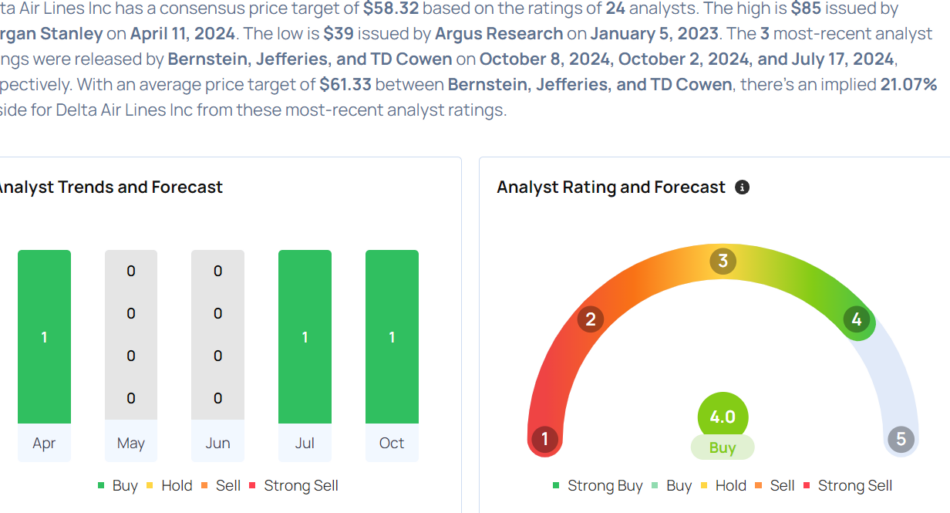

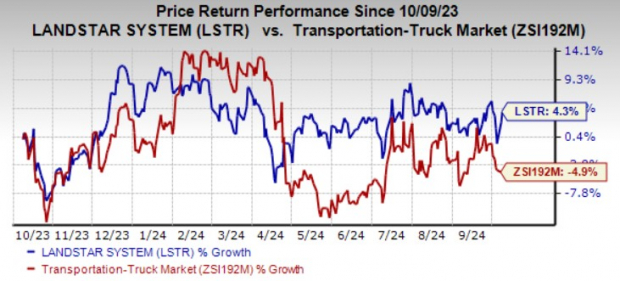

Delta Air Lines Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Delta Air Lines, Inc. DAL will release earnings results for its third quarter, before the opening bell on Thursday, Oct. 10.

Analysts expect the Atlanta, Georgia-based company to report quarterly earnings at $1.51 per share, down from $2.03 per share in the year-ago period. Delta Air projects to report revenue of $14.71 billion for the quarter, compared to $14.55 billion a year earlier, according to data from Benzinga Pro.

On Sept. 12, Delta reportedly said FY24 EPS is expected to be at or above the midpoint of the $6-$7 range, with September quarter ASMs up around 4% YoY.

Delta Air shares gained 2.3% to close at $50.62 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Jefferies analyst Sheila Kahyaoglu maintained a Buy rating and raised the price target from $56 to $60 on Oct. 2. This analyst has an accuracy rate of 71%.

- Citigroup analyst Stephen Trent maintained a Buy rating and boosted the price target from $55 to $65 on May 29. This analyst has an accuracy rate of 70%.

- Deutsche Bank analyst Michael Linenberg maintained a Buy rating and increased the price target from $50 to $60 on April 11. This analyst has an accuracy rate of 74%.

- UBS analyst Atul Maheswari initiated coverage on the stock with a Buy rating and a price target of $59 on March 20. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Jamie Baker maintained an Overweight rating and slashed the price target from $71 to $68 on Oct 13, 2023. This analyst has an accuracy rate of 63%.

Considering buying DAL stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

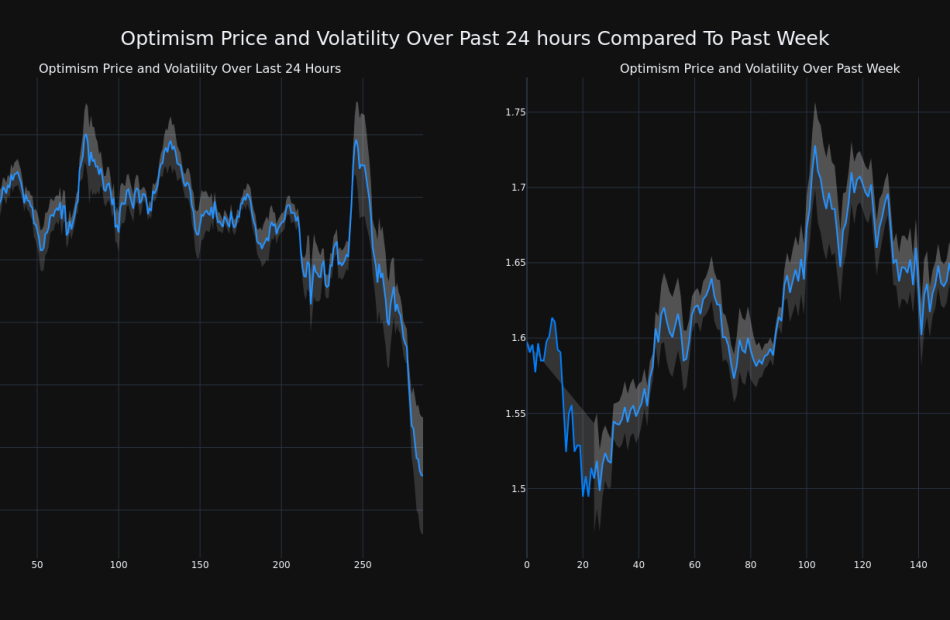

Cryptocurrency Optimism Falls More Than 4% In 24 hours

Over the past 24 hours, Optimism’s OP/USD price has fallen 4.21% to $1.55. This continues its negative trend over the past week where it has experienced a 0.0% loss, moving from $1.6 to its current price.

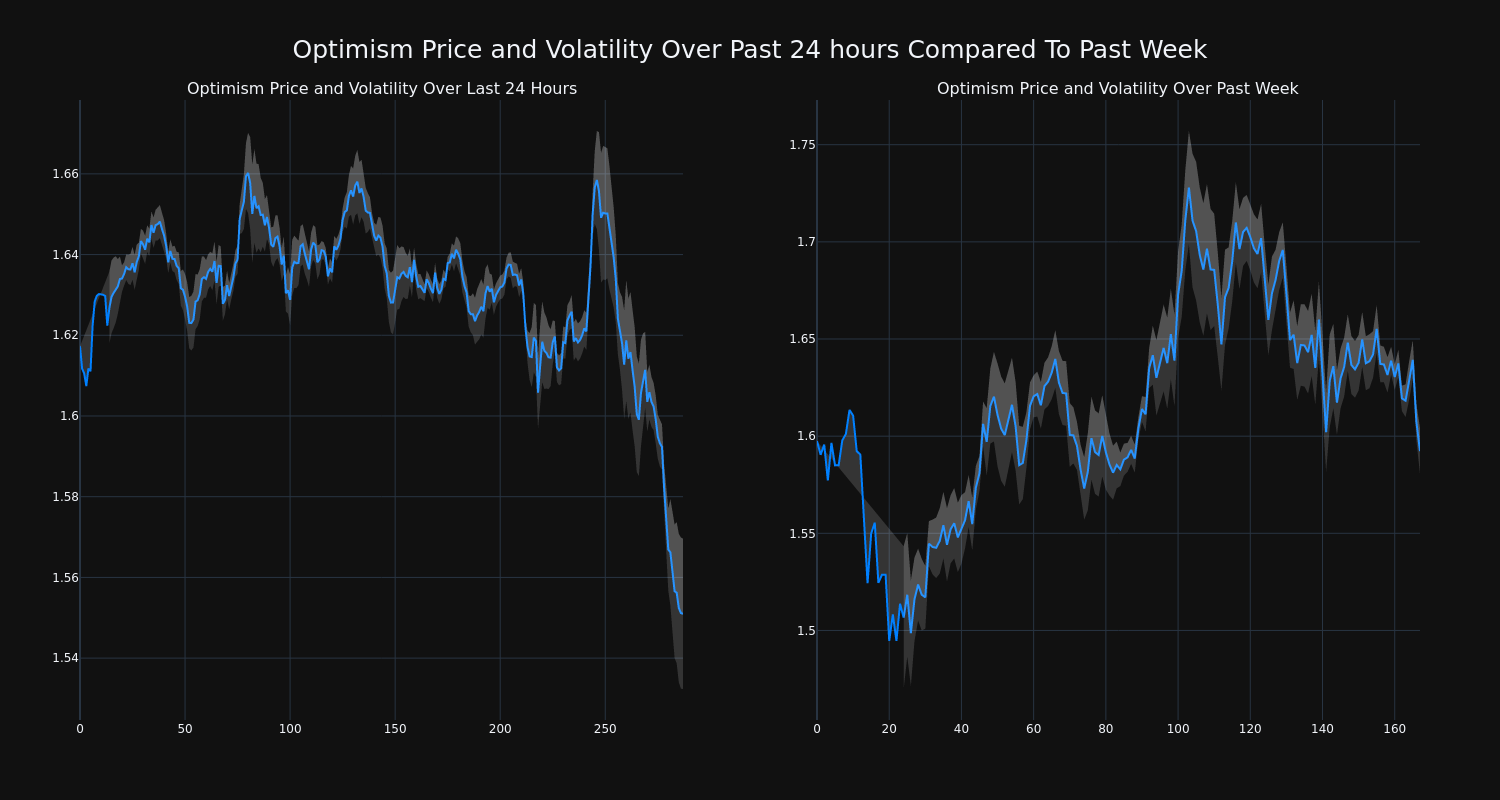

The chart below compares the price movement and volatility for Optimism over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

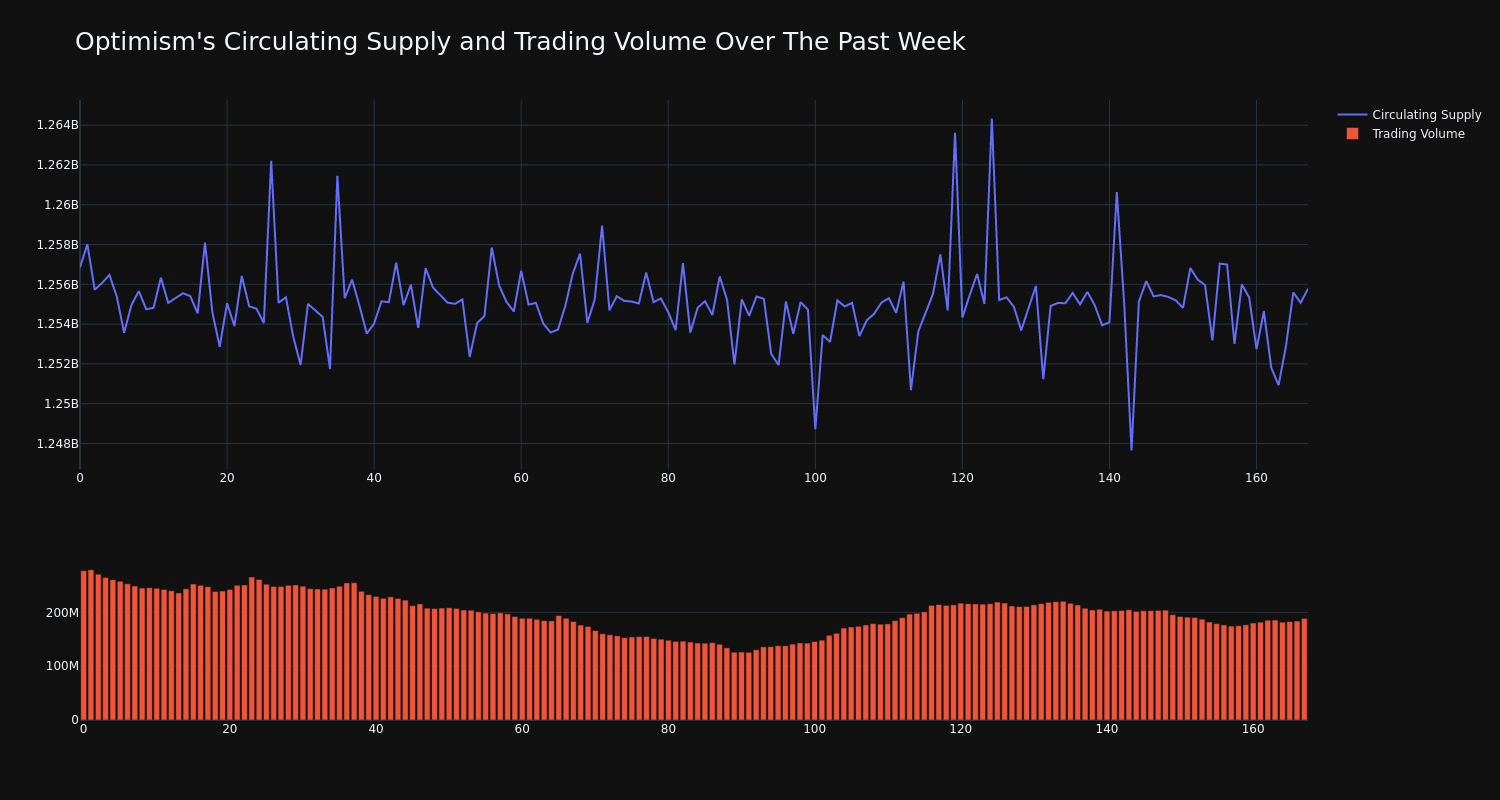

The trading volume for the coin has tumbled 32.0% over the past week along with the circulating supply of the coin, which has fallen 0.09%. This brings the circulating supply to 1.26 billion, which makes up an estimated 29.22% of its max supply of 4.29 billion. According to our data, the current market cap ranking for OP is #48 at $1.94 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pureed Food Market to reach $1224.9 million by 2031, growing at 5.1% CAGR: Coherent Market Insights

Burlingame, Oct. 09, 2024 (GLOBE NEWSWIRE) — The global pureed food market, valued at 864.7 million dollars in 2024, is on a trajectory of rapid expansion, with projections indicating it will soar to 1,224.9 million dollars by 2031, as per a recent report by Coherent Market Insights. The pureed food market has been witnessing significant growth over the past few years mainly due to the growing awareness among consumers about the nutrition benefits of pureed food. Pureed food is soft, smooth and simple to eat which makes it easily digestible especially for infants, elderly people and those recovering from illnesses or injury. It ensures adequate intake of all important nutrients in a pre-chewed form.

Request Sample of the Report on Pureed Food Market Forecast 2031: https://www.coherentmarketinsights.com/insight/request-sample/7026

Market Dynamics

The growth of the pureed food market is attributed to the growing geriatric population globally. According to the United Nations (UN) report, the world’s population aged 60 years and above is expected to reach 2.1 Bn by 2050 from 962 Mn in 2017.

Rising incidence of dysphagia also contributes to the market growth. The aging population is more prone to dysphagia or swallowing disorders. This is increasing the demand for easy-to-swallow pureed food products. Changing dietary habits are expected to drive market growth during the forecast period. Moreover, increase in hectic lifestyle leaves little time for proper chewing. This will also contribute to the market growth.

Pureed Food Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $864.7 million |

| Estimated Value by 2031 | $1,224.9 million |

| Growth Rate | Poised to grow at a CAGR of 5.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product Type, By Packaging Type, By Distribution Channel: |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing elderly population • Changing lifestyles and time poverty |

| Restraints & Challenges | • High price of organic pureed food products • Risk of contamination during production |

Market Trends

Growing demand for organic pureed food products: The demand for organic food products is rising globally. This is due to increasing health consciousness among people. According to the USDA Economic Research Service, sales of organic food grew from $3.6 Bn in 1997 to $47.9 Bn in 2018.

Product innovation in terms of flavors and variety: Major players are prioritizing continuous innovation to address the evolving preferences of consumers. They are launching new flavors and diverse range of pureed food products to meet these changing demands.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7026

Market Opportunities

Vegetable puree forms a major part of baby food segment. With increasing awareness regarding nutritional value of different vegetables for babies, the demand for customized vegetable purees is growing. Manufacturers are introducing organic and non-GMO vegetable purees. These purees contain multiple nutrients required for baby’s development.

Manufacturers are introducing superfoods like acai and maqui into their product lines. These fruit purees are rich in antioxidants and help support the immune system. Companies are capitalizing on the health benefits of lesser-known fruits. Thus, companies are focusing on innovative product varieties aimed at attracting health-conscious consumers.

Key Market Takeaways

The global pureed food market is anticipated to witness a CAGR of 5.1% during the forecast period 2024-2031. This is owing to increasing preferences for nutritional and convenient baby food products.

On the basis of product type, vegetable puree segment is expected to hold a dominant position. This is due to high nutritional value of vegetables and growing focus on baby’s health.

By packaging type, glass jar segment is expected to hold a dominant position over the forecast period. This is due to perceived premium quality and reusability.

On the basis of region, North America is expected to hold a dominant position over the forecast period, due to rising awareness about baby food and working women population.

Competitor Insights

- Blossom Foods

- Dohler

- Elite Pureed Meals

- Gourmet Pureed

- Little Spoon Inc.

- Mom Meals

- Smoothe Foods

- The Punjab Kitchen Ltd

- Thick-It

- SVZ

Pureed Food Industry News

In March 2024, Andhra Pradesh Food Processing Society (APFPS), established by the Government of Andhra Pradesh, planned to set-up a new tomato processing plants in Pathikonda, Kurnool, with a capacity of 1,200 tons per month.

In July 2023, Kraft Heinz Company launched a new range of products. These include chopped and peeled tomatoes, a classic pizza sauce, and tomato puree.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7026

Detailed Segmentation-

By Product Type:

- Vegetable Puree

- Fruit Puree

- Meat Puree

- Cereal Puree

- Others

By Packaging Type:

- Glass Jar

- Tins

- Cans

- Plastic Containers

- Others

By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Region:

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Food and Beverages Domain:

Global Food Extrusion Market is estimated to be valued at USD 88.30 Bn in 2024 and is expected to reach USD 137.22 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 6.5% from 2024 to 2031.

Global food diagnostics market is estimated to be valued at USD 17.45 Bn in 2024 and is expected to reach USD 29.33 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 7.7% from 2024 to 2031.

Global Prepared Meal Delivery Market is estimated to be valued at USD 10.92 Bn in 2024 and is expected to reach USD 23.85 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 11.8% from 2024 to 2031.

Global vegan yogurt market is estimated to be valued at USD 3.63 Bn in 2024 and is expected to reach USD 11.98 Bn by 2031, growing at a compound annual growth rate (CAGR) of 18.6% from 2024 to 2031.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

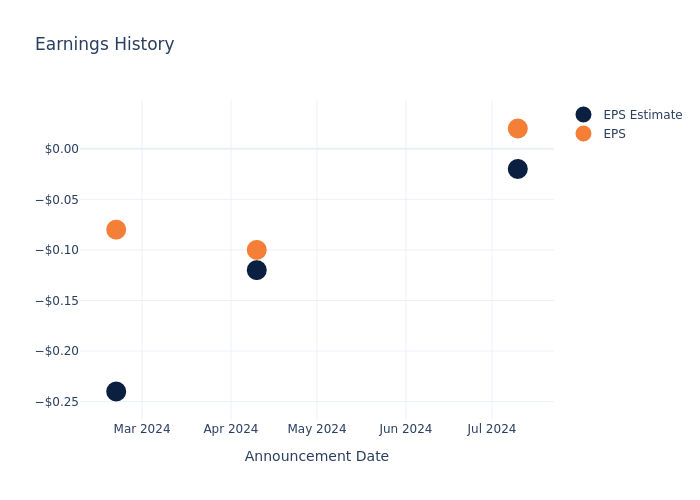

Examining the Future: Theratechnologies's Earnings Outlook

Theratechnologies THTX is preparing to release its quarterly earnings on Thursday, 2024-10-10. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Theratechnologies to report an earnings per share (EPS) of $0.03.

Investors in Theratechnologies are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

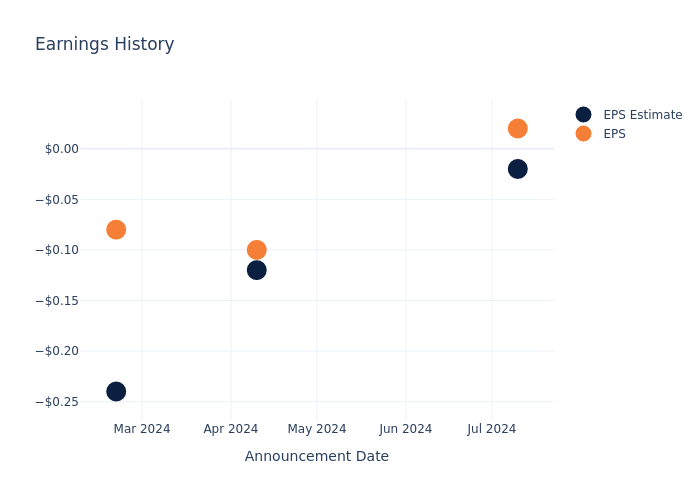

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.04, leading to a 3.33% drop in the share price the following trading session.

Here’s a look at Theratechnologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.02 | -0.12 | -0.24 | -0.29 |

| EPS Actual | 0.02 | -0.10 | -0.08 | -0.03 |

| Price Change % | -3.0% | 1.0% | -5.0% | 23.0% |

Market Performance of Theratechnologies’s Stock

Shares of Theratechnologies were trading at $1.21 as of October 08. Over the last 52-week period, shares are down 31.35%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Theratechnologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

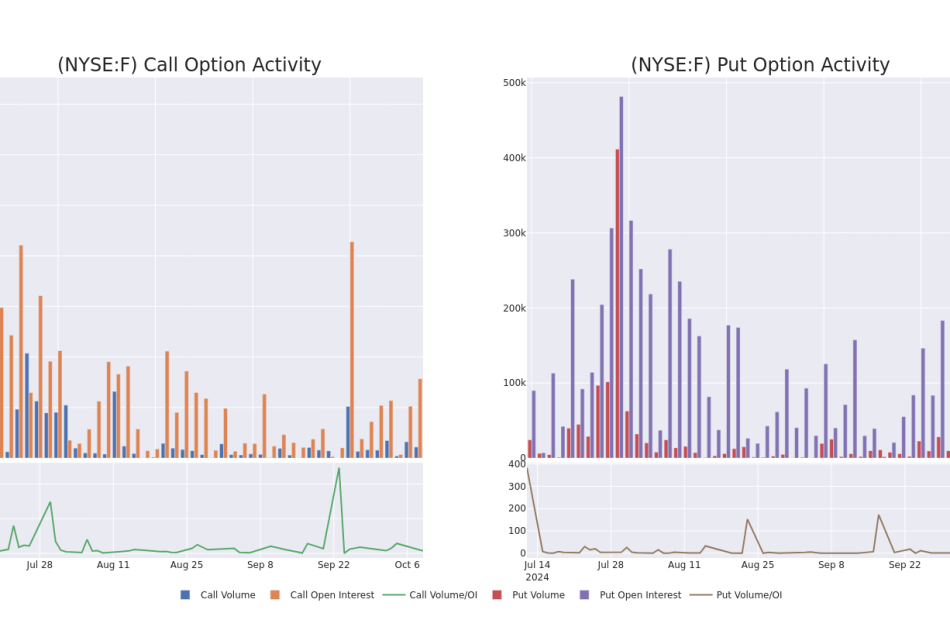

This Is What Whales Are Betting On Ford Motor

Investors with a lot of money to spend have taken a bearish stance on Ford Motor F.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with F, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

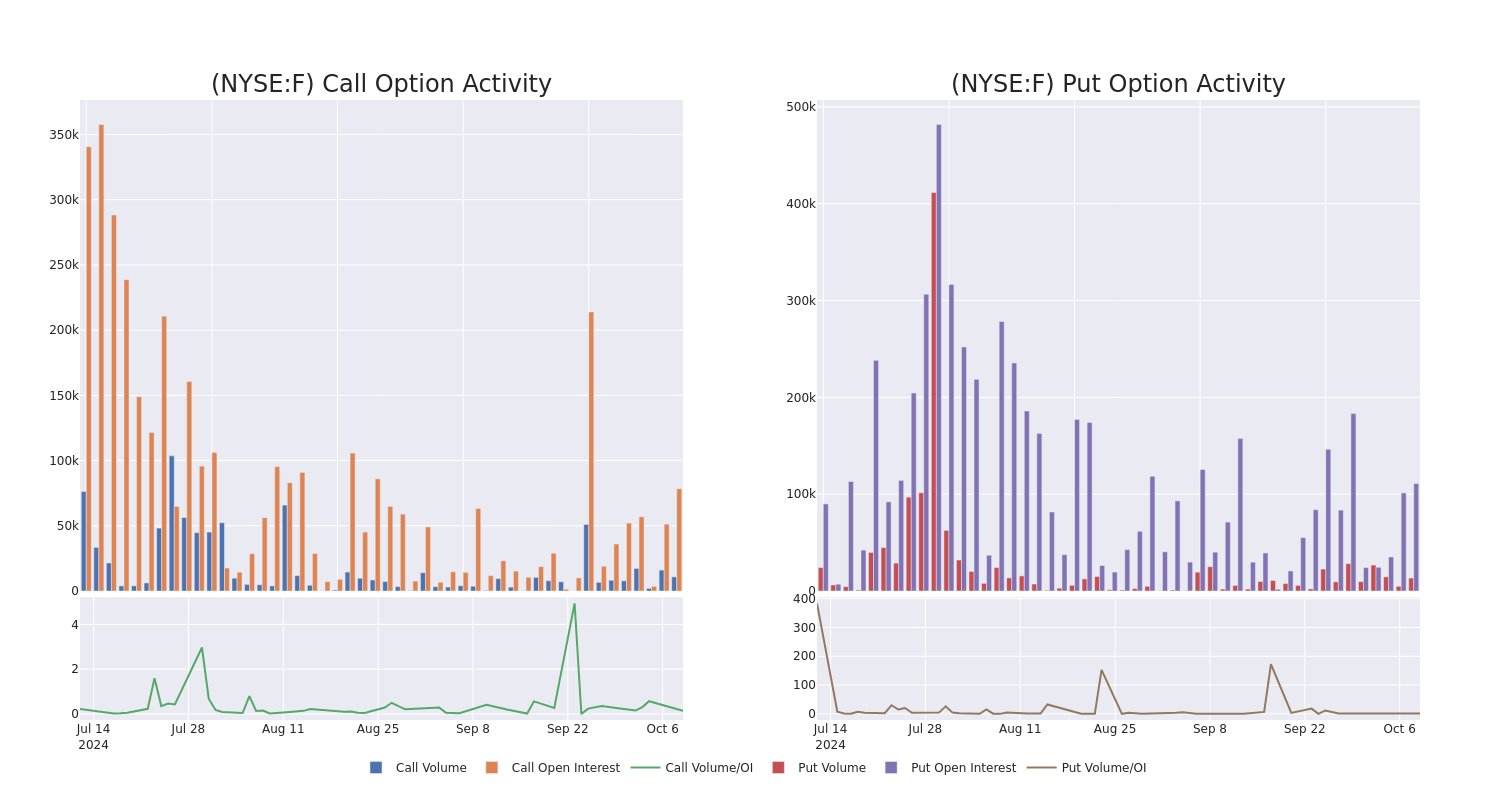

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Ford Motor.

This isn’t normal.

The overall sentiment of these big-money traders is split between 20% bullish and 80%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $935,004, and 6 are calls, for a total amount of $284,929.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $9.0 to $15.0 for Ford Motor during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Ford Motor’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Ford Motor’s whale trades within a strike price range from $9.0 to $15.0 in the last 30 days.

Ford Motor 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| F | PUT | TRADE | BEARISH | 06/20/25 | $1.57 | $1.54 | $1.56 | $11.17 | $390.0K | 54.6K | 4.8K |

| F | PUT | TRADE | BEARISH | 11/15/24 | $0.83 | $0.79 | $0.82 | $11.00 | $205.0K | 12.7K | 3.4K |

| F | CALL | SWEEP | BEARISH | 12/20/24 | $0.5 | $0.49 | $0.49 | $11.00 | $91.9K | 22.7K | 1.9K |

| F | PUT | SWEEP | BEARISH | 06/20/25 | $1.62 | $1.61 | $1.61 | $11.17 | $74.8K | 54.6K | 1.8K |

| F | PUT | SWEEP | BEARISH | 06/20/25 | $1.61 | $1.6 | $1.61 | $11.17 | $69.5K | 54.6K | 1.2K |

About Ford Motor

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, Ford Blue, and its BEV business, Ford Model e, as separate businesses but still all under Ford Motor. The company has nearly 13% market share in the United States, about 11% share in the U.K., and under 2% share in China including unconsolidated affiliates. Sales in the U.S. made up about 66% of 2023 total company revenue. Ford has about 177,000 employees, including about 59,000 UAW employees, and is based in Dearborn, Michigan.

Having examined the options trading patterns of Ford Motor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Ford Motor

- With a trading volume of 25,330,074, the price of F is up by 1.48%, reaching $10.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 15 days from now.

Professional Analyst Ratings for Ford Motor

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $12.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Showing optimism, an analyst from Goldman Sachs upgrades its rating to Buy with a revised price target of $13.

* An analyst from Deutsche Bank has revised its rating downward to Hold, adjusting the price target to $11.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Underweight rating for Ford Motor, targeting a price of $9.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Ford Motor, which currently sits at a price target of $16.

* An analyst from Morgan Stanley has revised its rating downward to Equal-Weight, adjusting the price target to $12.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Ford Motor options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nike's Forward March Hits Speed Bumps: Analyst Identifies Red Flags In SEC Filing

JPMorgan analyst Matthew R. Boss flagged several troubling signs for Nike Inc NKE, which may have investors tightening their seatbelts.

Boss maintains a neutral rating with a price target of $77 for December 2025 on Nike stock. His insights from the filing reveal potential challenges that could impact Nike’s growth trajectory.

Ominous Omission: Supply Chain Concerns

A significant red flag Boss noticed in Nike’s latest 10-Q filing is the absence of the “Supply Chain Conditions” reference, a staple in previous quarterly filings. This omission suggests a departure from previously reassuring statements about inventory health.

Boss points out that while Nike reported a 5% decline in inventories, revenues fell by 10%, indicating a widening gap that investors should watch closely.

Read Also: What’s Going On With Nike Stock?

New ‘Marketplace Management’ Factor: A Shaky Shift

Nike introduced a “Marketplace Management” factor, indicating a strategic pivot to balance product distribution between direct operations and wholesale partners.

However, this shift comes on the heels of disappointing first-quarter results, with traffic declines across both Nike Brand Digital and physical stores.

Boss warns that the competitive environment is fierce, and the company’s ability to regain market share could be jeopardized.

Greater China: The Weak Link

Nike’s performance in Greater China represents a significant concern. With comparable store sales down 8% in the first quarter, this region is facing intense competition from local brands.

As Boss notes, the company is struggling with declining unit sales across its key categories, including a 10% drop in footwear and a 12% drop in apparel. This underperformance signals an urgent need for Nike to rethink its strategy in one of its most critical markets.

Margin Compression: A Looming Threat

In addition to declining sales, Nike’s gross margins are under pressure. Management revealed a rise in inventory obsolescence reserves, particularly in Greater China, which contributed to a 60bps decline in gross margins.

As promotional activities ramp up to clear excess inventory, Boss highlights the need for vigilance, as the company’s gross margin guidance indicates a potential 150bps decline year-over-year for the second quarter.

Proceed With Caution

With these red flags waving, investors should be cautious. Nike’s path forward will depend heavily on how well it navigates these challenges in the upcoming quarters.

As Boss emphasizes, in this evolving landscape, execution will be critical for maintaining growth for Nike.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Cathie Wood Stocks That Could Soar 32% and 282%, According to Wall Street

Should investors follow the advice of big names on Wall Street? One challenge in doing so is that sometimes analysts have very different takes. Fortunately, there’s some agreement on other occasions.

Consider these two companies: Block (NYSE: SQ) and Intellia Therapeutics (NASDAQ: NTLA). Both are among picks by Cathie Wood, CEO of a famous investment management firm. These stocks also have consensus price targets from Wall Street analysts that imply significant upsides.

Should you consider purchasing shares of Block and Intellia Therapeutics on this basis? Let’s find out.

1. Block

Block has had a challenging year: The company’s shares are down 14% year to date. Though sales are still moving in the right direction, growth rates have slowed in the past few years and are, to some extent, influenced by Bitcoin-related revenue. This area of Block’s business is somewhat unpredictable, something the market doesn’t like.

On the other hand, Block is making progress on the bottom line; the company has turned in profits for the past three quarters in a row. If it can sustain that profitable growth, the stock could bounce back. But could it live up to the Street’s expectations in the next year?

Analysts’ average price target for the stock is $87.12, representing an upside of about 32% over its recent share price of $66.05. My view is that Block is unlikely to hit this target, because there are no significant catalysts ahead for the stock. While Bitcoin-related fluctuations could help its revenue growth jump, they could also do the opposite — it’s hard to predict which.

Furthermore, Block doesn’t seem to be deeply undervalued. True, its forward price-to-sales ratio is 1.6, and the “undervalued” range typically starts at 2. However, Block’s forward price-to-earnings is 18.6, a bit higher than the average of 16 for the financial industry.

Beyond the next 12 months, could the company deliver excellent returns over the long run? In this department, I think there are solid reasons to be optimistic. Block’s core ecosystems continue to perform well. They include its suite of tools for small and medium-sized businesses through Square. And its peer-to-peer payment app, Cash App, now offers various options that compete with banks, from direct deposits to stock and crypto trading to a debit card.

In the second quarter, Square gross profit jumped by 15% year over year to $923 million, while Cash App’s came in at $1.3 billion, 23% higher than the year-ago period. Total gross profit increased 20% year over year to $2.23 billion. And net income of $195 million was much better than the net loss of $102 million reported in the year-ago period.

Block has generally upgraded its platform by offering more services, thereby attracting more customers. The company’s solid position in fintech and large existing ecosystem make it a good pick to profit from long-term opportunities in the industry.

2. Intellia Therapeutics

In the past few years, investors have moved away from somewhat promising but speculative and unprofitable businesses. That description fits Intellia Therapeutics to a T. The biotech, which focuses on gene editing, looks like an innovative company. It currently has no approved products, but Intellia is making steady progress.

The company’s leading candidate is NTLA-2001, which is being developed to treat transthyretin (ATTR) amyloidosis, a rare disease caused when a transport protein called transthyretin fails to fold properly. It leads to various symptoms, including stomach pain, difficulty breathing and walking, and more. There are two types of ATTR amyloidosis: the hereditary version, which affects some 50,000 people worldwide, and wild-type (which comes with aging), which affects between 200,000 and 500,000 people.

Intellia is now enrolling patients for a phase 3 study of NTLA-2001 in treating ATTR amyloidosis with cardiomyopathy (a group of heart-related problems). It also expects to start another late-stage study in hereditary ATTR amyloidosis by the end of the year. There are as yet no cures for this disease; NTLA-2001 could be the first.

The biotech does have several other pipeline candidates. NTLA-2002, a potential therapy for hereditary angioedema (a disease that causes swelling under the skin) could start a phase 3 study this year after passing phase 2 clinical trials. And Intellia could have several catalysts, mainly data readouts from its ongoing studies, in the next 12 months. If the data is positive across the board, the company’s shares will almost certainly soar.

However, Wall Street’s target stock price of $67.92 implies a 282% upside over its recent share price of $17.77. In my view, that seems too optimistic a goal to reach within 12 months, even considering how volatile biotech stocks can be. Gene-editing therapies are expensive and complex to administer, which often limits their revenue potential, even when there are no other treatment options for a disease. That adds to the risks in investing in Intellia right now, beyond the fact that its shares will drop off a cliff if there are significant clinical or regulatory headwinds.

So, Intellia Therapeutics is a somewhat risky play. If you’re comfortable with heightened volatility, you might want to consider initiating a small position in the stock, considering how much shares have fallen in recent years and how much they could rise if the company’s programs progress without a hitch.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,363!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,938!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Prosper Junior Bakiny has positions in Block. The Motley Fool has positions in and recommends Bitcoin, Block, and Intellia Therapeutics. The Motley Fool has a disclosure policy.

2 Cathie Wood Stocks That Could Soar 32% and 282%, According to Wall Street was originally published by The Motley Fool

PHOENIX INVESTORS ACQUIRES FORMER MVP GROUP INTERNATIONAL DISTRIBUTION CENTER IN UNION CITY, TENNESSEE

UNION CITY, Tenn., Oct. 9, 2024 /PRNewswire/ — An affiliate of Phoenix Investors (“Phoenix“), a national leader in the revitalization of former manufacturing facilities, announced the acquisition of a large industrial complex in Union City, Tennessee. The property, located at 600 E Sherwood Drive, was previously owned by MVP Group International. This strategic acquisition adds over 411,000 square feet to Phoenix’s portfolio, which now exceeds 78 million square feet nationwide.

MVP Group International is a global leader in home fragrance and is one of the world’s largest manufacturers and distributors of private label scented candles with additional expertise in contract manufacturing.

The property is situated on 34 acres of land and features a total of 411,489 square feet, which includes nearly 398,000 square feet of warehouse space, 13,500 square feet of office space, and a 2,200-square-foot breakroom. Built in 1985 and renovated as recently as 1995, the building also features 18 dock doors, clear heights up to 28 feet, 2 compressors, and an extensive racking system. Ideally positioned directly on US Highway 51, the property serves as a convenient midpoint between Nashville, Memphis, and St. Louis. The property is zoned for both Planned Industrial and Intermediate Business.

Phoenix plans to implement a capital improvement plan to attract high-quality industrial users to the area. “We’re excited to be working with Union City and Obion County to repurpose this facility,” said Phoenix Investors Founder & Chairman Frank Crivello of the acquisition. “We look forward to revitalizing the property and bringing a renewed sense of growth and opportunity to Union City and the surrounding communities.”

Anyone with leasing inquiries is encouraged to reach out to Phoenix Investors Assistant VP, Acquisition & Leasing Luke Herder at (262) 470-6124.

About Phoenix Investors

Phoenix Investors is the leading expert in the acquisition, renovation, and releasing of former manufacturing facilities in the United States. The revitalization of facilities throughout the continental United States leads to positively transforming communities and restarting the economic engine in the communities we serve. Phoenix’s affiliate companies hold equity interests in a portfolio of industrial properties totaling approximately 78 million square feet spanning 29 states, delivering corporations with a cost-effective national footprint to dynamically supply creative solutions to meet their leasing needs.

For more information, please visit https://phoenixinvestors.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/phoenix-investors-acquires-former-mvp-group-international-distribution-center-in-union-city-tennessee-302271077.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/phoenix-investors-acquires-former-mvp-group-international-distribution-center-in-union-city-tennessee-302271077.html

SOURCE Phoenix Investors

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can ADI's New Developer-Centric Offerings Push the Stock Higher?

Analog Devices ADI announced the launch of CodeFusion Studio, a new embedded software development environment based on Microsoft’s Visual Studio code on Monday.

This will be ADI’s first-ever fully integrated suite comprising software and security solutions.

CodeFusion Studio uses a modern integrated development environment and command-line interface, incorporating open-source configuration and profiling tools to simplify development on multiple processors and drive efficiency and enhanced security.

CodeFusion Studio will be available for download on ADI’s new Developer Portal, a complete resource hub, offering extensive documentation, support, partnerships and community engagement.

ADI’s Strong Partner Base Aids Prospects

Analog Devices’ strategic partnership with India’s Tata Group to boost the latter’s electronic manufacturing ecosystem marks a significant achievement. Tata Electronics, Tata Motors and Tejas Networks signed a Memorandum of Understanding with ADI to use its products in Tata applications mostly in electric vehicles and network infrastructure.

ADI’s latest collaboration with Honeywell HON to digitize commercial spaces without replacing existing wiring, reducing costs and downtime is a notable development.

Analog Devices recently teamed up with Taiwan Semiconductor TSM to secure long-term wafer capacity via Japan Advanced Semiconductor Manufacturing. This partnership, while ensuring a stable chip supply and facilitating rapid scaling and increased output to meet customer needs can be beneficial for ADI.

Analog Devices and BMW Group’s announcement of the early adoption of E²B, ADI’s 10BASE-T1S Ethernet to the Edge bus technology within the automotive industry, is a noteworthy development. BMW will leverage ADI’s E²B for ambient lighting system design in its vehicles.

Analog Devices Suffers Persistent Headwinds

Despite having a diverse portfolio and strategic alliances, macroeconomic challenges remain a concern. Geopolitical tensions and recessionary fears are major negatives.

ADI faces stiff competition from players like Texas Instruments TXN, which is also making efforts to integrate generative AI capabilities into its products.

On a year-to-date basis, ADI has underperformed TXN, which gained 18.5%.

ADI shares have plunged 15.5% year to date against the broader Zacks Computer and Technology sector’s return of 22.2%.

In the first half of fiscal 2024, ADI reported revenues of $4.67 billion, down 36% year-ago period. This underperformance can be firmly pointed toward the softness in the industrial, communications and automotive end markets.

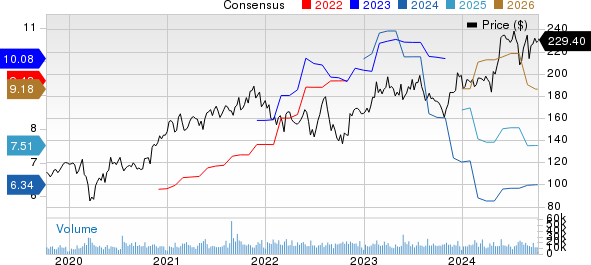

Earnings Estimate Revisions Trend Higher for ADI

For fourth-quarter fiscal 2024, ADI expects revenues of $2.40 billion (+/- $100 million), up 4% sequentially at the midpoint.

The Zacks Consensus Estimate for fourth-quarter fiscal 2024 revenues is pegged at $2.40 billion, indicating a fall of 11.58% year over year.

ADI anticipates a non-GAAP operating margin of 41% (+/- 100 bps).

It expects the Industrial and Consumer end markets to increase, Communications to be flattish and Automotive to decrease.

ADI expects non-GAAP earnings to be $1.63 (+/- $0.10) per share.

The consensus mark for fourth-quarter fiscal 2024 earnings is pegged at $1.63 per share, up by a couple of pennies for the past 60 days, suggesting a decline of 18.91% year over year.

Zacks Rank and Valuation

ADI shares currently have a stretched valuation, as suggested by a Value Score of D.

Analog Devices stock is trading with a forward 12-month Price/Sales of 11X compared with the industry’s 7.85X.

ADI currently carries a Zacks Rank #3 (Hold), implying that investors should wait for a favorable entry point to accumulate the stock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why Investors Should Hold on to Landstar Stock Now

Landstar System LSTR is benefiting from its robust financial stability and strong liquidity. The shareholder-friendly approach also bodes well for the company. However, the company is grappling with the freight market downturn.

Factors Favoring LSTR

Landstar’s commitment to shareholder value is commendable, as the company consistently returns significant capital to its investors through stock repurchase programs and dividends. In the first half of 2024, Landstar repurchased shares of its common stock for a total of $57 million and paid $95 million in dividends. Moreover, in August 2024, LSTR paid a quarterly dividend of $0.36 per share to its stockholders. This quarterly dividend includes a 9% increase to its regular quarterly dividend.

Despite the softness prevailing in the freight environment, the company demonstrates strong financial stability and cash-generating capabilities. By the end of the second quarter of 2024, LSTR reported cash and short-term investments totaling $504 million. For the first half of 2024, cash flow from operations reached $142 million, while cash capital expenditures amounted to $17 million.

The company exited the second quarter of 2024 with a current ratio (a measure of liquidity) of 2.17. A current ratio of greater than 1 is always desirable as it indicates that the company has enough cash to meet its short-term obligations.

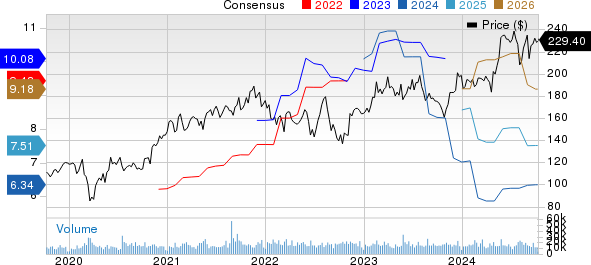

Shares of LSTR have rallied 4.3% over the past year compared to the industry’s decline of 4.9% in the same period.

Image Source: Zacks Investment Research

LSTR: Key Risks to Watch

The company’s prospects are being negatively affected by softness in freight market demand. In the second quarter of 2024, total loadings of machinery dropped by 12% year over year. Similarly, loadings for automotive equipment and parts fell by 1%, while building products and hazardous materials decreased by 1% and 14%, respectively.

Moreover, substitute linehaul loadings, which had been one of the strongest performers during the pandemic and are highly sensitive to consumer demand, decreased by 29% compared to the second quarter of 2023.

As a result, Landstar’s top line is expected to remain weak in the near term. For the third quarter of 2024, the company anticipates a decline in truckloads in the range of 6-10% year over year.

The trucking industry is also grappling with a persistent driver shortage. As seasoned drivers retire, companies struggle to attract new talent, particularly from younger generations, who may not find the profession appealing.

LSTR’s Zacks Rank

LSTR currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include Ryanair RYAAY and Canadian Pacific Kansas City Limited CP.

Ryanair currently sports a Zacks Rank #1 (Strong Buy). RYAAY has an expected earnings growth rate of 10% for the current year.

The company has a discouraging earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, delivering an average miss of 30%. Shares of RYAAY have risen 10.2% in the past year.

Canadian Pacific also sports a Zacks Rank #1 at present and has an expected earnings growth rate of 0.3% for the current year.

The company has an encouraging track record with respect to the earnings surprise, having surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missing once. The average beat is 2.2%. CP shares have rallied 10.6% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.