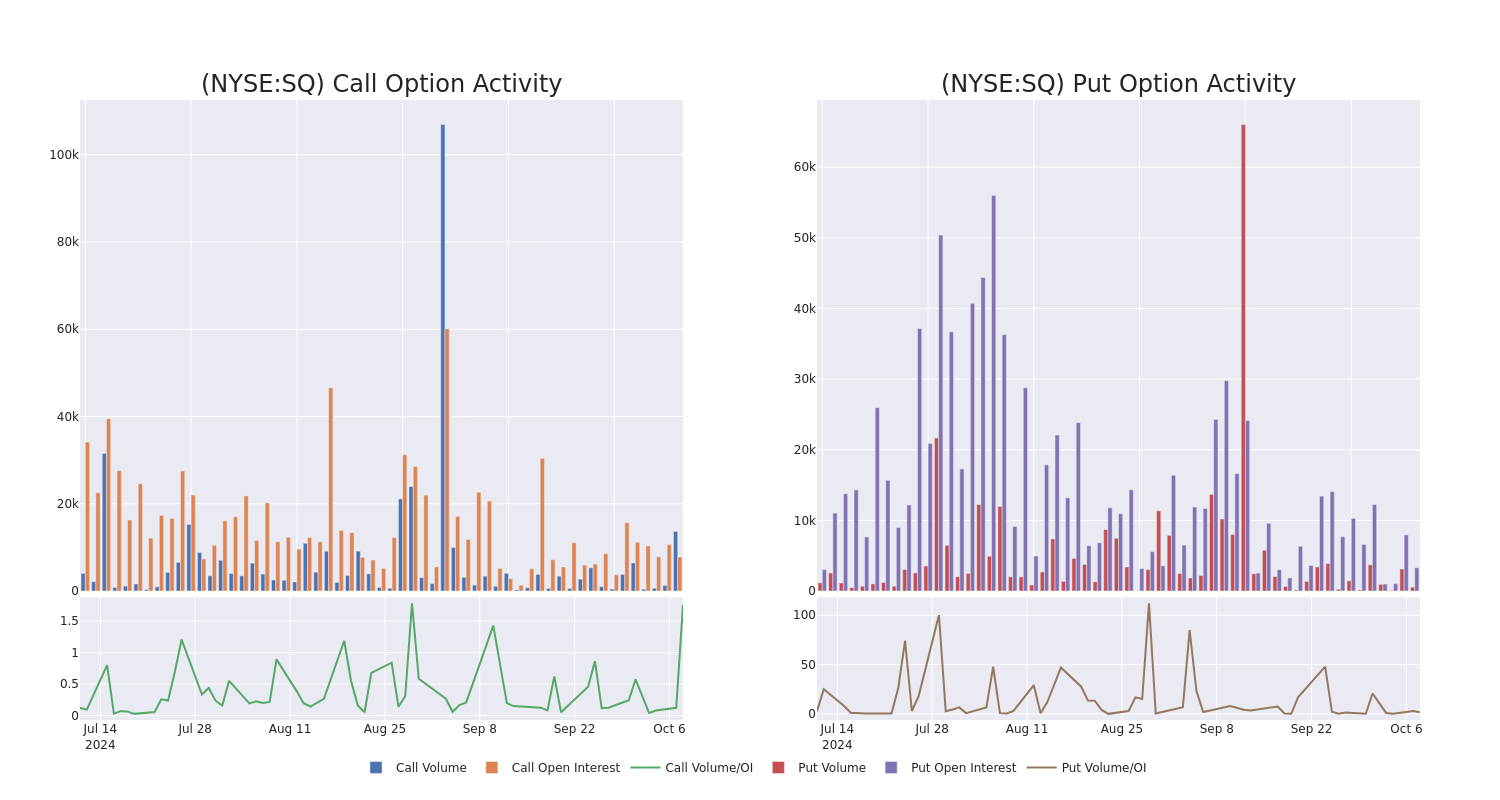

Block's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on Block.

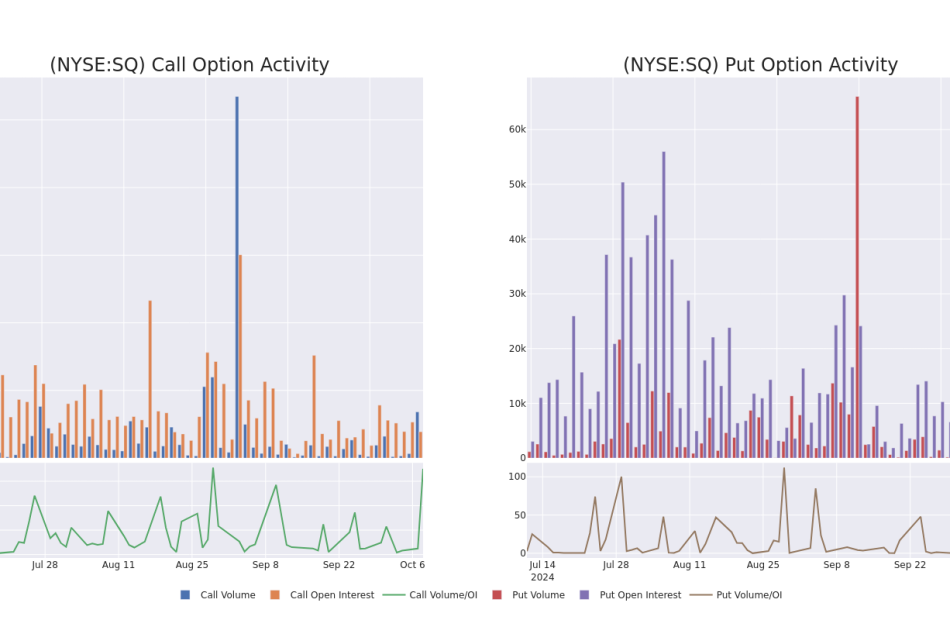

Looking at options history for Block SQ we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $241,874 and 6, calls, for a total amount of $262,790.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $77.5 for Block, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Block’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block’s whale activity within a strike price range from $50.0 to $77.5 in the last 30 days.

Block Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BULLISH | 06/20/25 | $16.15 | $16.0 | $16.12 | $60.00 | $80.6K | 1.3K | 53 |

| SQ | PUT | SWEEP | BEARISH | 11/15/24 | $10.25 | $10.0 | $10.25 | $75.00 | $54.3K | 142 | 0 |

| SQ | PUT | TRADE | NEUTRAL | 11/08/24 | $3.4 | $3.3 | $3.35 | $65.00 | $51.5K | 126 | 156 |

| SQ | PUT | TRADE | BEARISH | 11/15/24 | $5.5 | $5.45 | $5.5 | $67.50 | $49.5K | 1.8K | 90 |

| SQ | CALL | SWEEP | BEARISH | 11/15/24 | $4.25 | $4.15 | $4.15 | $70.00 | $44.4K | 1.2K | 592 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square’s payment volume was a little over $200 million.

In light of the recent options history for Block, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Block

- Trading volume stands at 2,794,690, with SQ’s price up by 3.53%, positioned at $68.03.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 23 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A millennial with a doctoral degree and over $250k in student-loan debt says she's been looking for a job for 4 years. She wishes she prioritized work experience over education.

-

A millennial with a doctoral degree and more than $250,000 in student-loan debt says she can’t find a job.

-

She’s looking for business roles while working as a nurse to help pay the bills.

-

She says she wishes she prioritized work experience over her graduate degrees.

Over the past decade, A. Rasberry has placed a great deal of value on higher education. She’s now come to regret it.

Rasberry earned a bachelor’s, master’s, and doctorate in business management from Saint Leo University in Florida. However, she says she’s struggled to find a job in her field of study over the past four years. She also has more than $250,000 in student-loan debt, according to a document viewed by Business Insider.

Since earning her doctorate, Rasberry has applied for various business-management roles but had little success. She said she’d been forced to expand her job search and explore a new career in nursing to help her make ends meet.

“I thought education was the road to financial freedom, but I was wrong,” the 38-year-old, who lives in Virginia, told Business Insider via email. She asked for partial anonymity, using only the first initial of her first name and her last name, because of privacy concerns.

We want to hear from you. Are you struggling to find a job and comfortable sharing your story with a reporter? Please fill out this form.

Rasberry’s search for work has spanned a wide range of economic conditions in the US, from the early days of the pandemic, through what turned into a major boom time for job seekers, to a present situation in which the unemployment rate and layoff rate remain low compared with historical levels but in which employers have nevertheless scaled back on hiring compared with a few years ago.

Rasberry shared why she thinks her job search has been so challenging, how she made her career pivot, and her top piece of advice for people pursuing higher education.

‘Most organizations prefer experience over education’

After receiving her doctoral degree, Rasberry said one of the first jobs she pursued was an adjunct professor position. However, after speaking with people in the education field, she decided to change course.

“I would have to go back to school to take more courses to support a teaching career,” she said, adding that she was told she’d specifically need more education-related credits.

As a result, Rasberry said, she decided to give up on teaching and focus on finding other roles in her area of study: business management.

But her job search has been challenging. Rasberry said she hasn’t landed many interviews, and when she has — and has been turned down — she’s had a hard time figuring out what went wrong. She said she’s expanded her job search to non-managerial bookkeeping, accounting, tutoring, and human resources roles but that she hasn’t had much luck with these either.

Rasberry thinks the biggest obstacle in her job search is her lack of work experience.

While pursuing her degrees, she gained some entry-level work experience in banking, human resources, and bookkeeping roles. However, she said this experience might be insufficient in the eyes of employers.

“I am over qualified for most entry-level positions, but I am under qualified for management or leadership positions,” she said. “Ultimately, my degree has been both a blessing and a curse.”

Rasberry’s top piece of advice for people who pursue higher education is to do your homework. She said she wishes she’d spent more time evaluating her school’s job placement programs, internship partnerships, and the employment rates of recent graduates across different fields before she pursued her degrees.

In December 2023, Saint Leo University was placed on probation after a commission determined that it wasn’t in compliance with financial responsibility standards. However, the university told BI that its accreditation remains in effect and that it’s working to address all areas of concern.

Rasberry also recommended taking time to think about the value of a college degree and the best ways to use it to land a job.

“I learned most organizations prefer experience over education,” she said. “Had I known that I would not have spent so many years in college.”

Nursing is helping to pay the bills during her job search

Rasberry said that in recent years, she’d worked various part-time jobs to pay the bills.

“It feels next to impossible to work a single job and earn enough money to cover essentials like rent, fuel, electricity, etc. in the state of Virginia,” she said. One analysis found Virginia was the 13th-most expensive state when it comes to overall cost of living.

She said she’s completing a training program to work remotely for TurboTax as a tax expert. At the same time, she’s also exploring a new career: nursing. Rasberry said that for roughly the past year, she’d been working as much as 80 hours a week as a nurse.

“I am new to nursing, but I find it rewarding, and I like the shift flexibility,” she said.

Rasberry found a nursing role that provided free training and certification. While she isn’t a registered nurse, she said this allowed her to work in an entry-level capacity at her employer. She said the downside was that this certification wouldn’t carry over to any other employers — limiting her opportunities in the industry. This is among the reasons she hasn’t stopped applying for business-related jobs.

Another reason is that she doesn’t think she’s paid particularly well — she said she was earning $21.50 an hour. Despite the long hours, she said the low pay is why she doesn’t view nursing as a full-time job.

“It doesn’t come with full time pay,” she said.

Rasberry said that in recent months, she’d begun focusing more on looking for remote roles such as the TurboTax opportunity. She said working remotely would make it easier to keep her nursing job, reduce her commuting costs, and care for her dog.

Over the past month, Rasberry finally had some luck in the job market. She said she landed a remote plan consultant position in the nursing field that pays about $70,000 a year — equivalent to an hourly rate of more than $30 an hour.

While she views this as a positive development, she said she’d “absolutely” continue searching for higher-paying roles in her field of study.

“When I’m not working, I’m online, putting in applications for employment,” she said.

Correction: October 7, 2024 — An earlier version of this story misstated the type of degree Rasberry earned. She earned a doctorate in business administration, not a Ph.D.

Read the original article on Business Insider

Piping Systems Market to Reach $6.5 Billion, Globally, by 2032 at 4.8% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 08, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Piping Systems Market by Product Type (Metal Piping Systems, Plastic Piping Systems and Composite Piping Systems), Material (Stainless Steel, Carbon Steel, Alloy Steel and Others), End User (Power Plants, Petroleum Refineries, Offshore And Marine, Chemical And Fertilizers and Others): Global Opportunity Analysis and Industry Forecast, 2024-2032“. According to the report, the piping systems market was valued at $4.4 billion in 2023, and is estimated to reach $6.5 billion by 2032, growing at a CAGR of 4.8% from 2024 to 2032.

Prime determinants of growth

In addition, stringent regulations concerning environmental conservation, health, and safety present challenges for the piping system market. However, the aging water and wastewater infrastructure in numerous regions present opportunities for piping system providers to engage in infrastructure upgrade and rehabilitation projects. These factors are expected to drive the growth of the piping systems market during the forecast period.

Download Sample Copy @ https://www.alliedmarketresearch.com/request-sample/A47273

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $4, 354.5 million |

| Market Size in 2032 | $6, 317.6 million |

| CAGR | 4.8% |

| No. of Pages in Report | 220 |

| Segments covered | Product Type, Material, End User, and Region |

| Drivers | Urbanization and Infrastructure Development Industrialization and Manufacturing Activities Renewable Energy Projects |

| Opportunities | Water and Wastewater Infrastructure Upgrades |

| Restraints | Regulatory Compliance and Environmental Concerns |

The metal pipes segment to maintain its leadership status during the forecast period.

By product type, the metal piping systems segment held the highest market share in 2023 and is estimated to maintain its leadership status during the forecast period, owing to their robustness, high-pressure handling capability, and suitability for diverse applications across industries such as oil and gas, construction, and manufacturing. However, the plastic piping systems segment is projected to attain the highest CAGR during forecast period 2024 to 2032, owing to their lightweight nature, corrosion resistance, cost-effectiveness, and expanding applications across various industries.

Buy This Research Report ( 220 Pages PDF with Insights, Charts, Tables, Figures):

https://www.alliedmarketresearch.com/checkout-final/bd0903ddb10ff97259e869000e594961

The carbon steel segment maintained its lead position during the forecast period.

By material, the carbon steel segment accounted for the largest share in 2023 and is estimated to maintain its leadership status during the forecast period, owing to its widespread availability, cost-effectiveness, durability, and suitability for diverse applications across industries such as oil and gas, construction, and manufacturing. However, the alloy steel is projected to attain the highest CAGR during the forecast period from 2024 to 2032. This is owing to its superior mechanical properties, corrosion resistance, and increasing applications in critical industrial sectors.

The petroleum segment to maintain its leadership status during the forecast period.

By end user, the petroleum segment held the highest market share in 2023 and is estimated to maintain its leadership status during the forecast period, their extensive demand for pipelines and infrastructure to transport crude oil, refined products, and natural gas globally. However, the pharmaceutical segment is projected to attain the highest CAGR during forecast period from 2024 to 2032, owing to increasing investments in pharmaceutical infrastructure, stringent regulations, and rising demand for hygienic fluid handling solutions.

Asia-Pacific to maintain its dominance by 2032.

By region, Asia-Pacific held the highest market share in terms of revenue in 2023 global piping system market revenue and is expected to witness the fastest CAGR during the forecast period 2024 to 2032, owing to rapid industrialization, urbanization, infrastructure development, and increasing investments in sectors like oil and gas, water treatment, and construction across the region.

Inquire Before Buying @ https://www.alliedmarketresearch.com/purchase-enquiry/A47273

Leading Market Players: -

- Prince Pipes And Fittings Ltd.

- Nippon Steel Corporation

- United States Steel Corporation

- Sumitomo Corporation

- Nucor Corporation (Nucor Tubular Products)

The report provides a detailed analysis of these key players of the global piping system market. These players have adopted different strategies such as new product launches, collaborations, expansion, acquisition, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Pipe Industry:

Pipeline Monitoring Systems Market – Global Opportunity Analysis and Industry Forecast, 2021-2030

Ductile Iron Pipes Market – Global Opportunity Analysis and Industry Forecast, 2021-2031

Pipes Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Steel Structure Market – Global Opportunity Analysis and Industry Forecast, 2024-2032

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” Allied Market Research has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.