Can You Guess What It Takes To Join The Top 4% Of Households? Here's A Hint – It's Not As High As You'd Expect

Think joining the top 4% of households means you need a vault full of gold or some secret hedge fund? Think again.

According to data from LIMRA reported by Rethinking65, only 4% of all U.S. households have $2 million or more in investable assets. That may not seem huge, but it represents a significant financial milestone that only a small fraction of households ever reach.

Don’t Miss:

Breaking it down further, the numbers shift depending on age. Among households headed by someone aged 60 or older, the percentage increases to 7%. For those aged 40 to 85, just 6% of households reach that $2 million mark in investable assets. These assets include IRAs, defined contribution plans, and investment accounts, but not home equity or personal property.

Crossing the $2 million threshold puts a household in a rare financial bracket. But what does that mean for their future?

LIMRA’s research shows that having $2 million comes with a strong sense of financial security, especially in retirement. Households with $2 million or more overwhelmingly feel confident they won’t run out of savings by the time they hit 90. Eighty to ninety percent agreed their savings would last, with over half strongly agreeing.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

That confidence starts to slip for households with between $1 million and $2 million. Only 28% of these households strongly agreed their savings would last their lifetime, and the percentage drops further for those with less savings.

Interestingly, many retirees in this group report their household income is sufficient to cover their basic living expenses. But for those planning their retirement, the future feels less certain. Only 44% of future retirees expect their income from sources like Social Security or pensions to fully cover their expenses.

Also Read: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

So, where do you stand? Being in the top 4% means more than just crossing a financial milestone. It’s about having the peace of mind that comes with knowing your savings will carry you through retirement. For those still working towards it, the journey to that number is just as important as reaching the goal.

If you aim to join the top 4% of households, traditional tips like cutting expenses and maxing out retirement accounts might not be enough. For a fresh approach to building net worth, here are some strategies you may not have considered:

-

Invest in alternative assets: Consider diversifying with assets like real estate crowdfunding, peer-to-peer lending, or private equity investments.

-

Leverage tax-advantaged accounts: Beyond 401(k)s, Health Savings Accounts (HSAs) and Roth IRAs provide powerful, tax-free growth.

-

Utilize Employee Stock Options: Take advantage of this benefit if your company offers stock options, especially at a discount. It’s an often-overlooked way to build wealth while leveraging your position at work. Ensure you contribute at least as much as your employer will match in your 401(k) plan or similar retirement accounts.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Keep in mind this analysis of the top 4% comes from just one survey, and it’s worth noting other reports may show different numbers. Each study has its own methodology, so the exact percentages can vary.

Consulting a financial advisor is a smart move if you’re looking to boost your wealth and potentially reach the top households. While there’s no guaranteed formula, a professional can help tailor a plan that aligns with your financial goals. It’s worth considering if you’re serious about building long-term wealth.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Can You Guess What It Takes To Join The Top 4% Of Households? Here’s A Hint – It’s Not As High As You’d Expect originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMN Stock Down Despite WorkWise Launch to Enhance Healthcare Delivery

AMN Healthcare Services, Inc. AMN launched an innovative technology suite, WorkWise, last Wednesday. The suite is expected to unify the company’s technologies into one single technology offering.

Per AMN Healthcare, WorkWise has been designed to streamline workforce processes by combining the capabilities of quantifying staffing demand with predictive scheduling, automated workforce management and enhanced clinician engagement using AI technology. The technology suite will likely empower healthcare systems to efficiently source the appropriate talent, while effectively managing costs.

The latest launch is expected to significantly boost AMN Healthcare’s Technology and Workforce Solutions business and solidify its foothold in the healthcare space.

Likely Trend of AMN Stock Following the News

Following the announcement on Oct. 2, shares of the company moved nearly 2.8% south to $38.64 at yesterday’s close.

Historically, the company has gained a high level of synergies from its product launches. Although the latest launch is likely to be beneficial for AMN’s top-line growth going forward, the stock declined overall since the announcement despite a slight gain yesterday.

AMN Healthcare currently has a market capitalization of $1.47 billion. It has an earnings yield of 8.3%, higher than the industry’s 3.6%. In the last reported quarter, AMN delivered an earnings surprise of 30.7%.

Significance of the Launch of AMN Healthcare’s WorkWise

Per AMN Healthcare, WorkWise is completely integrated with healthcare organizations’ internal systems. This is expected to enable hospitals to optimize personnel for any type of job (permanent, per diem, contract), sourcing from internal and external talent, to reduce costs and predict staffing needs with greater precision. The solution will likely leverage automation and data analysis to provide insights and build engaged talent networks for effective workforce management and increased speed-to-fill for staffing needs.

AMN Healthcare’s management believes that WorkWise will be an integrated solution with multiple capabilities that can work together to address complex workforce challenges in the healthcare industry. It is expected to provide a full end-to-end solution for hospitals and healthcare systems, which is built to adapt and evolve with their needs.

Industry Prospects in Favor of AMN

Per a report by Grand View Research, the global healthcare workforce management system market was valued at $1.9 billion in 2023 and is anticipated to witness a CAGR of 13.2% between 2024 and 2030. Factors like the shift toward value-based reimbursements and the increasing adoption of telehealth technologies and AI-driven analytics are likely to drive the market.

Given the market potential, the latest launch will likely provide a significant impetus to AMN Healthcare’s business.

AMN Healthcare’s Notable Launches

In August, AMN Healthcare launched Strategic Partnership Solutions. It aims to transform language access programs in healthcare organizations by providing comprehensive language services and strategic support to organizations.

In July, AMN Healthcare introduced a new teletherapy platform, Televate. Per the company, it has been designed to increase access to therapy services for students nationwide.

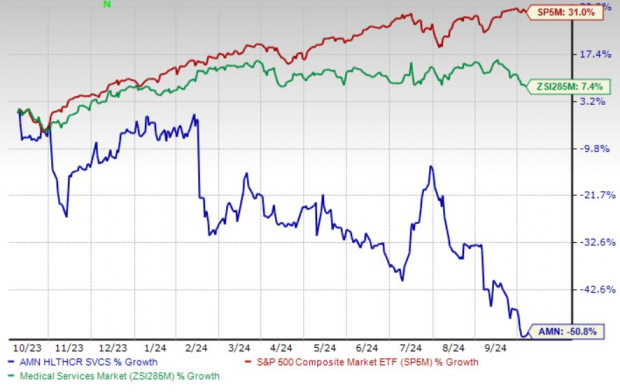

AMN’s Share Price Performance

Shares of the company have lost 50.7% in the past year against the industry’s 7.5% rise and the S&P 500’s 30.9% growth.

Image Source: Zacks Investment Research

AMN Healthcare’s Zacks Rank & Key Picks

Currently, AMN carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Baxter International Inc. BAX and Boston Scientific Corporation BSX.

DaVita, sporting a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 17.5%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 24.2%.

DaVita’s shares have gained 74.8% compared with the industry’s 31.7% rise in the past year.

Baxter, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 10%. BAX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 3.7%.

Baxter has gained 0.7% compared with the industry’s 22.9% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.6%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.2%.

Boston Scientific’s shares have rallied 62.4% compared with the industry’s 22.9% rise in the past year.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

67% of Warren Buffett's $315 Billion Portfolio Is Invested in These 5 Unstoppable Stocks

For almost 60 years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been on a pedestal. During that time, he’s watched his company grow into a trillion-dollar business, as well as delivered a cumulative return for his company’s Class A shares (BRK.A) that tops 5,600,000%!

One of the reasons the Oracle of Omaha is so widely followed on Wall Street — aside from his company’s outsized returns since the mid-1960s — is his willingness to share the characteristics he looks for when putting Berkshire’s capital to work. Buffett has regularly touted businesses with sustained moats, strong management teams, and exceptional capital-return programs.

But one of the unsung heroes of Buffett’s long-term success has been portfolio concentration. Buffett and longtime right-hand man Charlie Munger, who passed away in November, long believed that their top ideas are deserving of more investment capital.

Despite Berkshire Hathaway holding stakes in 43 stocks and two index funds, a whopping 67% ($210.4 billion) of the $315 billion portfolio Buffett oversees at his company is invested in just five unstoppable stocks.

Apple: $90.7 billion (28.8% of invested assets)

Even though more than 500 million shares of Apple (NASDAQ: AAPL) have been sold by Buffett since the start of October 2023 — potentially for tax purposes — this tech goliath is still the far-and-away largest holding for Berkshire Hathaway.

While Apple is lauded for its ultra-popular physical devices, including the iPhone, which holds a greater than 50% share of the domestic smartphone market, it’s the company’s Services segment that packs the most punch moving forward. A subscription service-driven operating model should steadily lift the company’s operating margin over time, as well as help smooth out the revenue fluctuations that typically occur during iPhone replacement cycles.

The Oracle of Omaha is also a big-time fan of Apple’s market-leading share repurchase program. Since the start of 2013, Apple has bought back $700.6 billion worth of its common stock, which would be enough to buy all but nine of the 499 other S&P 500 components. These buybacks have reduced Apple’s outstanding share count by more than 42% and boosted its earnings per share.

American Express: $41.8 billion (13.3% of invested assets)

The second-largest holding in the $315 billion portfolio Warren Buffett oversees at Berkshire Hathaway is credit-services provider American Express (NYSE: AXP). AmEx is the second-longest continuous holding for Berkshire Hathaway (since 1991).

What’s made American Express such a phenomenal stock to own for decades has been its ability to “double dip.” On one hand, AmEx is the No. 3 payment processor by credit card network purchase volume in the U.S. This is to say that it’s generating highly predictable processing fees from merchants. On the other hand, it’s also a lender and is able to bring in annual fees and net interest income from its cardholders. During lengthy periods of economic growth, AmEx’s ability to double dip is undeniably beneficial.

Furthermore, American Express has a knack for attracting affluent clientele. High-earning individuals are less likely to alter their spending habits than the average-earning cardholder. In theory, this should help AmEx navigate economic turbulence better than most lenders.

Bank of America: $31.9 billion (10.1% of invested assets)

Another top holding that Warren Buffett has been selling with regularity of late is Bank of America (NYSE: BAC). Between July 17 and Oct. 2, the Oracle of Omaha has green-lit the sale of roughly 240 million shares of BofA, equating to around $9.8 billion. Nevertheless, it’s still Berkshire Hathaway’s third-largest holding.

The beautiful thing about bank stocks is their strong cyclical ties. Even though recessions are a normal and inevitable part of the economic cycle, they’re historically short-lived. Only three of the 12 U.S. recessions since the end of World War II have stuck around for 12 months, and none of the remaining three surpassed 18 months in length. By comparison, most economic expansions endure for multiple years. These lengthy periods of growth allow bank stocks like BofA to prudently grow their loan portfolios.

Bank of America has also been able to fully take advantage of the most-aggressive rate-hiking cycle in four decades. The 525-basis-point increase in the federal funds rate between March 2022 and July 2023 has added billions of dollars in net interest income to Bank of America’s bottom line each quarter

Coca-Cola: $28.1 billion (8.9% of invested assets)

The fourth-largest holding in Berkshire’s portfolio, and the true definition of an unstoppable stock, is consumer staples juggernaut Coca-Cola (NYSE: KO). Coca-Cola, which has been a continuous holding for Berkshire since 1988, is providing Buffett’s company with a whopping 60% dividend yield, relative to its cost basis.

Coca-Cola’s ongoing success is a reflection of its geographically diverse operations. With the exception of North Korea, Cuba, and Russia, it’s operating in every other country and has more than two dozen brands generating over $1 billion in annual sales. This level of geographic breadth allows Coca-Cola to generate predictable cash flow in developed markets, while moving the organic growth needle in faster-growing emerging markets.

Coca-Cola’s marketing is also top-notch. According to the annually released “Brand Footprint” report from Kantar, Coca-Cola has been the most-chosen brand by consumers for 12 consecutive years. Being able to lean on more than a century of history, as well as connect with a younger audience via digital media platforms, has made Coca-Cola one of the strongest and most easily recognized brands in the world.

Chevron: $17.9 billion (5.7% of invested assets)

The fifth unstoppable stock that, along with Apple, American Express, Bank of America, and Coca-Cola, cumulatively accounts for two-thirds of Berkshire Hathaway’s $315 billion of invested assets, is integrated energy behemoth Chevron (NYSE: CVX).

Warren Buffett doesn’t have nearly $18 billion invested in this global oil and gas giant on a whim. A wager this large signifies an expectation that the spot price of crude oil will remain elevated or perhaps head even higher.

Multiple years of reduced capital investment by energy majors (including Chevron) during the COVID-19 pandemic, coupled with Russia’s invasion of Ukraine, strongly suggests the supply of crude oil will remain tight for the foreseeable future. When the supply of an in-demand energy commodity is constrained, it’s not uncommon for its spot price to benefit.

Additionally, the Oracle of Omaha likely appreciates the “integrated” aspect of Chevron’s operations. Though it generates its juiciest margins from its upstream drilling segment, Chevron also owns transmission pipelines and downstream chemical plants and refineries. These segments generate predictable cash flow and can operate as a hedge in the event that the spot price of crude oil declines. In short, they’re playing a key role in supporting Chevron’s meaningful capital-return program.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 774% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of October 7, 2024

Bank of America and American Express are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool has a disclosure policy.

67% of Warren Buffett’s $315 Billion Portfolio Is Invested in These 5 Unstoppable Stocks was originally published by The Motley Fool

Peter Schiff Encourages MicroStrategy Founder Micheal Saylor To 'Borrow' Another $4.3B To Buy Bitcoin That US Plans To Sell: 'Once In A While, The Government Does Something Smart'

Renowned economist Peter Schiff poked fun at Michael Saylor, recommending that the MicroStrategy Inc. MSTR boss buy the huge stash of Bitcoin BTC/USD that the U.S. government planned to sell.

What Happened: On Tuesday, Schiff took to X to express his views on the U.S. government’s decision to sell 69,370 BTC it had seized from the dark web marketplace Silk Road.

Earlier in the week, the Supreme Court declined to hear a case challenging the government’s ownership of the seized funds, clearing the door for future liquidations.

“Every once in a while, the government does something smart. I think Michael Saylor should have MicroStrategy borrow another $4.3 billion and buy it,” Schiff said, mocking the company’s Bitcoin reserve strategy.

Why It Matters: Schiff’s suggestion is particularly noteworthy given his previous criticism of Saylor and his approach to Bitcoin. He has previously slammed the trend of companies including Bitcoin on their balance sheets, arguing that it is a gamble with shareholder’s funds.

He has also questioned the ‘never sell your Bitcoin’ strategy advocated by Saylor, also backed by presidential hopeful Donald Trump on the campaign trail.

The “Bitcoin strategy playbook” has been successful in turning around MicroStrategy’s fortunes, with the company’s stock surging by 1208% since August 2020, while Bitcoin itself rose just by 445%.

Price Action: At the time of writing, Bitcoin was exchanging hands at $62,296.78, down 0.51% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy bounced 3.28% during Tuesday’s regular trading hours.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BYD Targets 100K EV Sales In Mexico By 2025 As Trump Vows 200% Tariffs On Chinese-Made Cars In North American Nation

Chinese electric vehicle giant BYD BYDDY BYDDF is setting ambitious targets for the Mexican market, aiming to sell 100,000 electric vehicles by 2025. This comes despite potential tariff challenges from former President Donald Trump that could impact the company’s growth strategy.

What Happened: Jorge Vallejo, who leads BYD’s operations in Mexico, announced plans to sell 50,000 EVs in the country this year, with a goal to double that figure by 2025, Reuters reported on Wednesday. Vallejo also mentioned that BYD plans to reveal the location of its first Mexican factory by the end of the year. The facility is expected to initially produce 150,000 vehicles, with a potential expansion to increase output by another 150,000 units.

This comes at a time when Trump has vowed to impose 200% tariffs on Chinese made cars in Mexico if he wins the 2024 Presidential election.

BYD, which began importing vehicles to Mexico last year, is seeking an extension of tariff relief for its EV imports. Despite the looming threat of tariffs, the company remains optimistic about its expansion in the Mexican market.

Why It Matters: BYD’s expansion plans in Mexico are part of a broader strategy to navigate global tariff challenges. Earlier this year, BYD reportedly delayed significant investments in Mexico, awaiting the outcome of the U.S. elections. This cautious approach reflects the uncertainties posed by fluctuating American policies.

In July, Chinese EV manufacturers, including BYD, began exploring alternative markets like Africa due to increased tariffs from the EU and U.S. These protectionist measures have prompted Chinese companies to diversify their market presence.

Despite these hurdles, BYD has shown resilience, with analysts predicting a rebound in the Chinese EV market. BYD’s aggressive global expansion and new model launches are expected to sustain its growth momentum, underscoring the company’s strategic adaptability in the face of international trade challenges.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

City Office REIT Announces Third Quarter 2024 Earnings Release and Conference Call

VANCOUVER, Oct. 8, 2024 /PRNewswire/ — City Office REIT, Inc. CIO (“City Office” or the “Company”) announced today it will release its financial results for the quarter ended September 30, 2024, before the market opens on Thursday, October 31, 2024.

City Office’s management will hold a conference call at 11:00 am Eastern Time on October 31, 2024 to discuss the Company’s financial results. Additionally, a supplemental financial package to accompany the discussion of the results will be posted on www.cioreit.com.

Webcast

Click on the webcast link under the “Investor Relations” section of the Company’s website at www.cioreit.com.

Telephone Conference Call

Domestic: 1-833-470-1428

International: 1-404-975-4839

Passcode: 102833

Please dial in at least 10 minutes before the scheduled start time.

Conference Call Replay

Domestic: 1-866-813-9403

International: 1-929-458-6194

Passcode: 801819

A replay of the call will be available later in the day on October 31, 2024, continuing through January 29, 2025. A replay will also be available at “Webcasts & Events” in the “Investor Relations” section of the Company’s website.

About City Office REIT, Inc.

City Office REIT is an internally-managed real estate company focused on acquiring, owning and operating office properties located predominantly in Sun Belt markets. City Office currently owns or has a controlling interest in 5.6 million square feet of office properties. The Company has elected to be taxed as a real estate investment trust for U.S. federal income tax purposes.

Contact

City Office REIT, Inc.

Anthony Maretic, CFO

+1-604-806-3366

investorrelations@cityofficereit.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/city-office-reit-announces-third-quarter-2024-earnings-release-and-conference-call-302270629.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/city-office-reit-announces-third-quarter-2024-earnings-release-and-conference-call-302270629.html

SOURCE City Office REIT, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AZZ, Helen of Troy And 3 Stocks To Watch Heading Into Wednesday

With U.S. stock futures trading lower this morning on Wednesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Helen of Troy Limited HELE to report quarterly earnings at $1.04 per share on revenue of $458.24 million before the opening bell, according to data from Benzinga Pro. Helen of Troy shares gained 2.5% to $63.93 in after-hours trading.

- Saratoga Investment Corp. SAR reported better-than-expected earnings and sales results for its second quarter. The company reported quarterly earnings of $1.33 per share which beat the analyst consensus estimate of 94 cents per share. Saratoga Investment shares gained 8.1% to $25.50 in the after-hours trading session.

- Analysts expect AZZ Inc. AZZ to post quarterly earnings at $1.32 per share on revenue of $411.8 million. The company will release earnings after the markets close. AZZ shares gained 1% to $81.50 in after-hours trading.

Check out our premarket coverage here

- Cardiol Therapeutics Inc. CRDL announced a preliminary prospectus for a proposed public offering of common stock. However, the size of the offering was not disclosed. Cardiol Therapeutics shares dipped 11.7% to $1.7301 in the after-hours trading session.

- Analysts expect E2open Parent Holdings, Inc. ETWO to post quarterly earnings at 5 cents per share on revenue of $154.82 million after the closing bell. E2open shares gained 2.5% to $4.11 in after-hours trading.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla's Party Could Be Crashed By Baidu As Chinese Rival Considers Global Robotaxi Expansion

Baidu Inc. BIDU is reportedly considering expanding its robotaxi unit, Apollo Go, into international markets. This move comes as the company’s CFO, Rong Luo, transitions to a new role within the company.

What Happened: Baidu’s Apollo Go is in discussions with several companies to potentially expand its robotaxi services to global markets in the near future, reported CNBC, citing a source familiar with the matter. The specifics of the expansion, such as the timing and regions, are yet to be disclosed.

Baidu did not immediately respond to Benzinga‘s request for comment.

Baidu is a significant player in the Chinese robotaxi market, with regulators in certain regions allowing commercial operations of self-driving taxis, a significant shift from previous regulations that only permitted internal testing.

Meanwhile, Tesla Inc TSLA is gearing up for its highly anticipated robotaxi event, scheduled for Thursday. In a separate move, WeRide, another Chinese robotaxi developer, recently announced a partnership with Uber to integrate its cars onto the ride-hailing giant’s platform in Abu Dhabi.

Why It Matters: Baidu’s move to expand its robotaxi services internationally comes at a time when the company’s stock is facing challenges. During Tuesday’s session, Baidu’s shares took a hit, dropping by 6.7% to $106.75, as Chinese planning officials reportedly fell short of investor stimulus expectations.

However, Baidu’s robotaxi unit has been making strides in its domestic market. In August, Goldman Sachs analyst Lincoln Kong noted that Baidu’s robotaxi unit was getting closer to scalable adoption, with unit economics breakeven in sight.

Despite Baidu’s progress, Tesla is still expected to dominate the robotaxi market, according to Ark Invest analyst Tasha Kenney.

Back in March, Baidu made headlines for launching China’s first 24/7 robotaxi service, a significant milestone for the company’s autonomous ride-hailing service platform Apollo Go.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Green Power Market Size to Reach USD 146.13 Billion by 2033 | Straits Research

New York, United States, Oct. 08, 2024 (GLOBE NEWSWIRE) — Green technologies transform these resources into sound energy, including electrical and mechanical energy, using renewable energy sources like wind, solar, water, waste, biomass, and geothermal energy. Green energy, also known as clean energy, is created with no waste that endangers the environment. The volatility of fossil fuel prices and the tightening of government regulations on greenhouse gas emissions are two factors affecting the growth of the green energy industry.

Download Free Sample Report PDF @ https://straitsresearch.com/report/green-power-market/request-sample

Market Dynamics

Asia-Pacific’s Prominence in the Green Power Market Drives the Global Market

The expansion of investment in green power projects in countries like China and India is the primary factor driving the growth of the Asia-Pacific green power market. Due to the rapid industrialization and population growth in countries like China and India, the energy demand has dramatically increased. The home and industrial sectors are expected to utilize more energy throughout the predicted time in Asia-Pacific. Additionally, India has a lot of space for growth. Still, historically unpredictable economic circumstances and legal frameworks have led to a lower share of green power in the nation’s overall energy production. India is one of the major countries with the quickest development in the Asia-Pacific green power industry due to the rapid increase in financial assistance for green power projects.

Government Initiatives Create Tremendous Opportunities

Several government bodies in countries like India have used community choice aggregation (CCA) policies, which allow governments to purchase green energy resources on behalf of constituents while keeping their current electricity providers for transmission and distribution services. These programs enable customers to purchase electricity from a distributed off-site solar system if they cannot install solar at their residences or places of business. The installed capacity of community solar systems was anticipated to triple between 2015 and 2016.

Regional Analysis

Europe is the most significant revenue contributor and is anticipated to exhibit a CAGR of 12.35% over the projection period. The European green power market examination covers Europe, including Germany, France, the UK, Spain, Italy, Sweden, and the remainder of the continent. In terms of market share in the region, France is surpassed by Germany. Italy has the lowest market share as well. The first area in Europe to make efforts toward renewable energy. According to the Climate Council of Australia, countries in the region like Denmark, Sweden, Scotland, and Germany are among the top 10 countries promoting green energy. Additionally, these countries are almost at the desired level of green energy contribution. The market for green electricity receives the most volume and financial support from Germany.

Asia-Pacific is anticipated to exhibit a CAGR of 12.90% during the forecast period. The Asia-Pacific green power market research covers China, Japan, India, Australia, South Korea, and the remainder of the Asia-Pacific area. China, followed by Japan, holds the largest market share in the region. South Korea also holds the smallest market share. In 2019, China and India led the growth of the Asia-Pacific green power market. The usage of green energy increased significantly in both countries and the region as a whole. The market in the area also grew due to the economy’s ongoing expansion.

To Gather Additional Insights on the Regional Analysis of the Green Power Market @ https://straitsresearch.com/report/green-power-market/request-sample

Key Highlights

- Based on power sources, the global green power market is bifurcated into the wind, solar, low-impact hydro, biomass, and others. The wind segment is the highest contributor to the market and is estimated to boost at a CAGR of 12.45% during the forecast period.

- Based on end-users, the global green power market is bifurcated into transport, industrial, and non-combusted buildings. The buildings segment is the highest contributor to the market and is estimated to boost at a CAGR of 12.20% during the forecast period.

- Europe is the most significant revenue contributor and is expected to grow at a CAGR of 12.35% during the forecast period.

Competitive Players

- Trina Solar

- First Solar

- Canadian Solar

- ABB

- GE

- Tata Power Solar Systems Limited

- Innergex

- Enel Green Power

- Xcel Energy

- EDF

- Geronimo Energy

- Invenergy LLC

- ACCIONA

- Vestas

- UpWind Solutions Inc.

- Senvion

- Sinovel Wind Group Co. Ltd.

Recent Developments

- February 2023- GreenPower launched the next round of all-electric school bus pilot projects in four new school districts in West Virginia.

- March 2023- Ørsted acquired the Irish solar project Garrenleen from renewable energy developer Terra Solar. The 160 MW solar farm is the company’s second solar project in Ireland and will be able to power up to 56,000 homes annually, making it one of the largest solar farms in the country.

Segmentation

- By Power Source

- Wind

- Solar

- Low Impact Hydro

- Biomass

- Others

- By End-User Sector

- Transport

- Industrial

- Non-Combusted

- Buildings

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Middle East And Africa

- Latin America

Get Detailed Market Segmentation @ https://straitsresearch.com/report/green-power-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

For more information on your target market, please contact us below:

Phone: +1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

XRP ETF Buzz Increases As Canary Capital Pursues SEC For Greenlight On Its Fund — Will The Gary Gensler-Led Regulator Give Its Nod?

Cryptocurrency asset trading and management firm Canary Capital has lodged a registration statement with the SEC for an XRP XRP/USD exchange-traded fund (ETF), marking the second such filing this month.

What Happened: Canary Capital submitted the S-1 filing—a prerequisite for issuers to file to publicly offer new securities—on Tuesday.

The proposed Canary XRP ETF intended to provide direct exposure to the value of XRP held by the trust and allow investors the opportunity to access the market through a traditional brokerage account

Canary Capital didn’t immediately return Benzinga’s request for comment.

Why It Matters: Canary Capital’s move follows Bitwise Asset Management’s S-1 filing for an XRP ETF last week, which became the first company to attempt something of this sort in the U.S.

That said, the possibility of such an investment vehicle coming to fruition remains clouded by legal and regulatory uncertainties.

The Gary Gensler-led SEC is currently embroiled in a legal battle with Ripple Labs, alleging that the company generated billions through the sale of XRP, which it views as an unregistered security.

Price Action: At the time of writing, XRP was trading at 0.5335, up 0.72% in the last 24 hours, according to data from Benzinga Pro.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.