Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2029

It’s amazing how much things can change in just 20 years. Two decades ago, industrial and energy stalwarts General Electric and ExxonMobil were the most valuable companies when measured by market cap, worth $319 billion and $283 billion, respectively. Jump ahead to 2024, and technology concerns are leading the way.

Topping the list are three of the world’s most recognizable tech companies. Apple leads the pack at $3.4 trillion (as of this writing). Nvidia and Microsoft are trailing close behind, with market caps of $3.1 trillion and $3 trillion, respectively.

With a market cap of just $1.9 trillion, it might seem premature to suggest that Amazon (NASDAQ: AMZN) has all the attributes necessary for membership in the $3 trillion club. However, the stock has gained 42% over the past year and 109% over the past five years, and its rebound appears poised to continue.

Recent improvements in the economy, the company’s strong market position, and its measured adoption of artificial intelligence (AI) could be the drivers needed to fuel Amazon’s membership in this elite fraternity.

Improving performance

The past several years have been rife with challenges, not the least of which was an economic downturn fueled by decades-high inflation. There’s been a vast improvement in recent months, however, as consumer sentiment in September reached its highest point in five months and the Federal Reserve Bank began its long-awaited campaign of interest rate cuts.

The improving economic conditions are favorably impacting Amazon’s results. In the second quarter, net sales of $148 billion climbed 10% year over year, while diluted earnings per share (EPS) of $1.26 nearly doubled.

Helping fuel the robust results were improvements from each of the company’s major operating segments. Online sales in the U.S. increased 9%, while international sales climbed 7%. Perhaps most important was a reacceleration from Amazon Web Services (AWS) — the company’s cloud computing business — which jumped 19%, its highest rate of growth since late 2022.

Equally important is advertising — the company’s fastest-growing business — which increased 20%, as Amazon is working to become a major player in the ad world.

An industry leader — in more ways than one

Amazon is the undisputed leader in the realm of e-commerce, which is an area it pioneered. The company accounted for 38% of U.S. digital retail sales last year, more than its next 15 largest rivals combined, according to data compiled by eMarketer. That dominance is expected to continue in 2024, with the company expected to nab 40% of online sales in the U.S. this year.

The company has long employed AI to maintain a competitive advantage over its rivals. Amazon uses AI to make product recommendations to customers and predict and maintain adequate inventory levels at its distribution centers and warehouses. The company also uses AI-powered robots to stock shelves and gather merchandise for shipping, and deploys these advanced algorithms to determine the most efficient delivery routes.

Amazon is also the leader in cloud computing, another business it pioneered. Amazon Web Services (AWS) is the top provider of cloud infrastructure services, with 33% of the market in the second quarter, with Microsoft Azure at No. 2 and Alphabet‘s Google Cloud at No. 3, with 20% and 10% of the market respectively, according to research firm Canalys. Amazon offers one of the largest repositories of AI models for its cloud customers, which has helped reaccelerate its cloud growth.

Last but certainly not least is Amazon’s digital advertising business. The company displays ads on its e-commerce website, Prime Video, Freevee, Amazon Music streaming services, its Twitch video game streaming platform, and more. The company uses AI to help ensure the advertising reaches its target market. The results are undeniable, as advertising has been Amazon’s fastest-growing business for several years running.

The path to $3 trillion

Amazon currently boasts a market cap of roughly $1.9 trillion, which means it will take stock price gains of roughly 57% to drive its value to $3 trillion. According to Wall Street, Amazon is expected to generate revenue of $635 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 3. Assuming its P/S remains constant, Amazon would have to grow its revenue to roughly $998 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting revenue growth for Amazon of 11% annually over the next five years. If the company achieves that benchmark, it could achieve a $3 trillion market cap as soon as 2029. It’s worth noting that Amazon has grown its annual revenue by nearly 400% over the past decade, so those expectations could well be conservative.

Furthermore, Amazon is currently selling for roughly 3.2 times sales, a slight discount compared to its average multiple of more than 3.3 over the past five years. That’s a pretty attractive price to pay for a company with so many ways to win.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2029 was originally published by The Motley Fool

History Says This Vanguard ETF Could Be Your Ticket to a Million-Dollar Portfolio

No one financial goal applies to everyone. Financial situations vary so much that what one person strives for could completely differ from someone else’s priorities.

That said, $1 million has long been a recognized mark of financial success. I must admit, there’s something about seeing a second comma in a number that feels validating and comforting.

The good news is that it doesn’t take “hitting it big” or generational returns to make a million-dollar portfolio a reality. In many cases, all it takes is consistent investments in an exchange-traded fund (ETF) like the Vanguard S&P 500 ETF (NYSEMKT: VOO).

If there’s one ETF to lean on en route to a million-dollar portfolio, it would be this one. Here’s why.

A history of impressive and encouraging returns

This ETF was created in Sept. 2010, and since then it has been on an impressive run, averaging over a 12.4% annual return and over 14.5% annual total returns.

It’s been repeated plenty of times that “past results don’t guarantee future performance.” However, if this trend continues, here’s how long it would take you to hit the million-dollar mark, averaging 12% annual returns at different monthly contributions.

|

Monthly Contributions |

Years Until $1 Million |

|---|---|

|

$500 |

27 |

|

$750 |

24 |

|

$1,000 |

22 |

|

$1,500 |

18 |

|

$2,000 |

16 |

Calculations by author. Years rounded to the nearest whole year.

You don’t need a lump sum of money to invest to get to a million-dollar portfolio; you need consistent investments over time.

Getting exposure to some of the world’s best companies

I always like to say that investing in an S&P 500 ETF is akin to investing in the U.S. economy. Of course, the U.S. economy runs off more than just 500 companies, but their influence is undeniable considering the size and scope of the companies in the S&P 500 index. Here are the top 10 holdings in this ETF (as of Aug. 31):

-

Apple: 6.97%

-

Microsoft: 6.54%

-

Nvidia: 6.20%

-

Amazon: 3.45%

-

Meta Platforms: 2.41%

-

Alphabet (Class A): 2.03%

-

Berkshire Hathaway (Class B): 1.82%

-

Alphabet (Class C): 1.70%

-

Eli Lilly: 1.62%

-

Broadcom: 1.50%

When you’re trying to build a million-dollar portfolio, the one thing you need is consistency. There will inevitably be ups and downs along the way (no stock or ETF is exempt from volatility), but you want companies with a history of long-term growth leading the way — and that’s what these have proven.

Don’t overlook how much money you can save in fees

An underrated part of this ETF is the low expense ratio of 0.03%. That works out to $0.30 per $1,000 invested annually, and it’s one of the cheapest you’ll find from any ETF on the stock market, regardless of type. Even another S&P 500 ETF, the SPDR S&P 500 Trust ETF, is more than three times more expensive at 0.0945%.

To give you some perspective, here’s how much you’d pay in fees over 20 years by investing different amounts and averaging 10% annual returns in both ETFs.

|

Monthly Contributions |

Fees Paid With Vanguard S&P 500 ETF |

Fees Paid With SPDR S&P 500 ETF |

|---|---|---|

|

$500 |

$1,160 |

$3,660 |

|

$750 |

$1,750 |

$5,500 |

|

$1,000 |

$2,330 |

$7,330 |

|

$1,500 |

$3,500 |

$10,990 |

|

$2,000 |

$4,670 |

$14,660 |

Calculations by author. Fees rounded down to the nearest 10.

The seemingly slightest difference on paper could save you thousands in fees over time. Don’t overlook it.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple, Microsoft, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

History Says This Vanguard ETF Could Be Your Ticket to a Million-Dollar Portfolio was originally published by The Motley Fool

This Ridiculously Cheap Warren Buffett Stock Could Make You Richer

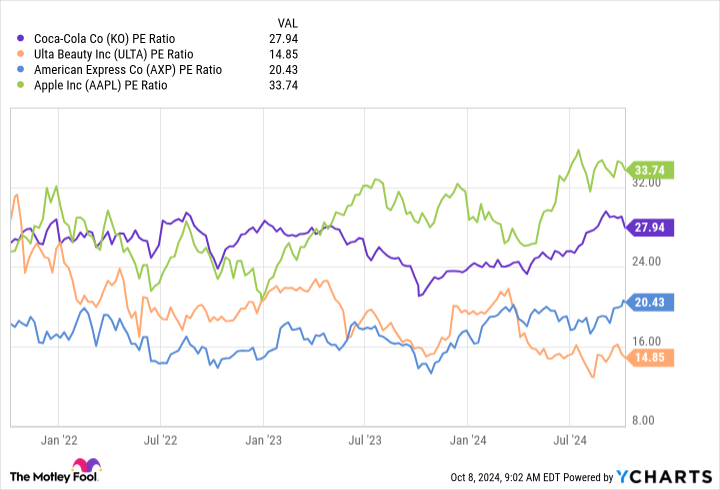

Investors know what Warren Buffett’s favorite stocks are. He often talks about Coca-Cola and American Express, his two longest-held stocks, and he recently added Apple as a stock he’d never (fully) sell.

But Berkshire Hathaway has a full list of about 45 stocks, and some of them don’t get enough attention. Consider Ulta Beauty (NASDAQ: ULTA). This is a new Buffett stock, and he and his team were likely drawn to it right now because of its cheap price. But obviously, there’s a lot more to the investing thesis than that.

Let’s take a closer look.

A huge market opportunity

Ulta isn’t a surprising Buffett stock. It fits most of the typical Buffett criteria: excellent management, a dominant position in its industry, a competitive edge, and a cheap price.

It operates a national chain of beauty stores, but it’s differentiated in its model, and customers love it. Ulta bridges the gap between mass brands, traditionally sold in pharmacies and discount stores, and luxury brands, typically sold in upscale department stores. It caters to the beauty enthusiast by housing 600 brands under one roof and on its website.

It also offers beauty services, making it a complete, one-stop beauty shop. The full range of products and services increases overall engagement and loyalty, and Ulta has skyrocketed to the top of the industry.

Beauty is a fast-growing industry with sales increasing 10% year over year globally in 2023, according to McKinsey. Sales surpassed expectations and as well as other industries like apparel. In the U.S., Ulta’s domain, sales were up 9%. McKinsey expects sales to increase at a compound annual growth rate (CAGR) of 6% through 2028.

Beauty enthusiasts account for 83% of beauty product dollars spent, putting Ulta squarely in the middle of growing trends. Ulta believes there are 70 million such enthusiasts in the U.S., and it continues to attract them to its loyalty program, which reached 43 million last year. They represent 95% of Ulta sales, and this gives the company a huge data pool to meet demand as it grows and changes.

With nearly 1,400 stores and more to come, Ulta should benefit from industry growth. But it also continues to stretch its position with new products, brands, and collaborations, such as Target “stores within stores.”

Still waiting out the economy

The pitfall to offering the kitchen sink of beauty brands is that with inflation and tight pockets, customers are switching down to cheaper brands. However, since Ulta sells both, it’s still getting those dollars. It’s retaining its loyal customers and it’s well-positioned to rebound as inflation cools.

Total sales increased 4% year over year in the fiscal second quarter (ended Aug. 3), but comparable sales were down 1.2%. Gross margin fell from 39.3% to 38.3%, and operating margin fell from 15.5% to 12.9%. These were continuing trends, but they were worse than expected. Management revised guidance lower across the board.

It’s not surprising that Ulta stock is down 25% this year. However, savvy investors should look at the bigger picture. Every company goes through ups and downs, and Ulta is dealing with strong headwinds right now.

The good news is, it looks like these external factors are starting to lift. Inflation seems to be moderating, interest rates are going down, and the economy might pick up soon. Whenever it does, Ulta could make a quick rebound.

Low price, high potential

Ulta stock trades at an attractively low P/E ratio of 15. Buffett is known to like a good bargain, or at least what he thinks is an undervalued stock. And Ulta is a lot cheaper than some of his favorite ones.

Buffett knows how to spot a great deal, and Ulta fits the bill. If you buy Ulta stock today, you could benefit from years of long-term gains.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in American Express and Apple. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Target, and Ulta Beauty. The Motley Fool has a disclosure policy.

This Ridiculously Cheap Warren Buffett Stock Could Make You Richer was originally published by The Motley Fool

Is ServiceNow a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let’s see what these Wall Street heavyweights think about ServiceNow NOW.

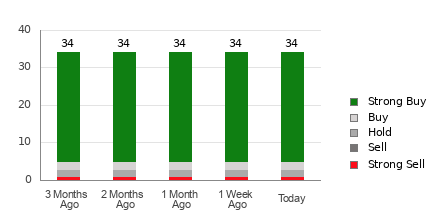

ServiceNow currently has an average brokerage recommendation of 1.29, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 34 brokerage firms. An ABR of 1.29 approximates between Strong Buy and Buy.

Of the 34 recommendations that derive the current ABR, 29 are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 85.3% and 5.9% of all recommendations.

Brokerage Recommendation Trends for NOW

While the ABR calls for buying ServiceNow, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock’s future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations. Since the ratings issued by these analysts are more favorable than their research would support because of the vested interest of their employers, they mislead investors far more often than they guide.

On the other hand, earnings estimate revisions are at the core of the Zacks Rank. And empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company’s changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Is NOW a Good Investment?

Looking at the earnings estimate revisions for ServiceNow, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $13.75.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for ServiceNow.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for ServiceNow.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Molecular Oncology Market Size is projected to Reach USD 7.4 billion, Garnering an 11.0% by 2034: Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 11, 2024 (GLOBE NEWSWIRE) — The global molecular oncology market (분자종양학 시장) was projected to attain US$ 2.3 billion in 2023. It is likely to garner an 11.0% CAGR from 2024 to 2034, and by 2034, the market is expected to attain US$ 7.4 billion.

Molecular diagnostics in cancer is becoming more and more common in clinical laboratories. Targeted therapy possibilities for malignancies such as multiple myeloma, lymphoma, melanoma, lung, breast, ovarian, prostate, and others are now being assessed using molecular oncology assays.

Molecular oncology researchers use a variety of methods, including as in-vitro and in vivo functional models, computational biology, genomics, and tumor imaging, to comprehend biological and clinical characteristics.

The genes that produce these proteins may be used as targets in the development of novel anti-cancer medications, chemotherapeutic medicines, or imaging scans. These combinatorial methods are used in molecular oncology to confirm the involvement of novel candidate genes in the genesis of cancer.

Request a PDF Sample of this Report Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86057

Key Findings of Market Report

- Due to its high rates of morbidity and death, particularly in the United States, lung cancer is leading the worldwide molecular oncology market.

- The frequency of illnesses and fatalities has decreased due to declining smoking rates and improvements in early diagnosis and treatment. Lung cancer, however, is still a problem for public health.

- There is a well-established link between smoking and the development of this disease; risk factors such as a history of lung illness and occupational conditions also have an impact. Global access to molecular oncology technology and treatments is crucial due to the prevalence of lung cancer patients.

Market Trends For Molecular Oncology

- As per the most recent molecular oncology market projection, North America has a significant position in the industry. Robust healthcare systems, state-of-the-art medical equipment, and significant investments in cancer research and development are driving the region’s market dynamics.

- Molecular oncology diagnoses and therapies are the focus of several leading pharmaceutical and biotech businesses in the United States, a major contributor to North America’s leadership.

- The American Cancer Society provides thorough data and analysis on cancer outcomes, rates, and trends, which facilitates informed decision-making and efficient resource allocation.

- North America enjoys favorable regulatory rules, a sizable patient base, and high healthcare spending, all of which present profitable market potential for molecular oncology in the area.

- Diagnostic labs are critical to the global molecular oncology industry from an end-user perspective. They support the development of treatment programs and the evaluation of the efficacy of treatments by providing quick and accurate testing.

- Precise testing is becoming increasingly important to inform treatment decisions as cancer care grows more specialized. This demonstrates the significance of testing laboratories in delivering accurate cancer diagnosis and treatment.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86057

Global Market for Molecular Oncology: Regional Outlook

Various reasons propel the molecular oncology market growth throughout the regions. These are:

- As per the most recent molecular oncology market projection, North America has a significant position in the industry. The region’s market dynamics are being driven by robust healthcare systems, state-of-the-art medical equipment, and significant investments in cancer research and development.

- Molecular oncology diagnoses and therapies are the focus of several leading pharmaceutical and biotech businesses in the United States, a major contributor to North America’s leadership.

- Furthermore, the American Cancer Society provides thorough data and analysis on cancer outcomes, rates, and trends, which facilitates informed decision-making and efficient resource allocation.

- Moreover, North America enjoys favorable regulatory rules, a sizable patient base, and high healthcare spending, all of which present profitable market potential for molecular oncology in the area.

Global Molecular Oncology Market: Key Players

Prominent organizations in the global molecular oncology industry are implementing tactics including creating and introducing novel goods. Molecular oncology is a moderately competitive business with a number of major competitors.

The following companies are well-known participants in the global molecular oncology market:

- Roche Diagnostics

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- Qiagen N.V.

- Agilent Technologies, Inc.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Myriad Genetics, Inc.

- Genomic Health, Inc.

- Other Players

Key Developments

- Roche announced the release of the LightCycler PRO System in November 2023. This system expands upon the well-proven gold standard technology of earlier LightCycler® Systems. Roche’s molecular PCR testing portfolio, which includes solutions for researchers and clinicians testing patients for infectious diseases, cancer, and other public health concerns, is expanded with the introduction of the LightCycler PRO System.

- Zydus Lifesciences and Guardant Health joined forces in November 2023 to market the Guardant360 bodily fluid and tissue biopsy test in Nepal and India. The tests, which consist of the Guardant360 Response test and the Guardant360 TissueNext evaluation, are designed to enhance treatment results for advanced malignancies by offering targeted genetic testing.

Global Molecular Oncology Market Segmentation

- Product

- Instruments

- Reagents

- Others

- Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Ovarian Cancer

- Pancreatic Cancer

- Others

- Technology

- PCR (rt-PCR, d-PCR)

- NGS (Next Generation Sequencing)

- Microarray

- FISH (Fluorescent in situ-hybridization)

- Others

- End-user

- Hospitals and Clinics

- Diagnostic Laboratories

- Cancer Centers and Specialty Clinics

- Others (Government and Public Health Agencies)

- By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=86057<ype=S

More Trending Reports by Transparency Market Research –

Pediatric Medical Devices Market (小児医療機器市場) on Track to Reach USD 47.4 Billion by 2031: Driven by Advancements in Medical Devices and Digital Solutions at 6.3% CAGR: Analysis by TMR

Disposable Medical Sensors Market (سوق أجهزة الاستشعار الطبية القابل للتصرف) Size to be Worth USD 25.4 billion by 2034, Growing at CAGR of 11.1% | Exclusive Report by TMR

Kidney Transplant Market (Markt für Nierentransplantationen) to Grow at a 3.3% CAGR from 2024 to 2034, Fueled by Healthcare Spending and Renal Calculi Retrieval Devices Landscape | TMR

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Medical Properties Trust Stock Got Socked Today

While large-scale insider sales don’t necessarily mean a publicly traded company’s management is abandoning ship, they generally don’t inspire investor confidence. News of such a divestment hit Medical Properties Trust (NYSE: MPW) on Thursday, and the resulting sell-off saw the shares lose slightly more than 4% of their value.

A director sold a chunk of stock

A regulatory document filed after market close on Wednesday revealed that Medical Properties Trust director Michael Stewart sold 32,780 shares of its common stock. The price was $5.46 per share, and the sale left Stewart with 221,245 shares remaining in his portfolio.

That isn’t a massive chunk of the company’s more than 600 million shares currently outstanding, but for any individual it’s a meaningful stake. That goes double for Stewart, as he’s a director at the specialty real estate investment trust (REIT).

Medical Properties Trust has had quite a see-saw year. Its largest and most troubled tenant, Steward Health Care, declared Chapter 11 bankruptcy earlier this year. In September, the REIT and Steward reached agreement to transfer tenancy to 15 hospitals it had formerly operated.

Previous to that, Steward’s difficulties badly affected its landlord’s fundamentals, leading the REIT to aggressively cut its dividend twice in the space of less than two years.

Timing matters

Although the outlook for Medical Properties Trust is now brighter after the Steward deal, investors still have painful memories of the recent struggles stemming from the relationship of the two companies. In other words, investors are still in need of morale-boosting news, and a 32,000-plus share sale doesn’t seem to be fitting the bill.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Medical Properties Trust Stock Got Socked Today was originally published by The Motley Fool

Analyst Report: BJ`s Wholesale Club Hldgs In

Summary

BJ’s Wholesale Club Holdings owns BJ’s Wholesale Club, which operates a chain of warehouse clubs in the Eastern U.S. BJ’s positions itself between traditional grocery stores and warehouses like Sam’s Club and Costco, and offers a wider range of items and smaller pack sizes than Costco and Sam’s. The company posted total revenue of $20 billion in FY24, which ended on February 3, 2024. Income from membership fees represented 2.2% of total revenue and 53% of operating income. The company sells name-brand merchandise and food to members, who are small business owners and consumers. Based in Westborough, Massachusetts, the company also offers specialty services, including tire installation, optical services, and photo developing.

At the end of FY24, the company operated 244 BJ’s clubs and 175 gas stations in 20 states. More than half of the clubs are in four states: New York, Florida, Massachusetts, and New Jersey. About 23% of FY24 sales were generated in the New York City metro area (down from 25% in FY21 and FY20). Clubs range from 44,000 to 177,000 square feet. BJ’s sells a relatively narrow assortment of approximately 7,000 SKUs, which it plans to trim to about 6,000 to improve inventory turnover. Groceries represented 70% of the company’s FY24 net sales (67% in FY23, 71% in FY22); general merchandise and services accounted for 11% in FY24, and 12% in FY23 and 14% in FY22 and gasoline rose to 21% in FY23 from 15% in FY22 and 9% in FY21. Gas was 19% of sales in FY24.

A predecessor company, BJ’s Wholesale Club, traded as a public company until it was acquired on September 30, 2011 by an investor group led by Leonard Green & Partne

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Wall Street Analysts See Celestica as a Buy: Should You Invest?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Let’s take a look at what these Wall Street heavyweights have to say about Celestica CLS before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

Celestica currently has an average brokerage recommendation of 1.57, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by seven brokerage firms. An ABR of 1.57 approximates between Strong Buy and Buy.

Of the seven recommendations that derive the current ABR, four are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 57.1% and 28.6% of all recommendations.

Brokerage Recommendation Trends for CLS

While the ABR calls for buying Celestica, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

On the other hand, earnings estimate revisions are at the core of the Zacks Rank. And empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company’s changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Is CLS a Good Investment?

In terms of earnings estimate revisions for Celestica, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $3.65.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Celestica.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for Celestica.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Barrick Gold: Analyzing the Surge in Options Activity

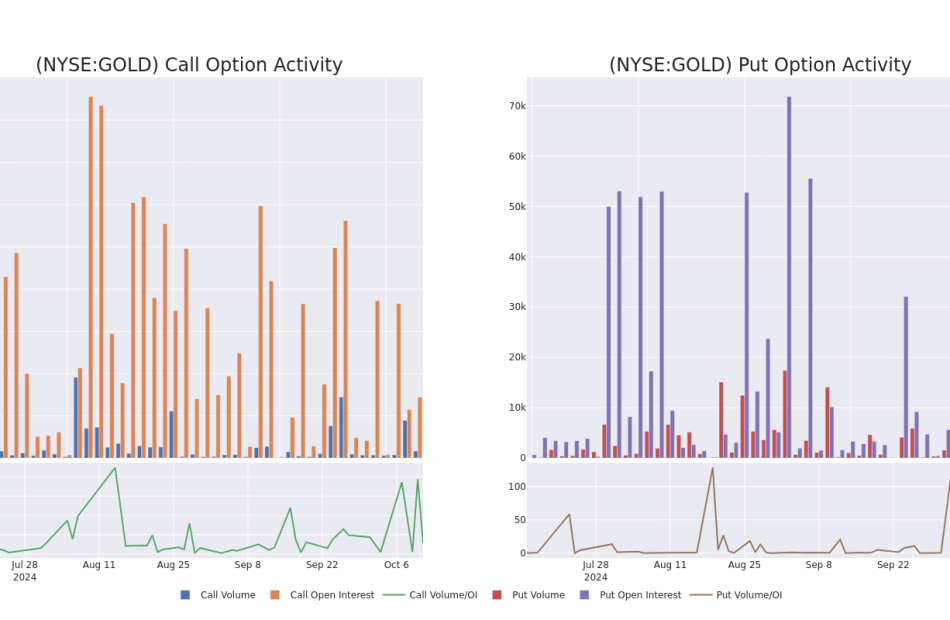

Deep-pocketed investors have adopted a bullish approach towards Barrick Gold GOLD, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOLD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Barrick Gold. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 33% bearish. Among these notable options, 4 are puts, totaling $364,606, and 5 are calls, amounting to $485,755.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $17.0 and $25.0 for Barrick Gold, spanning the last three months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Barrick Gold options trades today is 11794.14 with a total volume of 11,396.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Barrick Gold’s big money trades within a strike price range of $17.0 to $25.0 over the last 30 days.

Barrick Gold Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | SWEEP | BEARISH | 01/17/25 | $3.45 | $3.4 | $3.4 | $17.00 | $340.0K | 40.9K | 2.0K |

| GOLD | PUT | SWEEP | BULLISH | 03/21/25 | $5.1 | $5.0 | $5.0 | $25.00 | $149.5K | 131 | 300 |

| GOLD | PUT | SWEEP | BULLISH | 01/16/26 | $5.75 | $5.65 | $5.65 | $25.00 | $111.3K | 940 | 206 |

| GOLD | PUT | SWEEP | BULLISH | 10/18/24 | $0.35 | $0.34 | $0.34 | $20.00 | $68.0K | 7.7K | 2.4K |

| GOLD | CALL | SWEEP | BULLISH | 11/15/24 | $1.16 | $1.14 | $1.15 | $20.00 | $50.4K | 22.5K | 502 |

About Barrick Gold

Based in Toronto, Barrick Gold is one of the world’s largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

In light of the recent options history for Barrick Gold, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Barrick Gold Standing Right Now?

- With a volume of 14,983,988, the price of GOLD is down -0.45% at $19.98.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 27 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Barrick Gold, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Widens Lead Over Harris In Polymarket Betting Odds; Big Banks Kick Off Earnings Season – Top Headlines Today While US Slept

US Markets

- Wall Street On Backfoot As PPI Print, JPMorgan Earnings Loom: This Strategist Expects Positive Market Performance, But With Muted Returns

- S&P Pulls Back From Record High As Inflation Data Dents Investor Optimism: Fear Index Remains In ‘Greed’ Zone

Crypto

- Justin Bieber’s 2024 Crypto Returns – Discover How Much The Pop Icon Made On His Ethereum Investment!

- SEC Showdown: Gary Gensler Defends Crypto Policy While Commissioner Mark Uyeda Calls It ‘Disaster’ For Assets Like Bitcoin, Ethereum, Dogecoin

- Tron Founder Justin Sun Appointed ‘Prime Minister’ Of A Crypto-Focused Micronation In Europe

- Tesla-Themed Coins Spike After EV Giant Unveils ‘Cybercab’ Robotaxi — Why You Should Be Careful

- Tesla Unveils 2-Seater Cybercab That Drives Itself, Price Expected To Be Under $30K: Also Shows Off 20-Seater Robovan To Rival Uber Shuttle

- Bitcoin, Ethereum, Dogecoin Muffled After September Inflation Dampens Rate Cut Outlook: Analyst Warns Of ‘Downside Deviation’ If King Crypto Loses This Support

US Politics