This Is What Whales Are Betting On Ford Motor

Investors with a lot of money to spend have taken a bearish stance on Ford Motor F.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with F, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Ford Motor.

This isn’t normal.

The overall sentiment of these big-money traders is split between 20% bullish and 80%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $935,004, and 6 are calls, for a total amount of $284,929.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $9.0 to $15.0 for Ford Motor during the past quarter.

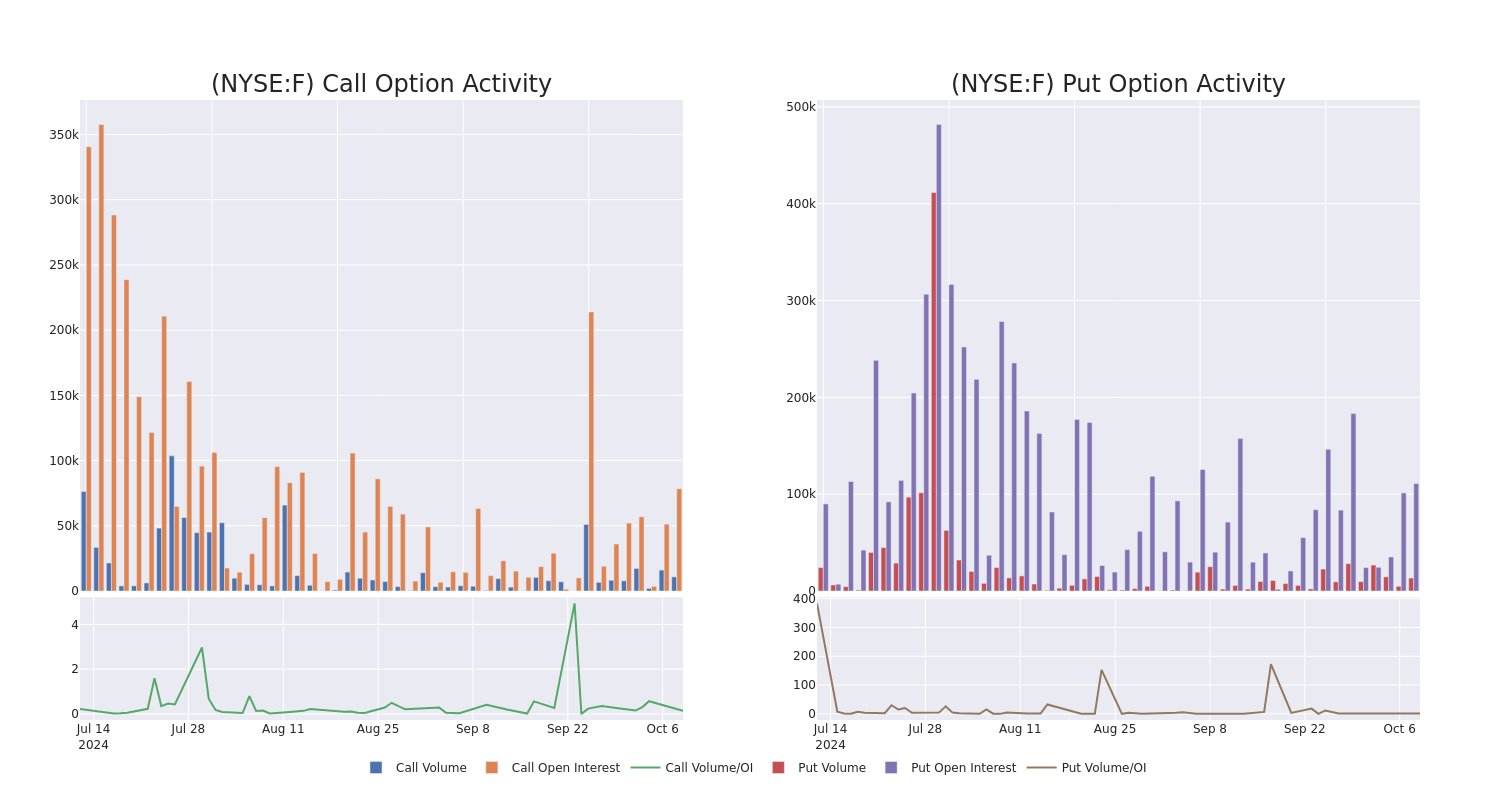

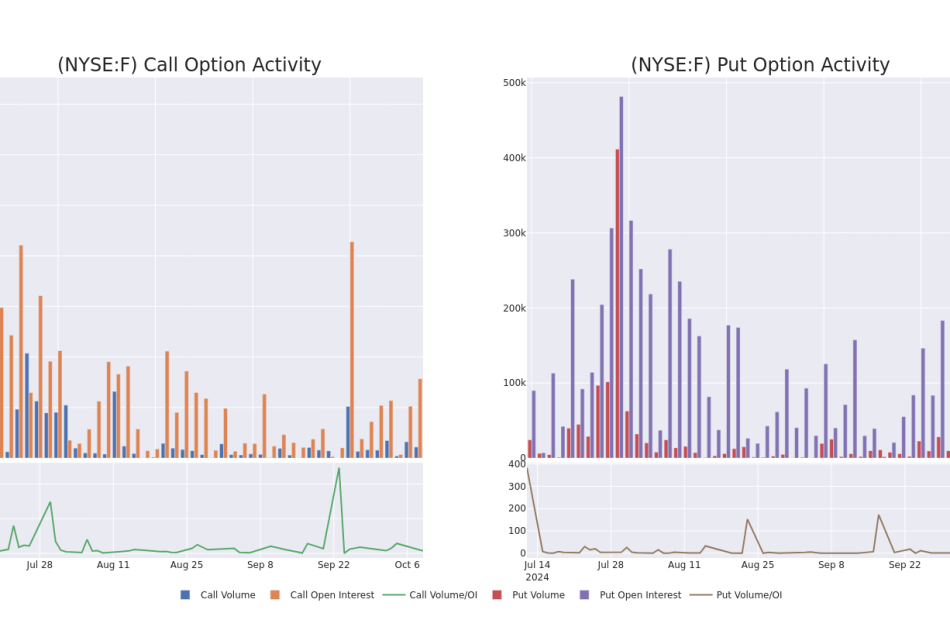

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Ford Motor’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Ford Motor’s whale trades within a strike price range from $9.0 to $15.0 in the last 30 days.

Ford Motor 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| F | PUT | TRADE | BEARISH | 06/20/25 | $1.57 | $1.54 | $1.56 | $11.17 | $390.0K | 54.6K | 4.8K |

| F | PUT | TRADE | BEARISH | 11/15/24 | $0.83 | $0.79 | $0.82 | $11.00 | $205.0K | 12.7K | 3.4K |

| F | CALL | SWEEP | BEARISH | 12/20/24 | $0.5 | $0.49 | $0.49 | $11.00 | $91.9K | 22.7K | 1.9K |

| F | PUT | SWEEP | BEARISH | 06/20/25 | $1.62 | $1.61 | $1.61 | $11.17 | $74.8K | 54.6K | 1.8K |

| F | PUT | SWEEP | BEARISH | 06/20/25 | $1.61 | $1.6 | $1.61 | $11.17 | $69.5K | 54.6K | 1.2K |

About Ford Motor

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, Ford Blue, and its BEV business, Ford Model e, as separate businesses but still all under Ford Motor. The company has nearly 13% market share in the United States, about 11% share in the U.K., and under 2% share in China including unconsolidated affiliates. Sales in the U.S. made up about 66% of 2023 total company revenue. Ford has about 177,000 employees, including about 59,000 UAW employees, and is based in Dearborn, Michigan.

Having examined the options trading patterns of Ford Motor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Ford Motor

- With a trading volume of 25,330,074, the price of F is up by 1.48%, reaching $10.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 15 days from now.

Professional Analyst Ratings for Ford Motor

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $12.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Showing optimism, an analyst from Goldman Sachs upgrades its rating to Buy with a revised price target of $13.

* An analyst from Deutsche Bank has revised its rating downward to Hold, adjusting the price target to $11.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Underweight rating for Ford Motor, targeting a price of $9.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Ford Motor, which currently sits at a price target of $16.

* An analyst from Morgan Stanley has revised its rating downward to Equal-Weight, adjusting the price target to $12.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Ford Motor options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply