Saratoga Investment Corp. Announces Fiscal Second Quarter 2025 Financial Results

NEW YORK, Oct. 08, 2024 (GLOBE NEWSWIRE) — Saratoga Investment Corp. SAR (“Saratoga Investment” or “the Company”), a business development company (“BDC”), today announced financial results for its 2025 fiscal second quarter ended August 31, 2024.

Summary Financial Information

The Company’s summarized financial information is as follows:

| For the three months ended and as of | ||||||

| ($ in thousands, except per share) | August 31, 2024 | May 31, 2024 | August 31, 2023 | |||

| Assets Under Management (AUM) | 1,040,711 | 1,095,559 | 1,098,945 | |||

| Net Asset Value (NAV) | 372,054 | 367,855 | 362,079 | |||

| NAV per share | 27.07 | 26.85 | 28.44 | |||

| Total Investment Income | 43,003 | 38,678 | 35,514 | |||

| Net Investment Income (NII) per share | 1.33 | 1.05 | 1.15 | |||

| Adjusted NII per share | 1.33 | 1.05 | 1.08 | |||

| Earnings per share | 0.97 | 0.48 | 0.65 | |||

| Dividends per share (declared) | 0.74 | 0.74 | 0.71 | |||

| Return on Equity – last twelve months | 5.8% | 4.4% | 9.6% | |||

| – annualized quarter | 14.4% | 7.2% | 9.0% | |||

| Originations | 2,584 | 39,301 | 27,447 | |||

| Repayments | 60,140 | 75,703 | 6,036 | |||

Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment, commented, “Highlights this quarter include the successful full repayment and resolution of our Knowland investment, the last of our four non-accrual or watchlist investments in our portfolio resolved this past year, a return to increasing NAV per share and continued substantial overearning of our record level of dividends. Our annualized second quarter dividend of $0.74 per share implies a 12.7% dividend yield based on the stock price of $23.26 per share on October 7, 2024. The substantial overearning of the dividend this quarter continues to support the current level of dividends, increases NAV, supports increased portfolio growth and provides a cushion against adverse events. This quarter’s earnings continue to benefit from elevated levels of rates and spreads on Saratoga Investment’s largely floating rate assets, while costs of long-term balance sheet liabilities are largely fixed but callable either now or in the future.”

“Though interest rates have decreased from their highs, they remained stable throughout our fiscal second quarter, resulting in solid recurring net interest margins on our portfolio. In addition, our strong reputation and differentiated market positioning, combined with our ongoing development of sponsor relationships, continues to create attractive investment opportunities from high quality sponsors. We appear to be seeing the early stages of a potential increase in M&A in the lower middle market, reflected in multiple repayments over the past few months, in addition to significant new originations, including importantly, two new portfolio investments closed subsequent to quarter-end.”

“Saratoga’s solid overall performance is reflected in our continued strong key performance indicators this past quarter, including: (i) sequential adjusted NII per share increase of 26.7% over the past quarter ($1.05 to $1.33 per share), including one-time accrued interest benefits from the Knowland sale, (ii) sequential NAV per share increase of $0.22 per share ($26.85 to $27.07 per share), (iii) dividend of $0.74 per share, up 4.2% from $0.71 per share in the second quarter of 2023, and (iv) continued over-earning of the current dividend.”

“At the foundation of our strong operating performance is the high-quality nature, resilience and balance of our $1.041 billion portfolio in the current environment. Where we have encountered significant challenges in four of our portfolio companies over the past year, we have completed decisive action:

- the Zollege restructuring was completed last quarter, and the Pepper Palace restructuring this quarter. As of quarter-end, both investments are now being held at a total combined remaining fair value of $3.6 million, and Saratoga has taken control over both investments and brought in new CEOs through consensual restructurings with the prior sponsors and former management. We continue to actively implement management changes, capital structure improvements and business plan adjustments, which have the potential for future increases in recovery value;

- our Knowland investment repaid our full principal as well as all accrued and reserved interest through a sale transaction. As of August 31, 2024, we recognized the $7.9 million previously reserved interest into NII, and also booked a $0.5 million unrealized appreciation. This leaves $2.7 million that will be recognized into unrealized appreciation in the third quarter; and

- our Netreo investment was also sold in the prior quarter, with full recovery of our invested debt capital and a modest overall return.”

“The remaining core non-CLO portfolio was relatively unchanged this quarter, and the CLO and JV were marked down by $2.7 million, for a total net reduction in portfolio value of $4.7 million this quarter. Our total portfolio fair value is now 0.2% above cost, while our core non-CLO portfolio, is 3.3% above cost. With the two restructurings completed and Knowland and Netreo having repaid, we have resolved uncertainties related to all four portfolio companies on our watch list. The overall financial performance and strong earnings power of our current portfolio reflects strong underwriting in our solid, growing portfolio companies and sponsors in well-selected industry segments.”

“We continue to remain prudent and discerning in terms of new commitments in the current volatile environment. Originations this quarter demonstrate that, despite an overall robust pipeline, there are periods when investments we review do not meet our high-quality credit and pricing standards, like this quarter where we originated no new portfolio company investments while benefitting from five follow-on investments in existing portfolio companies that we know well with strong business models and balance sheets. Subsequent to quarter-end we have seen actionable opportunities, and closed on two new platform companies for the first time in several quarters.”

“Our quarter-end cash position grew to $162.0 million, largely due to net repayments of $57.6 million, with originations this quarter totaling $2.6 million versus $60.1 million of repayments and amortization. This increase in cash and cash equivalents has improved our effective leverage from 159.6% regulatory leverage to 172.0% net leverage, netting available cash against outstanding debt.”

“Our overall credit quality for this quarter increased to 99.7% of credits rated in our highest category, with the two investments remaining on non-accrual status being Zollege and Pepper Palace and which have been successfully restructured, representing only 0.3% and 0.4% of fair value and cost, respectively. With 85.2% of our investments at quarter-end in first lien debt and generally supported by strong enterprise values and balance sheets in industries that have historically performed well in stressed situations, we believe our portfolio and company leverage is well structured for future economic conditions and uncertainty.”

Mr. Oberbeck concluded, “As we navigate through a dynamic interest rate environment and uncertain economic outlook, we remain confident in our experienced management team, robust pipeline, strong leverage structure, and high underwriting standards to continue to steadily increase our portfolio size, quality and investment performance over the long-term to deliver exceptional risk adjusted returns to shareholders.”

Discussion of Financial Results for the Quarter ended August 31, 2024:

- AUM as of August 31, 2024, was $1.041 billion, a decrease of 5.3% from $1.099 billion as of August 31, 2023, and a decrease of 5.0% from $1.096 billion as of last quarter.

- Total investment income for the three months ended August 31, 2024, was $43.0 million, an increase of $7.5 million, or 21.1%, from $35.5 million in the three months ended August 31, 2023, and $4.3 million, or 11.2%, as compared to $38.7 million for the quarter ended May 31, 2024. This quarter’s investment income increases were primarily due to the reversal of the Knowland interest reserve of $7.9 million that was previously on non-accrual status, following the investment’s full repayment subsequent to quarter-end, including accrued interest. Investment income reflects a weighted average interest rate of 12.6%, consistent with last quarter and last year.

- Total expenses for second fiscal quarter 2025, excluding interest and debt financing expenses, base management fees and incentive fees, and income and excise taxes, increased $0.1 million to $2.2 million as compared to $2.1 million in the second quarter of fiscal year 2023, and decreased $0.7 million as compared to $2.9 million for the quarter ended May 31, 2024. This represented 0.7% of average total assets on an annualized basis, unchanged from 0.7% last year and down from 1.0% last quarter.

- Adjusted NII for the quarter ended August 31, 2024, was $18.2 million, an increase of $5.0 million, or 38.3%, from $13.2 million in the period ended August 31, 2023, and $3.9 million, or 26.9%, from $14.3 million in the prior quarter. The increases in investment income were primarily offset by (i) increased interest expense resulting from the various new Notes Payable and SBA debentures issued during the past year, and (ii) increased incentive management fees from higher average AUM and earnings.

- NII Yield as a percentage of average net asset value was 19.7% for the quarter ended August 31, 2024. Adjusted for the incentive fee accrual related to net capital gains, the NII Yield was also 19.7%. In comparison, adjusted NII Yield was 15.0% for the quarter ended August 31, 2023, and 15.5% for the quarter ended May 31, 2024.

- NAV was $372.1 million as of August 31, 2024, an increase of $10.0 million from $362.1 million as of August 31, 2023, and an increase of $4.2 million from $367.9 million as of May 31, 2024.

- NAV per share was $27.07 as of August 31, 2024, compared to $28.44 as of August 31, 2023, and $26.85 as of May 31, 2024.

- Return on equity (“ROE”) for the last twelve months ended August 31, 2024, was 5.8%, down from 9.6% for the comparable period last year, and up from 4.4% in the previous quarter. ROE on an annualized basis for the quarter ended August 31, 2024 was 14.4%.

- The weighted average common shares outstanding increased from 12.2 million last year to 13.7 million for both this year’s quarters.

Portfolio and Investment Activity as of August 31, 2024

- Fair value of Saratoga Investment’s portfolio was $1.041 billion, excluding $162.0 million in cash and cash equivalents, principally invested in 50 portfolio companies, one collateralized loan obligation fund (the “CLO”) and one joint venture fund (the “JV”).

- Cost of investments made during the period: $2.6 million, including five follow-ons and no investments in new portfolio companies.

- Principal repayments during the period: $60.1 million, including three full and four partial repayments of existing investments, plus amortization.

- The fair value of the portfolio also decreased by $4.7 million of net realized losses and unrealized appreciation, consisting of a $34.0 million realized loss on our Pepper Palace investment following its restructuring this quarter, offset by a $0.5 million realized gain on our Book4time Class A preferred investment resulting from the sale of the company, and $28.7 million unrealized appreciation across the portfolio.

- The unrealized appreciation includes (i) reversal of $32.1 million net unrealized depreciation previously recognized on our Pepper Palace and Book4 time realized investments, offset by (i) $2.7 million net unrealized depreciation on our CLO and JV, primarily related to mark-downs due to individual credits in the CLO broadly syndicated portfolio, (ii) an additional $0.2 million unrealized depreciation completing the Zollege investment restructuring, and (iii) $0.5 million unrealized depreciation on the remaining core BDC portfolio.

- Since taking over management of the BDC, the Company has generated $1.03 billion of repayments and sales of investments originated by Saratoga Investment, generating a gross unlevered IRR of 15.2%. Total investments originated by Saratoga is $2.2 billion.

- The overall portfolio composition consisted of 85.2% of first lien term loans, 2.5% of second lien term loans, 1.6% of unsecured term loans, 2.2% of structured finance securities, and 8.5% of common equity.

- The weighted average current yield on Saratoga Investment’s portfolio based on current fair values was 11.5%, which was comprised of a weighted average current yield of 12.3% on first lien term loans, 18.0% on second lien term loans, 10.8% on unsecured term loans, 13.3% on CLO subordinated notes and 0.0% on equity interests.

Portfolio Update:

- Subsequent to quarter-end, Saratoga Investment has executed approximately $56.7 million of new originations in two new portfolio companies and two follow-ons, including delayed draws, and had one repayment of $20.5 million, for a net increase in investments of $36.2 million. The repayment was the full repayment of Knowland, including interest, as previously noted.

Liquidity and Capital Resources

Outstanding Borrowings:

- As of August 31, 2024, Saratoga Investment had a combined $52.5 million in outstanding combined borrowings under its $65.0 million senior secured revolving credit facility with Encina and its $75.0 million senior secured revolving credit facility with Live Oak.

- At the same time, Saratoga Investment had $175.0 million SBA debentures in its SBIC II license outstanding, $39.0 million SBA debentures in its SBIC III license outstanding, $269.4 million of listed baby bonds issued, $250.0 million of unsecured unlisted institutional bond issuances, five unlisted issuances of $52.0 million in total, and an aggregate of $162.0 million in cash and cash equivalents.

Undrawn Borrowing Capacity:

- With $87.5 million available under the two credit facilities and $162.0 million of cash and cash equivalents as of August 31, 2024, Saratoga Investment has a total of $249.5 million of undrawn credit facility borrowing capacity and cash and cash equivalents for new investments or to support its existing portfolio companies in the BDC.

- In addition, Saratoga Investment has $136.0 million in undrawn SBA debentures available from its existing SBIC III license. Availability under the Encina and Live Oak credit facilities can change depending on portfolio company performance and valuation. In addition, certain follow-on investments in SBIC II and the BDC will not qualify for SBIC III funding. Overall outstanding SBIC debentures are limited to $350.0 million across all active SBIC licenses.

- Total Saratoga undrawn borrowing capacity is therefore $385.5 million.

- As of quarter-end, Saratoga Investment had $48.4 million of committed undrawn lending commitments and $83.7 million of discretionary funding commitments.

Additionally:

- Saratoga Investment has an active equity distribution agreement with Ladenburg Thalmann & Co. Inc., Raymond James and Associates, Inc, Lucid Capital Markets, LLC and Compass Point Research and Trading, LLC, through which Saratoga Investment may offer for sale, from time to time, up to $300.0 million of common stock through an ATM offering.

- As of August 31, 2024, Saratoga Investment has sold 6,543,878 shares for gross proceeds of $172.5 million at an average price of $26.37 for aggregate net proceeds of $171.0 million (net of transaction costs). During the three and six months ended August 31, 2024, Saratoga Investment did not sell any shares under the ATM program.

- On June 14, 2024, Saratoga Investment and its wholly owned financing subsidiary, Saratoga Investment Funding III LLC (“SIF III”), entered into the First Amendment and Lender Joinder to the Credit and Security Agreement (the “Amendment” and the Credit and Security Agreement as amended by the Amendment, the “Credit Agreement”), by and among SIF III, as borrower, the Company, as collateral manager and as equity holder, the lenders parties thereto, and Live Oak Banking Company, as administrative agent and as collateral agent, relating to the special purpose vehicle financing credit facility (the “Live Oak Credit Facility”). The Amendment, among other things: (i) increased the borrowings available under the Live Oak Credit Facility from up to $50.0 million to up to $75.0 million, subject to a borrowing base requirement; (ii) added New Lenders (as identified in the Amendment) to the Credit Agreement; (iii) replaced administrative agent approval with “Required Lender” (as defined in the Credit Agreement) approval with respect to certain matters; (iv) replaced Required Lender approval with 100% lender approval with respect to certain matters; and (v) changed the definition of Required Lender to require the approval of at least two unaffiliated lenders.

Dividend

On August 22, 2024, Saratoga Investment announced that its Board of Directors declared a quarterly dividend of $0.74 per share for the fiscal quarter ended August 31, 2024, paid on September 26, 2024, to all stockholders of record at the close of business on September 11, 2024.

Shareholders have the option to receive payment of dividends in cash or receive shares of common stock, pursuant to the Company’s DRIP. Shares issued under the Company’s DRIP is issued at a 5% discount to the average market price per share at the close of trading on the ten trading days immediately preceding (and including) the payment date.

The following table highlights Saratoga Investment’s dividend history over the past eleven quarters:

| Declared | Ex-Date | Record | Payable | Amount | |

| August 22, 2024 | September 11, 2024 | September 11, 2024 | September 26, 2024 | $0.74 | |

| May 23, 2024 | June 13, 2024 | June 13, 2024 | June 27, 2024 | $0.74 | |

| February 15, 2024 | March 12, 2024 | March 13, 2024 | March 28, 2024 | $0.73 | |

| November 15, 2023 | December 8, 2023 | December 11, 2023 | December 28, 2023 | $0.72 | |

| August 14, 2023 | September 13, 2023 | September 14, 2023 | September 28, 2023 | $0.71 | |

| May 22, 2023 | June 12, 2023 | June 13, 2023 | June 29, 2023 | $0.70 | |

| February 28, 2023 | March 15, 2023 | March 16, 2023 | March 30, 2023 | $0.69 | |

| November 15. 2022 | December 14, 2022 | December 15, 2022 | January 4, 2023 | $0.68 | |

| August 29, 2022 | September 13, 2022 | September 14, 2022 | September 29, 2022 | $0.54 | |

| May 26, 2022 | June 13, 2022 | June 14, 2022 | June 29, 2022 | $0.53 | |

| February 28, 2022 | March 11, 2022 | March 14, 2022 | March 28, 2022 | $0.53 | |

Share Repurchase Plan

As of August 31, 2024, the Company purchased 1,035,203 shares of common stock, at the average price of $22.05 for approximately $22.8 million pursuant to its existing Share Repurchase Plan. During the three and six months ended August 31, 2024, the Company did not purchase any shares of common stock pursuant to its Share Repurchase Plan.

Of note, in fiscal year 2015, the Company announced the approval of an open market share repurchase plan that allows it to repurchase up to 200,000 shares of its common stock at prices below its NAV as reported in its then most recently published financial statements. Since then, the Share Repurchase Plan has been extended annually, and the Company has periodically increased the amount of shares of common stock that may be purchased under the Share Repurchase Plan, most recently to 1.7 million shares of common stock. On January 8, 2024, our board of directors extended the Share Repurchase Plan for another year to January 15, 2025.

2025 Fiscal Second Quarter Conference Call/Webcast Information

| When: | Wednesday, October 9, 2024 |

| 10:00 a.m. Eastern Time (ET) | |

| How: | Webcast: Interested parties may access a live webcast of the call and find the Q2 2025 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website (Webcast Details). A replay of the webcast will also be available for a limited time at Saratoga events and presentations. |

| Call: | To access the call by phone, please go to this link (Registration Link) and you will be provided with dial in details. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time |

About Saratoga Investment Corp.

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment Corp. owns two active SBIC-licensed subsidiaries, having surrendered its first license after repaying all debentures for that fund following the end of its investment period and subsequent wind-down. Furthermore, it manages a $650 million collateralized loan obligation (“CLO”) fund and co-manages a joint venture (“JV”) fund that owns a $400 million collateralized loan obligation (“JV CLO”) fund. It also owns 52% of the Class F and 100% of the subordinated notes of the CLO, 87.5% of both the unsecured loans and membership interests of the JV and 87.5% of the Class E notes of the JV CLO. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains historical information and forward-looking statements with respect to the business and investments of the Company, including, but not limited to, the statements about future events or our future performance or financial condition. Forward-looking statements can be identified by the use of forward looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or negative versions of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These statements are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including, but not limited to: changes in the markets in which we invest; changes in the financial, capital, and lending markets; an economic downturn and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us; the impact of interest rate volatility on our business and our portfolio companies; the impact of supply chain constraints and labor shortages on our portfolio companies; and the elevated levels of inflation and its impact on our portfolio companies and the industries in which we invests, as well as those described from time to time in our filings with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which it is made. The Company undertakes no duty to update any forward-looking statements made herein or on the webcast/conference call, whether as a result of new information, future developments or otherwise, except as required by law. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s Annual Report on Form 10-Q for the fiscal quarter ended August 31, 2024 and subsequent filings, including the “Risk Factors” sections therein, with the Securities and Exchange Commission for a more complete discussion of the risks and other factors that could affect any forward-looking statements.

Contacts:

Saratoga Investment Corporation

535 Madison Avenue, 4th Floor

New York, NY 10022

Henri Steenkamp

Chief Financial Officer

Saratoga Investment Corp.

212-906-7800

Lena Cati

The Equity Group Inc.

212-836-9611

Val Ferraro

The Equity Group Inc.

212-836-9633

Financials

| Saratoga Investment Corp. Consolidated Statements of Assets and Liabilities |

||||||

| August 31, 2024 | February 29, 2024 | |||||

| (unaudited) | ||||||

| ASSETS | ||||||

| Investments at fair value | ||||||

| Non-control/Non-affiliate investments (amortized cost of $932,599,967 and $1,035,879,751, respectively) | $963,176,509 | $1,019,774,616 | ||||

| Affiliate investments (amortized cost of $27,197,048 and $26,707,415, respectively) | 29,193,438 | 27,749,137 | ||||

| Control investments (amortized cost of $79,244,797 and $117,196,571, respectively) | 48,341,503 | 91,270,036 | ||||

| Total investments at fair value (amortized cost of $1,039,041,812 and $1,179,783,737, respectively) | 1,040,711,450 | 1,138,793,789 | ||||

| Cash and cash equivalents | 84,569,590 | 8,692,846 | ||||

| Cash and cash equivalents, reserve accounts | 77,434,591 | 31,814,278 | ||||

| Interest receivable (net of reserve of $21,216 and $9,490,340, respectively) | 10,085,266 | 10,298,998 | ||||

| Management fee receivable | 333,826 | 343,023 | ||||

| Other assets | 1,567,007 | 1,163,225 | ||||

| Current income tax receivable | 1,931 | 99,676 | ||||

| Total assets | $1,214,703,661 | $1,191,205,835 | ||||

| LIABILITIES | ||||||

| Revolving credit facilities | $52,500,000 | $35,000,000 | ||||

| Deferred debt financing costs, revolving credit facilities | (1,651,311 | ) | (882,122 | ) | ||

| SBA debentures payable | 214,000,000 | 214,000,000 | ||||

| Deferred debt financing costs, SBA debentures payable | (5,306,833 | ) | (5,779,892 | ) | ||

| 8.75% Notes Payable 2025 | 20,000,000 | 20,000,000 | ||||

| Discount on 8.75% notes payable 2025 | (61,587 | ) | (112,894 | ) | ||

| Deferred debt financing costs, 8.75% notes payable 2025 | (2,557 | ) | (4,777 | ) | ||

| 7.00% Notes Payable 2025 | 12,000,000 | 12,000,000 | ||||

| Discount on 7.00% notes payable 2025 | (132,133 | ) | (193,175 | ) | ||

| Deferred debt financing costs, 7.00% notes payable 2025 | (16,212 | ) | (24,210 | ) | ||

| 7.75% Notes Payable 2025 | 5,000,000 | 5,000,000 | ||||

| Deferred debt financing costs, 7.75% notes payable 2025 | (46,883 | ) | (74,531 | ) | ||

| 4.375% Notes Payable 2026 | 175,000,000 | 175,000,000 | ||||

| Premium on 4.375% notes payable 2026 | 439,902 | 564,260 | ||||

| Deferred debt financing costs, 4.375% notes payable 2026 | (1,283,387 | ) | (1,708,104 | ) | ||

| 4.35% Notes Payable 2027 | 75,000,000 | 75,000,000 | ||||

| Discount on 4.35% notes payable 2027 | (254,551 | ) | (313,010 | ) | ||

| Deferred debt financing costs, 4.35% notes payable 2027 | (859,567 | ) | (1,033,178 | ) | ||

| 6.25% Notes Payable 2027 | 15,000,000 | 15,000,000 | ||||

| Deferred debt financing costs, 6.25% notes payable 2027 | (237,503 | ) | (273,449 | ) | ||

| 6.00% Notes Payable 2027 | 105,500,000 | 105,500,000 | ||||

| Discount on 6.00% notes payable 2027 | (105,834 | ) | (123,782 | ) | ||

| Deferred debt financing costs, 6.00% notes payable 2027 | (1,871,368 | ) | (2,224,403 | ) | ||

| 8.00% Notes Payable 2027 | 46,000,000 | 46,000,000 | ||||

| Deferred debt financing costs, 8.00% notes payable 2027 | (1,099,544 | ) | (1,274,455 | ) | ||

| 8.125% Notes Payable 2027 | 60,375,000 | 60,375,000 | ||||

| Deferred debt financing costs, 8.125% notes payable 2027 | (1,358,240 | ) | (1,563,594 | ) | ||

| 8.50% Notes Payable 2028 | 57,500,000 | 57,500,000 | ||||

| Deferred debt financing costs, 8.50% notes payable 2028 | (1,474,914 | ) | (1,680,039 | ) | ||

| Base management and incentive fees payable | 9,316,716 | 8,147,217 | ||||

| Deferred tax liability | 4,417,880 | 3,791,150 | ||||

| Accounts payable and accrued expenses | 1,497,040 | 1,337,542 | ||||

| Interest and debt fees payable | 4,001,012 | 3,582,173 | ||||

| Directors fees payable | 80,000 | – | ||||

| Due to Manager | 784,693 | 450,000 | ||||

| Total liabilities | 842,649,819 | 820,981,727 | ||||

| Commitments and contingencies | ||||||

| NET ASSETS | ||||||

| Common stock, par value $0.001, 100,000,000 common shares authorized, 13,745,769 and 13,653,476 common shares issued and outstanding, respectively | 13,746 | 13,654 | ||||

| Capital in excess of par value | 373,087,033 | 371,081,199 | ||||

| Total distributable deficit | (1,046,937 | ) | (870,745 | ) | ||

| Total net assets | 372,053,842 | 370,224,108 | ||||

| Total liabilities and net assets | $1,214,703,661 | $1,191,205,835 | ||||

| NET ASSET VALUE PER SHARE | $27.07 | $27.12 | ||||

| Asset Coverage Ratio | 159.6% | 161.1% | ||||

| Saratoga Investment Corp. Consolidated Statements of Operations (unaudited) |

||||||

| For the three months ended | ||||||

| August 31, 2024 | August 31, 2023 | |||||

| INVESTMENT INCOME | ||||||

| Interest from investments | ||||||

| Interest income: | ||||||

| Non-control/Non-affiliate investments | $35,721,214 | $28,489,719 | ||||

| Affiliate investments | 491,015 | 907,064 | ||||

| Control investments | 1,247,256 | 2,085,448 | ||||

| Payment in kind interest income: | ||||||

| Non-control/Non-affiliate investments | 1,654,044 | 493,338 | ||||

| Affiliate investments | 250,346 | 215,547 | ||||

| Control investments | 1,277 | 142,289 | ||||

| Total interest from investments | 39,365,152 | 32,333,405 | ||||

| Interest from cash and cash equivalents | 1,671,031 | 539,093 | ||||

| Management fee income | 792,323 | 817,250 | ||||

| Dividend income(*): | ||||||

| Non-control/Non-affiliate investments | 162,779 | 94,613 | ||||

| Control investments | 915,590 | 1,536,970 | ||||

| Total dividend from investments | 1,078,369 | 1,631,583 | ||||

| Structuring and advisory fee income | 35,000 | 45,000 | ||||

| Other income | 61,500 | 147,814 | ||||

| Total investment income | 43,003,375 | 35,514,145 | ||||

| OPERATING EXPENSES | ||||||

| Interest and debt financing expenses | 13,128,941 | 12,413,462 | ||||

| Base management fees | 4,766,445 | 4,840,899 | ||||

| Incentive management fees expense (benefit) | 4,550,270 | 2,481,473 | ||||

| Professional fees | 125,886 | 486,673 | ||||

| Administrator expenses | 1,133,333 | 904,167 | ||||

| Insurance | 77,597 | 81,901 | ||||

| Directors fees and expenses | 80,000 | 111,000 | ||||

| General and administrative | 821,584 | 467,116 | ||||

| Income tax expense (benefit) | 121,921 | (237,330 | ) | |||

| Total operating expenses | 24,805,977 | 21,549,361 | ||||

| NET INVESTMENT INCOME | 18,197,398 | 13,964,784 | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||||

| Net realized gain (loss) from investments: | ||||||

| Non-control/Non-affiliate investments | 558,701 | – | ||||

| Control investments | (34,007,428 | ) | – | |||

| Net realized gain (loss) from investments | (33,448,727 | ) | – | |||

| Net change in unrealized appreciation (depreciation) on investments: | ||||||

| Non-control/Non-affiliate investments | 32,524,852 | (11,657,451 | ) | |||

| Affiliate investments | 353,445 | 39,648 | ||||

| Control investments | (4,150,142 | ) | 5,880,232 | |||

| Net change in unrealized appreciation (depreciation) on investments | 28,728,155 | (5,737,571 | ) | |||

| Net change in provision for deferred taxes on unrealized (appreciation) depreciation on investments | (159,187 | ) | (221,206 | ) | ||

| Net realized and unrealized gain (loss) on investments | (4,879,759 | ) | (5,958,777 | ) | ||

| Realized losses on extinguishment of debt | – | (110,056 | ) | |||

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $13,317,639 | $7,895,951 | ||||

| WEIGHTED AVERAGE – BASIC AND DILUTED EARNINGS (LOSS) PER COMMON SHARE | $0.97 | $0.65 | ||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING – BASIC AND DILUTED | 13,726,142 | 12,158,440 | ||||

* Certain prior period amounts have been reclassified to conform to current period presentation.

| Saratoga Investment Corp. Consolidated Statements of Operations (unaudited) |

||||||

| For the six months ended | ||||||

| August 31, 2024 | August 31, 2023 | |||||

| INVESTMENT INCOME | ||||||

| Interest from investments | ||||||

| Interest income: | ||||||

| Non-control/Non-affiliate investments | $66,945,491 | $54,800,512 | ||||

| Affiliate investments | 987,855 | 1,634,150 | ||||

| Control investments | 3,244,368 | 4,131,308 | ||||

| Payment in kind interest income: | ||||||

| Non-control/Non-affiliate investments | 1,717,874 | 618,233 | ||||

| Affiliate investments | 491,450 | 423,136 | ||||

| Control investments | 284,590 | 283,852 | ||||

| Total interest from investments | 73,671,628 | 61,891,191 | ||||

| Interest from cash and cash equivalents | 2,295,662 | 1,343,382 | ||||

| Management fee income | 1,596,779 | 1,634,038 | ||||

| Dividend income(*): | ||||||

| Non-control/Non-affiliate investments | 412,270 | 112,033 | ||||

| Control investments | 2,212,640 | 3,360,480 | ||||

| Total dividend from investments | 2,624,910 | 3,472,513 | ||||

| Structuring and advisory fee income | 445,843 | 1,474,222 | ||||

| Other income | 1,046,703 | 330,842 | ||||

| Total investment income | 81,681,525 | 70,146,188 | ||||

| OPERATING EXPENSES | ||||||

| Interest and debt financing expenses | 26,091,022 | 24,106,284 | ||||

| Base management fees | 9,749,025 | 9,405,088 | ||||

| Incentive management fees expense (benefit) | 8,135,004 | 2,584,821 | ||||

| Professional fees | 1,125,196 | 972,723 | ||||

| Administrator expenses | 2,208,333 | 1,722,917 | ||||

| Insurance | 155,193 | 163,802 | ||||

| Directors fees and expenses | 193,000 | 200,068 | ||||

| General and administrative | 1,430,711 | 1,297,844 | ||||

| Income tax expense (benefit) | 61,638 | (231,093 | ) | |||

| Total operating expenses | 49,149,122 | 40,222,454 | ||||

| NET INVESTMENT INCOME | 32,532,403 | 29,923,734 | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||||

| Net realized gain (loss) from investments: | ||||||

| Non-control/Non-affiliate investments | 558,701 | 90,691 | ||||

| Control investments | (55,202,425 | ) | – | |||

| Net realized gain (loss) from investments | (54,643,724 | ) | 90,691 | |||

| Net change in unrealized appreciation (depreciation) on investments: | ||||||

| Non-control/Non-affiliate investments | 46,681,677 | (13,385,585 | ) | |||

| Affiliate investments | 954,668 | (205,636 | ) | |||

| Control investments | (4,976,759 | ) | (8,468,657 | ) | ||

| Net change in unrealized appreciation (depreciation) on investments | 42,659,586 | (22,059,878 | ) | |||

| Net change in provision for deferred taxes on unrealized (appreciation) depreciation on investments | (620,188 | ) | (161,799 | ) | ||

| Net realized and unrealized gain (loss) on investments | (12,604,326 | ) | (22,130,986 | ) | ||

| Realized losses on extinguishment of debt | – | (110,056 | ) | |||

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $19,928,077 | $7,682,692 | ||||

| WEIGHTED AVERAGE – BASIC AND DILUTED EARNINGS (LOSS) PER COMMON SHARE | $1.45 | $0.64 | ||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING – BASIC AND DILUTED | 13,704,759 | 12,011,180 | ||||

* Certain prior period amounts have been reclassified to conform to current period presentation.

Supplemental Information Regarding Adjusted Net Investment Income, Adjusted Net Investment Income Yield and Adjusted Net Investment Income per Share

On a supplemental basis, Saratoga Investment provides information relating to adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income, net investment income yield and net investment income per share. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or reversal attributable to realized and unrealized gains. The management agreement with the Company’s advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year. In addition, Saratoga Investment accrues, but does not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. All capital gains incentive fees are presented within net investment income within the Consolidated Statements of Operations, but the associated realized and unrealized gains and losses that these incentive fees relate to, are excluded. As such, Saratoga Investment believes that adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share is a useful indicator of operations exclusive of any capital gains incentive fee expense or reversal attributable to gains. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income, net investment income yield to adjusted net investment income yield and net investment income per share to adjusted net investment income per share for the three and six months ended August 31, 2024 and August 31, 2023.

| For the Three Months Ended | ||||||

| August 31, 2024 | August 31, 2023 | |||||

| Net Investment Income | $18,197,398 | $13,964,784 | ||||

| Changes in accrued capital gains incentive fee expense/ (reversal) | – | (808,452) | ||||

| Adjusted net investment income | $18,197,398 | $13,156,332 | ||||

| Net investment income yield | 19.7% | 16.0% | ||||

| Changes in accrued capital gains incentive fee expense/ (reversal) | – | (1.0)% | ||||

| Adjusted net investment income yield(1) | 19.7% | 15.0% | ||||

| Net investment income per share | $1.33 | $1.15 | ||||

| Changes in accrued capital gains incentive fee expense/ (reversal) | – | (0.07) | ||||

| Adjusted net investment income per share(2) | $1.33 | $1.08 | ||||

(1) Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.

(2) Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

| For the Six Months Ended | ||||||

| August 31, 2024 | August 31, 2023 | |||||

| Net Investment Income | $32,532,403 | $29,923,734 | ||||

| Changes in accrued capital gains incentive fee expense/ (reversal) | – | (3,918,274) | ||||

| Adjusted net investment income | $32,532,403 | $26,005,460 | ||||

| Net investment income yield | 17.6% | 17.2% | ||||

| Changes in accrued capital gains incentive fee expense/ (reversal) | – | (2.3)% | ||||

| Adjusted net investment income yield(1) | 17.6% | 14.9% | ||||

| Net investment income per share | $2.37 | $2.49 | ||||

| Changes in accrued capital gains incentive fee expense/ (reversal) | – | (0.32) | ||||

| Adjusted net investment income per share(2) | $2.37 | $2.17 | ||||

(3) Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.

(4) Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Incredible High-Yield Dividend Stock Could Slowly Make You Richer

Realty Income (NYSE: O) knows how to make money for its investors. The real estate investment trust (REIT) has delivered a 14.3% compound annual total return since its listing on the New York Stock Exchange in 1994. That has enabled it to grow a $10,000 investment 30 years ago into more than $555,000.

The REIT should have no trouble growing the wealth of its investors in the future. Here’s why it should continue to be an enriching investment.

Growing wealth one dividend payment at a time

Dividend payments have significantly contributed to Realty Income’s success over the years. The REIT has paid over $14.1 billion in dividends since it came public. It has an incredible record of increasing its dividend. The REIT has raised its payout an incredible 127 times, including for 108 straight quarters, growing its payout at a 4.3% compound annual rate.

Those dividend payments have been a meaningful contributor to Realty Income’s returns. For example, it would have cost an investor $37,330 to buy 1,000 shares at the end of 2013. That investment would have generated nearly $30,000 in dividend income over the course of a decade, paying back about 80% of the original investment. The annual income stream would have grown by nearly $1,000 over that period, or by 44%. Meanwhile, the overall investment would have increased in value by 54%, driven largely by the growing dividend payments.

Realty Income has been able to steadily increase its payout by growing its portfolio of income-producing real estate. The REIT has made about $47 billion of real estate investments since 2010, including acquiring other REITs and buying properties in sale-leaseback transactions. These accretive investments have grown the company’s adjusted funds from operations (FFO) per share by around a 5% annual rate.

Built to continue growing

Realty Income is targeting to grow its adjusted FFO per share by 4% to 5% annually in the future. Three factors drive that view:

-

Rent growth: Realty Income’s rental contracts contain embedded rental escalation clauses. The REIT expects rising rents to increase its adjusted FFO per share by around 1% annually after adjusting for bad debt expense.

-

Internally funded investments: The REIT has a very conservative dividend payout ratio, at 73.3% of its adjusted FFO in the second quarter. That enables it to retain significant free cash flow to internally fund accretive new investments. It estimates that it can internally fund 2% to 3% annual FFO per share growth, which will more than offset the 1% to 2% expected annual negative impact on its adjusted FFO from refinancing maturing debt, good for 1% to 2% net growth.

-

Externally funded growth: Accretive acquisitions financed with a blend of new debt and equity capital can further enhance its growth rate. The REIT estimates that it can add 0.5% to its adjusted FFO per share for every $1 billion of externally funded acquisitions it makes. It’s targeting $4 billion-$6 billion of externally funded investments annually, which would add another 2% to 3% to its adjusted FFO per share each year.

Realty Income should have no shortage of investment opportunities. The REIT sees a $5.4 trillion total addressable market for net lease real estate in the U.S. and another $8.5 trillion in Europe. It has been expanding its opportunity set by adding new property verticals. For example, it has added data centers, gaming properties, additional European countries, and credit investments to its portfolio in recent years.

The REIT has an elite balance sheet, which gives it ample financial flexibility to fund its continued growth. It’s one of only eight REITs in the S&P 500 with two A3/A- credit ratings or better. That enables it to borrow money at lower rates and better terms, enhancing its ability to make accretive acquisitions.

It all adds up to a potentially very enriching investment

Realty Income believes it can grow its adjusted FFO per share at a 4% to 5% annual rate, which is close to its historical average. That should enable the REIT to continue growing its high-yielding dividend of currently over 5%, potentially by around the same annual rate. Put the two together, and the REIT could produce total returns of around 10% annually, with additional upside if it makes more acquisitions. At that rate, the REIT would double your investment about every seven years.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,363!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,938!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

This Incredible High-Yield Dividend Stock Could Slowly Make You Richer was originally published by The Motley Fool

TSMC’s sales beat estimates in good sign for AI chip demand

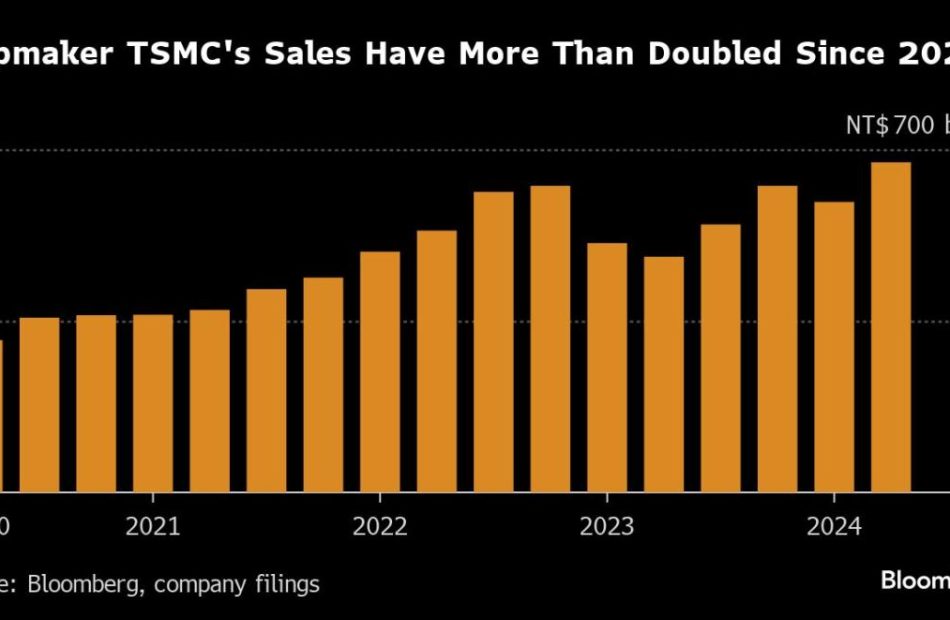

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. posted a better-than-expected 39% rise in quarterly revenue, assuaging concerns that AI hardware spending is beginning to taper off.

Most Read from Bloomberg

The main chipmaker to Nvidia Corp. and Apple Inc. reported September-quarter sales of NT$759.7 billion ($23.6 billion), versus the average projection for NT$748 billion. Taiwan’s largest company will disclose its full results next Thursday.

The better-than-anticipated performance may reinforce the view of investors betting that AI spending will remain elevated as companies and governments race for an edge in the emergent technology. Others caution that the likes of Meta Platforms Inc. and Alphabet Inc.’s Google can’t sustain their current pace of infrastructure spending without a compelling and monetizable AI use case.

Hsinchu-based TSMC is one of the key companies at the heart of a global surge in spending on AI development, producing the cutting-edge chips needed to train artificial intelligence. Its sales have more than doubled since 2020, with the seminal launch of ChatGPT sparking a race to acquire Nvidia hardware for AI server farms.

Shares in Nvidia were up about 1.2% in premarket trading in New York on Wednesday, while TSMC’s US-traded ADRs rose a more modest 0.8%.

What Bloomberg Intelligence Says

This reflects strong demand for AI chips and new N3E process orders from Apple, Qualcomm and MediaTek, despite delays in shipments of Nvidia’s Blackwell chips. Gross margin might also exceed the guidance midpoint of 54.5%. Focus in 3Q earnings call will be on whether 4Q guidance can exceed consensus’ 7% sequential-growth estimate. While Apple’s A18 chip orders may decline due to soft demand for new iPhone 16s, robust orders from Nvidia and Intel are likely to offset any revenue shortfall. Other key topics include the potential for earlier 2-nanometer (N2) node mass production and plans to expand its chip-on-wafer-on-substrate (CoWoS) advanced packaging capacity in 2025.

– Charles Shum, analyst

Click here for the research.

TSMC’s stock has more than doubled since the launch of ChatGPT, with its market capitalization briefly crossing the $1 trillion mark in July. That month, Taiwan’s largest company also lifted its outlook for 2024 revenue growth after quarterly results beat estimates.

In recent months, however, views have begun to diverge on whether the AI-driven growth momentum will last. That skepticism has led to a pullback in AI stocks, including flag bearer Nvidia, earlier this year.

TSMC’s view is that AI spending will remain high despite growing US-Chinese trade tensions. In both countries, startups and tech firms from Microsoft Corp. to Baidu Inc. are splurging on AI infrastructure in a race to develop applications.

Nvidia’s key server assembly partner Hon Hai Precision Industry Co. earlier this week also reaffirmed demand for AI hardware remains solid. Hon Hai Chairman Young Liu told Bloomberg TV on Tuesday that his company plans to boost server production capacity to meet “crazy” demand for the next-generation Blackwell chips, echoing similar remarks from Nvidia Chief Executive Officer Jensen Huang earlier this month.

But analysts worry that delays in the delivery of Nvidia’s latest Blackwell chips might disrupt the industry, though most investors don’t view that as a long-term issue for TSMC. With Intel Corp. and Samsung Electronics Co. both struggling to get ahead in the business of bespoke chipmaking, TSMC’s market leadership is expected to help prop up margins.

TSMC now makes more than half of its revenue from high-performance computing, the segment of its business driven by AI demand. It also remains the sole manufacturer for the iPhone’s processor, although a growing number of analysts have voiced concerns over worse-than-expected demand for the new iPhone 16 range.

–With assistance from Vlad Savov.

(Updates with shares and analyst’s comment from the fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

1 Vanguard ETF That Could Soar 37.3% Before the End of 2024, According to a Select Wall Street Analyst

Investors should take every prediction from Wall Street analysts with a grain of salt, because they don’t always get things right. However, Tom Lee from Fundstrat Global Advisors has made some stellar calls over the last couple of years:

-

He predicted the S&P 500 (SNPINDEX: ^GSPC) index would soar to 4,750 in 2023 (while many other analysts were bearish), and it ended the year at 4,769.

-

He came into 2024 with a 5,200 target for the index, which was hit within three months.

-

Lee then forecasted the S&P 500 would hit 5,500 by the end of June, and it did.

-

He followed that up with a year-end call of 5,700, which has already been surpassed.

But Lee also came into 2024 with an ambitious target for another stock market index: The Russell 2000, which features approximately 2,000 of the smallest companies listed on U.S. stock exchanges. He believed the combination of falling interest rates and cheap valuations in small-cap stocks would propel that index to a 50% gain in 2024.

The Russell 2000 is currently up just 10% year to date, so it would have to soar another 37.3% in the next three months to meet Lee’s forecast. That seems very unlikely, but the Federal Reserve did slash interest rates in September, and Lee reiterated his bullish stance on the smaller end of the stock market a few days later.

The Vanguard Russell 2000 ETF (NASDAQ: VTWO) directly tracks the performance of the Russell 2000, so it’s a simple way for investors to profit if Lee turns out to be right.

The Vanguard ETF is a simple way to invest in small-caps

The technology sector makes up almost one-third of the entire value of the widely followed S&P 500 index, so its performance is heavily influenced by a small number of stocks. The Russell 2000, on the other hand, is far more balanced across its 11 different sectors.

Its largest sector is industrials with a weighting of 18.9%, followed by healthcare at 15.1%, financials at 15%, and consumer discretionary at 12.6%.

In fact, the top 10 holdings in the Vanguard Russell 2000 ETF represent just 3.47% of the total value of its entire portfolio:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. FTAI Aviation |

0.47% |

|

2. Insmed Inc |

0.44% |

|

3. Sprouts Farmers Market |

0.39% |

|

4. Fabrinet |

0.33% |

|

5. Vaxcyte |

0.33% |

|

6. Fluor Corp |

0.32% |

|

7. Ensign Group |

0.31% |

|

8. Mueller Industries |

0.30% |

|

9. Halozyme Therapeutics |

0.29% |

|

10. Applied Industrial Technologies |

0.29% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31, 2024, and are subject to change.

Following a 209% gain in its stock this year, FTAI Aviation has a market capitalization of $14.3 billion, making it the largest company in the Russell 2000. It supplies aftermarket aircraft engine components and provides maintenance services to airlines. It’s benefiting from Boeing‘s regulatory issues because the manufacturer is shipping fewer planes, so airline companies have to run older fleets, which require more maintenance.

Insmed is a biopharmaceutical company that develops therapies for rare diseases. Then there is Sprouts Farmers Market, an organic grocery chain with more than 400 stores across the U.S.

Outside of its top 10 positions, the Vanguard ETF holds well-known names like cybersecurity powerhouse Tenable, semiconductor-service company Axcelis Technologies, and clothing retailer Abercrombie and Fitch.

Interest rates are falling, which is a tailwind for small-caps

The Fed slashed the federal funds rate (overnight interest rates) by 50 basis points at its September policy meeting, because inflation is trending toward its target and there were signs that the jobs market is getting less robust. As a result, the Fed’s future projections also suggest more cuts are on the way in 2024, 2025, and even 2026.

Rate cuts tend to benefit smaller companies more than large ones. Tech giants like Apple, Microsoft, and Nvidia are sitting on so much cash that they each return tens of billions of dollars to their shareholders every year through stock buybacks and dividends. They don’t need debt financing.

But smaller companies often need to borrow money to fuel their growth. A lot of that debt comes with floating interest rates, which are very sensitive to changes in the Fed’s policy rate. Therefore, when interest rates come down, small companies experience an increase in their borrowing capacity and a reduction in their interest payments, both of which can be a tailwind for their earnings.

That’s why Tom Lee believes lower rates could push the Russell 2000 higher, especially considering its current valuation. The index trades at a price-to-earnings (P/E) ratio of just 17.8 (excluding companies with negative earnings), which is a 35% discount to the 27.4 P/E ratio of the S&P 500.

Investors pay a premium for the S&P 500 because of the extremely high quality of its constituents. Apple, Microsoft, and Nvidia, for example, have track records of success that span decades, along with secure revenue streams, and consistent earnings growth. Therefore, it’s unlikely the Russell 2000 will completely close the valuation gap to the S&P 500, but it could certainly make some inroads if rates continue to fall as expected.

Tom Lee’s forecast might be ambitious

A gain of 50% for the Russell 2000 might be out of reach this year, since it’s only up 10% so far. But there’s another glaring problem: The index has never returned 50% in a single year (going all the way back to 1988).

The Vanguard Russell 2000 ETF has delivered a compound annual return of just 10.4% since it was established in 2010, so a 50% gain would be truly extraordinary. Plus, the federal funds rate was below 1% for most of the period between 2010 and 2022, which still wasn’t enough to drive outsized gains in small-caps.

The index could certainly climb further in the final three months of 2024, but a 37.3% gain in that stretch is probably out of the question. With that said, for investors who already have ample exposure to the S&P 500, adding the Vanguard Russell 2000 ETF to their portfolio can be a good way to diversify.

However, investors with no exposure to the S&P 500 might want to look there instead. The Vanguard S&P 500 ETF has delivered a compound annual return of 14.7% since 2010, so it’s crushing the Russell 2000 ETF. That 4.3% differential each year makes a huge difference in dollar terms, thanks to the effects of compounding:

|

Starting Balance (2010) |

Compound Annual Return |

Balance Today (2024) |

|---|---|---|

|

$10,000 |

10.4% (Russell 2000 ETF) |

$39,954 |

|

$10,000 |

14.7% (Vanguard S&P 500 ETF) |

$68,216 |

Calculations by author.

Given the quality of the companies in the S&P 500, it’s likely to continue outperforming the smaller end of the market for the long term.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,363!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,938!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends Sprouts Farmers Market and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Vanguard ETF That Could Soar 37.3% Before the End of 2024, According to a Select Wall Street Analyst was originally published by The Motley Fool

1 Vanguard Index Fund Could Turn $500 Per Month Into a $968,400 Portfolio That Pays $16,000 in Annual Dividend Income

The median annual income for full-time workers aged 25 to 34 was $57,200 in the second quarter, according to the Bureau of Labor Statistics. That means after-tax earnings would be about $43,800 in the worst case scenario. Financial planners generally advise saving 20% of after-tax earnings for retirement, which would be $8,760 per year or $730 per month for the median earner.

Even a percentage of that figure invested wisely could grow into a sizable portfolio given enough time. For instance, history says $500 invested monthly in the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) would be worth about $968,400 after three decades. The portfolio would initially generate about $16,000 per year in dividend income.

However, the underlying investment would continue to grow even without further contributions, so the dividend payout could be even larger by retirement, depending on when that occurs. For instance, the portfolio would reach $1.2 million after three more years, at which point it would generate about $19,800 in annual passive income.

Here are the important details.

The Vanguard Dividend Appreciation ETF provides diversified exposure to financially stable companies

The Vanguard Dividend Appreciation ETF tracks U.S. companies that have consistently raised their dividends for at least 10 years. It excludes dividend payers with yields in top 25% to avoid companies with unsustainable payouts or limited growth prospects.

The fund includes 337 domestic companies, comprising value stocks and growth stocks, with a median market capitalization of $197 billion. The dividend yield is currently 1.65%. The 10 largest holdings are listed by weight below:

-

Apple: 4.6%

-

Broadcom: 3.8%

-

Microsoft: 3.7%

-

JPMorgan Chase: 3.5%

-

UnitedHealth Group: 2.9%

-

ExxonMobil: 2.9%

-

Visa: 2.2%

-

Procter & Gamble: 2.2%

-

Johnson & Johnson: 2.2%

-

Mastercard: 2.2%

The Vanguard Dividend Appreciation ETF lets investors spread money across a group of companies with the financial stability needed to not only pay a regular dividend, but also to raise the payout consistently. It bears a below-average expense ratio of 0.06%, meaning the annual fees on a $10,000 portfolio will total just $6.

How to turn $500 per month into $16,000 in annual dividend income

The Vanguard Dividend Appreciation ETF has returned 473% since its inception in 2006, assuming dividends were reinvested, which is equivalent to 9.9% annually. At that pace, $500 invested monthly in the ETF would be worth $95,100 in one decade, $339,700 in two decades, and $968,400 in three decades.

As mentioned, the Vanguard ETF currently pays a dividend yield of 1.65%, which is slightly below the 10-year average of 1.9%. But I will use the smaller figure to ensure a conservative estimate. To that end, if dividends are no longer reinvested after three decades, the $968,400 portfolio will generate about $16,000 per year in dividend income.

Meanwhile, the underlying investment will continue to grow even without further contributions. For instance, when dividends are excluded, the Vanguard ETF has returned 7.6% annually since its inception. At that rate, the $968,400 portfolio would be worth $1.2 million after three more years, and that sum would generate about $19,800 in annual dividend income.

Importantly, the scenario I just described involved saving $500 per month. But the median worker should be saving about $730 per month, meaning we have yet to account for $230. That money (and additional capital) could be invested in individual stocks, as long as the investor does the requisite research. Alternatively, the money could be invested in an S&P 500 index fund, which provides diversified exposure to the most influential U.S. stocks.

Should you invest $1,000 in Vanguard Dividend Appreciation ETF right now?

Before you buy stock in Vanguard Dividend Appreciation ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Dividend Appreciation ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $782,682!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Mastercard and Visa. The Motley Fool has positions in and recommends Apple, JPMorgan Chase, Mastercard, Microsoft, Vanguard Dividend Appreciation ETF, and Visa. The Motley Fool recommends Broadcom, Johnson & Johnson, and UnitedHealth Group and recommends the following options: long January 2025 $370 calls on Mastercard, long January 2026 $395 calls on Microsoft, short January 2025 $380 calls on Mastercard, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Vanguard Index Fund Could Turn $500 Per Month Into a $968,400 Portfolio That Pays $16,000 in Annual Dividend Income was originally published by The Motley Fool

Adagene Announces Upcoming Poster Presentations on Masked Anti-CTLA-4 SAFEbody® ADG126 (Muzastotug) at Society for Immunotherapy of Cancer (SITC) 39th Annual Meeting

SAN DIEGO and SUZHOU, China, Oct. 09, 2024 (GLOBE NEWSWIRE) — Adagene Inc. (“Adagene”) ADAG, a company transforming the discovery and development of novel antibody-based therapies, today announced poster presentations at the upcoming SITC 39th Annual Meeting, taking place in Houston, Nov. 6 – 10, 2024.

Details include:

Deciphering Improved Clinical Therapeutic Index (TI) of Muzastotug (ADG126), a Masked Anti-CTLA-4 SAFEbody® over its Unmasked Form (ADG116) as Monotherapy or in Combination with anti-PD-1 Therapy

- Date: Saturday, November 9

- Lunch & Poster Viewing: 12:15–1:45 PM CST

- Poster Reception: 7:10-8:30 PM CST

- Onsite Location: George R. Brown Convention Center (Level 1, Exhibit Halls AB)

- Abstract Number: 506

Phase 1b/2, Multicenter Dose Escalation and Expansion Study of Muzastotug (ADG126, a Masked Anti-CTLA-4 SAFEbody®) in Combination with Pembrolizumab in Advanced/Metastatic MSS CRCs

- Date: Saturday, November 9

- Lunch & Poster Viewing: 12:15–1:45 PM CST

- Poster Reception: 7:10-8:30 PM CST

- Onsite Location: George R. Brown Convention Center (Level 1, Exhibit Halls AB)

- Abstract Number: 744

Both posters will be made available on the Publications page of the company’s website here.

About Adagene

Adagene Inc. ADAG is a platform-driven, clinical-stage biotechnology company committed to transforming the discovery and development of novel antibody-based cancer immunotherapies. Adagene combines computational biology and artificial intelligence to design novel antibodies that address globally unmet patient needs. The company has forged strategic collaborations with reputable global partners that leverage its SAFEbody® precision masking technology in multiple approaches at the vanguard of science.

Powered by its proprietary Dynamic Precision Library (DPL) platform, composed of NEObody™, SAFEbody, and POWERbody™ technologies, Adagene’s highly differentiated pipeline features novel immunotherapy programs. The company’s SAFEbody technology is designed to address safety and tolerability challenges associated with many antibody therapeutics by using precision masking technology to shield the binding domain of the biologic therapy. Through activation in the tumor microenvironment, this allows for tumor-specific targeting of antibodies in tumor microenvironment, while minimizing on-target off-tumor toxicity in healthy tissues.

Adagene’s lead clinical program, ADG126 (muzastotug), is a masked, anti-CTLA-4 SAFEbody that targets a unique epitope of CTLA-4 in regulatory T cells (Tregs) in the tumor microenvironment. ADG126 is currently in phase 1b/2 clinical studies in combination with anti-PD-1 therapy, particularly focused on Metastatic Microsatellite-stable (MSS) Colorectal Cancer (CRC). Validated by ongoing clinical research, the SAFEbody platform can be applied to a wide variety of antibody-based therapeutic modalities, including Fc empowered antibodies, antibody-drug conjugates, and bi/multispecific T-cell engagers.

For more information, please visit: https://investor.adagene.com.

Follow Adagene on WeChat, LinkedIn and Twitter.

SAFEbody® is a registered trademark in the United States, China, Australia, Japan, Singapore, and the European Union.

Safe Harbor Statement

This press release contains forward-looking statements, including statements regarding certain clinical results of ADG126, the potential implications of clinical data for patients, and Adagene’s advancement of, and anticipated preclinical activities, clinical development, regulatory milestones, and commercialization of its product candidates. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including but not limited to Adagene’s ability to demonstrate the safety and efficacy of its drug candidates; the clinical results for its drug candidates, which may not support further development or regulatory approval; the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approval of Adagene’s drug candidates; Adagene’s ability to achieve commercial success for its drug candidates, if approved; Adagene’s ability to obtain and maintain protection of intellectual property for its technology and drugs; Adagene’s reliance on third parties to conduct drug development, manufacturing and other services; Adagene’s limited operating history and Adagene’s ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates; Adagene’s ability to enter into additional collaboration agreements beyond its existing strategic partnerships or collaborations, and the impact of the COVID-19 pandemic on Adagene’s clinical development, commercial and other operations, as well as those risks more fully discussed in the “Risk Factors” section in Adagene’s filings with the U.S. Securities and Exchange Commission. All forward-looking statements are based on information currently available to Adagene, and Adagene undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Investor & Media Contact:

Ami Knoefler

Adagene

650-739-9952

ir@adagene.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CROMBIE REIT ANNOUNCES OFFERING OF $300 MILLION SERIES M UNSECURED NOTES

NEW GLASGOW, NS, Oct. 8, 2024 /CNW/ – Crombie Real Estate Investment Trust (“Crombie” or the “REIT”) CRR, announced today that it entered into an agreement to issue $300 million aggregate principal amount of Series M Senior Unsecured Notes maturing January 15, 2032 (the “Series M Notes”). The Series M Notes will bear interest at a rate of 4.732% per annum and were offered at a price of $999.79 per $1,000.00 principal amount.

The Series M Notes are being offered with a syndicate of agents, co-led by Scotia Capital Inc. and CIBC World Markets Inc., and including Desjardins Securities Inc., National Bank Financial Inc., TD Securities Inc., BMO Nesbitt Burns Inc., and RBC Dominion Securities Inc., to sell, on a best effort, private placement basis.

Net proceeds from the Series M Notes offering will be used to repay, redeem, or refinance existing indebtedness, including maturing mortgage financings, indebtedness under existing bank credit facilities, and outstanding debt securities, as well as general trust purposes.

The offering is expected to close on or about October 11, 2024 and is subject to customary closing conditions, including receipt of necessary consents and approvals and the Series M Notes receiving a rating of at least BBB(low) with a positive trend from Morningstar DBRS.

The Series M Notes will be sold in Canada on a private placement basis pursuant to certain prospectus exemptions. The offer and sale of the Series M Notes will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”) or any state securities laws, and the Notes may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities laws.

This news release does not constitute an offer to sell, or a solicitation of an offer to buy, any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such an offer, solicitation, or sale would be unlawful. The Toronto Stock Exchange has neither approved nor disapproved the form or content of this press release.

About Crombie REIT

Crombie invests in real estate with a vision of enriching communities together by building spaces and value today that leave a positive impact on tomorrow. As one of the country’s leading owners, operators, and developers of quality real estate assets, Crombie’s portfolio primarily includes grocery-anchored retail, retail-related industrial, and mixed-use residential properties. As at June 30, 2024, our portfolio contains 304 properties comprising approximately 19.3 million square feet, inclusive of joint ventures at Crombie’s share, and a significant pipeline of future development projects. Learn more at www.crombie.ca.

Cautionary Statements

This news release may contain forward-looking statements that reflect the current expectations of management of Crombie about Crombie’s future results, performance, achievements, prospects and opportunities. Wherever possible, words such as “continue”, “may”, “will”, “estimate”, “anticipate”, “believe”, “expect”, “intend” and similar expressions have been used to identify these forward-looking statements. These statements reflect current beliefs and are based on information currently available to management of Crombie, and include, without limitation, statements regarding the expected amount and timing of the offering which remains subject to the sale by the agents and may be impacted by market conditions. There is no assurance that the offering will be completed.

Readers are cautioned that such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from these statements. Crombie can give no assurance that actual results will be consistent with these forward-looking statements. A number of factors, including those discussed in the 2023 annual Management’s Discussion and Analysis under “Risk Management” and in the Annual Information Form for the year ended December 31, 2023 under “Risks”, could cause actual results, performance, achievements, prospects or opportunities to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and a reader should not place undue reliance on the forward-looking statements. There can be no assurance that the expectations of management of Crombie will prove to be correct.

SOURCE Crombie REIT

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/08/c8475.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/08/c8475.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hanmi Financial Corporation Announces Third Quarter 2024 Earnings and Conference Call Date

LOS ANGELES, Oct. 08, 2024 (GLOBE NEWSWIRE) — Hanmi Financial Corporation HAFC (“Hanmi”), the holding company for Hanmi Bank, today announced that it will report third quarter 2024 financial results after the market close on Tuesday, October 22, 2024. Management will host a conference call that same day, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss the results.

Investment professionals and all current and prospective shareholders are invited to access the live call on October 22 by dialing 1-877-407-9039 before 2:00 p.m. Pacific Time, using access code “Hanmi Bank”. To listen to the call online visit the investor relations page of Hanmi’s website at www.hanmi.com. The webcast will also be available for replay approximately one hour following the call.

About Hanmi Financial Corporation

Headquartered in Los Angeles, California, Hanmi Financial Corporation owns Hanmi Bank, which serves multi-ethnic communities through its network of 32 full-service branches and eight loan production offices in California, Texas, Illinois, Virginia, New Jersey, New York, Colorado, Washington and Georgia. Hanmi Bank specializes in real estate, commercial, SBA and trade finance lending to small and middle market businesses. Additional information is available at www.hanmi.com.

Contact

Romolo (Ron) Santarosa

Senior Executive Vice President & Chief Financial Officer

213-427-5636

Lisa Fortuna

Investor Relations

Financial Profiles, Inc.

310-622-8251

Source: Hanmi Bank

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.