TSMC’s sales beat estimates in good sign for AI chip demand

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. posted a better-than-expected 39% rise in quarterly revenue, assuaging concerns that AI hardware spending is beginning to taper off.

Most Read from Bloomberg

The main chipmaker to Nvidia Corp. and Apple Inc. reported September-quarter sales of NT$759.7 billion ($23.6 billion), versus the average projection for NT$748 billion. Taiwan’s largest company will disclose its full results next Thursday.

The better-than-anticipated performance may reinforce the view of investors betting that AI spending will remain elevated as companies and governments race for an edge in the emergent technology. Others caution that the likes of Meta Platforms Inc. and Alphabet Inc.’s Google can’t sustain their current pace of infrastructure spending without a compelling and monetizable AI use case.

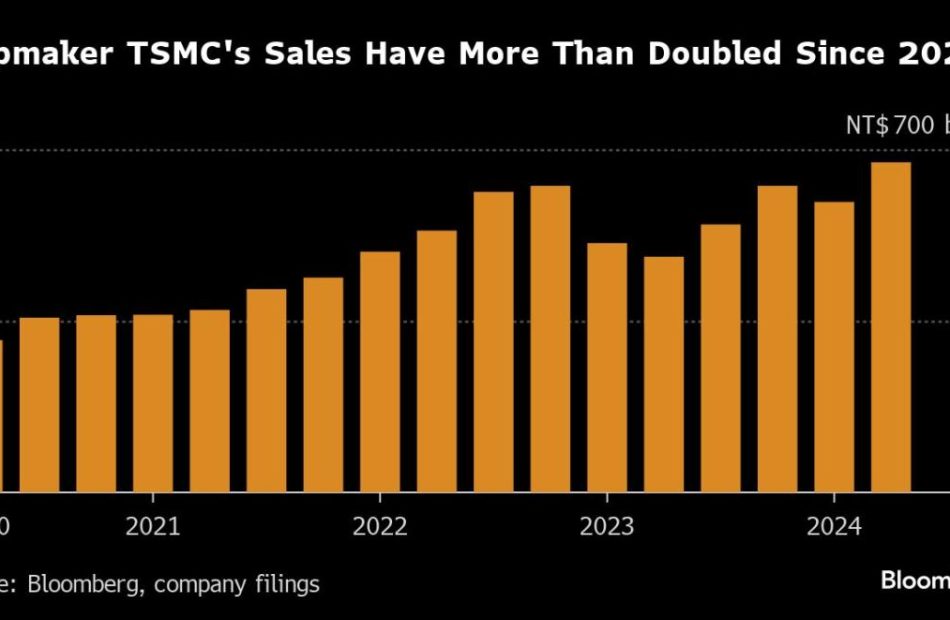

Hsinchu-based TSMC is one of the key companies at the heart of a global surge in spending on AI development, producing the cutting-edge chips needed to train artificial intelligence. Its sales have more than doubled since 2020, with the seminal launch of ChatGPT sparking a race to acquire Nvidia hardware for AI server farms.

Shares in Nvidia were up about 1.2% in premarket trading in New York on Wednesday, while TSMC’s US-traded ADRs rose a more modest 0.8%.

What Bloomberg Intelligence Says

This reflects strong demand for AI chips and new N3E process orders from Apple, Qualcomm and MediaTek, despite delays in shipments of Nvidia’s Blackwell chips. Gross margin might also exceed the guidance midpoint of 54.5%. Focus in 3Q earnings call will be on whether 4Q guidance can exceed consensus’ 7% sequential-growth estimate. While Apple’s A18 chip orders may decline due to soft demand for new iPhone 16s, robust orders from Nvidia and Intel are likely to offset any revenue shortfall. Other key topics include the potential for earlier 2-nanometer (N2) node mass production and plans to expand its chip-on-wafer-on-substrate (CoWoS) advanced packaging capacity in 2025.

– Charles Shum, analyst

Click here for the research.

TSMC’s stock has more than doubled since the launch of ChatGPT, with its market capitalization briefly crossing the $1 trillion mark in July. That month, Taiwan’s largest company also lifted its outlook for 2024 revenue growth after quarterly results beat estimates.

In recent months, however, views have begun to diverge on whether the AI-driven growth momentum will last. That skepticism has led to a pullback in AI stocks, including flag bearer Nvidia, earlier this year.

TSMC’s view is that AI spending will remain high despite growing US-Chinese trade tensions. In both countries, startups and tech firms from Microsoft Corp. to Baidu Inc. are splurging on AI infrastructure in a race to develop applications.

Nvidia’s key server assembly partner Hon Hai Precision Industry Co. earlier this week also reaffirmed demand for AI hardware remains solid. Hon Hai Chairman Young Liu told Bloomberg TV on Tuesday that his company plans to boost server production capacity to meet “crazy” demand for the next-generation Blackwell chips, echoing similar remarks from Nvidia Chief Executive Officer Jensen Huang earlier this month.

But analysts worry that delays in the delivery of Nvidia’s latest Blackwell chips might disrupt the industry, though most investors don’t view that as a long-term issue for TSMC. With Intel Corp. and Samsung Electronics Co. both struggling to get ahead in the business of bespoke chipmaking, TSMC’s market leadership is expected to help prop up margins.

TSMC now makes more than half of its revenue from high-performance computing, the segment of its business driven by AI demand. It also remains the sole manufacturer for the iPhone’s processor, although a growing number of analysts have voiced concerns over worse-than-expected demand for the new iPhone 16 range.

–With assistance from Vlad Savov.

(Updates with shares and analyst’s comment from the fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply