What China's fading stock rally could mean for investors

The recent surge in Chinese stocks hit the pause button on Tuesday after Beijing failed to roll out another large stimulus package, a surprise to investors hoping to add more fuel to the unprecedented rally.

Hong Kong’s benchmark Hang Seng Index (^HSI), which is loaded with large Chinese stocks, dropped around 9% on Tuesday, its worst day since October 2008, after climbing around 20% over the past month on the heels of China unleashing its most aggressive monetary stimulus since the pandemic.

China’s benchmark CSI 300 (000300.SS) also experienced a volatile day as expectations of a large stimulus announcement fueled an initial 10% rise after markets reopened from the country’s weeklong holiday. The index later gave up those gains, finishing the day up a more modest 6%.

The stimulus, an effort by China to course-correct its struggling economy, was first announced on Sept. 24. Since then, a surge of inflows has dramatically boosted Chinese equities, particularly in real estate and consumer staples, as investors bet on Beijing’s comeback.

But Wall Street remains split on whether or not now is the right time to buy into the market.

“The short-run pop [signals that] people are feeling better,” Jeremy Schwartz, chief investment officer at WisdomTree, told Yahoo Finance’s Market Domination. “Will it be enough to move their economy? That’s very much an open question [because] the sentiment was so, so negative.”

The stimulus, which includes interest rate cuts, lower reserve requirements for banks, liquidity for the stock market, and mortgage relief, among other measures, comes as the nation’s second-largest economy attempts to pull itself out of a long slump spurred by deflationary pressures from a sluggish property market and weak domestic demand.

At a press conference on Tuesday hosted by China’s top economic planner, the National Development and Reform Commission (NDRC), Beijing said it’s committed to enacting further support in order to reach its economic goals, which include an annual growth target of “around 5%.”

“We are fully confident in achieving the annual economic and social development targets,” Zheng Shanjie, chairman of the NDRC, told reporters. However, he did acknowledge that the Chinese economy is facing a “more complex and extreme” global environment.

At the press conference, the NDRC announced it would issue 200 billion yuan ($28 billion) to local governments for spending and investment projects by year’s end. But economists have been waiting for a fiscal package worth around 2 trillion yuan ($284 billion) to be announced.

On Tuesday, other Chinese-listed exchanges and companies were also on the move. The Shanghai Composite (000888.SS), a key indicator of the overall performance of the Chinese stock market, eked out gains of around 5% after initially opening the day higher. The index has rallied by double digits, jumping more than 20% from its September lows. It’s up about 30% over the past month.

Similarly, shares of Chinese e-commerce giants like Alibaba (BABA) and PDD Holdings (PDD) have surged over that same period, up more than 35% and 55%, respectively, despite single-digit losses on Tuesday.

WisdomTree’s Schwartz said investing in the region depends on whether or not traders can afford to be “nimble” and “move in and out” of the market depending on the level of risk.

“For strategic, long-term investors, it’s tricky,” he said, noting that a “very dicey” geopolitical environment, coupled with the upcoming US election, further complicates the investment thesis.

“The ultimate question is: Are you going to be rewarded to be in China as a communist country and all of the other problems with the geopolitics, versus the democratic countries like Japan and India that are more US allies versus US adversaries at the moment?” he said.

Others say it’s only the start of China’s recovery and now could be the time to reassess.

“We’re really in the very, very early innings,” Brendan Ahern, CIO at KraneShares, told Yahoo Finance’s Morning Brief. “And then you have the high probability of better news coming. Instead of looking through the rearview mirror, let’s look through the windshield.”

‘If not now, when?’

Goldman Sachs added to bullish commentary in a note on Monday titled “China strategy: if not now, when?” The team, led by analyst Kinger Lau, upgraded China stocks to Overweight from Marketweight and argued for potential upside between 15% and 20% for both the MSCI China Index (2801.HK) and CSI 300 Index.

Other big banks, including HSBC Holdings and BlackRock, also upgraded mainland Chinese stocks in recent days, building on expectations that the rally still has more room to run.

“Many China watchers may have suffered ‘policy fatigue’ over the past 1 to 2 years, with the policy delivery in the post Covid-era generally being perceived as underwhelming,” Goldman Sachs wrote in its report. “Given low market expectations, the latest easing package has positively surprised investors and altered the policy narrative along a few dimensions.”

The analyst team added, “More stimulus is probably needed to turn things around, but the profit outlook [for Chinese companies] has moderately improved,” with valuations still below historic averages amid depressed stock prices.

“Even if the rally falters, [Chinese equities] still have a place in investor portfolios,” the report read.

As investors look ahead to the next possible catalyst for Chinese stocks, analysts say positive momentum will likely hinge on the magnitude and execution of more fiscal policy, rather than just monetary support.

“A well-targeted fiscal stimulus, aimed at rejuvenating the property sector and reviving animal spirits, could significantly improve China’s economic prospects, potentially generating positive spillovers for the global economy,” Seema Shah, chief global strategist at Principal Asset Management, wrote in a note on Monday.

“While investors have reason for cautious optimism, much will depend on the size and implementation of the various measures, details of which are still pending.”

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.

Elon Musk Warns America Is Spiraling Towards Bankruptcy – Trump Taps Him As 'Cost Cutter' With A Salary Of Zero To Fix It

America’s national debt is spiraling out of control, and Tesla CEO Elon Musk isn’t shy about sounding the alarm.

At the All-In Summit, hosted by the “All-In Podcast,” Musk pulled no punches. “America is going bankrupt extremely quickly,” he warned, “and everyone seems to be whistling past the graveyard on this one.” It’s not the first time Musk has expressed his concerns.

Don’t Miss:

This past July, he highlighted a headline that screamed, “Interest Payments on U.S. National Debt Will Shatter $1,140,000,000,000 This Year – Eating 76% of All Income Taxes Collected.”

Musk added his usual blunt commentary: “America is going bankrupt btw.”

His warnings are backed up by cold, hard facts. The U.S. national debt is now at a staggering $35.3 trillion and climbing fast. The root of the problem is a growing deficit that shows no signs of slowing down.

Trending: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

In fiscal year 2024, the government spent a jaw-dropping $1.9 trillion more than it collected. Musk pointed out that annual interest payments on the debt have crossed $1 trillion, and he didn’t mince words when he said, “We’re adding a trillion dollars to our debt, which our kids and grandkids are going to have to pay somehow.”

If the debt keeps growing at this pace, Musk warns the country will be trapped in a vicious cycle where “the only thing we’ll be able to pay is interest.”

See Also: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

The real fear, Musk says, is that at some point, “the only thing we’ll be able to pay is interest.” But can a country like the U.S. go bankrupt? It’s complicated. Governments can’t file for bankruptcy the way companies do. Technically, they can keep borrowing as long as there are buyers for their bonds.

The real risk, though, lies in inflation and economic instability. If the government prints more money to cover its debts, the dollar’s value could plummet, leaving Americans with the short end of the stick.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

As the co-hosts of the “Words & Numbers” podcast put it, “Technically, the government can’t go bankrupt, but it can print enough money to make dollars nearly worthless.”

The economic consequences are clear.

According to the Peter G. Peterson Foundation, rising debt crowds out investments in the public sector and economic growth. Confidence in the government’s ability to repay its debt diminishes and private investment takes a hit.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

Former President Donald Trump has noticed the issue, too. And in typical Trump fashion, he has a bold solution – bring in Elon Musk. At a rally in Walker, Michigan, Trump told supporters, “I’m going to get Elon, and he’s going to be our cost-cutter. I think he can save trillions.”

Though Trump admits Musk probably won’t be able to commit full-time due to his many ventures – rockets, electric cars, brain interfaces – he’s confident Musk’s efficiency could change the game. And with a net worth of $270 billion, Trump assured the crowd, “He’s going to do it for zero. He doesn’t want anything.”

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Musk seems open to the idea, too. In a post on X (formerly Twitter), Musk said he would serve without pay, title, or recognition if the opportunity arose.

The billionaire likened the U.S. fiscal situation to someone with too much credit card debt. He warned that the consequences could be severe if the country doesn’t curb its spending. Supporting Trump’s bid for the presidency, Musk sees a potential “once in a lifetime” chance to reduce government size and eliminate waste.

With Musk’s history of cutting costs – such as slashing Twitter’s workforce by 80% after acquiring the company – Trump is betting that this “cost-cutter” approach could reshape the government. He told supporters that Musk’s potential role wouldn’t hurt anyone but would target “waste, fraud and abuse.”

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Elon Musk Warns America Is Spiraling Towards Bankruptcy – Trump Taps Him As ‘Cost Cutter’ With A Salary Of Zero To Fix It originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I'm 65 With $500k in Cash and $1 Million in an IRA-Is It Finally Time to Retire?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Someone with $1.5 million in assets on top of Social Security income may be able to maintain a comfortable retirement starting at 65 with the right circumstances. While this is can be a relatively strong retirement profile depending on your needs, location and risk tolerance, you’ll need to plan carefully and make some critical decisions surrounding Social Security, your investments and spending. If you need additional help deciding whether you can afford to retire, consider speaking with a financial advisor.

Calculate Your Social Security Benefit

First, you’ll need to determine how much your Social Security benefits will be if you retire immediately at 65.

For someone born in 1958, the full retirement age is 66 years and 8 months. At age 65, you’d be collecting benefits 20 months early, which reduces your lifetime payments by 11.11%. For example, say you would have received the average payment of $1,759 per month or $21,108 per year at full retirement age. At age 65, you would instead receive $1,563 per month or $18,762 per year. Maximum benefits can pay up to $4,555 per month in 2023 if you wait until age 70 to begin collecting.

Your exact benefits depend on how many Social Security credits you earned while working. If possible, it would be wise to wait on collecting until full retirement age or later so that you can maximize your benefits. A financial advisor can help you determine when to start collecting Social Security.

Build an Income Plan

The next step is planning for other income. How much money can you generate from your combined savings, benefits and other assets?

First and foremost,if you have half a million dollars sitting in a low- or no-interest depository account, it’s likely not keeping up with inflation. You can do better.

Many investment pathways have a good chance of beating inflation so you don’t lose purchasing power to inflation over time. A financial advisor can help you create the right portfolio, as well as suggest other potential routes to sustainable financial health.

“Some of the excess $500,000 cash could be used to purchase permanent life insurance as this would provide a guaranteed tax-free death benefit,” said Bryan M. Kuderna, founder of the Kuderna Financial Team. “This might act as a ‘permission slip’ to spend down retirement assets and enjoy Social Security without disinheriting heirs and replenishing a lost Social Security check upon first spouse’s demise.”

Otherwise, the question is how to balance your income and risks. Depending on your spending and expenses, you should be able to generate enough income throughout retirement, but the scope of that income will depend on how you invest.

Before you restructure any investments, remember to consider required minimum distributions and withdrawal taxes, Kundera warns. “IRA distributions are reportable as taxable income, and as such, can push the IRA owner into higher tax brackets,” he said.

To understand different investment options, we can look at four possible alternatives for the $500,000 cash:

Option 1: Keep it in Cash

Say you keep everything in cash or cash equivalents. With $1.5 million in the bank, you can withdraw $50,000 per year for 30 years.

This is the weakest option. Coupled with even a mid-range Social Security income, this would likely be enough to live comfortably in most parts of the country, but not all.

Option 2: Invest in Bonds

The average interest rate on an Aaa corporate bond moves between 4% and 5%. With a 4% annual interest rate, a $1.5 million portfolio invested 100% in bonds could generate $60,000 per year without drawing down on the principal.

Option 3: Buy an Annuity

Annuities are often preferred by investors who want a mix of bond security and market payouts. A $500,000 annuity purchase could get you around $3,000 per month for life.

Option 4: Invest in a Balanced Portfolio

The S&P 500 has an average annual return of about 10%. Investing your entire $1.5 nest egg into the S&P 500 could produce approximately $150,000 in average annual income. That is, when the market meets its average return. There are years where the stock market suffers significant losses, including 2022 when the S&P 500 was down nearly 20%. Due to this risk, many retirees choose to have a more conservative portfolio, like a 60/40 portfolio.

Consider Your Spending

The combination of this income and however you structure it may be enough to retire on now at 65, but that depends entirely on your zip code, personal definition of comfort and any special circumstances.

Among other spending considerations, make sure to account for:

-

Known healthcare issues

-

Lifestyle and luxuries

-

Hobbies and travel

-

Bills and monthly spending

-

Gap and long-term care insurance

-

Housing in your community

-

Emergency funds

The last is important. When you live on a fixed income, it’s important to build financial flexibility for unexpected expenses. Whether this is as mundane as car repairs or as urgent as medical needs, keep a fund set aside for unexpected spending. Otherwise, you may find yourself reaching for money that isn’t there. A financial advisor can help you build a retirement budget based on your expenses and assets.

Bottom Line

You should be able to afford to retire comfortably with $1.5 million in assets, but be careful. While this is a lot of money, you’ll need a plan in place to ensure your assets can support your income needs and spending habits.

Retirement Planning Tips

-

Emergency funds are critical, especially for retirees who can’t generate new income. Fortunately, it’s not as hard to build one as you might think.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/JLco – Julia Amaral, ©iStock.com/RossHelen, ©iStock.com/Abdullah Durmaz

The post I’m 65 Years Old, Have $500k in Cash, $1 Million in an IRA and Social Security. Should I Retire Now? appeared first on SmartReads by SmartAsset.

Earnings Preview For Byrna Technologies

Byrna Technologies BYRN is preparing to release its quarterly earnings on Wednesday, 2024-10-09. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Byrna Technologies to report an earnings per share (EPS) of $0.05.

Investors in Byrna Technologies are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

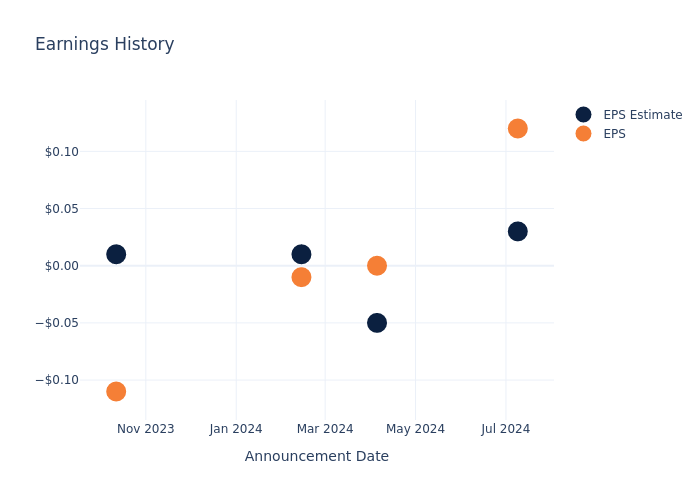

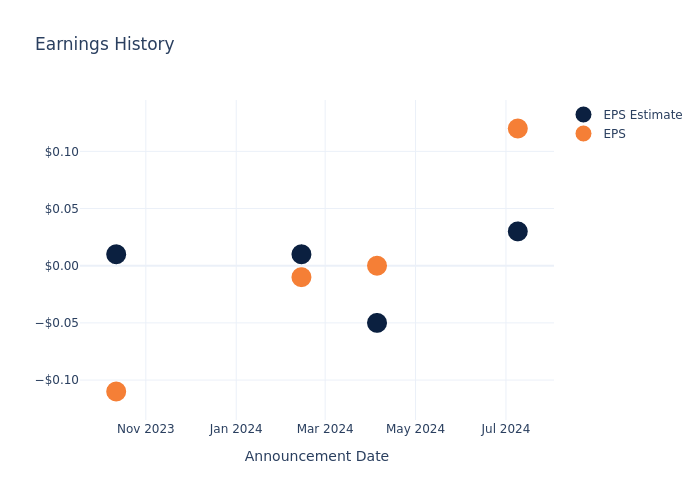

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.09, leading to a 7.31% drop in the share price the following trading session.

Here’s a look at Byrna Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.03 | -0.05 | 0.01 | 0.01 |

| EPS Actual | 0.12 | 0 | -0.01 | -0.11 |

| Price Change % | -7.000000000000001% | -4.0% | 12.0% | 23.0% |

Market Performance of Byrna Technologies’s Stock

Shares of Byrna Technologies were trading at $17.59 as of October 07. Over the last 52-week period, shares are up 582.72%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts’ Perspectives on Byrna Technologies

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Byrna Technologies.

Analysts have provided Byrna Technologies with 1 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $14.0, suggesting a potential 20.41% downside.

Comparing Ratings with Peers

The analysis below examines the analyst ratings and average 1-year price targets of AerSale, Virgin Galactic Hldgs and Astronics, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- AerSale received a Buy consensus from analysts, with an average 1-year price target of $9.67, implying a potential 45.03% downside.

- Virgin Galactic Hldgs is maintaining an Neutral status according to analysts, with an average 1-year price target of $26.6, indicating a potential 51.22% upside.

- Analysts currently favor an Neutral trajectory for Astronics, with an average 1-year price target of $21.0, suggesting a potential 19.39% upside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for AerSale, Virgin Galactic Hldgs and Astronics are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Byrna Technologies | Buy | 76.13% | $12.56M | 4.69% |

| AerSale | Buy | 11.22% | $21.72M | -0.81% |

| Virgin Galactic Hldgs | Neutral | 125.55% | $-23.07M | -23.09% |

| Astronics | Neutral | 13.56% | $41.35M | 0.60% |

Key Takeaway:

Byrna Technologies ranks at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity. Overall, Byrna Technologies is positioned favorably compared to its peers in terms of financial performance metrics.

Get to Know Byrna Technologies Better

Byrna Technologies Inc is a designer, manufacturer, retailer and distributor of technological solutions for security situations that do not require the use of lethal force. The company generates its revenue from the United States, South Africa, Europe, South America, Asia and Canada.

A Deep Dive into Byrna Technologies’s Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Byrna Technologies showcased positive performance, achieving a revenue growth rate of 76.13% as of 31 May, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Byrna Technologies’s net margin is impressive, surpassing industry averages. With a net margin of 10.25%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Byrna Technologies’s ROE stands out, surpassing industry averages. With an impressive ROE of 4.69%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Byrna Technologies’s ROA excels beyond industry benchmarks, reaching 3.77%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.03.

To track all earnings releases for Byrna Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ciena Stock Powers the AI Cloud Boom—Don't Miss Out

Ciena Co. CIEN can be considered a legacy company in the computer and technology sector when it comes to the Internet. It was one of the original manufacturers of optical fiber, which provided networking switches and connectivity solutions since 1992. The company has managed to stay relevant, unlike so many internet boom companies, and remains on the cutting edge of the artificial intelligence (AI) revolution. Ciena is essential to the AI boom as it provides one of the crucial elements required for AI deployment: high bandwidth and low latency connectivity.

Ciena operates in the computer and technology sector, competing with networking companies like Cisco Systems Inc. CSCO, Juniper Networks Inc. JNPR, which was acquired by Hewlett Packard Enterprises Inc. HPE, and Infinera Co. INFN which is being acquired by Nokia Oyj NOK.

How Ciena Is Essential to the AI Revolution

Ciena is a leader in the optical networking segment, as its products enable long-distance, high-capacity data transmission solutions for the backbones of numerous networks. Data transmission volumes will only grow, driven by AI deployment and cloud computing. Its optical transceivers enable low-latency transmission, which is essential for AI applications to relay responsiveness and fast performance. Its Blue Planet AI-powered software-defined network (SDN) enables network operators to program, automate, and manage networks, orchestrate end-to-end services, and scale bandwidth on demand as needed.

Cloud Providers Lead the Recovery

Ciena is approaching positive normalization after many volatile years driven by the pandemic shortage and post-pandemic inventory glut. Cloud providers are leading the recovery, building out networks to support cloud and growing AI traffic. Data centers are a big chunk of Ciena’s cloud provider clients. Three of the four major cloud providers are driving demand for Ciena’s 400 ZR, a high-capacity datacenter interconnect (DCI) capable of transmitting 400 GB ethernet over DCI links, targeting a minimum of 80 kilometers.

Ciena’s other client group, service providers, is experiencing a gradual recovery as the inventory glut is digested. Ciena still expects the U.S. to recover fully in a few quarters, while Europe continues to lag due to geopolitical and macroeconomic headwinds.

Gloomy Headline Numbers Underscore Improving Metrics

Ciena’s third-quarter of 2024 earnings report was a sign of relief as results underscore the recovery occurring, enabling a turnaround after many negative quarters. The company reported EPS of 35 cents, beating analyst expectations by 6 cents. GAAP net income was $14.2 million, down from $29.7 million last year. Adjusted net income was $50.8 million, which was also lower than the $89.1 million non-GAAP income in the year-ago period. Revenue fell 11.8% YoY to $942.3 million, which was better than expected compared to the consensus estimates of $928.31 million. Ciena reported a strong book-to-bill ratio above 1, indicating stronger demand that it can fulfill.

Ciena Issues Flat Guidance

Ciena expects revenues of $1.06 billion to $1.14 billion in the fourth quarter of 2024 versus $1.12 billion in consensus estimates. Adjusted gross margin is expected to be in the low 40% range, and adjusted operating expenses are expected to be around $350 million. Full-year 2024 revenues are estimated at around $4 billion, with a 4% to 8% CAGR long-term. CIEN stock tumbled 7% the following days.

Ciena CEO Gary Smith commented, “We delivered strong results for the fiscal third quarter that reflect growing momentum with cloud providers and continued gradual recovery with service providers. With leading innovation that is well-aligned with our customers’ focus on building cloud and AI-capable infrastructures, we are well-positioned to continue to gain share and deliver profitable growth.”

On Oct. 2, 2024, Ciena announced a $1 billion stock buyback program commencing in fiscal 2025 and ending in fiscal 2027. CIEN stock surged 7% on the announcement.

CIEN Is Forming a Potential ABCD Reversal Pattern

An ABCD pattern is a harmonic reversal pattern comprised of two higher peaks and one higher low. The pattern resembles a rising lightning bolt. A market structure high (MSL) sell trigger often triggers the reversal.

CIEN stock initially sold off on its earnings report and guidance to a swing low of $50.83, forming the C-point. Shares rallied higher through the B-point pre-earnings peak at $59.42 to continue higher toward an imminent D-point, which could trigger a reversal. The daily anchored VWAP support is rising at $56.78. The daily relative strength index (RSI) is rising to the 75-band. Fibonacci (Fib) pullback support levels are at $62.91, $57.69, $53.76, and $50.83.

Ciena’s average consensus price target is $61.00, and its highest analyst price target is $68.00. Analysts have given it 10 Buy ratings and three Hold ratings.

The article “Ciena Stock Powers the AI Cloud Boom—Don’t Miss Out” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marijuana Operator TerrAscend To Report Quarterly Earnings Soon, Hear From Its Top Exec At Benzinga Cannabis Conference

North American cannabis company TerrAscend Corp. TSND TSNDF will host a scheduled conference call to discuss the results for its third quarter ended Sept. 30, 2024 on Wednesday, Nov. 6, 2024, at 5:00 pm Eastern Time.

The company will report its financial results for the third quarter of 2024 the same day after the market closes.

In early August, TerrAscend reported net revenue of $77.5 million for the second quarter of 2024, reflecting a 7.5% increase compared to $72.1 million in the same period in 2023.

Executive chairman Jason Wild highlighted the company’s material revenue and EBITDA growth during the quarter, positive free cash flow and a strategic focus on geographic expansion supported by a recently secured $140 million term loan.

Read Also: TerrAscend Cannabis Co Shares Expansion Plans On Water Tower Research Podcast

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

The company completed the second and final draw of $26 million earlier this month as part of its $140 million senior secured term loan, initially announced in August 2024. The loan, managed by FocusGrowth Asset Management, LP, was used to pay down higher-interest debt in Michigan, helping the company strengthen its financial position.

In the meantime, the company also announced a $10 million share repurchase program in August, marking the first stock buyback initiative by TerrAscend, authorized by its board of directors under a normal course issuer bid (NCIB).

Wild said the move “demonstrates our confidence in TerrAscend’s future and commitment to enhancing shareholder value. As famed investor Benjamin Graham famously stated, ‘In the short run, the market is a voting machine, but in the long run, it’s a weighing machine.’”

Wild is slated to speak at this week’s Benzinga cannabis event in Illinois. The 19th Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Read Next:

TSNDF Price Action

TerrAscend’s shares traded 0.81% higher at $1.24 per share at the time of writing on Tuesday.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘Mag Seven’ Rally as Nvidia’s Winning Run Hits 14%: Markets Wrap

(Bloomberg) — The world’s largest technology companies drove stocks higher, with the market rebounding from its worst session in a month. A rout in Treasuries eased as bets on Federal Reserve rate cuts stabilized. Oil sank.

Most Read from Bloomberg

Equities closed within a striking distance of their all-time highs, with the S&P 500 up 1%. Chipmakers led gains on Tuesday as Nvidia Corp. extended a five-day rally to 14%. A Bloomberg gauge of the “Magnificent Seven” megacaps climbed 1.7%. Wall Street’s favorite volatility gauge — the VIX — dropped from its highest since August.

“We expect equities will ‘back and filling’ in October as the earnings season begins,” said Craig Johnson at Piper Sandler. “Investors should use ‘health’ pullbacks that confirm key support to add to positions.”

Traders also waded through remarks from US policymakers.

Fed Bank of Boston President Susan Collins noted that rate cuts should be careful and data-based. Her Atlanta counterpart Raphael Bostic said while risks to inflation have come down, threats to the labor market have risen, though the economy is still strong. Governor Adriana Kugler said officials should keep the focus on bringing inflation to target, with a “balanced approach” that avoids a slowdown in jobs.

“The US data is not so strong that the Federal Reserve’s contribution to the global rate-cutting cycle looks set to end,” said Mark Haefele at UBS Global Wealth Management. “We therefore maintain our conviction for investors to position for lower rates.”

The S&P 500 topped 5,750. Honeywell International Inc. gained on plans to spin off its advanced materials division. Energy stocks joined oil lower and US-listed Chinese stocks tumbled as Beijing stopped short of launching more major stimulus. Roblox Corp. dropped as Hindenburg Research said it’s betting against the gaming platform.

Treasury 10-year yields were little changed at 4.02%. A $58 billion sale of three-year Treasuries was soft. West Texas Intermediate crude fell 4.6% to $73.57 a barrel.

Mohamed El-Erian says the guessing game that’s taking place over the Fed’s path for monetary policy is creating market volatility.

“Markets are all over the place. In the last 15 days the probability of a 50 basis point cut in November has gone from over 60% to zero. November is next month,” El-Erian, the president of Queens’ College, Cambridge, told Bloomberg Television on Tuesday.

“That is how much uncertainty there has been in this market. These are massive moves based on data points,” he added.

Billionaire investor Ray Dalio said he doesn’t anticipate the Fe making “significant cuts in rates,” and that bonds are a risky investment given recent fluctuations in Treasury markets.

“Treasury bonds have not been a great investment,” the Bridgewater Associates founder said Tuesday at the Greenwich Economic Forum. “We have an interest rate risk in that bond market.”

Yields have risen after a healthy decline and for now, this indicates the bond market is pricing in fewer rate cuts and not more, according to Michael Landsberg at Landsberg Bennett Private Wealth Management.

“Yields will likely stay range bound and even if they rise from here, they have plenty of upside room before rising yields start to negatively affect stock prices,” he said.

Corporate Highlights:

-

Boeing Co. managed to hand over 33 aircraft to customers in September, when a strike shut down large parts of its manufacturing, while warning that the work stoppage at its main production hub in the Seattle area will reduce future deliveries.

-

DocuSign Inc. climbed after S&P Dow Jones Indices said that the e-signature company will join the S&P Midcap 400 Index before trading opens on Oct. 11.

-

PepsiCo Inc. reduced its revenue outlook, citing slower-than-expected growth and international unrest, but said cost cutting and greater efficiency will allow it to meet its profit goal.

-

WW International Inc. said it would begin offering a copycat version of weight-loss drugs that costs far less than Novo Nordisk A/S’s Ozempic and Wegovy.

Key events this week:

-

Fed minutes, Wednesday

-

Fed’s Lorie Logan, Raphael Bostic, Austan Goolsbee and Mary Daly speak, Wednesday

-

US CPI, initial jobless claims, Thursday

-

Fed’s John Williams and Thomas Barkin speak, Thursday

-

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

-

US PPI, University of Michigan consumer sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 1% as of 4 p.m. New York time

-

The Nasdaq 100 rose 1.6%

-

The Dow Jones Industrial Average rose 0.3%

-

The MSCI World Index rose 0.4%

-

Bloomberg Magnificent 7 Total Return Index rose 1.7%

-

The Russell 2000 Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0978

-

The British pound rose 0.1% to $1.3099

-

The Japanese yen was little changed at 148.30 per dollar

Cryptocurrencies

-

Bitcoin fell 1.4% to $62,114.69

-

Ether fell 0.3% to $2,434.47

Bonds

-

The yield on 10-year Treasuries was little changed at 4.02%

-

Germany’s 10-year yield declined one basis point to 2.24%

-

Britain’s 10-year yield declined two basis points to 4.18%

Commodities

-

West Texas Intermediate crude fell 4.6% to $73.57 a barrel

-

Spot gold fell 0.8% to $2,621.72 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

4 Reasons to Buy British American Tobacco Stock Like There's No Tomorrow

People skip over tobacco stocks for several reasons. For some, the stigma of companies that sell a harmful product turns them away. Others want more upside than what tobacco stocks have delivered in recent years. However, open-minded investors may be surprised to learn what British American Tobacco (NYSE: BTI) can offer.

Don’t expect the stock to double or triple anytime soon. In fact, the share price is down more than 30% from a decade ago.

But despite its poor past performance, there are many reasons to love the stock today and in the future. Here are four reasons to buy British American Tobacco like there’s no tomorrow.

1. An 8.3% dividend yield

Tobacco stocks haven’t produced much capital gains over the past decade, but the dividends are famous. British American Tobacco yields a whopping 8.3% at its recent share price, more than what investors will find from other sources. High yields are a common warning sign for most stocks, but tobacco companies are an exception because they generally don’t need much reinvestment and can pass most of their profits along to shareholders.

Analysts estimate that British American Tobacco will earn approximately $4.60 per share this year and pay $2.93 in dividends. That’s a dividend payout ratio of 63%, which leaves a big cushion in case profits dry up unexpectedly. Still, that’s unlikely; nicotine’s addictive properties have made tobacco companies quite resilient. Investors can use the dividend to pay for living expenses or reinvest it to buy more shares of British American Tobacco or another stock.

2. Rate cuts

The dividend is the primary reason to own British American Tobacco, and changes in the economy’s interest rates impact that dynamic. The Federal Reserve recently announced a 50-basis-point reduction to the federal funds rate, the benchmark interest rate for the U.S. economy. Depending on how the economy performs, there could be more rate cuts in the future.

When interest rates fall, it impacts the yield people can generate in places like high-yield savings accounts. Lower interest rates could make high-yield dividend stocks, like British American Tobacco, more appealing. A dependable, high-yield stock has more value when rates are low.

3. Success in smokeless products

As smoking gradually declines, tobacco companies are shifting to smokeless products, including electronic cigarettes (vapes), heat-not-burn tobacco devices, and oral nicotine pouches. It’s essentially a race to transition from the past to the future, and British American Tobacco is doing well. Smokeless products were 17.9% of total sales in the first half of 2024.

I’d say competitor Philip Morris International boasts better smokeless product brands, such as Zyn and Marlboro-branded Iqos, but that’s OK. British American Tobacco is making genuine strides with its brands and is faring far better than Altria, which still depends primarily on combustible products for its business.

4. The price makes a ton of sense

Eventually, British American Tobacco may grow faster as the company’s composition shifts from its declining cigarette business to its growing smokeless group. That transition will take years, so it’s not something that needs to be top of mind today. Short-term growth matters, though, and British American Tobacco can deliver. Analysts expect the company to grow earnings by about 4% annually over the next three to five years. It matters because that can fuel annual dividend increases without changing the financial math.

Additionally, it helps justify buying the stock at its current price. British American Tobacco trades at a price-to-earnings ratio (P/E) of 7.6 using 2024 earnings estimates. The S&P 500 has a P/E ratio of 21, so the market has meager expectations for British American Tobacco.

Slow growth is OK when the price makes sense.

Which sounds like a better deal:

Company B is Costco Wholesale. I don’t know about you, but I’d rather buy Company A, British American Tobacco.

Putting it all together

All stocks are risky to some degree, but the fact that British American Tobacco trades at a valuation appropriate for its pedestrian growth reduces the odds that investors endure a catastrophic price decline.

British American Tobacco won’t be the right stock for everyone. It’s unlikely to turn modest sums of money into millions, and you must have dividends pretty high on your priority list to have interest here. That said, the right investor will struggle to find a better high-yield dividend stock they can buy and hold without losing sleep.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,006!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,905!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $388,128!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Justin Pope has positions in Philip Morris International. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

4 Reasons to Buy British American Tobacco Stock Like There’s No Tomorrow was originally published by The Motley Fool

Global Pharma Selects Kneat to Digitize Computer System Validation

LIMERICK, Ireland, Oct. 08, 2024 (GLOBE NEWSWIRE) — kneat.com, inc. KSI KSIOF, a leader in digitizing validation and quality processes, is pleased to announce that a global pharmaceutical company has signed a three-year Master Services Agreement with Kneat to digitize its validation processes.

Headquartered in Germany with over 11,000 employees across more than a dozen facilities, the company is a trusted maker of household consumer health care brands and generic and specialty pharmaceuticals for customers in over 120 countries. The company selected Kneat as their corporate solution after a comprehensive evaluation process. The company’s goal is to enhance the efficiency, accuracy, and compliance of complex validation processes across its global operations, starting with Computer System Validation (CSV).

“This announcement further demonstrates Kneat’s leadership position across the full Validation spectrum,” said Eddie Ryan, Chief Executive Officer of Kneat. “We look forward to supporting this company to achieve harmonization for all their validation processes on a single platform.”

About Kneat

Kneat Solutions provides leading companies in highly regulated industries with unparalleled efficiency in validation and compliance through its digital validation platform Kneat Gx. We lead the industry in customer satisfaction with an unblemished record for implementation, powered by our user-friendly design, expert support, and on-demand training academy. Kneat Gx is an industry-leading digital validation platform that enables highly regulated companies to manage any validation discipline from end-to-end. Kneat Gx is fully ISO 9001 and ISO 27001 certified, fully validated, and 21 CFR Part 11/Annex 11 compliant. Multiple independent customer studies show a 40% or more reduction in validation cycle times, nearly 20% faster speed to market, and 80% reduced changeover time.

Cautionary and Forward-Looking Statements

Except for the statements of historical fact contained herein, certain information presented constitutes “forward-looking information” within the meaning of applicable Canadian securities laws. Such forward-looking information includes, but is not limited to, the relationship between Kneat and the customer, Kneat’s business development activities, the use and implementation timelines of Kneat’s software within the customer’s validation processes, the ability and intent of the customer to scale the use of Kneat’s software within the customer’s organization and the compliance of Kneat’s platform under regulatory audit and inspection. While such forward-looking statements are expressed by Kneat, as stated in this release, in good faith and believed by Kneat to have a reasonable basis, they are subject to important risks and uncertainties. As a result of these risks and uncertainties, the events predicted in these forward-looking statements may differ materially from actual results or events. These forward-looking statements are not guarantees of future performance, given that they involve risks and uncertainties.

Kneat does not undertake any obligation to release publicly revisions to any forward-looking statement, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued forward-looking statement constitutes a reaffirmation of that statement. Continued reliance on forward-looking statements is at an investor’s own risk.

For further information:

Katie Keita, Kneat Investor Relations

P: + 1 902-450-2660

E: investors@kneat.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JLL Income Property Trust Fully Subscribes $65 Million Industrial DST

CHICAGO, Oct. 8, 2024 /PRNewswire/ — JLL Income Property Trust, an institutionally-managed daily NAV REIT (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX) with approximately $6.6 billion in portfolio equity and debt investments, announced today that it has fully subscribed JLLX Grand Prairie, DST. The $65 million program was structured as a Delaware Statutory Trust designed to provide 1031 exchange investors the opportunity to reinvest proceeds from the sale of appreciated real estate while also deferring taxes.

JLLX Grand Prairie, DST consisted of two Class A industrial distribution facilities located in Grand Prairie, TX, a submarket of the Dallas-Fort Worth metropolitan area. Both properties are 100% leased to and occupied by Fruit of the Earth, Inc., a leading provider of skin care, sun care, and health care products.

“We are pleased to have fully subscribed JLLX Grand Prairie, DST,” said Drew Dornbusch, Head of JLL Exchange. “The continued demand we see from 1031 exchange investors and their advisors is a testament to the success of the program to provide solutions that can facilitate the transfer of generational wealth, while mitigating the significant tax consequences associated with the sale of appreciated investment real estate.”

“JLLX Grand Prairie, DST provided 1031 exchange investors access to the industrial property sector – one of the strongest performing property types over the past several years due to the continued acceleration of e-commerce, supply change configuration and strong consumer demand,” said Allan Swaringen, President and CEO of JLL Income Property Trust. “We’re proud that institutional-quality investment solutions like ours have proven to be an attractive avenue for wealth management firms and their clients who are seeking to reinvest proceeds from the sales of appreciated investment real estate while deferring taxes.”

Since its inception in 2019, JLLX has attracted more than $1.5 billion across 24 DST offerings from property owners seeking to maintain a meaningful allocation to real estate in a tax efficient manner. JLL Income Property Trust has completed 13 full cycle UPREIT transactions totaling $900 million to date.

For more information on JLL Income Property Trust, please visit our website at www.jllipt.com.

About JLL Exchange

The JLL Exchange program offers private placements through the sale of interests in Delaware Statutory Trusts (DSTs) holding core real estate investment properties. For more information, visit www.jllexchange.com.

About JLL Income Property Trust, Inc. (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX)

JLL Income Property Trust, Inc. is a daily NAV REIT that owns and manages a diversified portfolio of high quality, income-producing residential, industrial, grocery-anchored retail, healthcare and office properties located in the United States. JLL Income Property Trust expects to further diversify its real estate portfolio over time, including on a global basis. For more information, visit www.jllipt.com.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Valuations, Forward Looking Statements and Future Results

This press release may contain forward-looking statements with respect to JLL Income Property Trust. Forward-looking statements are statements that are not descriptions of historical facts and include statements regarding management’s intentions, beliefs, expectations, research, market analysis, plans or predictions of the future. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. Past performance is not indicative of future results and there can be no assurance that future dividends will be paid.

Contacts:

Alissa Schachter

LaSalle Investment Management

Telephone: +1 (312) 228-2048

Email: alissa.schachter@lasalle.com

Doug Allen

Dukas Linden Public Relations

Telephone: +1 646 722 6530

Email: JLLIPT@DLPR.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-fully-subscribes-65-million-industrial-dst-302268988.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-fully-subscribes-65-million-industrial-dst-302268988.html

SOURCE JLL Income Property Trust

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.