A Closer Look at Starbucks's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Starbucks. Our analysis of options history for Starbucks SBUX revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $468,352, and 2 were calls, valued at $59,896.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $120.0 for Starbucks over the recent three months.

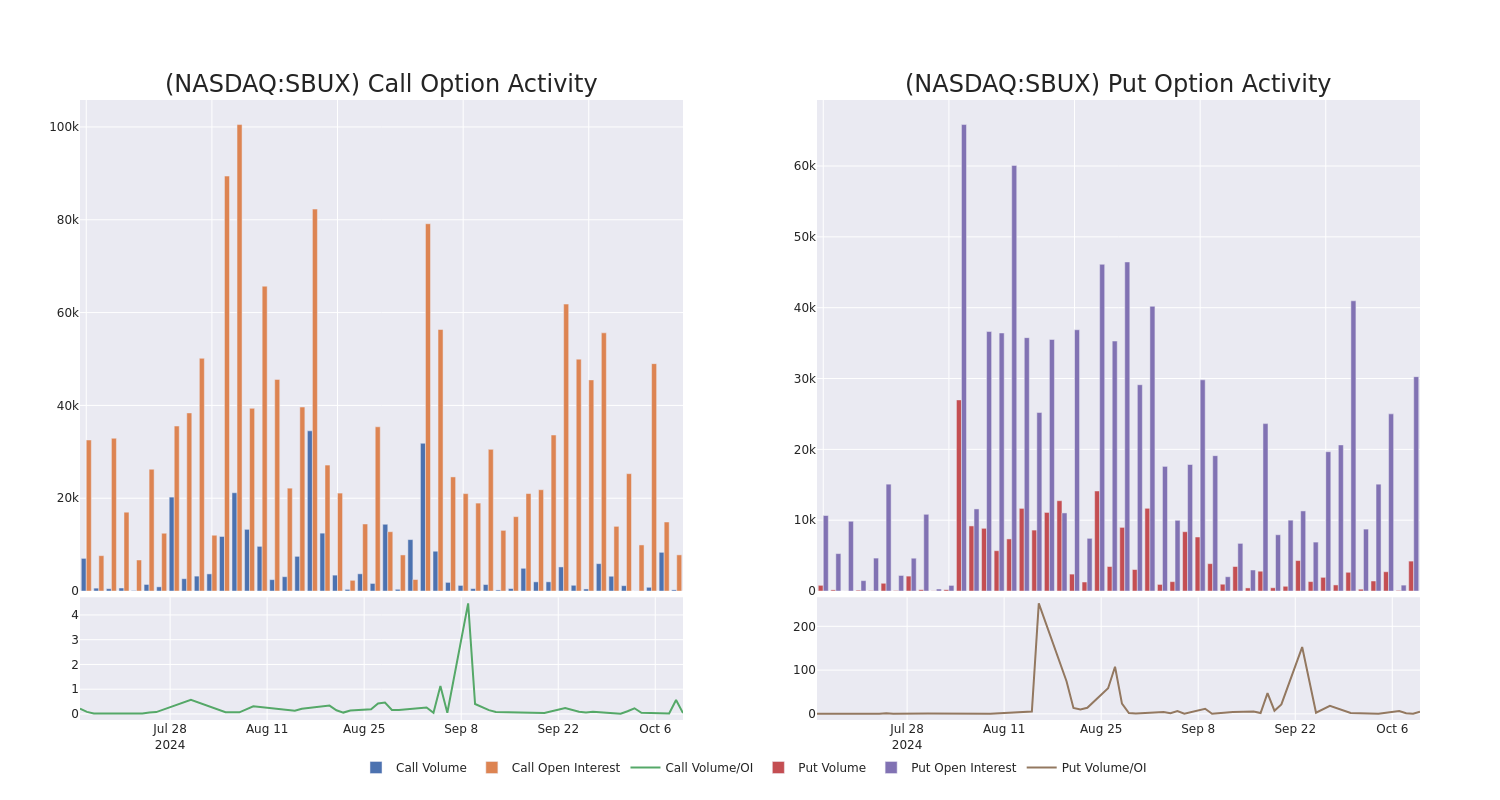

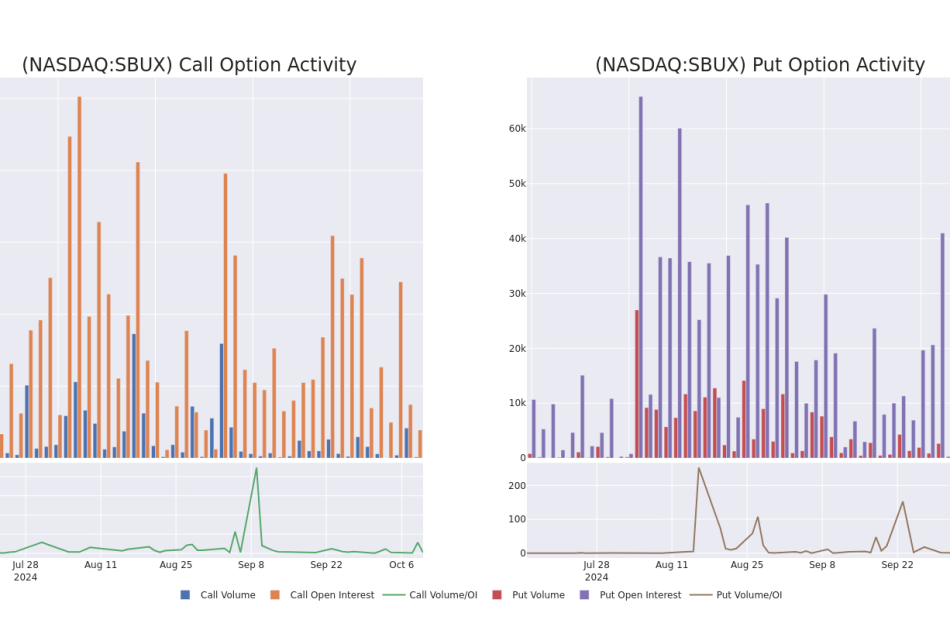

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Starbucks stands at 4229.33, with a total volume reaching 4,485.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Starbucks, situated within the strike price corridor from $80.0 to $120.0, throughout the last 30 days.

Starbucks Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SBUX | PUT | TRADE | BULLISH | 10/18/24 | $0.62 | $0.55 | $0.55 | $92.00 | $110.0K | 521 | 2.0K |

| SBUX | PUT | TRADE | BEARISH | 01/16/26 | $27.85 | $27.85 | $27.85 | $120.00 | $97.4K | 97 | 35 |

| SBUX | PUT | SWEEP | NEUTRAL | 11/15/24 | $2.34 | $2.33 | $2.34 | $90.00 | $53.6K | 9.6K | 364 |

| SBUX | PUT | TRADE | BEARISH | 11/15/24 | $4.5 | $4.4 | $4.5 | $95.00 | $45.0K | 6.6K | 333 |

| SBUX | PUT | SWEEP | BULLISH | 10/18/24 | $1.71 | $1.7 | $1.7 | $95.00 | $42.5K | 7.9K | 881 |

About Starbucks

Starbucks is one of the most widely recognized restaurant brands in the world, operating more than 38,000 stores across more than 80 countries as of the end of fiscal 2023. The firm operates in three segments: North America, international markets, and channel development (grocery and ready-to-drink beverage). The coffee chain generates revenue from company-operated stores, royalties, sales of equipment and products to license partners, ready-to-drink beverages, packaged coffee sales, and single-serve products.

Following our analysis of the options activities associated with Starbucks, we pivot to a closer look at the company’s own performance.

Current Position of Starbucks

- Trading volume stands at 5,263,230, with SBUX’s price down by -2.09%, positioned at $93.88.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 21 days.

Professional Analyst Ratings for Starbucks

In the last month, 5 experts released ratings on this stock with an average target price of $102.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Starbucks, targeting a price of $99.

* Showing optimism, an analyst from Bernstein upgrades its rating to Outperform with a revised price target of $115.

* An analyst from Jefferies downgraded its action to Underperform with a price target of $76.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Starbucks, which currently sits at a price target of $105.

* An analyst from B of A Securities persists with their Buy rating on Starbucks, maintaining a target price of $118.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Starbucks, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply